Home / AI Invoice Management: AP Automation with Artificial Intelligence

AI Invoice Management: AP Automation with Artificial Intelligence

- Last updated:

- Blog

Artificial Intelligence (or AI as many people call it) has emerged as a true game-changer in many areas of life, but especially in the business world. As finance executives grapple with the perennial challenge of reducing costs while enhancing operational effectiveness, the spotlight increasingly falls on Accounts Payable (AP) processes. Astonishing statistics underscore the urgency of the matter: Nearly 45 per cent of finance executives prioritize slashing invoice processing costs, while a staggering 86 per cent of CFOs champion digitisation as pivotal to their company’s triumph.

With the rise of AI-powered invoice management, the business is poised for a seismic shift. Organisations such as yours might think about revolutionising AP with automation, as it sounds like the only way to go forward. Studies have shown that invoice automation reduces data entry by over 80 per cent. Moreover, you can reclaim more than 70 per cent of the time typically spent on accounts payable tasks when your business uses automated invoice management.

What is AI-based invoice management?

AI-based invoice management utilises artificial intelligence technology to streamline and enhance the process of handling invoices within a company. This approach allows AI to improve the speed, accuracy, and efficiency of financial transactions related to Accounts Payable.

These are the key features of AI-based invoice management:

Automated data extraction

Smart data validation and verification

Automated approval workflows

Fraud detection and compliance

Real-time analytics and reporting

Easy ERP integration

Using advanced technologies like optical character recognition (OCR), AI systems can automatically extract key details from invoices. This includes information such as supplier names, dates, invoice numbers, and amounts, reducing the need for manual input. AI algorithms are capable of cross-verifying extracted data against other documents such as purchase orders and delivery receipts, performing what is known as 2-way or 3-way matching. This process helps ensure that only correct and authorised payments are processed.

After data is captured and verified, AI can automatically route invoices through the appropriate approval workflows. The system can also prioritise invoices based on factors like payment terms or amounts and efficiently escalate exceptions to relevant team members. Moreover, AI tools are adept at spotting unusual patterns and potential fraud, as well as ensuring that invoice processing adheres to both internal policies and external regulations.

Incorporating AI into invoice management processes not only simplifies these processes but also helps companies manage growth and complexity more effectively. AI-driven systems offer detailed analytics and real-time reporting capabilities. These insights can track performance metrics such as average processing time, cost per invoice, and payment schedules, providing valuable data that supports financial strategy and management. The improved accuracy resulting from reduced human errors, along with enhanced fraud detection capabilities and compliance monitoring, adds a crucial layer of financial security and risk management.

Good AI systems integrate smoothly with existing Enterprise Resource Planning (ERP) systems, ensuring that financial records are automatically updated and that reporting is both accurate and timely.

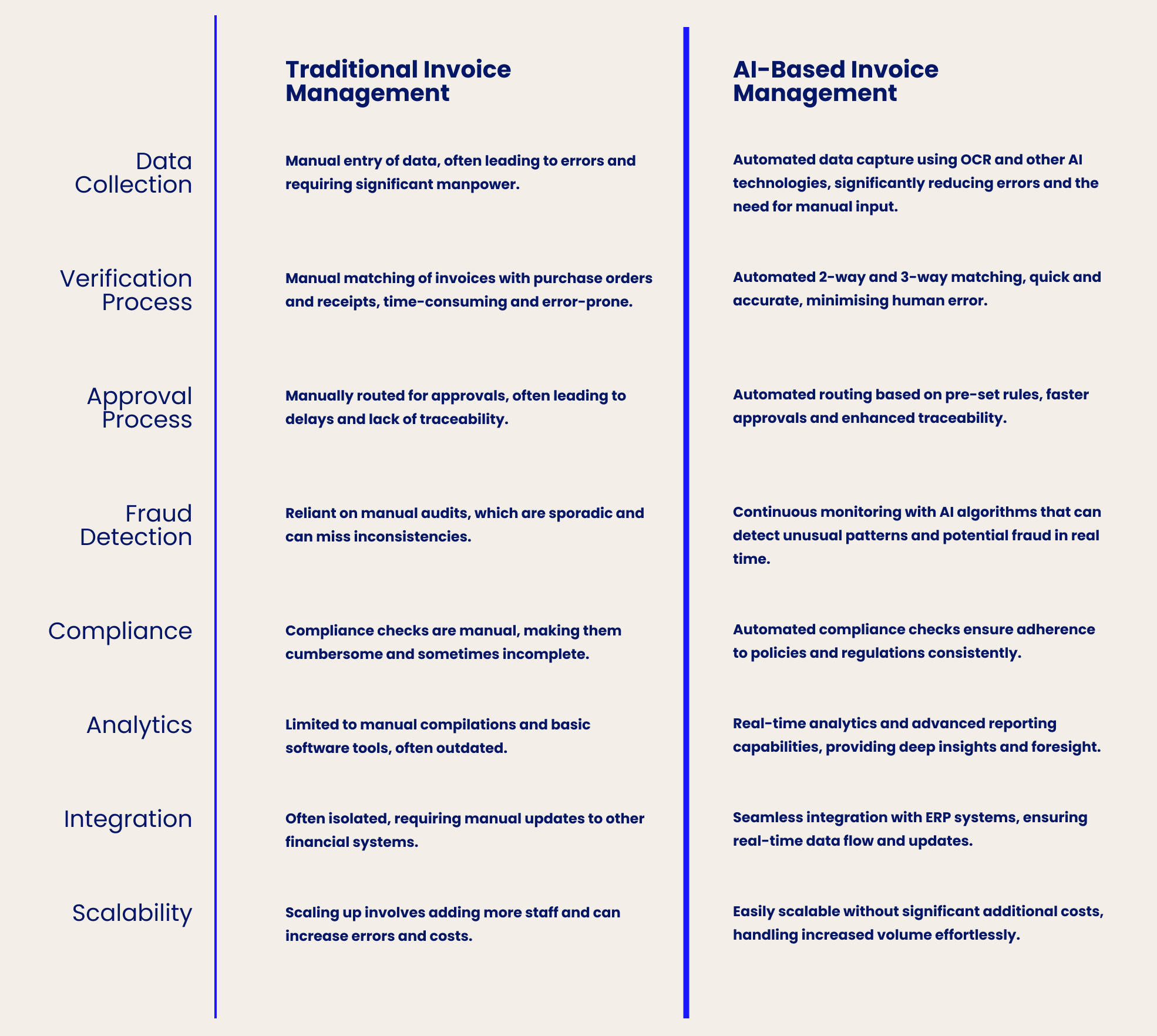

Differences between AI-based and traditional invoice management

The evolution of invoice management from traditional methods to AI-based systems marks a significant shift in how businesses handle their financial operations. Let us explore the differences between these two approaches, highlighting how AI has transformed various aspects of invoice management.

Benefits of Invoicing with AI

Invoicing with AI offers transformative improvements, tackling age-old challenges in traditional invoicing methods with sophisticated solutions. By embracing AI in your invoicing processes, your business can operate smoothly and act more strategically.

1. Error reduction:

Challenge: Manual data entry is susceptible to human errors, leading to discrepancies and prolonged audit processes.

AI solution: Automated data entry through technologies like OCR drastically minimises errors, ensuring data is captured accurately and consistently.

2. Fraud detection:

Challenge: Detecting fraud with manual systems is often inefficient, potentially causing significant financial damage.

AI solution: Advanced AI algorithms constantly monitor transaction patterns, swiftly identifying and alerting you when potential fraud is detected.

3. Compliance and regulation adherence:

Challenge: Manually ensuring compliance with changing regulations is error-prone and laborious.

AI solution: AI systems continuously update and enforce regulatory compliance automatically, reducing the risk of non-compliance penalties.

4. Improved efficiency in approval workflows:

Challenge: Manual approval processes are typically slow and lack transparency, causing payment delays.

AI solution: AI speeds up invoice approvals with automated routing based on predefined rules that are clear to everyone involved.

5. On-time payments:

Challenge: Manual invoicing often delays payment, which can strain business relationships.

AI solution: AI systems optimise payment timings and process transactions promptly, helping maintain healthy supplier relationships and often securing early payment discounts. As reconciliation happens much faster than with traditional methods, everyone involved will be happy to work with your organisation.

6. Centralised invoice management:

Challenge: Managing a variety of invoice sources and formats can be chaotic without a structured system.

AI solution: Artificial intelligence centralises all invoices in one platform, regardless of their origin or format, simplifying management and access.

7. Advanced analytics and reporting:

Challenge: Manual data aggregation for insights is impractical and time-consuming.

AI solution: AI-powered systems offer real-time analytics and detailed reporting, providing valuable insights into spending patterns and financial health.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Optimised invoicing with AI and Yokoy

Enhanced invoicing with AI, particularly through smart invoice processing solutions like the ones provided by Yokoy, transforms how your business manages its accounts payable procedures. Here is a breakdown of how Yokoy supports each step of the invoice management process, enhancing efficiency and precision:

Capturing invoices: Yokoy automates invoice capture from diverse formats, be it paper-based or digital e-invoices. This automation eliminates manual data entry, reducing task duration and typical errors.

Extracting data: Post-capture, Yokoy employs OCR document processing technology and other AI mechanisms to extract data from invoices accurately. This ensures all pertinent invoice data, such as dates, line items, pricing, amount due, and vendor information, are automatically and accurately logged into the system.

Validating data: Yokoy automatically verifies extracted data against predefined datasets to ensure accuracy. Early validation prevents errors in the processing chain, enhancing the functionality and reliability of the entire accounts payable process.

Invoice matching: Yokoy conducts meticulous 2-way and 3-way matching by cross-referencing invoices with purchase orders and receipts. This guarantees accurate payments and flags fraudulent or erroneous invoices before processing.

Automated error detection and correction: Yokoy uses machine learning to spot invoice inconsistencies or errors, no matter which layouts the documents have. Upon detection, the system either rectifies errors automatically or alerts human employees for review, ensuring adherence to high standards of accuracy and compliance.

Approval: Yokoy streamlines approvals within its system, automatically routing invoices based on predefined rules. This automated routing expedites interactive approval processes, minimises typical bottlenecks, respects due dates, and enhances overall process transparency. This also helps your relationships with freelancers, vendors and suppliers who rely on swift payments.

Payment: Following approvals, Yokoy facilitates invoice payment, seamlessly integrating with existing ERP systems. This ensures timely payments, helps create strong supplier relationships, and capitalises on potential early payment incentives.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Next steps

Yokoy helps simplify your invoice tracking and ensures an audit-proof invoice management process with automated audit trails. See all your invoices, approvals, and bill payments in one central place, for easy financial reporting and plenty more benefits.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.