Home / Managing Expense Reimbursements at Scale: Challenges and Best Practices

Managing Expense Reimbursements at Scale: Challenges and Best Practices

- Last updated:

- Blog

Product Marketing

Managing employee expense reimbursements in large enterprise companies with multiple entities is particularly challenging due to several factors.

- First, large enterprises have a lot of employees who need to be reimbursed. This means there are many transactions and lots of paperwork to keep track of.

- Second, there may be different reimbursement policies, approval processes, and accounting systems to deal with for each entity and department, which can lead to mistakes and delays.

- Third, employees who travel a lot have a hard time managing expense receipt, tracking expenses, adhering to company policies and tax regulations.

- Finally, large companies usually have stricter rules and audits to make sure they are following regulations and policies, which can add even more complexity to the reimbursement process.

Because of these challenges, some organizations are hesitant to automate their expense reimbursement process, as they worry that automation might make the process more complicated and reduce their control over it.

So in this article, we’ll take a closer look at how large companies can tackle these challenges, and we’ll share some best practices to help make the process more efficient while still complying with regulations.

Most common types of reimbursable expenses

Let’s start by clarifying the different types of reimbursable expenses and the considerations involved in managing and processing these reimbursements.

Travel expenses

Travel expense reimbursement usually covers a broad range of expenses related to business travel, from airfare costs, train tickets, public transportation and taxi fares to accommodation, meals, and other incidental expenses incurred while traveling for business purposes.

Now, please note that some companies have different policies for travel costs such as the ones described above, and transportation expenses associated with company or personal vehicle usage. These are covered in the next section.

Mileage reimbursement

In most countries and companies employees receive reimbursement when commuting for business purposes, so using a private or company vehicle for such trips is considered a legitimate business expense.

So although both mileage reimbursement and travel expense reimbursement are designed to cover costs associated with business travel, the key difference is that mileage reimbursement specifically focuses on costs incurred for the distance driven using a company or personal vehicle.

The amount of reimbursement is often based on a standard mileage rate set by the organization or local government. Besides fuel cost, mileage reimbursement amount could also cover maintenance cost, and the deprecation cost of the vehicle.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

There are two ways to calculate mileage reimbursement: fixed rate and complex rate.

- The fixed rate method for mileage reimbursement is the most common way to do it. Basically, you calculate the distance traveled and multiply it by a set rate per kilometer or mile. This means that every mile you drive gets reimbursed at the same rate, no matter what. For example, a company might use a fixed rate of $0.50 per mile for all mileage expenses.

- On the other hand, a complex rate takes into account various factors that may impact the cost of travel, such as the type of vehicle, fuel prices, maintenance costs, and other expenses. The reimbursement rate can be different for different types of vehicles or based on the purpose of the trip. For instance, a company might use a complex rate that’s higher for electric vehicles and lower for older, less fuel-efficient vehicles.

The key difference between fixed rate and complex rate is that fixed rate provides a simpler, more straightforward method of reimbursement that does not take into account specific circumstances, while complex rate is a more tailored approach that considers various factors that may impact the cost of travel.

Blog article

Avoiding Fraud in Mileage Reimbursements: The Yokoy Solution

Learn how AI automation reduces errors, duplicates, and fraud, helping you manage trip expenses and mileage reimbursements automatically, at scale.

Lars Mangelsdorf,

Co-founder and CCO

Meal reimbursements

Meal reimbursements are a common type of expense that employees may incur while on business trips or working long hours. These expenses can include the cost of business meals at restaurants, cafes, or hotels.

The way organizations pay back employees for these expenses can differ depending on their policies. In some cases, depending on the country’s regulatory requirement – organizations may provide a per piem allowance to cover meal expenses while employees are traveling for business.

Alternatively, organizations may require employees to submit receipts for meal expenses and will reimburse the actual cost of the meal up to a certain spending limit. In such cases, employees must keep track of their meal expenses and submit receipts along with their expense reports.

There may also be restrictions on the types of meals that can be reimbursed. For example, some companies might say that expensive or fancy meals, or meals with alcohol, can’t be reimbursed. In such cases, employees might have to get permission beforehand or state a proper reason for such overspend.

No matter the rules, companies need to make sure they follow tax laws and must keep good records and paperwork to prove that the expenses were for business purposes in case of an audit.

Lump sums / Per diem allowances

A lump sum or per diem rate refers to a fixed daily amount that an employee is provided to cover their meals, accommodation, and incidental expenses while traveling for business.

The per diem rate is typically based on the location where the employee is traveling and is meant to cover the employee’s reasonable expenses for the day. This approach provides a simple and consistent way to reimburse employees for meals without requiring them to submit receipts or track expenses.

However, it is important to note that lump sum reimbursements may not be appropriate for all types of expenses, as they can be less transparent and may not provide adequate control or oversight over the use of the funds.

Lump sums tend to be paid either due to legal requirements in some countries and / or by company preference. The calculation of the per diem amounts tends to be different between countries, as does the deduction amount and logic.

If the employee has already been paid for the meal by the company, for example if breakfast was already included in the accommodation, employees should deduct such allowances for the meal or for the day.

Per diem rates can be beneficial for organizations as they provide a simpler reimbursement process, eliminate the need for employees to track individual expenses, and can provide cost savings for the organization if the per diem rate is set at a lower amount than the actual expenses incurred by the employee.

Blog article

What Is Per Diem? Exploring the Basics of This Reimbursement System

Learn about per diem rates, how they’re different from actual expense reimbursement, as well as the legal and tax implications across countries.

Andreea Macoveiciuc,

Growth Marketing Manager

All these types of business expenses can be automated to a greater extent with AI and machine learning technologies embedded in expense management software – it saves time and money for finance professionals, employees and for businesses.

Both the reporting of business-related expenses and the submission of reimbursement requests can be automated with expense management software.

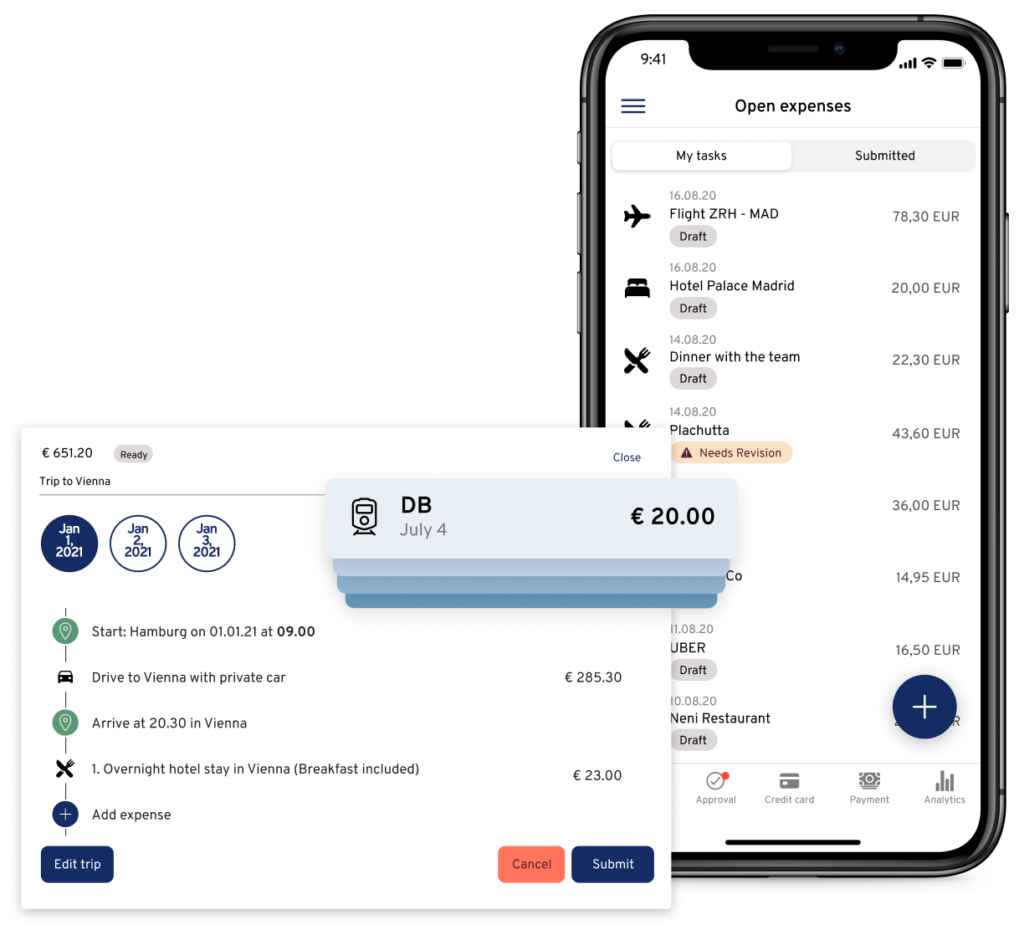

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Receipt expense

Receipt expense is the most common expense types, employees can submit expense receipts and receive reimbursements.

This type of expense can also occur not just during business trip but also in office management expense, team dinners or lunch or any type of single expense that happens just once and does not necessarily belong to a business trip.

Challenges in the employee expense reimbursement process

Now that we’ve clarified the types of expenses that can be reimbursed, let’s look at the main challenges large companies face when reimbursing their employees.

Manual, time-consuming process

One of the biggest challenges in the employee expense reimbursement process is the manual and time-consuming nature of the process. Managing paper-based receipts, manual data entry, and spreadsheet-based tracking can be cumbersome and prone to errors.

According to a survey conducted by PayStream Advisors, 47% of companies still use manual or paper-based expense management processes. This can lead to delays in the reimbursement process, which can cause dissatisfaction among employees and affect their productivity.

Lack of visibility and control

Another major challenge in the employee expense reimbursement process is the lack of visibility and control over the entire process.

In many cases, finance teams rely on employees to submit their expenses and receipts, which can lead to a lack of control over the employee’s spending. This can make it difficult to set limits and track expenses and ensure compliance with company policies and regulations, which brings us to the next challenge: risk of errors and fraud.

Planted keeps spend under control with Yokoy

“A corporate card should be secure and uncomplicated – and this is exactly what the Yokoy Mastercard offers. In addition, the card is smart, saving us significant time.”

Christoph Jenny, Co-founder Planted

Risk of error and fraud

Processing employee expenses is especially challenging in large companies with multiple entities, particularly if employees are based in multiple countries or if the corporation operates in jurisdictions with complex tax laws.

Non-compliance can result in legal and financial consequences for the corporation, which then leads to making compliance a top priority. The manual nature of the process, combined with the lack of visibility and control, can create opportunities for employees to submit inaccurate or fraudulent expense reports.

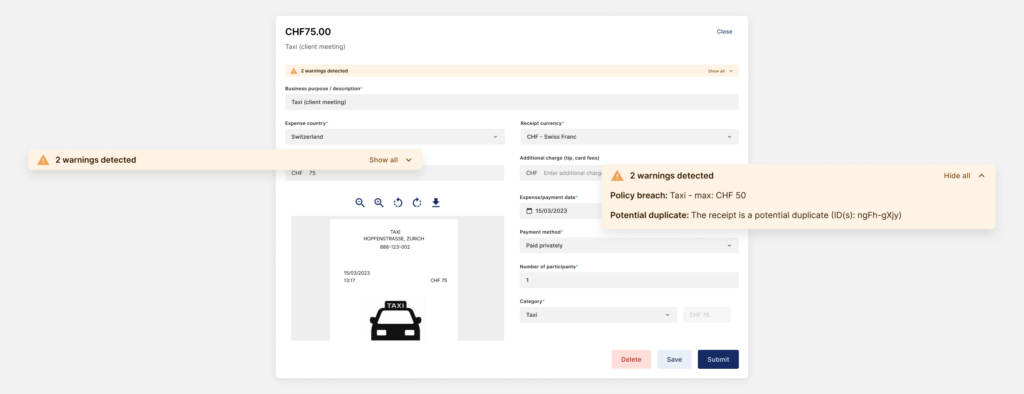

For example, policy breaches can occur when a receipt is submitted twice, an employee claims a wrong daily lump sum, spends over a certain limit, or buys something that doesn’t fall under the reimbursement policy.

With spend management software like Yokoy, companies can detect the duplicate submissions, frauds and policy breaches, and even calculate lump sums automatically based on the entity. This reduces the risk of fraud and policy breaches due to human errors.

Blog article

How to Prevent Expense Fraud with AI-Driven Compliance and Custom Workflows

Expense fraud is a pervasive problem that continues to plague companies of all sizes and industries. In fact, a recent survey by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being one of the most common types of fraud.

Lars Mangelsdorf,

Co-founder and CCO

Complexity due to volume

As companies get bigger, their expense policies and approval processes get more complicated, which makes it harder for employees to submit their expenses correctly and on time.

The high volume of employee expense reports adds to the complexity, making it a time-consuming and resource-intensive task for finance teams, which can lead to delays and mistakes in reimbursement.

To simplify the process, large companies can implement streamlined expense policies and expense management tools that reduce the workload for finance teams and make it easier for employees to submit expenses and reduces cost for company.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

Best practices for automating the expense reimbursement process

Now that we’ve covered the types of expenses that can be reimbursed and the common challenges faced by large companies in this process, let’s look at practical ways to simplify and streamline employee expense reimbursements.

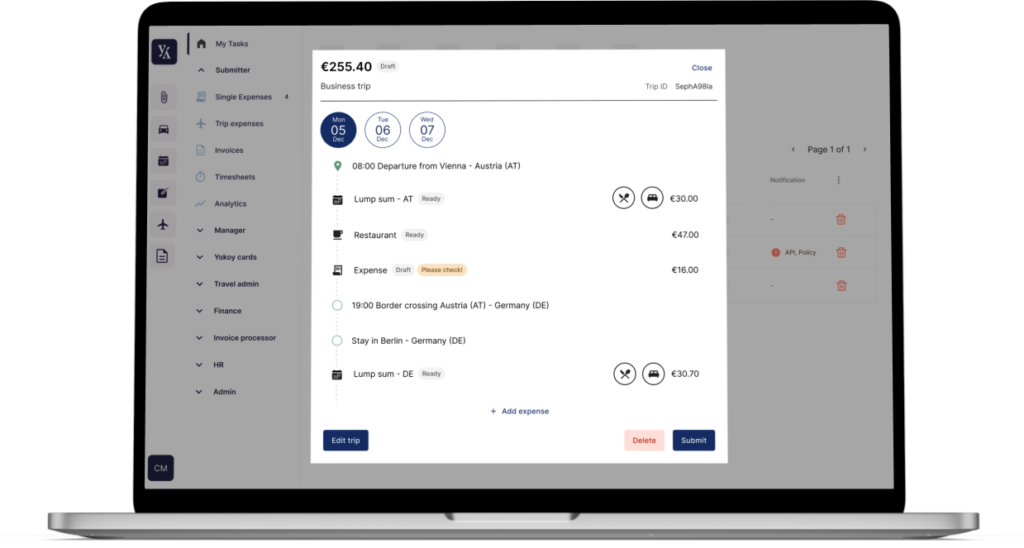

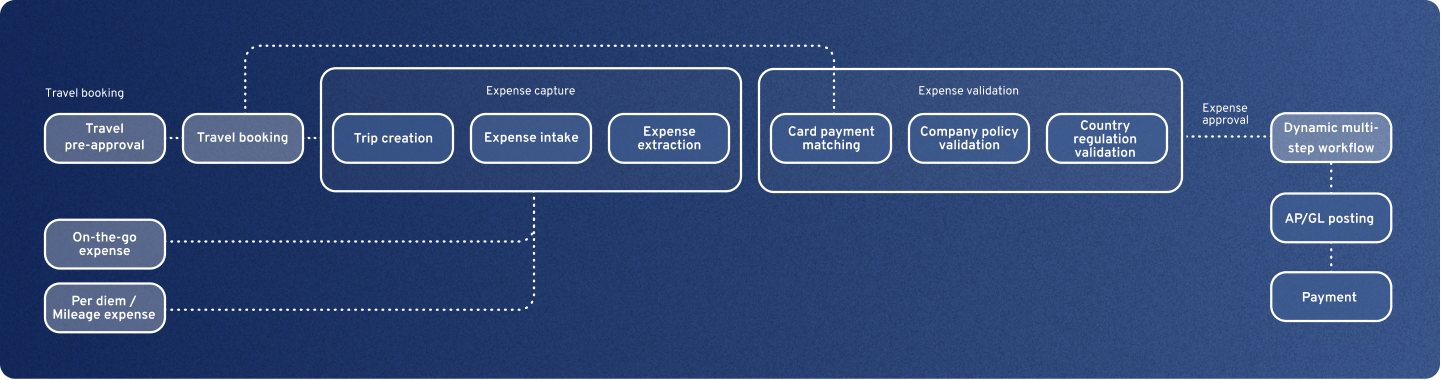

1. Map the process

The first best practice is to map the expense reimbursement process.

Mapping this process involves documenting all the steps from the expense submission to approval and reimbursement. This helps organizations identify areas of inefficiency and determine where automation can be most effective.

To map the process effectively, companies should start by identifying all the stakeholders involved in the expense reimbursement process. Once all stakeholders have been identified, companies can then begin to document the specific steps involved in the process for each stakeholder.

- For example, the process for an employee submitting an expense might include capturing a receipt or invoice, filling out an expense report, and submitting the report to their manager for approval.

- The manager’s process might include reviewing and approving the expense report, forwarding the report to finance for reimbursement, and providing feedback to the employee if necessary.

- The finance team’s process might involve verifying the expense against company policies and local regulatory policy, exporting VAT rates, reimbursing the employee, and booking the reimbursement in the company’s financial software.

By mapping out the entire process in detail, companies can gain a better understanding of how each step in the process is currently being handled and identify opportunities for improvement. For instance, they may identify steps that can be eliminated, automated, or streamlined to make the process faster and more efficient.

2. Clarify the internal policies, rules and regulations

Next, it’s important to clarify internal policies – including expense reimbursement policies, rules, and regulations. This involves defining clear and comprehensive expense policies that all employees can easily understand.

For example, organizations should outline which expenses are eligible for reimbursement, the maximum amount that can be reimbursed for each expense category, and any required supporting documentation or approval processes.

Understanding tax and regulatory requirements is also essential. Organizations need to be aware of which expenses are taxable and which are not, as well as any specific tax or regulatory requirements that apply to their industry or location.

- For example, in Germany, companies are legally required to pay per diem based on the country the employee travels. The government sets the base per diem amounts that companies need to pay as minimum.

- In addition, from a regulatory perspective Germany has a legal limit on issuing per diem for employees under the “three month rule or Dreimonatsfrist” – if the employee travels for a business trip for more than 3 months in accordance with the additional criteria set by the government, then the per diem amounts are income taxable.

Compliance in Germany

Stay up-to-date with rules and regulations around per diem rates – including the midnight rule and 3-month rule, mileage allowances, proof of receipt, and VAT rates in Germany, while Yokoy keeps you audit-ready.

- In The Netherlands, it is common for companies to cover transport costs, and the common mileage rate is 0.19 EUR/km for distances traveled, regardless of the vehicle type, or the actual cost of the trip by public transport.

- In Switzerland, there aren’t regulations for lump sums, and the normal practice is to pay actuals. For mileage allowances, rates vary depending on the vehicle and total distance traveled per year.

Compliance in Switzerland

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates in Switzerland, while Yokoy keeps you audit-ready.

- Similarly in Austria, per diems are issued based on certain criteria and duration of the trip. For instance, while issuing per diem, companies have to adhere to the specific regulatory requirement that has been agreed between worker’s unions known as Collective agreement or “Kollektivvertrag”.

Compliance in Austria

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates in Austria, while Yokoy keeps you audit-ready.

As you can imagine, it’s very easy for errors to occur when the finance team needs to calculate the lump sums, verify the local regulations and internal policies, and then reimburse employees.

To make the employee reimbursement process efficient by adhering to internal policies and regulatory rules and to avoid human error, companies can automate their expense management process.

3. Automate the expense reimbursement process

The first best practice mentioned here helps companies to understand the current process and compare it to their versus feature state with the help of automation tools.

While the second best practice brings clarity on the policies that can be enforced to achieve local regulatory compliance while saving indirect spend.

For example, with a spend management platform like Yokoy, you can automate all the steps below.

Expense submission

In a traditional process, the employee collects paper receipts, takes a photo or scans them, and uploads the receipts into an expense management tool, or records them in a spreadsheet-based expense report and/or even sends an email of the receipt to the Finance team.

This process is done either immediately after a trip or at the end of the month, but it’s not a real-time process. This affects finance teams to close the books on a timely basis and sometimes finance teams doesn’t get a complete overview on why the spend is over the limit.

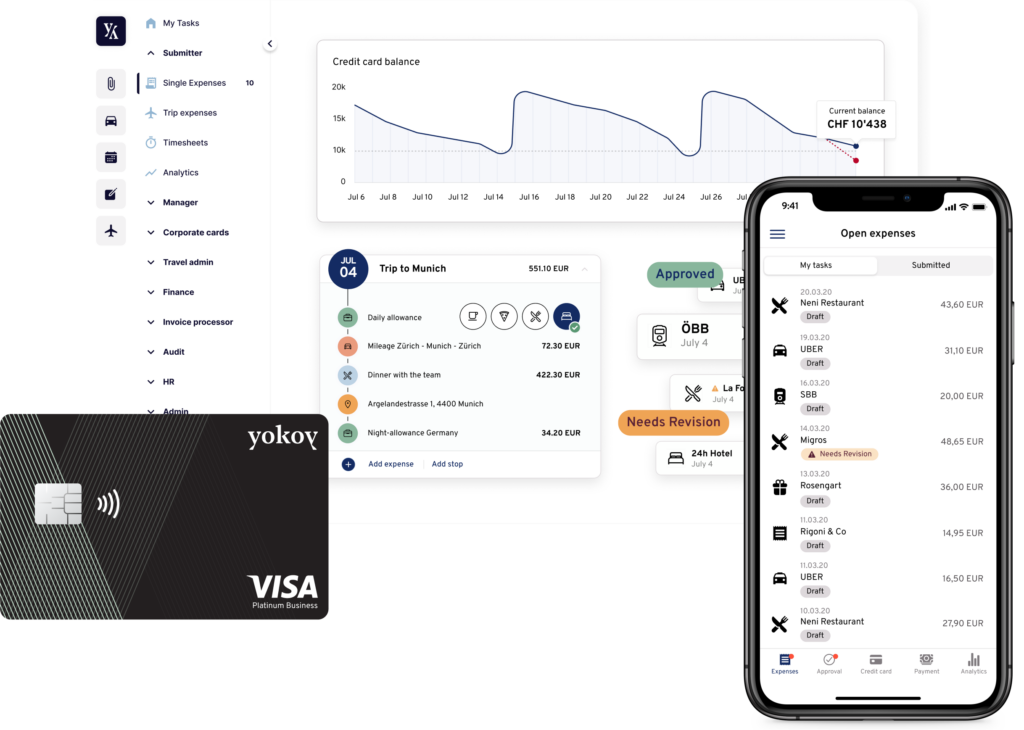

In comparison, with a platform like Yokoy, the expense submission phase can be fully automated.

Employees can submit expense reports on-time for reimbursement, and the Finance team can gain a complete overview on every single expense report. Even if there is any overspend, with a valid reason the information is recorded forever which highly helps during the audit.

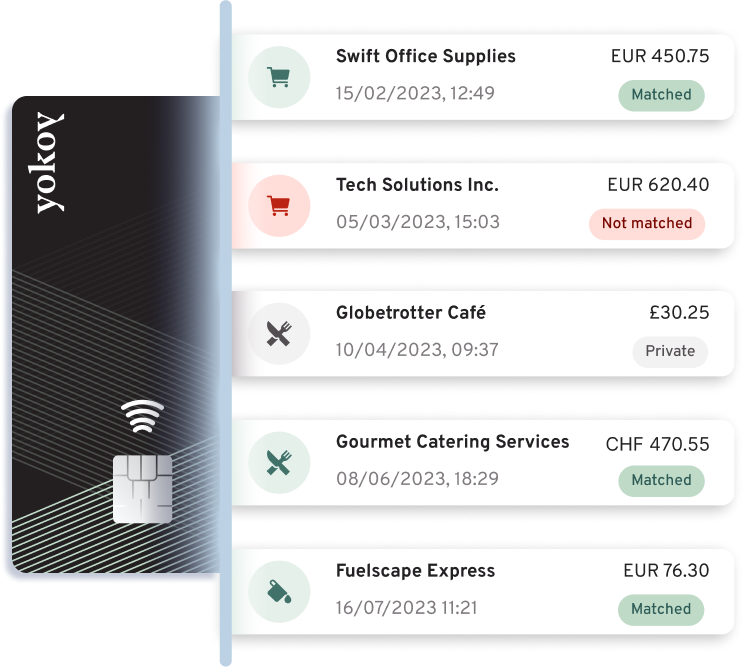

Besides, employees can also pay with Yokoy smart corporate cards instead of private cards, so that their transactions are reconciled with the receipts in real time. This not only gives finance teams full visibility, but also prevents policy breaches, as duplicate receipts can be easily detected and users will also be warned about the expenses that does not fall under the policy.

As an intermediate solution, if traditional corporate cards are used instead of smart corporate cards, the process can still be automated, as tools like Yokoy allow employees to take a picture or upload the receipt directly from the app and match transactions automatically.

The data is read in real-time, expense items are automatically categorised by AI technology and the reconciliation is done automatically, so employees don’t need to manually enter data. Once the expenses reports are ready, it can be sent for approval in just a click. And all these processes can be done in seconds.

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Approval workflow

Once the expenses are submitted, the approval phase starts. In a traditional, manual process, this can take several minutes to hours, depending on the type of expenses and the legal complexities involved.

With a spend management platform like Yokoy, the step can be fully automated, by implementing auto-approval workflows. Companies can set limits for auto-approvals workflows and if any expenses falls under the limit can be automatically approved unless the AI technology detects any policy breaches or duplicate expenses.

If, however, any outliers, duplicates, or potential fraudulent expenses are found by the AI, then the report can be sent back to the employee for revisions or the submission can be rejected permanently.

Policy enforcement

As mentioned above, enforcing compliance can be rather cumbersome and time consuming in a manual process; but with the help of automation tools like Yokoy, it is completely effortless.

With Yokoy, for example, all the rules and policies are configured into the system, and the AI algorithms validates every submission in accordance with the whole organization level and also on a legal entity level. Hence, there is no need for human intervention to manually check for anomalies.

Unless outliers are found, minimal human intervention is required but the efforts are far simpler and straightforward as the tool itself warns about the policy breach in the submitted expense report, therefore the user can edit the report in accordance with the policies and limits.

In some cases, there might be exceptions and employees might need to give a bit more explanation on few policy breaches (For example, overspend on a client dinner); on such cases employees should have the ability to report or provide a reason for such overspend inorder to avoid the expense being rejected permanently.

Reimbursement and reporting

Once the expenses have been reviewed, approved and exported to the finance system, the reimbursement can be processed automatically, and employees can expect to receive their money in a timely manner.

In addition, with software like Yokoy, finance teams can generate reports, to gain real-time insights into their employee’s spending patterns. Reports can be generated on various aspects and fields to show specific data and can help finance teams identify opportunities for cost savings and areas of inefficiency – both process-wise and in the reimbursement plans.

Use smart corporate cards for full visibility

Another best practice is to replace out-of-pocket expenses and private payments with smart corporate card payments, for full visibility and better control over employee expenses.

A smart corporate card is more than just a typical corporate credit card. It functions like a regular card, allowing users to make payments using debit, credit, or prepaid methods. However, it is integrated with financial software to provide data-based insights and advanced features.

In essence, a smart corporate card is a modernized version of a traditional corporate card, with benefits that go beyond basic payment capabilities. Some of its advanced features include real-time expense management, automated accounting and reporting, improved security and control measures, and a streamlined user experience for cardholders.

Smart corporate cards leverage advanced technology such as machine learning, artificial intelligence, and data analytics to offer these enhanced capabilities. By using these technologies, companies can manage their expenses more efficiently, reduce fraud, and gain valuable insights into their spending patterns.

DO & CO tracks expenses in real time with Yokoy

“Yokoy’s integrated corporate credit card solution played a pivotal role in our decision-making process. The seamless data transfer streamlines expense tracking, minimizing manual efforts and significantly enhancing efficiency.”

Johannes Echeverria, CFO at DO & CO

Next steps

To sum it up, automated expense reimbursement is a game-changer for mid and large size enterprise companies looking to streamline their expense management processes.

With the help of automation, finance teams can save time and resources, reduce errors, ensure compliance, adhere to local regulations and gain valuable insights into their business spend patterns.

Yokoy’s spend management platform helps companies to simplify their spend management and expense management process. The AI technology is self-learning, which means that the automation rate improves in time, as the AI learns to understand more of the data. This makes the expense management process effortless for both the end user and finance teams.

If you’d like to see how Yokoy can automate expense management for your company, you can book a demo below.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.