Home / Invoice Management for Modern Businesses

Invoice Management for Modern Businesses

- Last updated:

- Blog

Every business professional will agree with us: Managing invoices is a crucial factor contributing to the success of financial operations. However, many businesses still grapple with cumbersome manual invoice processing methods, resulting in substantial costs and prolonged processing durations.

A report from PayStream Advisors shows that the average company spends around £32 on manual invoice processing and takes 16 days to process one invoice from start to finish. This should not be the norm, though automated invoice processing can slash the cost per invoice to a mere £2.67 and trim processing time to less than four days.

In an era defined by digital transformation, the necessity of automating invoice management processes has never been more apparent. By embracing automation, businesses unlock unparalleled benefits. Let us explore how your business can improve its workflows!

What is invoice management?

Managing invoices involves the organised handling of these documents within a company. It covers a range of tasks such as receiving, verifying, recording, and processing invoices for payment, all aimed at ensuring precision, productivity, and adherence to financial standards.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Invoice management is important for various reasons

Building and maintaining positive relationships with suppliers is connected to efficient invoice management. How so? Prompt payment and smooth transaction processes are essential for fostering trust. Timely settlements can even pave the way for favourable terms, discounts, and priority access to products and services.

Moreover, your business can benefit from cash discounts. It is a common practice among suppliers for early invoice payments. Effective management ensures businesses capitalise on these opportunities, thus optimising cash flow and curbing expenses.

The management of invoices directly influences a company’s liquidity. Mishandling or delaying invoices can tie up cash flow, potentially leading to liquidity challenges. On the other hand, well-organised processes contribute to better cash flow management and overall financial stability.

Collaboration with tax consultants is streamlined when invoice records are accurate and well-organised. Detailed documentation aids in ensuring compliance with tax regulations and simplifies the preparation of financial reports and tax filings.

Invoice data serves as a valuable resource for making sound financial decisions. Comprehensive records enable businesses to analyse spending patterns, identify areas for cost reduction, and plan for future investments and budget allocations.

Invoice Management as part of Accounts Payable

Accounts Payable (AP) is an important cornerstone of any company’s financial structure. It handles the intricate task of managing outstanding invoices and liabilities owed to suppliers and vendors. In a nutshell, AP represents the monetary commitments a business has made for goods or services acquired on credit.

Invoice management is part of Accounts Payable and encompasses a series of essential steps:

Receipt and authentication

Recording

Approval protocol

Payment execution

However, Accounts Payable extends beyond invoice management to cover broader financial duties, including:

Expense oversight: AP manages invoices and a spectrum of other expenses (including debit and credit card charges to your business bank accounts), ensuring timely payment and meticulous record-keeping.

Vendor relations: AP often maintains relationships with vendors, negotiating payment terms to optimise cash flow and cultivate positive associations.

Financial reporting: Data from Accounts Payable feeds into financial reports, offering insights into cash flow, liabilities, and overall financial stability.

In essence, Accounts Payable serves as the backbone of financial operations. Invoice management is a critical function that ensures precision, compliance, and efficiency in the payment process.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

How invoice management has changed

Before digitalisation, invoice management was a predominantly manual and paper-based process. Invoices were typically received via mail or fax, requiring physical handling and storage. Invoices had to be physically sorted, verified, and manually entered into accounting systems and Excel sheets. This manual data entry was time-consuming and increased the likelihood of mistakes and discrepancies. While this still sounds like a manageable task for a small business, big players would spend a great amount of resources.

Managing paper invoices also required much storage space and manual filing systems. Therefore, retrieving and accessing specific invoices could be cumbersome and time-consuming. Moreover, paper-based systems restricted access to invoices, often requiring personnel to be physically present in the office to handle and process documents. This limitation hindered remote work and collaboration, especially in decentralised or globalised organisations. All this led to delays in payment approvals and processing. Invoices could get lost in transit or misplaced, resulting in late payments, strained supplier relationships, and missed opportunities for early payment discounts.

Digitalisation has revolutionised invoice management

With the transition from paper to electronic invoicing, the need for physical handling and storage of invoices has been reduced significantly. Documents can now be sent and received electronically, minimising processing times and errors associated with manual data entry. You can also choose from a wide variety of free invoice templates and create invoices that can be sent and received electronically.

Advanced software solutions and automation technologies have automated many aspects of invoice management, from invoice capture and data extraction to approval workflows and payment processing. This automation significantly reduces manual intervention, speeds up processing times, and enhances accuracy and compliance. Digital invoice management solutions seamlessly integrate with enterprise resource planning (ERP) systems, streamlining end-to-end financial processes and enabling easy data exchange between different business functions.

Cloud-based invoice management platforms offer access to invoice data anytime, anywhere, enabling remote work, collaboration, and real-time visibility into invoice status and payment workflows. A huge benefit in terms of efficiency and transparency is the capture of rich invoice data, which can be analysed to gain insights into spending patterns, vendor performance, and potential cost-saving opportunities. Advanced reporting capabilities, therefore, provide actionable intelligence for strategic decision-making.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

The future of invoice management

In the foreseeable future, invoice management is about to change further, thanks to artificial intelligence (AI). Technologies are already reshaping how invoices are handled, analysed, and overseen. Here is a brief glimpse into what is ahead of us:

Automated data extraction: Picture AI-driven optical character recognition (OCR) and natural language processing (NLP) seamlessly extract crucial information from invoices. Think of vendor details, invoice dates, amounts, and line items being effortlessly parsed without the need for manual input. This automation promises to slash processing times and errors, revolutionising how data is handled.

Intelligent invoice classification: Imagine AI algorithms intelligently sorting invoices based on predefined criteria like vendor type, expense category, or payment urgency. This intelligent classification streamlines approval processes, ensuring faster processing and heightened accuracy as invoices flow through the system.

Predictive analytics for cash flow management: Envision AI-powered predictive analytics forecasting cash flow trends, anticipating payment obligations, and optimising working capital management. By analysing historical data alongside external factors, AI could help businesses navigate cash flow challenges and capitalise on opportunities with greater foresight.

Smart invoice approval workflows: Consider AI-driven decision engines automating invoice approval workflows by studying historical approval patterns, vendor relationships, and budget constraints. These smart workflows dynamically route invoices for approval, circumventing bottlenecks and expediting payment cycles with precision.

Fraud detection and risk mitigation: Think of AI algorithms scrutinising invoice metadata and transaction patterns in real-time to detect potential fraud risks. By flagging anomalies and triggering alerts, AI safeguards businesses against financial losses and reputational harm

Personalised insights and recommendations: AI-driven analytics platforms give tailored insights and recommendations to customise individual business needs. By leveraging historical data and performance metrics, AI empowers businesses to optimise processes, identify cost-saving measures, and negotiate with vendors strategically.

How AI simplifies invoice management

Nowadays, AI-driven automation already significantly reduces the need for manual intervention in invoice processing, and by harnessing advanced algorithms and machine learning, AI helps eliminate errors and detect anomalies in invoice data.

Moreover, AI enables companies to streamline payment processes, ensuring that business invoices are processed and paid promptly – for stronger relationships with suppliers. Modern systems centralise all invoices and payment details in a single digital repository, accessible to authorised personnel at all times via desktop or mobile app. But that is not all: AI optimises approval workflows by intelligently routing invoices based on predefined rules and criteria. This ensures that invoices are directed to the appropriate team members for approval.

AI automates the extraction of key invoice data, including due dates, total amounts, invoice numbers, company names, payment terms, invoice dates, and payment methods. This automated data extraction eliminates manual data entry, speeds up processing times, and enhances accuracy. This also comes in handy as preparatory work for the bookkeeping department as organising and categorising invoices becomes easier than ever and frees up time for bookkeepers to focus on higher-value tasks, such as financial analysis and reporting.

AI benefits at a glance:

reduces manual tasks

eliminates errors, fraud, and late payments

enables to pay suppliers on time

centralises invoices in one place

enables simplified approval workflows

automates the invoice processing: automatically detects due dates, total amounts, invoice numbers, company names, payment terms, invoice dates and payment methods

performs valuable preparatory work for the bookkeeping department

The benefits of automating your invoice management

By embracing automation, your business can streamline operations, heighten efficiency, and prepare for future regulations and business needs.

Advantages of automated invoice management:

saves time, costs and effort by reducing manual tasks

finance teams gain time for important, strategic decisions

real-time data gives them a better basis for decision-making

secure and clearly organised file storage

the risk of errors is reduced: fewer duplicate payments, no incorrect information, no incorrect entries

Blog article

How to Use Invoice Matching Technology to Improve Your Process Efficiency

See how invoice matching technology automates the 2- and 3-way matching of supplier invoices with POs and goods receipts, for an efficient AP process.

Mauro Spadaro,

Product Manager

How to automate your invoice management with Yokoy

Automating your invoice management with Yokoy involves a seamless process designed to streamline workflows, enhance accuracy, and drive efficiency in your company. Here is a comprehensive guide on how to use Yokoy for automated invoice management:

Capture the invoice: Yokoy enables the capture of different types of invoices from various sources, including paper-based documents and electronic/online invoices. Whether it is scanning physical invoices or receiving them digitally, Yokoy’s intuitive platform ensures all legal documents are captured efficiently and securely.

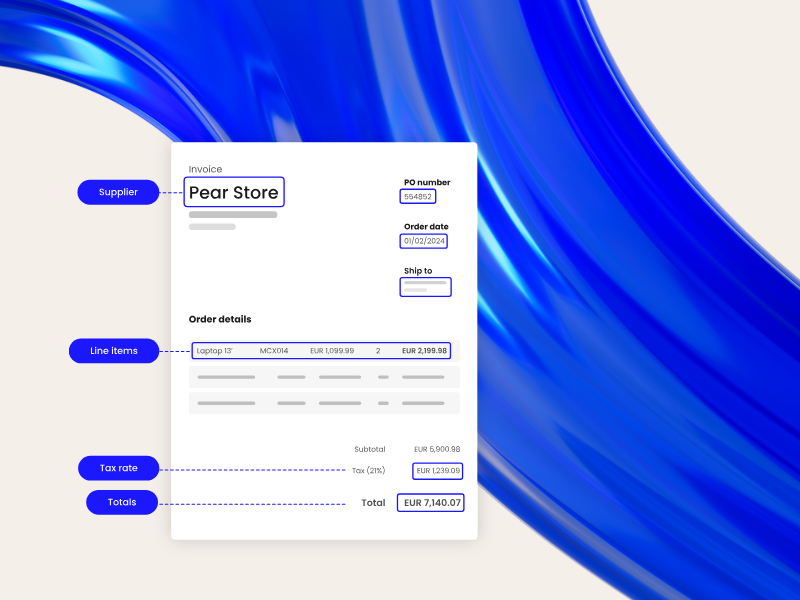

Extracting data from invoices: Once captured, Yokoy employs advanced optical character recognition (OCR) technology to extract key data from invoices. This includes extracting information such as vendor details, contact information, invoice numbers, supply dates, line items, and amounts accurately, swiftly and HMRC-compliant.

Verifying invoices: Yokoy facilitates comprehensive verification of invoices, including 2-way and 3-way matching processes. This ensures that invoices match corresponding purchase orders and receipts, validating the accuracy and legitimacy of each transaction.

Customised approval workflows: Yokoy offers customisable approval workflows tailored to your specific needs and preferences as a business owner or financial expert. You can define approval hierarchies, thresholds, and escalation procedures, ensuring that invoices are routed to the appropriate team members for timely approval and online payments.

Automated compliance checks: Yokoy automates compliance checks, minimising the risk of errors and ensuring adherence to regulatory requirements and internal policies. Yokoy’s intelligent algorithms flag any discrepancies or anomalies, alerting users to take necessary actions promptly.

Direct ERP integrations: Yokoy seamlessly integrates with leading enterprise resource planning (ERP) systems, enabling direct synchronisation of invoice data with your existing financial infrastructure. This ensures precise data transfer between Yokoy and your ERP system, eliminating manual data entry and ensuring data accuracy and consistency across platforms.

Real-time data analytics: Yokoy provides real-time data analytics and insights, empowering your finance team with actionable intelligence. With Yokoy’s robust reporting capabilities, you can gain valuable insights into spending patterns, invoice processing times, and compliance metrics.

Next steps

By leveraging Yokoy’s comprehensive suite of features, businesses can automate their invoice management processes from start to finish. Are you interested in learning more about Yokoy’s powerful management tools? Book a demo today and experience it for yourself.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.