Home / What Is Budgeting? Key Steps to Manage Expenses

What Is Budgeting? Key Steps to Manage Expenses

- Last updated:

- Blog

Could you imagine doing business without paying attention to your financial situation but instead relying on your gut feeling? Probably not, right? That is why budgeting is so essential for financial leaders and accounts payable managers. More than just a plan for allocating resources, budgeting is a strategic process that can optimise cash flow, enhance financial agility and ensure that your organisation’s broader economic objectives are met.

Given the rapid changes in today’s economy, using advanced budgeting techniques such as rolling budgets or activity-based budgeting can help your business stay adaptable, efficient, and ready for growth. Integrating modern technology into the budgeting process is also crucial, as automation can streamline operations and improve the accuracy and responsiveness of financial planning.

In this guide we offer you actionable insights. It focuses on budgeting strategies that align with business goals, manage payables efficiently, and allow your organisation to adapt to fluctuating market conditions. By applying these strategies, you can unlock the full potential of your team’s budgeting practices.

Meaning and importance of budgeting

At its core, budgeting refers to planning and allocating financial resources to meet a company’s objectives. It involves forecasting revenues, estimating expenditures, and ensuring that the organisation remains on track to achieve its short—and long-term goals.

For financial leaders and accounts payable managers, effective budgeting is essential for maintaining a healthy cash flow and staying on top of the company’s financial health. Whether managing monthly expenses or annual budgets, budgeting helps ensure the business can meet its obligations, including payments to vendors, employees, and other stakeholders. It also enables companies to foresee potential challenges, prioritise projects, and allocate resources effectively to boost profitability. A well-structured budget can additionally provide the financial agility needed to respond quickly to market shifts, such as economic downturns, supply chain disruptions, or unexpected expenses.

From a strategic perspective, budgeting plays a vital role in aligning day-to-day operations with broader financial goals. For example, a robust business budget will guide decisions about cost-cutting, financial risk management, rethinking previous spending habits, and how much money can be invested. This helps your organisation weather economic uncertainty without sacrificing long-term growth potential.

Different budgeting methods

Various approaches to budgeting exist, each with strengths and limitations. Like any other tool, the right method for budgeting depends on a company’s size, industry, and financial objectives.

Zero-based budgeting

Zero-based budgeting requires that every expense be justified for each new budgeting period, regardless of what or how much money was spent in the past. Unlike traditional budgeting methods, which typically rely on incremental adjustments to the previous budgeting, zero-based budgeting starts from scratch and builds the budget from the ground up. This approach promotes efficiency by carefully examining each variable expenses, making it perfect for organisations aiming to reduce costs or shift resources.

Percentage-based budgeting

Percentage-based budgeting allocates funds based on predetermined percentages of total revenue. This method is often used in smaller businesses or departments with predictable income streams. For example, a business might allocate 50 per cent of revenue to operating expenses, 30 per cent to growth initiatives, and 20 per cent to debt repayment.

While this method offers a clear and easy way to budget, it might lack the flexibility needed for more complex financial situations. However, percentage-based budgeting can still be handy for smaller, more predictable expenses like office supplies or utility bills.

Cash envelope system

The cash envelope system is a budgeting method in which physical cash is allocated to specific expense categories, and once the cash is spent, no more is available for that category. While primarily used in personal finance, businesses can apply this principle by allocating strict limits to different areas of the budget and enforcing spending controls.

This method can be useful for handling discretionary or non-essential spending in your business. The envelope system encourages discipline by keeping departments or teams within their allocated budgets and helping to avoid overspending.

Rolling budgeting

A more dynamic approach that updates the budget throughout the year is called rolling budgeting: Instead of sticking to a fixed budget set at the start of the fiscal year, you or your financial leaders revise it regularly, for example, month to month. For organisations in fast-moving industries or with variable revenue, rolling budgets offer the flexibility to stay agile and responsive, while being able to decide based on actual performance and shifting business conditions.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Budgeting process step by step

Every experienced financial leader knows that creating an effective budget requires a structured approach. Here are the five key steps you should follow:

Step 1: Review the existing budget

The first step in the budgeting process is to review the previous year’s budget. This review should focus on identifying areas where actual spending deviated from projections and determining whether those deviations were justifiable. This analysis will help establish a baseline for the new budget. This is crucial to understanding past trends in payment processing, vendor management, and cash flow, as it enables you to make informed adjustments to the budget for the coming year.

Step 2: Set goals

As mentioned earlier, clear, measurable financial goals are essential for driving budgeting decisions. These goals may include reducing expenses, increasing profitability, expanding operations, or improving payment terms with suppliers.

When setting goals, you should consider short-term objectives (such as reducing outstanding payables) and long-term ambitions (such as building reserves for future growth). Your company’s budgeting process should align with these goals for an effective allocation and consideration of your variable costs.

Step 3: Consider projects in the coming year

Every organisation has a unique set of projects and initiatives planned for the coming year, such as launching a new product, expanding into new markets, or upgrading technology infrastructure. These projects often require significant financial resources, so they must be factored into the budget.

Therefore, you should assess how these projects will impact cash flow and ensure sufficient funds are available to meet vendor payments and other obligations while supporting the organisation’s growth initiatives.

Step 4: Make a forecast

Financial projections based on current trends, market conditions, and organisational goals are the core of budgeting. Forecasting involves predicting revenue, estimating expenses, and analysing different types of budgets for the upcoming year. AP managers should also consider the timing of payments and expected fluctuations in working capital requirements. This way, Chief Financial Officers (CFOs) can use advanced analytics tools to improve the accuracy of their forecasts, helping to mitigate the risk of budget shortfalls or liquidity challenges.

Step 5: Track and adjust your budget

Once the budget is set, tracking actual performance against projections is essential. AP managers should monitor cash flow, payment schedules, and expenses to ensure that the organisation remains within its financial limits.

As you might realise by now, rolling budgets are particularly useful in this step, as they allow for continuous adjustments based on real-time data. By tracking and adjusting the budget throughout the year, you can maintain financial agility and respond proactively to challenging shifts in market conditions or business needs.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Tips for efficient budget management

We have pointed out that aligning budgeting practices with broader business objectives, monitoring performance, and making adjustments when necessary are necessary for efficient budget management. Here are some additional tips for you that can help you excel.

Align budgeting with business goals

Budgeting should not be viewed in isolation but rather as a tool for achieving the organisation’s strategic objectives. You should ensure the budget reflects the company’s priorities, such as growth, profitability, or cost reduction.

For example, suppose the company aims to expand into new markets. In that case, the budget should allocate resources for market research, marketing campaigns, and operational costs while guaranteeing that vendor payments and other financial obligations are met.

Tracking and adjusting budgets

Consistently tracking performance against the budget is critical for maintaining financial discipline. You should regularly review your organisation’s cash flow, vendor payments, and team expenses to ensure that spending is in line with the budget.

Budgeting for business travel

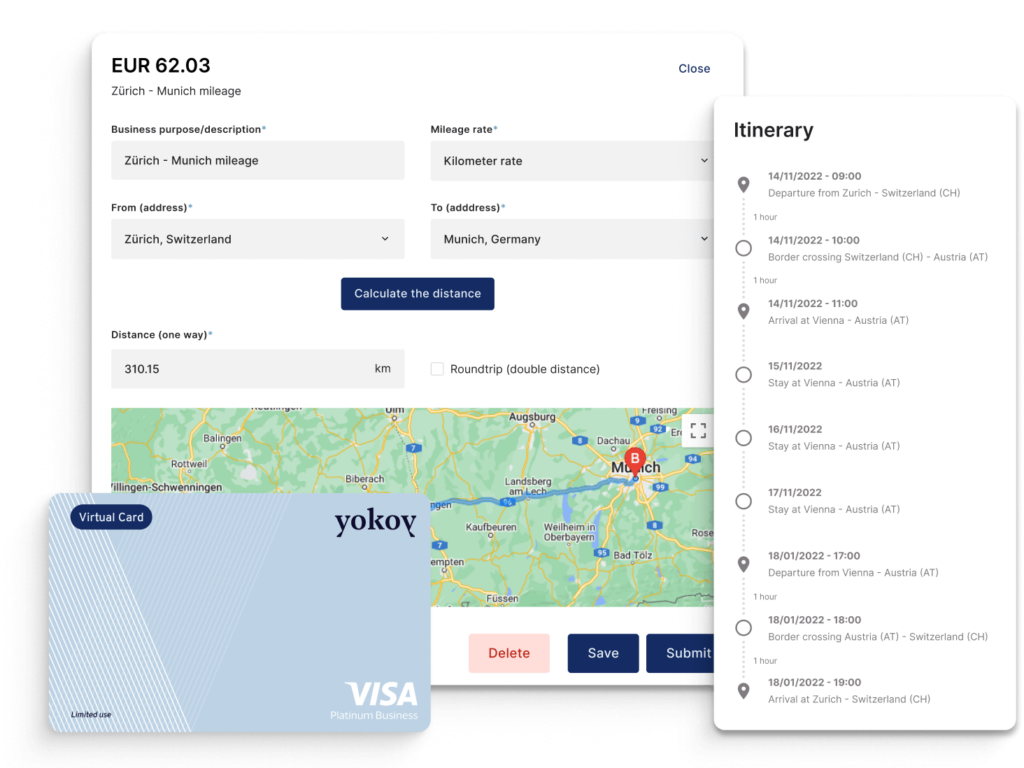

Business travel is a significant expense for many organisations, and it can be challenging to manage effectively. By incorporating advanced travel expense management tools, you can gain better control over travel spending and reduce the risk of non-compliance with company policies.

How to stick to a budget

Sticking to a budget requires discipline and monitoring. You should set clear expectations across departments, enforce spending limits, and provide regular updates on budget performance. Also, make sure that vendors are paid promptly while controlling discretionary expenses.

Software for holistic expense management

Integrating expense management software is a key step in optimising budgeting practices. Solutions like Yokoy’s finance automation and spend management platform enable you to streamline expense reporting, manage payables, and gain insights into spending trends. Yokoy’s automated systems also reduce the risk of human error while also improving the accuracy of financial data, making tracking and adjusting budgets way easier.

Tools like Yokoy’s automated travel expense management solution can help streamline your budgeting process, and enable your employees to submit expenses easily while providing real-time visibility into actual travel costs.

Reach your financial goals with effective budgeting and Yokoy

Budgeting is a powerful tool to to manifest your financial success, but it also requires a strategic approach and the right tools to be truly effective. Advanced techniques like as rolling budgets and activity-based budgeting allow your company to remain agile, efficient, and resilient—even amid economic uncertainty.

Yokoy automates the entire expense management process, eliminating the need for manual entries and lengthy spreadsheets. This automation saves a lot of time and reduces errors that can lead to inaccurate budgeting or misallocated funds. Yokoy simplifies the expense reporting process with automated expense reports that integrate seamlessly with existing financial systems.

With our spend management automation tools, businesses can consolidate all spending data into a single platform, offering a clear and consolidated view of expenses across departments. This improves cash flow visibility and enables organisations to implement stricter spending controls and align their cash outflows with revenue cycles.

Yokoy offers spend analytics that provides deep insights into spending trends, vendor costs, and department-specific expenditures. By analysing this data, your financial leaders can identify opportunities for cost savings, negotiate better vendor contracts, and adjust budgets to reflect actual needs rather than just projections.

Yokoy supports compliance by automating approval workflows, setting spending limits, and ensuring all expenditures meet predefined criteria. Yokoy’s built-in features reduce the risk of overspending and fraud.

Our automatic travel expense management system allows you to manage travel costs more effectively by automating the reporting and reimbursement process. The platform integrates with travel booking systems, providing a seamless way to track travel-related expenses and ensuring they are aligned with the company’s travel budget.

Next steps

We hope our article demonstrates that effective budgeting and budget planning are critical if you aim to optimise cash flow, enhance financial agility, and align with broader financial goals. To be honest, those all are goals every well-working business should pursue. By using advanced budgeting techniques, integrating modern technology such as Yokoy’s tools and AI-powered features, and regularly reviewing and adjusting budgets, organisations can stay financially resilient and poised for long-term success.

Take the next step by booking a demo for Yokoy today!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.