Home / Expense Reconciliation: Enhancing Efficiency with Automation Software

Expense Reconciliation: Enhancing Efficiency with Automation Software

- Last updated:

- Blog

Co-founder & CCO, Yokoy

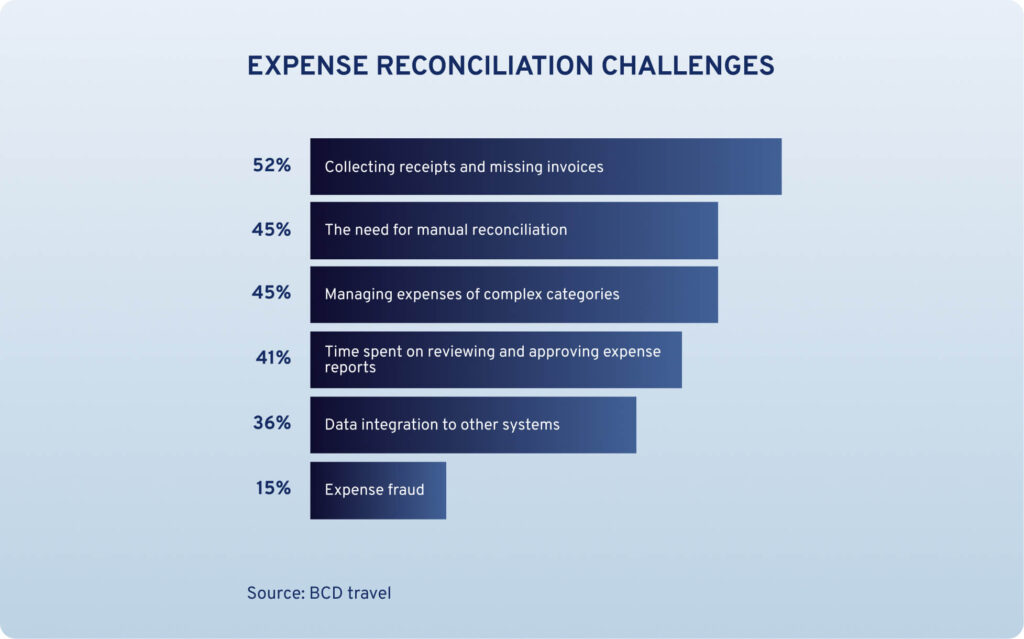

Earlier this year, BCD Travel published a report that reveals the primary challenges in expense reconciliation: manual processes, managing expenses of complex categories, and collecting receipts and missing invoices.

All of this will be familiar to those managing expenses at scale.

Despite the progress in digitizing and automating the expense management process and the rapid adoption of expense management tools, many companies, from midsize to large enterprises, still reconcile expenses manually.

Let’s explore why this is the case and how to eliminate manual reconciliation once and for all.

What is expense reconciliation?

In finance, the term reconciliation is used to describe the process of cross-referencing and confirming the alignment of two sets of records.

The primary objective is to ensure the accuracy of your financial documentation, verify that the income statements and expenditures in your accounts correspond precisely to your financial records, and to detect any errors, fraudulent activities, or misconduct.

For example, account reconciliation involves comparing the general ledger accounts for the balance sheet with supporting documents like bank statements, sub-ledgers, and other transaction details.

Finally, expense reconciliation involves comparing invoices, receipts, and expense reports with the corresponding entries in the company’s accounting system. Any discrepancies or errors found during this process can be addressed, and corrective actions can be taken to maintain financial accuracy and compliance.

What are ways to reconcile expenses?

Reconciling business expenses is a critical task for finance professionals, and there are various methods to achieve this. Each have their advantages and disadvantages and are suitable for specific company types. Here’s a high-level overview.

Paper records

Method: Traditional, manual expense reconciliation using physical receipts and documents.

Pros:

Suitable for small businesses with a limited volume of expenses.

Doesn’t require advanced technology or software, as expense claims and reports are done manually.

Cons:

When the volume of expense reports increases, the process can become very time-consuming and prone to errors.

Limited scalability and visibility, finance team only has visibility into the actual expenses and cash flow at the end of the month.

Excel sheets

Method: Using spreadsheet software like Microsoft Excel to track and reconcile expenses.

Pros:

Familiar and readily available tool.

Customizable for specific bookkeeping needs.

Cons:

Limited automation, still manual data entry.

Risk of formula errors, double entry, and data discrepancies.

Accounting software

Method: Utilizing accounting software such as QuickBooks or Xero for expense tracking and reconciliation.

Pros:

Streamlines financial processes.

Offers basic automation and financial reporting.

Cons:

May lack advanced features for large-scale operations.

Data integration can be a challenge.

Expense management software

Method: Leveraging specialized expense management software designed for efficient tracking, reconciliation, and control of expenses.

Pros:

Comprehensive automation, reducing manual work.

Robust expense policies and compliance controls.

Real-time spend visibility.

Integration with other financial systems.

Cons:

Initial investment required for software implementation.

Depending on vendor, might have a steep learning curve for employees.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

What pain points does expense reconciliation software solve?

Expense reconciliation software addresses several pain points for finance professionals. Here’s a breakdown of the issues it helps resolve:

Missing invoices and receipts

The challenge of locating missing invoices can lead to delays in the reconciliation process and incomplete financial records, causing frustration.

In the same way, gathering and organizing receipts from various sources can be a cumbersome and time-intensive process for both employees and finance teams.

Expense management systems often provide digital receipt capture, making it easier to keep track of all expenses and eliminate the problem of missing receipts.

Manual processes

Relying on manual reconciliation processes is time-consuming, error-prone, and often involves a significant amount of human effort. Expense reconciliation software automates data entry, reducing the time-consuming and error-prone nature of manual input.

errors requiring rework

Identifying and rectifying errors in expense reports can be a laborious and frustrating task. These errors may range from incorrect calculations to missing information. Expense reconciliation software has built-in error-checking mechanisms that can help detect and correct errors in real-time, minimizing the need for manual error resolution.

Data source integrations

In general, expense reconciliation requires data from POs and credit card statements, receipts and proof of purchase documents, invoices, as well as approvals. Integrating all the data from such sources can be complex and time-consuming, making it challenging to achieve a unified view of expenses.

Many expense reporting and reconciliation platforms integrate with various data sources through APIs, consolidating expenses from different departments and systems into one central location.

Non-compliant RECEIPTS and expenses

Handling non-compliant invoices, whether they violate internal company policies or external regulations, can be a headache for finance professionals. Expense management tools enforce expense policies and compliance rules, automatically flagging non-compliant expenses and reducing the need for manual oversight.

Expense fraud

Detecting and preventing expense fraud, whether committed by employees or external parties, is a persistent concern that can impact a company’s financial integrity. By employing fraud detection algorithms and controls, expense reconciliation software can significantly reduce the risk of expense fraud.

How to automate the expense reconciliation process with Yokoy

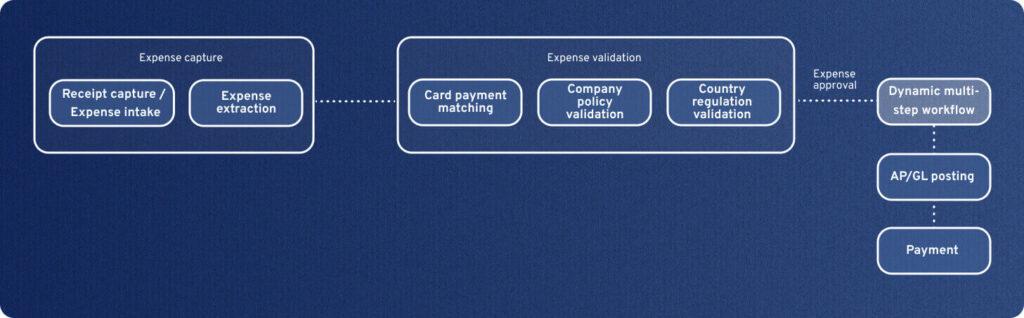

Yokoy Expense enables companies to fully automate the expense management process, including the reconciliation of expenses and card transactions, by automatically recognizing, validating, and matching relevant fields on a receipt with card payments.

This offers complete transparency and end-to-end visibility into employee expenses, while centralizing all expenses in one platform.

Customers can reimburse not just single expenses with or without receipts but also mileage expenses, hotel booking, and transport costs, covering all categories of business and trip expenses.

Here’s how reconciling expenses with card transactions works in Yokoy.

Step 1: Automated receipt submission and data extraction

To initiate an expense, take a photo of your receipt directly in your Yokoy expense management software or upload it to your mobile or web app. Alternatively, you can also forward the receipt to Yokoy as an email attachment.

Step 2: Automated categorization and validation

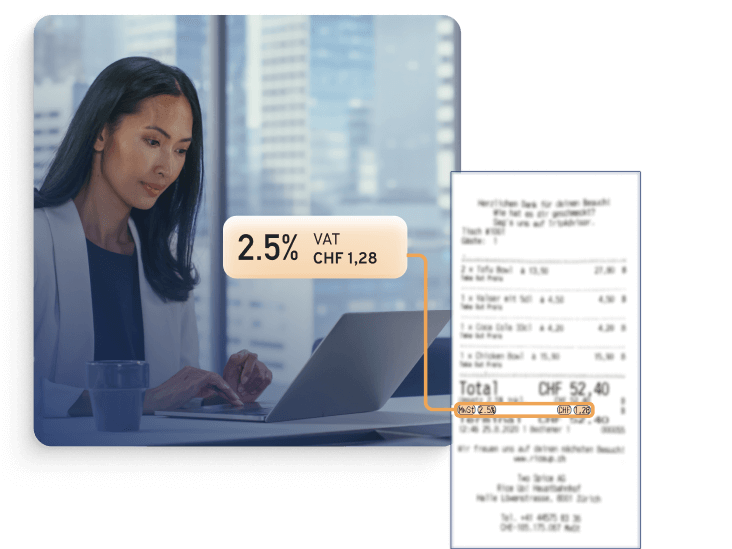

Yokoy’s OCR automatically reads and extracts all relevant information from the receipt. Yokoy’s AI engine then fills the expenses report with all relevant information such as receipt number, merchant, expense country & currency, total amount, expense category, and multiple VAT.

Step 3: Automated compliance checks

Yokoy checks the expense or expense report against relevant company policies and local regulatory policies, triggering notifications in case of potential fraudulent items, duplicate receipts, policy breaches, and missing VAT rates. Our AI model learns and gets smarter with every processed expense report.

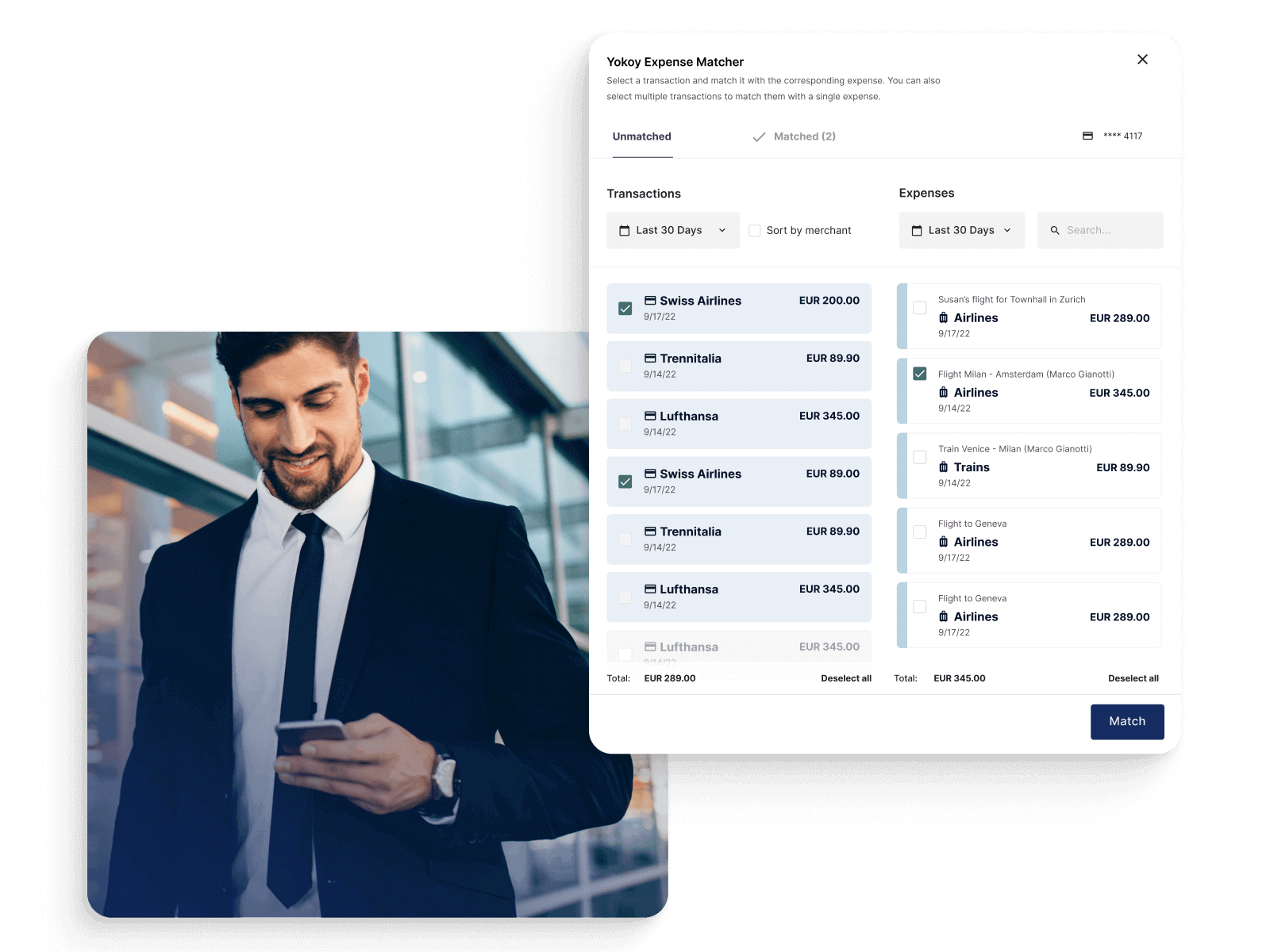

Step 4: Automated expense matching and reconciliation

Yokoy’s AI matches incoming card payments with expenses automatically, detecting duplicates in real time so you avoid fraudulent payments and reimbursing employees twice. This happens in the background, in parallel with the compliance checks, and takes only a few seconds.

Step 5: Data review and approval

Yokoy automatically identifies the approval steps for the expense based on the cost object or line manager. The tool offers customizable approval flows, allowing you to set multi-level conditional workflows.

Step 6: Booking and expense reimbursement

If no policy violations are detected, the approved expenses are automatically booked to the ERP system. Yokoy connects with leading ERP systems such as SAP, Oracle Netsuite, Microsoft Dynamics 365, and many more.

This enables fully automated expense reimbursements, shortening the waiting time and keeping employees happy.

Next steps

As you can see, all steps in the expense reconciliation process can be automated with expense management software like Yokoy, reducing the risk of error and fraud and increasing the overall efficiency of the process.

If you’d like to see our platform in action, you can book a demo below.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.