Home / Compliance Center / Compliance in Spain

Compliance in Spain

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

Within the sphere of spend management in Spain, compliance emerges as a pivotal consideration.

Spanish enterprises engaged in spend management are confronted with a multifaceted framework of rules and expectations. Adhering to these compliance stipulations is not only obligatory from a legal standpoint but also mirrors Spain’s dedication to upholding transparent and ethical financial methodologies.

Proficiency in negotiating these regulations is indispensable for businesses striving to refine spending procedures while upholding the highest standards of honesty and accountability.

Download for later

No time to read right now? Get the .pdf version of the guide below.

Proof of Receipt

Regulations in place

According to Spanish regulation, companies can store expense receipts digitally. The government also allows companies to store expense receipts digitally as long as the expense management tool is compliant and should be certified by Spanish Tax Agencies (AEAT).

If the expense management tool is not compliant and is not certified by AEAT, companies must collect and store physical expense receipts for a valid reimbursement of business expenses.

Yokoy's solution

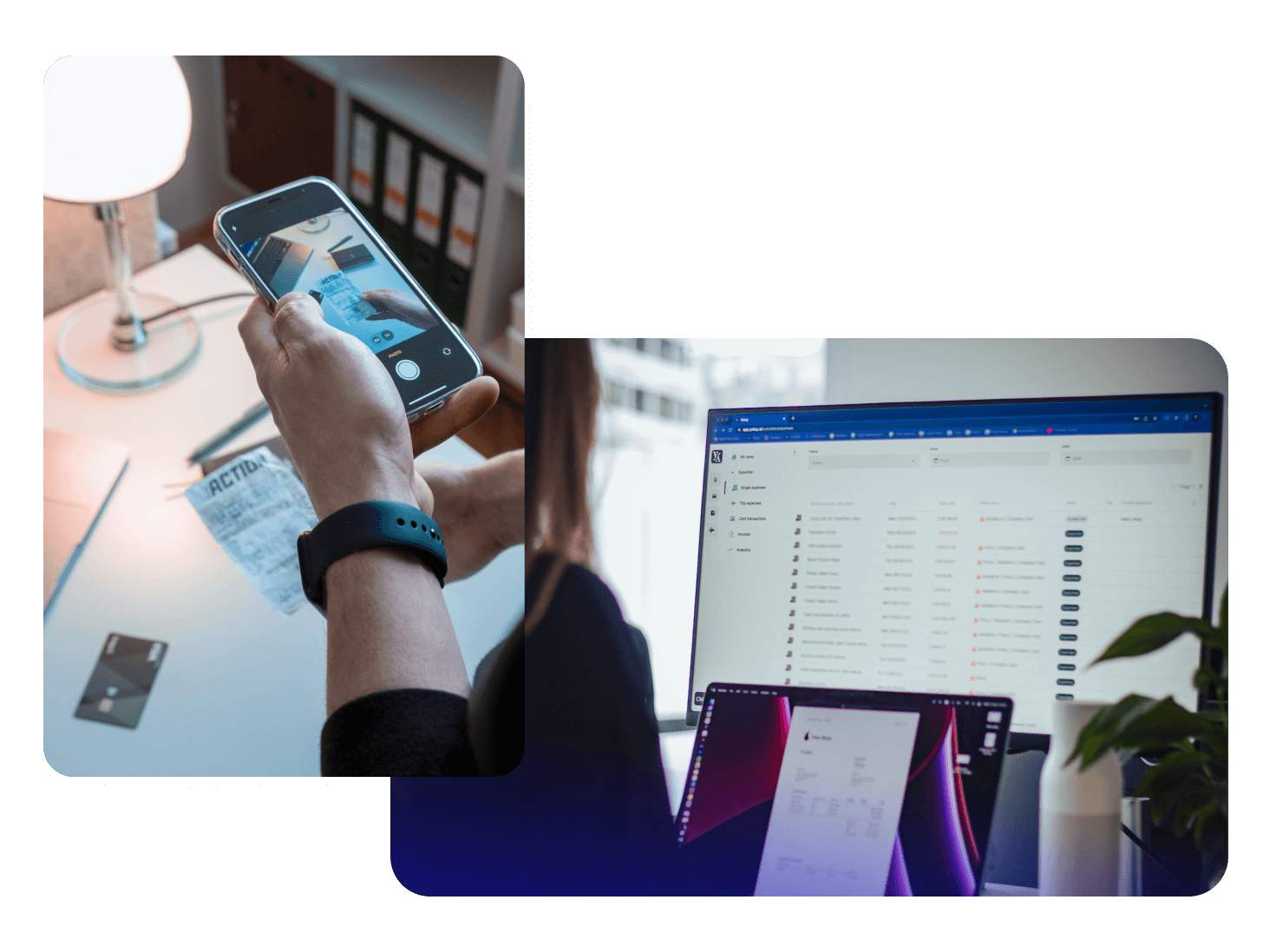

Yokoy allows employees to upload or take pictures of receipts and submit them in the Yokoy app (mobile phone or computer).

Yokoy extracts all necessary data from the picture, prepares the expense report automatically in a few seconds and even validates the expense report by generating warnings to highlight specific events (e.g. duplicate of picture).

Depending on the workflow of the company, the data and pictures can be checked by multiple parties (including the Finance team) before the expense is approved, booked in the Finance tool and reimbursed to the employee. Such checks can include the correctness of the data or quality and completeness of the picture.

Additionally, Yokoy has the possibility of signing pictures compliant with the Spanish Tax Agency (AEAT).

Per Diem

Regulations in place

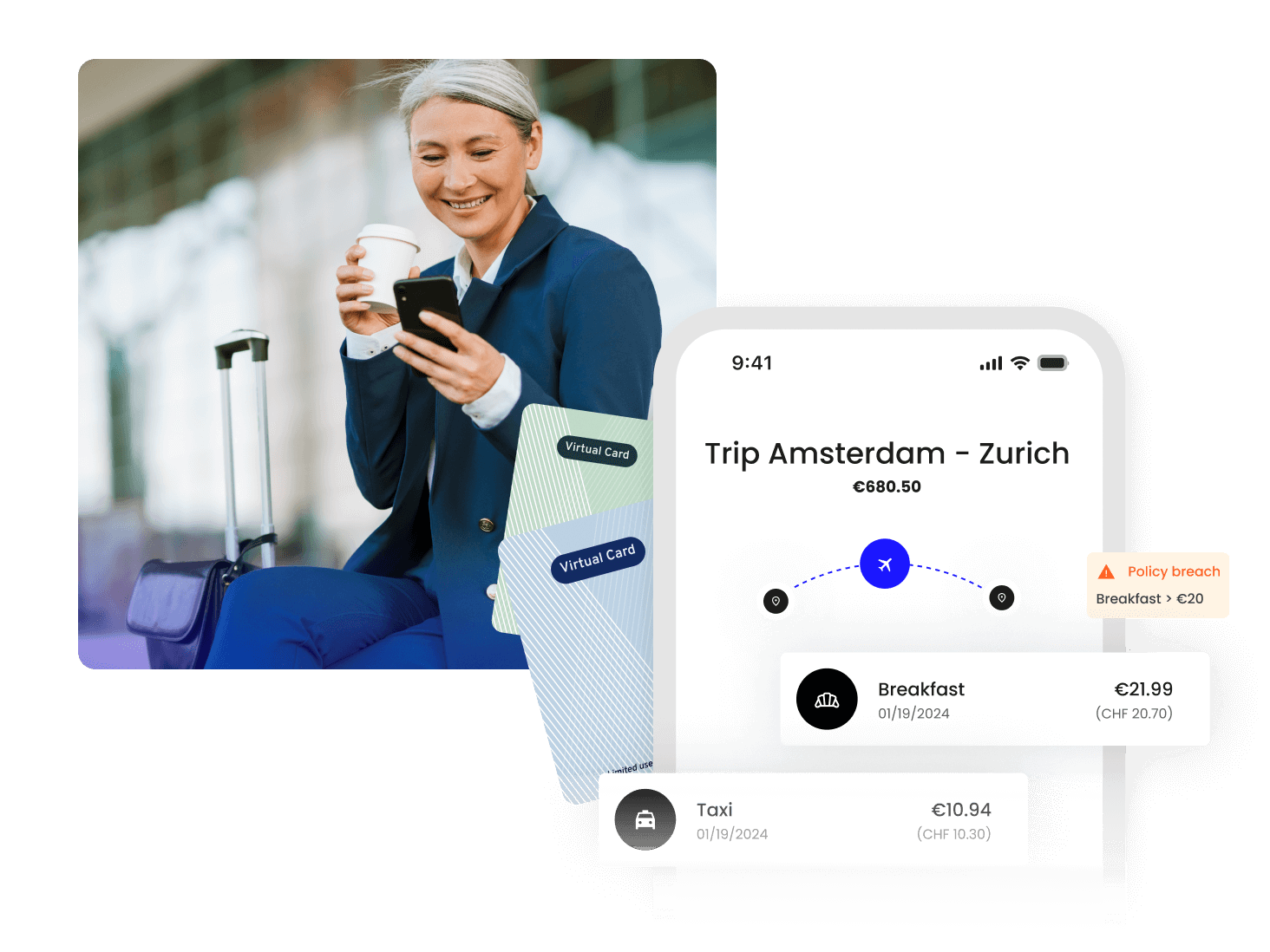

According to Spain regulations, companies can reimburse Per Diem to compensate employees for the cost incurred during the business trip. If the employee travels and resides in a temporary workplace for more than nine months, Per Diem will become subject to income tax.

Per Diem are highly dependent on the location and duration of the business trip. Companies should adhere to the allowances that are defined by the Spanish government based on the city or the country that the employee travels, if the company reimburses employees more than what’s recommended by the government, the additional amount will be taxable.

Domestic Per Diem

- If the employee travels for an overnight domestic business trip, then the employee is entitled to receive 53.34 € as a daily allowance.

- If the employee travels for a business trip without an overnight stay, then the employee is entitled to receive 26.67 € as a daily allowance.

Foreign Per Diem

- If the employee travels to a foreign destination with an overnight stay for a business trip, then the employee is entitled to receive 91.35€ as a daily allowance.

- If the employee travels to a foreign country without an overnight stay, then the employee is entitled to receive 48.08€ as a daily allowance.

Yokoy's solution

A company can enter different Per Diem rates and the respective calculation rules. Per Diems are thereby automatically calculated based on the rates and the calculation rules without any manual work needed from the employees. If the user receives an allowance that is higher than the governmental rate, the difference can be booked/exported differently to the Finance tool.

Mileage Allowance

Regulations in place

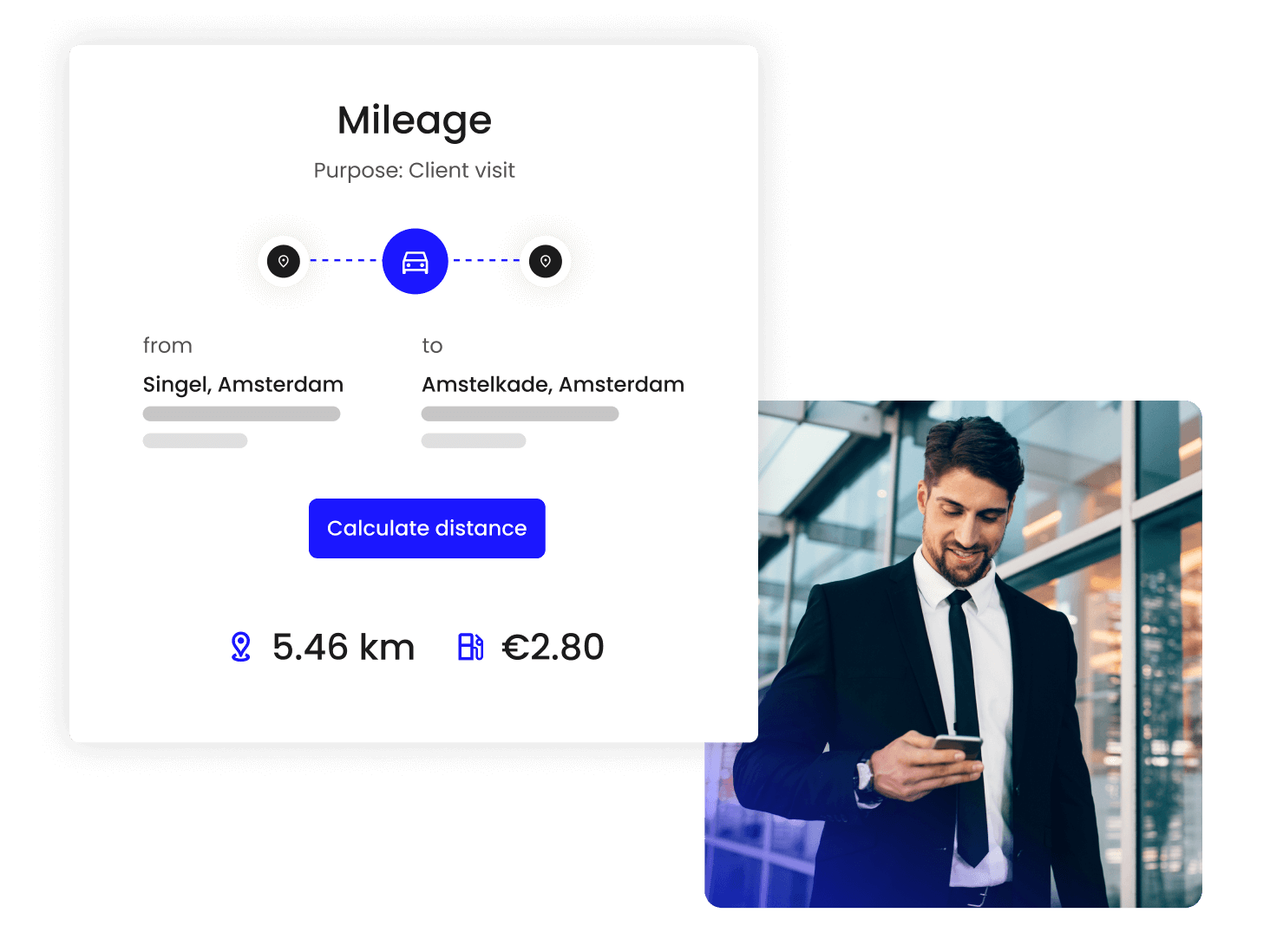

Companies can reimburse employees to compensate expenses incurred for the usage of private vehicle for a business trip.

In such cases, the employees are entitled to receive 0.19€ per kilometer as “Mileage allowance” recommended by the government.

Yokoy's solution

Yokoy recognises all the official rates defined by the government and therefore can automatically calculate mileage expenses based on the distance travelled. If a company decides to pay more than the rates defined by the government, Yokoy can export/book the excess amount separately in the Finance tool.

VAT Rate

Regulations in place

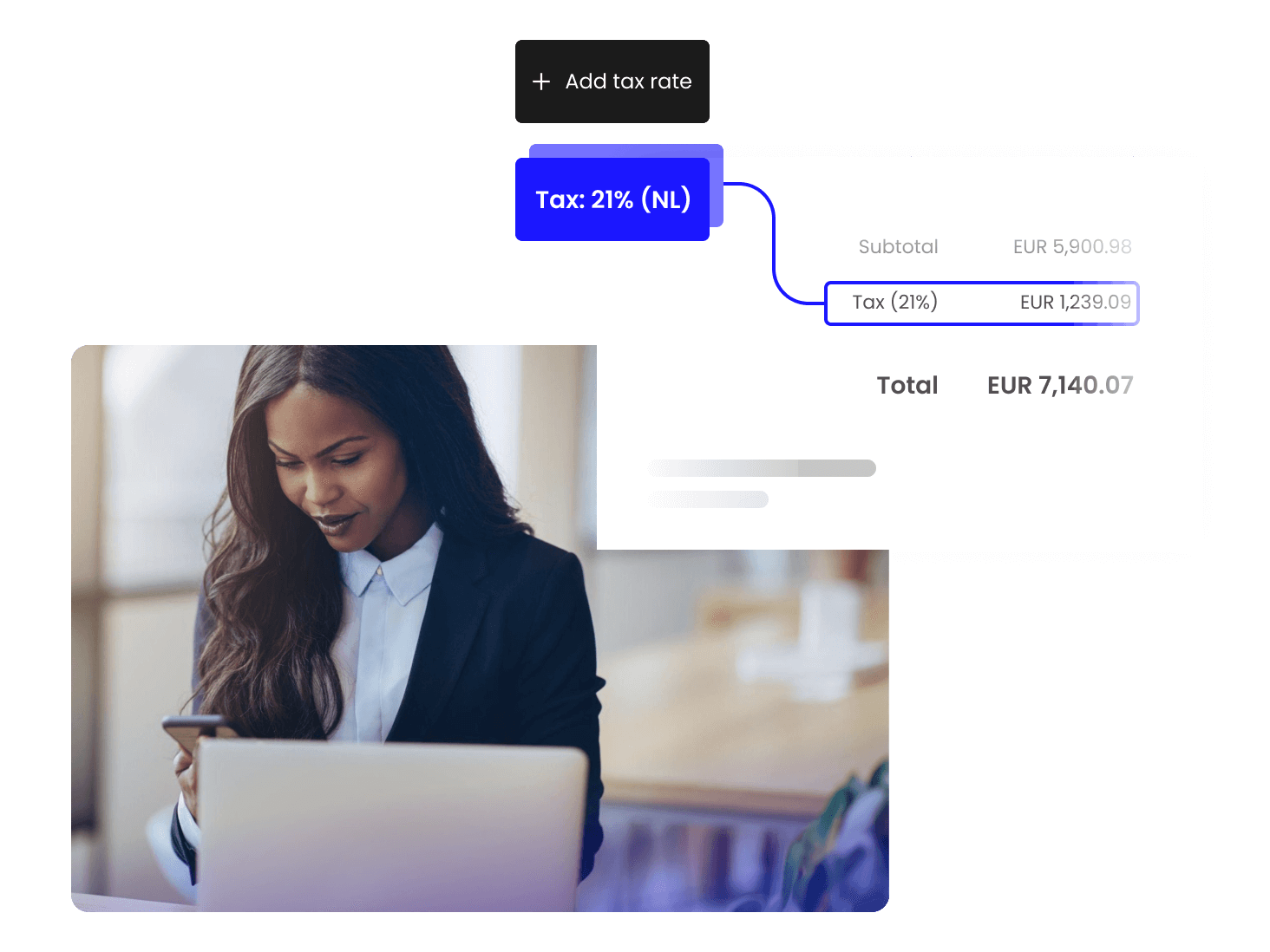

The Spanish government levies VAT rates for exchange of goods and service. Companies should report VAT to tax authorities digitally via SII. here are four different VAT rates relevant for expense management:

- 21% standard VAT rate for all goods and service

- 10% intermediary VAT rate

- 4% reduced VAT rate

- 0% VAT rate

Yokoy's solution

Yokoy automatically extracts all VAT rates relevant for expense management (see table above) on the receipt pictures. Companies can also add additional VAT rates for extraction, if relevant.

Yokoy can also extract VAT rates from other countries (e.g. Germany) and book/export them separately in the Finance tool.

Additionally, Yokoy offers standard integrations with external VAT reclaim providers, whereby the receipt pictures and the extracted VAT rates are for specific countries are automatically sent from Yokoy to the third party.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo