Home / Streamlining the Accounts Payable Process for Modern CFOs

Streamlining the Accounts Payable Process for Modern CFOs

- Last updated:

- Blog

With technology, the way companies pay bills has changed a lot in the past few decades. Invoices being sent via e-mail has simplified work tremendously, as nowadays, scanning for digital archiving is only necessary for paper invoices. However, there are some time-consuming methods in the accounts payable process that seem to be persistent: Entering data manually for each invoice is labor-intensive and prone to human error. But still, many businesses hold on to traditional ways that require plenty of physical handling and sorting.

Every company knows: A thorough verification of invoice accuracy involves cross-referencing with purchase orders and goods receipt notes, demanding meticulous attention to detail. This process is followed by approvals, often routed physically or through e-mails, causing bottlenecks and delays. All of this can be time-consuming and lacks transparency. And finally: Payment processing involves issuing physical checks or manual bank transfers, further elongating the payment cycle. Document storage and retrieval rely on physical filing systems or digital folders, making it challenging to locate and manage records efficiently.

And let us be honest: Even the best of us can slip up sometimes. Errors from manual handling and approving can cause a company to lose money or risk crucial relationships with suppliers. So why not streamline the accounts payable process to save time and money? We have compiled useful tips that work for every business.

What are accounts payable?

Accounts Payable (AP) refers to a company’s immediate financial obligations to suppliers and vendors for delivered goods or services. This encompasses vital steps, starting with the verification of incoming invoices. Matching purchase orders and delivery receipts ensures alignment between billed items and received goods. Subsequently, invoices undergo approval from relevant departments or designated personnel. Once approved, the AP department initiates the payment process, concluding the cycle by disbursing funds to fulfill the company’s financial commitments to its suppliers.

Accounts payable vs. accounts receivable

There is no shame in admitting it: Accounting terminology sometimes can be a bit tricky. That is why we want to highlight the differences between accounts payable and accounts receivable for you to eliminate possible insecurities. As mentioned earlier, the accounts payable process includes receiving invoices, validating bills, getting necessary approvals, processing vendor payments, and keeping track of financial transactions. Needless to say: This complex workflow requires precision and oversight to avoid discrepancies and payment delays.

Accounts receivable, on the other hand, comprise the money owed to you by your customers for goods or services provided on credit. Therefore, AR starts with invoicing clients for what you have delivered or done for them. So it is important to understand: While AP is recorded as a liability, AR is recorded as an asset. Understanding the nuances between these two terms is crucial for your company’s financial health.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

The accounts payable process summarized

To summarize what the AP process really is about, let us break it down into the following key steps:

invoice processing

verifying the accuracy of billing and delivery

obtaining approvals

processing payments

maintaining accurate records.

This intricate workflow demands precision and oversight to avoid discrepancies and delays. So it is best to be prepared for any challenge that might occur.

Typical challenges for accounts payable

Handling vendor invoices, approvals, and payments creates complexities that demand great attention to detail. Each of the following aspects contributes to the intricacies and hurdles faced within the AP domain, requiring efficient and effective solutions for seamless operation:

Invoice approval process

Inefficiencies in the approval chain often result in delays. With a longer approval process for a single invoice, your business extends payment cycles and might even strain important supplier and vendor relationships.

Invoice processing

Manual data entry and paper-based bookkeeping processes plague traditional AP workflows. This not only prolongs processing times, it also leads to inaccuracies, impacting financial reporting and decision-making. Even worse: You might be prone to fraudulent activities.

Late payments / due dates / late fees

Late payments are more than an inconvenience – they come with a cost, adding up significantly over time and adversely affecting cash flow. Therefore, it is best to always keep an eye on upcoming due dates.

Duplicate payments

The complexity of manual accounting systems can also result in duplicate payments that can impact financial stability severely.

Internal controls

Ensuring internal controls within the AP department is paramount. The Association of Certified Fraud Examiners reports that businesses lose an average of more than $1.78 million per case to fraudulent activities. That is 5% of their revenue every year.

Adhering to constantly evolving regulatory requirements is a challenge in itself. Ensuring compliance with tax laws, accounting standards, and industry regulations demands meticulous attention to detail and often necessitates significant resources. Luckily, there are smart ways to streamline the AP process significantly.

Streamline the accounts payable workflow

When talking about streamlining the accounts payable workflow, optimizing and automating processes is unnegotiable. Why so? With the integration of software and automation, the accounts payable process has undergone a remarkable transformation and is evolving even further as we speak. Invoices are received digitally and automatically captured using Artificial Intelligence technology, eliminating manual data entry. Smart AI technology is able to reduce processing time significantly and minimize errors to less than 1%. But there is more you can do. Here is a checklist for you.

Optimization through process improvement

Establish standardized procedures for invoice receipt, validation, approval workflows, and payment processing. It is crucial to implement consistent procedures to minimize new and recurring errors.

Centralize the receipt and management of invoices through a digital platform. This streamlines the handling of invoices, reduces manual intervention, and enhances visibility across the AP process.

Implement automated approval workflows to slim the approval process for all team members involved. With predefined rules and routing, approvals can be streamlined, reducing typical pain points, bottlenecks, and processing time.

Develop clear communication channels with vendors to optimize the invoicing process.

Encourage suppliers to submit digital invoices, negotiate favorable payment terms, and establish efficient communication channels to speed up the AP process.

Cloud-based storage has revolutionized the management of documents. The technology enables easy access, retrieval, and secure storage of records from anywhere in the world. On top, storing all info in one centralized place facilitates data-driven insights and reporting, empowering finance teams to make even smarter business decisions for the company’s future.

Blog article

How to Automate Your Invoice Approval Workflows with Yokoy

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. Here’s how Yokoy can help.

Mauro Spadaro,

Product Manager

Accounts payable automation

AP automation a true blessing for every business. With their help, your team can effortlessly validate invoices against purchase orders and receipts. And even better: The technology is flagging discrepancies for review while ensuring accuracy and compliance. By digitizing approval workflows, you allow for seamless approvals and reduce processing time from weeks to days. This lowers costs and also provides real-time visibility into invoice status.

Use AI technology to capture data from invoices automatically. This eliminates manual data entry while reducing errors and accelerating the validation process.

Implement automated systems that match invoices against purchase orders and receipts to save time and money. Automated validation ensures accuracy and avoids difficulties, including fraudulent activities.

Adopt electronic payment systems that integrate seamlessly with accounting software. Automated payments streamline the payment process, reduce manual efforts, and enable timely settlements, reducing late fees and trouble with suppliers.

Implement reporting tools that offer real-time insights into accounts payable metrics. Analyzing data on processing times, error rates, and payment trends enables continuous improvement and better decision-making.

The traditional AP process for 100 invoices can take your business several weeks to complete, with a higher error rate and limited visibility into the status of each invoice. With AP automation, the same workload can be managed in a matter of days, with minimal errors and complete transparency throughout the process. This paradigm shift from manual, paper-based processes to streamlined, automated workflows not only enhances efficiency and accuracy but also unlocks substantial cost savings and operational agility for AP departments in companies of all sizes.

Next steps

Finding useful support for your AP department does not have to be stressful: Yokoy’s invoice management and procure-to-pay solutions revolutionize your AP process. Our tools not only streamline workflows, reduce manual efforts, and enhance accuracy but also empower your organization to optimize your procurement and financial operations: The result: increased efficiency, a flawless balance sheet, and sustainable competitiveness.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Invoice management with Yokoy

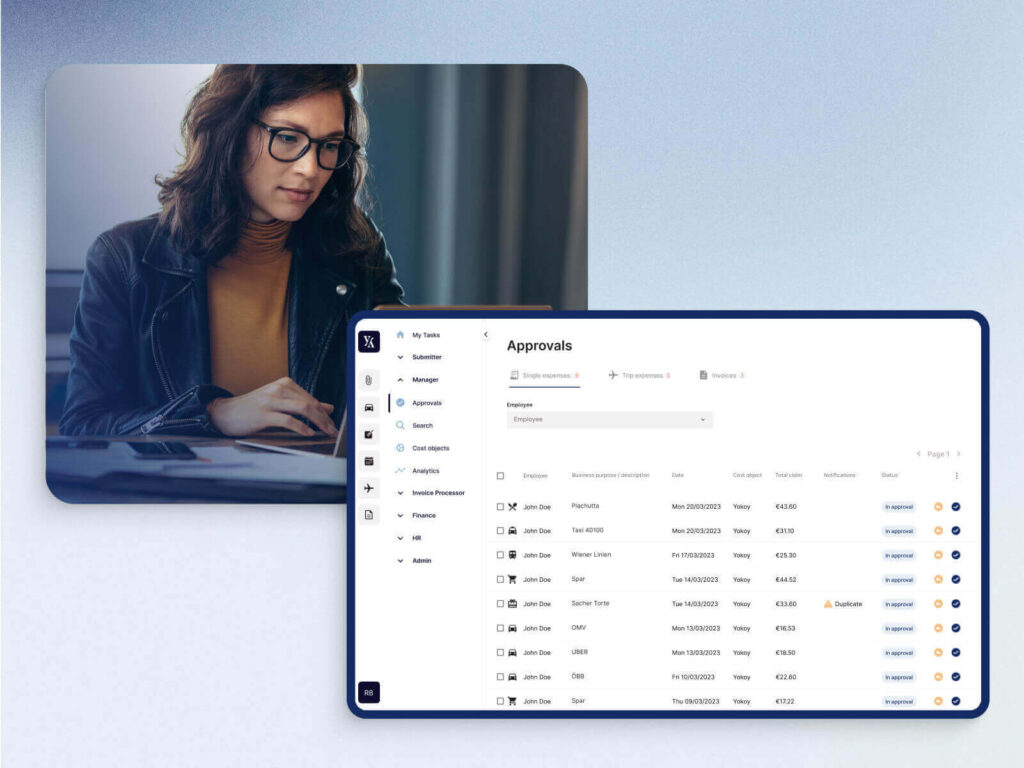

Yokoy’s invoice management employs advanced AI technology to automatically capture invoice data. This eliminates the need for manual data entry and significantly reduces errors, leading to a quicker AP process. Moreover, the system facilitates customizable approval workflows. This feature allows for invoices to be routed automatically to the right team members in your AP department for approval. So say goodbye to typical bottlenecks and speed up the approval process, while gaining real-time visibility into your invoice status.

Yokoy’s solution also compares invoices against purchase orders and receipts, automatically flagging discrepancies for review within the accounts payable department. This automated validation ensures accuracy and helps resolve discrepancies in no time. Of course, Yokoy invoice management offers competent reporting tools that provide real-time insights into crucial accounts payable metrics. Analysis of processing times and error rates supports you in making informed decisions.

Procure-to-pay solution: Optimizing procurement workflows with Yokoy

With our procure-to-pay solution, your AP team will have access to a central platform that can handle all invoice formats, whether they be paper-based or electronic. Let AI take the reins in speeding up your invoice processing. Yokoy’s smart line-item coding uses artificial intelligence to automatically assign general ledger account predictions to each invoice document. This not only accelerates the process but also enhances accuracy, making your workflow more efficient.

Our system goes beyond simple matching. Yokoy performs comprehensive 2- and 3-way invoice matching by integrating your procurement data from ERP systems. With real-time anomaly detection, you’ll immediately spot any irregularities, empowering you to take timely action. Ensuring compliance is vital. Yokoy automates compliance checks on invoice documents, verifying duplicates and confirming payment data aligns with information imported from your ERP. This automated validation ensures accuracy and compliance effortlessly.

Customize your invoice workflows effortlessly: Define approvals based on cost objects, suppliers, or line managers and set up exception-handling rules without compromising on governance. Yokoy empowers you to create tailored processes that suit your unique business needs. Stay ahead of the curve with real-time spend analysis. Proactively limit maverick spending, identify cost-saving opportunities, and take timely actions to optimize spending.

Access invoice details seamlessly across devices. Yokoy’s intuitive design ensures a consistent user experience, allowing you to view and manage invoices at your fingertips and making invoice approvals easy, regardless of the device you use. On top of this, Yokoy offers pre-built connectors for major procurement solutions and ERP systems. Our intuitive API removes system and data silos, providing flexibility in integrating various systems seamlessly. Yokoy’s API facilitates seamless integrations with enterprise-level systems, enabling end-to-end automation across different entities and geographical locations. So why wait? Start streamlining your IT landscape effortlessly for a more efficient workflow.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.