Home / KPIs for Accounts Payable: A CFO’s Guide to Optimisation With Benchmark Insights

KPIs for Accounts Payable: A CFO’s Guide to Optimisation With Benchmark Insights

- Last updated:

- Blog

Co-founder & CFO, Yokoy

CFOs are constantly challenged to optimise their Accounts Payable (AP) operations, as agility and precision define and significantly impact the success of an organisation. Why? Every company operates within a certain capacity, which represents the maximum level of performance it can achieve given its available time and resources. To enhance this capacity, you can opt for solutions and improvements which increase efficiency and productivity.

The challenge in modernising Accounts Payable processes

Automation holds the promise of revolutionising how we work, offering opportunities to achieve better outcomes in less time with fewer resources. Despite significant investments in technology and transformation efforts, Celonis’ 2021 State of Business Execution Benchmarks Report has observed that many companies fail to reach their full execution capacity, with the three biggest challenge areas for Accounts Payable being:

- balancing working capital with supplier relationships

- managing rising supplier demands

- reducing costs without impacting other key performance indicators (KPIs)

An intriguing finding from the report reveals that a significant percentage of teams prioritise invoices based on traditional methods rather than considering their impact on target KPIs. This raises the pressing question: How can CFOs optimise KPIs for Accounts Payable without undermining previous successes?

To address this challenge, CFOs must embrace a strategic approach to AP optimisation, focusing on KPIs that align with organisational objectives. By leveraging benchmark insights and adopting innovative solutions, CFOs can streamline AP processes, enhance efficiency, and drive sustainable growth.

In this guide, we will explore effective strategies for prioritising AP KPIs, navigating common challenges, and implementing solutions to achieve optimal performance. On top, integrating helpful insights with Yokoy’s AI solutions empowers CFOs to transform their AP departments into bastions of efficiency, setting new standards in financial management. So let us embark on this journey together and unlock the full potential of Accounts Payable optimisation.

KPIs for Accounts Payable: Crucial Accounts Payable performance metrics

As a CFO, you are very much aware of what the best KPIs for Accounts Payable are. The AP Performance Benchmark Report 2023, crafted by the Institution of Financial Operations and Leadership (IFOL), provides essential insights to guide strategic enhancements:

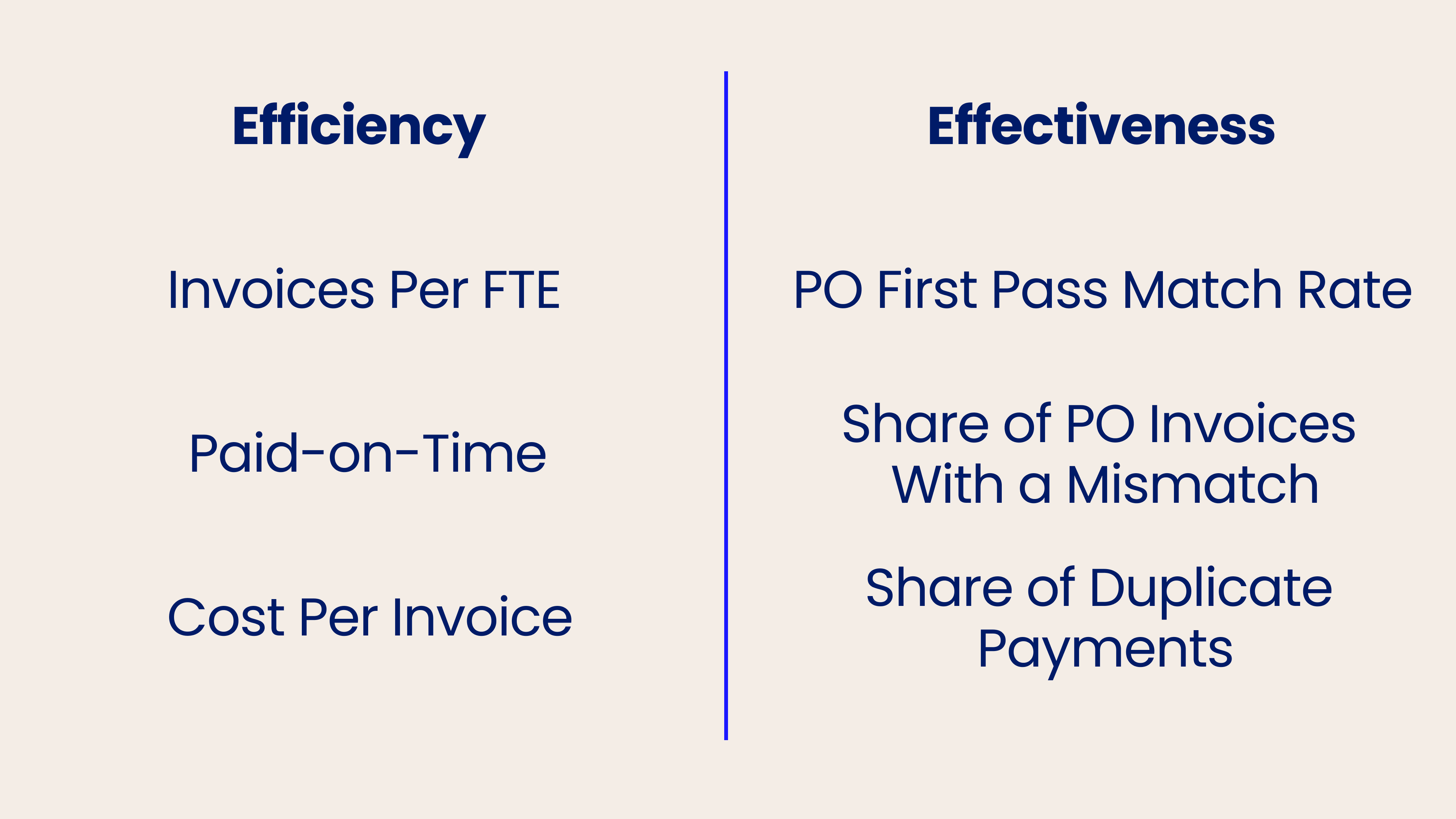

Tracking Accounts Payable: Key insights to maximise efficiency

Let us have a closer look at what KPIs for efficiency can provide us with:

Invoices per Full-Time Equivalent (FTE): Assessing the number of invoices handled by each FTE offers a direct indicator of your AP process’s operational efficiency. Elevated automation levels tend to correlate with heightened productivity, with top-tier environments managing up to 23,000 invoices per FTE annually, in stark contrast to lower figures (1,350 invoices annually) observed in predominantly manual setups.

The solution: Yokoy’s self-learning AI suggests cost objects, categories, and tags for each line item, streamlining invoice processing and allowing each FTE to manage a higher volume of invoices. This automation enhances productivity and allows staff to focus on strategic tasks.

Paid-on-Time: Research indicates that approximately 29 per cent of respondents with significant automation achieve exceptional on-time payment rates for non-PO invoices, reaching at least 96 per cent accuracy. In contrast, only 13 per cent of those with moderate automation attain similar results.

The solution: Yokoy allows for the customisation of approval flows, ensuring invoice approval through automated workflows and visibility on routing and status. Iinvoices are verified against company policies and approved promptly. This feature helps in maintaining control over the invoice payment process, minimising delays.

Cost Per Invoice: Grasping the expenses tied to processing individual invoices holds paramount importance in identifying operational inefficiencies and potential cost savings. Costs exhibit wide-ranging variances contingent upon the degree of automation; highly automated processes may achieve costs as minimal as £2.70 per invoice, whereas less automated environments might incur expenses upwards of £6.27 per invoice.

The solution: Yokoy’s use of AI and Machine Learning, enriches data and automates processing and matching, continually learning over time reducing risks from manual activity / as manual activity prone to error.) By improving workflow automation and automatically enriching and validating data.This results more effiecient invoice processing, thereby lowering operational costs and pushing your AP department towards the more efficient end of the spectrum.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Key insights to maximise effectiveness

On top of KPIs for efficiency, you should also check the crucial key insights to maximise your organisation’s effectiveness:

PO First Pass Match Rate:

The PO First Pass Match Rate measures the percentage of purchase orders matched to invoices accurately on the initial attempt. Higher rates indicate a streamlined and error-minimised process. Industry benchmarks reveal that top performers achieve match rates exceeding 90 per cent, while lower-performing entities may only reach around 70 per cent.

The solution: Yokoy offers a 2- or 3-way matching process performed against Purchase Orders (PO) and Goods Receipts (GR), with automatically detected anomalies. This ensures a high first-pass match rate, enhancing accuracy and efficiency in invoice processing.

Share of PO Invoices With a Mismatch:

The Share of PO Invoices With a Mismatch signifies the proportion of purchase order invoices that exhibit discrepancies. Low rates of mismatches indicate an effective AP process, minimising the need for additional work. The occurrence of mismatches can vary significantly based on the level of automation and organisational structure. Higher automation levels typically result in fewer mismatches due to improved accuracy in processing.

The solution: Yokoy minimises the need for corrections in AP transactions through accurate data capture, processing, and matching against supplier master data from ERP systems. This aligns operations with industry best practices and minimises mismatches, leading to fewer corrections and improved efficiency.

Share of Duplicate Payments:

The Share of Duplicate Payments indicates the percentage of transactions requiring adjustments due to duplicate payments. Successful organisations aim to keep duplicate payments below 1 per cent. However, even a 0.5 per cent occurrence of duplicate payments, when scaled to the higher spend volume common in AP departments, can result in a substantial financial impact reaching six-figure numbers.

Yokoy’s solution: Beyond flagging errors and warnings, Yokoy’s AI is able to detect and prevent duplicate payments across the AP department. This feature ensures financial integrity and minimises errors to nearly 0 per cent.

Tip: When combined with Yokoy’s state-of-the-art AI solutions, the findings from the AP Performance Report 2023 empower you to elevate your AP departments, driving efficiency and innovation to new heights. You can build an Accounts Payable KPI dashboard and further learn how to measure Accounts Payable performance.

Blog article

AP Automation: How to Accelerate the Accounts Payable Process with AI Software

We’ve put together this mini-guide to what accounts payable automation is all about, what technologies are involved, and how we apply them to make your AP process faster and smoother.

Mauro Spadaro,

Product Manager

Conclusion

For CFOs looking to improve their AP departments amidst today’s financial challenges, focusing on automation and AI integration with great Accounts Payable tracking software offers a clear path forward. Yokoy provides tools that not only meet industry benchmarks but also enhance overall department efficiency and accuracy. By adopting Yokoy’s solutions, CFOs can ensure their AP processes are both efficient and strategically aligned with their organisation’s goals.

Yokoy’s AI-driven solutions provide CFOs with the tools necessary to optimise AP operations, enhance efficiency, ensure accuracy, and achieve strategic alignment with organisational objectives. By leveraging Yokoy’s capabilities, you can propel your AP departments towards greater efficiency and effectiveness and stay on top of your financial game.

Next steps

If your organisation is ready to embrace the future of finance and revolutionise your spend management processes, reach out to our experts today to explore how our AI-powered solution can transform your financial operations for the better.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.