Home / Accounts Payable Software for Global Enterprises: Essential Features and Mistakes to Avoid

Accounts Payable Software for Global Enterprises: Essential Features and Mistakes to Avoid

- Last updated:

- Blog

Co-founder & CCO, Yokoy

I talk to a lot of companies who are in the market for accounts payable software, and over and over again I hear the same fears and misconceptions about AP solutions.

So I thought it’s worth writing this article to briefly explain what AP software should do for global enterprises, and how to make sure you don’t buy a solution that’s overly complicated or doesn’t solve for your specific challenges.

Of course, as co-founder of Yokoy, I might be biased, and it’s very likely that the pain points will vary from one company to the other.

However, through our work with over 600+ midsize and large enterprises, we’ve gained a comprehensive understanding of the bottlenecks in a traditional accounts payable process, and the main questions asked by companies when purchasing an AP automation solution.

So I’ll do my best to keep this hands-on and insightful, so you can make an informed buying decision.

Let’s dive right into it.

What to look for in accounts payable software

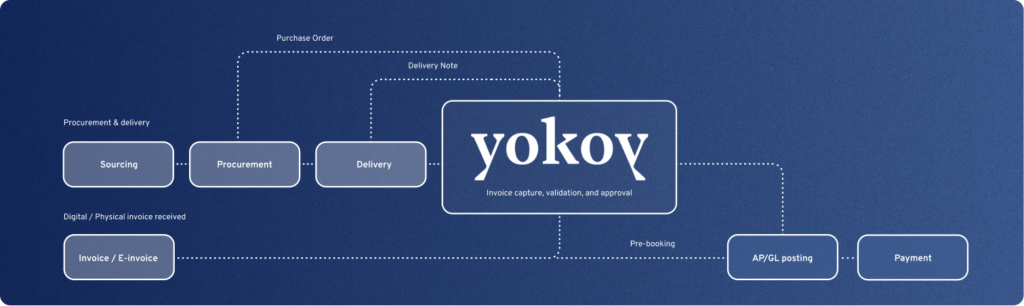

AP software doesn’t come in one size that fits all needs. However, generally, accounts payable solutions are designed to automate the steps in the P2P or AP process, from invoice capturing and invoice processing to matching with POs and goods receipts, approval, and supplier payment.

Thus, when considering the purchase and implementation of an AP automation solution, it is essential to focus on key features that effectively tackle the most prevalent challenges within the procure-to-pay (P2P) or accounts payable process.

These functionalities ensure that the software can successfully address and overcome common obstacles, leading to a smoother and more efficient workflow.

Now, keep in mind that I’m focusing on AP solutions for large, global enterprises. If you’re looking for an invoice automation tool for a small business, these criteria may not be directly applicable.

Automated invoice capture and support for e-invoicing

Invoice management capabilities, along with support for e-invoicing, is a crucial feature in enterprise accounts payable software. It goes beyond simply managing invoices and includes the automation of invoice capture, ensuring a seamless and efficient payment process.

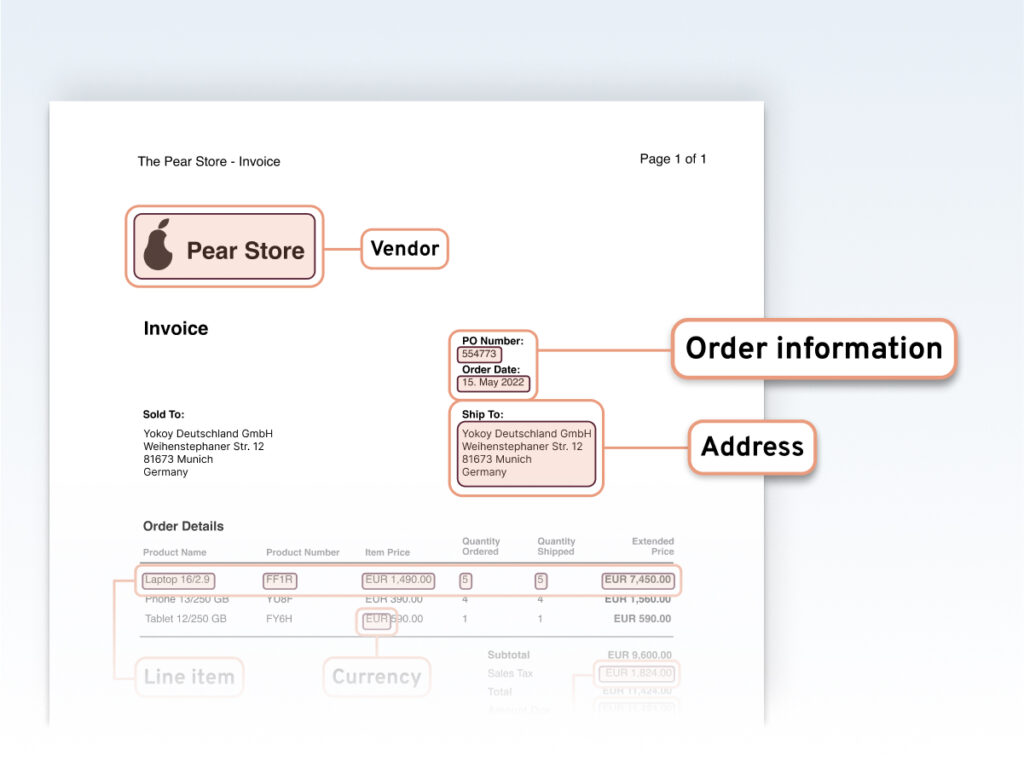

So the first criterion to look for is the ability to handle different invoice formats, as it replaces manual processes with automation. Most invoice management software use OCR (optical character recognition) technology for invoice data capture and extraction.

Suppliers may send invoices in PDF, XML, or EDI formats. A robust AP software should be able to handle all these, eliminating time-consuming, manual steps and human errors, and ensuring flexibility and adaptability to the needs of different vendors.

In the same way, the ability to automatically capture invoice data is crucial for large enterprises. This feature allows the software to automatically capture invoice data from various sources, such as email attachments, scanned documents, or electronic invoicing portals. It reduces the need for manual data entry, minimizing errors, and speeding up the entire invoice processing workflow.

Yokoy & Pagero: Compliant e-invoicing for full AP automation

Yokoy integrates seamlessly with Pagero’s cloud-based e-invoicing solution, for a fully digital and fully automated AP process, from invoicing to payment.

Automated invoice processing

The next functionality to look for is the automation of the entire invoice processing workflow, from capturing invoice data to approvals and payments. Automation can significantly reduce manual data entry, minimize errors, and accelerate processing times.

Although technology may vary from one AP platform to the other, our recommendation is to choose a vendor that relies on AI-powered automation, versus one that uses RPA for example.

We’ve covered the topic in this article, so I won’t get into too much detail now, but in principle, OCR technology is essential for converting scanned or image-based invoices into machine-readable text. It enables the software to extract relevant information like invoice numbers, amounts, due dates, and vendor details accurately.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

OCR enhances data accuracy and eliminates manual data extraction, so your AP tool of choice should make use of this subset of AI technology to shorten the invoice processing time.

Still, note that OCR may encounter challenges when dealing with unstructured data that lacks clear organization or predefined patterns. For processing and extracting insights from highly unstructured data, advanced AI technology comes into play.

So if you want to automate more than just process steps, and let machines take over the ‘logic’ of your AP process as well, you should invest in software that uses AI-powered automation.

AI enables more comprehensive data extraction and categorization, which is extremely helpful especially in large enterprises where the AP department handles thousands of invoices, POs, and goods receipts per month.

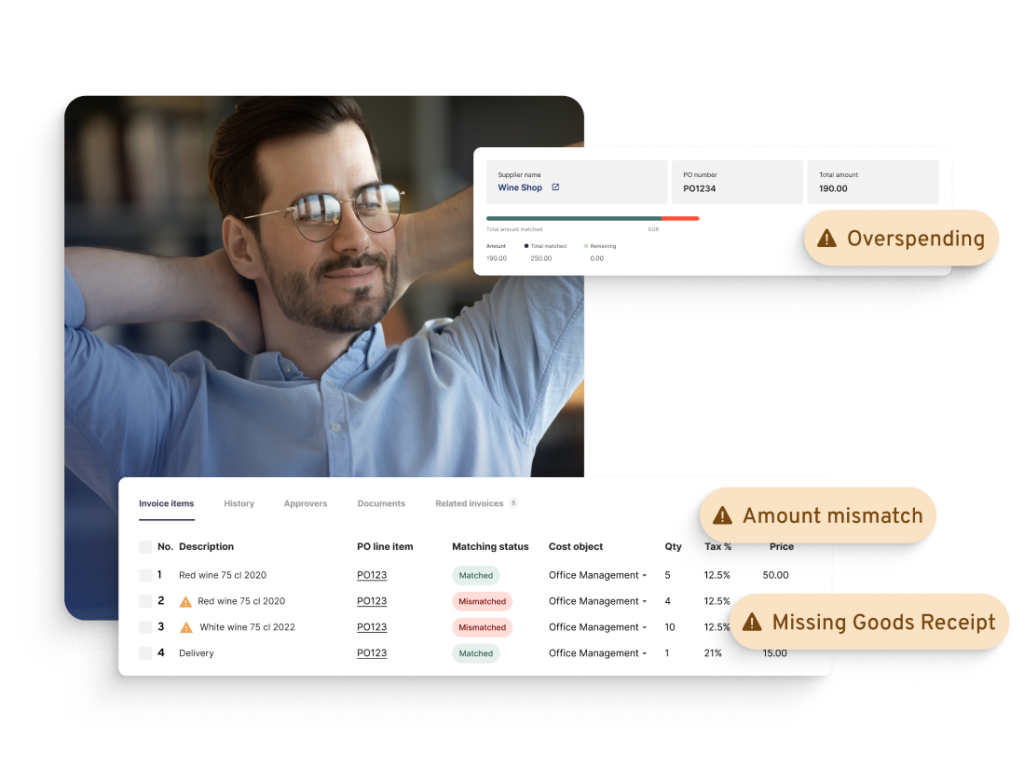

Automated matching of invoices, POs, and goods receipts

Once the invoice is processed, it needs to be matched with POs and goods receipts. In small and even medium-sized companies, this step can be handled manually or with partial automation. But at scale, you need AI-powered automation for an efficient and error-free process.

Purchase order matching involves comparing invoices against POs and receipts, to ensure the items match, and to avoid duplicate payments or paying for goods that weren’t delivered.

For a robust invoice matching functionality, you should look for an AP platform that ensures seamless integration with procurement and ERP systems, for automated PO data transfers. Also, the 2- or 3-way matching should be automated, and mismatches and discrepancies should be detected by the software in real time.

In case of mismatches, the AP automation software should offer robust exception handling capabilities for efficient exception management and to prevent payment delays. Ideally, your AP team should be able to see the status of the invoice matching process at any point. Real-time visibility ensures bottlenecks are fixed in a timely manner.

Blog article

How to Use Invoice Matching Technology to Improve Your Process Efficiency

See how invoice matching technology automates the 2- and 3-way matching of supplier invoices with POs and goods receipts, for an efficient AP process.

Mauro Spadaro,

Product Manager

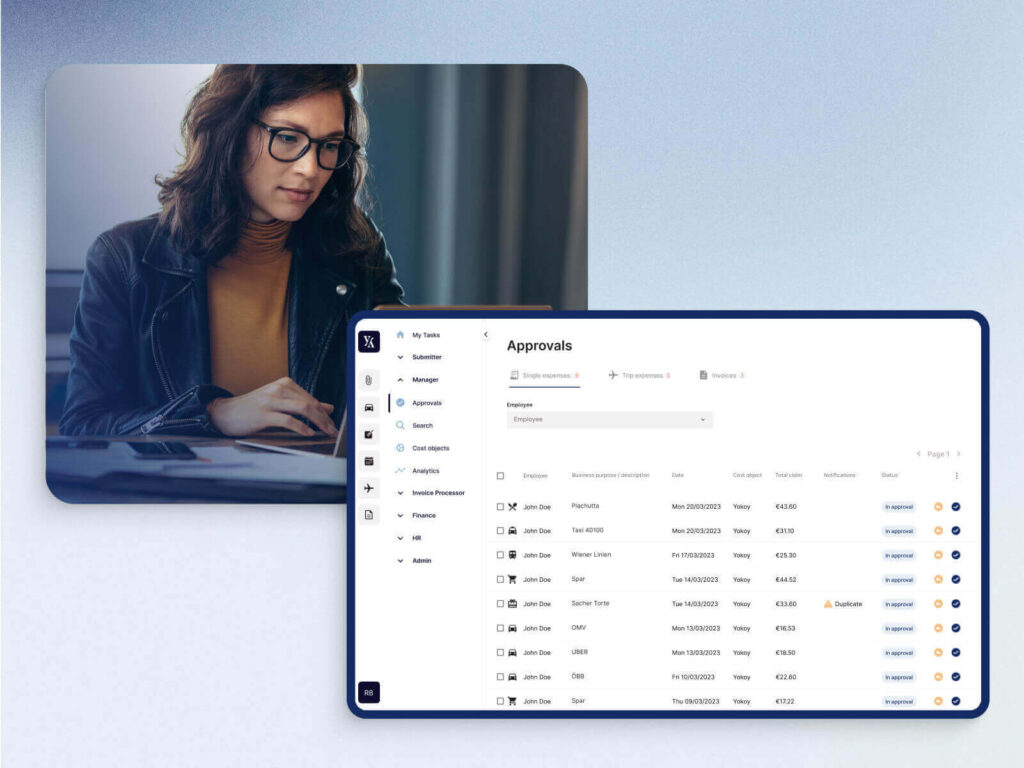

Automated invoice approval through customizable workflows

An efficient and configurable invoice approval workflow is essential for companies with complex approval processes. Workflow and approval automation capabilities facilitate the streamlined routing and approval of invoices, shortening the invoice processing time and speeding up vendor payments.

Thus, enterprise invoice management or AP automation software should allow for customizable approval hierarchies with multiple levels of approvals, automated routing based on predefined rules and roles, and real-time notifications for pending invoices.

For instance, certain invoice amounts or categories might require approval from specific individuals or departments. Automation ensures that invoices are directed to the right approvers, reducing manual intervention and potential bottlenecks.

At the same time, AP solutions should ensure compliance with internal controls, security protocols, and regulatory requirements. This includes setting spending limits, monitoring spending patterns, and verifying that invoices adhere to established guidelines.

Compliance with internal controls is essential to maintain financial transparency and prevent unauthorized or fraudulent activities.

Blog article

How to Automate Your Invoice Approval Workflows with Yokoy

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. Here’s how Yokoy can help.

Mauro Spadaro,

Product Manager

Seamless integrations with ERP, procurement, and document management systems

A well-integrated accounts payable solution ensures that data flows seamlessly between the AP software and the ERP or accounting systems.

This streamlined integration eliminates data silos, minimizes the risk of manual errors during data transfer, and enables all departments to access up-to-date financial information. Such synchronization fosters efficient collaboration, optimizing decision-making processes across the organization.

Also, because invoice processing often involves handling numerous documents, such as receipts, contracts, and supporting documents, an AP software with seamless integration to document management systems allows for the centralized storage of all relevant invoices and associated files.

This centralized repository ensures easy access to past invoices, facilitating quick retrieval during audits and compliance checks. With all documents securely stored and readily accessible, businesses can effortlessly maintain a comprehensive audit trail, simplifying financial reporting and bolstering transparency.

API-first platform

This aspect is often overlooked, but flexible APIs unlock interconnectivity. This interconnectivity empowers businesses to scale and adapt to changing needs, enabling them to harness the full potential of their accounts payable solution.

An API-first platform allows for seamless integration with various systems without being tied to a specific vendor or proprietary solution. By adopting an API-first approach, businesses can adapt and integrate the AP software with their existing tech stack, expanding the functionality and flexibility of the entire ecosystem.

Real-time tracking and reporting capabilities

Real-time tracking allows businesses to monitor the progress of invoices and payments instantaneously. As invoices move through the approval workflow, stakeholders can access up-to-date status updates at any moment, reducing delays and promoting faster processing times.

This real-time visibility empowers finance teams to identify potential bottlenecks or issues early on, allowing for timely interventions and smoother invoice processing. By having a real-time overview of the AP processes, businesses can maintain tighter control over their financial operations and enhance overall agility.

Data security and compliance

Data security is a top priority when dealing with financial information. To safeguard sensitive financial data, it is crucial to choose an AP solution that provides robust data encryption, adheres to industry standards, and employs strict access controls.

The accounts payable automation software should protect against data breaches, unauthorized access, and potential cyber threats. Compliance with industry regulations and data protection laws, such as GDPR (General Data Protection Regulation), ensures that the handling of financial data meets the required standards and prevents legal and reputational risks.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

Ease of use across devices

The software should have an intuitive and user-friendly interface to make onboarding and daily usage easy for your team members. Complex and convoluted interfaces can lead to resistance and hinder adoption.

In today’s fast-paced business environment, the ability to access and process invoices on mobile devices is crucial. Look for software that offers mobile apps or responsive web access.

Blog article

Prioritizing Employee Satisfaction: The Case for Better UX in Finance Tools

The world of finance is changing rapidly, with disruptive technologies and shifting consumer expectations reshaping the landscape. Yet, despite these changes, many finance tools remain stuck in the past, with a poor user experience and interface.

Lars Mangelsdorf,

Co-founder and CCO

Multi-entity support for scalability

As businesses grow and evolve, the accounts payable software should be capable of scaling alongside the company’s expansion. This includes handling increased invoice volumes, supporting additional entities or subsidiaries, and accommodating growing supplier networks.

Thus, an enterprise-level AP software should offer multi-entity support, allowing centralized management of accounts payable processes across different branches or locations. Scalability ensures that the AP solution remains effective and efficient, even as the organization undergoes significant growth and changes.

Multi-currency and language capabilities

For businesses operating globally, multi-currency and language capabilities are indispensable features in accounts payable software. The solution should handle invoices and payments in various currencies, supporting exchange rate calculations and facilitating international transactions.

Moreover, multi-language support enables smooth communication and collaboration with vendors and suppliers worldwide, regardless of language barriers. These capabilities streamline cross-border financial operations, ensuring accuracy and efficiency in managing payments and financial data across diverse regions.

Tax and regulatory compliance features

To comply with tax regulations and financial reporting requirements, the AP software should incorporate specific tax and regulatory compliance features. This includes automated tax calculations, adherence to country-specific tax codes, and the ability to handle various tax jurisdictions.

The AP platform should also generate tax reports and audit trails, facilitating tax-related compliance and audits. By integrating these features, businesses can rest assured that their financial processes align with relevant tax laws and regulations, mitigating the risks of non-compliance.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

Onboarding program, customer support, and training

A reliable accounts payable software vendor should offer a structured and well-defined onboarding program for new customers. The onboarding process should guide organizations through the implementation of the software, ensuring a smooth transition and seamless integration with existing systems.

A well-designed onboarding program includes clear milestones, timelines, and a designated point of contact to address any queries or concerns. By having a comprehensive onboarding process in place, businesses can quickly adopt the new AP solution and maximize its benefits.

Also, adequate training resources are vital for ensuring that users can harness the full potential of the accounts payable software. The chosen vendor should offer comprehensive training materials, including user guides, tutorials, and video demonstrations, to facilitate a thorough understanding of the software’s functionalities.

Blog article

Implementation Plan for a Global Spend Management Solution – Yokoy’s Approach

Through our work with global customers ranging from mid- size businesses to large enterprises, we’ve developed our own implementation blueprint for rolling out spend management solutions.

Gordan Grcman,

Senior Implementation Manager, Yokoy

Common misconceptions and mistakes when buying AP software

Now, let’s address some common mistakes to avoid when purchasing and implementing accounts payable software.

- Overlooking specific needs: Each company has unique AP challenges. Avoid choosing a one-size-fits-all solution and instead, identify the specific pain points in your AP process to find a solution that addresses those needs.

- Ignoring integration compatibility: Failure to assess the software’s compatibility with your existing systems can lead to data silos and manual workarounds. Choose a solution that seamlessly integrates with your current setup.

- Underestimating the importance of data security: Data breaches can be catastrophic for your business. Don’t compromise on data security features when selecting an AP software.

- Falling for flashy features: While advanced features can be appealing, focus on the functionalities that align with your requirements. Investing in unnecessary features can complicate your workflow and inflate costs.

- Focusing solely on price and ignoring long-term value: Choosing an AP solution solely based on its initial cost can be a costly mistake. A cheaper software might lack critical features, robust support, or future scalability, leading to inefficiencies and limited long-term value. Considering the software’s overall value and potential ROI is essential for making a well-informed decision.

- Ignoring scalability and future needs: Failing to account for scalability can lead to the need for costly migrations or software replacements down the road.

ROI calculator

Calculate your savings

How much can you save annually if you choose Yokoy as your spend management suite? Our ROI calculator helps you quantify the return on investment, so you can build a solid case for finance transformation.

Overall, understanding the realities of accounts payable software and the AP process is crucial for making informed decisions.

So now that you have a good understanding of what accounts payable solutions should do for you, let’s take one moment to dispel some common misconceptions.

Common misconceptions about accounts payable tools

AP software is only for large enterprises

One common misconception is that accounts payable software is designed exclusively for large enterprises with extensive financial operations. In reality, AP software can benefit businesses of all sizes. Even small and medium-sized businesses can streamline their AP processes, reduce manual tasks, and improve efficiency using AP software.

Accounts payable tools eliminate the need for human involvement

Some people mistakenly believe that implementing AP software means replacing human involvement entirely. While AP software automates various tasks, it doesn’t eliminate the need for human oversight and decision-making. Human involvement is still necessary for verifying invoices, resolving exceptions, handling vendor relationships, and strategic financial planning.

AP software is complicated and difficult to implement

Another misconception is that AP software is overly complex and challenging to implement. Modern AP software solutions are designed with user-friendliness in mind. Many software providers offer easy-to-use interfaces, seamless integration with existing systems, and comprehensive training and support to ensure a smooth implementation process.

AP software is not cost-effective

Some businesses may avoid adopting AP software because they believe it is expensive and not cost-effective. However, the benefits of such platforms often outweigh the initial investment. The software can save time, reduce errors, improve vendor relationships, and enhance compliance, leading to significant long-term cost savings and operational efficiencies.

The AP process doesn’t require automation

Some organizations might underestimate the complexity of the AP process and assume that manual methods are sufficient. They may believe that automating AP tasks is unnecessary.

However, as businesses grow and transaction volumes increase, manual AP processes become prone to errors, inefficiencies, and delayed payments. Implementing AP software can optimize the process and enhance accuracy and productivity.

By considering these factors and avoiding common mistakes, you can make an informed decision when choosing accounts payable software that fits your company’s needs and maximizes the efficiency of your financial operations.

Best accounts payable platforms for global enterprises

Now that you know what to look for in an accounts payable management tool, let’s see some recommendations that fit the needs of global enterprises.

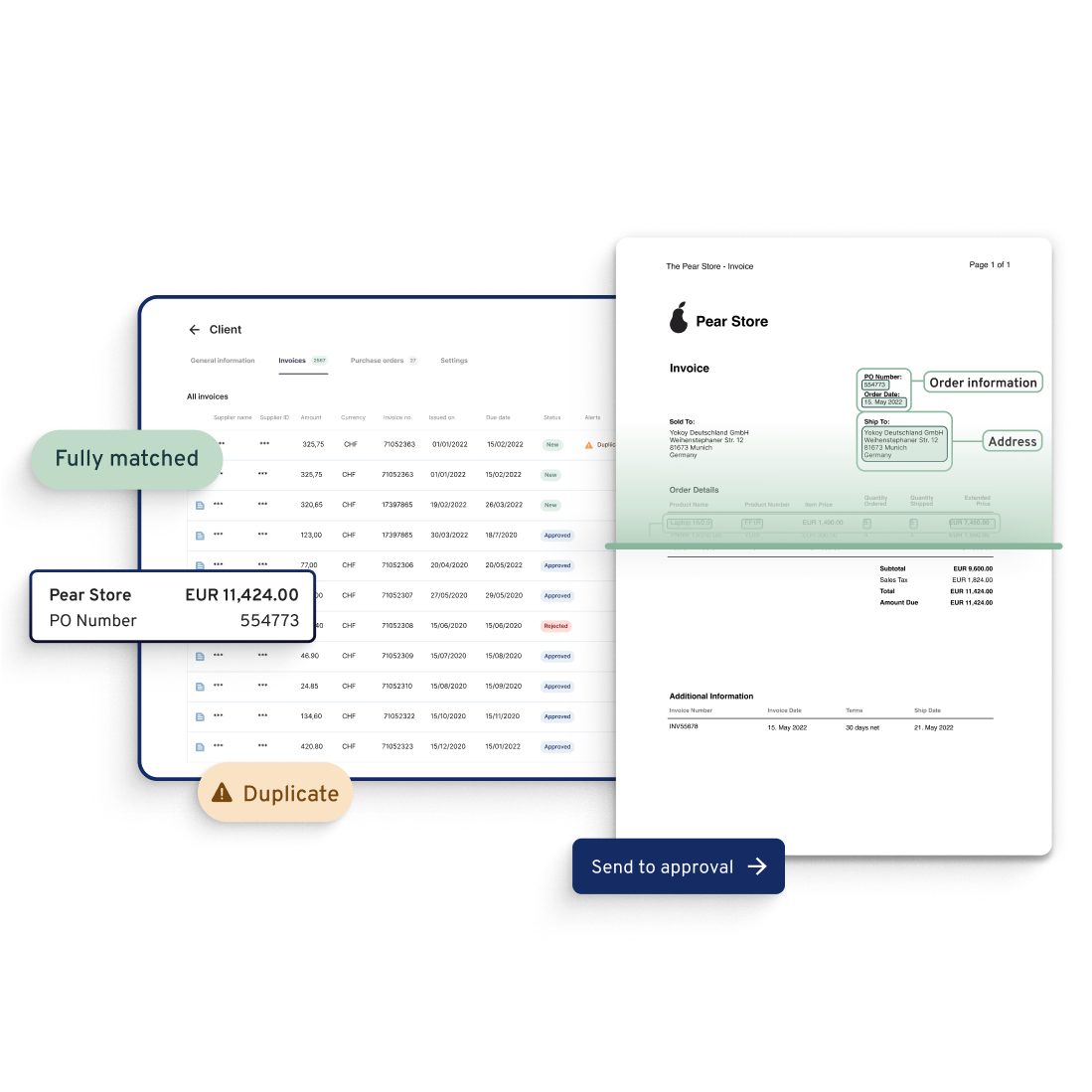

Yokoy

As already shown above, Yokoy is a game-changer, harnessing AI to automate the entire invoice management flow, from invoice capture to approval, payment, and booking to the ERP system.

The platform relies on OCR and AI to read invoices in all formats, and can handle multiple currencies and languages, making it ideal for complex international setups.

Yokoy offers functionalities such as:

- Automated invoice capture

- Support for e-invoicing

- Automated invoice data structuring for ERP integration and end-to-end AP automation

- Invoice processing powered by AI and automation

- Automated matching of invoices with POs and goods receipts

- Custom workflows and pre-approval flows

- Automated fraud and duplicate detection

- Compliance with company policies and local and international regulations

- Automated posting to ERP systems for simplified bookkeeping

- API integration with procurement and accounting software

- Streamlined vendor invoice payments

Along with invoice management, Yokoy’s spend management suite offers expense management capabilities and streamlined payments through smart corporate cards. The three modules – Invoice, Expense, and Pay – come together in one powerful all-in-one suite that enables true end-to-end AP automation.

The platform offers flexible API integrations, and comes with ready-to-use integrations for ERP systems such as Oracle Netsuite, SAP, Microsoft Dynamics, Datev, Exact, and so on.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Tipalti

Tipalti is a one-stop solution for AP, covering everything from invoice capture to payments. It aims to free up the finance team’s time and resources while strengthening controls and accelerating business visibility for scale.

It ensures compliance with tax regulations and international payment laws and supports automated matching and reconciliation, as well as a touchless invoicing process.

The platform enables large enterprises to managing global payments, reducing complexity. Also, it offers automated supplier onboarding and communication to foster better vendor relationships.

Medius

Medius links invoice capture, processing, and payment to replace the worry and wondering of managing AP with calm and confidence. The software focuses on procure-to-pay, optimizing spend across the board and minimizing compliance risks.

It offers user-friendly invoice management, reducing manual errors. The platform is built for large companies and provides access to dashboards for data-driven insights for informed decision-making. Also, it is built with scalability in mind, offering customization options and support for complex setups and AP workflows.

Coupa

Coupa takes a holistic approach to spend management and combines AP, procurement, and expenses in a unified platform. The tool uses AI for data-driven decision-making and control, but doesn’t offer the same capabilities that Yokoy does when it comes to AI-powered process automation. The platform enables streamlined processes and real-time visibility into global spend, as well as procurement features.

Next steps

To begin the AP software buying process, assess your current accounts payable processes and identify pain points and areas for improvement.

Then, create a list of essential features and functionalities that would address these challenges effectively. Don’t forget to involve key stakeholders from your finance, procurement, and IT departments during the evaluation process.

Finally, consider the long-term value and potential return on investment when choosing an AP solution. With the right accounts payable software in place, your organization can embrace the future of financial management, optimize AP processes, and stay ahead in today’s dynamic business landscape.

When you’re ready to start, book a demo below. Yokoy’s spend management suite can support you in fully automating your accounts payable process, with the power of AI.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.