Home / How to Use Invoice Matching Technology to Improve Your Process Efficiency

How to Use Invoice Matching Technology to Improve Your Process Efficiency

- Last updated:

- Blog

Product Manager

The manual matching of invoices with purchase orders and goods receipts is time-consuming and error-prone, and can lead to discrepancies in inventory and financial records.

To address these issues, most businesses use automated methods of invoice matching, including 2-way, 3-way, and 4-way matching.

In this article, we will explore these different invoice matching methods, the pain points associated with them, and we’ll show you the automated invoice matching can help you overcome these challenges.

2-way matching vs. 3-way matching vs. 4-way matching: What is the difference?

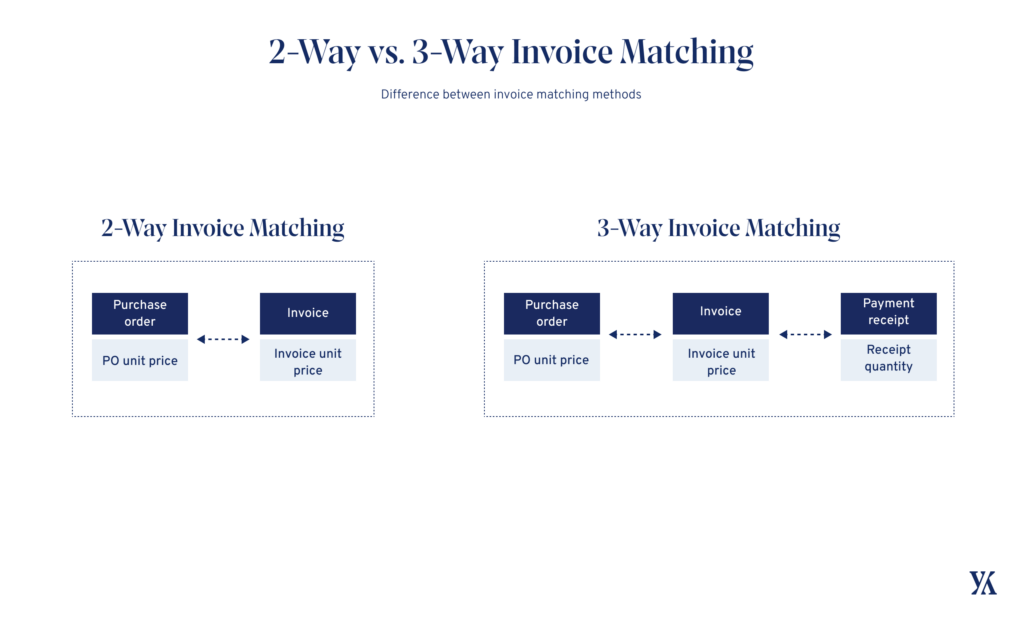

The term “2-way match” refers to a process in which only the match between an invoice and purchase order is considered. However, this approach assumes that the received goods always match the order in terms of quantity and quality.

In contrast, the “3-way match” method not only verifies the invoice against the order but also considers the goods receipt. This approach reduces the likelihood of incorrectly approving invoices and prevents discrepancies between physical and accounting stock.

Next to these two methods, we also have 4-way matching, which introduces an additional step of matching the invoice with the inspection report. The inspection report is typically created when the delivered goods are received, and it verifies that the items meet the quality standards specified in the purchase order.

By including the inspection report in the matching process, a 4-way match helps to prevent invoicing errors, reduce the risk of fraud, and improve the accuracy of financial records.

When using the 2-way match method, for example, it is possible to book goods for accounting purposes based on the invoice, even if they never arrived and are not actually in stock. And with 3-way invoice matching, it’s possible for the goods to be in stock, but to not meet the expected quality criteria.

So although the four-way matching can be more time-consuming than a two-way match or a three-way match, it does provides an extra layer of security and ensures that businesses receive the goods they pay for at the quality level they expect.

Of course, when an automation solution is chosen, the process goes much faster. But before we show you how Yokoy’s invoice automation software works, let’s look at the criteria companies should consider when deciding what matching method to use.

Blog article

What Is Spend Management? Fundamentals and How It Works

In today’s competitive market, companies that can effectively manage their spending are better positioned to grow and remain profitable.

Lars Mangelsdorf,

CCO at Yokoy

How to decide what invoice matching method to use

Company size

As you can imagine, in a small company, matching documents by hand might work. But at scale, in AP teams that deal with hundreds and thousands of invoices per month, manual matching is not sustainable.

The process is prone to errors and requires too much time and effort from the accounts payable department – time that could be better used in other areas of the business that add more value. Thus, an automated system is a must.

So here are some general considerations for choosing the invoice matching method to use.

Typically, small and local midsize businesses use paper or PDF invoices, and header-level data is used for account coding. Purchase order usage is low, and two-way matching is common if POs are used.

In low-regulation countries, compliance with country-specific regulations is not a major concern, and non-real-time integrations with accounting systems are acceptable.

In such companies, AP automation is beneficial, but finance teams can manage with a mix of manual and digital processes. Thus, although invoice matching software is beneficial, smaller companies can manage without it.

However, midsize and large companies have different needs, with legal and compliance aspects being a priority. Account coding is moving towards the invoice line level, and PO usage is increasing.

As such, two-way matching, especially a manual process, is no longer sufficient for the AP department. These companies require improved supplier collaboration, invoice inquiry support, and integration with multiple backend systems, particularly those growing through acquisition.

For these organizations, automated invoice processing is preferred – ideally, 3-way matching. The data capture process is often the most pressing need for fast-growing organizations as vendor invoice volume outgrows AP staffing.

And if we look at global enterprises, requirements are even more complex. Legal compliance support is needed for multiple countries, and complex account coding and PO-matching rules are necessary.

Three-way, four-way and/or n-way matching may be a better option, and multiple language support and formats of electronic invoices must be provided. Real-time integration support is common, and advanced capabilities such as artificial intelligence, real-time auditing, and APIs are often used.

Purchase and invoice complexity

However, it’s worth mentioning that even in midsize and large enterprises, not every purchase requires three-way matching.

For example, if a business frequently orders a product or service and the invoice details are known and consistent – as happens, for example, with recurring purchases like software subscriptions, a 2-way match may suffice to prevent matching errors.

For one-time purchases of significant value, though, a tighter invoice approval process is recommended. This is because the cost may not be as familiar, and it is important to ensure that all three documents align to avoid any discrepancies. Vigilance is necessary to catch errors, and using a 3-way matching approach can help achieve this goal.

Then, we have to consider the complexity of invoices and invoice data. For example, simple invoices with a few line items, no deductions and no anomalies, can be easily and fully automated, and depending on the goods purchased, 2-way matching may be enough.

For more complex ones where the number of line items varies, there is incomplete or inconsistent information, and there are also deductions and anomalies, 2-way matching is not the best solution, and manual work should be replaced by process automation and AI.

How does the manual invoice matching work?

Now that the differences between the matching methods are clear, let’s look at the typical steps in a manual three-way invoice matching process, to understand what gets automated and what not.

As mentioned, in three-way matching, the invoice is compared to both the purchase order and the goods receipt to ensure that all three documents match, before the invoice is paid.

In a manual matching process, the AP team would have to check all these documents:

The purchase order (PO) issued by the buyer to the supplier, outlining the goods or services to be purchased, the quantity, the agreed price, and the delivery date.

The goods receipt (GR) issued by the buyer to confirm that the goods or services have been received and that they match the details on the purchase order. The GR includes details such as the date of receipt, the quantity received, and any discrepancies or damages.

The invoice issued by the supplier to request payment for the goods or services delivered. The invoice includes line items with details such as the item description, quantity, price, and payment terms.

If this process is done manually, any discrepancies must be investigated and resolved before the invoice can be processed for payment. Once the invoice has been verified and approved, the payment can be processed.

By matching all three documents, three-way matching helps ensure that invoices are accurate, that suppliers are paid for goods or services delivered, and that fraud and errors are minimized.

The matching of invoices and POs is only one step in the invoice automation process, but it’s a time-consuming one. Thus, automating this part of the process can have a significant impact on the bottom line, especially if your procurement and AP departments are dealing with large volumes of invoices and POs.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

Challenges in a manual invoice matching process

Manual invoice matching can present a number of challenges for businesses, including an increased number of errors due to the large amount of data that needs to be processed, or to discrepancies between receipts, invoices, and corresponding purchase orders.

The process is labor-intensive and time-consuming, as it requires personnel to manually check each invoice against purchase orders and receipts. This can be a drain on resources and can lead to delays in processing payments, impacting cash flow.

Moreover, in a manual setup, it can be difficult to gain full visibility into the entire purchase-to-pay process. This can make it difficult for the AP team to identify areas where processes can be improved or identify potential fraud or errors.

And last, we have the issues of mismatches, overpayments, and fraudulent invoices. Mismatches can occur due to a variety of reasons, such as errors caused by fluctuating international currency exchange rates, incorrect data entry, or unanticipated shipping costs being added.

Blog article

Invoice Capture Solutions: From Manual Processing to OCR and AI Technology

Unlock the power of invoice capture methods in finance, transitioning from manual processing to advanced Invoice OCR and AI technology.

Andreea Macoveiciuc,

Growth Marketing Manager

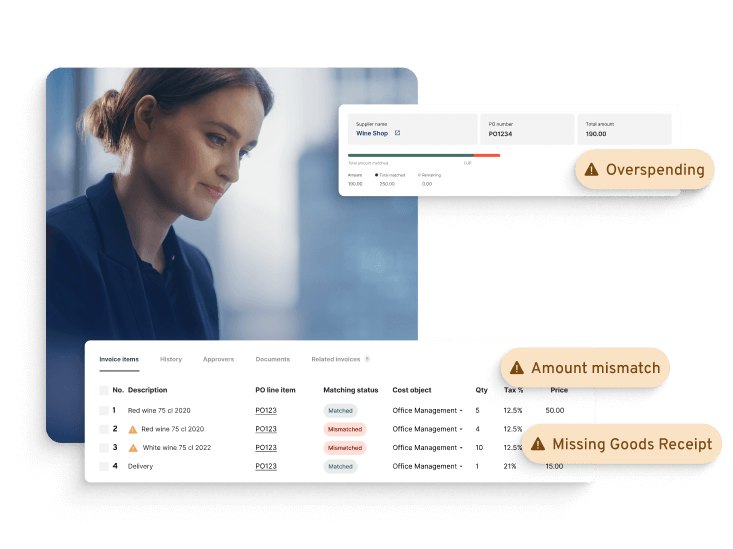

The most frequent types of deviations include discrepancies in the number of items on the invoice compared to those on the purchase order or sales receipt, and inconsistencies between the invoice price and the purchase order price.

These errors can lead to overpayment for goods or services. For example, if the quantity or price of the received goods is incorrect, the invoice may be paid in full without the discrepancy being noticed.

By contrast, automating the matching process through AP software solutions can reduce errors, increase efficiency, and save money by preventing overpayments.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

How invoice matching technology improves efficiency

The challenges mentioned can be effectively addressed through the implementation of invoice matching technology. By incorporating automated invoice matching processes, organizations can streamline operations and enhance operational efficiency.

Enhanced accuracy and error reduction

One of the primary challenges in manual invoice matching is the increased risk of human errors due to the sheer volume of data involved.

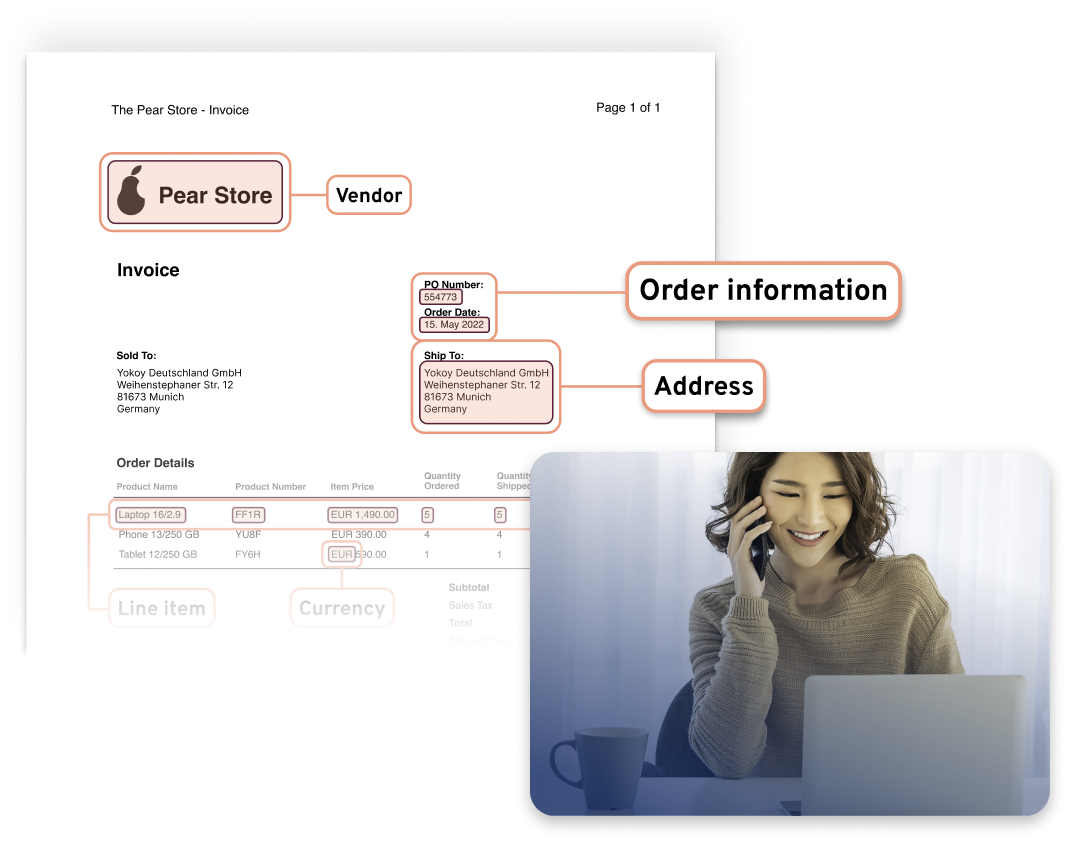

Invoice matching technology uses advanced AI algorithms and machine learning capabilities to accurately match invoices with purchase orders and receipts.

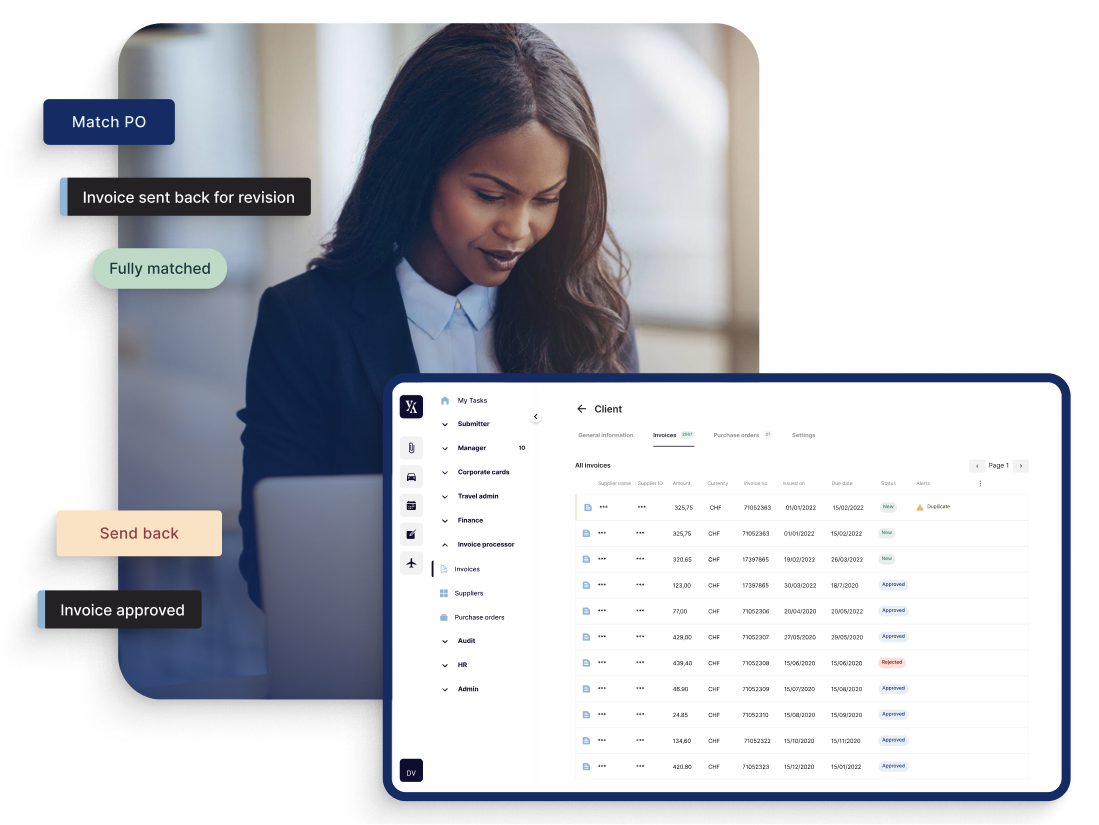

For example, with Yokoy’s invoice module, the entire data capture, validation, and matching is done by AI, and most of the process is automated, leading to a significant decrease in errors and improvement in speed.

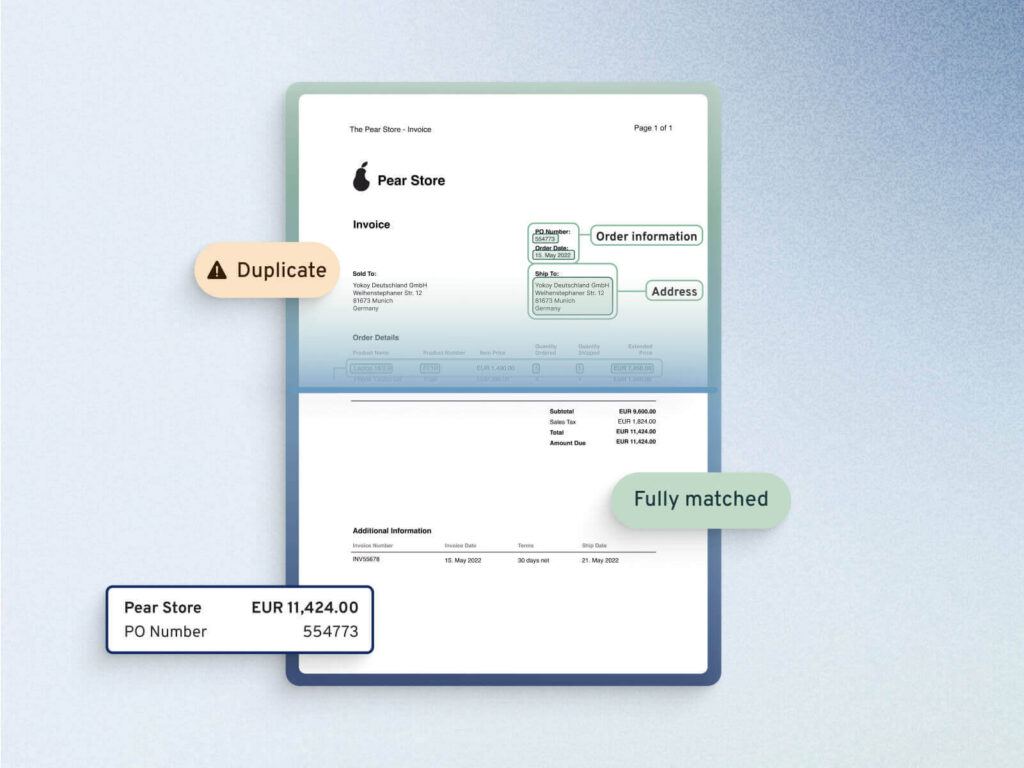

Duplicate invoices are automatically detected, so that Finance teams can quickly act on the invoices that need their attention.

Thus, by automating the process with artificial intelligence, businesses can significantly reduce errors caused by human data entry mistakes, duplicate invoices, or discrepancies in pricing and quantities.

Increased efficiency and time savings

Manual invoice matching is a labor-intensive task that consumes valuable time and resources. Technology-driven automation speeds up the matching process, enabling faster invoice processing and approval cycles.

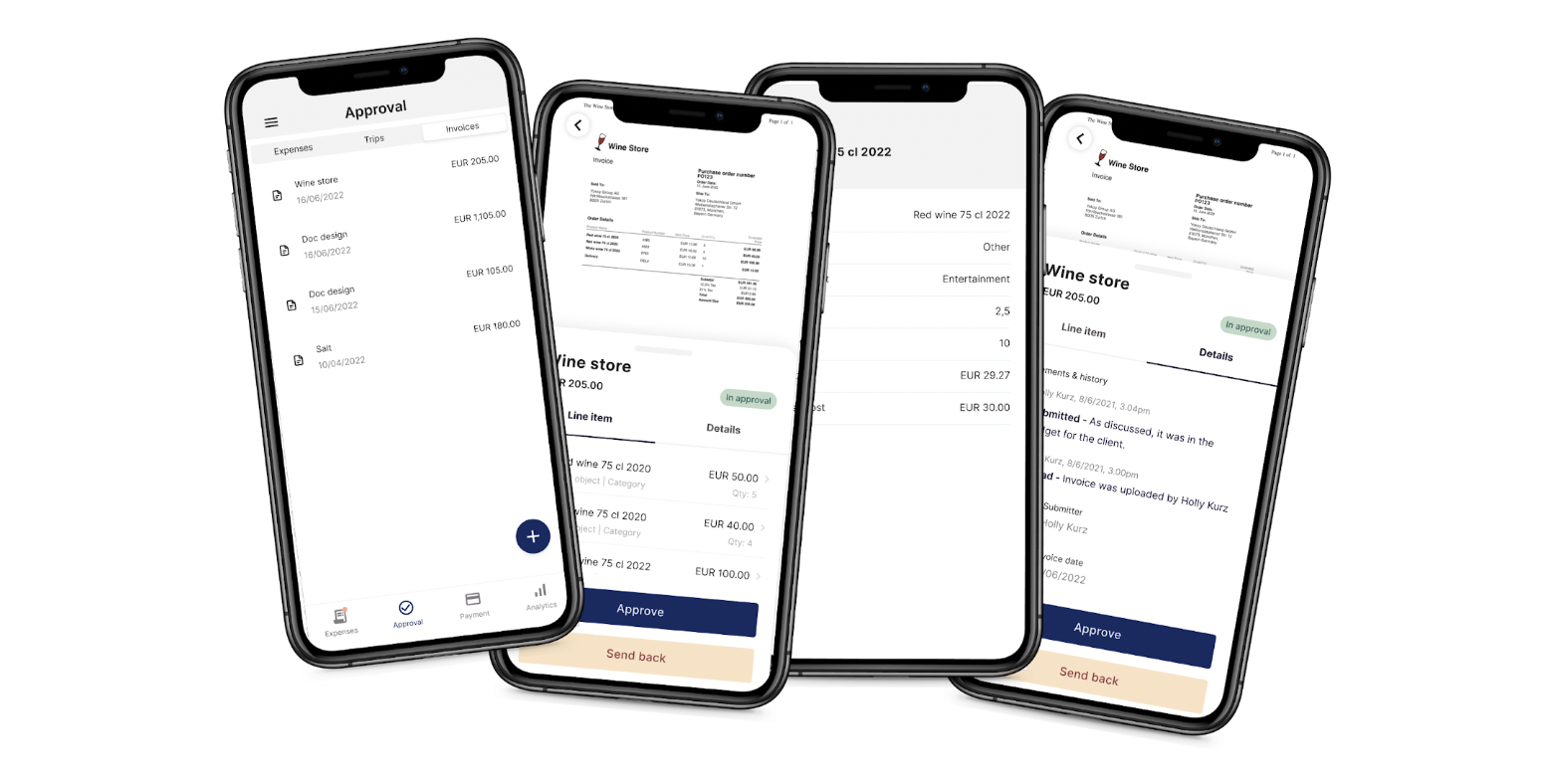

For example, with Yokoy, companies can implement approval flows for specific suppliers, cost centres, or route invoices to line managers for certain amounts.

By automating routine invoice management tasks, such as data extraction and comparison, employees can focus on value-added activities. This efficiency leads to time savings, accelerates cash flow, and improves vendor relationships.

Moreover, for added convenience, invoices can be managed both on mobile and desktop, the user experience being seamless across devices.

Improved visibility and control

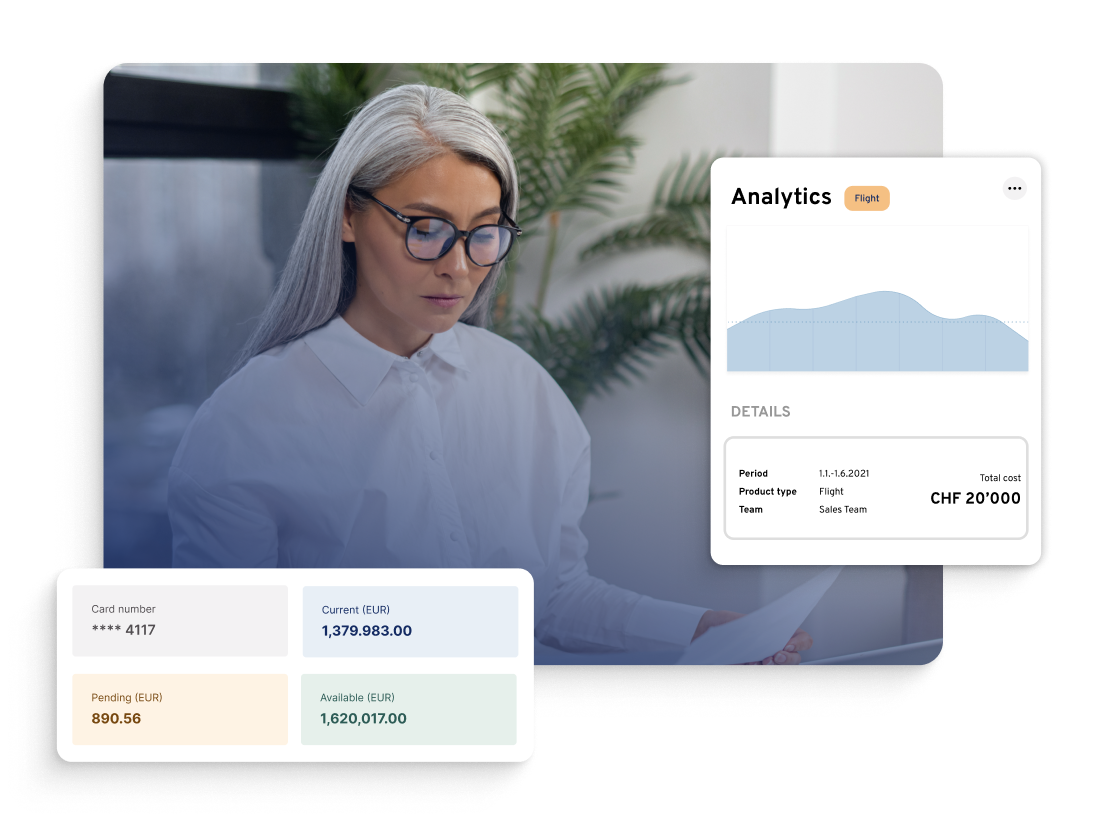

Lack of visibility into the invoice matching process can hinder effective financial management. Invoice matching technology provides real-time visibility into the status of invoices, enabling businesses to track and monitor the entire process.

This visibility helps identify bottlenecks, delays, or potential errors, allowing for prompt resolution. With increased control over accounts payable, businesses can optimize cash flow, improve forecasting, and make informed financial decisions.

For example, Yokoy’s analytics module provides real-time data, so AP departments can easily pull reports to see which supplier invoices are stuck in approval processes, and invoice payments are delayed.

Fraud detection and prevention

Invoice fraud is a significant concern for businesses, with potentially severe financial implications. Manual processes make it challenging to detect fraudulent invoices or suspicious activities.

With automated invoice matching technology, companies benefit from sophisticated algorithms that can identify anomalies, duplicate invoices, or unauthorized changes in real time. For example, Yokoy’s invoice processing AI detects policy breaches as they happen, ensuring compliance with internal policies and external regulations.

By flagging such discrepancies, businesses can prevent fraud, mitigate financial losses, and ensure compliance with internal controls and regulatory requirements.

Cost reduction and resource optimization

Manual processes involve substantial administrative costs, including labor, paper, and storage. By automating invoice matching, businesses can significantly reduce costs associated with manual data entry, printing, and physical storage.

Additionally, the streamlined process improves resource allocation by eliminating redundant tasks, enabling organizations to allocate human resources to more strategic activities.

Opinion

The ROI of Finance Transformation

Learn how to calculate, communicate, and maximize your returns when undergoing a digital transformation project.

Stephan Hebenstreit,

Managing Director Austria, Yokoy

Scalability and adaptability

As businesses grow and transaction volumes increase, manual processes may struggle to handle the workload effectively. Invoice matching technology offers scalability, effortlessly managing higher invoice volumes without compromising accuracy or efficiency, and without increasing employee headcount.

Moreover, modern invoice automation solutions such as Yokoy can integrate with existing enterprise resource planning (ERP) systems, allowing for seamless end-to-end processes.

Next steps

In conclusion, the manual matching of invoices with purchase orders and goods receipts poses significant challenges, including time consumption and the potential for errors that can lead to inventory and financial discrepancies. To overcome these challenges, businesses have turned to automated invoice matching methods, such as 2-way, 3-way, and 4-way matching.

When deciding on the appropriate matching method, companies should consider various criteria, including the need for accuracy, fraud prevention, and the level of control over inventory and financial records.

By selecting the right matching method and leveraging automation tools, businesses can streamline their operations, minimize errors, and optimize financial management.

Automation solutions, such as Yokoy’s invoice automation software, can significantly expedite the matching process, improving the efficiency of AP departments. If you’d like to see it in action, you can book a demo below.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.