Home / Setting Individual Spend Limits with Smart Corporate Cards

Setting Individual Spend Limits with Smart Corporate Cards

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Finance professionals have long grappled with the limitations of traditional corporate cards. One of the most vexing issues they face is the need to engage in time-consuming and often frustrating bank calls whenever adjustments to spend limits are required.

This outdated practice not only consumes valuable hours but also introduces unnecessary hurdles in the path to effective spend management.

Limitations of traditional corporate cards

Traditional corporate cards, while once groundbreaking, have become a source of frustration for finance professionals.

These cards lack the flexibility and agility required to adapt to the dynamic nature of modern business expenses. Their rigid structures and outdated processes make them ill-suited for the rapid pace of today’s financial landscape.

To list just a few of their limitations:

- Administrative overhead: Obtaining new corporate cards or adjusting spend limits with traditional cards involves a laborious and time-intensive administrative process. Finance professionals are burdened with paperwork, back-and-forth communication with banks, and a myriad of bureaucratic hurdles.

- Manual processes: The entire process is very time-consuming due to the numerous manual steps involved. This manual approach not only increases the risk of errors but also diverts valuable human resources away from more strategic financial tasks.

- Complexity and inefficiency: Finance teams often find themselves juggling multiple card providers, each with its own set of rules, procedures, and limitations. This complexity can lead to inefficiencies, confusion, and increased administrative overhead.

- Limited visibility into employee spend: The static nature of traditional company cards and their adherence to outdated processes hinder the ability of finance professionals to keep track of employee spending. Even with limits in place, finance teams get full visibility into business spend only at the end of the month, during the month-end closing process.

- Multiple card providers and entities: Accounting teams in global enterprises often deal with multiple card providers for their different entities. This makes the card ordering process as well as the adjustment of spend limits even more cumbersome.

- Limited control: Moreover, the accounting team has very little control over the spend limits, as everything lies outside of their IT infrastructure.

- Reactive approach: With traditional business spend cards, it’s virtually impossible for the accounting team to issue cards on the go or to set new limits, so special requests such as an employee needing a temporary card for an event are very hard to honour.

In the face of these limitations, it’s evident that traditional corporate cards are not just relics of the past; they are barriers to progress and efficiency in the financial world.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

What this means for finance professionals

To shed light on the magnitude of the issue, consider these statistics:

- On average, finance teams spend 20 hours per month per employee on managing corporate cards and related tasks.

- Furthermore, a staggering 70% of finance professionals report frustration with the time and effort required to make even simple adjustments to spend limits.

To illustrate the frustration faced by finance professionals, let’s consider the experience of a global corporation’s finance team.

When a sudden need arose to adjust the spend limits for a team of sales executives attending a critical overseas client meeting, the finance manager found herself ensnared in a bureaucratic nightmare.

Multiple phone calls and emails later, the simple task of adjusting spend limits took nearly a week, causing undue stress and hampering the company’s ability to seize a lucrative business opportunity.

The traditional corporate card model is in dire need of an overhaul, and the good news is that a transformative solution is at hand: smart corporate cards.

Smart corporate cards are revolutionizing the way finance professionals manage expenses, eliminating the traditional hassles and inefficiencies that have long plagued the industry.

These intelligent payment solutions consolidate the various card types into a single, user-friendly spend management platform, simplifying the management of different spending categories, such as advertising, travel, marketing, software, and office events.

In the following sections, we will explore how these employee cards offer a respite from the frustrations of the past and provide a pathway toward streamlined, efficient spend management.

Planted keeps spend under control with Yokoy

“A corporate card should be secure and uncomplicated – and this is exactly what the Yokoy Mastercard offers. In addition, the card is smart, saving us significant time.”

Christoph Jenny, Co-founder Planted

Controlling spend limits with smart corporate cards

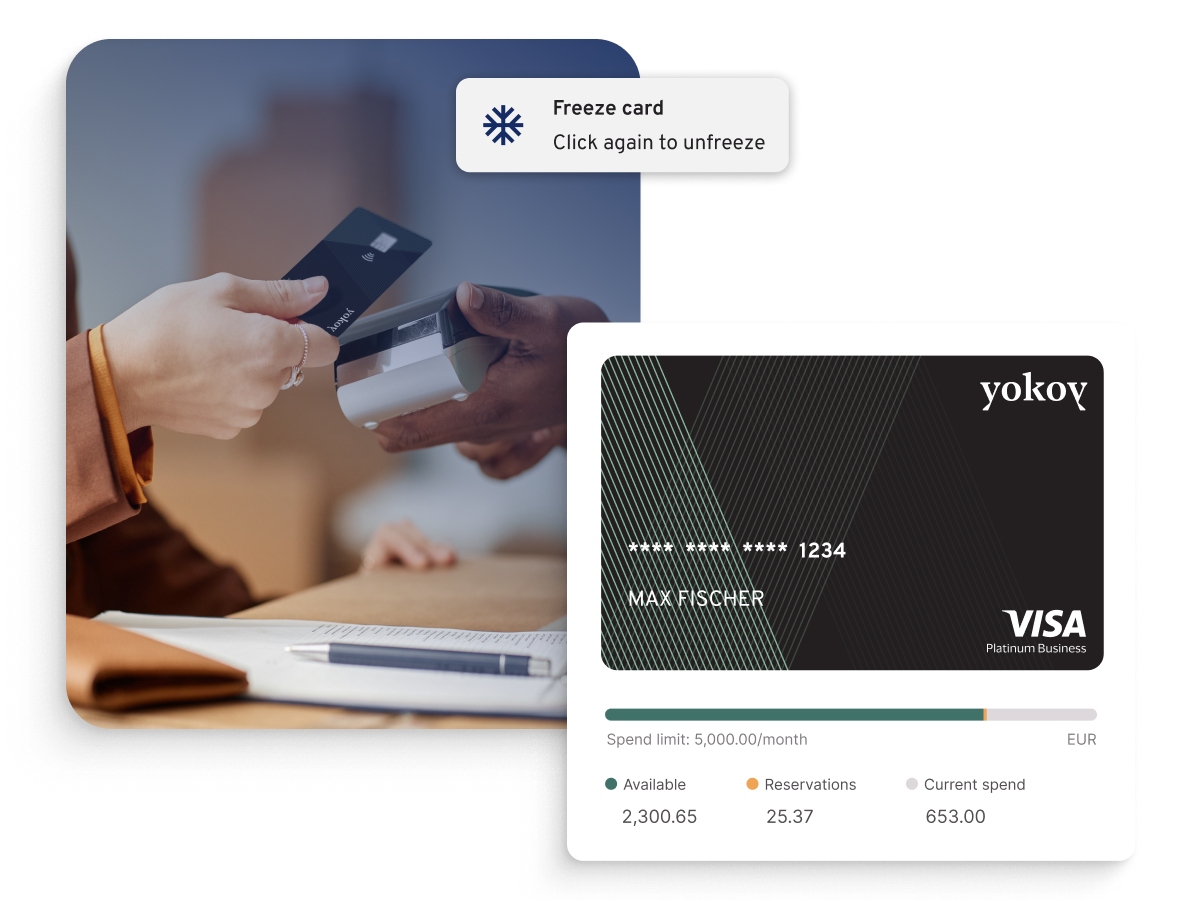

Smart corporate cards enable finance teams to set spend limits and monitor employee spending in real time, from one central platform. Let’s see how they work.

Order cards on the go

With Yokoy’s smart corporate cards, finance teams can create new spend cards – virtual or physical – and set the spending limits on the go, from the desktop or mobile app.

The currency, spend amount, and spend frequency can be set up from the beginning and adjusted later, if needed. The default options to choose from are Physical employee card, Virtual employee card, Virtual high spend volume card, and Physical high spend volume card.

There is no limit to the numbers of cards that can be issued, and there’s no need to call any bank. The process is very straight-forward and convenient.

Granular cost controls and individual spend limits

The Yokoy cards offer granular spend control mechanisms. Not only can finance teams allocate funds when and where they’re needed and define spending limits and controls for individual employees, but they can also restrict the usage of cards for specific types of expenses.

For example, a card can be issued for marketing expenses only, while another card can serve as travel or fuel card. In the latter case, the card will only be accepted if the expense fits the assigned category.

Bitpanda relies on Yokoy's smart corporate cards

“We chose the Yokoy card as our corporate card because thanks to the zero-fee model, we not only enjoy the ideal solution on the cost side, but at the same time it allows us to avoid a lot of manual administrative work as well as making our spend management much clearer and more efficient.”

Peter Grausgruber, former CFO Bitpanda

Pre-payments for employees

Smart corporate cards are a lifeline for employees who require pre-payments to cover last-minute business trips. With the ease of setting up specific expiration dates and predetermined spending limits, employees can receive these cards immediately, ensuring a seamless and stress-free experience.

Let’s say an employee is not a frequent traveler, therefore doesn’t have a company credit card. However, he has an urgent client visit, and needs a card that will cover his expenses for accommodation, flights, and all the trip expenses.

His personal card doesn’t have a high spending limit, so he needs a pre-payment or wire transfer to fund his trip.

Yokoy’s virtual smart corporate cards are the perfect solution in this scenario. The card can be ordered in one click and the employee receives it and can use it without delay, via his mobile phone.

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Centralized card management

The Yokoy platform offers full visibility into company spending. From their Admin section, finance teams can see all their cards, including the current balance, reservations, and the amount still available.

They can transfer money to a card or account in real time, on the go, from the central dashboard. Moreover, the accounting team can freeze and terminate cards in a few clicks.

The platform can be configured to spend push notifications for authorisations and detect potentially fraudulent payments in real-time, ensuring compliance and preventing overspend and fraud.

Next steps

In conclusion, smart corporate cards are transforming the way finance professionals manage expenses, offering a pathway toward streamlined, efficient spend management.

If you’d like to see the Yokoy smart cards in action, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.