Home / How Retailers are Tackling AP Automation Challenges

How Retailers are Tackling AP Automation Challenges

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Efficient invoice management is a mission-critical component for retail businesses, considering the staggering volume of transactions they process daily, along with the multitude of discounts, promotions, and special pricing adjustments that need to be accounted for in their invoices.

Recent data reveals that the invoice management landscape in the retail industry presents significant challenges. 20 to 30 percent of all invoices still require manual handling, leading to error-prone practices, slow invoice processing, and delays in supplier payments.

The impact of inefficient invoice management is further exacerbated by data inconsistencies.

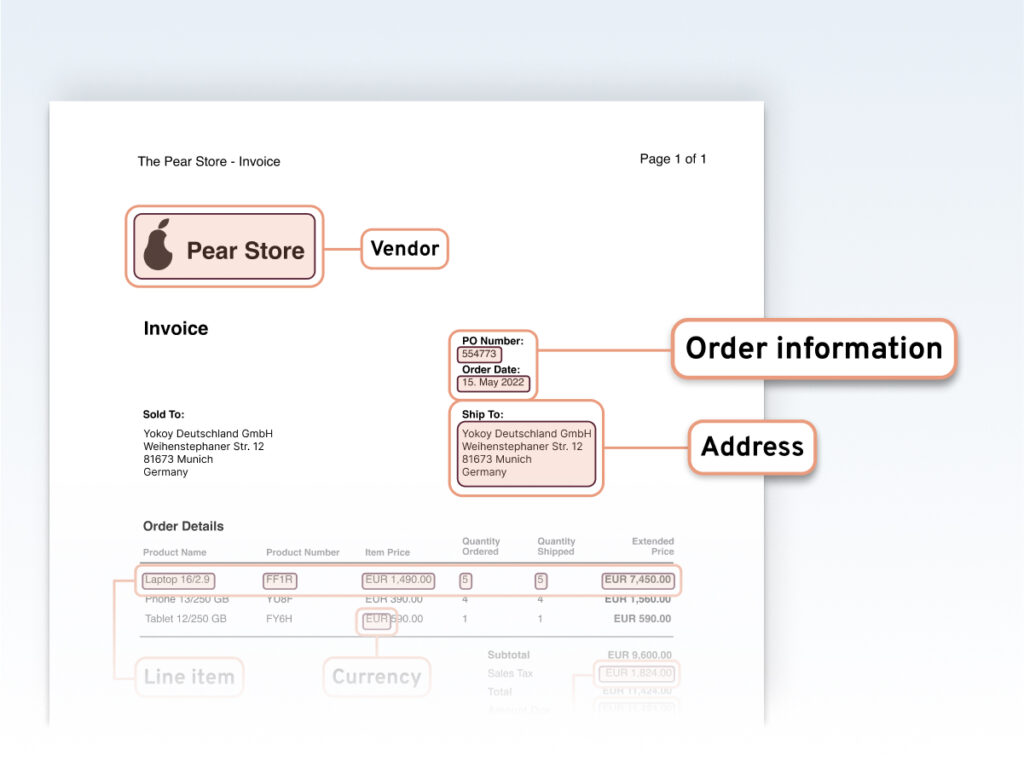

Retailers struggle with the lack of standardization in supplier invoice data, invoices and POs that are hard to read, as well as increasingly diverse invoice formats and requirements from manufacturers, suppliers, and partners. This diversity complicates automated data extraction and processing, hampering retailers’ ability to efficiently manage their invoices.

However, amid these challenges, there is a silver lining in the form of Accounts Payable (AP) automation. Retailers adopting AP automation solutions witness remarkable improvements in their invoice processing efficiency, reducing the time it takes to process invoices, minimizing errors and manual follow-ups, and enhancing overall data accuracy.

In this article, we will delve into the dynamic landscape of invoice management in the retail sector, exploring how retailers are tackling these challenges head-on by leveraging the latest technologies to transform their accounts payable processes.

Invoice management challenges in retail

Retailers operate in a fast-paced industry where responding promptly to new product trends is crucial to meet consumer demands and deliver excellent service.

While much attention is placed on enhancing front-end processes to improve the customer experience, retailers often overlook the significance of optimizing back-end processes, such as accounts payable (AP).

In fact, what we see with our customers is that many companies often lack a comprehensive overview of the total costs in the invoicing process. So when they reach out to us, they don’t have a clear understanding of how much money they’re losing due to ineffective accounts payable systems.

What we usually do is help them quantify their direct and indirect costs, as well as calculate the ROI of switching to a solution like Yokoy. I won’t detail the topic of return on investment here, as we’ve talked about it in previous article. But let’s take a moment to look at direct and indirect financial losses affecting retailers.

Direct and indirect cost drivers in retail

Managing direct spend poses significant challenges for retailers, especially when handling extensive product lists with large inventories. Manually matching invoices to specific product details, such as flavor, color, and size, is extremely complex, time-consuming, and prone to error.

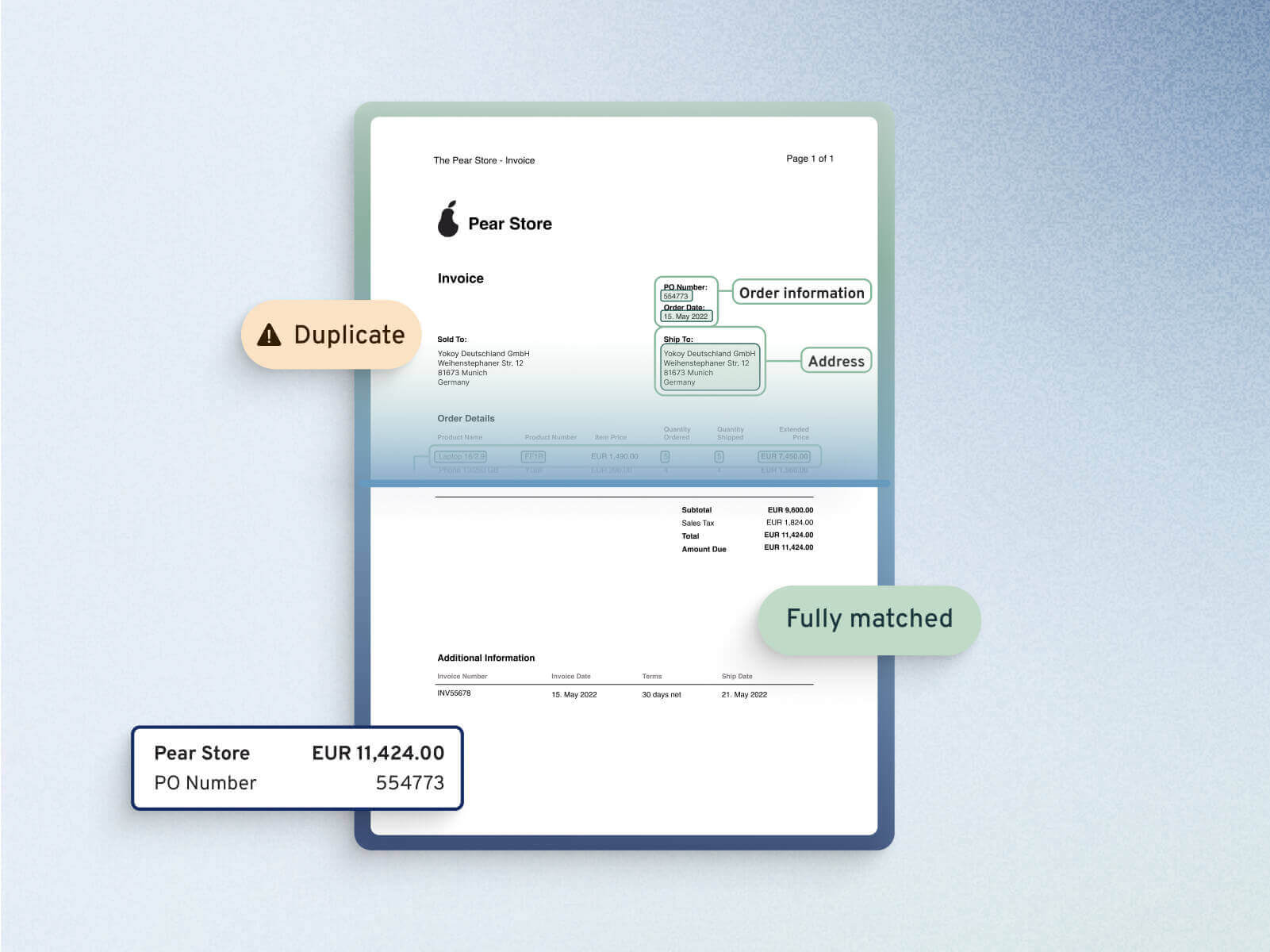

Direct financial losses may result from failure to identify duplicate or fraudulent invoices, leading to duplicate payments, or from data entry mistakes, leading to overpayments or paying the wrong supplier or invoice. Missing payment terms may lead to loss of early payment discounts, on top of strained vendor relationships.

Moreover, money can be lost when dealing with international suppliers, due to fluctuating exchange rates and dealing with multiple tax regulations or adhering to diverse invoicing requirements.

As for indirect costs, these are most often the result of time-consuming, manual processes that lead to slow processing of invoices and purchase orders, inefficient routing of invoices between approvers, errors that have to be manually checked by AP staff, and so on.

Now that this is clear, let’s see how accounts payable automation software like Yokoy, that relies on artificial intelligence, can help retailers tackle the most common invoice management challenges.

Time-consuming manual processes

Although most retailers have some digital solution in place for managing their inventory, both paper-based processes and partially-automated AP processes remain a major challenge for retail industry.

With employees tasked to manually enter, manage, and process a large volume of order, billing, and payment information, the tedious nature of these tasks hampers overall productivity. This becomes especially evident when dealing with the intricacies of import business, where the accounting department must also record freight costs and customs duties on goods purchased abroad to ascertain the exact cost of purchase.

The AP team manages and processes a large amount of order, billing and payment information, which is tedious and time-consuming – especially if the whole thing is done manually. When no automation system is in place, the risk of data entry errors increases significantly, costing retailers both time and money.

If the company is active in the import business, the accounting department must also record the freight costs and customs duties on the goods purchased abroad in order to determine the exact cost of purchase. Such tasks could benefit from process automation.

How to tackle this challenge

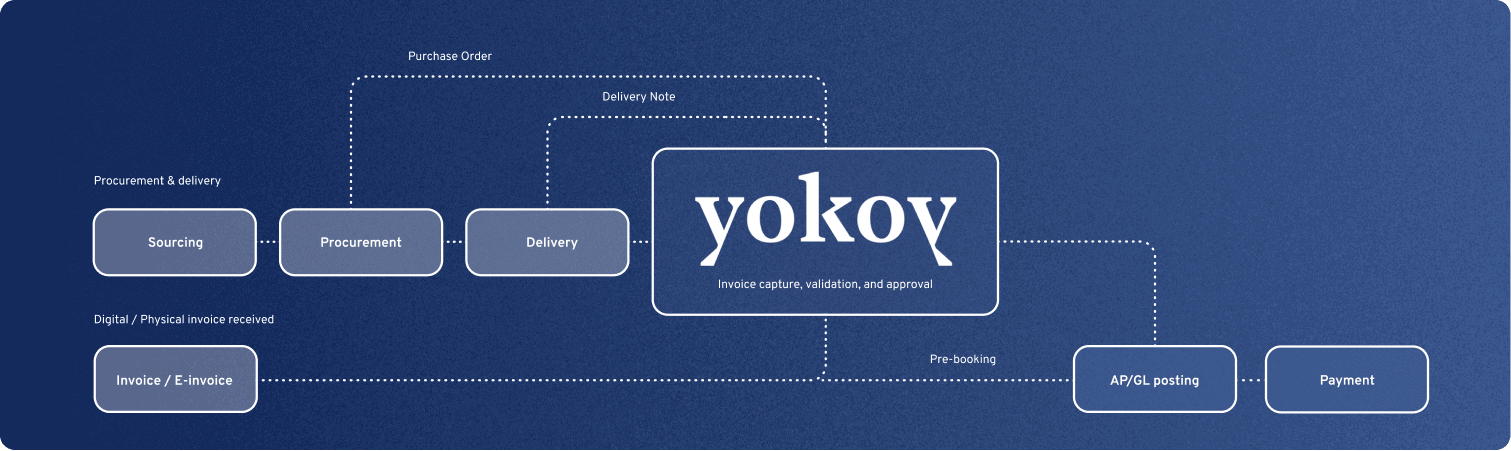

Leading retailers rely on modern cloud solutions to fully automate their AP management process – including the end-to-end invoice processing.

Paper invoices are scanned or uploaded to appropriate platforms through web and mobile apps, and the data is automatically extracted and assigned to the respective booking categories, removing the need for manual records or spreadsheets that promote discrepancies.

This reduces the time required for invoice processing enormously, streamlining the invoice capture, extraction, matching, and approval. In addition, it ensures high-quality and correct bookings, as the risk of human error is greatly reduced.

Inaccurate or incomplete data

Manual data entry and a lack of standard processes when entering invoices result in incorrect or incomplete data – especially when paper receipts and Excel sheets accompany the process.

We have many retail customers who decided to implement Yokoy because their previous solutions weren’t able to handle complex invoices with many line items, or to recognize purchase orders without manual intervention.

Although it may sound counterintuitive, partially automated accounts payable processes may cause more harm than good. When the invoice recognition isn’t accurate, or the three-way matching can’t be automated, the AP team still needs to do these tasks manually, and these are the most data-intensive steps.

In fact, nearly 63% of retail companies report encountering data accuracy issues in their AP operations due to manual entry and lack of standardized processes. These inaccuracies result in delayed payments, damaged supplier relationships, and difficulty in reconciling financial records.

How to tackle this challenge

In a survey conducted by Levvel Research in 2021, 72% of respondents from retail companies acknowledged that adopting AP automation led to better error detection and resolution, saving time and resources in the process.

By embracing automated solutions for text recognition and data extraction, retail businesses can elevate their AP processes to a new level of accuracy and reliability. The benefits of such technology extend beyond data precision, as they empower finance teams to focus on strategic initiatives, supplier relationship management, and overall growth in an increasingly competitive retail landscape.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Complicated approval workflows

Another major AP challenge for retailers is the approval of invoices, especially when the AP process is decentralized.

The approval process in retail is often complex, especially in global organizations with different accounting systems and software solutions. This can result in longer processing times, potential compliance issues, and difficulty tracking invoices. Invoices that require multiple levels of approval can even get lost between systems.

How to tackle this challenge

With an automated solution, you can use different approval flows for different entities or types of invoices. Roles and responsibilities for everyone involved in the approval process can also be easily defined. This reduces the risk of duplicate or conflicting approvals and minimizes delays and errors.

Blog article

How to Automate Your Invoice Approval Workflows with Yokoy

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. Here’s how Yokoy can help.

Mauro Spadaro,

Product Manager

Lack of standardization

Consumers nowadays use various payment methods such as credit cards, mobile payments and online payment platforms.

Manufacturers, suppliers and partners can also have different invoice processing programs, formats and requirements, which easily leads to data inconsistencies. This makes it difficult to automatically extract and process the required information.

How to tackle this challenge

Automated software enables uniform data formats and a reduced number of software solutions that are seamlessly connected. This enables you to read any invoice format and receive invoices through different channels. The data is processed directly in the solution and sent to the connected ERP system. In this way, real-time analyzes of expenses and more precise forecasts are also possible.

DO & CO standardized their global spend management with Yokoy

“One unified process for the entire DO & CO Group. Yokoy enables us to collaborate optimally across all locations and entities.”

Michael Kultscher-Burger, Teamlead Accounts Payable & Receivable

Complex data protection requirements

Invoices often contain sensitive information such as customer and supplier data that needs protection from unauthorized access. Retailers must ensure data protection and data security and comply with legal requirements.

How to tackle this challenge

An automated solution offers you the possibility to configure all legal guidelines and regulations. The AI validates each submission in accordance with the policies of the entire company and at the legal level. This guarantees automatic data protection and data security.

Next steps

By embracing advanced AP automation software that relies on artificial intelligence, retailers can overcome challenges related to manual processes, inaccurate data, complex approval workflows, lack of standardization, and data protection requirements.

Implementing such solutions can undoubtedly position retailers at the forefront of the industry and unlock the full potential of their invoice management processes.

If the challenges above resonate with you and you’d like to see how Yokoy can automate your invoice management process, you can book a demo below.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.