Home / AP Automation: How to Accelerate the Accounts Payable Process with AI Software

AP Automation: How to Accelerate the Accounts Payable Process with AI Software

- Last updated:

- Blog

Product Manager

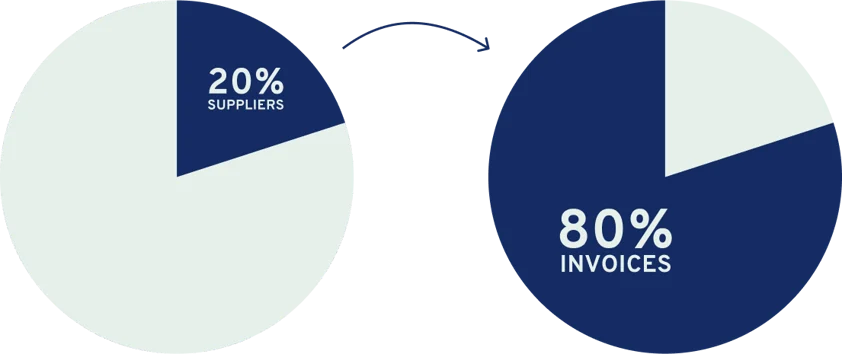

Supplier invoices make up almost 90% of spending in businesses, which makes transparency and control crucial in this area. But it also means that little wins make the biggest impact.

This is why we’ve turned our eye on the accounts payable process, to bring cost- and time-savings to the AP department through AI technology. See what payback it offers.

What is accounts payable automation?

Accounts payable automation refers to the use of technology and software solutions to streamline and optimize the entire process of managing and paying invoices. It involves automating tasks such as data extraction, invoice validation, approval workflows, and payment processing.

By eliminating manual, time-consuming processes, organizations can achieve greater efficiency, reduce errors, enhance control and visibility over their financial operations, and ultimately save valuable time and resources.

AP automation plays a pivotal role in modern finance departments, allowing them to focus on strategic activities while ensuring accuracy and compliance in their day-to-day operations.

The cost of a traditional AP process

For decades, accounting professionals have dreamed of “straight through processing”. A world where the whole process of Accounts Payable, or AP – from initial order to invoice settlement – is smooth, efficient, and as automated as possible.

However, for most AP departments, day-to-day work remains a whirlwind of administrative busywork: posting, allocating, approving invoices as they come in from various suppliers, and endlessly typing in purchase order numbers and costs to accounting software.

All these steps cost companies time and money.

Ardent Partners’ survey from 2021 shows that:

- 60% of companies face lengthy invoice and payment approval times

- The average processing time for an invoice is 10 days

- 22% of AP staff’s time is spent dealing with supplier inquiries

- The average cost of processing a single invoice is $10.89

Other studies show that 84% of the average AP professional’s time is spent on manual processes, and almost a quarter – 22% – of invoices trigger exceptions that need human attention.

Although this differs from one company to another, overall, the most time-consuming steps in a traditional AP process are the manual data entry and error fixing, the approval of invoices and payments, and the management of vendor payment and banking details.

So what’s the solution?

Automated accounts payable solutions have been around for a while but most miss one or more vital elements in the process.

Some AP automation software works fine as a standalone solution, but doesn’t play well with ERP platforms. Other accounts payable automation tools connect all the right dots, but need too many human eyes to check and approve actions along the way.

At Yokoy, we believe the solution isn’t a single innovation, but a set of them – the right technologies connected in the right way.

So we’ve put together this mini-guide to what accounts payable automation is all about, what technologies are involved, and how we apply them to make your AP process faster and smoother.

Blog article

From $456K Lost/Year, to Full Spend Control: Three Process Changes You Can Implement Today

In the current economic context, with inflation peaking and recession looming, finance departments are under pressure to control costs and cut unnecessary spending. The fastest way to do this is to identify hidden costs – a task proves to be more challenging than it should.

Thomas Inhelder,

CFO at Yokoy

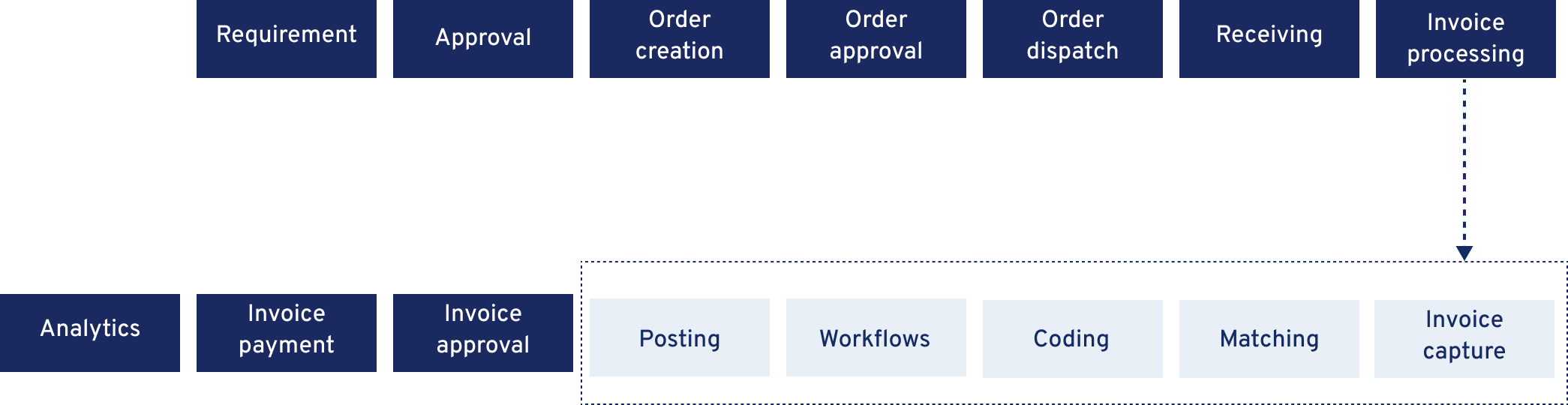

Which invoice processing steps can be automated?

By automating these steps, organizations can significantly improve efficiency, reduce errors, enhance visibility, and optimize their overall AP process.

Purchase Order (PO) matching: Automating the matching of invoices to corresponding purchase orders, ensuring accuracy and reducing manual effort.

Data extraction: Automatically extracting critical data from invoices, such as supplier information, invoice numbers, and line item details.

Invoice validation: Automated validation of invoices against predefined rules and policies to identify errors or discrepancies.

Approval workflows: Implementing automated approval workflows based on predefined rules, routing invoices to the appropriate approvers based on factors like invoice amount.

Blog article

How to Use Invoice Matching Technology to Improve Your Process Efficiency

See how invoice matching technology automates the 2- and 3-way matching of supplier invoices with POs and goods receipts, for an efficient AP process.

Mauro Spadaro,

Product Manager

- Data entry: Automating the data entry process, including entering invoice details into the accounting or ERP system, reducing manual data input errors.

- Invoice coding: Automatically assigning general ledger codes or cost centers to invoices based on predefined rules.

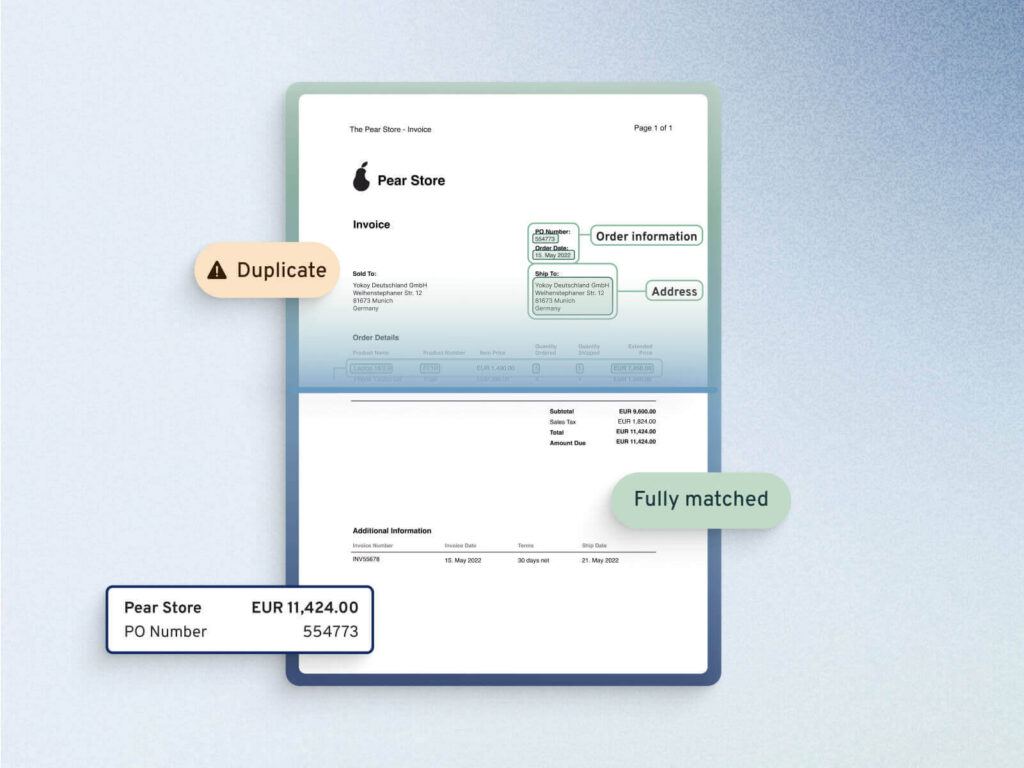

- Duplicate invoice detection: Identifying and flagging duplicate invoices to prevent overpayments.

- Payment processing: Streamlining payment processing, including generating payment files, issuing payments, and reconciling payments with invoices.

- Reporting and analytics: Utilizing automation for generating reports and conducting data analytics to gain insights into AP performance and trends.

- Compliance and audit trail: Ensuring compliance with regulations by maintaining an automated audit trail of all AP activities and transactions.

- Document management: Automating the storage and retrieval of AP-related documents, such as invoices, receipts, and purchase orders.

- Exception handling: Implementing automated workflows to handle exceptions, such as non-standard invoices or discrepancies, efficiently.

Blog article

How to Automate Your Invoice Approval Workflows with Yokoy

A well-structured invoice approval workflow ensures accuracy, compliance, and transparency in the payment process. Here’s how Yokoy can help.

Mauro Spadaro,

Product Manager

The journey of an invoice

Issuing a purchase order (PO) sounds simple enough, but there’s not a 1:1 correspondence between the average PO and the supplier’s invoice.

A PO can span multiple deliverables from that supplier, with each invoice “biting off” a chunk, and multiple POs can be in play with a single supplier.

Then, even with the PO number clear on the invoice, it still takes time to enter it into an accounting system. And processing it takes many more steps: for example, different approvers might be needed depending on invoice total.

There’s also a host of other data that needs checking and cross-checking: delivery dates, SKUs per pallet or hours accounted for, plus the huge job of making sure what you’re paying for was actually delivered.

What unites these administrative tasks: they’re repetitive. While boring for humans, they are ideal for machines and automation systems. If a task is repeated in the same way a thousand times, it’s ripe for automation.

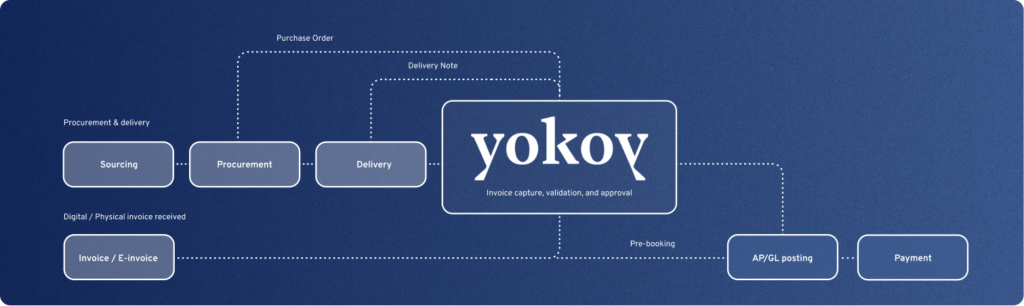

This is what we at Yokoy solve with our solution for automated invoice processing. Our software takes over the entire invoice processing and approval flow, accelerating the AP process.

The first step towards AP automation success is to get the paperwork into the system, kicking off the process. And while few companies deal with paper invoices received in the mail these days – at the very least they’re emailing you a PDF – the lack of standardisation still creates hurdles.

A PDF invoice, uploaded to an accounting system, suffers many of the same problems as a paper document: It’s not in machine-readable form.

Important details like the relevant PO number and tax information can be at the top, at the bottom, in a table or consigned to a second page. Reading out this information manually is not only time consuming, it’s prone to errors, too.

To improve the accounts payable process right at the start, Yokoy’s solution uses software character recognition. “Flat” information on a PDF – like the supplier’s name, invoice data, PO data, and its totals and subtotals – can be recognised and lifted from the document straight into your accounting software.

That’s just the start.

How Yokoy uses AI to automate invoice processing

Most companies use set formats for their invoices. They’ll differ from firm to firm, but over time most invoices from a single source will look much the same, with information arranged in the same way. And that’s great news if you want software to pick out PO numbers and dates from a document.

Automation can reduce manual workload by 60-90% per document. To reach 90% automation, the key ingredient is software intelligence, achieved through AI.

In short, Yokoy’s artificial intelligence handles the following steps:

- The invoice capture – Invoices can be received in multiple formats, from e-invoice to PDF or EDI

- The invoice processing – The AI algorithms “read” the invoice data and extract all the information needed for matching it with POs and goods receipts, coding it, and approving it.

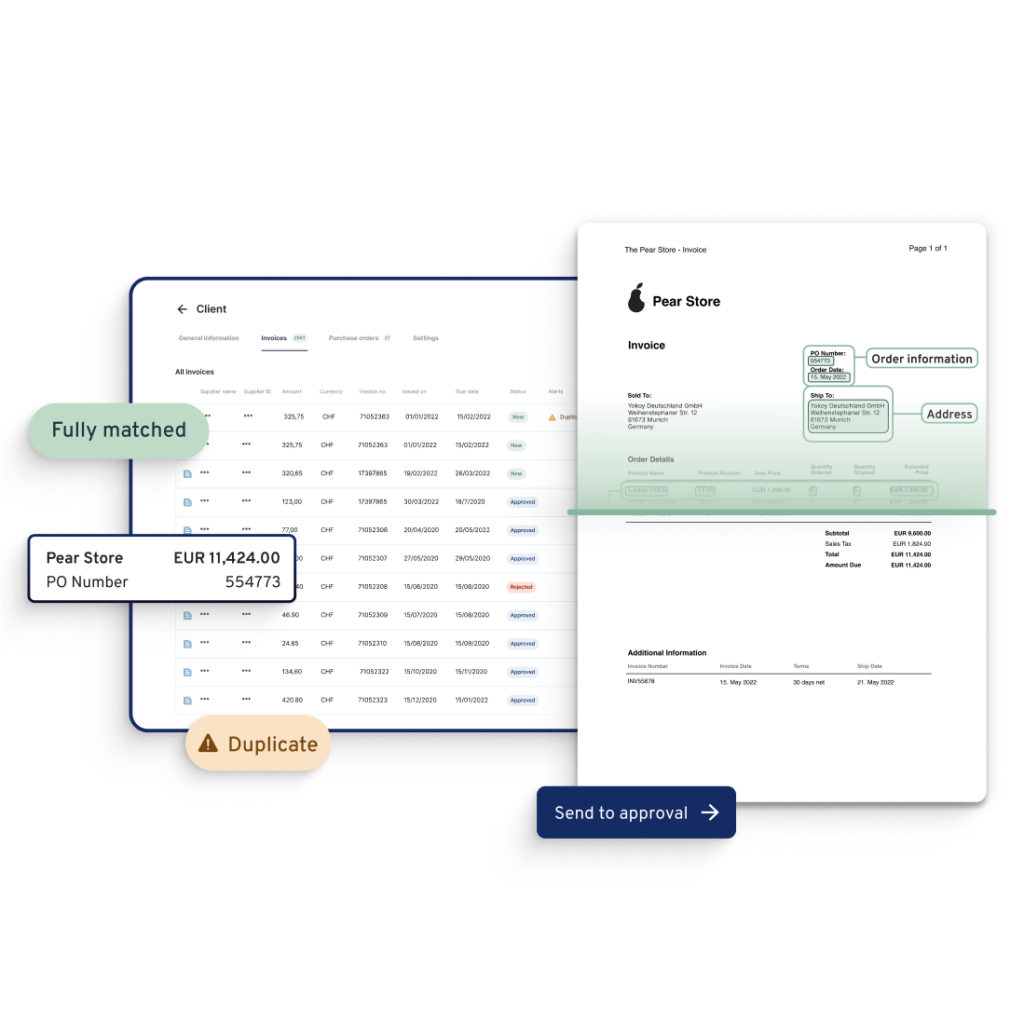

- The invoice approval workflows – These can be fully automated, or you can choose to have some manual intervention. Yokoy enables you to add policy and compliance checks and trigger notifications automatically, when there’s a policy breach or an error – for example, a duplicate invoice or an amount that exceeds the approved vendor budget.

- The invoice approval and export – This step can be automated as well, as Yokoy integrates seamlessly with ERP systems through API and ready-to-use connectors.

- The archiving of invoices can also be done in Yokoy, as the system stores all digital documents, for smooth audits.

This simplifies the procure-to-pay and AP processes significantly, enabling finance teams to fully automate their workflows and free up time to focus on more strategic tasks.

Here’s what this automation looks like in practice.

By recognising the formats data falls into, Yokoy’s AI accounts payable automation software can “learn” what it means and where it should be sent, completely integrated with invoice submission.

This results in automated invoice entry with far less human resource needed – reducing your workload dramatically, and removing virtually all errors and bottlenecks caused by manual work. The OCR technology “reads” the data and the AI structures it and adds it to the system, while doing the coding, matching, and duplicate checks automatically.

After the opening steps are dealt with, the process of invoice approval starts moving forward – at every stage of the process there’s an interaction of data with criteria triggering a course of action.

Interaction by interaction, output by output, the invoice follows that process pathway across your accounting system and connected platforms like ERP, requiring a set of rules to be applied at each touchpoint.

The data is captured automatically and approved based on pre-defined rules and customer-specific workflows. For example, duplicate payments are prevented through real-time notifications in case of duplicate invoice detection. Yokoy’s AI engine compares all captured invoices to detect duplicates, and ensures high compliance during the PO matching step.

The result?

Full automation and control of the entire invoice processing flow, in a cost-effective and compliant manner. Automating the AP process enables faster procurement too, preventing payment delays and ensuring access to early payment discounts.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Benefits of AP automation

Based on the above, it becomes quite clear that automating the accounts payable process is not just a “nice to have”: In a digital-first world, using digital AP solutions to improve the efficiency of the AP process is imperative.

If we look at the main benefits of automating the accounts payable process, the most important ones are:

- Increased efficiency

AP and invoice automation reduces the time-consuming manual tasks involved in the accounts payable process, such as data entry, invoice processing, and payment processing. By automating these tasks, organizations can increase efficiency and reduce the time and resources required to complete these tasks.

- Improved accuracy

Manual data entry is prone to errors, which can result in incorrect payments, delayed payments, or lost invoices. By automating the accounts payable process By automating the accounts payable process and using electronic invoicing options, organizations can improve accuracy and reduce the risk of errors.

- Faster processing times

Automation streamlines the AP workflows, allowing vendor invoices to be processed and paid faster. This helps AP teams to improve vendor relationships by ensuring timely payments and can help to reduce the risk of late payment fees.

- Better financial control

Automating the accounts payable process can provide organizations with better financial control and visibility. By automating the approval process and providing real-time access to financial data, organizations can ensure that expenses are approved according to policy and that spending is tracked and monitored effectively.

- Cost savings

Automating the accounts payable process can lead to significant cost savings by reducing the time and resources required to process invoices and payments. Additionally, automation can help to reduce the risk of errors and fraud, which can result in costly audits, fines, and legal fees.

Overall, automating the accounts payable process can help organizations to increase efficiency, improve accuracy, reduce processing times, improve financial control, and save costs.

Next steps

While many of our clients think expense automation is a revolution, accounts payable is more of an evolution: taking what we’ve learned from our expense automation experience and applying it to AP.

Through automation and AI, Yokoy streamlines the entire accounts payable process, ensuring:

- Fewer errors and exceptions,

- Faster invoice processing and approval times,

- Lower processing costs,

- Full visibility into spending, and

- Improved cash flow forecasting

If you’d like to see what our software can do for you, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.