Home / AI Invoice Processing — How Technology Is Transforming Accounts Payable

AI Invoice Processing — How Technology Is Transforming Accounts Payable

- Last updated:

- Blog

Finance executives are constantly seeking innovative solutions to streamline operations and drive business growth. One area experiencing a profound transformation is accounts payable, thanks to the integration of artificial intelligence (AI). As technology continues to evolve, AI-powered invoice processing is revolutionising traditional AP practices, offering unprecedented innovations that save you plenty of time and resources. In this guide, we delve into the transformative possibilities that AI has to offer when it comes to invoice management. So, let us explore how your organisation can manage invoices more intelligently using AI.

Automation of invoice processing: Reducing time-consuming manual tasks

Automating invoice processing helps reduce repetitive tasks, saving your finance team plenty of resources. It also minimises the potential for human errors, increasing overall efficiency and accuracy.

Here’s a few ways automation can benefit you:

Invoice Capture:

AI-powered invoice capture builds on legacy Optical Character Recognition (OCR) technology that can scan and digitise your paper invoices, by adding context to the document. That means it not only ‘reads’ what’s on an invoice, but it understands what each datapoint means thanks to its deep understanding of the invoice format, and can also fill in or correct missing or inaccurate information. This allows for faster data capyure as well as increased consistency and accuracy when it comes to capturing invoices, even if they come in various formats.

Data extraction:

AI tools can accurately extract and structure data from invoices, such as invoice number, date, amount, and supplier details, directly into the accounting system. Natural Language Processing (NLP) can even understand and extract relevant information from unstructured data within invoices.

Data validation:

AI can cross-check extracted data against existing records and databases to ensure accuracy and consistency for a real-time data check. This way, AI algorithms can identify anomalies or discrepancies in invoice data, such as incorrect totals or mismatched supplier information. Moreover, verification could be calling back to your supplier database to validate that a supplier is legitimate, and it could also include performing checks against watch lists and banned suppliers.

Reducing human errors:

Machine learning significantly reduces the likelihood of human errors and fraud that can happen with manual data entry and checks. Being able to rely on accurately captured data gives you the ability to streamline your workflow and focus on higher-value tasks. With ML-powered automation handling repetitive and error-prone processes, your team can spend more time on strategic activities, such as analysing spending patterns and optimising supplier relationships. Additionally, the improved accuracy and consistency provided by ML minimise the need for rework and corrections. This reliability also builds greater confidence in your financial data, enabling better decision-making and fostering a proactive approach to managing compliance and risk.

Customised approval workflows:

AI can create customised approval workflows based on your company’s policies, ensuring that invoices are routed to the right approvers. While legacy automation technology is restricted by using a few pre-built templates, artificial intelligence is able to dynamically adjust workflows in response to changes in the environment, without needing a template. For example, if an invoice comes from a supplier on a company’s watchlist, AI would send the invoice through a different route than if it was a validated invoice from a utility company, which is might automatically approve because it knows the route such invoices normally take through the company.

Smart coding:

AI can automatically assign general ledger (GL) codes to invoices based on historical data and predefined rules. This automated process saves time and enhances the accuracy and consistency of financial records. Moreover, machine learning can predict the correct expense categories for invoices based on learning from how your people have coded invoices in the past, improving coding accuracy and ensuring that costs are properly categorised for further reporting and analysis.

Maintain compliance and minimise risks with AP automation

AP automation can be customised for every company to maintain compliance and minimise risks. By implementing advanced technologies, your organisation can ensure adherence to regulatory requirements, reduce the likelihood of fraud, and improve overall financial integrity.

Fraud detection

AI systems can monitor transactions in real time, identifying suspicious activities and potential fraud. This continuous monitoring allows for immediate action to prevent fraudulent transactions. Machine learning models can analyse historical data to identify patterns and detect anomalies that may indicate fraudulent behaviour, such as unusual transaction amounts or frequency.

Automated systems can cross-check supplier information against global watch lists and sanction databases to ensure compliance and avoid engaging with banned or high-risk entities. In addition, AI can track suppliers’ behaviour over time to identify any changes that might indicate potential fraud, such as sudden increases in invoice amounts or changes in bank account details.

Detecting discrepancies

AI algorithms can automatically validate invoice data by cross-referencing it with purchase orders, contracts, and delivery receipts. This ensures that the invoice details are accurate and consistent. This helps detect discrepancies such as incorrect amounts, mismatched supplier details, or duplicate invoices, allowing for prompt resolution before payments are made.

When discrepancies are detected, automated systems can generate alerts and route them to the appropriate personnel for further investigation, ensuring timely resolution of issues. If they are not resolved within a certain timeframe, the system can automatically escalate the issue to higher management, ensuring accountability and swift action.

Customised workflows

AP automation allows for the creation of customised approval processes that align with the company’s specific policies and regulatory requirements. These workflows ensure that incoming invoices are reviewed and approved by the right personnel. Automated systems can enforce role-based access controls, ensuring that only authorised individuals can approve invoices, reducing the risk of unauthorised payments.

Two-way matching

Automated two-way matching compares the invoice with the purchase order to ensure that the invoice details, such as quantity and price, match the order terms. If any discrepancies are found, the system can flag them for review and resolution before the invoice is approved for payment.

Three-way matching

Three-way matching involves comparing the invoice and purchase order and receiving the report to ensure that all three documents agree on key details such as quantity, price, and terms. This comprehensive check helps prevent fraudulent invoices from being processed, as it requires verification that the goods or services were actually received.

Improving decision-making with better data, analytics and insights

Efficient and reliable data capture and real-time data insights help your company make better decisions. Moreover, automating repetitive and manual tasks saves time, which can be used for more strategic activities. With AI and machine learning, AP teams can use comprehensive data analytics to their advantage, as it drives informed decision-making and optimises financial processes.

Detect early payment discounts

Save whenever you can: AI can identify opportunities for early payment discounts by analysing payment terms and prioritising qualifying invoices. It can also predict cash flow availability to ensure discounts are captured without affecting financial stability.

Detect risks of double or late payments

Avoid unnecessary costs: Machine learning models can detect potential duplicate payments by identifying patterns in historical data. Automated reminders and due date monitoring help prevent late payments and associated penalties.

Data capture

AI-driven OCR technology captures data accurately from various invoice formats, reducing manual data entry. Automated validation ensures data accuracy and consistency, minimising errors.

Real-time data

Stay informed: AI-powered analytics provide real-time reporting on key financial metrics, enabling continuous monitoring and proactive decision-making. Customisable dashboards display up-to-date KPIs for a clear overview of financial health and procurement needs.

Strategic task allocation

Automation eliminates manual tasks, allowing AP teams to focus on higher-value activities like financial planning and vendor management. Accurate and timely data enables data-driven decisions and continuous process improvement.

Blog article

Six Main Challenges in Invoice Automation and How to Overcome Them

Accounts payable is often considered overhead and part of the cost of doing business. Consequently, CFOs may not pay much attention to their invoice management process, assuming it will take care of itself. Unfortunately, this assumption couldn’t be further from the truth.

Lars Mangelsdorf,

Co-founder and CCO

How Yokoy’s AI helps transform accounts payable

Yokoy’s AI transforms accounts payable by centralising invoice management, boosting processing speed and efficiency, increasing accuracy, enhancing compliance, streamlining cash flow, improving supplier relationships, and simplifying audit processes. These results lead to a smooth, reliable, and efficient accounts payable function, ultimately contributing to better financial management and strategic growth for your company.

Centralise your invoices: Yokoy’s AP automation solution consolidates all of your invoices into a single platform, reducing the need for multiple tools. Its multi-legal entity setup simplifies managing accounts payable across different business units.

Manage multiple invoice formats: With Yokoy, you can easily handle various invoice formats. Capture paper invoices, automatically process PDFs, and integrate with e-invoicing platforms to receive electronic invoices directly.

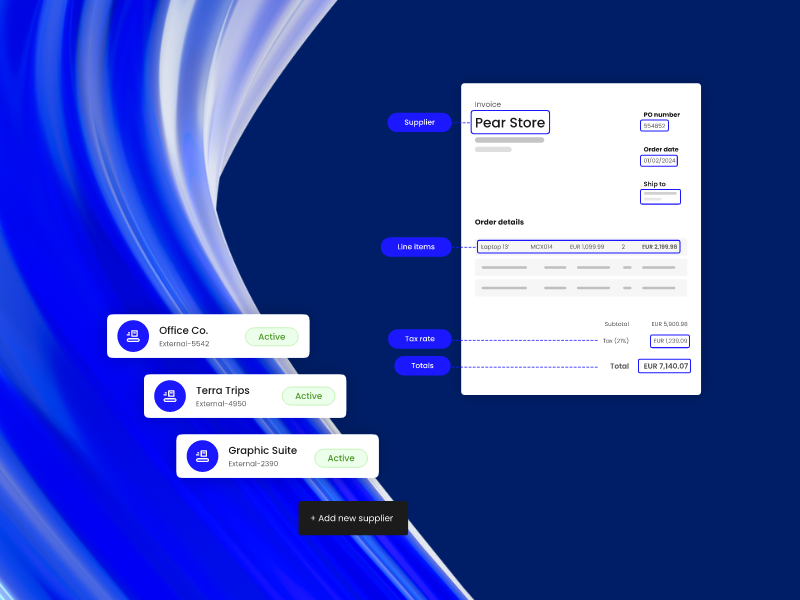

Automate invoice processing: Eliminate manual processes with AI-driven automation. Yokoy helps you extract header and line item information from incoming invoices, transforming unstructured data into structured formats for seamless processing.

Match invoices with POs and goods receipts: Boost efficiency with AI-based invoice processing and smart coding. Yokoy automates two- and three-way matching of invoices to purchase orders and goods receipts, ensuring compliance and reducing your company’s fraud risk.

Increase accuracy through smart coding: Yokoy’s AI technology improves coding accuracy by using up-to-date master data from your ERP. It learns from each processed invoice, handling new supplier invoices with increasing precision.

Avoid unauthorised payments: Enhance transparency in invoice approvals to ensure only authorised supplier invoices are paid. This helps prevent duplicate and erroneous payments, which could financially hurt your business.

Reduce approval steps with pre-approval flows: Automate approval routing for faster supplier payments. Yokoy identifies necessary approvals and dynamically submits invoices to the appropriate cost object, line manager, or supplier.

Enforce governance with custom workflows: Set up tailored workflows and pre-approval flows to automatically route invoices to the correct approvers or PA teams, ensuring governance across global entities.

Prevent payment delays: Custom workflows automatically approve recurring invoices, avoiding late fees and maintaining good supplier relationships. Sync bill payments with your accounting system or ERP for accurate bookkeeping.

Close your books faster: Streamline your monthly closing process by automating invoice processing and validation. Yokoy helps you ensure compliance with company rules, and syncs spend data in real time through API integrations.

Stay audit-proof and simplify reporting

Yokoy simplifies invoice tracking and ensures an audit-proof process with automated audit trails. You and your team can access all invoices, approvals, and payments in one place for easy financial reporting.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Next steps

Are you ready to revolutionise your accounts payable? Take the next step with us by embracing AI automation. Say goodbye to manual processes and hello to streamlined efficiency and discover the power of AI with Yokoy by transforming your AP workflow and unlocking new levels of productivity and accuracy.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.