Home / Addressing Accounts Payable Challenges in Manufacturing Companies: Strategies for Success

Addressing Accounts Payable Challenges in Manufacturing Companies: Strategies for Success

- Last updated:

- Blog

Co-founder & CCO, Yokoy

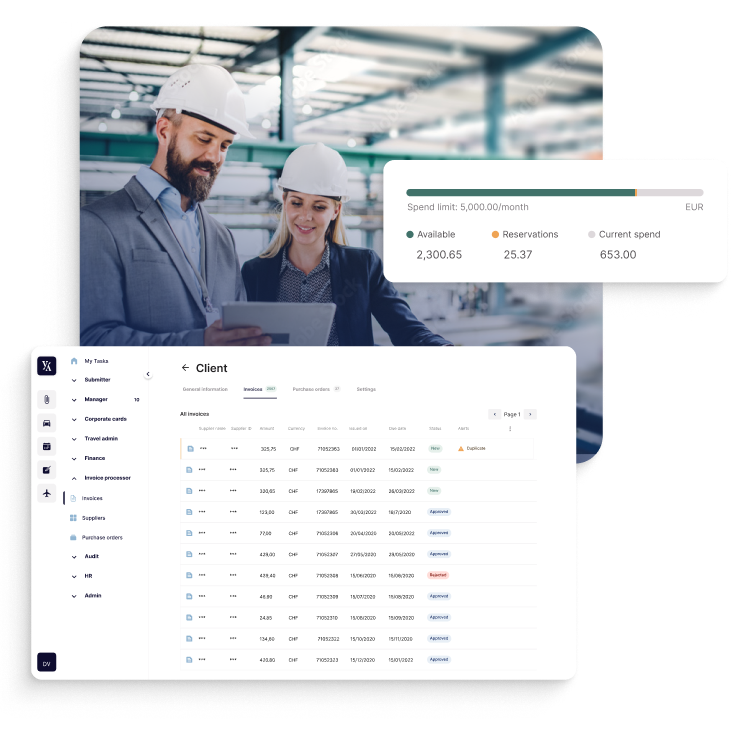

In the manufacturing industry, bottlenecks in the AP process can grind operations to a halt. Delays in invoice approvals, discrepancies in purchase orders, and manual data entry errors are just a few of the hurdles that manufacturers commonly face.

Such bottlenecks not only strain supplier relationships but also hinder financial visibility and decision-making.

At Yokoy, we understand the unique challenges that manufacturing companies face when it comes to their accounts payable (AP) processes, and we’re here to transform the way you manage your finances.

In this article, we’ll provide you with insights on how AI technology can be a game-changer for manufacturers looking to streamline their AP processes.

Accounts payable challenges in manufacturing companies

Accounts Payable (AP) processes pose unique challenges for manufacturing companies, owing to the intricacies of their supply chains and the sheer volume of transactions. Before delving into solutions, let’s take a closer look at these challenges.

Manual data entry errors: Human errors in data entry are a common challenge in manufacturing AP processes. Mistyped numbers or incorrect information can result in financial inaccuracies and compliance issues.

Invoice and purchase order discrepancies: Matching invoices with purchase orders can be a painstaking task, prone to errors. Discrepancies can lead to payment disputes, further delaying the AP cycle.

Delayed invoice approvals: Manufacturers often deal with a high volume of invoices, and use a mix of manual approval processes and Excel spreadsheets along with their financial tooling. This is not only time-consuming, but often leads to late payments to suppliers, affecting relationships and potentially incurring penalties.

Complex payment terms: Manufacturers often negotiate complex payment terms with suppliers, including discounts, credits, and extended payment periods, which can be challenging to manage manually.

Multiple locations and global suppliers: Manufacturing companies may have multiple locations and deal with suppliers from various regions, making it challenging to coordinate AP processes across different time zones and languages.

Supplier diversity: Many manufacturing companies work with a diverse range of suppliers, each with their own invoicing methods, invoice formats, and systems, adding complexity to the procurement process.

Inventory management: The timing of payments to suppliers is crucial to inventory management, and delays can impact production schedules and supply chain efficiency.

Limited financial visibility: Inefficient AP processes hinder financial visibility, making it difficult for finance professionals to make informed decisions and plan effectively.

Regulatory compliance: Complying with industry-specific regulations and tax laws can be intricate and demanding for manufacturers, requiring careful attention to detail from the AP department.

Auditing and reporting: Manufacturers often face rigorous auditing requirements, and maintaining detailed audit trails and reports can be time-consuming and resource-intensive.

Addressing these challenges often requires the adoption of advanced technologies such as AI-powered automation, which can streamline business processes, reduce errors, improve compliance, and enhance overall efficiency in manufacturing companies.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

How AI-powered automation can fix the AP process

AI automation software delivers inventive solutions that transcend the limitations of manual processes.

While we won’t delve into every application of artificial intelligence within the financial department of manufacturing companies, we’ll focus on the key areas where AI can enhance the AP process, showcasing how AI-powered software like Yokoy offers innovative solutions beyond the constraints of manual procedures.

Cut manual work to increase efficiency

AI-powered automation significantly reduces manual work in the accounts payable process.

By automating routine tasks such as data entry and approval workflows, AI frees up valuable time for finance professionals. This leads to faster invoice processing and improved overall efficiency.

Here’s how Yokoy’s AI accomplishes this:

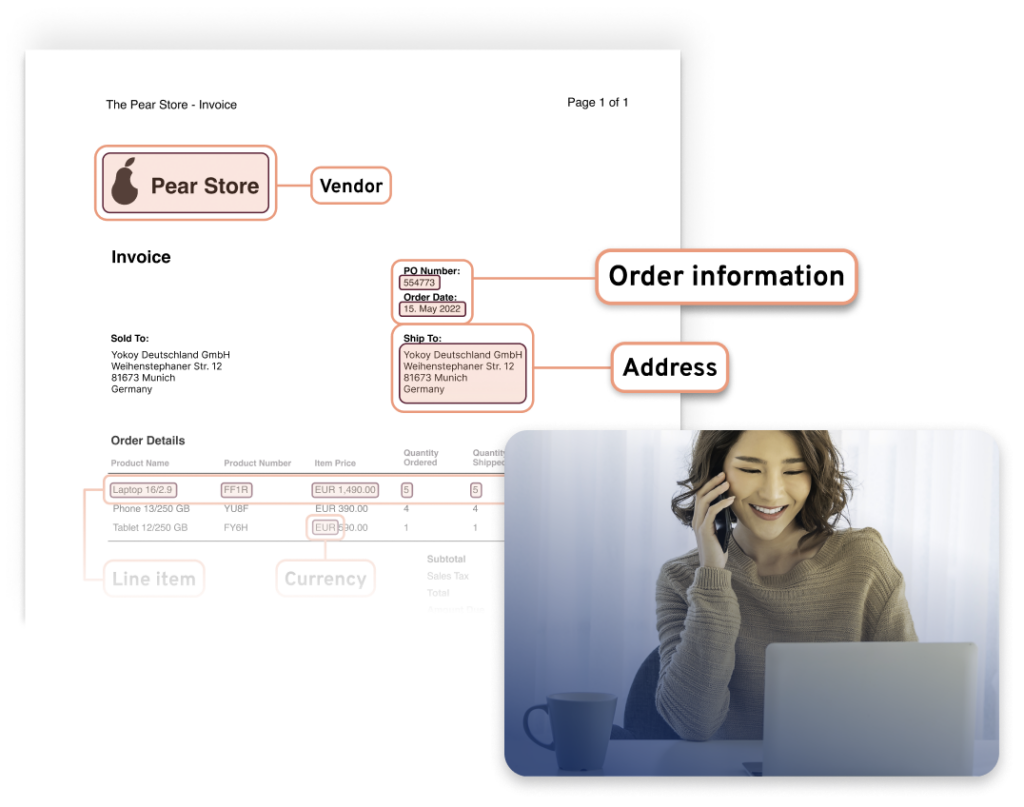

Invoice capture and data extraction

Artificial intelligence systems can automatically capture data from supplier invoices, including vendor details, invoice amounts, and line items. This eliminates the need for manual data entry, saving time and reducing the risk of errors.

Unlike legacy software that cannot properly processes unstructured data and often leads to a mix of manual and digital steps, Yokoy’s invoice engine is able to not only read invoice items, but also “understand” the data and structure it for further use.

This is extremely helpful as it enables seamless data flows between finance tools, for true end-to-end automation.

Automated approval workflows

Automation powered by artificial intelligence can route invoices for approval based on predefined rules, ensuring governance and preventing chaos in setups with complex hierarchies.

For example, low-value invoices may be approved automatically, while high-value ones are directed to the appropriate personnel. This ensures that invoices move through the approval process swiftly, removing the need for manual processes and enabling end-to-end accounts payable automation.

Yokoy allows finance teams to set up multi-level hierarchies and to create custom workflows and pre-approval flows. It’s therefore up to your AP department to decide how much standardization and flexibility they want to have.

Blog article

How to Automate Your Invoice Approval Workflows with Yokoy

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. Here’s how Yokoy can help.

Mauro Spadaro,

Product Manager

Invoice data validation

AI technology is designed to eliminate manual data entry errors. With intelligent data extraction and validation, the risk of inaccuracies is significantly reduced, ensuring data integrity. But this doesn’t stop at entering data into an invoice processing system.

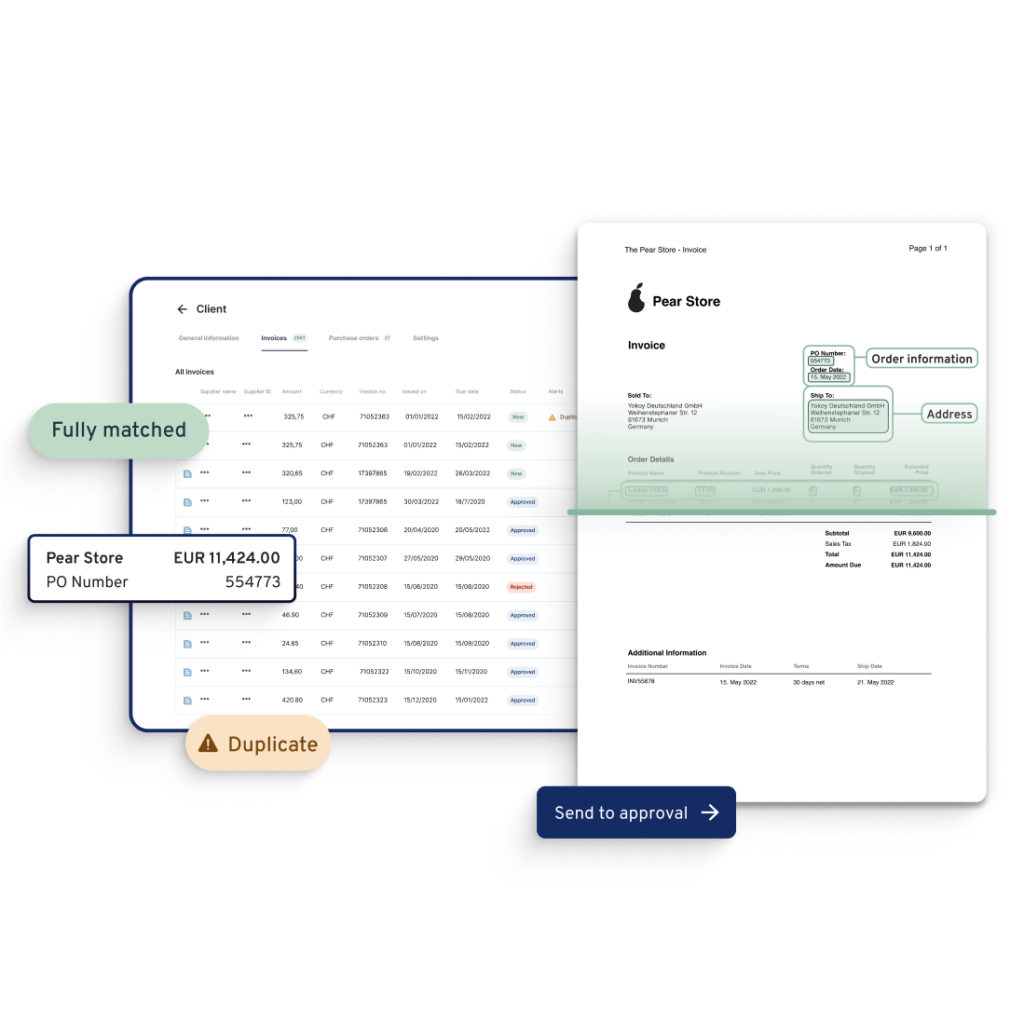

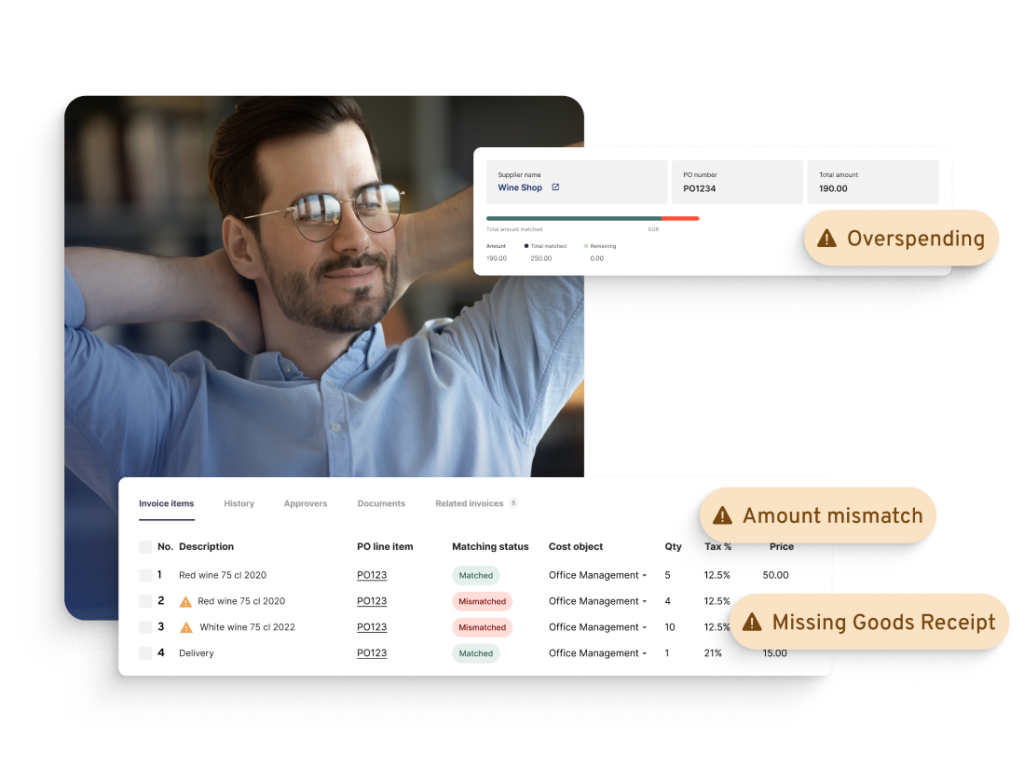

AI systems such as Yokoy can validate vendor invoice data against purchase orders and receipts. Any discrepancies are flagged for review, in real time, reducing the likelihood of incorrect or duplicate payments.

Over time, the artificial intelligence learns from historical data, improving their accuracy in recognizing and validating information. This is possible through machine learning algorithms, the continuous improvements reducing error rates to a minimum.

Besides this benefit, the automated checks enable functionalities like two-way or three-way matching and exception handling.

Moreover, artificial intelligence can automatically correct common data entry errors, such as typos or missing information, ensuring data accuracy. This way, the AP team doesn’t have to manually fix errors, and can free up time for more strategic tasks. Through integrations with ERP systems, the data can be pushed automatically, for accurate records.

Streamline invoice processing

Another way AI-driven automation can benefit the manufacturing industry is by streamlining the entire invoice processing cycle.

We’ve already mentioned that software like Yokoy can automate the invoice data capture, but on top of that, the tool can also take over the coding, matching, and exception handling.

Invoice coding and matching

Yokoy automatically assigns general ledger codes or cost centers to invoices based on predefined rules, speeding up the invoice coding process and removing the need for manual intervention.

AI software for AP automation can match invoices with purchase orders and goods receipts automatically. Depending on the tool used and your setup, this can include the two-way match, three-way match, or 4-way match.

Exception handling

In cases where there are discrepancies or issues with an invoice, invoice processing solutions like Yokoy can flag them for review in real time. This ensures that only invoices that require human attention are delayed, speeding up the process for the majority of invoices.

Through custom workflows, the edge cases can be automatically redirected to the designated stakeholders, for further checks.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Consolidate the tech landscape

When engaging with clients and prospects in the manufacturing industry, we frequently encounter concerns about poorly executed implementations and the absence of system integration, which are major contributors to disjointed processes and fragmented AP workflows.

As a result, we strongly recommend selecting an AI-powered AP automation solution that aligns with your manufacturing company’s unique requirements and seamlessly integrates with your existing IT infrastructure.

AP automation solutions are designed to integrate with existing ERP systems, accounting software, or procurement tools. This consolidation streamlines data flow and reduces the need for multiple applications.

Also, modern AP software enables scalability and doesn’t lock you in with a single vendor.

Yokoy, for example, is built for global organizations with multiple entities and complex P2P and AP setups. It’s engineered to be highly flexible and modular, supporting multiple currencies and languages, and enforcing compliance across geographies through built-in AI and automation rules.

Case study

How Buhler Turbocharged their Spend Management with Yokoy

Buhler needed a digital solution to streamline their spend management process across global entities. With Yokoy, they achieved 4.7x ROI, processing 46.7% of their expenses within 24 hours.

Improve visibility through real-time data

Artificial intelligence provides real-time insights into your AP process. Finance professionals can access up-to-the-minute data and analytics, enhancing visibility and enabling data-driven decision-making.

Customized reporting

Many AI solutions provide a centralized dashboard where finance professionals can access all spend analytics information, from invoices to approvals, in one place. This simplifies the user experience and reduces the complexity of managing various tools, making it easier to generate expense reports on the go.

Forecasting

With historical data and AI-powered predictive analytics, you can forecast future cash flow and plan accordingly, ensuring financial stability.

Enforce compliance

Another major benefit of automation software for the manufacturing industry is that it ensures that your AP process complies with industry regulations and company policies. It helps identify and flag any discrepancies or potential compliance issues, reducing risk and keeping your processes audit-proof.

Automated compliance checks

AI can automatically check invoices for compliance with tax regulations, company spending policies, and other legal requirements. This reduces the risk of non-compliance and associated penalties.

For example, Yokoy checks invoices and expenses against such regulations and policies in real time, flagging suspicious activities and notifying the relevant stakeholders.

The artificial intelligence algorithms identify irregularities or potentially fraudulent activities, such as duplicate invoices or unusual payment patterns. This early detection helps prevent financial loss.

Simplify audit trails

With modern accounts payable tools, maintaining detailed audit trails becomes effortless. Every step in the AP process is recorded, making audits smoother and reducing the risk of fraud.

Automatic record keeping

Yokoy records every step in the AP process, from invoice receipt to payment, automatically. All this happens in the background and doesn’t interfere with your work. This comprehensive audit trail simplifies the audit process, as auditors can easily trace each transaction’s history.

Data retention and access control

AI solutions can securely store historical data for extended periods, ensuring that you meet regulatory requirements for data retention. AI allows you to control who has access to audit trail information, enhancing security and privacy.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

Improve vendor relationships

In the world of manufacturing, strong vendor relationships are essential for maintaining a smooth supply chain and securing favorable terms. AI automation offers a powerful tool to strengthen these relationships by optimizing payment processing.

With manual work reduced, invoices can be processed and paid more quickly. This not only improves supplier relationships but can also take advantage of early payment discounts, saving the company money.

Next steps

Streamlining the accounts payable process in manufacturing companies through AI-powered automation is a strategic investment that not only enhances efficiency but also drives cost savings and compliance.

By embracing AI-powered automation in your AP process, you can achieve significant improvements in efficiency, accuracy, compliance, and visibility, ultimately driving success in the competitive manufacturing industry.

If you’d like to see how Yokoy can help simplify your AP operations, you can book a demo below.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.