Home / Travel and Expense Management Software: Switching From SAP Concur to Yokoy

Travel and Expense Management Software: Switching From SAP Concur to Yokoy

- Last updated:

- Blog

Co-founder & CEO, Yokoy

Implementing T&E management software is essential for global enterprises looking to streamline their travel and expense processes, enhance financial control, and enforce compliance across multiple entities.

The great news is that there are plenty of software solutions that cater to the needs of medium and large enterprises. To list just a few options: SAP Concur, Expensify, Emburse, Certify, Coupa, Divvy, Zoho Expense, Rydoo, Ramp, Payhawk, Pleo, and so on.

Obviously, each of these expense management tools have their strengths, and I’m not here to comment in detail what each of our competitors does well in terms of business travel expense management.

But the reality is that for many years, companies running on SAP as their Enterprise Resource Planning (ERP) system, which are typically global businesses, have not had many alternatives to SAP Concur when it came to digitalizing and automating their Travel & Expense (T&E) process.

Most of the modern expense management tools are not made for global businesses and cannot handle various lump sums and multiple cost objects, functionalities which are needed to integrate the expense tool with the SAP ERP system to avoid manual data entries.

So my goal in this article is to provide an objective overview of the differences between Yokoy and SAP Concur, so you can make an informed decision when buying travel expense software.

What makes Yokoy different from Concur for expense management

Before we delve in, a quick note: Choosing the right business spend management solution involves more than just functionalities and features. It’s also a matter of finding a partner that aligns with your company’s unique needs, growth trajectory, and vision.

At Yokoy, we’re dedicated to fostering an environment of customer-centricity.

This commitment is reflected not only in the excellence of our software but also in the unparalleled service we extend throughout the implementation process and beyond.

Your satisfaction and success remain at the core of our mission, as we strive to be a true partner in your growth journey.

So without further ado, let’s look at what makes Yokoy different – and why we think your finance team will be happier with our solution.

AI-powered automation

I’ll start with artificial intelligence – not because it’s trendy now, but because at Yokoy we truly believe that future-proof finance software requires AI.

Yokoy is built with AI at its core, automating not only the steps of the T&E and P2P processes, but also the logic of it. This is a major differentiator and it’s what makes our solution stand out in a crowded market.

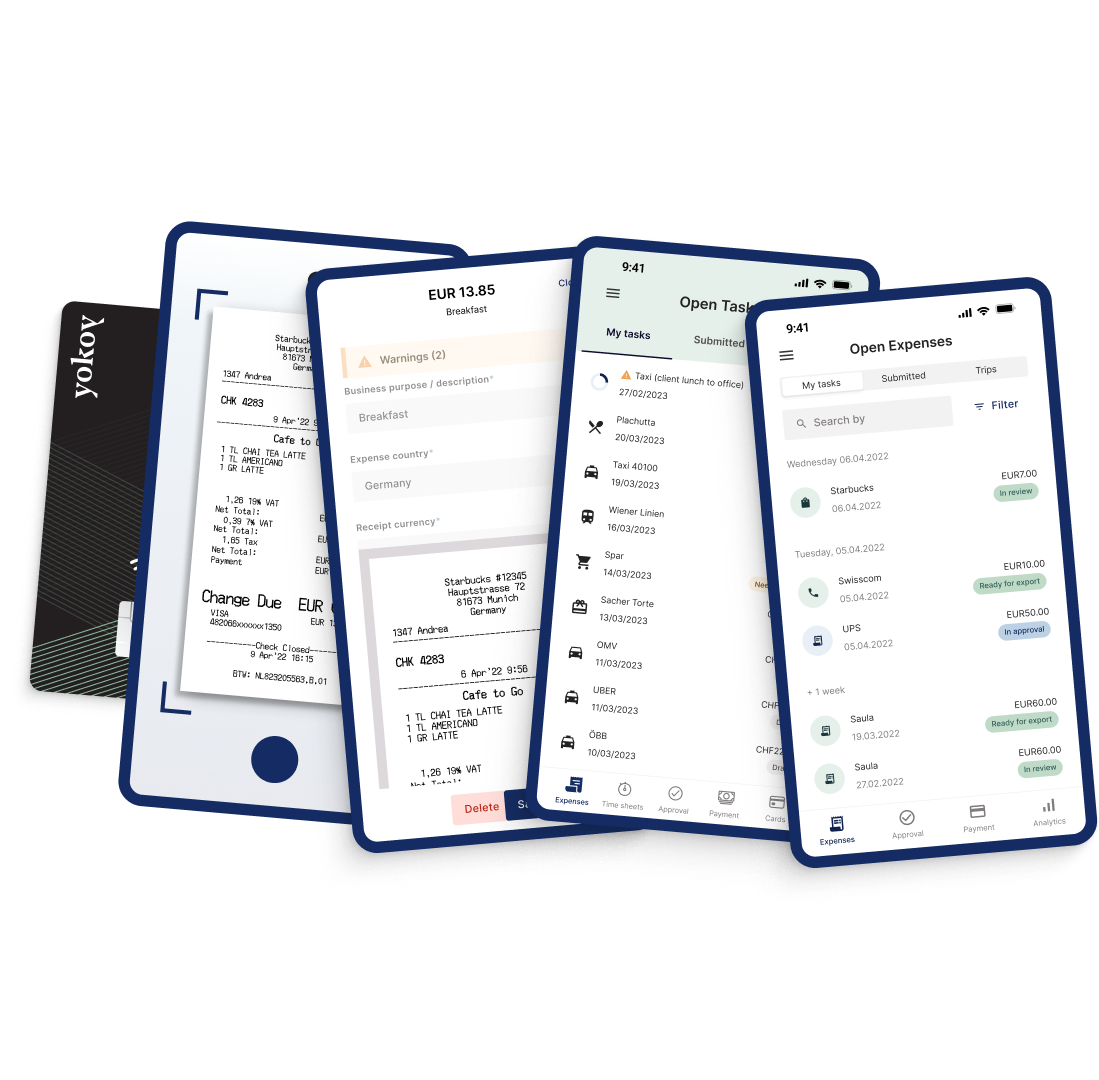

Unlike legacy systems that use OCR technology to read out receipts for example, but can’t really ‘understand’ the data or structure it further, Yokoy’s AI is engineered to not just capture receipts, but extract the data, structure it, and process it as well.

Moreover, it doesn’t matter where the receipt comes from – our software can process the information for receipts that were scanned with the mobile app, as well as for documents that were uploaded to the web app or sent to a specific email address as .PDF attachments for example.

Once a receipt is read, the AI algorithms validate the data – meaning that all the data is checked for duplicates and policy breaches. This process is fully automated and takes only a few seconds, saving a lot of time for finance teams.

An important mention here is that in case policy breaches and fraudulent items are detected, all these happens in real time, and the submitter of the receipt can directly check and adjust the expense report before submitting it.

This ensures a much more effective expense management process, as it minimizes the number of mistakes, errors, and fraudulent items, removing the need for human intervention almost entirely.

Of course, you can always set up approval flows to accommodate more manual checks, if it’s required in your country or industry. But in principle Yokoy can fully automate the T&E process using AI technology, so your finance team only has to focus on edge cases and exceptions.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

Automatic VAT readout

Yokoy’s expense management solution enables automatic VAT readouts for both domestic and international VAT. The AI technology recognizes VAT rates on receipts and invoices, and the data is automatically sent to the ERP system for processing.

However, although Yokoy doesn’t handle the tax reclaim in the platform itself, our solution integrates with VAT reclaim systems for simplifying the process and automating it. You can read more about our VAT partners here.

Blog article

Reclaim VAT Automatically: How Yokoy Uses AI to Simplify VAT Recovery

Reclaiming foreign VAT (Value Added Tax) is something that’s usually complicated and a manual task. Read here how Yokoy automates VAT recovery with AI.

Vishnuram Muthuraman,

Product Marketing Manager

API integrations for major ERPs

API integrations are crucial for expense management systems, as they enable companies to scale without having to increase employee headcount or revamp their processes every time they need to add a new system to their tech stack.

Unlike file-based integrations, plug-and-play API connections prevent vendor lock-in, a common complaint of customers using legacy software.

Yokoy is built from the ground up as an API-first solution, designed to handle a multi-entity setup with various regulations, currencies, workflows, languages, and an API-based bi-directional SAP integration.

We take a best-of-breed approach when it comes to our integrations and partners. This means that we offer ready-to-use integrations for most of the major ERP systems, as well as travel management companies, e-invoicing solutions, HR systems, and so on.

For a full list of our integrations, take a look at our dedicated page: Yokoy integrations.

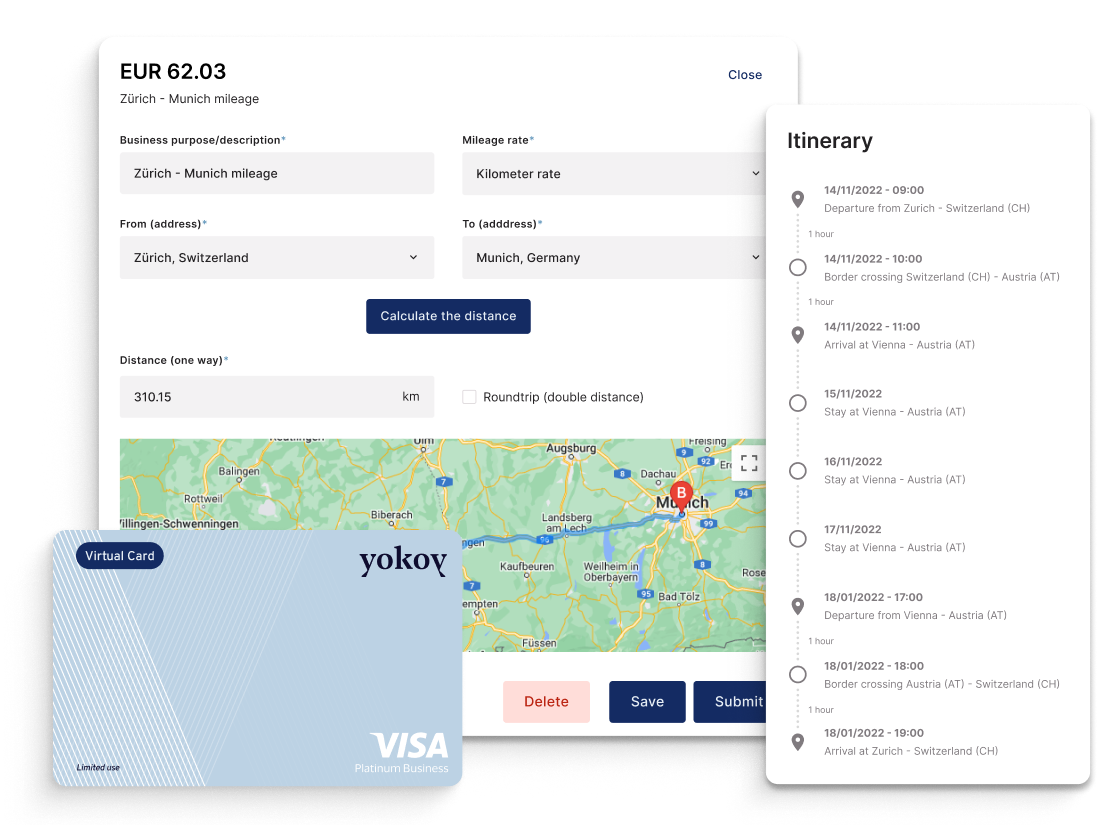

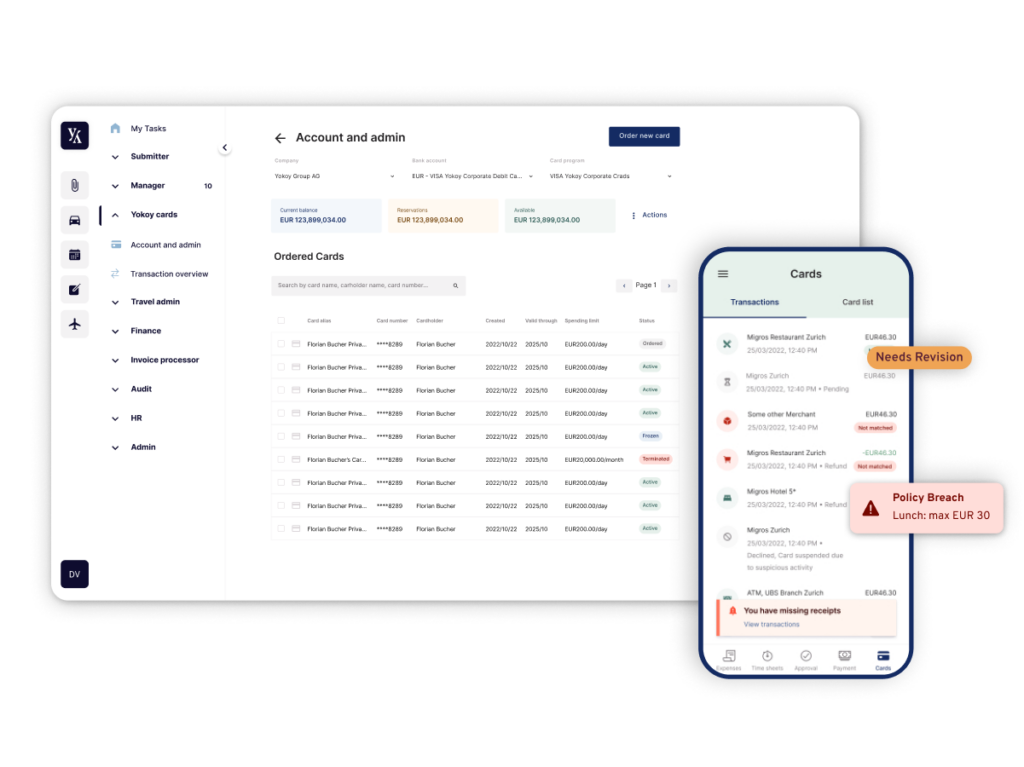

Real-time data for card transactions

As said, Yokoy offers smart corporate cards and smart lodge cards that fully streamline the travel expense reporting and help keep spend under control by offering end-to-end, real-time visibility.

Smart cards also make reimbursements seamless, as all transactions are automatically reconciled with expenses, and the finance team can set up automation workflows and pre-approval flows to reimburse employees on time.

Not only are card transactions instantly visible in the Yokoy suite, but our spend management platform comes with native cards. This means true, end-to-end integration, with no additional effort on your side.

With legacy systems, integrating card is more complicated and time consuming, and often requires your team to connect card feeds to other systems to have the transaction data centralized.

With Yokoy, everything is integrated from the start and synchronized in real time with your ERP data, thanks to the previously-mentioned integrations.

DO & CO tracks expenses in real time with Yokoy

“Yokoy’s integrated corporate credit card solution played a pivotal role in our decision-making process. The seamless data transfer streamlines expense tracking, minimizing manual efforts and significantly enhancing efficiency.”

Johannes Echeverria, CFO at DO & CO

In-system credit card management

Another major advantage of our native corporate cards is the in-system management. With Yokoy it literally takes a few seconds to order new cards, set individual spend limits, freeze them in case of missing receipts, or block employee cards in case of people leaving your company.

Everything is effortless, and the card management can be done in both the mobile and the web apps, on the go. This is a great advantage as you don’t need to buy an expense management platform and a separate solution for your corporate cards.

Yokoy offers a variety of payment options, from physical corporate cards and lodge cards to virtual cards and even single-use cards, for streamlined expense tracking.

Our solution supports mobile payments as well, for increased ease of use and flexibility, and the smart cards can handle multiple currencies across geographies thank to partnerships with Visa, Mastercard, and so on.

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

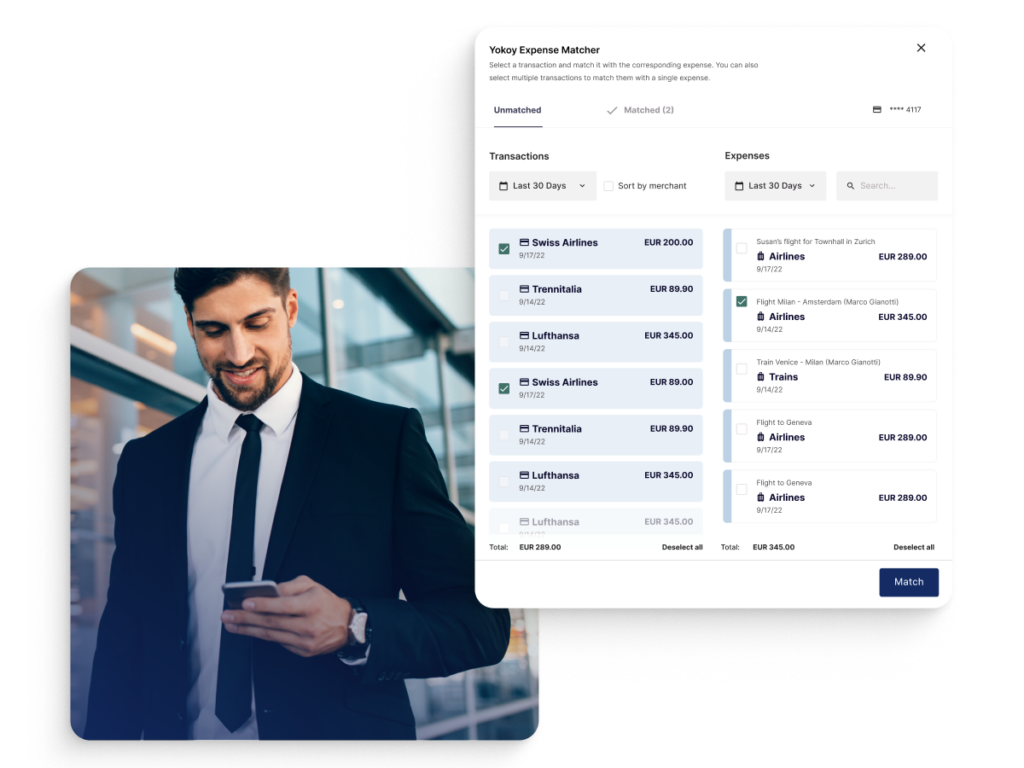

Instant transaction matching

Yokoy enables centralized expense data for employee expenses and card transactions, and uses AI automation to instantly match transactions with receipts.

This makes the expense management process extremely efficient as it removes the need for manual intervention, and simplifies the expense processing and approval steps. Moreover, it makes it possible to scale expense management without increasing employee headcount, even when your company grows.

As said, the AI takes over most of the process steps, from capturing the receipt and reading it to processing it, and then matching it with the submitted expense.

Because everything is done automatically, the finance team doesn’t have to waste time on manual matching – their intervention is only needed in case of exceptions or policy breaches. Also, you don’t have to wait until the end of the month for bank statements.

The automation of expense reimbursements is also a major time saver for finance teams and it also contributes to better employee satisfactions, as it prevents payment delays – a common issue in the reimbursement process.

Handling duplicate expenses and policy breaches

In Yokoy, it’s very easy to detect duplicates – the system does all the work for you, removing the hassle of manually checking receipts and card transactions. Moreover, Yokoy’s AI flags policy breaches in real time, notifying the submitter before the expense report is sent for approval.

This saves a lot of time for the finance team, as it ensures most of the reports submitted by employees are already checked and free of errors or duplicates. In case duplicates do slip through, you can open them simultaneously for quick checking.

Once everything is checked, the expense approval workflows kick in – these can be fully automated for increased efficiency, and you can set up as many approval layers as needed to fit the needs of your multiple entities.

Fenaco standardized their expense management with Yokoy

“With Yokoy, we have opted for a uniform and group-wide expense management solution that unifies our different expense processes on one platform and automates them across organizations, for increased efficiency.”

Marianne Schluep, Head of Finance and Accounting

Automated policy compliance

The use of AI for expense policy enforcement is another strong differentiator for our platform. Yokoy’s artificial intelligence ensures not only compliance with company policy, but also with international rules and regulations, while preventing overspending and fraud.

As already mentioned, in case policy breaches are detected, the issues are flagged in real time, so that employees can review and adjust their expense claim reports before submission.

In Yokoy, there’s no need to check every receipt, card transaction, mileage or lump sum manually. Receipts that are within policy and budget and have a low fraud potential can be automatically processed all the way to the export into SAP with the correct ledger booking, which automatically triggers the payout.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

Automatic per diem calculation, including VAT

Finance roles can edit per diems (lump sums), adding and removing values as needed. This is especially useful for global enterprises where employees travel between locations, with the difference that in Yokoy employees don’t have to do any adjustment themselves. The finance team can directly make all the changes needed, avoiding too much back and forth.

Also, Yokoy makes it easy to configure an unlimited number of custom fields directly on the mileage configuration. This functionality is separated for the Expense and Invoice modules, giving finance teams more flexibility.

Travel bookings are also simplified, as the end-to-end integrations with travel partners such as Travelperk, Egencia, or Atriis, coupled with the use of Smart Lodge Cards, ensure that all travel expenses are centralized and visible in real time.

To give just an example: With Yokoy, all the pre-trip expenses can be paid with the Smart Lodge Card directly in the corporate travel management platform.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

User experience

We take this topic very seriously, as too many legacy systems have neglected the experience of both submitters and approvers, resulting in a really poor user experience.

At Yokoy, we believe finance teams should work with tools that are easy to use, intuitive, and offer a great experience across devices. Our software is built with usability at its core, being extremely easy to use on both desktop and mobile.

Employees can submit expenses on the go, by simply taking a picture of their receipt with the mobile app, and they can pay with the smart Yokoy card to have their transaction instantly matched with the receipt.

Managers and the finance team can see transactions in real time, for both expenses and invoices. They can check exceptions and approve expense reports using their mobile phone. They can order cards and adjust spend limits on the go, as needed.

Blog article

Prioritizing Employee Satisfaction: The Case for Better UX in Finance Tools

The world of finance is changing rapidly, with disruptive technologies and shifting consumer expectations reshaping the landscape. Yet, despite these changes, many finance tools remain stuck in the past, with a poor user experience and interface.

Lars Mangelsdorf,

Co-founder and CCO

Invoice management capabilities

Finally, although the topic of this article is expense management, it’s worth mentioning that Yokoy offers a full spend management suite that integrates invoice management, T&E management, and corporate cards.

Just like our Expense module, the Yokoy Invoice module uses AI automation to fully automate the accounts payable process, from invoice receipt to supplier payment.

You can read more about our invoice solution below.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Next steps

Although there’s more to mention, this should give you a good understanding of what Yokoy can do for your T&E process, in big lines, and where our software is superior to SAP Concur.

As a next step, I encourage you to take a look at our approach to implementing global solutions. Unlike legacy tools that often require custom code to accommodate specific business requirements, Yokoy offers a modern no-code solution that enables a faster implementation and flexible onboarding.

Of course, customization is always possible, and the length of implementation projects can vary from one company to the other, but our phased approach enables our customers to experience a very short time to value.

If you’d like to discuss some aspects in more detail, feel free to book a call with our team below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.