Home / Compliance Center / Compliance in Switzerland

Compliance in Switzerland

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

Switzerland’s perspective on compliance profoundly influences the landscape of spend management.

Swiss businesses engaged in spend management encounter an intricate tapestry of rules and directives. Conforming to these compliance mandates is not merely a legal requisite but also underscores Switzerland’s emphasis on principled and responsible fiscal practices.

Grasping and adeptly incorporating these measures is imperative for businesses seeking to optimize spending processes while upholding an unblemished reputation for ethical and transparent financial conduct.

Download for later

No time to read right now? Get the .pdf version of the guide below.

Proof of Receipt

Regulations in place

According to Swiss regulation, companies can store expense receipts digitally.

The records must be retained electronically in a digital format for 10 years (until end of every calendar year). Meaning, expense receipts from 01.04.2012 must not be deleted before 01.01.2023 (and not already on 01.04.2022).

The Swiss Code of Obligations provides for the following book-keeping principles:

- Complete, truthful and systematic recording of business transactions and facts;

- Documentary evidence for the individual accounting transactions

- Clarity

- Appropriateness with regard to the type and size of the company

- Verifiability

In addition, the ordinance on Bookkeeping states that the records shall not be changeable without a trace. The ordinance also stipulates that, the records shall not be modifiable and should be provided at the time of audit.

Besides, the ordinance also permits for modifiable data carriers on certain conditions such as:

- technical procedures are used which guarantee the integrity of the stored information (e.g., digital signature procedures)

- the time at which the information is stored is verifiable in an unforgeable manner (e.g. , by means of “time stamps”)

- the further regulations existing at the time of storage concerning the use of the technical procedures concerned are complied with,

- the processes and procedures for their use are defined and documented, and the corresponding auxiliary information (such as logs and log files) is also retained

Yokoy's solution

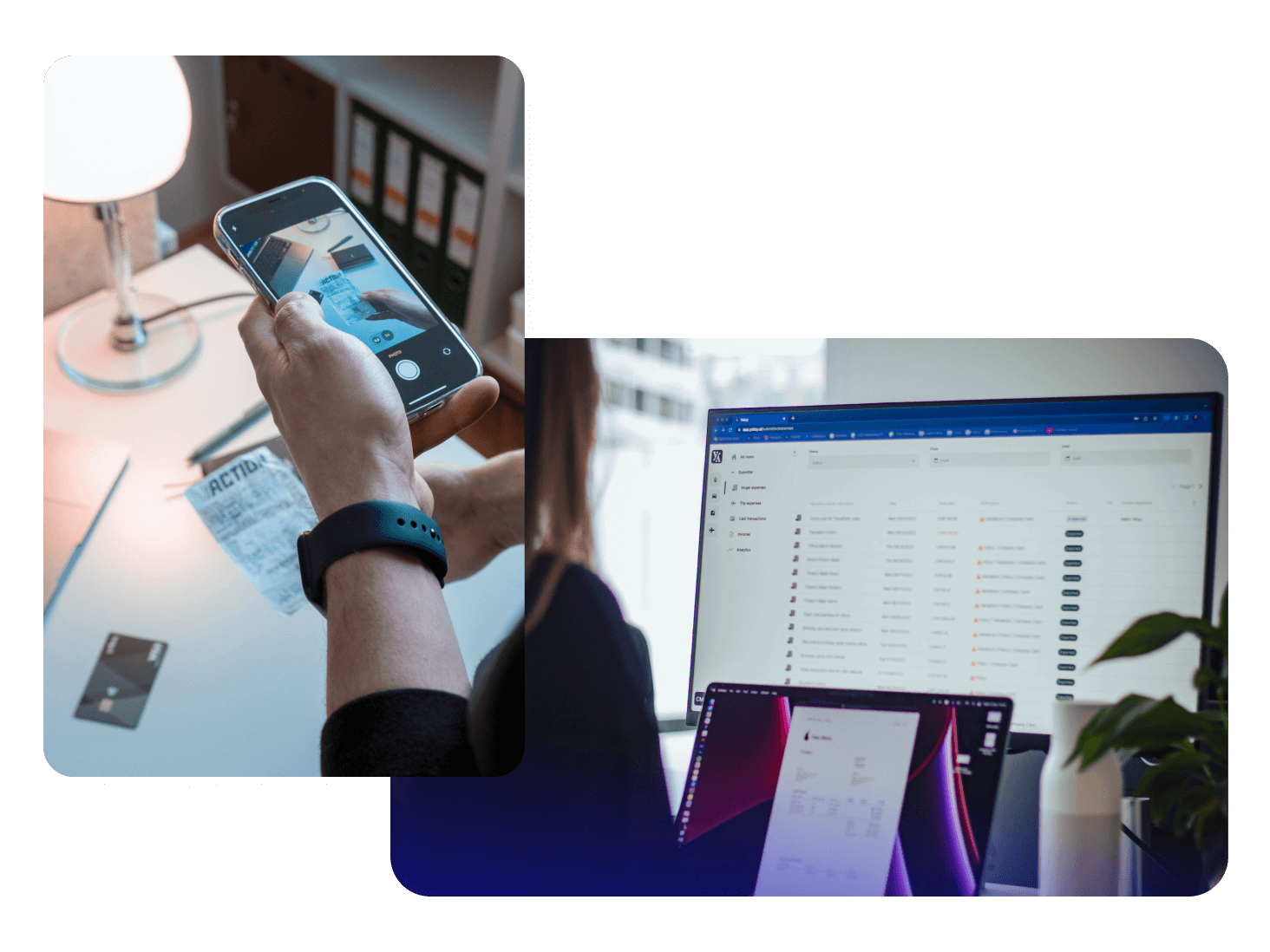

Yokoy allows employees to upload or take pictures of receipts and submit them in the Yokoy app (mobile phone or computer).

Yokoy extracts all necessary data from the picture, prepares the expense report automatically in a few seconds and even validates the expense report by generating warnings to highlight specific events (e.g. duplicate of picture).

Depending on the workflow of the company, the data and pictures can be checked by multiple parties (including the Finance team) before the expense is approved, booked in the Finance tool and reimbursed to the employee.

Such checks can include the correctness of the data or quality and completeness of the picture. Yokoy archives the pictures in line with the requirements for storing electronic photos for at least the statutory retention period.

Per Diem

Regulations in place

According to the Swiss regulations, companies can define their own Per Diem rate; the Swiss government does not set any specific rates or any limitations for employees to receive Per Diem.

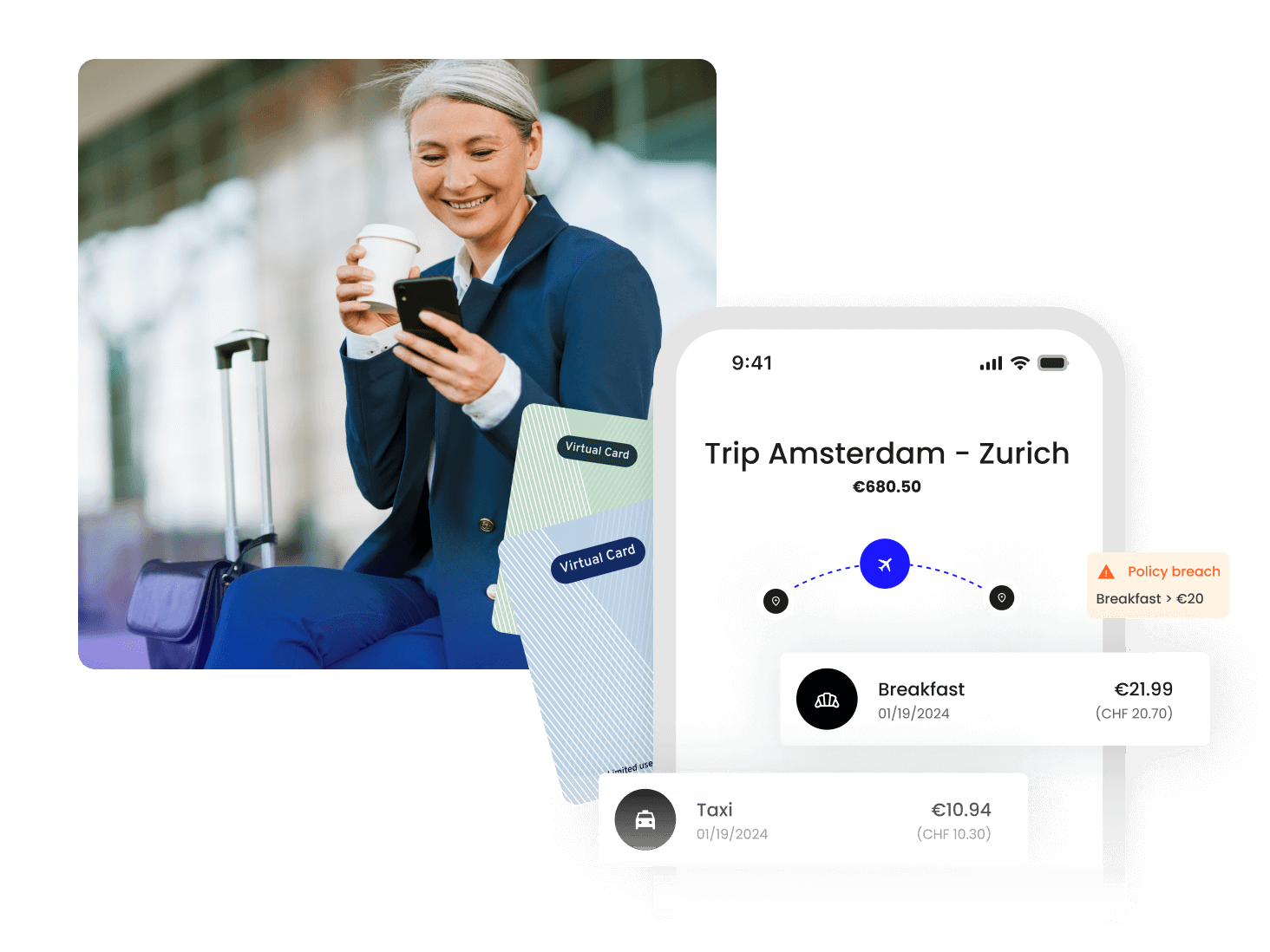

With Yokoy’s powerful Per Diem engine, you can configure, manage and assign Per Diem at ease, based on the employee’s business trip.

Yokoy's solution

A company can enter different Per Diem rates and the respective calculation rules. Per Diems are thereby automatically calculated based on the rates and the calculation rules without any manual work needed from the employees.

Mileage Allowance

Regulations in place

According to Swiss code of obligations, employees are entitled to receive mileage allowances for using their private vehicles for business purpose.

The official mileage rates set by the Swiss government are:

- For Car

- CHF 0.72 per kilometer (upto 10,000 Kilometer per year)

- CHF 0.60 per kilometer (more than 10,000 Kilometer per year)

- For Motorcycle the employees are entitled to receive CHF 0.40 per Kilometer

- For Bicycle the employees are entitled to receive CHF 0.30 per Kilometer

Yokoy's solution

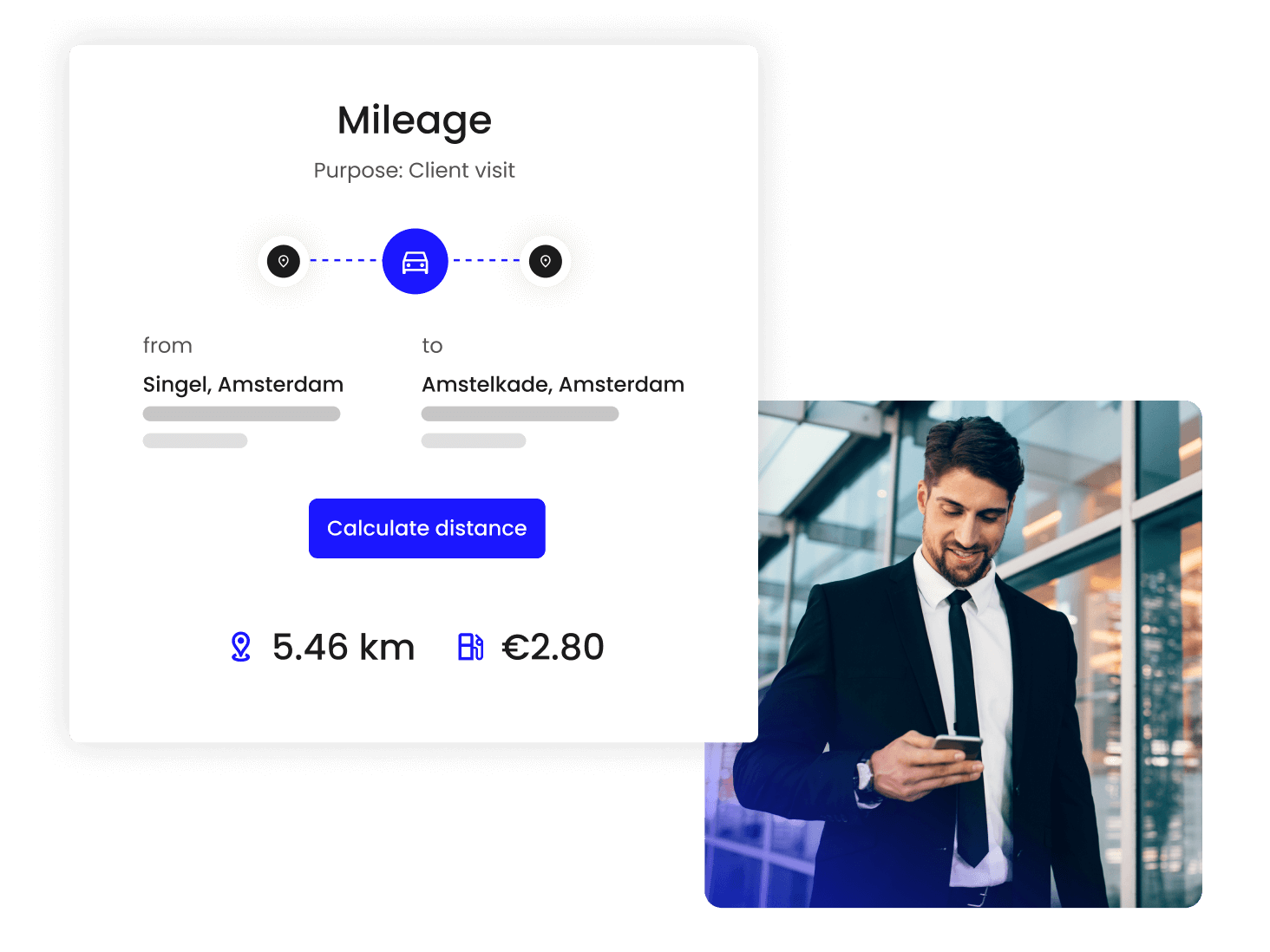

Yokoy recognises all the official rates defined by the government and therefore can automatically calculate mileage expenses based on the distance travelled. If a company decides to pay more than the rates defined by the government, Yokoy can export/book the excess amount separately in the Finance tool.

VAT Rate

Regulations in place

Swiss government levies VAT rates for exchange of goods and service. There are four different VAT rates relevant for expense management:

- Standard VAT – 7.7%

- Reduced VAT – 3.5%

- Reduced VAT – 2.5%

- No/Zero VAT – 0%

Changes soon to come:

The Swiss Federal Tax Administration announced new VAT rates which will be effective from 1st January 2024. The following new VAT rates will be applicable for Switzerland and the municipalities of Lichtenstein:

- Standard Rate: 8.1% (from 7.7%)

- Reduced Rate: 2.6% (from 2.5%)

- Accommodation rate: 3.8% (from 3.7%)

Yokoy's solution

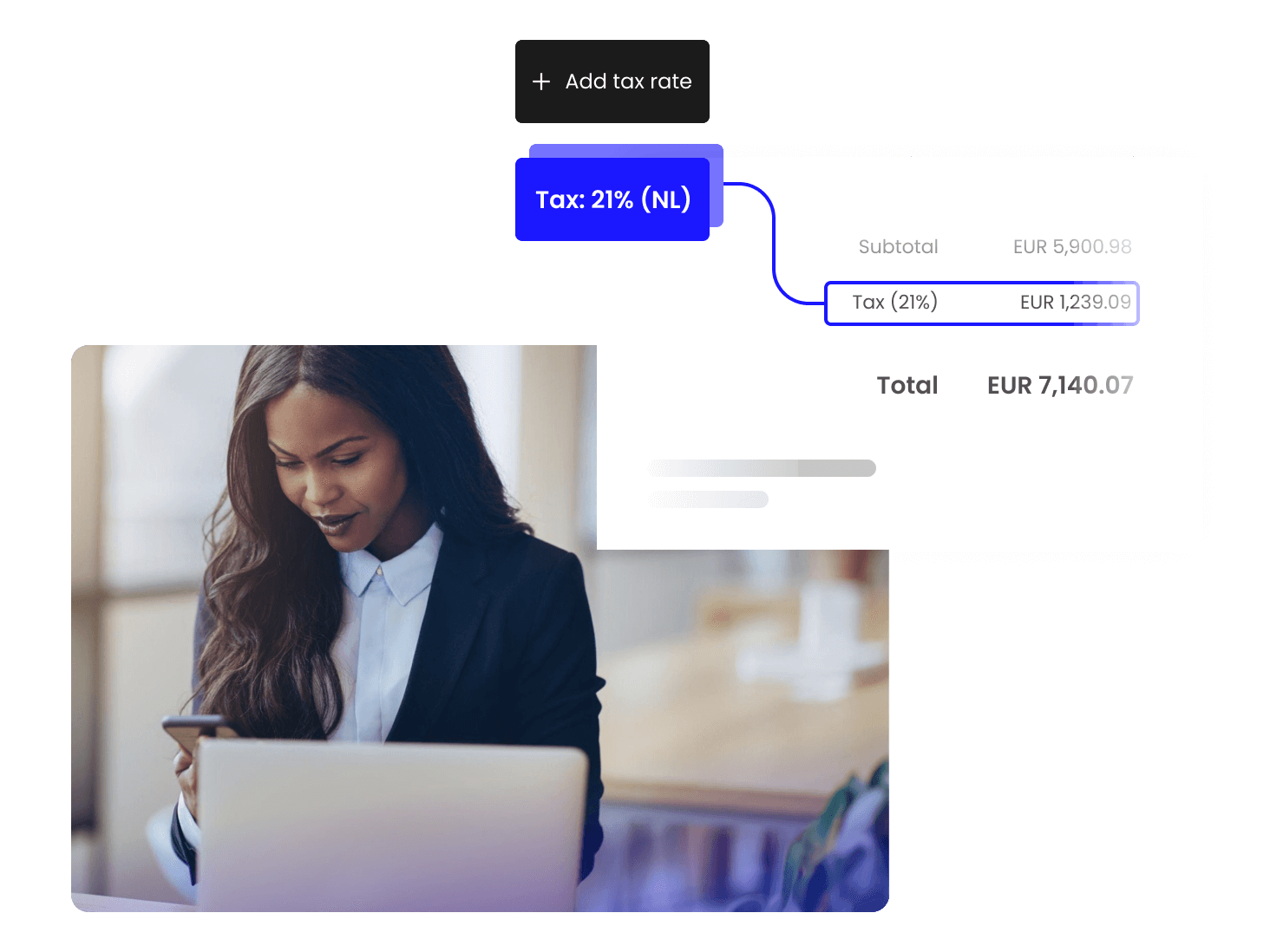

Yokoy automatically extracts all VAT rates relevant for expense management (see table above) on the receipt pictures. Companies can also add additional VAT rates for extraction, if relevant. Yokoy can also extract VAT rates from other countries (e.g. Germany) and book/export them separately in the Finance tool.

Additionally, Yokoy offers standard integrations with external VAT reclaim providers, whereby the receipt pictures and the extracted VAT rates are for specific countries are automatically sent from Yokoy to the third party.

Simplify your invoice management

Related content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.