Home / How to Speed up the Invoice Reconciliation Process with Automation

How to Speed up the Invoice Reconciliation Process with Automation

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Critics might argue that relying too heavily on automation in the invoice reconciliation process could lead to a lack of oversight and control.

While it’s true that automation cannot account for all potential discrepancies or errors, it can significantly reduce the occurrence of common mistakes through error-checking mechanisms and validation rules.

Spend management solutions such as Yokoy can be configured to handle exceptions in an effective manner.

AI-based checks and controls, as well as custom workflows allow for human oversight and intervention at critical stages of the reconciliation process, ensuring that complex issues or exceptions are appropriately addressed.

Moreover, the AI algorithms can continuously learn and improve over time, identifying patterns and anomalies that may indicate potential discrepancies or errors, thereby enhancing accuracy.

Therefore, we firmly believe that automation in invoice reconciliation should be regarded as a means to boost efficiency and accuracy rather than a wholesale substitution for human involvement. This approach enables companies to address complex scenarios with effectiveness and precision.

Now let’s dissect the topic further, to see how you can speed up invoice reconciliation with automation, without sacrificing security or compliance.

What is invoice reconciliation?

In the world of accounting, reconciliation means comparing two or more sets of numbers to ensure their coherence and accuracy.

Invoice reconciliation is the process of aligning bank statements with both outgoing and incoming invoices to ensure the integrity of all accounts while accurately matching each entry in the financial records.

Furthermore, invoice reconciliation involves the meticulous cross-checking of details present within each individual invoice to make sure there are no discrepancies or errors. This ensures that a company pays the right amounts to the right vendors and avoids erroneous or duplicate payments, as well as payment delays.

For example, the finance department might check line item details to make sure that all items listed on an invoice match the actually ordered or received goods. They might check the prices listed for each item and see if the amounts match those agreed upon with vendors. Other details checked during this process include invoice dates, payment terms, tax and fees, as well as purchase order details.

NOTE:

Please note that invoice matching and invoice reconciliation are not the same thing. The process of checking if a supplier invoice matches the PO and goods receipts (three-way match) is usually referred to as invoice matching, and is done by the accounts payable department before an invoice payment is approved.

Reconciliation on the other hand is the process of matching invoices recorded in the AP ledger with payments made to suppliers and balances in bank statements. The end goal here is to resolve discrepancies – missing invoices, late and partial payments, or refunds.

Blog article

How to Use Invoice Matching Technology to Improve Your Process Efficiency

See how invoice matching technology automates the 2- and 3-way matching of supplier invoices with POs and goods receipts, for an efficient AP process.

Mauro Spadaro,

Product Manager

How do you reconcile an invoice?

The typical invoice reconciliation process involves several steps to ensure accuracy and completeness. These steps are common in both traditional, manual processes, and in automated ones. However, a manual reconciliation process that relies on paper invoices and spreadsheets is much more time-consuming and prone to error than an automated one.

Collect the invoices for the specified period

To kick off the reconciliation process, start by gathering all the invoices that pertain to the specific timeframe you’re examining. Ideally, you’d have these neatly organized in your accounting software, so you can easily sort the documents by invoice numbers, invoice dates and due dates, vendors, and amounts.

Create a detailed transaction record

Next, create a comprehensive ledger of transactions that happened during this period. This set of records record will be your go-to guide for reconciling invoices with payments made to vendors.

It’s not just about payments going out – make sure you capture all those deposits and payouts too. Sometimes, transactions can be labeled in ways that lead to confusion, so be thorough in gathering all the pieces.

Organize the documents and add up the numbers

Once you have all your invoices and transactions at hand, organize them for easy matching. As you add up the numbers, you might find that things line up perfectly – but don’t be surprised if vendor accounts aren’t perfectly balanced. In case you find discrepancies, you’ll need to dig deeper to find the cause. In a manual process, this step can take hours or even days, depending on the amount of invoices processed.

Align invoice payments with recorded transactions

Take your ledger and check off each payment made for the invoices during this period. If an invoice is fully paid, consider it done and mark it as processed. But if an invoice received only partial payment, it’s time to schedule another round of payment. As for unpaid invoices, those will be carried over as accounts payable for the next reporting period.

Address discrepancies and duplicates

Finally, uncover any hidden financial issues and address potential discrepancies and duplicates.

Did your company accidentally send double payments or make payments too early? Were there instances of overpayments or unnecessary payouts to suppliers? Are you still making payments to vendors you no longer do business with?

By following these steps diligently, you’re not only ensuring the alignment of your financial records, but you’re also setting the stage for financial transparency and uncovering any irregularities that need your attention.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Disadvantages of manual invoice reconciliation

Manual invoice reconciliation, while a valid method, comes with certain drawbacks that can impact efficiency and accuracy. Some of the disadvantages of manual invoice reconciliation include:

Human error: Manual processes are prone to human errors, such as mistyping numbers or miscalculations, which can lead to inaccuracies in reconciled data.

Time-consuming: Reconciling invoices manually can be time-consuming, especially when dealing with a high volume of transactions. This inefficiency can delay not only the accounting process but also the payment of vendor invoices, as well as financial reporting. Moreover, traditional reconciliation processes requires significant manpower, which can strain resources and limit the allocation of personnel to more strategic tasks.

Dependency on personnel: Manual reconciliation heavily relies on specific individuals or teams, making the process vulnerable to disruptions in case of employee turnover or unavailability.

Complex process: As the number of invoices and transactions increases, the complexity of manual reconciliation grows, increasing the likelihood of errors and making the process more intricate.

Limited scalability: Manual reconciliation becomes increasingly challenging to manage as a business grows and handles more transactions. Scaling up with manual processes can be difficult and may lead to bottlenecks.

Lack of real-time data: Manual processes don’t offer real-time updates on financial status, which can hinder decision-making and prevent timely identification of discrepancies. Moreover, traditional processes lack the advanced analytical capabilities that automated systems offer, preventing in-depth insights into financial trends and patterns.

Difficulty in auditing: Auditing manual reconciliation processes can be challenging due to the lack of a clear digital trail and increased reliance on physical documents.

Data security: Manual processes may involve sensitive financial information being handled physically, raising concerns about data security and privacy.

Difficulty in maintaining compliance: In industries with strict regulations, manual processes can be challenging to maintain in a compliant manner, increasing the risk of regulatory issues.

Considering these disadvantages, many businesses are transitioning towards automated solutions for invoice reconciliation, leveraging AP automation software to streamline invoice and account reconciliation processes, enhance accuracy, and facilitate efficient financial management.

Benefits of automating the reconciliation of invoices

Automation can help address the challenges faced by businesses in invoice reconciliation. But, before exploring its benefits, a note on objections to automation in AP processes.

I engage with finance professionals daily, often from global enterprises. They raise concerns that automating invoice reconciliation is costly and time-intensive. Initial software and training costs might outweigh speed benefits.

Compatibility worries arise about automation fitting with existing systems. Integration hurdles might disrupt reconciliation workflows. New software adoption is another concern. Many finance leaders think software learning effort offsets time saved in reconciliation.

Though valid, automation’s benefits can outweigh hurdles. Choosing AP management or invoice reconciliation software that ensures great usability across devices, flexibility through API integrations, and scalability across entities and geographies is key.

Blog article

AP Automation: How to Accelerate the Accounts Payable Process with AI Software

We’ve put together this mini-guide to what accounts payable automation is all about, what technologies are involved, and how we apply them to make your AP process faster and smoother.

Mauro Spadaro,

Product Manager

Enhanced efficiency

Automation significantly reduces manual effort by automating repetitive tasks, such as data entry and matching invoices, line by line, with purchase orders and receipts. This accelerates the overall reconciliation process, allowing businesses to handle a higher volume of invoices in less time.

AI-based automation technology can learn from historical data and automatically apply rules in case of exceptions and discrepancies, accelerating the process and minimizing the need for time-consuming, manual interventions.

Consistency through standardization

Automation ensures standardized processes across accounts payable and finance departments. By automating task assignments, notifications, and approvals, workflows are streamlined, reducing bottlenecks.

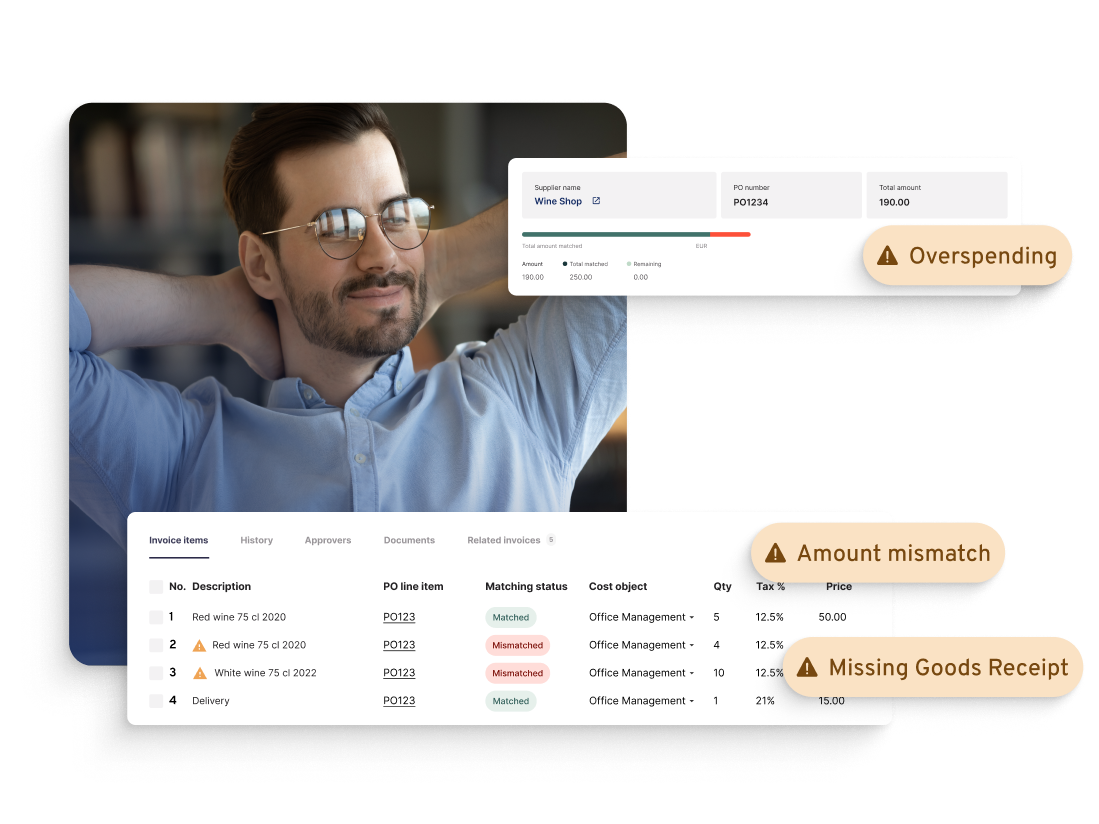

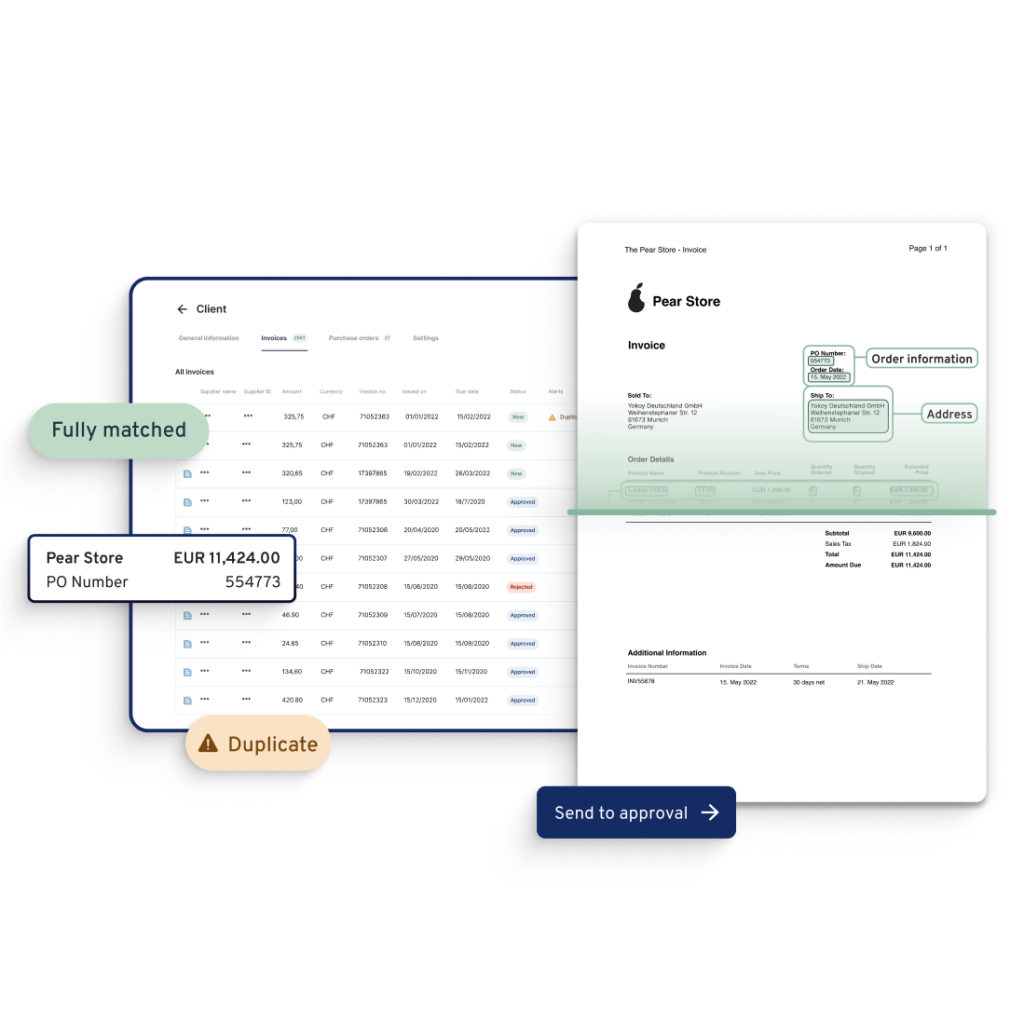

For example, Yokoy’s AI-powered Invoice module helps companies process invoices in bulk, automatically routing them to the correct approver based on custom workflows, and flagging errors and discrepancies in real time.

Moreover, Yokoy facilitates the matching of invoices with POs, speeding up the checking of invoice items and enabling finance teams to allocate resources more effectively to manage the workload.

Minimized errors and discrepancies

Manual data entry, invoice validation and matching, as well as manual reconciliation processes are prone to human errors. Automation software can flag potential discrepancies between invoices, purchase orders, and receipts, enabling timely identification and resolution of issues.

For example, Yokoy automates the entire AP process from data extraction to invoice approval, ensuring consistency and reducing the risk of discrepancies.

At the same time, automated reconciliation can provide detailed audit trails and document versions, facilitating the resolution of disputes with suppliers/vendors and ensuring increased accuracy.

Improved accuracy and compliance

Automation eliminates data entry errors and enforces compliance with policies and regulations, validating invoice amounts and aligning them with budgets or contracts.

Automation systems can be programmed to flag complex or exceptional cases that require human intervention. In such cases, the system can route the specific item to designated personnel for manual review and resolution.

Moreover, invoice automation software can integrate with document management tools, ensuring that all relevant documentation from suppliers/vendors is captured and linked to the corresponding invoices.

Real-time visibility

Automation provides real-time visibility into the invoice reconciliation process, making it easy to track the progress, identify bottlenecks, and promptly address any issues that may arise. This visibility enables better decision-making, improves collaboration between departments, and ensures timely resolution of discrepancies.

Automated reporting and dashboard functionalities provide insights into key metrics, such as reconciliation cycle time or outstanding invoices, enhancing visibility for stakeholders.

Overall, automation in invoice reconciliation mitigates challenges by reducing manual effort, improving accuracy, streamlining workflows, providing real-time visibility, and facilitating timely dispute resolution. It empowers businesses to optimize their processes, enhance productivity, and achieve greater efficiency in their invoice management process.

Next steps

While valid objections exist, the benefits of automating the invoice reconciliation process far outshine the limitations of manual efforts.

With the potential to significantly reduce errors, expedite workflows, and ensure compliance, automated invoice reconciliation emerges as the definitive choice for modern businesses striving for financial excellence.

Still, it’s essential to recognize that the journey towards automation doesn’t stop at reconciliation alone; automating invoice processing and matching serves as a strategic precursor that maximizes the effectiveness of the overall process.

By seamlessly integrating these steps, businesses can not only streamline their operations but also equip themselves with the agility needed to thrive in today’s rapidly evolving financial landscape.

If you want to see what Yokoy can do for your invoice management and reconciliation process, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.