Home / Avoiding Fraud in Mileage Reimbursements: The Yokoy Solution

Avoiding Fraud in Mileage Reimbursements: The Yokoy Solution

- Last updated:

- Blog

Co-founder & CCO, Yokoy

In today’s business landscape, where remote work and field operations are common, mileage reimbursement plays a pivotal role in ensuring fair compensation for employees’ travel expenses.

To navigate this crucial aspect of business finance and prevent potential fraud, companies are turning to innovative solutions like Yokoy.

In this article, we delve into the intricacies of mileage reimbursement, the significance of accurate expense management and how AI-powered technology is transforming the process.

From simplifying administrative burdens to preventing errors and fraudulent claims, let’s see how embracing automation enhances efficiency, compliance, and overall financial operations.

What is mileage reimbursement?

Business mileage refers to the costs incurred when employees travel for work-related purposes using their own vehicle instead of a company car.

A business mileage claim involves submitting a formal request to lower the annual taxable liability, accounting for the expenses associated with these work-related travels.

Thus, mileage reimbursements are a way for employees to get repaid for the money they’ve spent during their business travels.

How mileage reimbursement works

The responsibility for tracking business mileage rates can vary and depends on factors such as the type of vehicle used and the distance traveled, but the commonality is that employees have to use their own car for these business trips.

Different rules and rates may apply to different vehicle categories and engine sizes, for example:

Cars and vans mileage rate: The calculation for cars and vans might differ based on established rates for each category.

Mileage rates for hybrid or electric vehicles: Special rates could be in place for hybrid or electric cars, reflecting their unique environmental benefits.

Motorcycles mileage rate: Similar to cars and vans, motorcycles may have distinct mileage rates due to their different nature.

Bicycles mileage rate: Some organizations offer reimbursement rates for employees who use bicycles for work-related travel, acknowledging the eco-friendly choice.

Mileage allowance rates per country

The rules and regulations around mileage allowances vary from one country to another, as you can see below.

United Kingdom (UK):

HMRC provides mileage reimbursement guidelines. Rates vary based on the number of miles.

Recommended rates:

45p per mile for the first 10,000 miles.

25p per mile thereafter.

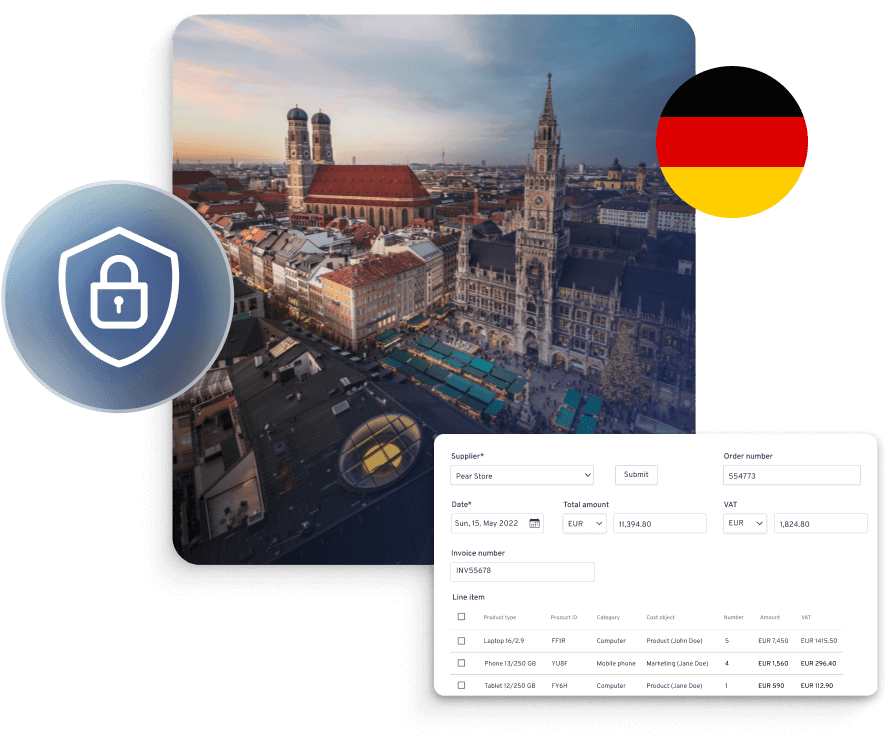

Germany:

Regulated by government tax laws and collective agreements.

Tax authorities set rates for mileage reimbursement – 0.30€ per kilometer for car, 0.20€ per kilometer for a motorcycle.

- If the employee receives the amount more than what’s recommended by the government, the additional amount falls under income tax.

Compliance in Germany

Stay up-to-date with rules and regulations around per diem rates – including the midnight rule and 3-month rule, mileage allowances, proof of receipt, and VAT rates in Germany, while Yokoy keeps you audit-ready.

Austria:

Influenced by tax regulations and labor agreements.

Typical rate for car allowance: around 0.42€ per kilometer for up to 30,000 kilometers per year.

Compliance in Austria

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates in Austria, while Yokoy keeps you audit-ready.

Spain:

- Often follows government-set rates.

- Companies can reimburse employees to compensate expenses incurred for the usage of private vehicle for a business trip. In such cases, the employees are entitled to receive 0.19€ per kilometer as “Mileage allowance” recommended by the government.

Compliance in Spain

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates in Spain, while Yokoy keeps you audit-ready.

Netherlands:

Based on tax authority guidelines and industry standards.

Standard rate: around 0.19€ to 0.20€ per kilometer for personal cars.

Switzerland:

Subject to Swiss-specific legislation.

Tax authorities provide guidance. Rates vary from around CHF 0.70 to CHF 0.80 per kilometer.

It’s essential for both employees and organizations to be aware of these mileage allowance rates and regulations to ensure accurate tracking and appropriate reimbursement for work-related travel expenses.

Compliance in Switzerland

Stay up-to-date with rules and regulations around per diem rates, mileage allowances, proof of receipt, and VAT rates in Switzerland, while Yokoy keeps you audit-ready.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Why should you reimburse mileage expenses?

Within the framework of reimbursing mileage expenses, businesses gain a unique vantage point that goes beyond cost reduction. Strategic management of this process translates into optimized financial operations and compliance.

Employee satisfaction

Providing mileage reimbursement sends a positive message to employees about their value within the organization. Fairly compensating them for the use of personal vehicles for business purposes fosters employee satisfaction and enhances overall morale.

Next to a clear reimbursement policy, companies can increase the satisfaction of their employees by simplifying the expense claim process.

For example, organizations can equip their teams with smart corporate cards that are set up to work for business travel expenses or for car mileage expenses only, and have approved amounts that employees can use for such costs.

This strategy reduces the risk of fraud and overspending, while making expense reporting faster and easier.

Opinion

Maximizing Compliance through Automated Expense Reporting

Automated expense reporting has been gaining traction as a solution to help finance teams streamline their workflows and gain real-time insights into company expenses. But there’s one more area where automation can help tremendously: Staying compliant.

Lars Mangelsdorf,

Co-founder and CCO, Yokoy

Simpler bookkeeping

The American Automobile Association (AAA) reports that employees who drive for work-related purposes spend an average of 12 hours per month on administrative tasks associated with business journeys, such as mileage tracking and expense reporting.

Having a clear structure for submitting mileage claims and reimbursing mileage allowance payments simplifies this process for finance teams, reducing administrative burdens and freeing up valuable time for other tasks.

Reduced business expenses and payroll tax

Reimbursing mileage expenses aligns with tax regulations, allowing businesses to claim tax deductions for these reimbursements. This adherence to tax rules not only reduces tax liabilities but also ensures compliance with tax laws, preventing potential penalties.

Properly managing payroll tax obligations through adherence to mileage reimbursement rates and regulations can result in significant tax savings, which can then be reinvested into the business.

How AI technology helps avoid fraud on duplicates and mileage allowances

Yokoy provides a comprehensive suite designed to streamline business spending management by seamlessly integrating expense management, invoice processing, and corporate card transactions into a unified platform powered by AI technology.

The use of artificial intelligence is particularly relevant for travel expense management and mileage reimbursements, as it enables organizations to fully automate their processes while staying compliant and ensuring employee satisfaction.

We’ll present a practical use case to demonstrate how Yokoy operates in practice.

Example of use case - Submitting reimbursement claims

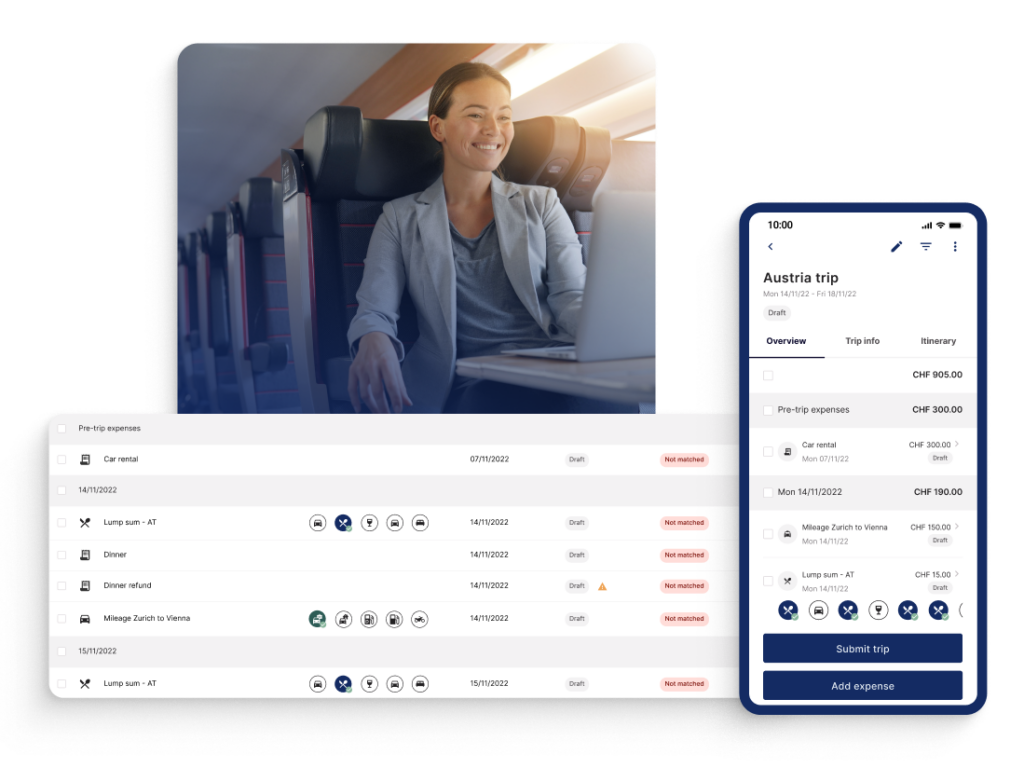

Let’s consider a scenario in which one of your employees from the sales or field team frequently travels and employs their personal car for business trips. The cost of fuel should be reimbursed by the company after the employee submits their expense claims.

However, in a traditional process – and even in companies that use legacy expense management tools – the employee has to perform a series of manual steps to receive their reimbursement:

First, they need to scan or take a picture of the receipt for submission to the expense management system.

Once the receipt is uploaded, the employee has to categorize it correctly and extract the accurate VAT rate from the document.

Then, the employee needs to claim the lump sum or Per Diem in accordance with the regulations that apply to their country. They also need to check internal policies to ensure the submission complies.

Given the manual and time-consuming nature of this process, it’s not unlikely for errors to occur. A very common scenario is the inadvertent submission of a receipt twice, resulting in a duplicate expense claim.

Beekeeper reclaims VAT automatically with Yokoy

“The Finance team can focus on exceptions only and all other expenses are processed fully automated within seconds. The VAT recognition that Yokoy helps to ensure an automated VAT reclaim.”

Herbert Sablotny, Beekeeper’s CFO

Or – another frequent scenario – the employee has traveled to a foreign country, but they are unfamiliar with the rate per business mile for that particular country. Consequently, they end up claiming the wrong Per Diem or filing the incorrect VAT rate for their tax return.

What we frequently observe with our global customers is that they train employees on travel and expense policies during onboarding programs. However, these policies are often not rechecked afterwards.

As a result, it is not uncommon for employees to forget the allowed amounts or how to calculate Per Diems and VAT rates for specific use cases.

Traditional approach to reimbursing employees

In a traditional travel and expense management process, these errors would only be identified after the expense reports are submitted, necessitating manual intervention from the finance team to rectify these reports.

This could lead to extensive back-and-forth communication, and in the worst-case scenario, if the volume of processed expense reports is substantial, duplicates might inadvertently slip through. Consequently, the company could end up overpaying.

AI-driven automation for mileage reimbursements

These issues can all be prevented by using an AI-driven automation solution like Yokoy, which enables global companies to efficiently manage employee expenses, including reimbursements.

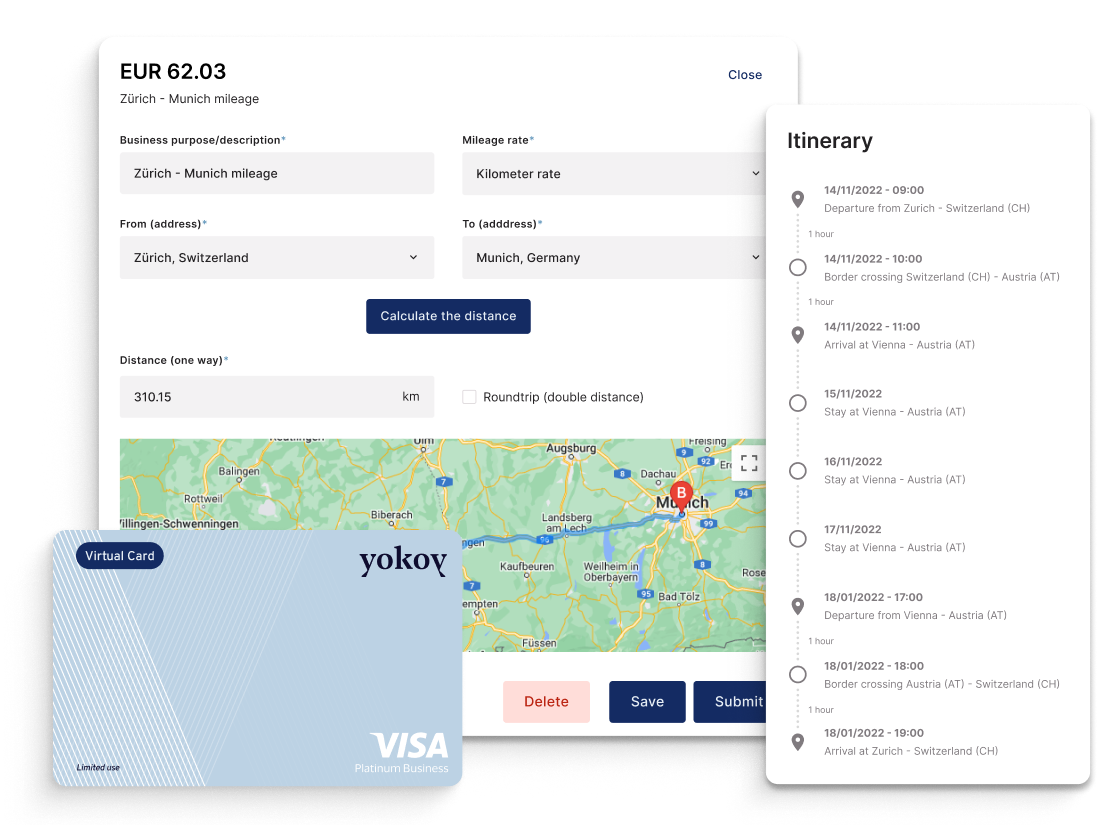

For instance, using Yokoy, employees can conveniently submit expenses while on the move by simply capturing a photo of the receipt through the mobile app and making payments using a Yokoy smart corporate card instead of a traditional credit card.

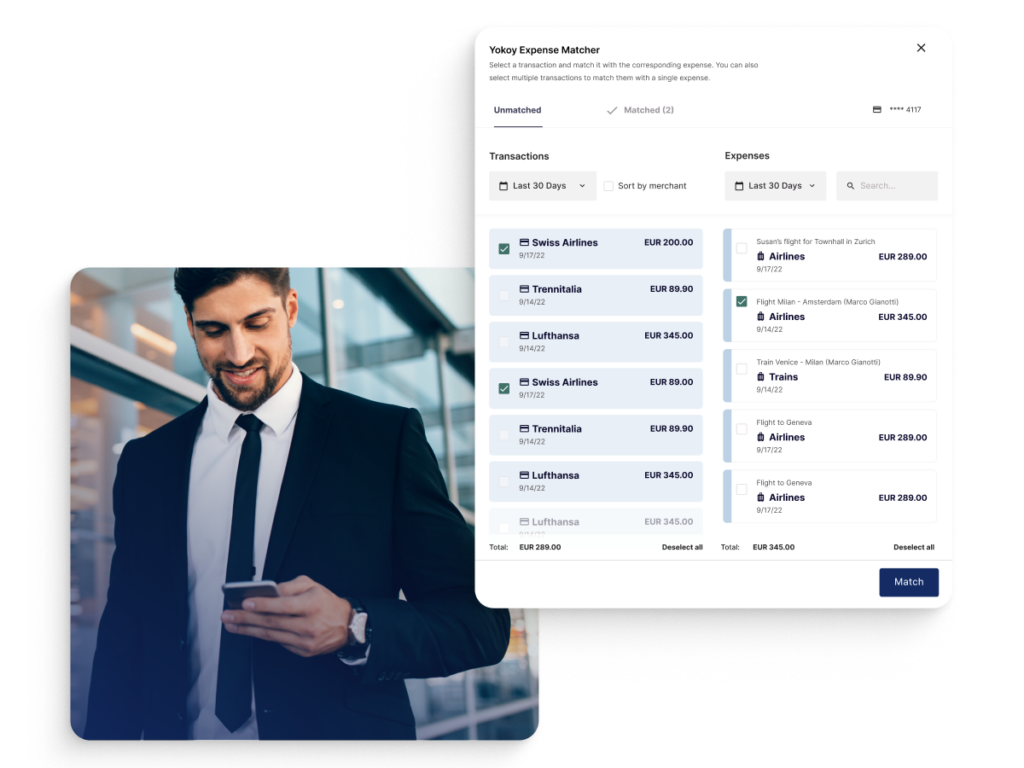

The transaction is matched with the corresponding expense automatically, in real time. In the absence of policy violations, the reimbursement process can proceed seamlessly.

The expense reports are then routed for approval via automated workflows, which can be customized for different entities and team hierarchies.

However, if the AI detects policy breaches during the matching process – such as spotting a duplicate receipt or identifying an incorrect Per Diem rate – it immediately highlights the expense in real time. This gives the employee the opportunity to make adjustments prior to submitting the reimbursement claim.

Consequently, approved mileage allowance payments are automatically processed without any need for human intervention. Simultaneously, expenses with errors or potential fraudulent elements are promptly flagged in real time.

This robust system significantly reduces errors and effectively prevents instances of duplicate payments and fraud cases. Moreover, it frees up time, so that the finance team can only review outliers and edge cases, while the rest of the process is fully automated.

Why OCR technology is not enough for automated compliance

Before we conclude, one note on AI technology vs OCR technology for this particular use case.

Traditional OCR (Optical Character Recognition) technology is limited in its ability to interpret complex data scenarios. It may extract basic information from receipts but lacks the contextual understanding required to accurately categorize expenses, identify policy violations, or catch potential errors.

AI-driven automation, on the other hand, leverages advanced algorithms to comprehend and interpret nuanced data, enabling accurate matching and identification of policy breaches.

Also, technology like RPA (Robotic Process Automation) can handle the progression of documents through automated workflows, but cannot deal with the “logic” of finance processes in the same way that finance AI can.

AI technologies possess the capacity for adaptive learning, which means that over time, the system becomes increasingly adept at identifying complex patterns and anomalies. Legacy systems do not possess the capability to learn and adapt, leading to missed opportunities for efficiency improvements and error reduction.

Finally, legacy systems often lack the real-time processing capabilities necessary for dynamic expense management. With AI-powered automation, transactions are matched in real time, policy violations are instantly flagged, and adjustments can be made before reimbursement claims are submitted.

This rapid processing ensures that issues are addressed promptly, preventing the need for extensive manual intervention later in the process, and ensuring real-time compliance.

White paper

Spend Management Transformation in the AI Era: A Framework

In the era of AI-driven digital transformation, traditional finance processes are becoming obsolete. As companies grapple with increasing complexities and rising competition, they must recognise the transformative potential of artificial intelligence to stay ahead of the curve.

Next steps

To conclude, by embracing AI-powered automation for your expense management and reimbursements, you empower your teams to focus on critical exceptions and complex cases while allowing the system to autonomously manage routine tasks, freeing up valuable time and resources.

This shift marks a strategic move towards increased efficiency, accuracy, and compliance in managing expenses and reimbursements.

If you’d like to see how Yokoy can support you in this process, you can book a demo below.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.