Home / Direct vs Indirect Spend: Key Differences & Identifying Savings Opportunities

Direct vs Indirect Spend: Key Differences & Identifying Savings Opportunities

- Last updated:

- Blog

Growth Marketing Manager

Both direct spend and indirect spend fall under the umbrella of procurement functions. Direct spend revolves around materials intended for eventual customer sales, while indirect spend encompasses expenses like office supplies or rent that sustain the business behind the scenes.

However, understanding the differences that distinguish these two categories extends beyond mere categorization in your company’s financial records. It can have a substantial impact on your business’s performance, whether you are involved in supply chain management, finance, procurement, or hold an executive role.

Now, let’s take a closer look at the differences between direct and indirect spending and explore how spend management software can assist you in pinpointing opportunities for savings in both these categories.

What is the difference between direct and indirect spend?

The most significant difference between direct and indirect spending lies in how they are managed. When it comes to indirect procurement, the primary objective is cost savings, while direct procurement places a strong emphasis on supplier management and change management.

As such, direct procurement focuses more on:

Cultivating enduring, strategic partnerships with key suppliers

Establishing a reliable and predictable supply chain and production workflow

Collaborating with suppliers renowned for delivering top-tier quality

On the other hand, indirect procurement focuses more on:

Efficiently managing and analyzing business spend

Identifying cost-saving opportunities while maintaining quality standards

Streamlining and optimizing various indirect spending categories

Here’s a more detailed overview of direct and indirect spend.

What is direct spend?

Direct spend, or direct procurement, pertains to the funds allocated for the acquisition of raw materials and items essential for end product creation. Those familiar with financial statements will recognize this as an integral part of the cost of goods sold (COGS).

For instance, let’s take the example of a bicycle manufacturing company. To produce a bicycle, they must procure essential components like metal frames, tires, brakes, and the indispensable bells for handlebars.

These components are indispensable for the company’s revenue generation, as without them, sales would be impossible. They directly contribute to the company’s income. Similarly, a cosmetics brand might obtain lipstick tubes from one supplier and mascara from another, both of which fall under the category of direct costs.

Regardless of where your business stands in the supply chain, any expenses directly linked to the production of physical products and future sales are classified as direct expenditures.

What is indirect spend?

Indirect procurement, in essence, encompasses expenditures associated with nearly everything else. If an expense lacks a direct connection to revenue generation, it falls into the category of indirect spending. On the income statement, these expenses are typically categorized as operating expenses.

Take, for instance, the bicycle manufacturer. They may have indirect expenses related to items such as coffee in the break room, computer monitors for new employees, and travel.

While these costs play a crucial role in facilitating the company’s revenue generation, it’s impossible to directly correlate a dollar spent on a new monitor to a dollar earned from a sale. As a result, these expenses are classified as indirect.

White paper

Report: State of Spend Management Transformation [2023]

This report offer a glimpse into the current state of spend management transformation and the trends, challenges, and opportunities shaping its future.

How does this affect spend management activities?

The origin of the different types of spending significantly impacts how they’re managed.

Organizational setup

In most companies, centralized procurement and supply chain teams typically oversee the management of direct costs. Category managers within centralized procurement teams focus on specific areas of expenditure, i.e., goods and materials.

Industries like manufacturing, distribution, and retail heavily rely on Enterprise Resource Planning (ERP) systems to analyze product demand and initiate orders for the necessary direct materials.

Once the ERP identifies the need for a purchase, a buyer steps in to manage the purchase order process, involving negotiations with suppliers. Managing these changes, such as shifts in ship dates, quantities, or prices, poses a challenge for direct procurement teams.

In contrast, indirect spend tends to follow a decentralized and fragmented approach, often involving various internal stakeholders operating with separate budgets and spending protocols.

Procurement professionals handling indirect costs primarily oversee expenses driven by employees. For example, if an employee’s headset breaks or a team member needs to travel, these are considered indirect expenses that can escalate if not carefully monitored.

Because indirect spend management is typically scattered across the organization, establishing frame agreements and using spend management software that is purpose-built for centralizing expenses can significantly improve efficiency and compliance and provide cost savings.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Supplier relationship management

Direct spending places a greater focus on managing supplier relationships. Communication with suppliers often occurs through channels like email and phone calls, with changes tracked in spreadsheets and PDFs.

Late deliveries can disrupt production, result in late fees, or necessitate expedited orders, potentially damaging customer trust. Buyers often specialize in specific areas of direct spending, becoming category managers.

In contrast, indirect procurement teams predominantly manage internal stakeholders and may establish closer relationships with some vendors. Large corporations may seek savings through strategic sourcing partnerships, such as consolidating purchases to secure discounts.

Inventory management

Inventory management entails keeping track of your available materials, their storage locations, and forecasting the necessary quantities.

In the realm of direct procurement, maintaining a stock of materials is crucial to ensure a seamless production process and prevent delays. In contrast, indirect procurement operates in response to demand, meaning purchases are made as needed, resulting in lower inventory stockpiles and associated costs.

KPIs and measuring performance

Due to the distinct processes involved, the metrics for measuring success differ between direct and indirect procurement.

Indirect procurement is typically measured by cost savings.

Direct procurement, on the other hand, is primarily assessed by its ability to fulfill customer orders on time and in full. Inventory management is crucial in direct spending, as unused inventory incurs costs and ties up cash flow.

White paper

How Spend Management Makes Money

Spend management solutions provide benefits beyond cost savings, including improved spend control and fraud prevention.

Technology and software needs

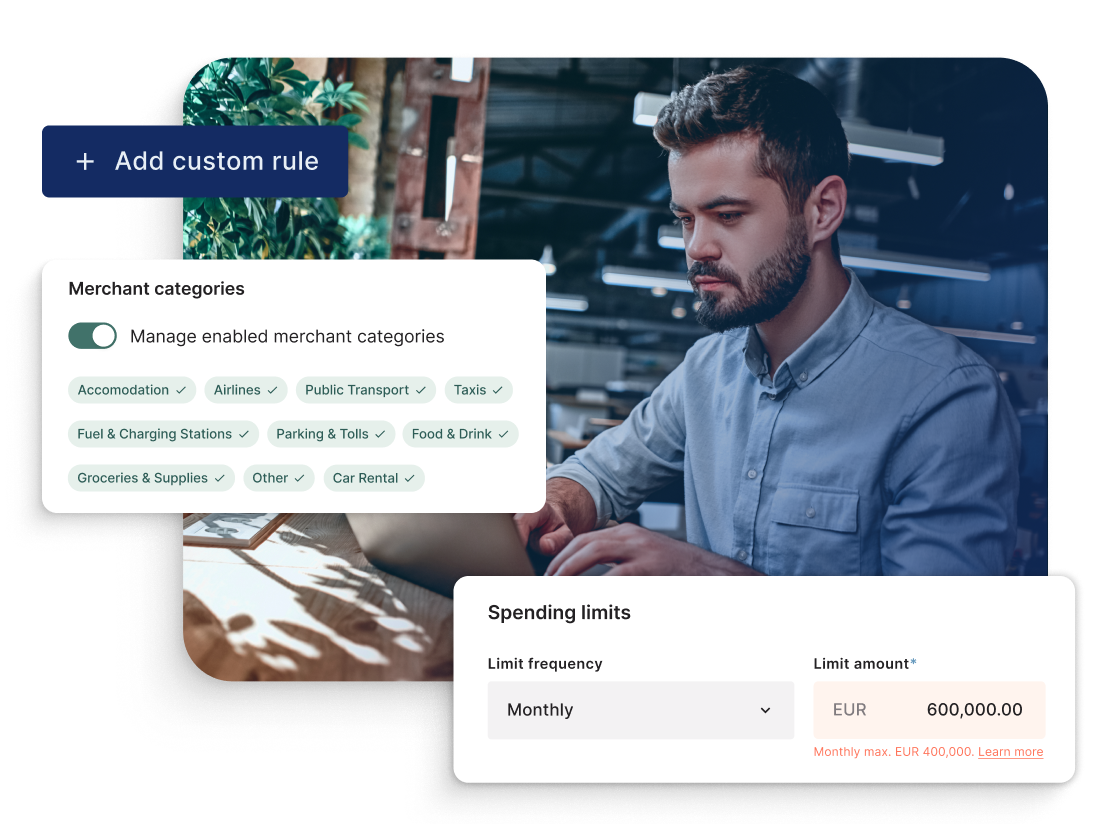

Industries with a strong emphasis on indirect spend, such as finance departments in large global companies, often benefit greatly from the implementation of e-procurement solutions or procurement software tailored to their specific needs. These software solutions play a pivotal role in streamlining the procurement process and ensuring efficient spend management.

For finance professionals like CFOs and heads of finance, accounting, and controlling, the importance of these tools cannot be overstated. They provide a centralized platform where approved vendors can be easily managed and accessed. This centralization not only simplifies the procurement process but also enhances control and visibility into spending patterns.

On the other hand, industries with substantial direct spend requirements have traditionally relied on manual methods like spreadsheets and email for supplier communication. This approach, while familiar, can often lead to inefficiencies, errors, and a lack of transparency in the procurement process.

Spend management solutions such as Yokoy offer a more sophisticated approach. They allow for the automation of AP and T&E tasks, enabling finance professionals to focus on more strategic activities.

Furthermore, they can incorporate AI and automation to optimize supplier selection, negotiate better terms, and even identify potential cost-saving opportunities.

Spend management and bottom line impact

Both direct and indirect spending play crucial roles in spend management’s impact on the bottom line. Reducing expenses increases revenue retention and enhances profitability.

Indirect spending is heavily focused on spend management, as it can be a source of waste within an organization. Keeping indirect spending in check is vital to influencing the bottom line positively.

Direct spending not only impacts profitability but also the top line, affecting a company’s ability to generate and recognize revenue. Delays or errors in materials procurement can hinder product shipments, billing, and revenue recognition. Late or incorrect orders can jeopardize customer relationships and the consistent revenue they provide.

In some industries, like manufacturing, distribution, and direct-to-consumer retail, direct spending has a far more significant impact on business success compared to indirect spending.

In summary, while there are several differences between direct and indirect spending, the key takeaway is that some industries prioritize direct spending more than others. Procurement strategies vary, and in some cases, a one-size-fits-all approach may suffice, while in others, tailored solutions are essential.

Identifying savings opportunities with spend management software

Spend management software is a critical tool that aligns with core objectives of efficiency, control, and visibility. Here’s how it can help you uncover savings opportunities in both direct and indirect spending:

Automation and efficiency

By automating routine procurement tasks, such as purchase order generation and invoice processing, you free up valuable time for your finance professionals.

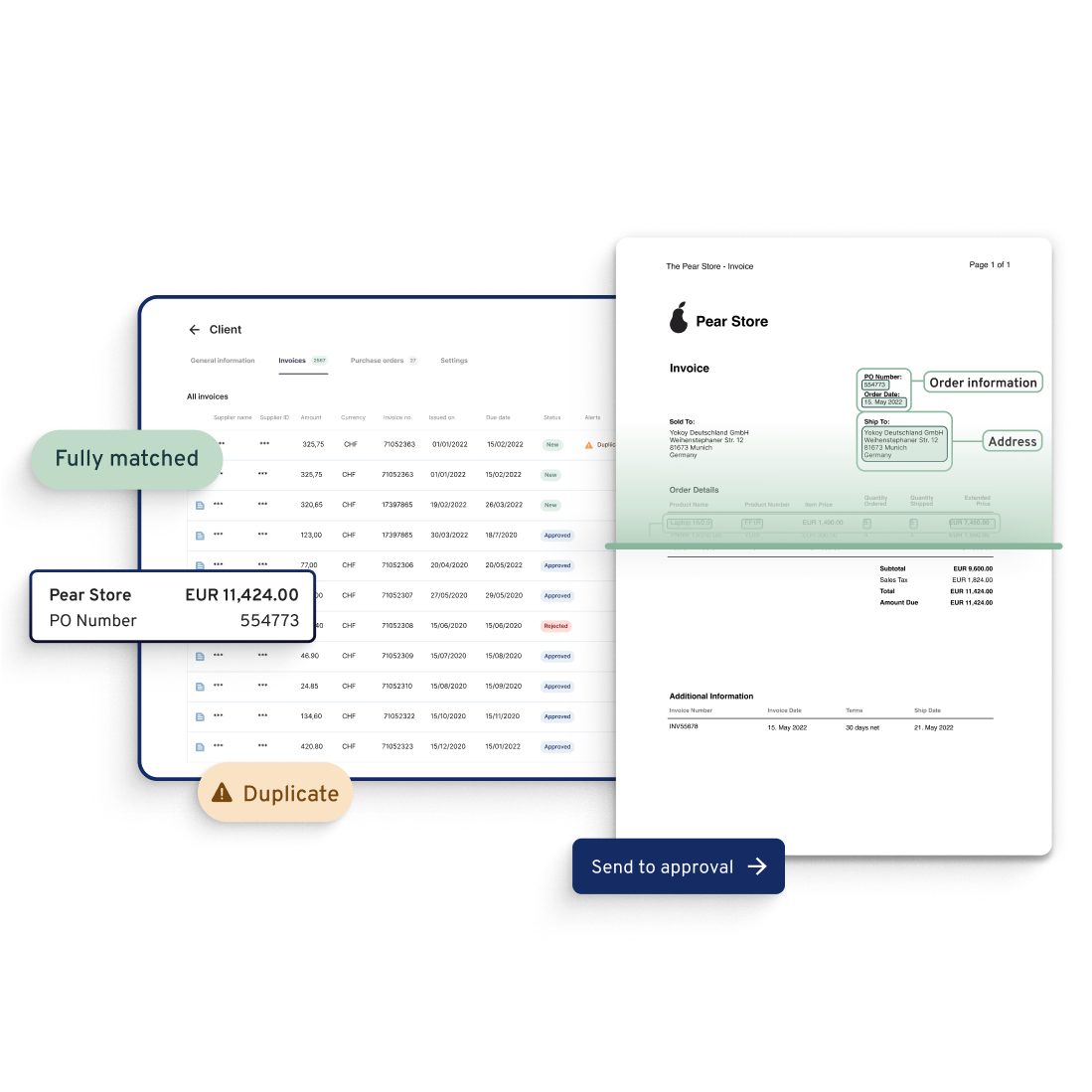

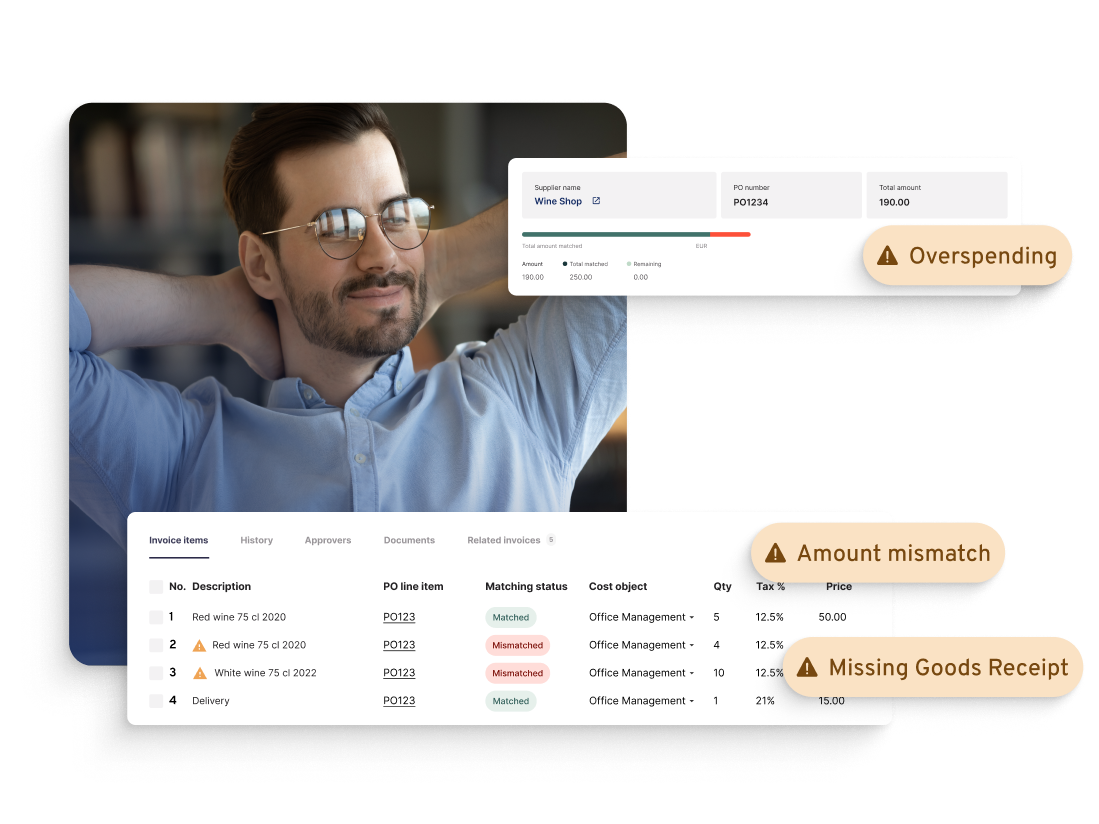

For example, Yokoy’s Invoice module can take over the entire AP process, from invoice capture and validation to approval and payment. The AI technology ensures errors such as inaccurate data or duplicates are caught in real time, preventing wrong payments.

At the same time, the automated invoice approval workflows help enforce governance, preventing delays in approvals and supplier payments. This helps organizations in negotiating better terms with vendors.

Moreover, invoice management software like Yokoy can automate the matching of invoices with purchase orders and receipts, speeding up the 2-way, 3-way, and 4-way matching process. This saves significant time, ensuring a smooth accounts payable and procure-to-pay process.

This efficiency can be channeled into strategic activities like supplier negotiations for direct spend or scrutinizing indirect spending categories for potential savings.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Data-driven insights

Spend management software allows you to collect and analyze vast amounts of data from your procurement processes. This data can unveil trends, anomalies, and areas where cost savings can be achieved. For direct spending, it helps you optimize supplier relationships and production workflows. In indirect spending, it identifies areas for cost reduction without compromising quality.

Visibility and control

Spend management software provides real-time visibility into your spending patterns. For direct procurement, this means instant access to supplier performance metrics and supply chain insights. In the case of indirect spending, you can monitor expenses across departments and identify areas where consolidation and optimization can yield cost savings.

Compliance and risk management

Ensuring compliance and mitigating risks are paramount in the finance and procurement world. Spend management software helps you enforce compliance with procurement policies and regulations, whether you’re dealing with direct materials or indirect expenses. By reducing errors and fraud, it safeguards your company’s financial health.

Supplier collaboration

For direct spend, nurturing strong, long-term partnerships with key suppliers is crucial. Spend management software provides a platform for efficient communication and collaboration with your suppliers, fostering better relationships that can lead to cost-saving opportunities. In indirect spending, it streamlines the approval process for purchases, ensuring that only necessary expenses are incurred.

Customized reporting

Tailored reporting capabilities within spend management software allow you to track key performance indicators specific to your business. Whether you’re focused on on-time delivery metrics for direct materials or cost savings percentages for indirect expenses, these reports empower you to make data-driven decisions.

Next steps

In conclusion, while direct and indirect spending have their nuances, the common goal of minimizing expenditure aligns with the objectives of finance professionals, CFOs, and heads of finance and accounting.

Spend management software can help you achieve this goal by identifying savings opportunities, streamlining processes, and ensuring compliance.

If you’d like to see how Yokoy’s spend management suite can help optimize your direct and indirect spend management and identify cost savings, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.