Home / How to Ensure Regulatory Compliance With Automated Audit Trails

How to Ensure Regulatory Compliance With Automated Audit Trails

- Last updated:

- Blog

Co-founder & CCO, Yokoy

In spend management, audit trails capture every step of the expenditure lifecycle, from purchase order requisition to approval, purchase, and payment.

This comprehensive form of record-keeping helps organizations monitor financial transactions, detect anomalies, and ensure adherence to internal controls and external regulations.

This article delves into the significance of automated audit trails in spend management and how they contribute to regulatory compliance.

What is an audit trail and what is it used for?

An audit trail is a compilation of documents or files that serve as evidence of the accuracy of financial records. Auditors follow a backward path from the final financial statement to trace every step that led to its creation, much like retracing steps using breadcrumbs.

Companies use audit trails in financial reporting. For an audit trail to be effective, it must encompass not only the source documents themselves but also document updates and changes, including the individuals responsible for these modifications.

An audit trail record loses its purpose if the financial information can be altered just before an audit, which could also potentially be illegal.

Audit logs vs audit trails

Before we continue, it’s worth mentioning the difference between an audit trail and a log.

While both audit trails and logs capture events and actions, they serve distinct purposes. Logs typically provide a concise record of system activities, errors, and notifications, often used for troubleshooting and system maintenance.

In contrast, audit trail data offers a more comprehensive narrative, detailing not only what happened but also the context surrounding each event. This contextual information is crucial for reconstructing the sequence of events, understanding decision-making processes, and supporting compliance audits.

Audit trails are used for both external and internal audits.

Blog article

Financial Audit Checklist: How to Prepare and How Automation Can Help

What should a finance audit include? See the difference between internal and external financial audits, and how to speed up the process with automation.

Lars Mangelsdorf,

Co-founder and CCO

Types of audit trails in spend management

In the realm of spend management, various types of audit trails are essential for maintaining financial integrity and compliance. These include:

Procurement audit trail: This records the steps involved in the procurement process, from requisition creation to supplier selection and purchase order issuance. It ensures that procurement policies are followed, vendor relationships are managed appropriately, and purchase decisions are well-documented.

Expense audit trail: This tracks employee-initiated expenses, from submission of expense reports to approval and reimbursement. It helps prevent fraudulent claims and ensures that only legitimate business expenses are reimbursed.

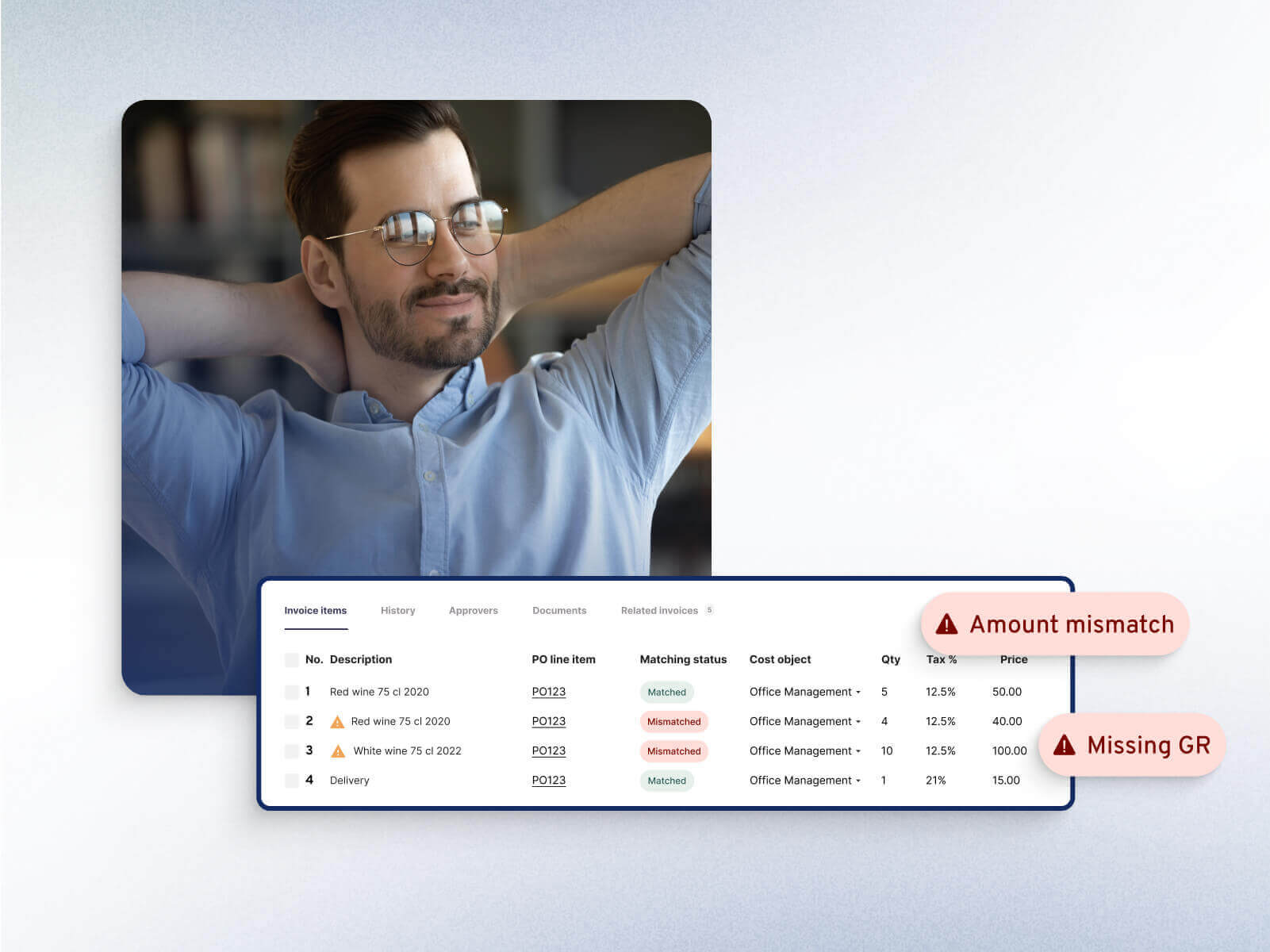

Invoice audit trail: This captures the journey of invoices from receipt to validation, approval, and payment. It safeguards against duplicate or erroneous payments and facilitates efficient invoice reconciliation.

In global organizations, staying on top of ever-changing financial regulations and laws to audit expenses and transactions is a very common challenge.

On the one hand, companies need to add rules for enforcing country-specific regulations in their financial software, and they need to do this for every country they operate it. On the other hand, finance teams need to maintain these rules, as they might change from one day or week to the other.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

For example, if VAT rates or per diem rates change in one country, they need to be updated in the invoice processing and expense management systems.

Doing this manually is possible if the company has subsidiaries in one country only. But for global enterprises that have entities in multiple countries, making such changes manually is a time-consuming and error-prone process.

AI-powered spend management software like Yokoy do this automatically, updating all regulations across geographies and currencies, for effortless compliance.

Let’s look at how audit trails work in Yokoy.

Audit trail software: How automated audit trails work in Yokoy

Our software helps finance teams ensure that all expenses are audit-proof, all the spend is compliant with local regulations, and only the allowed people have data access (especially in case of sensitive data), for maximum information security.

Although the requirements might vary depending on the type of document or record, in general, the following information needs to be readily available and clearly visible in audit trails:

The expense or transaction made

The time stamps for when the transaction or expense was created

A description of the expense item

The person who submitted the expense

The approver of the transaction

Records of all changes made to the submitted documents

Let’s look at what Yokoy does to facilitate automated financial audit trails.

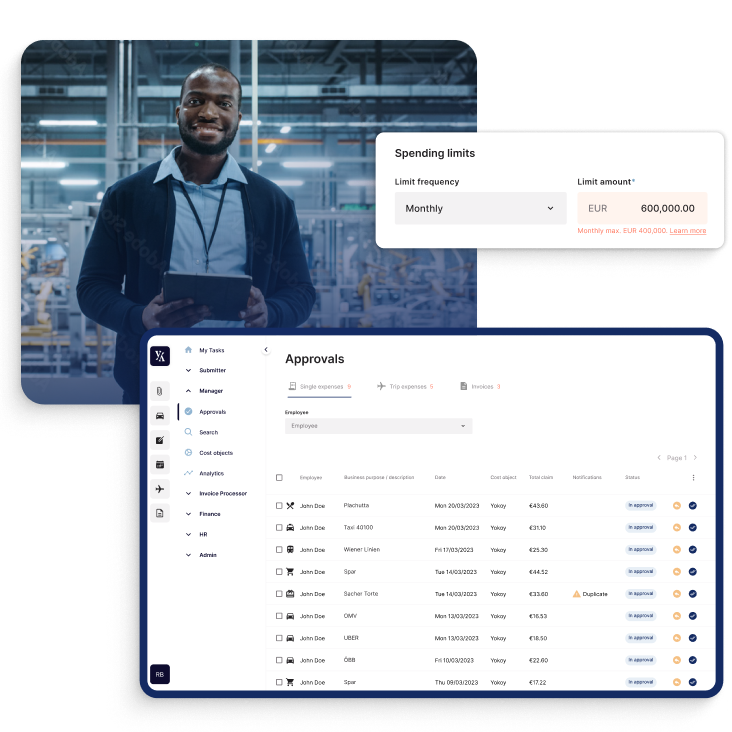

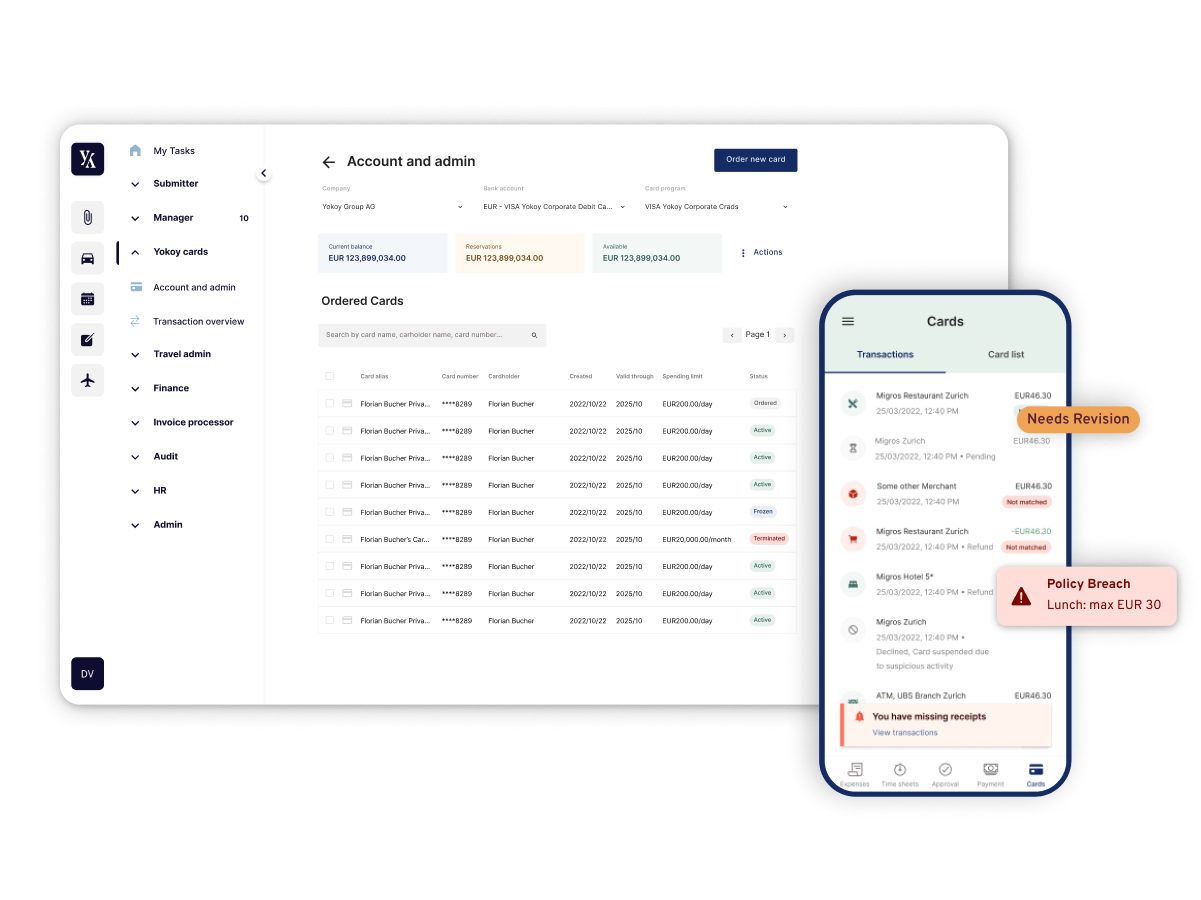

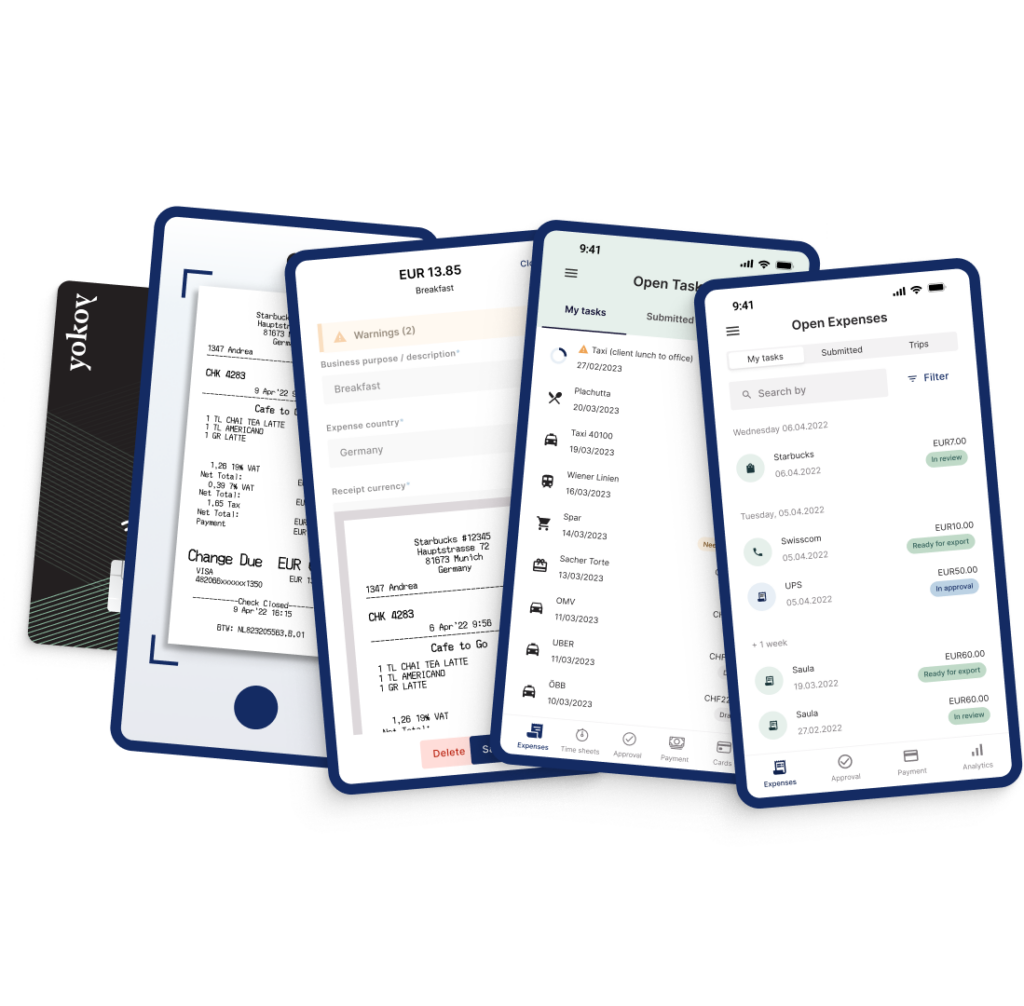

Automated expense management and integrated card transactions

In Yokoy, receipts are captured by taking a photo with the mobile app, or forwarding them to a specific email address. The processing of receipts is fully automated, from reading them and validating the data to checking the expenses against company policies.

Card transactions are automatically matched with submitted receipts, and in case everything is within policy, expenses are automatically approved, based on specific approval flows. This ensures a clear overview of who initiated the expense, who reviewed it, and who approved it.

The system’s AI flags duplicate receipts and policy breaches in real time, and notifies the submitter, reducing the amount of errors and making sure that most of the submitted expenses are compliant.

There is very little manual intervention, mostly in case of edge cases, so all in all, Yokoy makes it very easy to keep track of business expenses for audit purposes, at scale.

Moreover, using smart corporate cards for paying for all business expenses decreases the risk of fraudulent expenses and limits the use of petty cash, contributing to easily-traceable transaction data and an audit-proof expense management process.

Receipt storage

For example, in Germany, GoBD principles require companies to have a proper management and storage of books, records, and documents, and to ensure the traceability and verifiability of all individual business transactions. It must be possible to trace the origin and processing of business transactions without any gaps.

But not all countries apply the same rules and regulations when it comes to storing financial documents.

According to Spanish regulation, for example, it is not necessary that the companies need to collect and store physical expense receipts. The government also allows companies to store expense receipts digitally as long as the expense management tool is compliant and should be certified by Spanish Tax Agencies (AEAT).

If the expense management tool is not compliant and is not certified by AEAT, companies must collect and store physical expense receipts for a valid reimbursement of business expenses.

Yokoy stores all receipts and archives them as pictures, in line with the requirements for storing electronic photos, for the statutory retention period that applies in each respective country.

Also, Yokoy provides a detailed overview of all expenses submitted and approved, including who initiated the reports, who approved the transactions, and who made the reimbursements. All the financial data can be found and filtered in the system with time stamps, history, and photo of the receipt or invoice, at the push of a button.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

Automatic updates of VAT rates

VAT rates for exchange of goods and services are set by the government of each country. Of all the different rates, the ones below are relevant for expense management:

· Standard VAT rates – for most of the goods and services

· Reduced VAT rates – for art works, sporting event, delivery of living animals, plants, but also for accommodation, transportation

· No VAT – for excluded goods and services

Yokoy automatically extracts the VAT from invoices and receipts, for both domestic and international expenses. In the system, VAT rates are automatically updated across countries, so there is no need for manual intervention.

This ensures compliance with local and international regulations and audit-proof expense management with minimum human intervention.

Beekeeper reclaims VAT automatically with Yokoy

“The Finance team can focus on exceptions only and all other expenses are processed fully automated within seconds. The VAT recognition that Yokoy helps to ensure an automated VAT reclaim.”

Herbert Sablotny, Beekeeper’s CFO

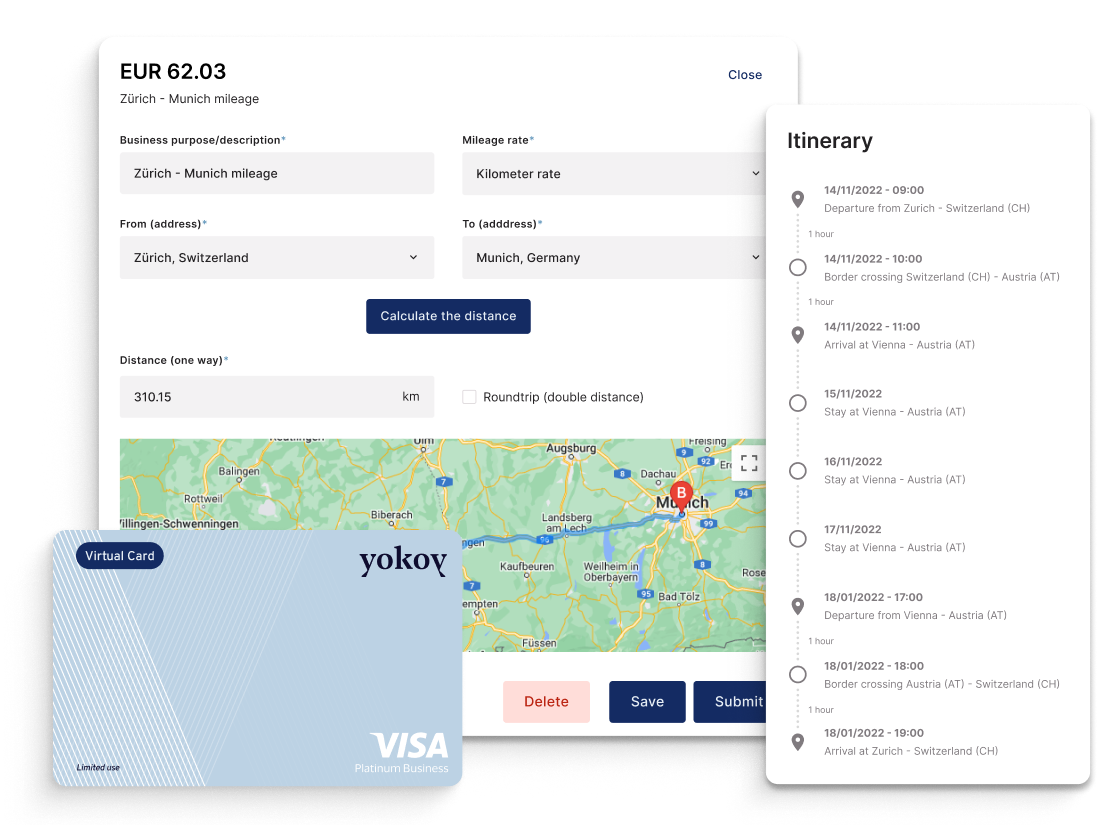

Mileage allowances and per diem rates

Mileage expenses are aimed to cover an employee’s commute cost for business trips when using a private vehicle apart from the daily allowance (Per Diem). In most countries, mileage allowances are flat-rates for all costs incurred for the usage of private car vehicles for a business trip.

For example, companies in Austria must adhere to the government-defined mileage rates. If the company decides to pay more than the government rates, the difference in amount is considered as taxable income and needs to be accounted for as such.

Per Diems are fix amount allowances paid to employees for expenses incurred when travelling (for lodging, meals, and incidental expenses) without the need to have a receipt. Although these can vary per country, in general the reimbursements adhere to government-defined Per Diem rates.

To keep the same example, in Austria, the government defines the permissible limits for meal and lodging reimbursements that come with no tax implications. However, any amounts surpassing these limits are regarded as taxable income and require meticulous tracking.

In numerous countries, such rates are subject to various collective agreements for worker’s unions. Furthermore, company-specific agreements with employees might also influence these rules.

Due to their complex nature, manually performing such calculations to determine the correct allowance or Per Diem based on the trip is not just time-consuming but also highly prone to errors.

Yokoy updates all mileage and Per Diem rates automatically, across countries, ensuring compliant expense management and risk-free audits.

As you can see, AI technology can automate this process, saving a lot of time for your finance team. But this isn’t the only benefit of letting AI take care of your compliance and audit trails.

Benefits of automated audit trails

Implementing automated audit trails in spend management confers numerous benefits to organizations, enhancing their financial operations and regulatory compliance efforts.

Data security and compliance

Automated audit trails offer robust data security measures through access control and authentication mechanisms. They ensure that only authorized individuals can access sensitive information.

By maintaining a comprehensive record of user activity and system activities, audit trails help organizations demonstrate compliance with regulatory requirements.

Fraud prevention

Automated audit trails serve as a defense mechanism against fraudulent activities and financial risks. By recording every step, they create a sequential record of actions taken, making it difficult for unauthorized changes to occur unnoticed. This sequential documentation deters potential fraudsters and supports early detection and resolution of issues.

Blog article

How to Prevent Expense Fraud with AI-Driven Compliance and Custom Workflows

Expense fraud is a pervasive problem that continues to plague companies of all sizes and industries. In fact, a recent survey by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being one of the most common types of fraud.

Lars Mangelsdorf,

Co-founder and CCO

Streamlined operations and efficiency

Automation is a key feature of audit trails. By enabling organizations to automate the tracking of activities, audit trails eliminate the need for manual record-keeping and minimize errors. This functionality enhances the accuracy of financial statements and financial reporting, facilitating quicker and more efficient financial audits.

Enhanced accountability

Automated audit trails promote a culture of accountability by documenting a clear sequence of events and actions taken. This transparency extends to internal controls, providing real-time insights into financial operations.

Each action, such as approving purchase orders or following predefined workflows, is recorded with a timestamp. This real-time tracking enhances transparency, accountability, and decision-making processes.

Risk management

Automated audit trails contribute to a more comprehensive risk management strategy. By tracking all financial transactions and associated activities, organizations can proactively identify potential risks and vulnerabilities. This early detection allows them to implement risk mitigation strategies and safeguards before issues escalate.

Easier regulatory reporting

Meeting regulatory requirements often involves compiling comprehensive reports on financial activities. With automated audit trails, the data needed for financial audits is readily available and organized. This simplifies the process of generating accurate and compliant reports, reducing the administrative burden on finance and compliance teams.

Next steps

In conclusion, automated audit trails bring numerous advantages to organizations, enhancing their financial operations and compliance efforts.

By securely documenting each step and action taken, these trails offer a strong defense against fraud and financial risks. They streamline processes, increase accountability, and contribute to better decision-making.

With automated audit trails, you can proactively manage risks, simplify regulatory reporting, and ultimately ensure a more efficient and transparent financial management process.

If you’d like to see how Yokoy can help you stay compliant and make your spend management process audit-proof, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.