Home / Why the AI-Driven Transformation of Finance Starts with Spend Management

Why the AI-Driven Transformation of Finance Starts with Spend Management

- Last updated:

- Blog

Co-founder & CEO, Yokoy

If we look at how companies spend money, it’s mainly through three processes: P2P, T&E, and payroll. Of these, payroll is handled by the HR department, so I won’t tackle it in this article. The other two processes – procure-to-pay and travel and expense management – form what we call spend management.

When we zoom into the spend management process, it’s easy to understand why companies have neglected modernizing their approach for so long. Both P2P and T&E are complex, often spanning multiple systems and operations. And in both these processes, money is lost directly or indirectly.

Directly, through out of pocket payments, unclaimed tax, missed supplier discounts, unnecessary tooling that’s part of complex tech stacks, or fines resulting from compliance breaches.

Indirectly, through inefficient workflows, repetitive manual tasks, and fragmented processes caused by disjointed tech stacks.

Given the significant cash flows involved, obtaining full visibility and control over the entire spend management process is crucial for businesses. Yet, despite the availability of point solutions and digitisation and automation efforts, these two processes remain prone to errors, inefficiencies, financial loses, and compliance issues.

Even in organizations with a high focus on leveraging technology across the business, optimizing the spend management practices has often been a forgotten aspect of the overall digital transformation of the finance function.

Now, companies are feeling the impact of overlooking their spend management process, as competition for talent becomes much fiercer and AI technologies are changing the way industries operate.

So why have companies neglected these processes for so long?

Because to tackle this complexity, especially when managing spend across geographies and currencies, technology like automation is not enough. Let’s zoom into the typical challenges of a traditional spend management process, for clarity.

Challenges of a traditional spend management process

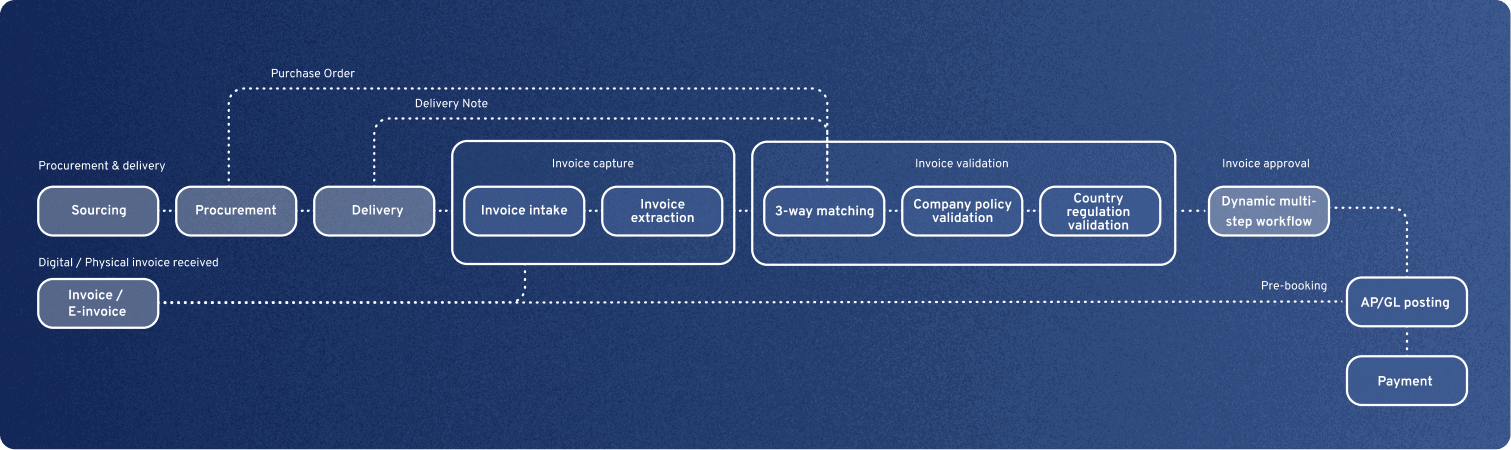

Some of the typical steps in the P2P process, such as the purchase request, the negotiation of prices, reading and understanding an invoice, or matching and validating invoices based on company and country regulations cannot be fully automated without AI.

Moreover, using only automation can introduce more issues than it solves, as this technology alone cannot prevent human errors or reduce deviations and reworks caused by such errors.

Thus, in the P2P process, automation can take over some tasks, such as sending a PO to a vendor, extracting invoice data, or authorising an invoice based on auto-approval flows. But to fully automate both the steps and the logic of the procure-to-pay process, using AI is mandatory.

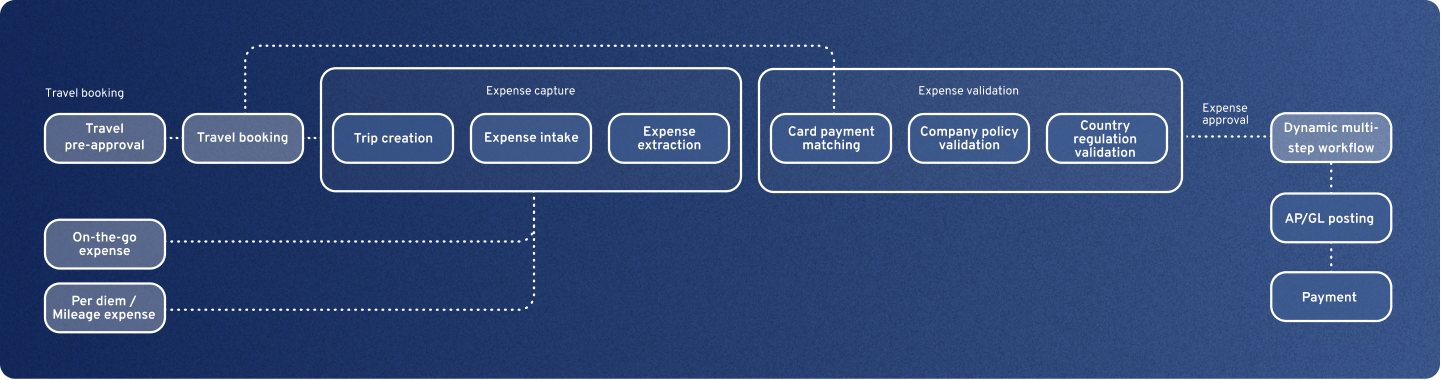

Same applies to travel and expense management. Let’s look at the typical T&E process, to understand what automation can and cannot do, and why the way forward is by incorporating AI into the process.

While expense approvals or calculating and issuing Per Diem and mileage allowance based on a trip can be automated, processing and extracting an expense receipt, matching expense with card transactions, or detecting policy breaches in real time require more than just automation.

So in both processes automation can only help finance teams up to a point. Technologies like RPA for example cannot take care of exception handling, and cannot recognise non-compliant and potentially fraudulent activities.

Thus, when automation alone is employed, the logic of the process lies with humans, and the true potential of transformation is missed.

We see this clearly in companies using incumbent solutions that are able to take over some of the repetitive, manual steps, but aren’t able to do the “thinking” and execute operations that AI can do.

To give just some examples: In a traditional T&E process where a mix of automation and manual steps is used, the cost of processing a single expense report is $58.

Incumbent travel and expense systems, as well as siloed solutions that handle only parts of the process can bring this cost down to $20 per report. However, our customers experience much more significant cost reductions: By using AI technology, they are able to bring the cost of processing an expense report down to $1 per report.

This is possible by automating 88%-90% of the process, and relying on AI and automation for all steps of the T&E process. The only areas that require human intervention are the exceptions and edge cases.

But even here, depending on one’s specific setup and policies, AI can come to the rescue. While in a traditional T&E process, 19% of expense reports contain errors, AI is able to eliminate most human errors, by fully automating the receipt reading and processing, as well as the matching of transactions and the approval of expenses that comply with the company policy.

AI-powered operations for autonomous finance

"Traditionally complex and often riddled with inefficiencies, spend management can be reimagined with AI at its core."

Philippe Sahli, Co-founder & CEO Yokoy

The concept of an autonomous finance department may seem like a distant vision, but it’s rapidly becoming a reality for forward-thinking organizations.

In an autonomous finance function, processes and activities are governed and operated by self-learning technology such as artificial intelligence. This advanced approach to finance goes beyond automation, offering real-time and predictive insights, seamless compliance, and enhanced flexibility in financial strategies.

In an autonomous – and not just automated – finance function, humans and AI work alongside, each doing what they’re best at. As we step into the AI era, there is no valid reason for finance teams to continue wasting time on processes that can be fully taken over by technology.

Leading organizations know this and are taking decisive action. Sixty-four percent of CFOs believe autonomous finance is the way forward and are prioritizing investments in AI-powered software.

Artificial intelligence is transforming finance operations, enabling teams to transcend manual, error-prone tasks and focus on strategic decision-making and value creation. And the spend management process, traditionally complex and often riddled with inefficiencies, is the ideal starting point for this transformation, as it can be fully reimagined with AI at its core.

AI-driven spend management introduces a new level of sophistication, automating manual tasks, detecting patterns in spending behavior, and delivering actionable insights. Real-time data analytics empower finance teams to make informed decisions quickly and accurately, leading to increased cost savings, reduced compliance risks, and improved overall financial performance.

Of course, the hurdles to implementing AI-based solutions lie in the complexity of spend management, and nuanced decision-making is necessary. But as the world irreversibly moves toward autonomous finance operations, companies must recognize that AI is the driving force propelling this transformation.

By embracing AI-powered technologies, finance teams lay a solid foundation for an autonomous finance future and gain the freedom to reimagine their roles, driving innovation and strategic value for their organizations.

The future of finance is within reach, and it all begins with a visionary embrace of AI in spend management.

Checklist

Finance Transformation Readiness Checklist

In this white paper, we delve into the essential steps for finance leaders to assess the readiness of their organization and construct a compelling case for digital transformation in finance.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.