Home / How to Automate Your Invoice Approval Workflows with Yokoy

How to Automate Your Invoice Approval Workflows with Yokoy

- Last updated:

- Blog

Product Manager, Yokoy

Even in today’s tech-savvy world, some companies are still adhering to paper-based processes when it comes to handling and approving invoices. We’re talking about stacks of paper invoices being sent off to remote teams who manually scan and type the invoice data into old-fashioned software.

Imagine receiving the supplier invoices in paper or electronic format, then having to digitize the data to make it more structured, and to manually check for duplicates before finally entering all that information into the invoice management system.

These time-consuming steps are not only prone to human error, but they can easily create unnecessary bottlenecks in the business processes handled by finance teams, leading to late payments, extra costs due to delays, and poor supplier relationships.

In this article, we’ll take a closer look at the implications of manual invoice management and explore the benefits of automation software.

What is an invoice approval workflow?

An invoice approval workflow is a structured approach to review, authorize, and manage incoming invoices from suppliers or vendors.

Workflows ensure that invoices are accurately verified, compliant with company policies and regulations, and approved for payment in a controlled and transparent manner. By streamlining their invoice approval workflows, businesses can prevent errors and duplicate payments, reduce fraud risks, maintain financial accuracy, and foster good vendor relationships.

The steps and components of an invoice approval workflow can vary based on the organization’s size, industry, and specific requirements, but there are some common steps that an invoice goes through before payment.

In the next section, we’ll delve into the typical steps that constitute a robust invoice approval workflow.

Typical steps in an invoice approval workflow

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. From initial verification to payment processing, each step plays a crucial role in safeguarding the financial integrity of the organization while maintaining positive vendor relationships.

Receipt of invoice

The process begins when the company receives an invoice from a vendor or supplier for goods or services provided. The format of the invoice might differ based on the approach taken for the accounts payable process and the extent of AP automation applied.

Invoice verification

The invoice is thoroughly reviewed to ensure accuracy and completeness. This includes checking for correct invoice number, pricing, quantity, and description of goods or services, as well as confirming that the invoice matches the terms of the original purchase order or contract.

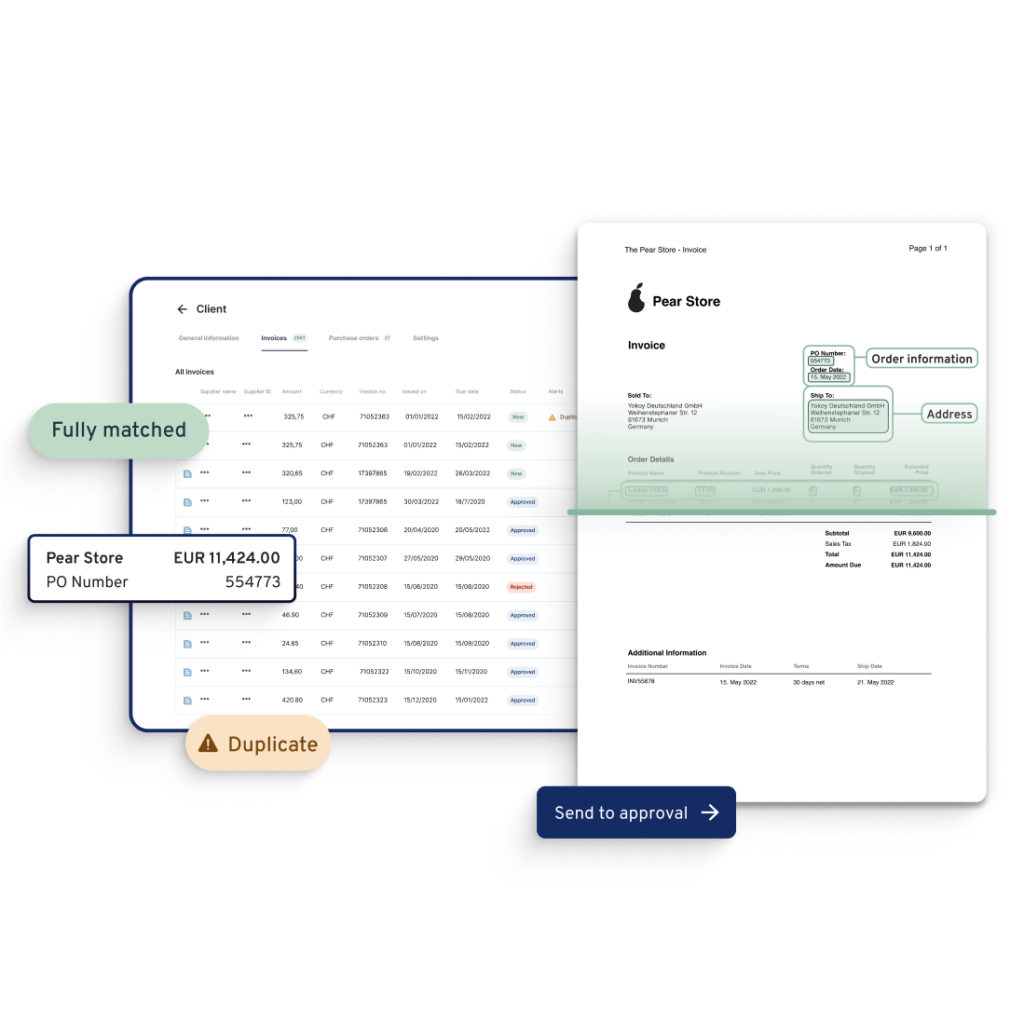

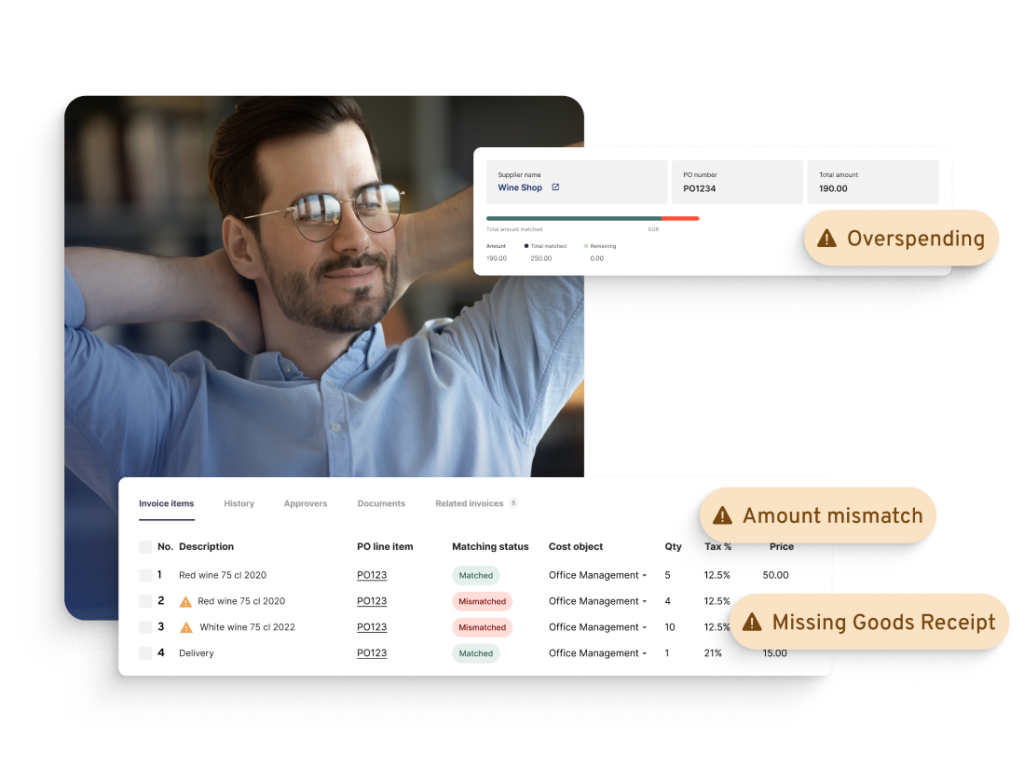

Matching and three-way matching

If applicable, a two, three, or four-way invoice match is performed. This involves comparing the invoice against the corresponding purchase order and receiving report. The three documents should align in terms of quantities, invoice amount, and items received.

This step ensures there’s no missing information and helps prevent fraudulent or erroneous invoice payments from being processed.

Blog article

How to Use Invoice Matching Technology to Improve Your Process Efficiency

See how invoice matching technology automates the 2- and 3-way matching of supplier invoices with POs and goods receipts, for an efficient AP process.

Mauro Spadaro,

Product Manager

Exception handling

If any discrepancies or exceptions are found during the verification process, these issues are addressed. Exceptions could include discrepancies in quantities, pricing, or incorrect items received.

An internal process is established to resolve these exceptions, which may involve communication with the vendor or relevant departments.

Approval routing

Once the invoice is verified and exceptions are resolved, it is routed for approval. The approval process can involve multiple levels of authorization based on the company’s hierarchy and policies. Approvers could include department managers, project managers, or the AP team.

Approval workflow

The invoice is sent through an approval workflow. This could be a manual process involving physical signatures or an automated workflow system that routes the invoice electronically to the appropriate approvers based on predefined rules. This can include cross-functional approvals involving not only the finance department, but other teams too.

Approvers review

Approvers review the invoice to ensure that it complies with company policies and budget allocations. They may also review any relevant documentation, such as contracts or agreements, to verify the accuracy of the invoice.

Approval decision

In some cases, approvers may request additional documentation or clarification before granting approval. Once all required approvals are obtained, the invoice is marked as fully approved and ready for payment.

Payment processing

After approval, the invoice enters the payment processing phase. Depending on the company’s payment terms and processes, payment could be initiated through check issuance, electronic funds transfer (EFT), or other payment methods.

Payment reconciliation

After the payment is made, the finance or accounts payable team reconciles the payment with the invoice. This step ensures that the correct amount was paid and helps maintain accurate financial records.

Archiving and record keeping

The approved invoice and all relevant documentation are archived for record keeping and auditing purposes. This helps maintain a transparent and traceable history of financial transactions.

It’s important to note that the specific steps and processes may vary based on the company’s size, industry, and internal policies. Some organizations might have more complex approval workflows, while others might have more streamlined processes.

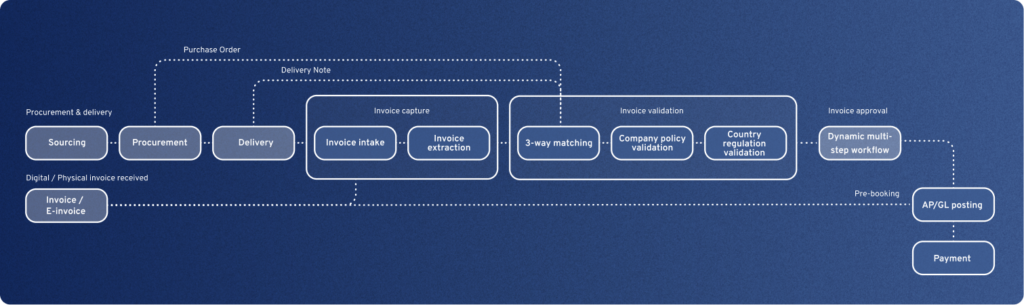

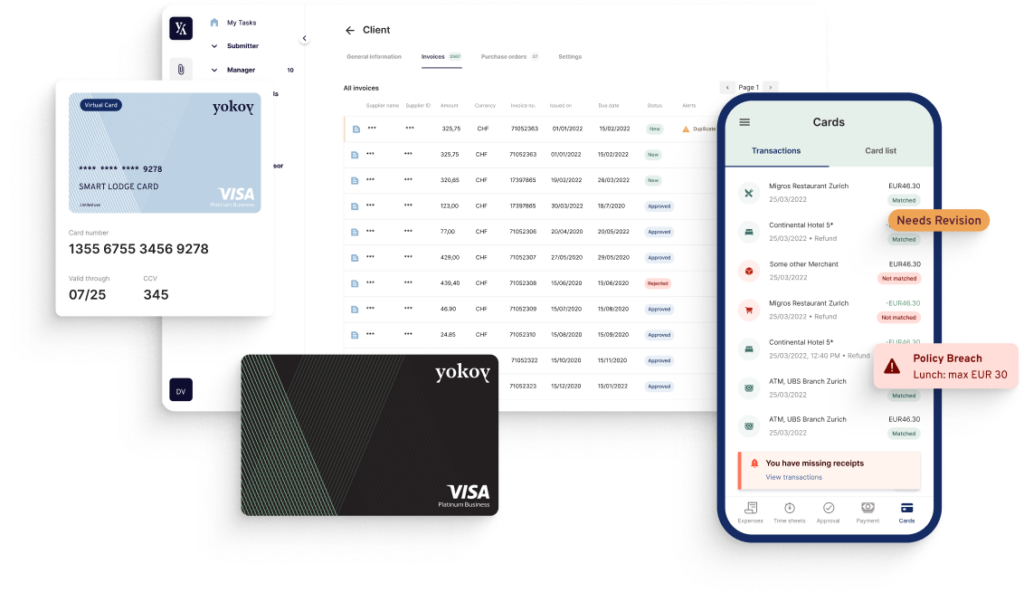

Invoice management software like Yokoy can significantly expedite and streamline these steps. Yokoy uses AI-powered automation to handle all the steps from invoice capture and matching to supplier and PO, to coding each line item (category, cost object, VAT, etc) and invoice approval through automated workflows.

Through integrations with ERP systems, Yokoy automates the posting step as well, ensuring true end-to-end invoice management automation.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

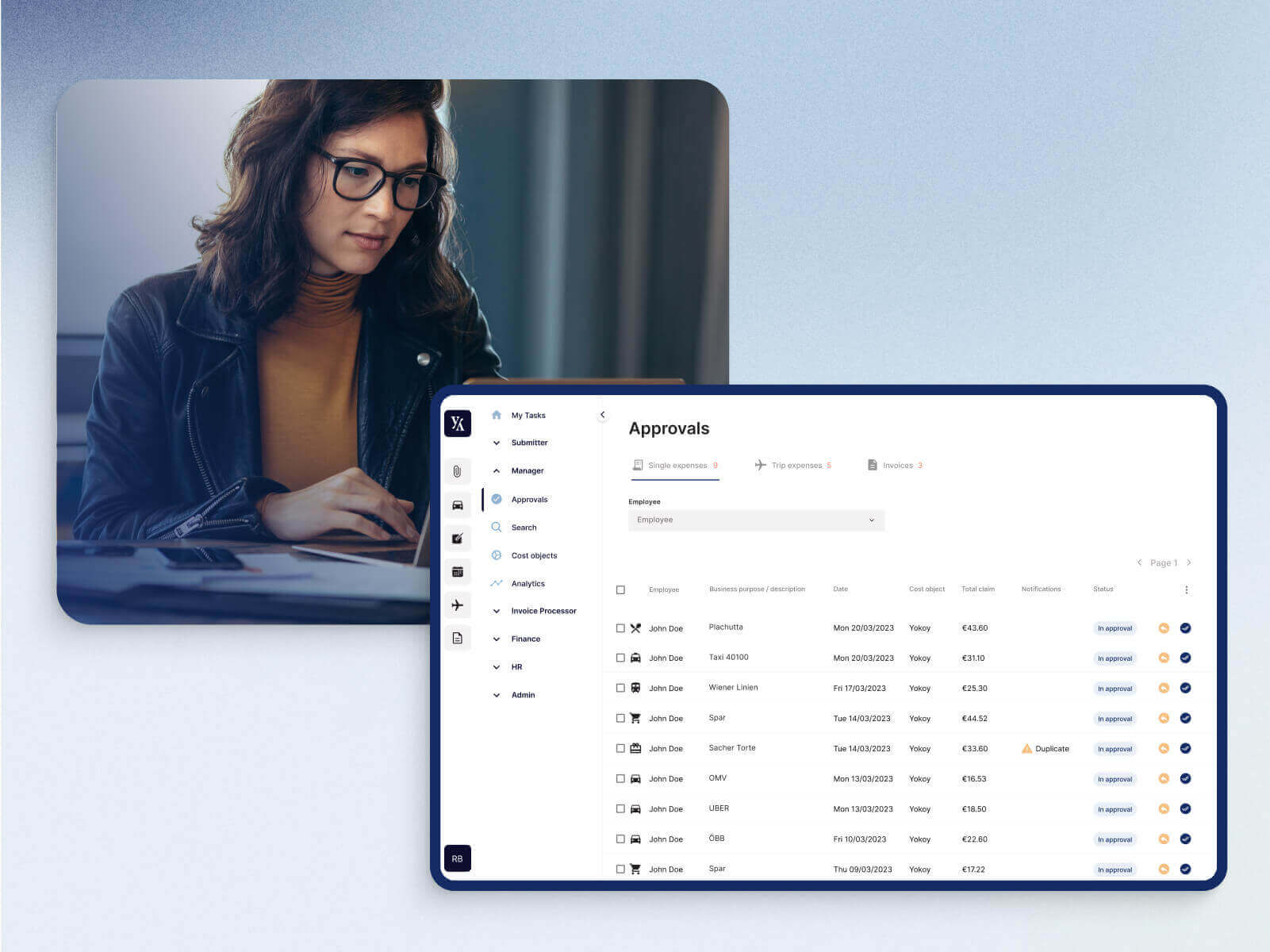

Types of invoice approval workflows in Yokoy

The most common types of invoice approval flows in Yokoy are cost object-based, line manager-based, and supplier-based workflows.

Supplier-based workflows

In this type of workflow, a customer can choose to assign a default supplier approver when an invoice is submitted. If no approver is assigned, the invoice is forwarded automatically to the reviewer.

Cost object-based workflows

In this type of workflow, Yokoy’s AI reads the submitted invoice and extracts all cost object data, assigning all cost object owners and their delegates automatically. Cost object owners have to approve the invoices in order for the process to continue. If the limit of the cost object is exceeded, the invoice can be escalated to the parent cost center.

Line manager-based workflow

In this case, the submitted invoice is automatically assigned to the line manager of the submitter. If there are auto-approval thresholds, everything up to those limits gets auto approved.

No approval flows

Yokoy makes it possible to approve invoices directly, without additional checks, in cases where only a finance review is required.

Although Yokoy customers can also opt for mixed approval flows that combine, for instance, cost object approvals with supplier based workflows, such automation workflows are less common. The workflows are set up in the technical phase of the implementation project, and are based on the mapping of the AP process that precedes the implementation kick-off.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Example: Cost object and supplier-based workflows

Let’s consider the scenario of setting up a workflow based on both the cost object and the supplier. The objective is to have an invoice approved by its respective cost object owners and an additional approver chosen based on the supplier.

In Yokoy, you can create a personalized workflow that incorporates both of these criteria. Here’s how the process unfolds:

The initial cost-object approval workflow is executed.

Upon completion of the first workflow, Yokoy assesses the need for supplementary approvers and includes them in the invoice approval process.

As a user of the Invoice module, it’s crucial to be able to track the progress of your submitted invoices and identify the next approver in line. This information can be accessed through the dedicated “Approvers” tab within the specific Invoice you’re interested in.

By clicking on an invoice, you’ll be able to view the upcoming approvers in the established approval flow. This feature grants you insights into who will review your invoice next, once you’ve entered all necessary details.

Furthermore, when configuring the approval workflow in Yokoy, there’s an option to request the system to send a summary email to the manager of the approver (or a designated user) outlining the approved details. This functionality enhances communication and record-keeping.

If you’re interested in a particular scenario, you can book a demo with our team below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

How can automation optimize the invoice approval workflow?

Automation can optimize the invoice approval workflow in several ways:

- Efficiency and speed: Automated invoice management systems can swiftly process invoices, eliminating the need for manual data entry and routing. This reduces processing times, allowing invoices to move through the approval pipeline faster, resulting in timely payments and improved cash flow.

- Reduced errors: Manual data entry is prone to errors, such as typos or incorrect figures. Automation ensures accurate data capture, reducing the risk of discrepancies, payment errors, and the need for time-consuming corrections.

- Workflow standardization: Automated workflows enforce consistent approval processes, ensuring that every invoice follows the same path and complies with company policies. This minimizes confusion and ensures adherence to regulatory requirements.

- Transparency and visibility: Automated systems provide real-time visibility into the invoice approval process. Stakeholders can track the progress of invoices, identify bottlenecks, and make informed decisions, enhancing transparency and accountability.

- Audit trail: Automation creates an electronic audit trail of all invoice-related activities, including approvals, rejections, and modifications. This traceability is invaluable for compliance, internal audits, and dispute resolution.

- Notification and alerts: Automated systems can send notifications and alerts to relevant parties when an invoice requires attention or approval. This reduces delays and ensures timely actions, preventing invoices from getting lost or overlooked in email chains.

- Data analytics: Automation generates data insights, offering valuable analytics on invoice processing trends, approval times, and performance metrics. This data can be used to identify areas for improvement and optimize processes further.

- Fraud prevention: Manual invoice processing exposes businesses to the risk of fraudulent activities and duplicate payments. In paper-based or email-driven workflows without robust validation mechanisms, it’s easier for unauthorized parties to manipulate or generate false invoices, leading to duplicate payments and financial losses. Automation can include built-in fraud detection algorithms and validation checks, reducing the risk of fraudulent or duplicate invoices slipping through the approval process.

- Reduce time to payment: Manual approval processes often introduce delays due to routing invoices through various departments and obtaining physical signatures. Automation reduces processing times, enabling companies to take advantage of early payment discounts, and maintain healthy supplier relationships.

In summary, automation optimizes the invoice approval workflow by enhancing efficiency, accuracy, transparency, and compliance. It empowers organizations to manage their accounts payable processes more effectively, leading to improved financial management and operational excellence.

Next steps

In a manual invoice approval process, a significant amount of time is consumed by tasks such as reviewing paper documents, forwarding invoices through email chains, obtaining physical signatures, and manually tracking the progress of approvals.

As a result, the efficiency of the entire process is compromised, leading to delays in payments, strained supplier relationships, and increased operational costs. Transitioning to an automated invoice approval workflow can drastically streamline the process, reduce approval times and enhancing accuracy through automated validation.

By implementing an invoice automation solution like Yokoy, companies gain real-time visibility into their invoice approval pipelines. This transparency allows for better coordination among teams, timely updates for stakeholders, and the ability to address bottlenecks promptly, ultimately fostering a more efficient and informed accounts payable process.

To see how Yokoy can automate your invoice management workflows, book a demo below.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Simplify your invoice management

Related content

If you enjoyed this article, you might find the resources below useful.