Home / Closing the Books Faster: How to Make Accounting More Efficient

Closing the Books Faster: How to Make Accounting More Efficient

- Last updated:

- Blog

Co-founder & CCO, Yokoy

The month-end close process is the last step in the accounting cycle, where all financial activities are brought together and reconciled to produce accurate financial statements.

For finance professionals, this ritual of “closing the books” marks the end of one accounting period and the beginning of another. It’s a time for reflection, analysis, and preparation for the road ahead, supporting informed decision-making.

However, the traditional month-end closing process, often laden with manual tasks, data silos, and delayed financial reports, can feel like a marathon rather than a sprint.

In this article, we’ll explore the need for efficiency in accounting and how modern spend management solutions can help finance teams close the books faster.

Common challenges in the month-end close process

In broad terms, “closing the books” at the end of the month entails a series of activities aimed at finalizing the financial records for a specific accounting period. This process involves several key steps:

Reviewing all sales, expenses, payroll, and any other financial activities that occurred during the month,

Reconciling accounts to ensure that the balances in the general ledger match supporting bank statements and invoices, and

Preparing financial statements, including income statements, balance sheets, and cash flow statements.

Any necessary accruals or deferrals are made to account for revenue or expenses that have not yet been realized or recognized but pertain to the current accounting period. Temporary accounts, such as revenue and expense accounts, are closed to the income statement, and their balances are transferred to permanent accounts like retained earnings on the balance sheet.

The finalized financial reports are typically reviewed and approved by relevant personnel, including management and auditors, to ensure accuracy and compliance. Once the financial records are closed and approved, they are archived for future reference and auditing purposes.

This process often comes with its own set of challenges that can impede efficiency and accuracy. Let’s delve deeper into these challenges.

Manual processes are prone to error

Many organizations still rely on manual processes, lacking automation tools that can streamline repetitive tasks.

Chasing receipts: Especially in organisations with multiple entities and complex accounts payable setups, accountants often miss a lot of receipts at the end of month or end of quarter, and they need to chase people in order to collect receipts. This is very time consuming and frustrating, leading to delays in closing entries.

Matching receipts with open card transactions: When multiple credit cards from different institutions are used, the tracking of all open transactions becomes even more complex, as accountants often don’t know to whom a transaction belongs. The process is further complicated by the use of spreadsheets for expense reporting.

Data entry pitfalls: Traditional month-end closing processes often involve a significant amount of manual data entry. This could range from transposed numbers to missed entries, potentially leading to financial misstatements.

Time-consuming reconciliation: The process of reconciling accounts, a pivotal part of the month-end close, can be time-consuming when performed manually. Accountants must painstakingly match each transaction, a process that is not only labor-intensive but also leaves ample room for errors.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Disparate systems cause bottlenecks when closing books

Many organizations rely on a patchwork of disparate systems for various accounting functions. These systems often struggle to communicate effectively with each other, leading to data silos.

Inadequate integration between financial systems, enterprise resource planning (ERP) systems, and other software can prevent data from flowing seamlessly and in real-time. This can cause bottlenecks when attempting to consolidate and reconcile financial data from different sources.

Data silos and lack of real-time visibility

Different departments within an organization often maintain their own databases and systems. This compartmentalization is driven by the need for specialized tools but results in data fragmentation.

As a result, information becomes trapped within these isolated systems, inaccessible and challenging to cross-reference. This not only affects data accuracy but also hampers the ability to gain comprehensive insights into the financial health of the organization.

Moreover, traditional processes may not provide real-time access to financial data, making it difficult for finance professionals to gain end-to-end visibility and make informed decisions promptly.

Compliance and reporting issues

Approvals for invoices, expenses, and other financial transactions may follow inefficient, paper-based workflows, leading to delays. Moreover, tracking changes and maintaining a comprehensive audit trail can be difficult without proper tools and systems in place.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

Time constraints that make it hard to double-check data

The month-end close operates on a tight schedule, with stringent deadlines. Accountants often find themselves racing against the clock to complete the process within the allocated timeframe.

This time pressure can lead to hurried procedures and insufficient time for meticulous data verification. In the haste to meet deadlines, accountants might skip essential steps, potentially leading to financial inaccuracies that can have repercussions down the line.

Addressing these challenges requires a combination of modern solutions, such as automation and integrated accounting systems, along with a commitment to continuous improvement in accounting processes.

In the next section, we’ll explore how businesses can overcome these obstacles to make their accounting processes more efficient, accurate, and timely.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

How spend management automation helps close the books faster

Spend management software plays a pivotal role in expediting the month-end closing process through automation of vital financial functions. By seamlessly integrating with an organization’s financial systems, it facilitates real-time data integration and precise expense management.

Furthermore, this automation significantly streamlines approval workflows, removing processing delays and simultaneously ensuring rigorous compliance and comprehensive audit trails.

In essence, spend management software serves as a time-saving, data-enhancing, and efficiency-boosting tool that empowers organizations to close the books more swiftly and with heightened effectiveness.

Let’s explore each of these facets to better understand their impact.

Real-time expense tracking and transaction matching

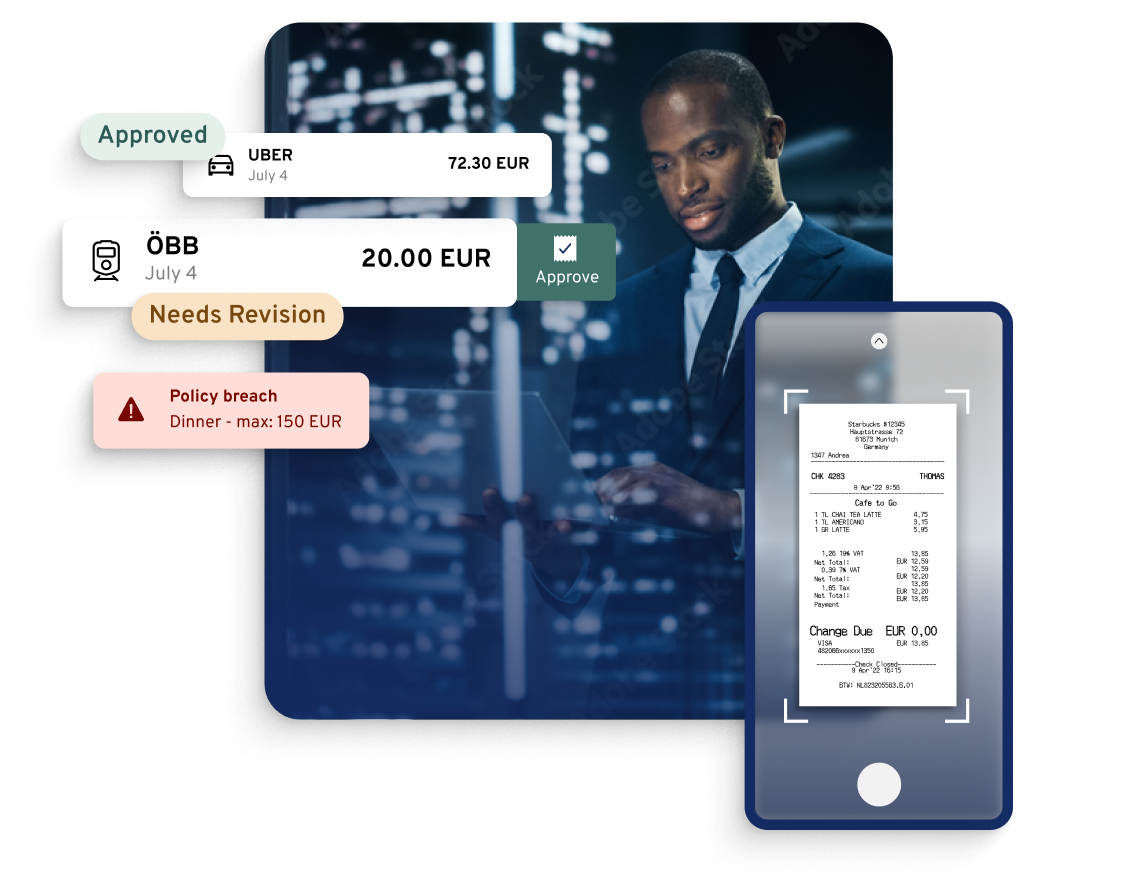

Chasing receipts is one of the most frustrating tasks for accountants, often delaying the end month closing process.

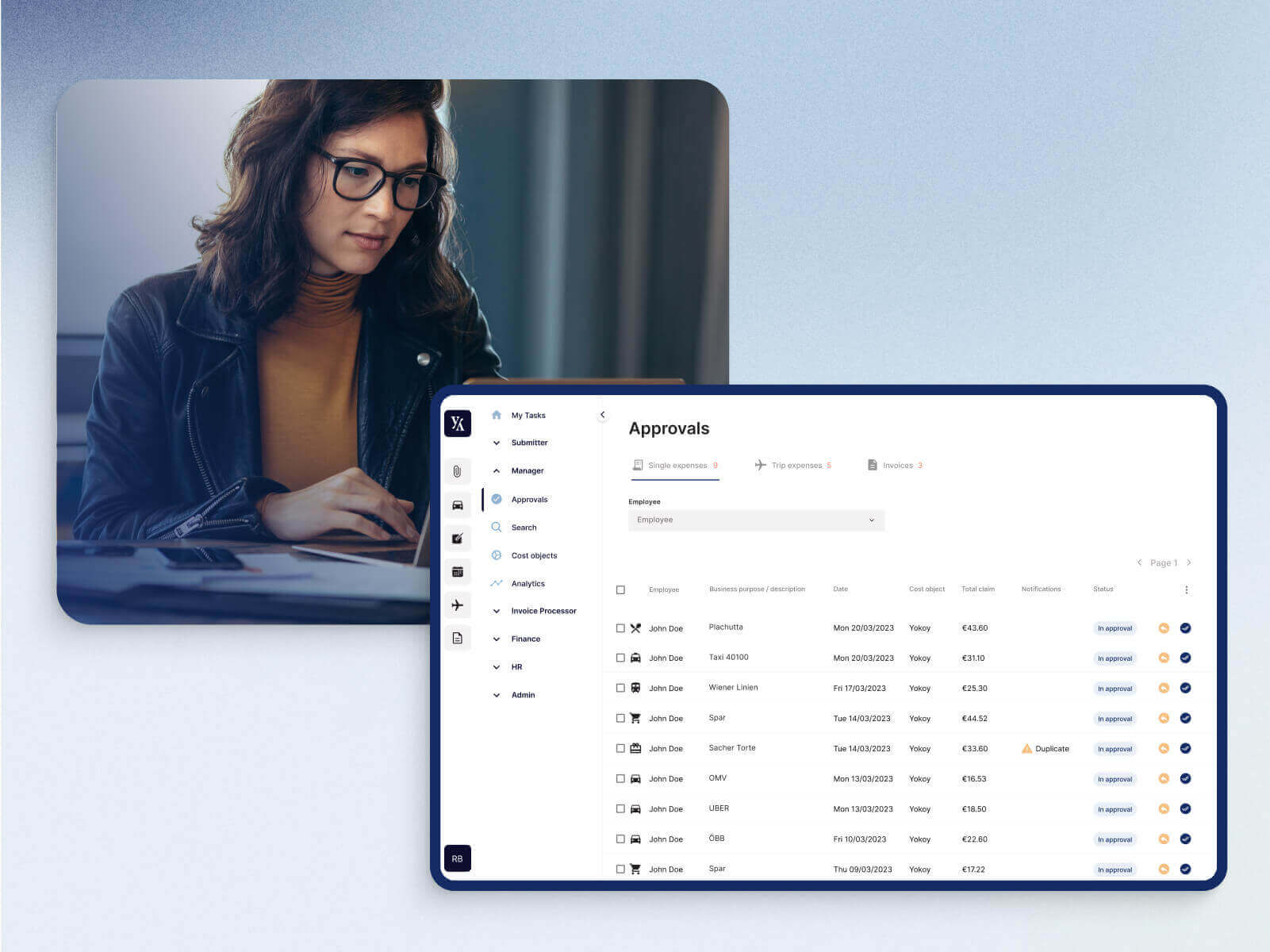

Spend management software such as Yokoy automatically reminds employees of missing receipts, sending real-time notifications at the moment an expense report is submitted.

Employees can simply take a picture of the receipt with their mobile app. Once submitted, the AI technology automatically matches it with the corresponding card transaction, significantly reducing the time needed for validating and approving expenses.

The process is even smoother when the expenses are paid with smart corporate cards, as these are fully integrated into the platform, so there’s no need for employees to upload additional bank statements.

Moreover, thanks to the real-time compliance checks, policy breaches, duplicates, and potentially fraudulent items are flagged in real time. This ensures that the finance team only needs to check edge cases – all the other expenses are automatically processed, approved, and booked in the ERP.

Blog article

How to Prevent Expense Fraud with AI-Driven Compliance and Custom Workflows

Expense fraud is a pervasive problem that continues to plague companies of all sizes and industries. In fact, a recent survey by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being one of the most common types of fraud.

Lars Mangelsdorf,

Co-founder and CCO

Centralized overview of all open expenses

Spend management solutions that are fully integrated with ERP systems and corporate cards help finance teams maintain a centralized view of all the open transactions and expenses.

Finance teams can view all the records from a single dashboard within the integrated system, making it easier to maintain data accuracy and review and approve expenses efficiently.

Automated expense categorization and validation

Automated expense management ensures that all employee expenses are accurately recorded and categorized. This eliminates the need for manual expense tracking and reduces the likelihood of errors or fraudulent claims.

With Yokoy, the submitted expenses are automatically categorized, processed, and validated, in accordance with company policy and local rules and regulations. Accurate expense data contributes to a smoother month-end closing process, while at the same time ensuring audit-proof processes.

Buhler processes 46.7% of expenses within 24 hours

Bühler Group’s implementation of Yokoy’s spend management suite has led to impressive results. With Yokoy Expense, almost half of their expense reports are processed within 24 hours of submission.

Christoph Jenny, Co-founder Planted

Streamlined approval workflows

Yokoy’s AI-powered automation enables efficient approval workflows for expenses, invoices, and other financial transactions.

These workflows eliminate the need for manual approvals and paperwork, accelerating the processing of financial transactions. Faster expense and invoice approvals mean that financial data can be finalized and included in the closing process without unnecessary delays.

Blog article

How to Automate Your Invoice Approval Workflows with Yokoy

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. Here’s how Yokoy can help.

Mauro Spadaro,

Product Manager

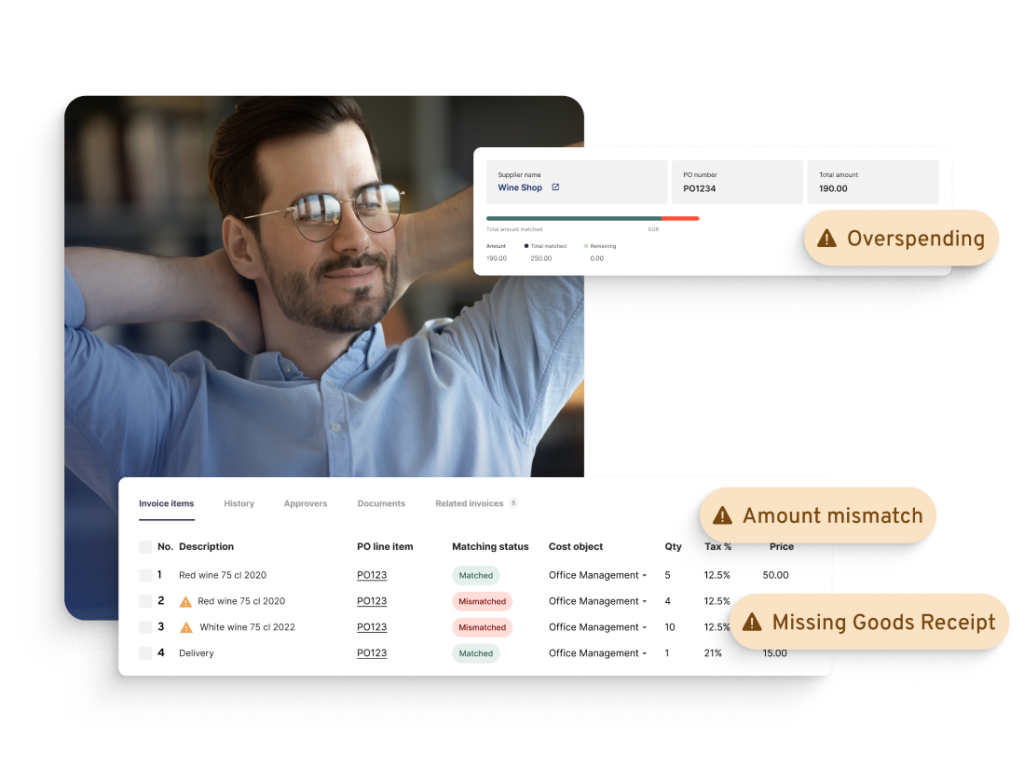

Automated accounts reconciliation

One of the most time-consuming aspects of month-end closing is reconciling accounts and ensuring that the data in the general ledger matches external records.

An end-to-end spend management solution automates this process by cross-referencing transactions and accounts, identifying discrepancies, and making necessary adjustments. This automation reduces the risk of errors and significantly speeds up the reconciliation process.

Compliance and audit trails

Spend management software using AI technology can be a powerful tool for automatically enforcing compliance within an organization. This capability plays a significant role in ensuring that expenses and invoices adhere to company policies and regulations.

AI algorithms can be trained to analyze expenses and invoices against the company’s predefined policies and rules. This includes checking for spending limits, preferred vendors, and categories of expenses that require approvals.

Moreover, Yokoy’s spend management system is designed to maintain comprehensive audit trails automatically. Every transaction and change is logged, including who made the change and when, providing a transparent and traceable history of financial data.

This feature not only aids in compliance with regulatory requirements but also simplifies the auditing process, making it faster and more efficient.

Yokoy Compliance Center

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates, while Yokoy keeps you audit-ready across countries.

Real-time data integration

Spend management automation solutions like Yokoy seamlessly integrate with other essential financial systems, such as ERP or accounting tools, aggregating data from various sources in real-time. This means that finance professionals have access to up-to-the-minute financial information, eliminating the need to wait for data to be manually input and reconciled.

Real-time data integration enables quicker decision-making and ensures that the books can be closed as soon as the month ends.

Moreover, spend management tools offer reporting and analytics capabilities, allowing finance professionals to quickly generate financial statements and performance reports. These reports provide insights into financial performance, enabling better-informed decisions at the end of each month.

Scalability

As organizations grow, spend management automation solutions can scale seamlessly to accommodate increased transaction volumes, while maintaining a degree of standardization that ensures governance and end-to-end visibility.

This scalability ensures that the closing process remains efficient and accurate across geographies and entities, even as the company expands.

DO & CO standardized their global spend management with Yokoy

“One unified process for the entire DO & CO Group. Yokoy enables us to collaborate optimally across all locations and entities.”

Michael Kultscher-Burger, Teamlead Accounts Payable & Receivable

Next steps

In conclusion, spend management automation is a game-changer for finance professionals aiming to close the books faster.

By providing real-time data integration, automated reconciliation, streamlined approval workflows, accurate expense management, compliance features, advanced reporting, and scalability, spend management solutions empower finance teams to meet month-end deadlines with confidence and efficiency.

If you’d like to see how Yokoy’s spend management software can help you close the books faster, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.