Home / How to Scale Your Expense Management Process Without Increasing Employee Headcount

How to Scale Your Expense Management Process Without Increasing Employee Headcount

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Expense management, a fundamental aspect of financial control, can often become a bottleneck as businesses expand. The challenge lies in scaling this process without inflating employee headcount, which could lead to increased costs and decreased efficiency.

This article explores strategies to effectively scale your expense management process while leveraging artificial intelligence and automation technology.

Common challenges in traditional expense management

Traditional expense management often faces numerous challenges that can hinder efficiency and accuracy in financial tracking and reporting. These challenges arise from manual processes and outdated methods, leading to errors, delays, and increased costs.

Some key challenges include:

Manual data entry: Reliance on manual data entry increases the risk of human errors, leading to inaccuracies in expense records.

Receipt management: Paper-based receipts are easily lost or damaged, making it difficult to validate expenses and causing delays in reimbursement.

Approval bottlenecks: Manual approval workflows can be slow, causing delays in processing expenses and impacting employee satisfaction.

Lack of visibility: Limited real-time visibility into spending makes it hard to monitor expenses effectively and make informed decisions.

Policy compliance: Ensuring adherence to expense policies becomes challenging without automated checks, leading to non-compliant spending.

Tedious reconciliation: Matching expenses with bank statements and invoices is time-consuming and prone to errors without automated reconciliation.

Audit preparation: Manual record-keeping complicates audit preparation and can result in non-compliance issues.

Data security: Storing sensitive financial information manually increases the risk of data breaches and unauthorized access.

Lack of analytics: Absence of data analytics tools hinders the ability to identify spending trends and potential cost-saving opportunities.

Modernizing expense management through digital solutions can address these challenges, streamlining processes, enhancing accuracy, and making it easy to scale your process without increasing employee headcount.

But where should you start?

Map your expense management process

Before implementing any changes, it’s essential to have a clear understanding of your existing expense management process.

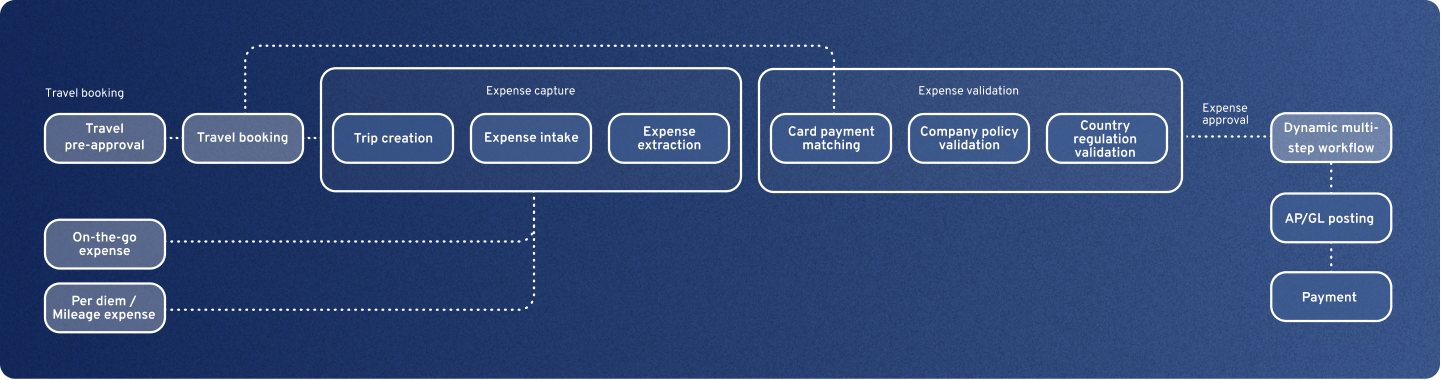

So our recommendation is to start by mapping your current expense process to identify areas of inefficiencies and bottlenecks caused by poor integrations between your expense management solution and other financial tools – for example, ERP system, accounting software, or travel management tools.

In practice, this step involves identifying the various stages business expenses go through, from receipt capture and expense submission to review, approval, and reimbursement.

According to research by the Global Business Travel Association (GBTA), the average expense report takes around 18 minutes to complete, which adds up significantly for businesses with numerous employees submitting expenses regularly.

Understand which steps require human intervention

Next, you need to understand what can be automated and which steps require human intervention. While automation can greatly enhance efficiency, certain steps still require human judgment.

For example, auditing employee expenses for policy compliance and accuracy is an area where human intervention is crucial. Although in tools like Yokoy, the artificial intelligence can automate both the steps and the logic of the process, there are always exceptions and edge cases that should be manually reviewed.

The Association of Certified Fraud Examiners (ACFE) reported that expense reimbursement fraud accounts for approximately 14% of all occupational fraud cases. Therefore, a balance between automation and human oversight is necessary.

To give just one example, different countries often have varying Value Added Tax (VAT) rates for different types of expenses. In a traditional expense management process, the finance team often has to manually check the VAT rates to ensure an accurate reporting process.

Automated expense management systems like Yokoy can fully automate the VAT extraction while keeping the rates up to date with country-specific rules and regulations.

Fenaco standardized their expense management with Yokoy

“With Yokoy, we have opted for a uniform and group-wide expense management solution that unifies our different expense processes on one platform and automates them across organizations, for increased efficiency.”

Marianne Schluep, Head of Finance and Accounting

Understand what you can automate

Most steps in the expense management process don’t actually require human intervention. However, an IT landscape where finance tools aren’t fully integrated and business spend is managed through multiple systems, it might be too challenging to automate expense tracking and reporting from end to end.

Analyzing the process data can help identify the repetitive and rule-based tasks that are suitable for automation for your particular case.

For instance, according to a study by Ardent Partners, approximately 66% of expense management tasks are considered “very suitable” for automation. However, Yokoy customers experience up to 90% automation in their expense and spend management, saving thousands of hours of manual work.

Buhler processes 46.7% of expenses within 24 hours

Bühler Group’s implementation of Yokoy’s spend management suite has led to impressive results. With Yokoy Expense, almost half of their expense reports are processed within 24 hours of submission.

Christoph Jenny, Co-founder Planted

As a general rule, expense management automation should help replace the repetitive manual processes that are prone to human error, fraud, policy breaches and other compliance issues.

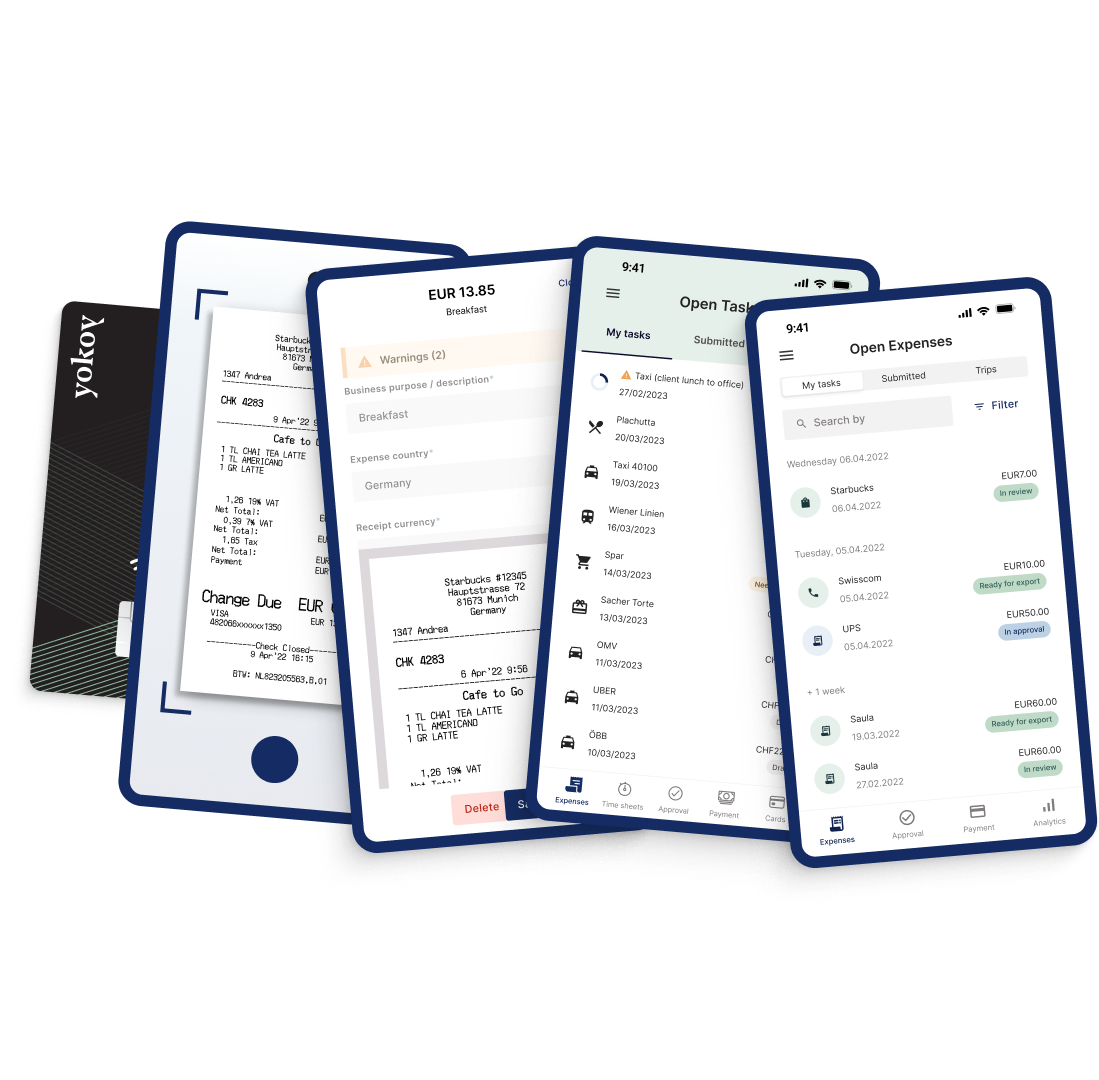

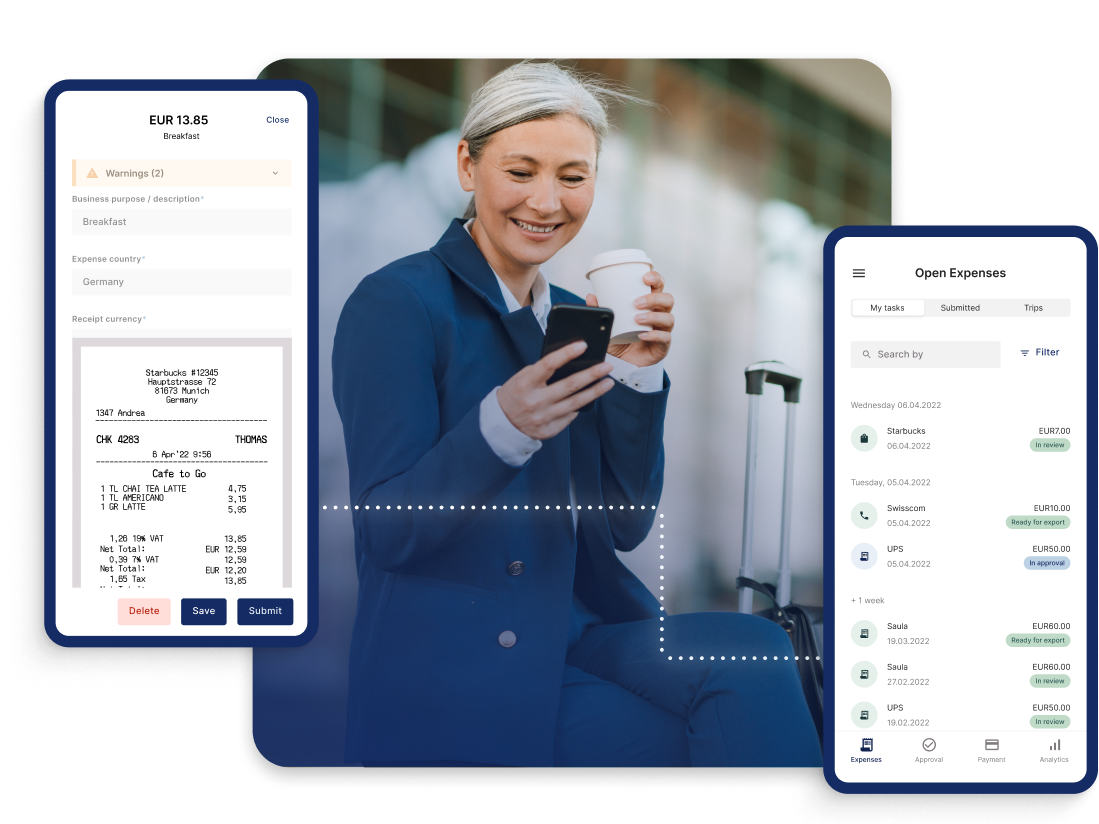

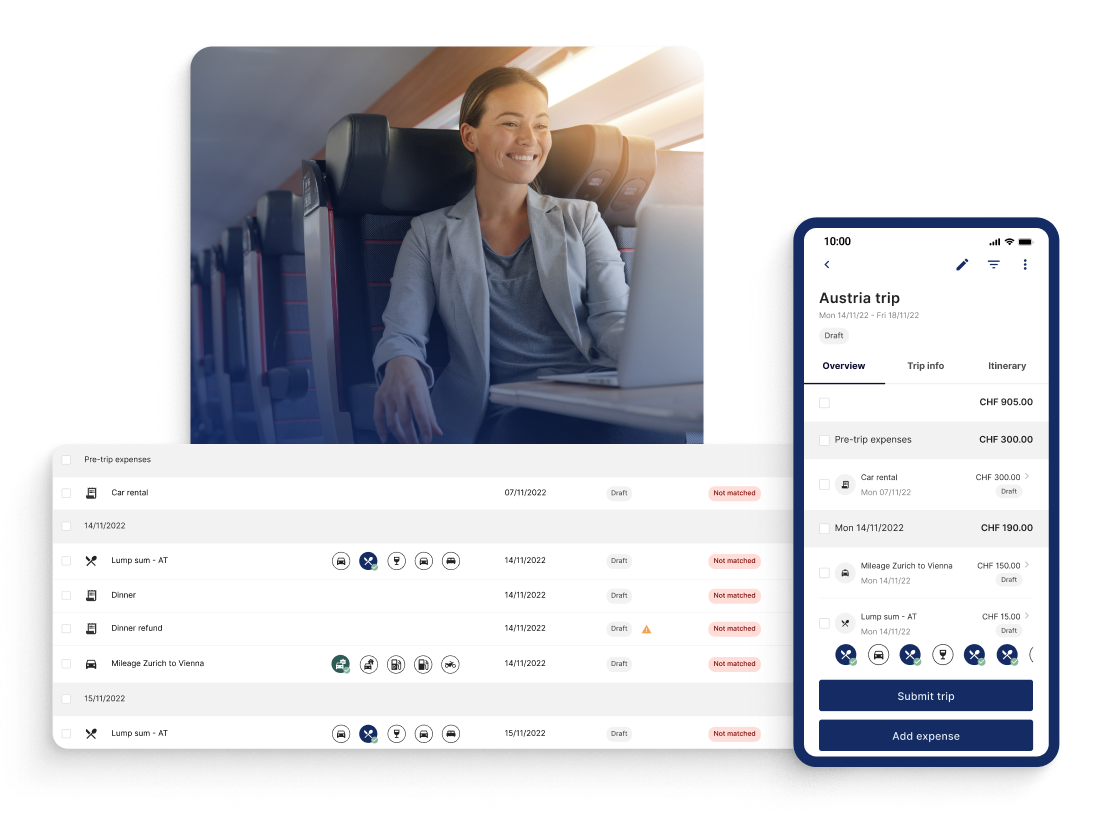

For example, instead of chasing paper receipts and asking employees to submit their business trip expenses into spreadsheets, you can equip them with modern travel expense solutions that enable them to capture a photo of a receipt on the go, with their mobile devices.

To simplify this process even more, you can give your employees a smart corporate cards, so that card transactions are automatically reconciled with expenses, as they happen. This also ensures real-time flagging of policy breaches, contributing to a virtually error-free process.

In the same way, instead of wasting your finance department’s time with manual approvals and financial reports, you can use a solution like Yokoy to automate the expense reimbursement process, from reviewing expense claims to redirecting the reports for approval through automated workflows.

All the submissions that are within the expense policy of the company should be automatically categorized, assigned to the correct cost center, and approved, ensuring timely employee reimbursements and significantly reducing expense fraud.

Note: Thanks to our end-to-end integrations with travel booking platforms such as TravelPerk, the trip booking process can also be fully automated.

This helps centralize all business trip bookings into one platform and streamlines payments as well, as your finance team can pay for all trip expenses with a Smart Lodge Card. This way, employees don’t have to book their own trip and don’t have to pay with private cards for business travel expenses.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Evaluate your IT landscape and automation readiness

Review your existing financial systems, accounting software, and IT infrastructure. Identify any potential integration points or compatibility issues that might arise when integrating an expense management automation solution.

An effective T&E software should integrate with your existing systems, such as ERP, HR, accounting, and payroll software. A seamless integration will help streamline data flows and reduce manual data entry.

Also, take a look at your organization’s data security protocols and compliance requirements, especially when handling sensitive financial and personal information. Ensure that the automated system complies with data protection regulations relevant to your industry and region.

And finally, consider the scalability of your current IT environment. Will the chosen automation solution be able to accommodate your organization’s growth without significant disruptions or the need for frequent updates?

Checklist

Finance Transformation Readiness Checklist

In this white paper, we delve into the essential steps for finance leaders to assess the readiness of their organization and construct a compelling case for digital transformation in finance.

Choose an expense management software solution that enables growth

If your organization is ready for expense management automation, the next step is to choose a vendor. In principle, next to the automation capabilities, we recommend that you look for a provider who will not lock you in with their software, to ensure the scalability and flexibility mentioned earlier.

Also, make sure to check:

The tool’s user experience: Evaluate the user-friendliness of the automation solution. Will your employees require extensive training to use the new system effectively? A solution with an intuitive interface can reduce the learning curve.

Mobile accessibility: Assess whether the automation solution offers mobile access. Mobile apps can empower employees to capture expenses on-the-go and ensure timely submission.

Technical support and service: Consider the technical support and maintenance services provided by the automation solution provider. A reliable support system can assist with troubleshooting and address any issues that arise.

Expected ROI: Determine the potential return on investment (ROI) of implementing the chosen expense automation solution. Consider both the initial costs and the long-term benefits in terms of time savings, reduced errors, and improved financial visibility.

We’ve detailed this topic in the article below.

Opinion

The ROI of Finance Transformation

Learn how to calculate, communicate, and maximize your returns when undergoing a digital transformation project.

Stephan Hebenstreit,

Managing Director Austria, Yokoy

What a fully automated expense management process looks like with Yokoy

Now that you know the theoretical part, let’s see what a fully automated process looks like with a spend management solution like Yokoy.

If you’re interested in the implementation part, make sure to check our white paper below, where you’ll see how we approach global rollouts.

Receipt capture

Manual receipt collection and entry is time-consuming and error-prone. With Yokoy, you can simply take a photo of a receipt directly in the mobile app or upload it to the mobile or web app. Alternatively, you can also forward the receipt to Yokoy as an email attachment.

In case of travel expenses, Yokoy’s AI calculates mileage rates automatically, in accordance with country regulations. Employees fill in the starting point and destination and Yokoy does the rest. Our software supports requirements such as the 3-month rule or midnight rule.

Automated expense processing

Yokoy’s OCR automatically reads and extracts all relevant information from the receipt, with a very high accuracy rate. Yokoy’s AI engine then fills the expenses report with all relevant information such as merchant, expense country & currency, total amount, expense category, and multiple VAT.

Then, the app checks the expense report against relevant company policies and local regulatory policies, triggering notifications in case of potential fraudulent items, policy breaches, and missing VAT rates. Our AI model learns and gets smarter with every processed expense report.

Expense submission

Yokoy automatically identifies the approval steps required for the expense based on the cost object or line manager. The tool offers customizable approval flows, allowing you to set multi-level conditional workflows.

In case there are policy breaches or compliance issues, Yokoy notifies the submitter so they can adjust the documents and fix the errors before submitting the expense report. This significantly decreases the rate of duplicates and anomalies, ensuring that your finance department doesn’t waste time on errors that could have been prevented.

For instance, if an employee attempts to submit an expense that exceeds the predetermined limit, the system can notify both the employee and the supervisor for review. Automating the submission process can mitigate errors by using predefined categories and limits, reducing the need for manual data entry.

Expense approval

Yokoy enables dynamic approval workflows for complex T&E setups, expediting the approval process by routing expense reports to the relevant cost object owners or line managers, with hierarchical and threshold based multi-step escalation.

The system can ensure that approvals are obtained in a timely manner and that no step is missed. This leads to faster reimbursements and improved employee satisfaction.

Automated booking to ERP system

Once expenses are approved, they need to be recorded in the company’s Enterprise Resource Planning (ERP) system. Automation can seamlessly transfer data from the expense management platform to the ERP system, reducing the chances of manual entry errors and saving time for finance teams.

For example, Yokoy automatically synchronises with the master data and exports all the financial booking to the ERP system, so you can close your books in time. Our platform connects with leading ERP systems such as SAP, Oracle Netsuite, Microsoft Dynamics 365, and many more, as you can see on our Integrations page.

At the same time, Yokoy ensures that all receipts are stored by the system for further checks, for simple audit trails, and that processed expenses are archived according to regulatory standards, simplifying the reporting process and preparing you for stress-free financial audits.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

Next steps

Scaling your expense management process without increasing employee headcount is not only possible but also essential for maintaining efficiency in a rapidly evolving business landscape.

By understanding the steps that can be automated and those that require human intervention, you can achieve a harmonious balance that reduces errors, saves time, and allows employees to focus on value-added tasks.

At Yokoy, we help mid-size and large global enterprises automate their travel and expense management process from end to end, saving them thousands of hours in manual work. If you’d like to see what Yokoy can do in practice, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.