Home / What is Spend Management? Fundamentals and How It Works

What is Spend Management? Fundamentals and How It Works

- Last updated:

- Blog

Co-founder & CCO, Yokoy

At its core, spend management is the practice of managing an organization’s spending to drive cost savings and increase efficiencies. In today’s competitive market, companies that can effectively manage their spending are better positioned to succeed, grow and remain profitable.

This article aims to provide a comprehensive overview of what spend management is, why it’s important, and how it can benefit businesses of all sizes and industries.

We will cover the basics of the concept and its key components, the benefits of using digital spend management solutions, and best practices for managing business spending successfully.

By the end of this article, you should have a clear understanding of what spend management is and how it can help your organization drive better financial outcomes.

The basics of business spend management

Let’s start by clarifying what business spend means.

Spend refers to all of the money that an organization spends on goods and services to support its operations. This includes everything from office supplies and equipment to raw materials and finished goods, but also all the employee expenses incurred while conducting business on behalf of the company.

Thus, spend management is the process of controlling and optimizing a company’s spending on goods and services.

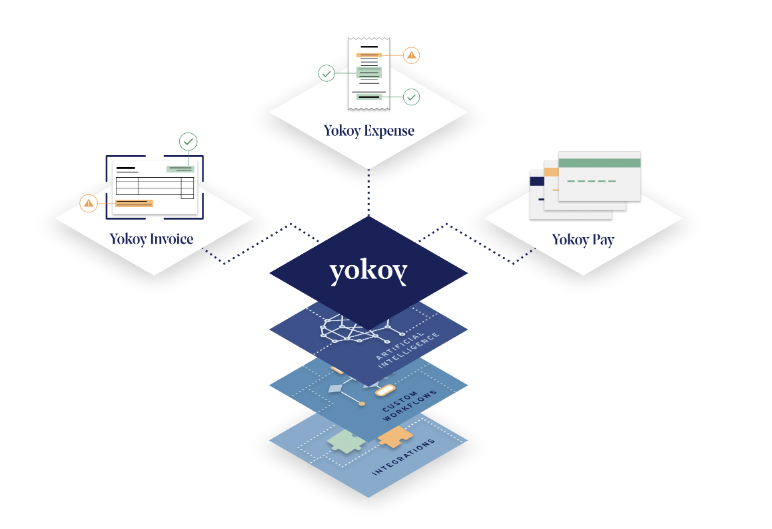

To achieve effective cost control and gain end-to-end spend visibility, companies use spend management software that is fully integrated with tools such as ERP systems, travel management platforms, VAT reclaim solutions, or procurement tools.

White paper

Report: State of Spend Management Transformation [2023]

This report offer a glimpse into the current state of spend management transformation and the trends, challenges, and opportunities shaping its future.

The difference between spend management and procurement

While spend management and procurement may seem similar, they are actually distinct processes.

In essence, procurement is a subset of spend management. While procurement is concerned with the tactical process of acquiring goods and services from suppliers, spend management is a broader, more strategic process that encompasses the entire spend cycle, from strategic sourcing and procurement to payment and compliance.

Procurement is often carried out by purchasing teams or individuals, who are responsible for ensuring that goods and services are procured at the best possible price, quality, and delivery terms.

Spend management, on the other hand, takes a more strategic approach, involving a wider range of stakeholders, such as finance teams, operations, and compliance teams.

The key components of spend management

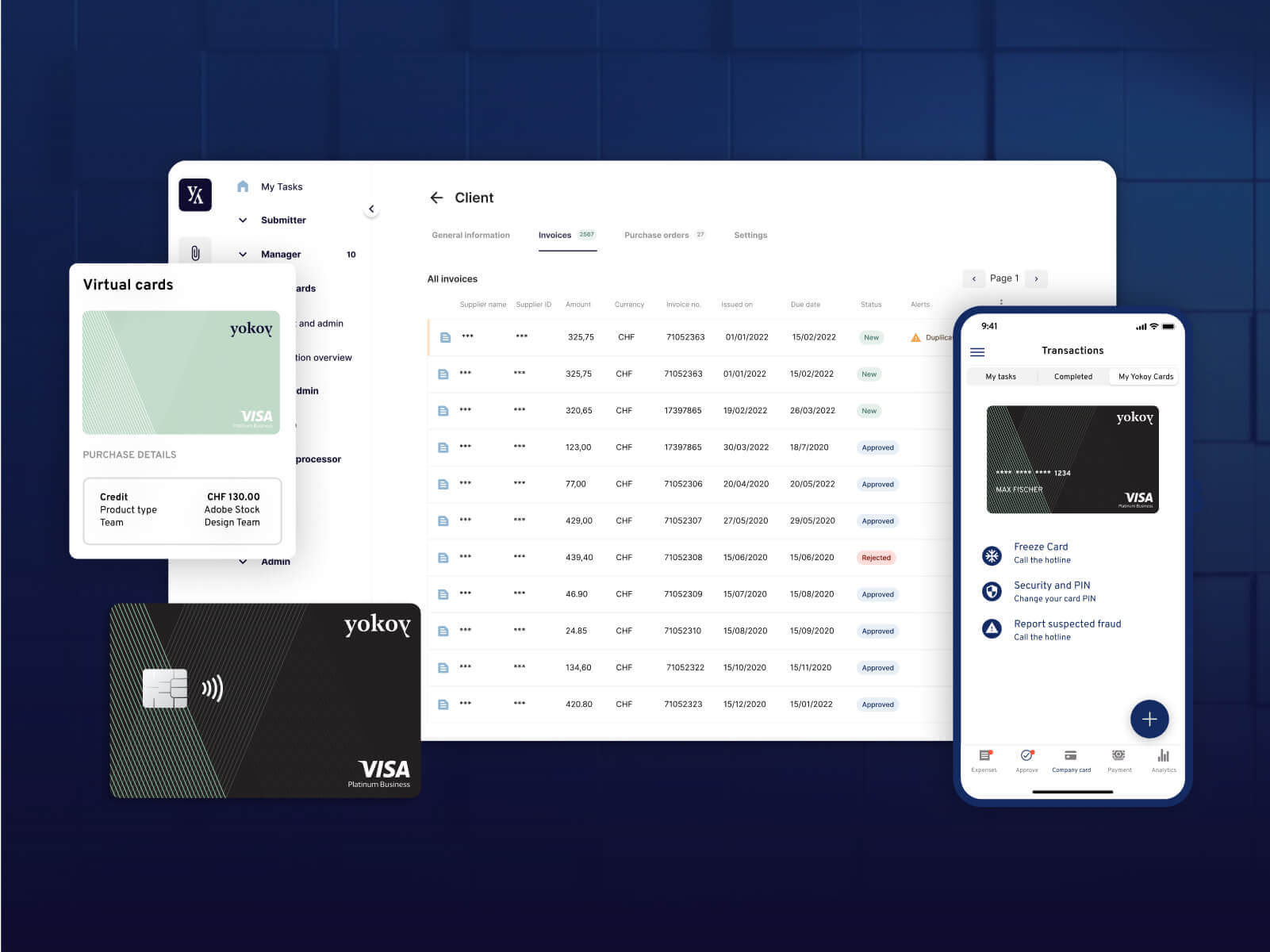

Expense management, invoice management, and corporate card management are all components of spend management. Thus, a comprehensive spend management platform should bring together the accounts payable process, along with the management of expenses and corporate card transactions.

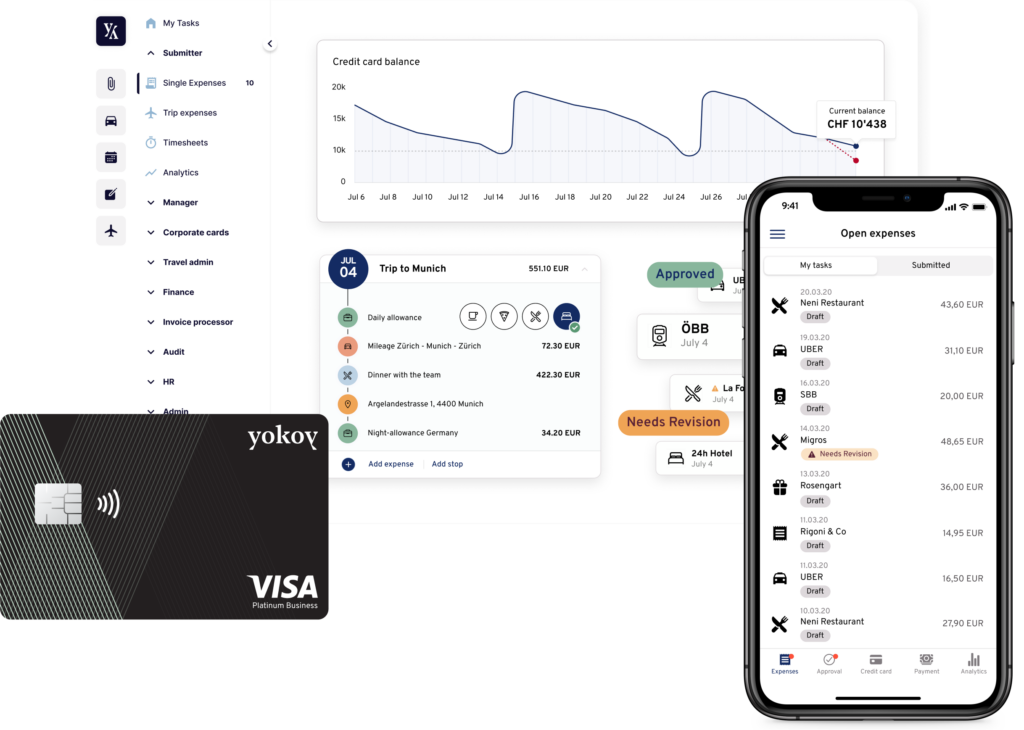

Expense management involves the process of tracking, approving, and reimbursing employee expenses incurred during the course of business. This can include travel expenses, meals, entertainment, and other miscellaneous expenses.

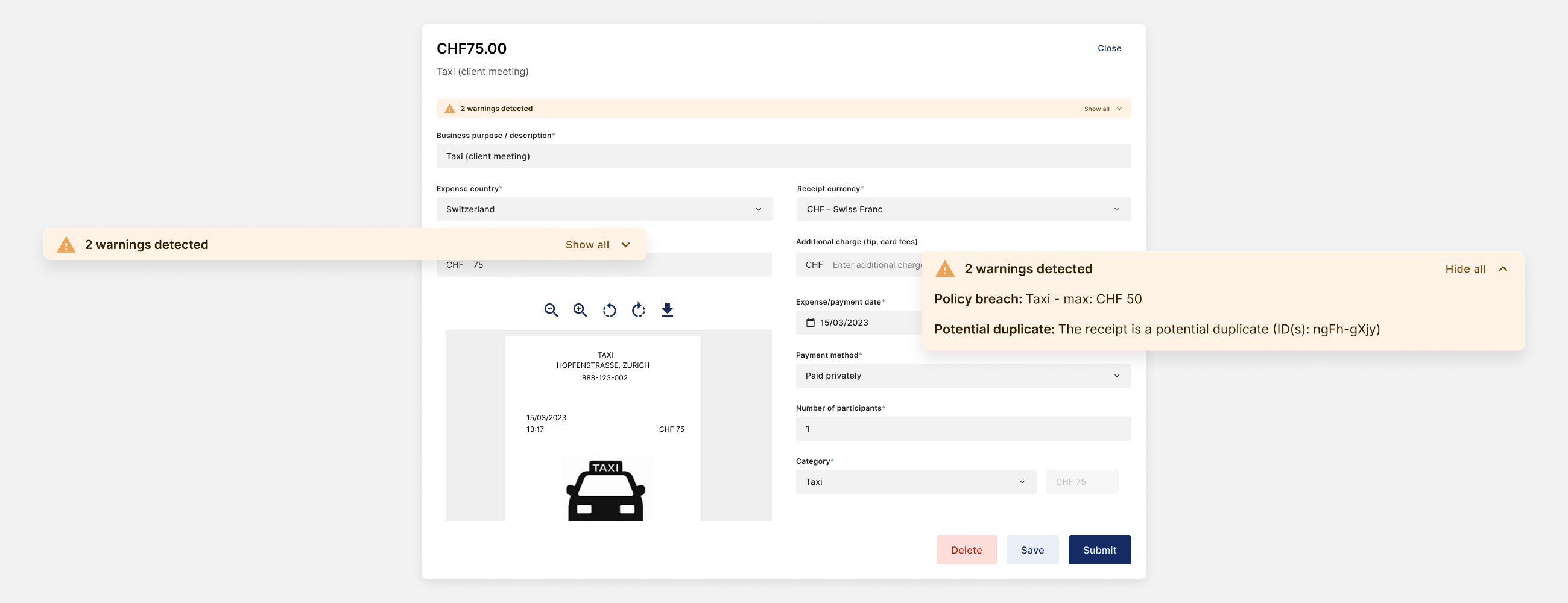

By managing employee expenses, organizations can reduce the risk of fraud and errors, while also ensuring compliance with corporate policies and government regulations.

Next, invoice management is also part of the broader spend management process, and it involves the receiving, processing, and payment of supplier invoices. This can include managing purchase orders, tracking payments, and reconciling invoices with supplier contracts.

Effective invoice management can help organizations improve cash flow and forecasting, reduce processing costs, and ensure timely payment to suppliers.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Finally, corporate card management involves managing corporate credit card programs, including card issuance, usage, and reconciliation.

By providing their employees with smart corporate cards, organizations can streamline payment processes, reduce administrative costs, and improve control over employee spending.

All of these processes are part of spend management because they involve managing the flow of money within an organization, from the initial identification of a need to the final payment to a supplier or employee.

By adopting a holistic approach to spend management, organizations can gain greater visibility and control over spend, reduce costs, and improve compliance with internal and external policies.

The benefits of using spend management software

Implementing effective spend management solutions can have a range of benefits for organizations, as shown below.

Real-time spend visibility

Spend management software provides real-time visibility into all spend activities across the organization, allowing businesses to identify spending patterns and gain insights into where they can reduce costs.

Spend management software collects data from multiple sources, such as purchase orders, invoices, contracts, and expense reports, and consolidates it into a central platform. This allows businesses to analyze their spending data in real-time and create reports and dashboards that provide a holistic view of their spending activities.

By providing real-time spend visibility, spend management software enables businesses to monitor their spending activities in real-time and track expenses against budget allocations. They can quickly identify any overspending or unusual spending patterns and take corrective action.

Cost reduction and savings

An effective spend management system can help organizations identify areas where they can reduce costs and achieve savings.

By analyzing spending patterns, organizations can identify areas where they may be overspending, negotiate better pricing and terms with suppliers and implement more efficient processes to reduce costs.

ROI calculator

Calculate your savings

How much can you save annually if you choose Yokoy as your spend management suite? Our ROI calculator helps you quantify the return on investment, so you can build a solid case for finance transformation.

Better decision-making

Effective spend management provides organizations with greater visibility and insights into their spending patterns. This can help companies make more informed decisions around supplier selection, contract negotiations and spending priorities.

By having access to real-time spend data and spend analytics, organizations can make better decisions that are aligned with their strategic goals.

Improved process efficiency

Spend management solutions can help streamline processes, reduce the time-consuming manual tasks and eliminate human errors through automation, enabling organizations to be more efficient.

This can help to reduce the time and resources required to manage spend and free up staff to focus on more strategic activities.

Fenaco standardized their expense management with Yokoy

“With Yokoy, we have opted for a uniform and group-wide expense management solution that unifies our different expense processes on one platform and automates them across organizations, for increased efficiency.”

Marianne Schluep, Head of Finance and Accounting

Enhanced compliance and risk management

Last but not least, spend management solutions can help organizations improve compliance and risk management. By having a better understanding of spending patterns and supplier relationships, organizations can identify and mitigate potential risks. This can help to reduce the risk of fraud, errors, and compliance violations.

In conclusion, implementing effective spend management solutions can help organizations achieve a range of benefits, including cost reduction, process optimization, better decision-making, and enhanced compliance and risk management.

By investing in the right tools and processes, organizations can achieve greater visibility and control over their spend and drive better outcomes for their business.

The challenges of implementing spend management solutions

While effective spend management can drive significant benefits for businesses, implementing digital spend management strategies can be challenging, especially for companies who still follow manual processes and rely on tools like spreadsheets instead of using dedicated software.

Here some of the common challenges that organizations may face when implementing spend management. We’ve covered the challenges, as well as how to tackle them, in our webinar below.

Blog article

Implementation Plan for a Global Spend Management Solution – Yokoy’s Approach

Through our work with global customers ranging from mid- size businesses to large enterprises, we’ve developed our own implementation blueprint for rolling out spend management solutions.

Gordan Grcman,

Senior Implementation Manager, Yokoy

Resistance to change

One of the biggest challenges that organizations face when implementing spend management is resistance to change. Employees may be resistant to changing the way they work, particularly if they’ve been doing things the same way for years.

Research indicates that up to 70% of change management initiatives fail due to resistance from employees. In a study by McKinsey & Company, 80% of executives reported that their organizations faced resistance when implementing a new initiative, and only 30% believed they had been successful in overcoming that resistance.

Thus, it’s important to communicate the benefits of spend management and involve employees in the process to help alleviate these concerns.

Lack of resources and expertise

Implementing a spend management platform often requires specialized expertise, and many growing organizations may not have the internal resources to effectively manage spend digitalization or transformation projects.

In a survey by Deloitte, 43% of organizations cited a lack of internal resources as a major challenge to implementing spend management tooling.

Addressing this challenge may require hiring additional staff with the necessary expertise, outsourcing certain tasks to external service providers or consultants, or investing in technology solutions to support spend management.

Data quality and integration

Effective spend management relies on accurate and timely data. However, many organizations struggle with data quality and integration. In traditional setups, data is siloed and stored in different systems or formats, which makes it difficult to get a comprehensive view of spending.

A study by Deloitte found that 43% of organizations struggle with data accuracy and completeness, while another study by Procurify found that 59% of companies lack the tools and processes to effectively manage spend data.

Addressing these challenges often requires investing in data management tools and processes to ensure that data is accurate and easily accessible. AI technology and automation can help with data reading, categorizing, matching, and so on.

How to get started: Criteria for choosing spend management software

While you might think that a spend management solution will only be used by your finance team, such a tool has a significant impact on your bottom line, as it impacts almost every team in your company.

Thus, you should aim for a clear list of requirements before investing in a platform to streamline business spend.

For example, your accounting team might need specific functionalities, while the employees who need to submit expenses might only care about the UX of the tool. At the same time, your IT department might want a tool that integrates perfectly into the existing tech landscape, to streamline both the process and the data flows.

Without a clear understanding of what a spend management platform should do for your teams, you might end up with a solution that’s overly engineered or badly implemented.

So here are some key criteria to consider when choosing spend management software:

1. Features

Look for software that offers the features you need to manage your business spend effectively, and that brings expense management, invoice processing, and card payments under one central tool. This will ensure end-to-end visibility and control for your finance department.

For example, Yokoy helps companies centralize and standardize their spend management processes into one core platform, removing inefficiencies.

It enables finance teams to manage expenses, invoices, and card payments into one single tool, and the innovative part is that by using smart corporate cards instead of traditional ones, it provides real-time data and insights into business spending.

Moreover, our platform uses AI to detect policy breaches, outliers and duplicates in real time, so it helps prevent overpayments and fraudulent activities, ensuring full control over a company’s spend.

DO & CO standardized their global spend management with Yokoy

“One unified process for the entire DO & CO Group. Yokoy enables us to collaborate optimally across all locations and entities.”

Michael Kultscher-Burger, Teamlead Accounts Payable & Receivable

2. Integrations

Consider whether the software integrates with other tools you use, such as accounting software, ERP systems, procurement tools, or travel booking platforms. For example, Yokoy provides integrations with the biggest ERP players on the market, for a smooth implementation.

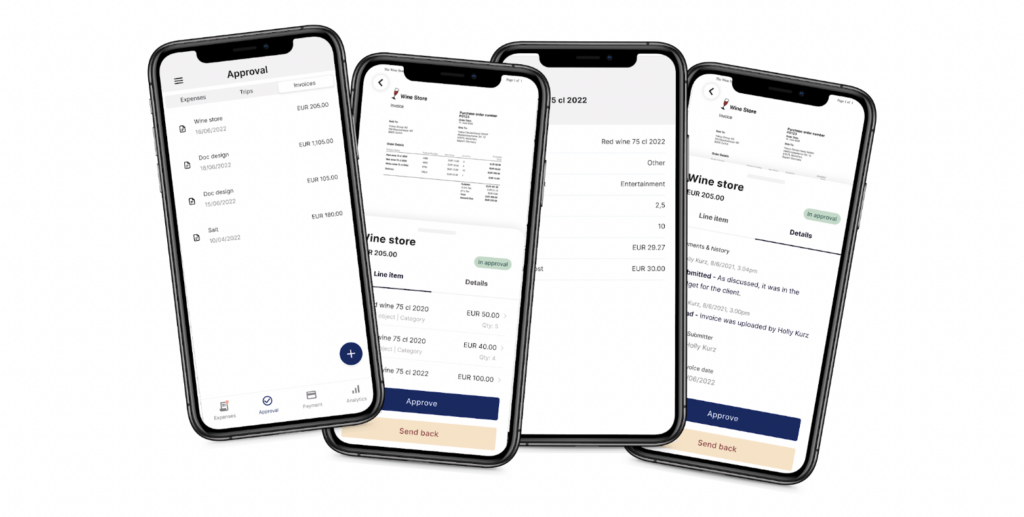

3. Ease of use

The software should be user-friendly and easy to navigate, with a clear and intuitive interface, for both the submitter and the approver. This aspect is often overlooked by spend management platforms, leading to a poor user experience, low adoption, and employee dissatisfaction.

Given that the expectations of end users are heavily influenced by B2C software, you should look for a solution that is available on both desktop and mobile, and that provides a seamless mobile experience not just for managing expenses, but for invoice processing too.

This way, your teams can submit receipts, process invoices, and approve payments while on the go.

4. Customization

Choose software that can be customized to your specific business needs, such as the ability to set up approval workflows for different types of expenses or amounts, as well as create custom reports.

5. Security

Make sure the software has strong security measures in place to protect sensitive financial data.

6. Support

Look for software that offers comprehensive customer support, including training, technical support, and a user community to help you get the most out of the software.

For example, at Yokoy, we offer our customers a phased roll-out, with extensive support in the Hypercare phase, both on the technical side and on the change management side.

By considering these criteria when choosing spend management software, you can find a solution that meets the unique needs of your business and helps you manage expenses more efficiently.

Blog article

Implementation Plan for a Global Spend Management Solution – Yokoy’s Approach

Through our work with global customers ranging from mid- size businesses to large enterprises, we’ve developed our own implementation blueprint for rolling out spend management solutions.

Gordan Grcman,

Senior Implementation Manager, Yokoy

Next steps

As organizations continue to face increasing pressure to manage spend effectively, it’s clear that spend management will remain a key priority for many years to come. By taking the necessary steps to implement effective spending practices, companies of all sizes and industries can reap the benefits and achieve greater success in the long run.

Thus, if you’d like to take the next step and want to see how Yokoy’s spend management solution can help your company automate expense management, invoice processing, and corporate card payments, with the power of AI, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.