The AI-powered spend management suite

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

ISO 27001, ISO 9001, and ISO 14001 certified. GDPR compliant.

Book no obligation demo

Take control of your global spend

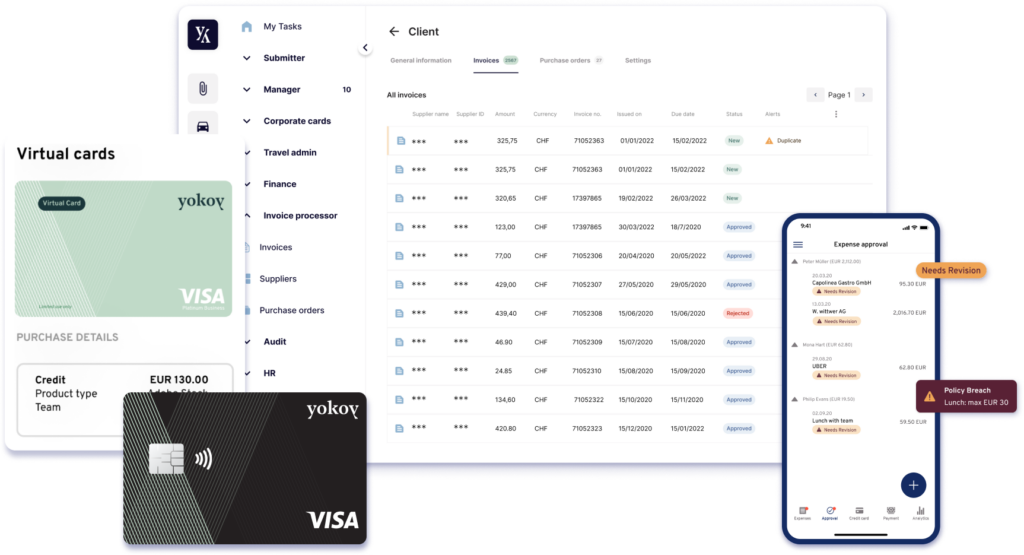

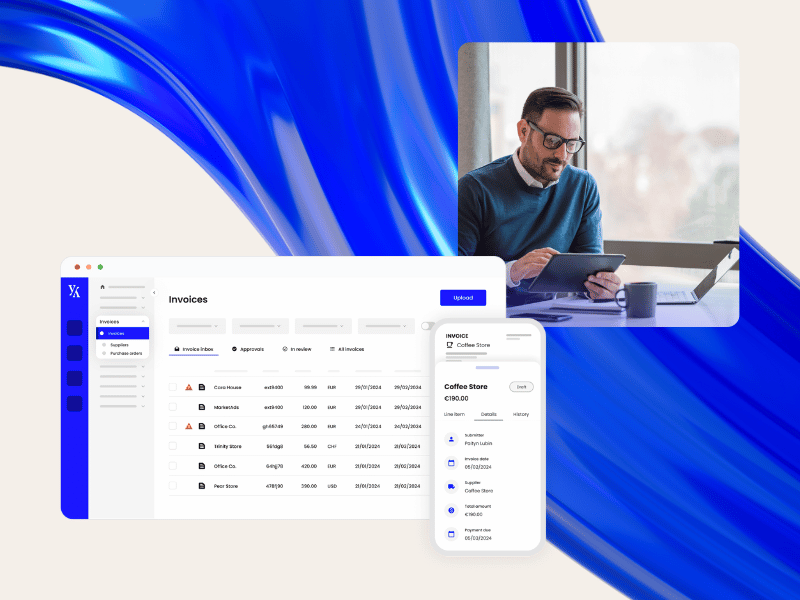

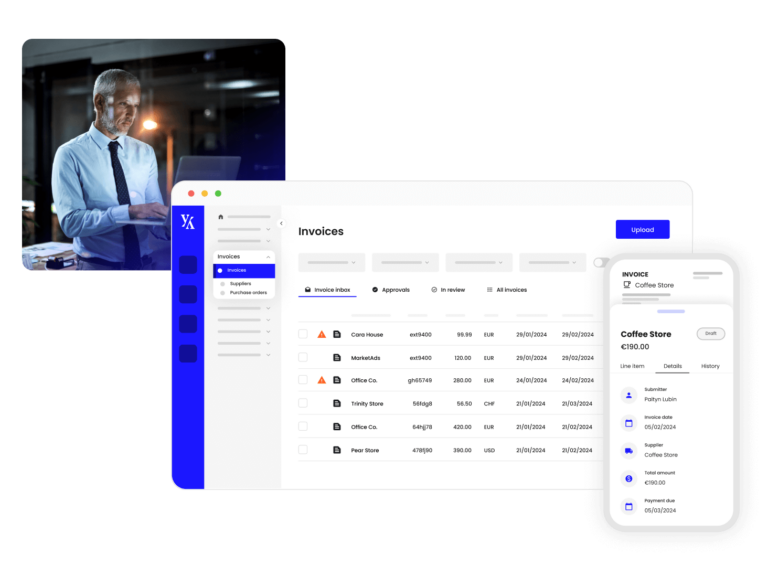

Yokoy Invoice

Process invoices automatically

Consolidate your accounts payable process, manage invoices at scale, automate approvals with custom workflows, and pay on time with Yokoy’s AI-powered invoice management solution.

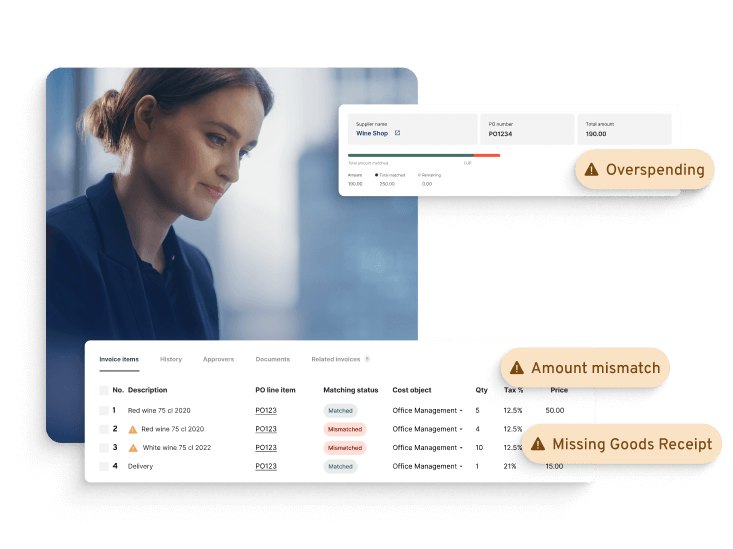

AI-based invoice data capture, extraction, and approval

Automated matching of invoices, POs, and good receipts data

Custom approval workflows for true AP automation

Real-time spend visibility and full spend control for global organizations

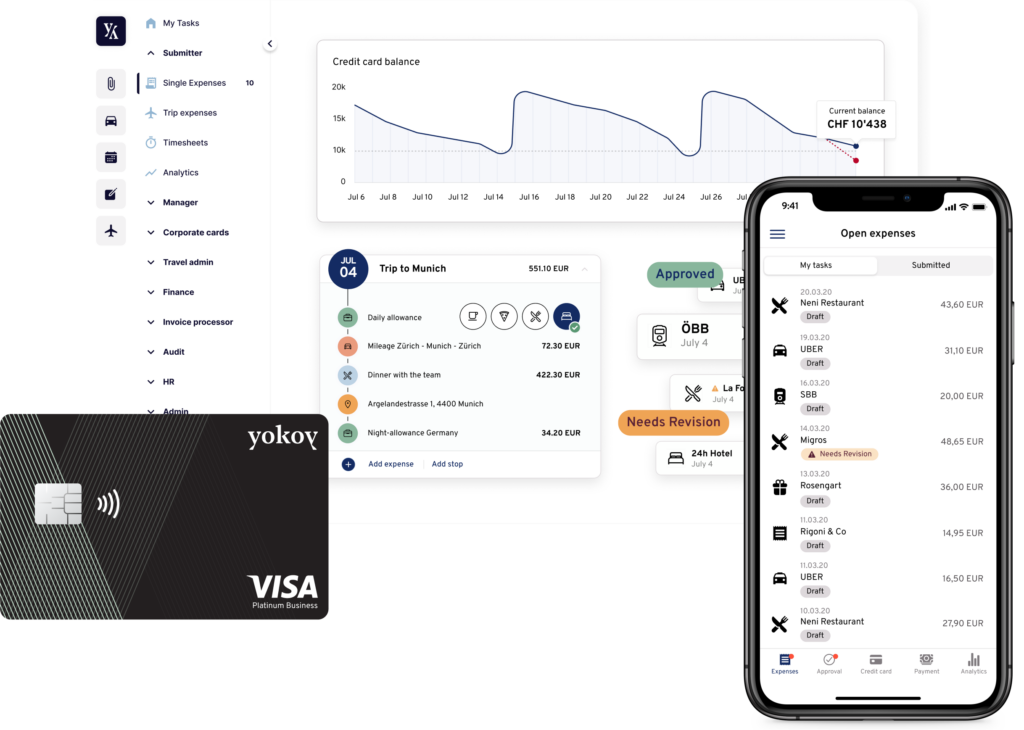

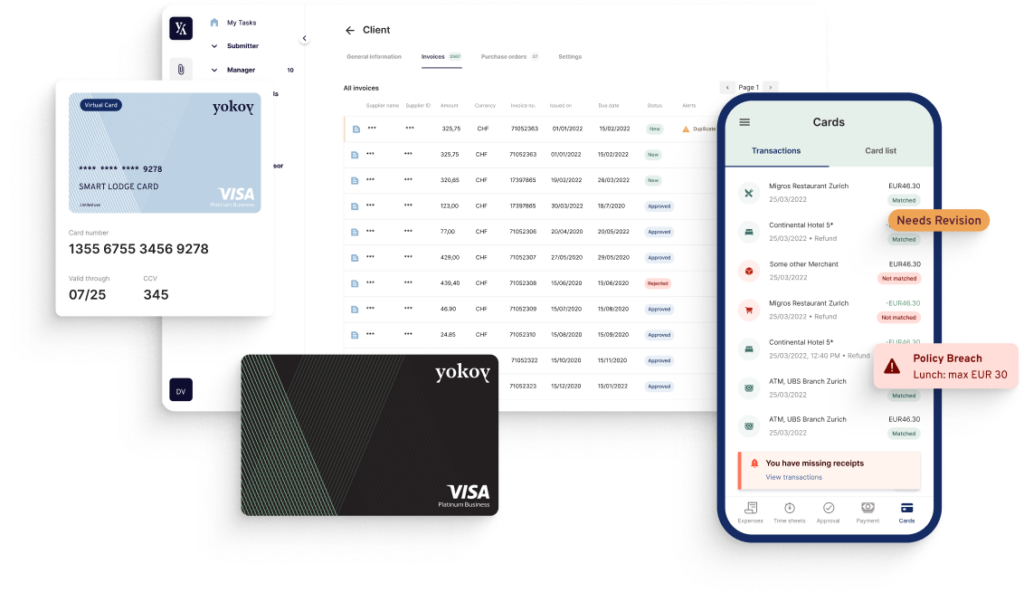

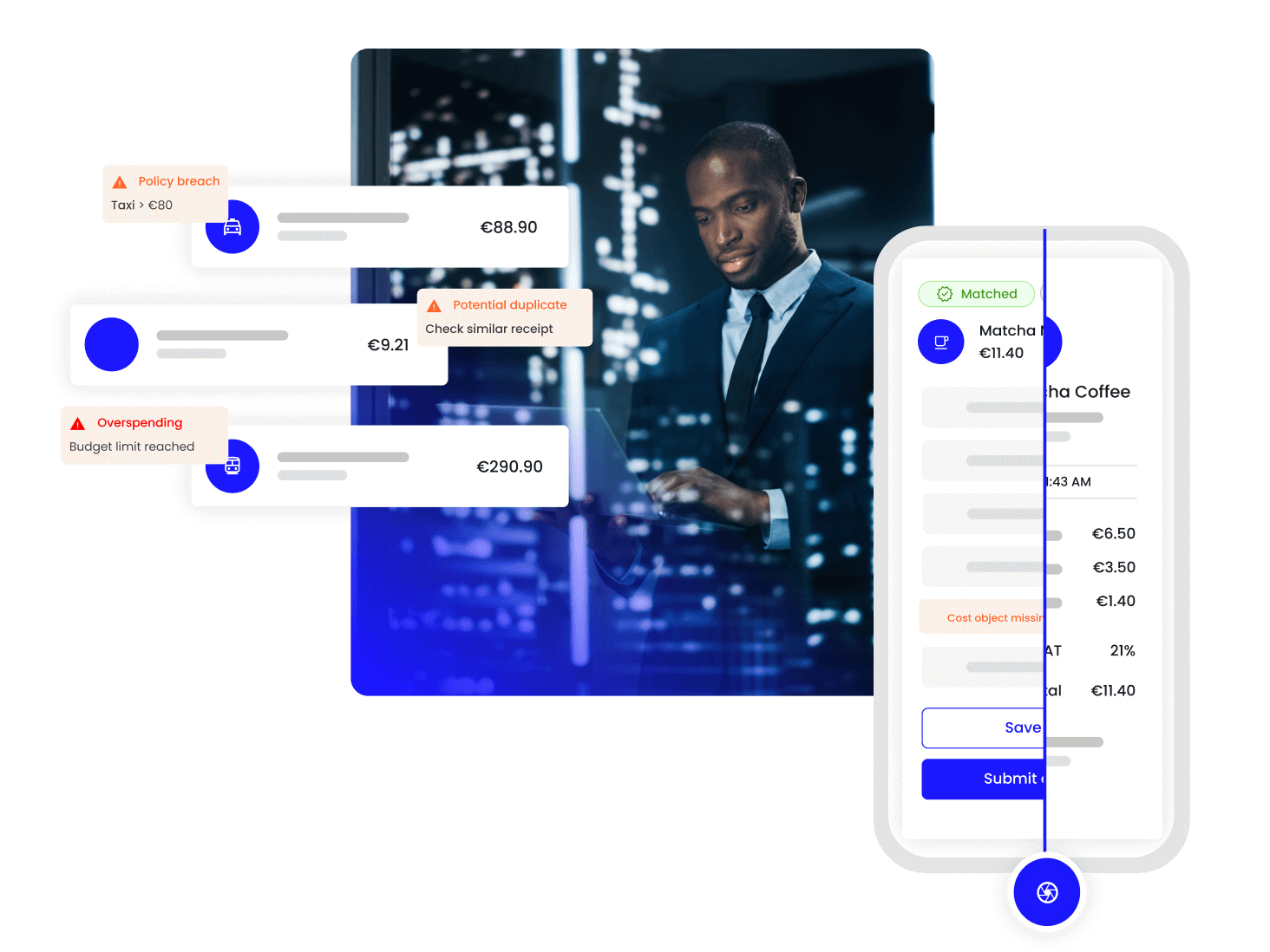

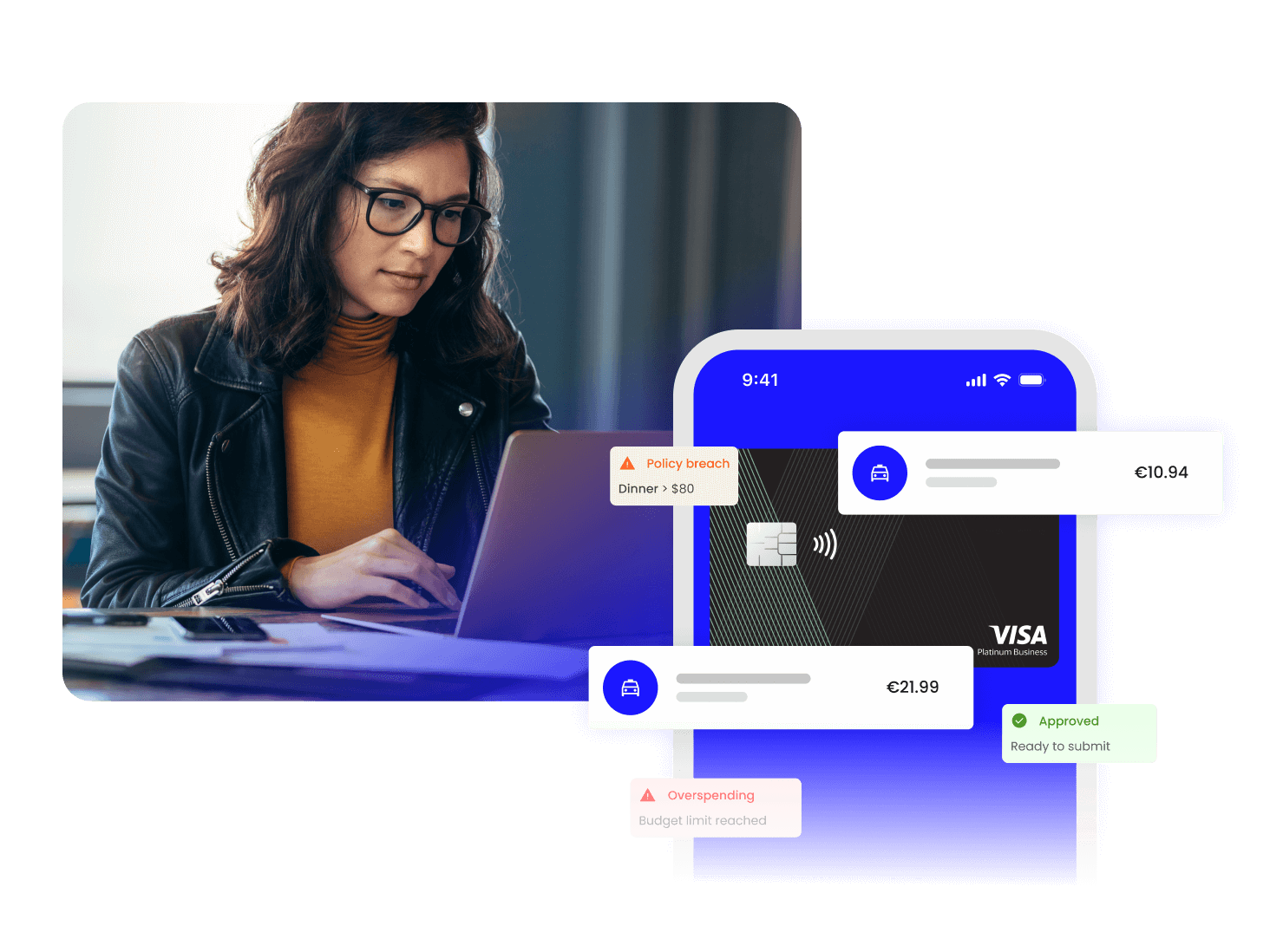

Yokoy Expense

Manage expenses effortlessly

Automate your expense management, simplify expense reporting, and prevent fraud and reimbursement delays with Yokoy’s AI-driven expense management solution.

Fully digital business expense reporting via web and mobile app

Automated matching of receipts and card transactions for real-time visibility

Real-time expense tracking and granular control over employee spending

Custom workflows and approval flows for fast reimbursements

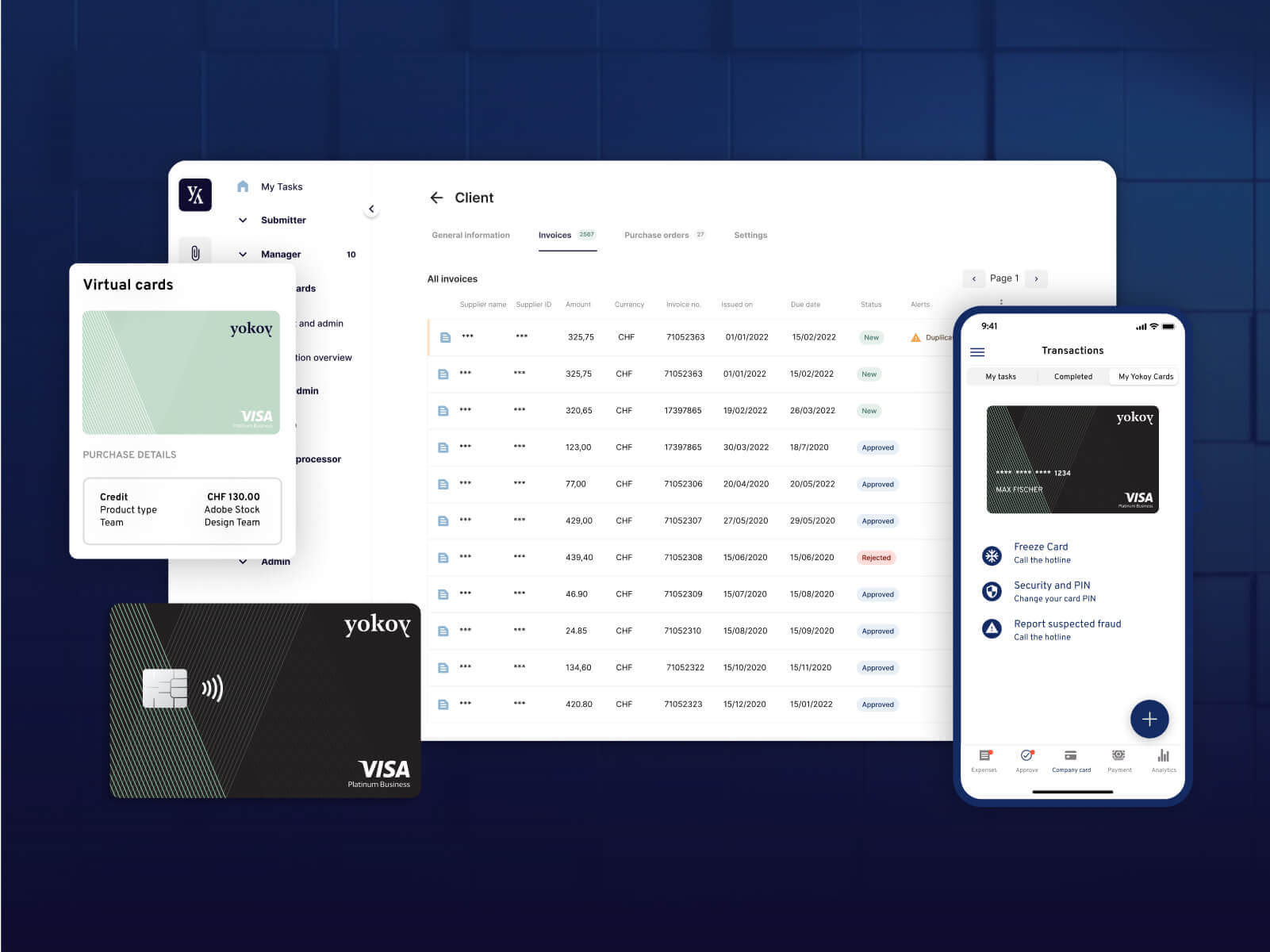

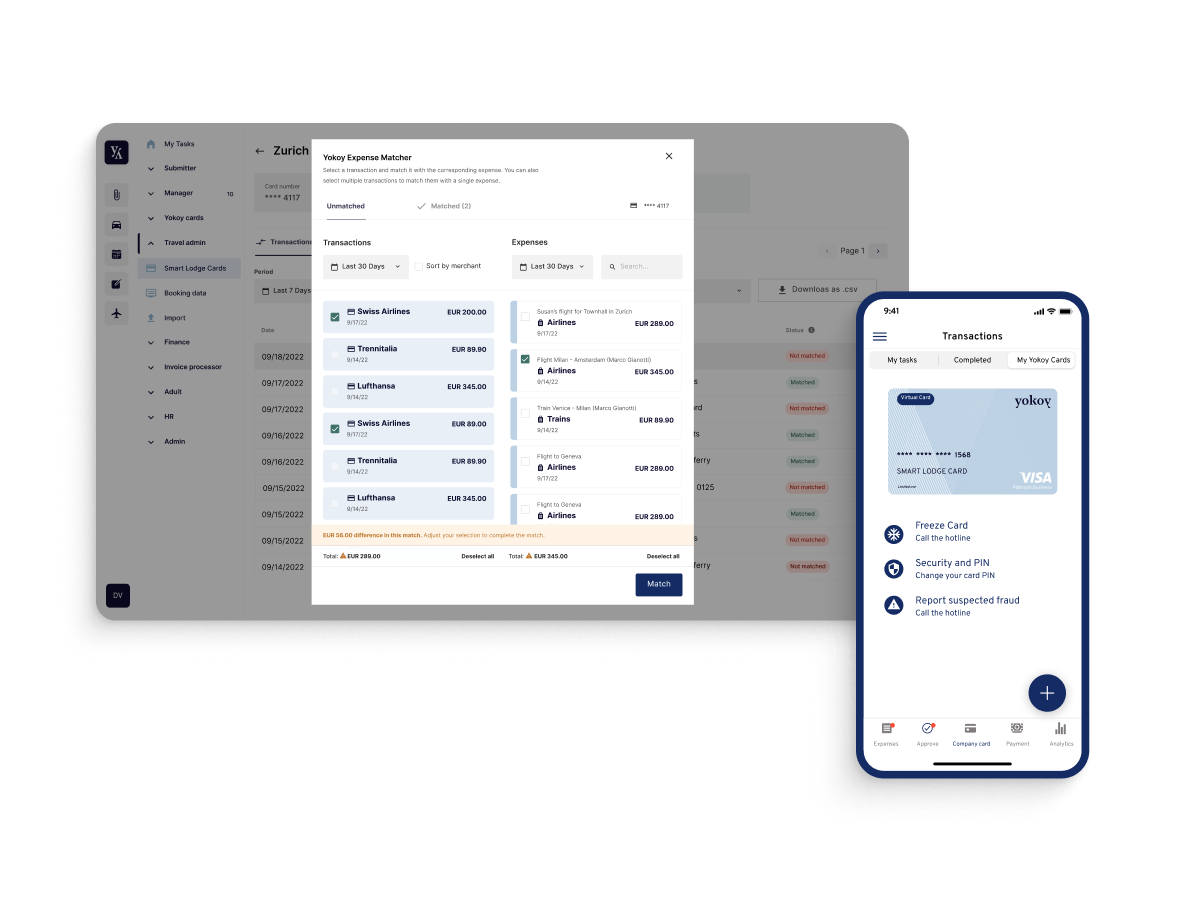

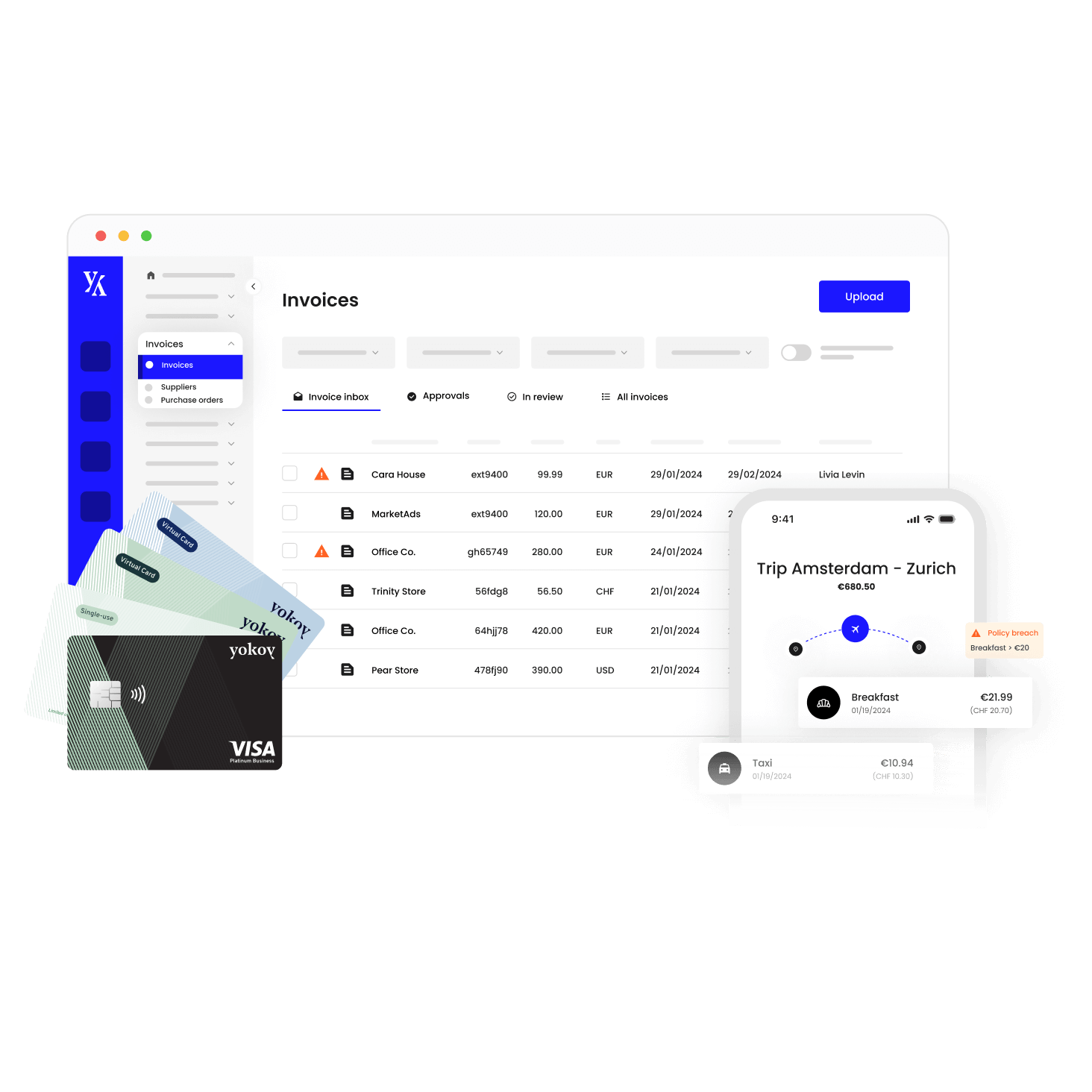

Yokoy Pay

Streamline your business payments

Gain real-time control of your global card spend and automatically match card transactions with receipts with Yokoy’s smart payment solutions.

Issue physical and virtual cards on the go and easily freeze them via the Yokoy app

Granular spend controls and individual spending limits to prevent overspending

Automated transaction matching and real-time compliance checks

Real-time spend data analysis for simple reporting and cost savings insights

“This tool is so invaluable for us that it’s hard to put a number on it. It saves us so much time and energy, and embodies in financial terms the level of freedom we want our employees to live at work.”

CFO & CO-CEO, On Running

Find out how Yokoy can help you achieve financial excellence

Stadler manages their global spend with Yokoy

“At Stadler Rail, we’ve automated our global expense management process with Yokoy. This means Yokoy’s Artificial Intelligence does the repetitive work for us and we only check outliers and exceptions manually, which saves us time and money.”

Raphael Widmer, CFO at Stadler Rail

Main features

Get to know our spend management solution.

AI-based automation

Eliminate manual work from your T&E and AP processes. Yokoy’s AI captures, extracts, validates, and approves employee expense and supplier invoices automatically.

End-to-end automation

Improve efficiency with AI automation and streamline operations by bringing all your processes into one central platform, fully integrated into your tech stack.

Custom approval flows

Map out your end-to-end approval workflows, customize them per entity, and define how exceptions should be handled, to reach full spend management automation.

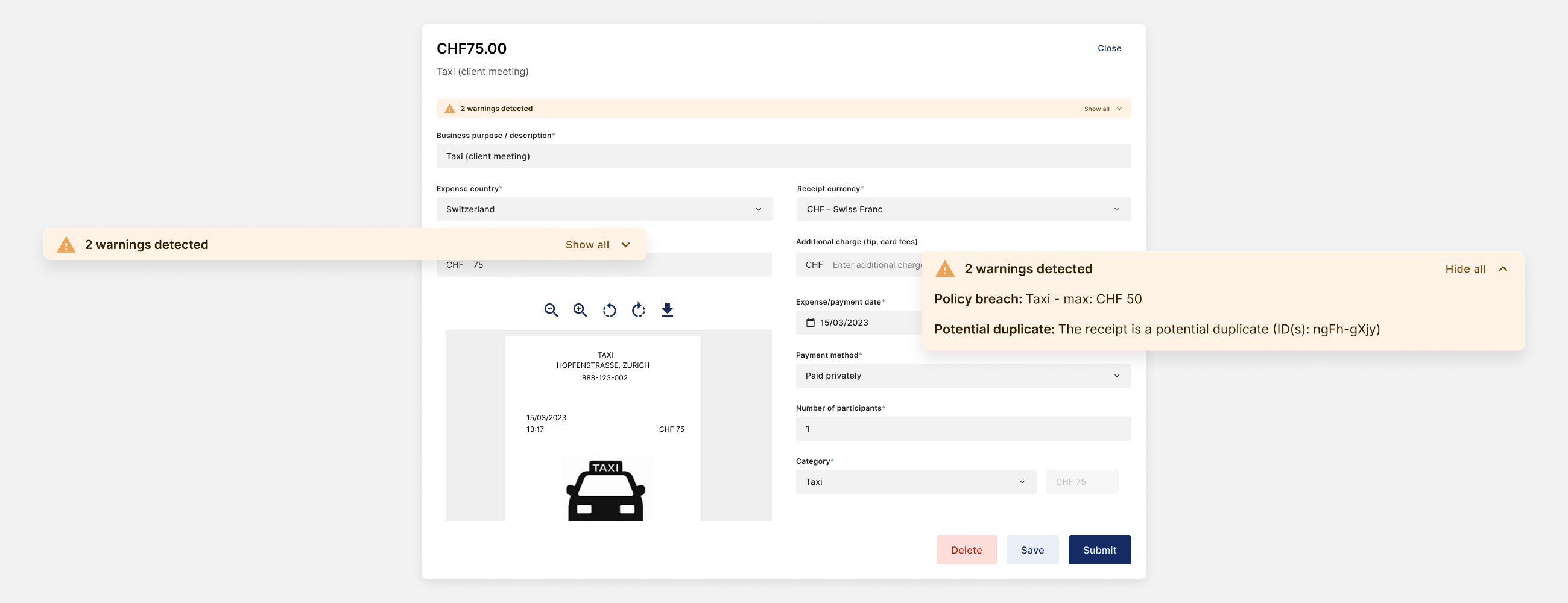

Built-in compliance

Prevent overspending and fraud and ensure compliance with company policies and country-specific regulations through built-in rules and pre-approval flows.

Real-time reporting

Track expenses as they happen, extract spending patterns and insights from your analytics dashboards, and gain real-time visibility into your spending for accurate forecasts.

Simple audit trails

Detect errors and fraud with ease and ensure accurate audit trails by safely storing all your expense receipts, card transaction history, and vendor invoices in the Yokoy platform.

Multi entity support

Streamline complex AP and T&E processes across entities and subsidiaries, and standardize your workflows for increased efficiency and control with a central spend management platform.

World-class service and support

Get answers to your questions right away, troubleshoot issues with help from our experts, and improve your knowledge with in-depth live and self-guided Academy trainings.

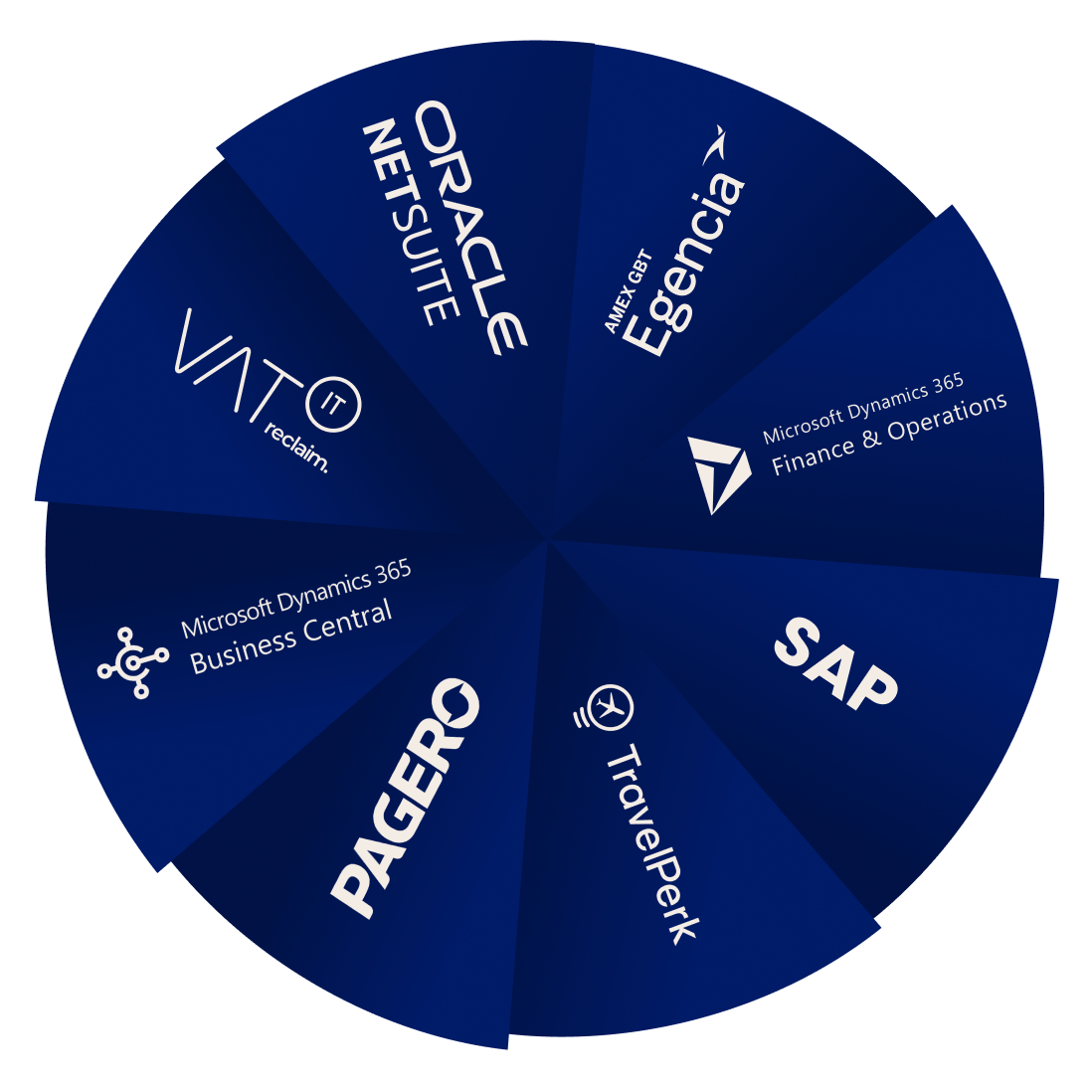

Streamline your

IT landscape

Yokoy’s API facilitates seamless integrations with enterprise-level systems for end-to-end automation across entities and geographies.

Stay safe, with the highest security standards

Yokoy is engineered for security and committed to information protection. We are ISO 9001, ISO 14001, ISO 27001, and GoBD compliant, as well as GDPR certified.

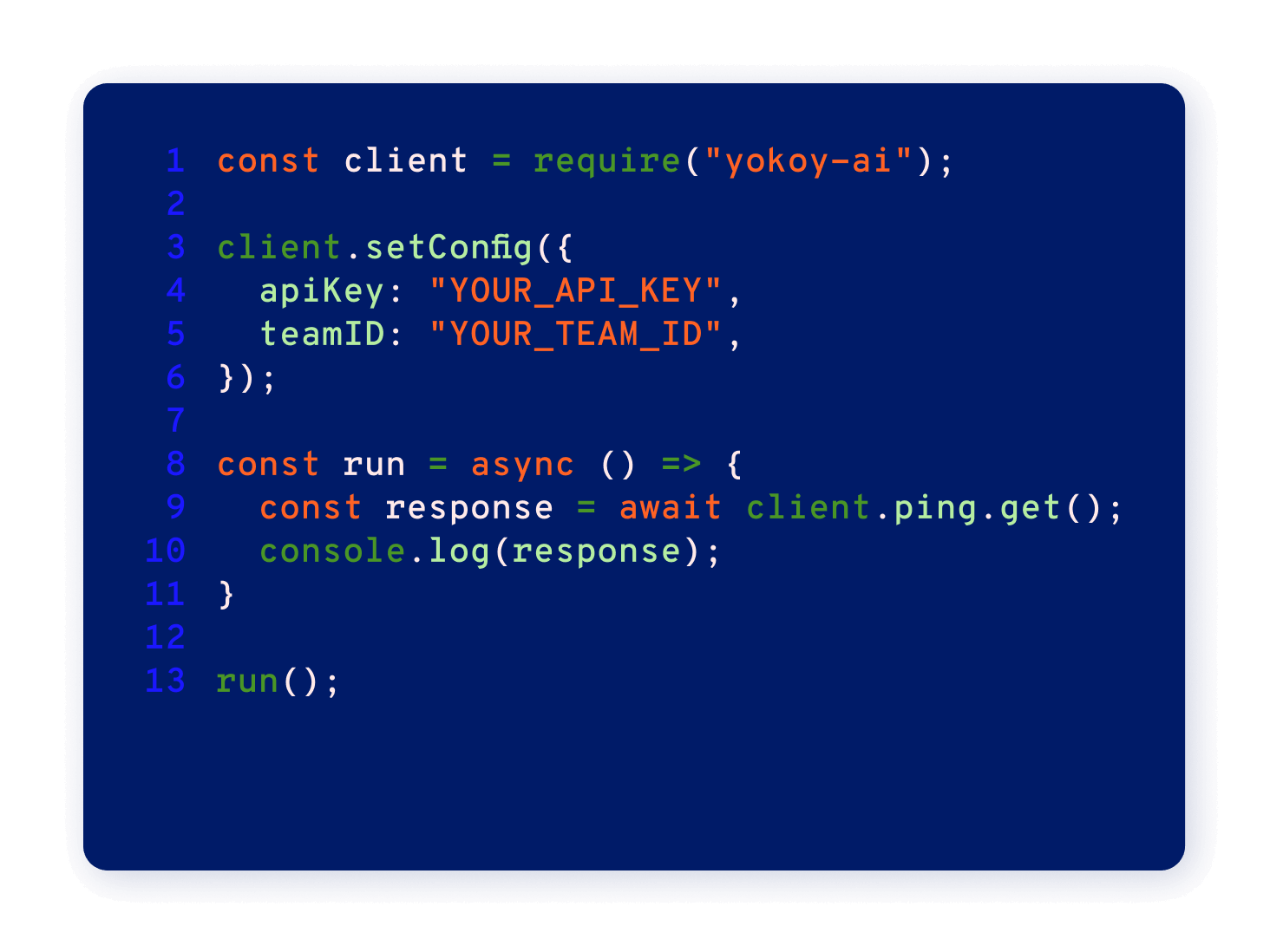

Yokoy API

API by developers, for developers

Yokoy’s engineers have created a free open API for you to build on top of Yokoy’s software and to connect your favorite tools and databases to the Yokoy platform.

“Automated expense management with Yokoy is efficient, economical, sustainable and compliant.”

Justice and Security Department of the Canton of Basel-Stadt, Switzerland

Find out how Yokoy can help you achieve financial excellence

What our customers say

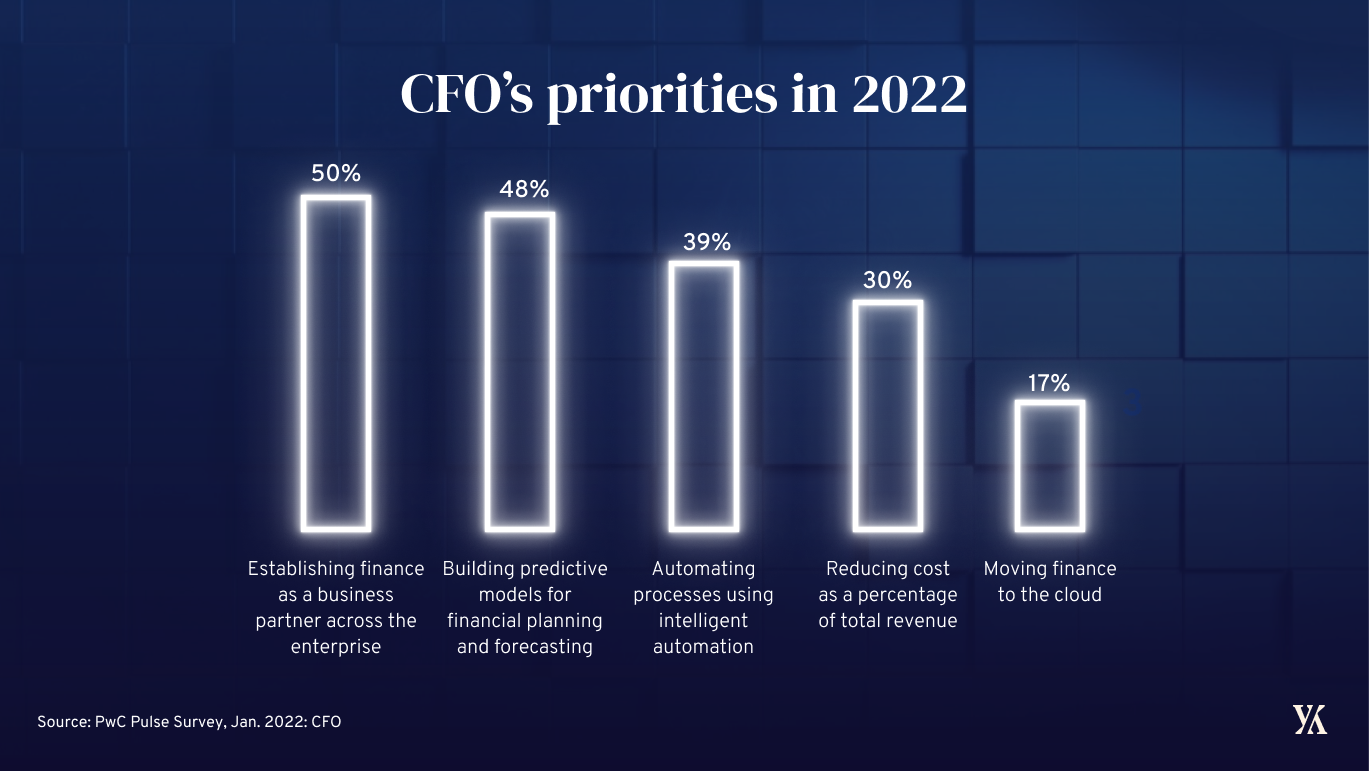

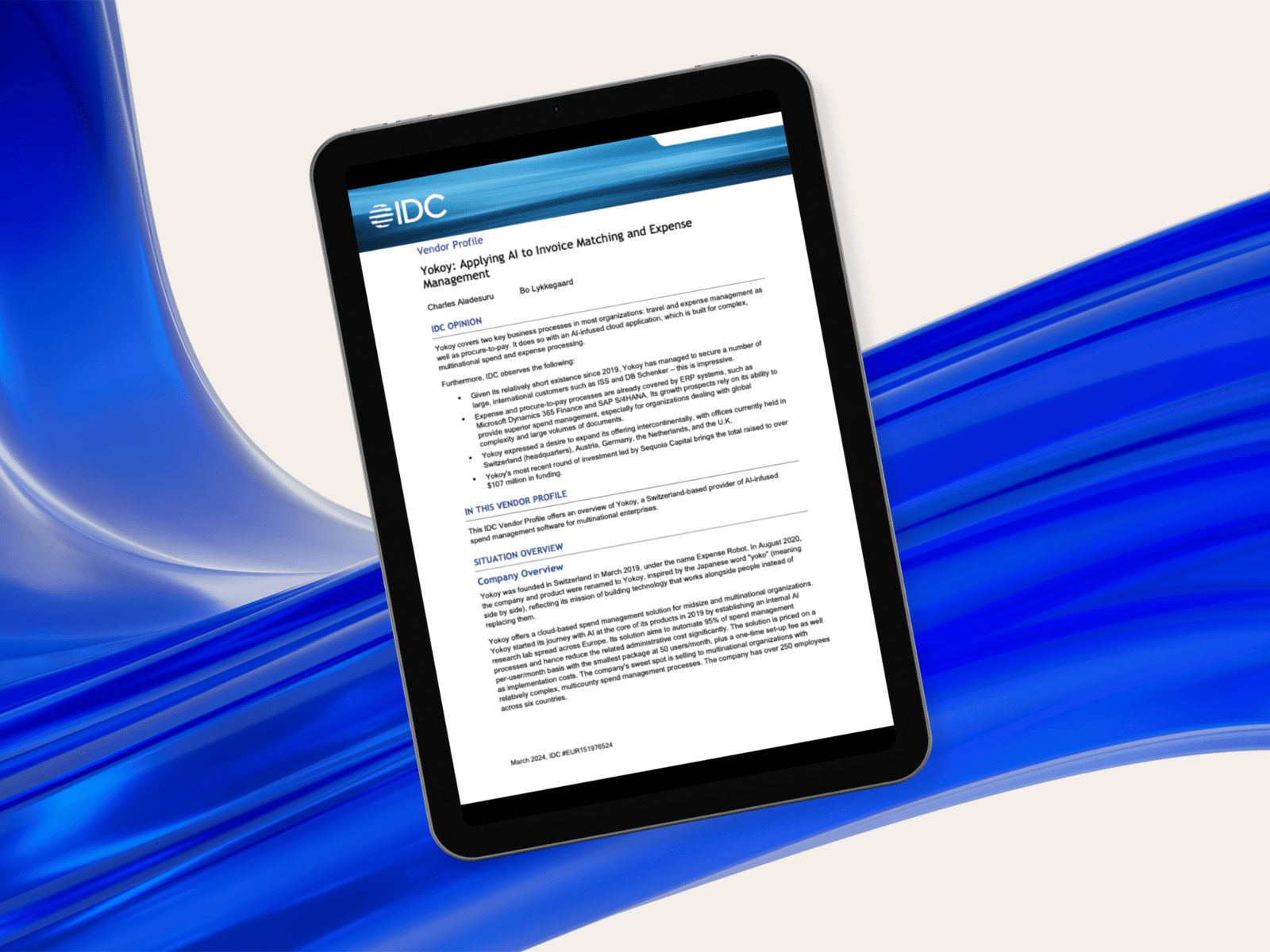

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

The Yokoy impact

See how we contribute to our customers’ success stories.

Frequently asked questions

Yes, you can buy each Yokoy module separately. However, using the full suite provides greater benefits, as you can manage your expenses, invoices, and card payments in one central platform, and you can reduce system and data silos by simplifying ERP integrations.

Yes, Yokoy integrates with more than 50 solutions, automating your entire spend management process from end to end. At the same time, our API makes it easy to build custom integrations, if you can’t find what you’re looking for. Check our Integrations page for more details.

Yes, although we serve both midsize and large customers, Yokoy’s added value is best experience by global enterprise customers. Our suite is built for complex, global multi-entity configurations, and integrates with most enterprise ERP & HRM tools such as SAP R3/S4 and Successfactors, among others.

This depends on your IT landscape and the required configurations and integrations. For example, a global implementation with 2 legal entities, an ERP system integration, credit card integrations, and SSO setup takes about 2 months. The projects are carried out either by the Yokoy Services team or a certified Implementation Partner.

Yes, our Implementation team will lead the project from planning to implementation and testing, and will coordinate training workshops for your team. Global enterprise customers benefit from a dedicated Key Account Manager and financial process consulting from our in-house finance experts.

We use modern data encryption standards for both stored data and data in transit. Additionally, we work with external penetration testers (hackers) to constantly challenge our platform’s vulnerabilities. We adhere to local regulations such as GDPR in the EU or the Swiss Data Protection Act, to deliver the best data protection standards.

Given that no two setups are the same, we’ll discuss your specific needs during the sales process, and provide you with a tailored offer that ensures you’ll get the most out of our spend management suite.