Home / Solving Automotive Accounts Payable Challenges with AI Automation

Solving Automotive Accounts Payable Challenges with AI Automation

- Last updated:

- Blog

Co-founder & CCO, Yokoy

The automotive sector is undergoing a remarkable wave of innovation, redefining the industry’s landscape. A shift towards electric vehicles and AI-powered autonomous driving technologies is reshaping the very essence of transportation, promising safer and more efficient roads.

As technology advancements accelerate, R&D expenditures and capital investments have skyrocketed, exerting pressure on companies’ bottom lines.

Staying ahead of competitors requires substantial investments in new manufacturing processes, supply chain reconfiguration, and workforce upskilling, but balancing these high costs while catering to the growing demand for innovation is a formidable challenge.

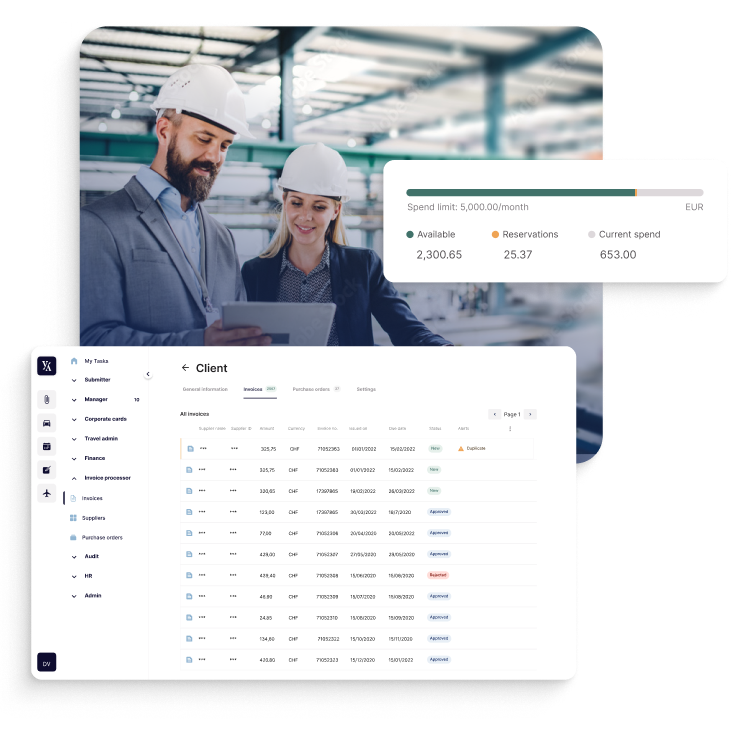

At Yokoy, we help automotive manufacturers streamline their spend management for better cost control and increased efficiency of their accounts payable processes.

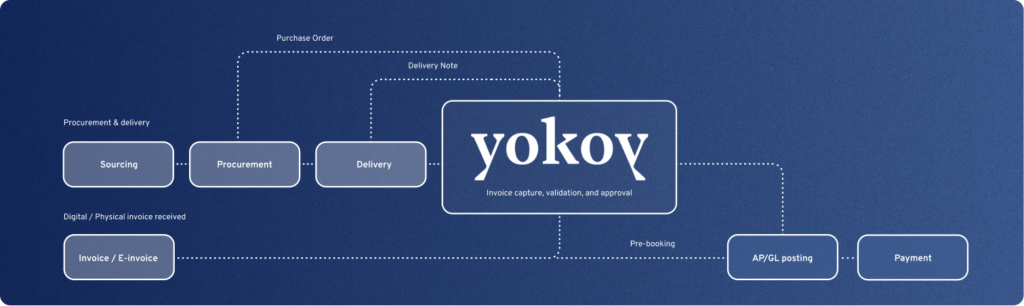

Our approach to accounts payable within the automotive sector has transformed procurement processes for international manufacturers. This was achieved by simplifying procure-to-pay (P2P) operations, strengthening compliance, and ensuring cost-effectiveness through full spend visibility.

Thus, within this article, I will offer a brief overview of how Yokoy’s AI-powered spend management suite introduces accounts payable automation to the automotive industry, assisting companies in reaching their cost reduction objectives.

Common accounts payable challenges for automotive industries

AP teams manage numerous suppliers and vendors, frequently overseeing their procure-to-pay (P2P) or accounts payable (AP) processes across a spectrum of systems, currencies, and geographical locations.

Frequently, their IT setup and financial technology aren’t well-suited for these needs, leading to scattered and inefficient processes. This causes errors and adds both time and money expenses for companies.

When we talk to customers in the automotive industry, we often hear that even after undergoing financial transformation projects, they still struggle with poor integrations between ERP tools, accounting software, spend management platforms, and procurement systems.

This causes errors and adds both time and money expenses for companies, highlighting just how important it is to evaluate your current P2P and AP processes and have a clear list of requirements before investing in accounts payable software.

But before we explore potential solutions, let’s first highlight the main challenges often faced in AP processes by automotive manufacturers.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Increased risk of human error

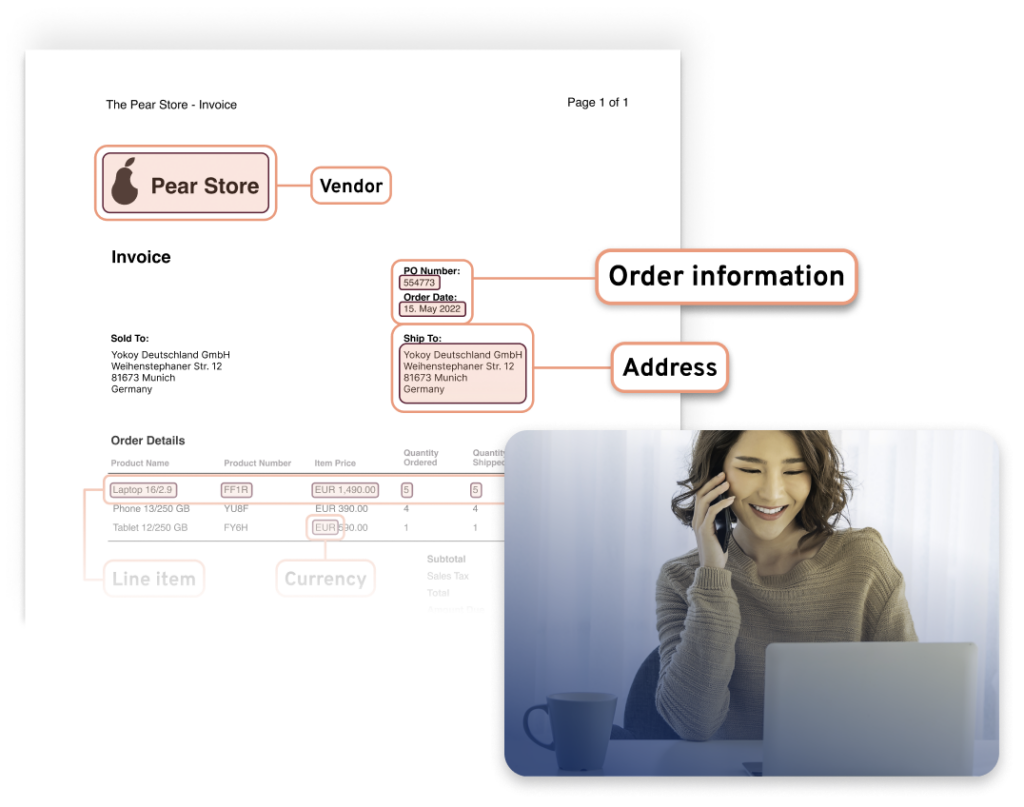

Mistakes during manual data entry, such as inaccurately inputting the payment amount from an invoice into the payment system, or failing to detect mismatches between invoice line items and purchase orders, can lead to significant financial losses for the company.

Furthermore, as the workload intensifies, the likelihood of errors during invoice data capture also escalates.

Considering that numerous companies in the automotive industry still handle a substantial volume of paper invoices and lack a proper document management system, the risk of human errors becomes particularly pronounced during the invoice capture and validation stages of the accounts payable process.

Using a mix of manual steps and digital solutions such as Excel spreadsheets doesn’t simplify things, as it creates unnecessary fragmentation in processes and leads to bottlenecks that are often hard to detect in real time.

Case study

How Buhler Turbocharged their Spend Management with Yokoy

Buhler needed a digital solution to streamline their spend management process across global entities. With Yokoy, they achieved 4.7x ROI, processing 46.7% of their expenses within 24 hours.

Missing, fraudulent, or duplicate supplier invoices

Addressing the issue of missing, fraudulent, or duplicate supplier invoices is a critical aspect of effective accounts payable management. These challenges can arise due to various factors, including manual data entry errors, communication gaps, and even malicious activities.

Missing invoices can lead to incomplete records and delayed payments, affecting vendor relationships and potentially incurring late fees. On the other hand, the occurrence of fraudulent or duplicate invoices can have severe implications, causing monetary losses and damaging the company’s reputation.

Processing non-PO invoices

Non-PO invoices do not have a corresponding purchase order. These invoices cover both indirect expenses and service-related costs.

Indirect expenses within the automotive sector span items such as tools, maintenance, travel costs, and utilities, supporting operations while not directly tied to core products. Similarly, service invoices involve payments for vital services like repairs, consulting, and professional services that ensure seamless operations.

However, managing non-PO invoices in this industry presents a challenge – the potential for maverick spending, i.e., purchases outside established procurement processes. This can lead to increased costs, reduced spending transparency, and possible compliance concerns.

Automating parts of the non-PO invoice processing using technology and software can help streamline the process, reduce errors, and improve efficiency.

Long invoice processing cycles

Automotive manufacturers engage with numerous suppliers, each of whom might submit invoices in various formats—ranging from paper and PDF to EDI, among others. Processing these diverse documents often necessitates manual intervention since most accounts payable solutions struggle to handle unstructured data effectively.

Following the reading of invoices and the entry of data into the system, the verification and approval workflows commence. Frequently, these workflows prove intricate and entail multiple stakeholders who are required to check the data manually, ensuring accuracy and confirming that the invoices align with purchase orders and goods receipts.

Lack of consistent procedures leads to long approval times and delayed supplier payments, straining vendor relationships.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Disjointed tech landscapes and poor integrations

Another key challenge lies in the disconnected nature of technology systems and the poor integrations between tools. These might include financial software, procurement platforms, invoicing tools, and communication tools.

When these systems are not seamlessly connected, it can lead to inefficiencies, data discrepancies, and challenges in maintaining a clear financial overview.

Even worse, when no accounts payable automation system is in place, financial transactions rely heavily on paper invoices, complicating tracking and management. When it comes to international payments, the use of separate systems scatters the spend data, adding to the complexity.

Case study

Efficiency Unleashed: BAWAG’s Journey to Automated Expense Management

Read the success story of BAWAG Group AG’s journey towards automated expense management using Yokoy’s innovative AI technology.

Lack of end-to-end visibility

The lack of visibility of cash flow for financial projections is another common challenge for automotive manufacturers. Without a holistic view of cash flow, accurately forecasting financial trends becomes a daunting task.

This can lead to uncertainties in budgeting, planning, and decision-making. In the dynamic and ever-evolving automotive industry, where market shifts, supply chain disruptions, and regulatory changes are frequent, having a clear understanding of financial inflows and outflows is crucial for staying adaptable and competitive.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

The cost of not automating the accounts payable process

Manual processing of invoices and documents can result in higher operational costs due to the need for additional staff, increased labor hours, and the risk of errors.

According to the Institute of Financial Operations, manual invoice processing can cost up to $20 per invoice, compared to $4 per invoice with automation.

Research from the Aberdeen Group indicates that manual processes can result in an error rate of around 5%, which can lead to significant financial losses and time-consuming error resolution.

The same group found that organizations with manual processes have an average invoice processing cycle of 10.3 days, compared to 3.8 days for those with automated processes.

According to Levvel Research, companies with automated AP processes can capture over 90% of early payment discounts, compared to only about 20% for those with manual processes.

White paper

Report: State of Spend Management Transformation [2023]

This report offer a glimpse into the current state of spend management transformation and the trends, challenges, and opportunities shaping its future.

How artificial intelligence transforms the AP process in the automotive industry

AI automation brings a host of benefits to the automotive industry’s AP landscape. It’s not just about speeding up tasks and reducing errors – AI’s influence goes much deeper.

By automating complex tasks and using its ability to understand patterns and data, AI is changing the very nature of how AP works. Listed below are just some of the advantages that AI automation offers to the automotive industry.

Increased process efficiency

One of the main benefits of adopting AI-powered automation in the accounts payable process is the increased efficiency resulting from automating both the steps and the logic of the process.

Speeding up invoice processing boosts operational efficiency and gives the finance team more time for strategic tasks like data analysis, leading to better financial decision-making.

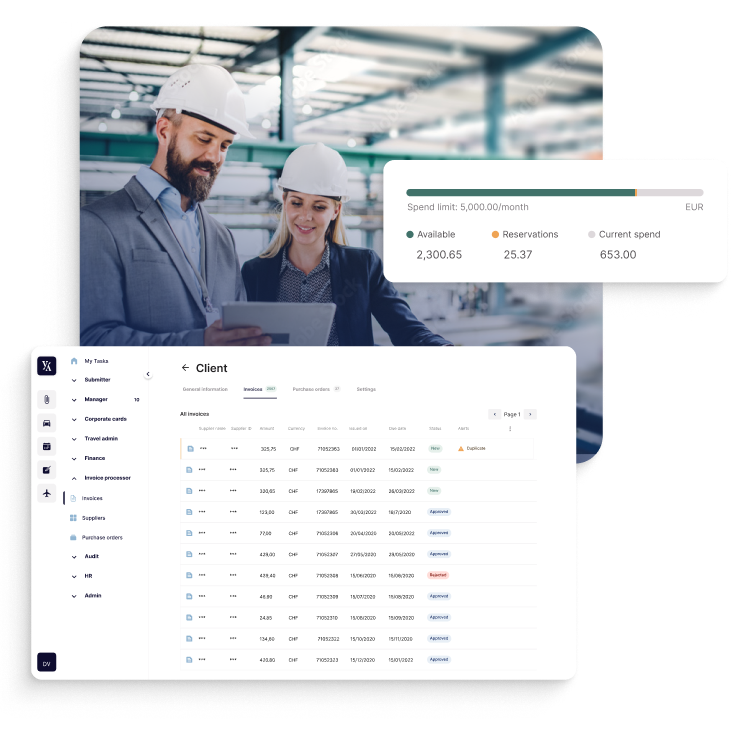

With Yokoy, for example, customers experience automation rates of up to 90%, savings thousands of hours in manual work every month. This is possible by automating all the steps in the AP process, from capturing the invoice, reading and structuring the data, and validating the invoice, to reviewing, approving, and posting it to the ERP system.

This degree of automation is hard to achieve with legacy software and technologies like RPA alone, as explained in this article: Why the Transformation of Finance Starts with Spend Management.

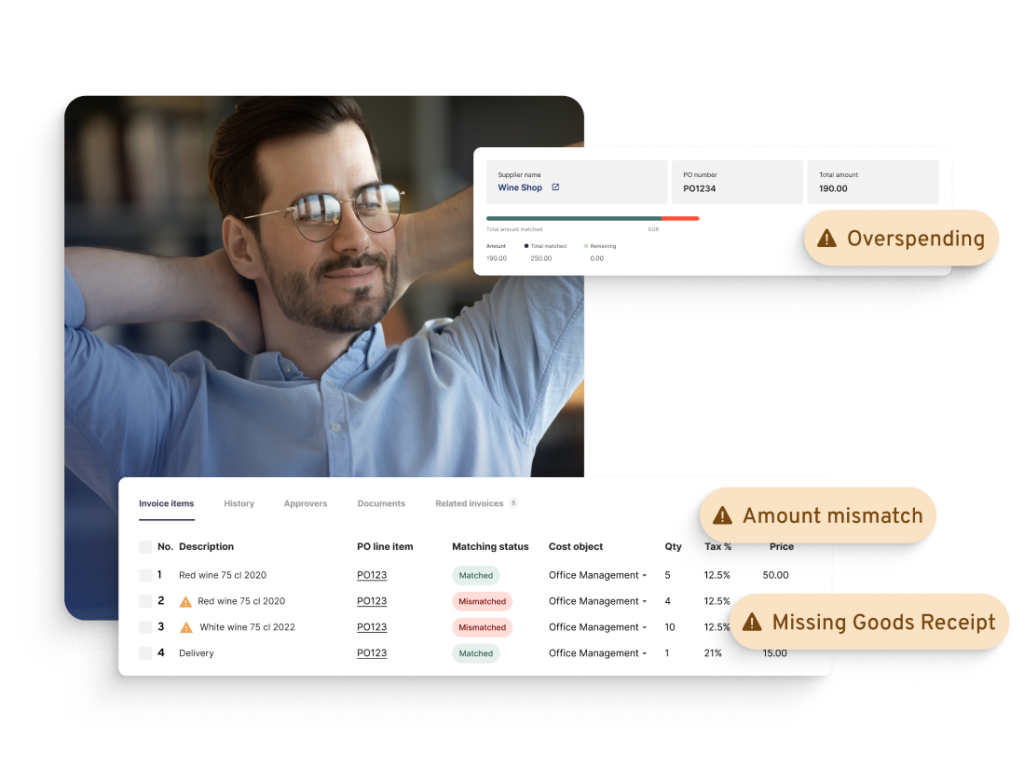

Streamlined matching and approval flows

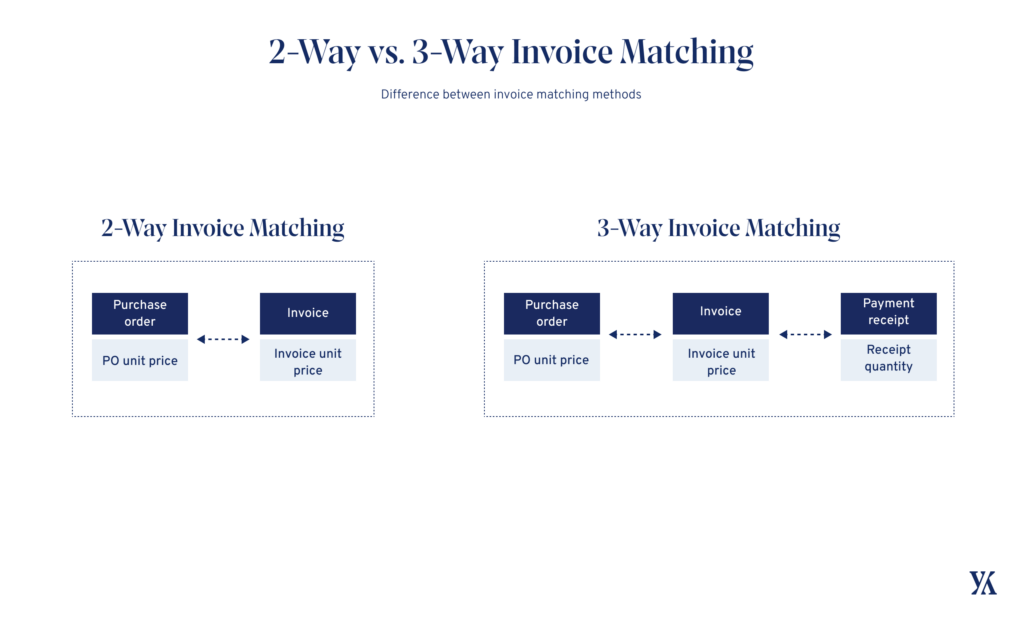

Automated two-way and three-way matching processes eliminate the need for human intervention.

In a two-way match, the AP system cross-references purchase order data with invoice details to ensure accuracy. Similarly, in a three-way match, the system validates information across purchase orders, invoices, and order receipts to verify consistency.

This seamless operation ensures comprehensive verification across multiple data points without requiring manual oversight. Moreover, by setting auto-approval workflows, AP teams can streamline all invoice approvals, ensuring faster supplier and vendor payments.

With Yokoy, companies can set multi-level approval workflows to accommodate complex processes spanning across departments and geographies, without sacrificing governance or compliance.

Blog article

How to Use Invoice Matching Technology to Improve Your Process Efficiency

See how invoice matching technology automates the 2- and 3-way matching of supplier invoices with POs and goods receipts, for an efficient AP process.

Mauro Spadaro,

Product Manager

Increased visibility and spend control

By integrating AI technology into automotive industry companies, AP teams gain the ability to establish stronger controls over budget allocation for different teams and individuals.

Moreover, AP automation solutions can consolidate data from diverse sources, providing real-time insights into cash flow and enabling well-informed decisions.

This holistic understanding of the financial landscape equips automotive manufacturers to enhance projection accuracy, optimize resource distribution, and elevate their overarching financial strategy.

Reduced risk of fraud or overpayment

AP automation software plays a crucial role in detecting potential issues by cross-referencing invoices with purchase orders and past transactions. This helps identify irregularities that could indicate fraudulent or duplicate submissions.

Furthermore, automated workflows ensure that invoices follow the correct approval routes, minimizing the chances of unauthorized or duplicate payments.

The time saved with automation is significant when compared to the manual process where an AP clerk would need to search through vendor files and unpaid invoices to ensure no duplicates exist.

Through the integration of AI-driven technologies, businesses can further enhance their capabilities to identify anomalies, validate invoice accuracy, and ensure adherence to established processes. This, in turn, enhances the efficiency and reliability of their accounts payable operations.

Blog article

How to Automate Your Invoice Approval Workflows with Yokoy

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. Here’s how Yokoy can help.

Mauro Spadaro,

Product Manager

Next steps

In summary, the automotive sector is in a transformative phase, driven by electric vehicles and AI technologies. With rising R&D costs and technological progress, effective cost management is crucial. Yet, achieving this while fostering innovation is a significant challenge for manufacturers.

Yokoy is here to assist automotive manufacturers in meeting these challenges head-on. Our AI-powered spend management suite offers tailored solutions to streamline spend management processes, identify potential cost savings, and optimize accounts payable operations.

By simplifying procure-to-pay operations, strengthening compliance measures, and ensuring cost-effectiveness through full spend visibility, we empower manufacturers to maintain cost control and drive efficiency.

If you’d like to see our spend management suite in practice, you can book a demo below.

See Yokoy for Automotive in action

Find cost-saving opportunities and drive efficiency in procurement operations by streamlining processes and analyzing spend patterns in real time.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.