Home / Automated Invoice Processing: How to Get Started and Process Steps

Automated Invoice Processing: How to Get Started and Process Steps

- Last updated:

- Blog

Product Manager

Processing invoices is a complex and at times opaque process. Companies that are not automating these tasks are missing out on a major opportunity to streamline their global finance operations.

What is invoice processing automation all about and how can companies leverage it?

Digitization and automation are becoming ever more prevalent in the corporate world. Not surprisingly, the vast majority of organizations have prioritized a “digital-first” business strategy.

Despite this, many have yet to realise the full benefits of digital adoption with regard to finance processes – particularly the invoice processing space.

Manual invoice processing and monitoring takes a lot of time. But that’s not all – a lack of insight into your company’s financial situation can cause a lot of frustration. For example, if you do not immediately know why an invoice from a supplier has not yet been paid or if you do not know where an invoice is in the approval process.

Overall, companies that are not automating their invoice processing are overlooking a huge opportunity to maximise workflow efficiency, mitigate risk, and ensure greater control across their global finance operations.

But how does invoice management automation work in practice and what are its benefits?

Different approaches to handling invoices

Buying products or services in a company follows the purchase to pay process that covers everything from defining the purchase requirements to issuing the payment. Invoice processing is a key part of this process.

However, to understand the full picture we need to look at the preceding steps, led by procurement. There are generally three approaches that revolve around the question if a purchase order (PO) is used or not.

Procurement without PO

When no PO is used, the finance department processes all quotes directly and they are paid immediately after the delivery of services or products.

PO-based approach

In a PO-based approach, several quotations are first obtained from suppliers. After choosing the right supplier, a supplier’s quote is processed into a purchase order. When the PO is issued, it means that the budget has been released. The supplier can then provide the materials or services and is paid – after completion.

PO and goods receipt

With a PO and goods receipt, there is an additional layer of verification built into the procurement process. During this process, a goods receipt document is signed before the invoice is actually paid.

The purchasing department or people working in the warehouse confirm that they have received the goods. This information is then fed into the ERP. The accounts payable department takes this, and then matches the receipt of the goods with the invoice and PO to release the payment.

Which approach an organization takes depends strongly on the circumstances.

Generally speaking, the bigger the company, the more complex its purchasing process. Not only are different organizational layers involved, they are also dealing with higher budgets.

Therefore, big companies are more likely to resort to purchase orders, if not a combination of POs and goods receipts. This helps them ensure a structured approach, enables them to keep better track of their spending and makes sure that they actually get what they ordered.

While the procurement department is responsible for raising a PO and getting it approved through the business owners, the accounts payable department must process the invoices related to this PO.

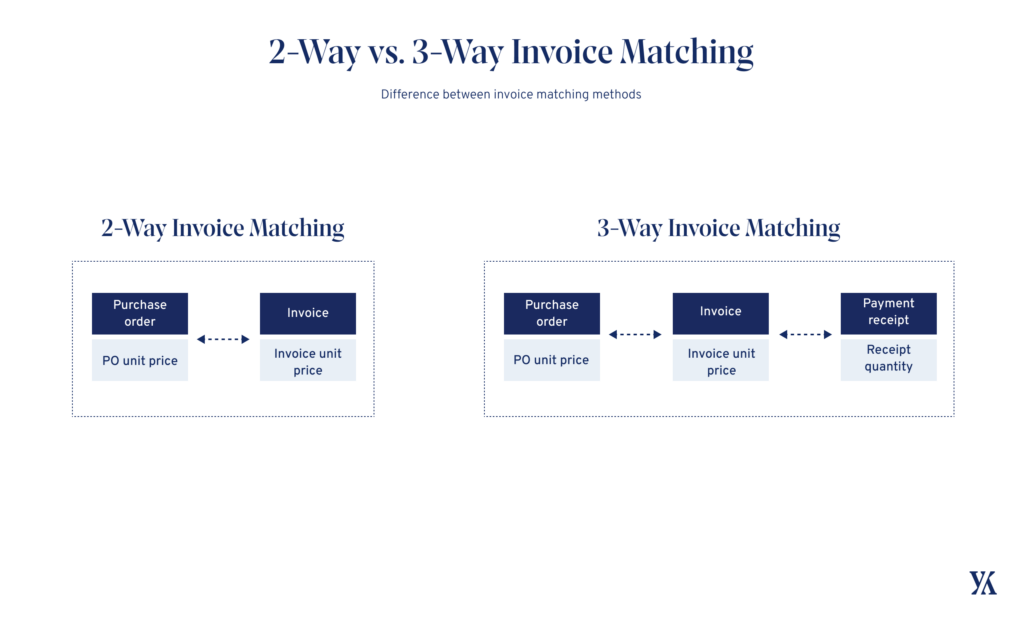

The moment they receive an invoice, it is matched with a purchase order in the ERP system. This is called 2-way matching.

The moment a goods receipt is used, the accounts payable department waits for a signal that the goods or services have been received in good order. After this information coming from the ERP is processed, the invoice is processed. This is called 3-way matching.

Companies that aren’t automating their invoice processing are overlooking the opportunity to maximize workflow efficiency, mitigate risks, and ensure greater control across the global finance operations.

Challenges in invoice processing

Invoices come in, are recorded against the relevant paperwork (purchase order and goods receipt note), approved by the relevant personnel, and then paid – all these steps make manual invoice processing a complex and at times opaque process.

The most common invoice processing challenges that arise are:

- Prone to error: Manual data entry is a labor-intensive task and is prone to human error. Without a robust checking process, inaccurate or duplicated information can find its way into the ERP system, resulting in incorrect payments and discrepancies.

- Poor oversight and traceability: With a fully manual approach, it becomes difficult to track the progress of an invoice and identify bottlenecks in the process. It’s not always clear who is responsible for the invoice, where it is in the process, or what needs to happen to move it forward.

- Inability to scale: As a company grows and processes more invoices, it becomes increasingly difficult to manage the volume manually. This is especially true when companies are working with suppliers around the world and transacting in different currencies. Manual processing can quickly become overwhelming and time-consuming.

- Slow processing times: Manual processing can be slow and time-consuming, which can lead to delays in invoice payments and strained relationships with suppliers. Moreover, this can lead to companies missing on early payment discounts.

Lack of visibility: Manual processing can make it difficult to gain a comprehensive view of the company’s cash flow and financial health. This can make it difficult to make informed decisions about spending and budgeting.

Taking these challenges into account, a manual process can lead to a loss of invoices and other related documents, payments to the wrong accounts, or even duplicate payments.

In addition, the many repetitive and manual operations create a high workload in the finance department. People spend much time handling invoices, while having less time available to check, monitor and analyze financial data of the company.

For example, processing invoices from various sources through different means – such as using one process for paper invoices and a a different approach for electronic invoices – increases error rates and drives down efficiencies. In the end, this impacts a company’s bottom line, as it means that time and money are wasted with inefficient processes.

We’ve detailed this topic in more detail in the article below.

Blog article

Six Main Challenges in Invoice Automation and How to Overcome Them

Accounts payable is often considered overhead and part of the cost of doing business. Consequently, CFOs may not pay much attention to their invoice management process, assuming it will take care of itself. Unfortunately, this assumption couldn’t be further from the truth.

Lars Mangelsdorf,

Co-founder and CCO

What does automated invoice processing look like?

By moving away from time-consuming, manual processes and adopting invoice processing software, companies can standardize their processes for both incoming invoices and approved invoices.

When all invoices run through the same, standardized process, and are received, processed, and stored into the same invoice processing system, finance teams gain full visibility into their AP processes.

An invoice processing solution can streamline all the steps from extracting the information from supplier invoices to feeding the data into your ERP system. This way you always have a clear picture of how far along an invoice is in the process, while also building the basis for timely and accurate payments.

Moreover, automated invoice processing workflows help to eliminate errors and discrepancies, saving the accounts payable team valuable time.

Now, if we look at the typical accounts payable process, a vendor invoice goes through some specific stages. The process typically involves the following steps:

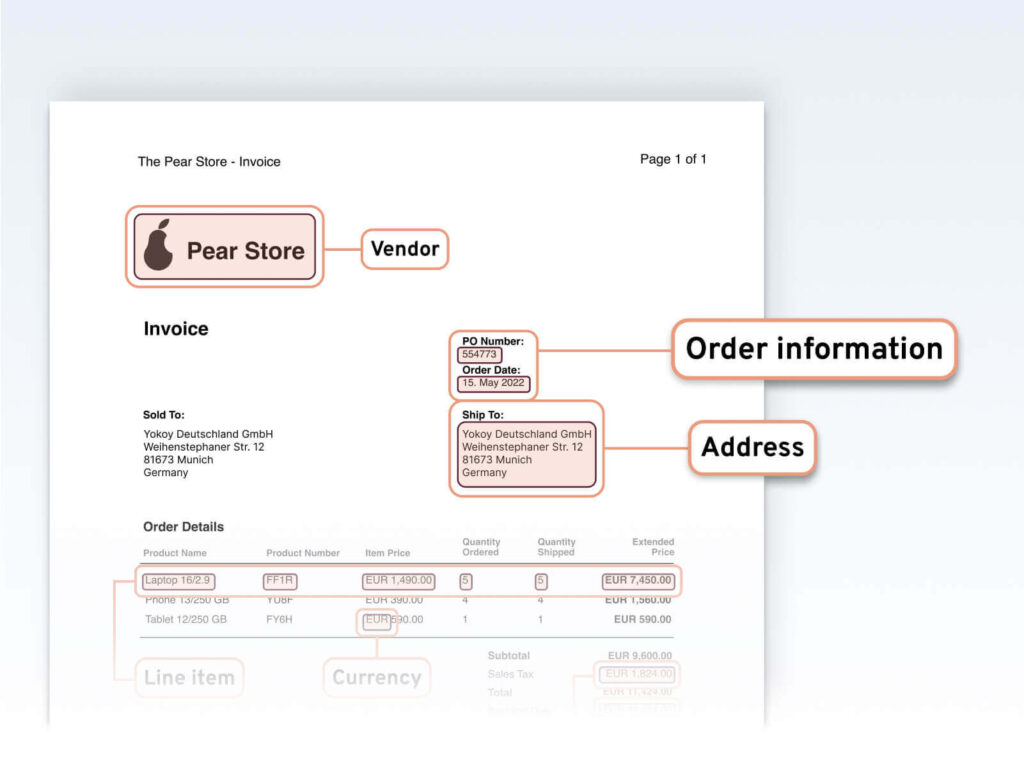

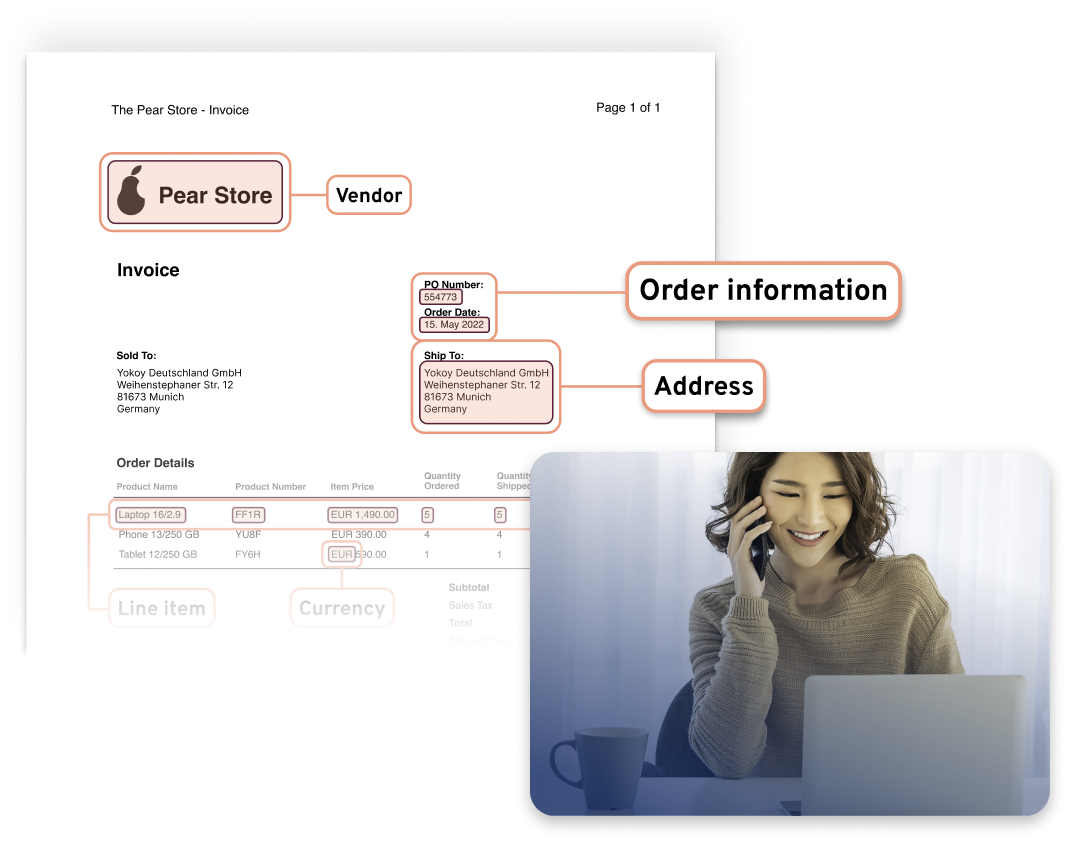

1. Digitizing the invoice

This involves scanning the invoice or capturing its data electronically. The data of the invoice is extracted and recorded, including information such as supplier details, payment terms, and invoice amount. Each item is then read out, and the user assigns the correct general ledger (G/L) account in the system. This step helps to reduce errors and manual data entry.

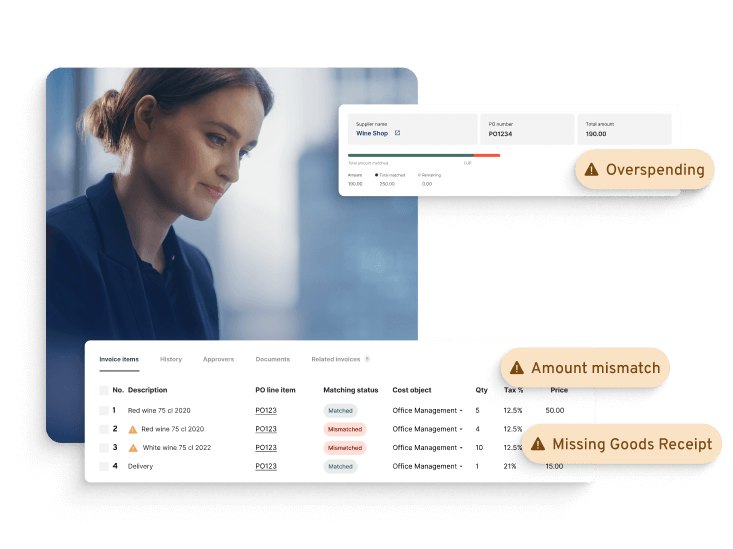

2. Invoice matching

Once the data capture step is done and the invoice is digitized, the automation software takes over and matches the invoice with the corresponding purchase order (PO) and goods receipt, if applicable. The automation system checks whether the details in the invoice match those in the PO and goods receipt, which ensures that the company only pays for what it has received.

The technology behind these steps varies from one vendor to another. For example, most vendors use OCR to capture the data. However, OCR is not capable of reading line items and understanding the logic, so for this type of functionality, AI technology is usually employed.

3. Invoice approval

In this step, the invoice is reviewed and approved based on predefined workflows. For example, the invoice may be approved based on the supplier, costs, services rendered or by issuing a manual approval. Several individual workflows can be set up to cater to different approval scenarios.

4. Export to ERP system

Once the invoice is approved, it is exported to the Enterprise Resource Planning (ERP) system for payment. The ERP system then records the invoice and initiates the payment process.

5. Archiving

After the invoice is paid, it is saved and archived under the appropriate budget, project or vendor. This ensures that all records are kept securely and can be accessed easily in the future for auditing or other purposes.

Overall, automated invoice management can bring many benefits to a company, including improved efficiency, reduced errors, better control over finances, and improved cash flow management. By automating this process, businesses can focus on other important tasks and increase their overall productivity.

How can Yokoy help with invoice automation?

At Yokoy, we specialize in helping midsize and large companies in achieving complete automation of their spend management processes, including invoice processing workflows. Our invoice automation module is built on the following core principles:

Streamlined invoice data extraction

Through automated processes, we eliminate the potential for errors and mitigate the risks associated with manual data entry. By extracting invoice data accurately and efficiently, we ensure the integrity of financial information.

AI-powered invoice processing

Our system employs cutting-edge artificial intelligence technology to guarantee that all invoices are promptly processed and paid. By leveraging AI capabilities, we enhance efficiency and accuracy while minimizing delays and bottlenecks.

Yokoy ensures seamless and automated invoice processing. Leveraging sophisticated AI models, our solution captures all the information from your invoices and matches them with POs as well as goods receipts.

Custom workflows and approval flows

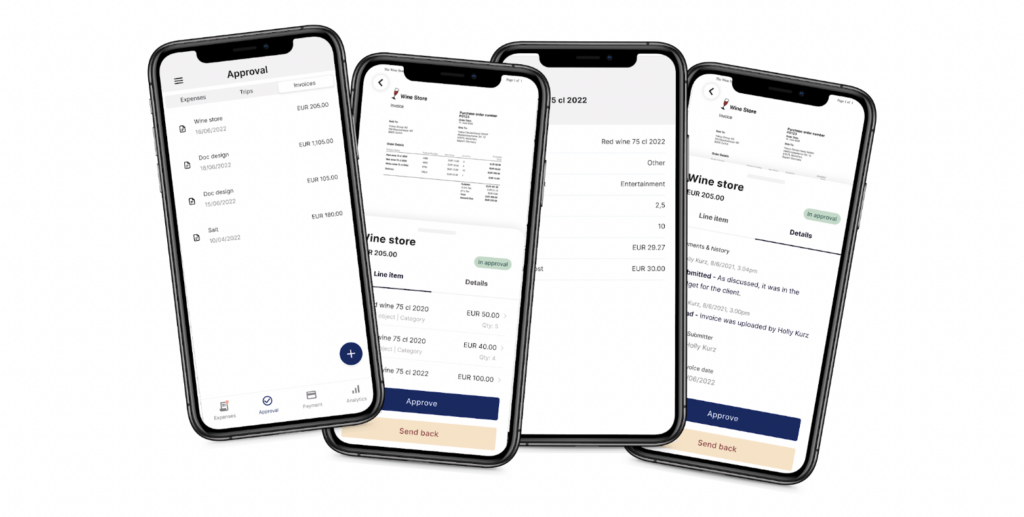

Our software allows you to map out the entire invoice approval flow and define how exceptions should be handled. Thus, you can monitor the status of each and every invoice in real-time and reach exactly the level of automation that you envision.

Real-time data visibility

Our solution offers real-time data access and visibility to various stakeholders within the organization, including requesters, approvers, and the finance team. This enables transparency and facilitates informed decision-making throughout the invoice management process.

User-friendly design

With a focus on usability, our software provides a seamless experience across devices, enabling users to effortlessly enter, review, and approve invoices even while on the move. We prioritize intuitive interfaces that enhance productivity and convenience.

Integration with major ERP systems and flexible API

We ensure seamless integration with leading enterprise resource planning (ERP) systems, allowing for seamless data flow and synchronization. Additionally, our open application programming interface (API) facilitates custom integrations with other software solutions as per specific business requirements.

By digitizing and automating the invoice management process, Yokoy delivers several key benefits:

- Accelerated time to payment: Our solution minimizes processing time, enabling invoices to be paid faster. This ensures improved cash flow management for businesses and fosters stronger supplier relationships.

- Reduced risk of errors and mistakes: By automating data extraction and leveraging AI-powered processing, we significantly diminish the likelihood of human errors, thereby enhancing accuracy and compliance.

- Lower cost of invoice processing: Our streamlined approach eliminates manual intervention and reduces the need for extensive administrative efforts, leading to substantial cost savings for organizations.

Next steps

At Yokoy, we are dedicated to addressing the challenges associated with invoice management, providing a comprehensive software solution that optimizes efficiency, accuracy, and cost-effectiveness. If you’d like to see our invoice automation module in action, you can book a demo below.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.