Home / Spend Management Automation: 5 Critical Mistakes to Avoid During Implementation

Spend Management Automation: 5 Critical Mistakes to Avoid During Implementation

- Last updated:

- Blog

Co-founder & CCO, Yokoy

We get it: Some companies might be hesitant to adopt spend management automation due to concerns about costs, the complexity of implementation projects, or simply the belief that traditional methods should suffice. But sooner or later, reality will hit them: While legacy tools and manual processes have indeed served businesses well in the past, data from leading industry research firms showcases their limitations in today’s fast-paced, data-driven environment.

State of spend management automation

According to a 2019 report by McKinsey & Company, companies leveraging AI-powered spend management solutions witness up to 20 per cent reduction in processing times, leading to significant cost savings and increased productivity. These numbers were remarkable even before the AI boom had even started. McKinsey now expects generative AI “to unleash the next wave of productivity“.

But how come? The answer becomes obvious, once you dive further into the subject: Legacy software often lacks the advanced capabilities of AI-powered solutions, which often results in a higher rate of manual errors and a decreased ability to provide valuable insights into spending patterns and trends.

An also well-documented issue: the challenges associated with end-to-end integrations. A survey by Gartner indicated that nearly 60 per cent of finance teams struggle to achieve seamless integration with other financial tools when using legacy systems, limiting their ability to gain full visibility and control over their financial data.

While smaller or mid-size companies might still manage with existing invoice processing software or expense management tools, it is crucial to recognise that fast-growing companies aiming for flexibility and control at scale, as well as large global enterprises, must embrace AI-powered spend management solutions to stay on top of their game.

IDC, for example, projects that by 2025, over 80 per cent of large organisations will adopt AI-powered spend analytics tools to enhance financial decision-making and drive business growth.

With this article, our goal is to help you prepare for a seamless transition and avoid the painful lessons that some of our customers faced before switching to Yokoy – let’s dive in!

Implementing spend management solutions: These mistakes can cost you

There are several challenges that finance teams might encounter when implementing a spend management solution. Knowing them can help reduce financial risks and save time. So why not prepare for what might affect your business negatively?

We have identified the top 5 mistakes that companies often make during this process:

Inadequate needs assessment: One of the most common mistakes is failing to conduct a thorough needs assessment before selecting a spend management solution. Rushing into the process without a comprehensive understanding of the organisation’s unique requirements can lead to choosing a solution that does not align with the company’s specific needs, resulting in wasted time and resources.

Lack of executive buy-in and support: Without strong executive buy-in and support, even the most promising spend management solution and automating processes can face roadblocks during implementation. In our opinion, it is crucial to have key stakeholders, including senior management, fully committed to the transformation and actively championing the initiative throughout the organisation.

Insufficient training and change management: Implementing a new spend management solution usually requires a shift in workflows and processes. Neglecting to invest in proper training for employees and adequate change management can lead to resistance from staff, hinder adoption, and limit the solution’s potential benefits.

Neglecting data quality and integration: Data integration is essential for a successful spend management implementation. Neglecting to ensure seamless integration with existing systems, such as ERP and CRM platforms, can result in data discrepancies, hampering decision-making and hindering the solution’s effectiveness.

Focusing solely on cost: Needless to say: cost considerations are crucial for every business, but solely prioritising the lowest-priced spend management solution can be a grave mistake. A solution with a lower upfront cost might lack the advanced features and scalability required to meet future business needs. Our advice is to strike a balance between cost-effectiveness and the solution’s ability to deliver long-term value.

By avoiding these five common mistakes and opting for a more strategic and well-informed approach, organisations can significantly increase the likelihood of a successful enterprise spend management implementation.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Inadequate planning and preparation

Two of most common bottlenecks in the process are inadequate planning and preparation. Some organisations rush into implementing new features in spend management without a clear roadmap, often paving the way for confusion, delays, and ultimately failure to achieve the desired results.

Consultancy firm Deloitte surveyed finance executives, revealing that 57 per cent of respondents considered poor planning and preparation as the most significant challenge during spend management solution implementation. The study highlighted that organisations often fail to align their strategic objectives with the capabilities of the chosen solution, resulting in a lack of clarity and direction.

Further data from Ernst & Young (EY) suggests that organisations that invest in robust planning and preparation for spend management implementation are 1.5 times more likely to achieve their intended objectives and experience a smoother transition.

Resistance to change

McKinsey & Company, in their research on digital transformation, found that resistance to change is a common challenge that impacts the success of spend management initiatives. Their data indicated that 70 per cent of transformation initiatives faced resistance from employees, leading to delays and decreased effectiveness.

PwC conducted a survey that shed light on the reasons behind employee resistance. The study found that 45 per cent of employees were concerned about their ability to adapt to new technologies, while 31 per cent were worried about the potential impact on their daily workflows.

Another key challenge is the resistance to change. Many employees might be accustomed to legacy tools or manual processes, and convincing them to embrace new technology can be met with scepticism.

Lack of proper training and communication

The lack of proper training and communication can exacerbate this issue, leaving employees feeling overwhelmed and uncertain about how to use the new spend management solution effectively.

Research by Ardent Partners, a supply chain and procurement research firm, highlighted that 60 per cent of organisations faced issues related to training and communication during spend management solution implementation. The study emphasised the importance of providing ongoing training and support to ensure successful adoption and utilisation of the new technology.

IDC, a global market intelligence firm, reported that organisations that invest in comprehensive training programs for employees experience a 50 per cent higher return on their technology investments compared to those that neglect training.

Blog article

What Is Spend Management? Fundamentals and How It Works

In today’s competitive market, companies that can effectively manage their spending are better positioned to grow and remain profitable.

Lars Mangelsdorf,

CCO at Yokoy

The benefits of spend management automation

Choosing the right spend management system and following best practices will empower your finance team to:

streamline work by simplifying data entry and data collection

significantly reduce human errors

optimise the approval process

provide real-time insights including expense reports

make complicated spreadsheets redundant

consolidate spend data and provide thorough spend analysis

improve visibility and avoid overspending

make data-driven decisions and allow forecasting for increased profitability

assure compliance

Good to know: While spend management means looking at all company expenditures, expense management specifies on specific reimbursable business expenses. So the former is rather about optimising the spending process in its entity, while the latter ensures individual expenses align with your company’s policies.

Conclusion

Implementing a spend management software can be a truly transformative journey with significant impact on several business processes. The step towards automation software can enhance your organisation’s financial workflow and decision-making capabilities if you choose the right automation tools and partnerships. By avoiding common mistakes mentioned above, companies can ensure a successful implementation that is fully supported by the whole team.

Embracing modern technology and harnessing the power of AI is the way forward for finance teams aiming to thrive in today’s competitive landscape. But remember, successful spend management implementation is not just about adopting a new tool; it is a strategic initiative that requires collaboration, adaptability, and a commitment to driving positive change. By doing so, organisations can reap the rewards of improved financial control, increased efficiency, and sustainable growth.

Say good-bye to time-consuming spend management: Let Yokoy do the work

Yokoy’s smart expense management solution is the key to revolutionising your spend management practices. Here are the key benefits that can compete with the top automation systems to date.

Effortless expense management:

Yokoy’s AI-driven solution simplifies expense reporting, ensuring that managing expenses becomes a seamless and effortless task. Say goodbye to manual hassles and welcome a new era of automated efficiency.

Automation for improved efficiency:

Put your expense management on autopilot with Yokoy, automating tasks such as VAT reclaims and travel expense reporting. This not only saves time but also ensures accuracy in financial processes.

Eliminate manual tasks:

With Yokoy, manual data entry becomes a thing of the past. Remove paperwork, automate repetitive tasks, and let AI handle the background work, allowing you to focus on core business matters.

Streamlined processes:

Consolidate and streamline your expense process from end to end using Yokoy’s AI-powered data processing and seamless integrations. Experience a simplified workflow that enhances overall efficiency.

Modern and intuitive experience:

Built with usability in mind, Yokoy provides a modern and intuitive experience. Submit, process, approve, and reimburse expenses on the go while the AI handles the intricate work in the background. Yokoy’s digital-first approach simplifies administration, eliminates human errors.

Centralised management solution:

Fully centralise and automate your travel payments, removing the hassle of managing multiple cards or reconciling business expenses manually. Yokoy takes care of the details, so you can focus on the bigger picture.

Full control over employee spend:

Enforce travel policies, set spend limits, and prevent fraud with Yokoy’s real-time spend controls. Ensure compliance and avoid overspending by assigning spend categories and individual limits.

Automated expense claim approval:

Streamline the expense approval process with hierarchical and threshold-based multi-step escalation. Yokoy enables dynamic approval workflows for complex setups, ensuring efficiency and compliance. Yokoy’s AI automatically matches card payments with expenses, preventing duplicates and fraudulent payments.

Built-in compliance and automated audit trails:

Yokoy comes with built-in compliance capabilities to effortlessly enforce travel and expense policies. Create custom workflows and detect policy breaches in real time to prevent fraudulent reimbursements. Keep track of expense claims and approvals with Yokoy’s automated audit trails. Digital receipt collection and storage simplify checks and contribute to fast financial reporting.

Automated booking to ERP:

Remove data silos by synchronising Yokoy with master data and exporting financial bookings to the ERP system. Achieve true end-to-end automation for a seamless business process and a faster month-end closing.

If your organisation is ready to embrace the future of finance and revolutionise your spend management processes, reach out to our experts today to explore how our AI-powered solution can transform your financial operations for the better.

Next steps

If your organisation is ready to embrace the future of finance and revolutionise your spend management processes, reach out to our experts today to explore how our AI-powered solution can transform your financial operations for the better.

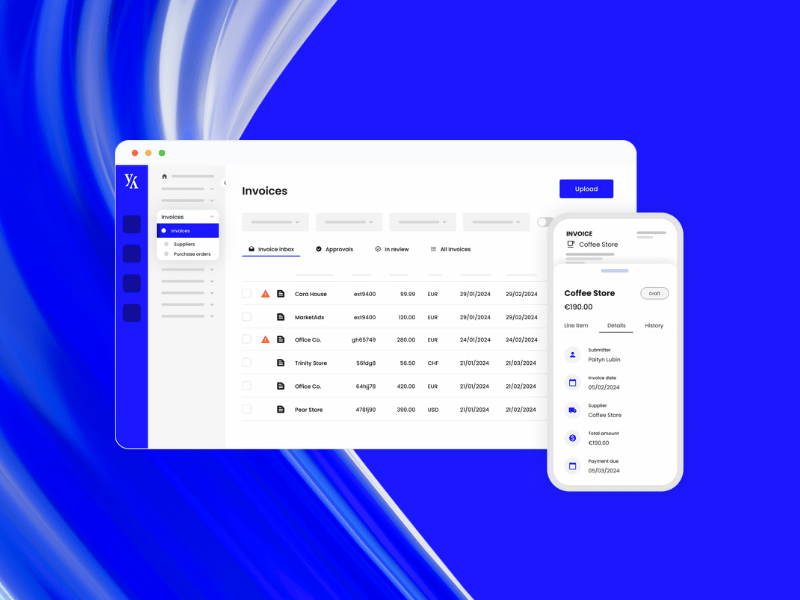

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.