Home / Automatic Business Travel Expense Tracking: Things to Know

Automatic Business Travel Expense Tracking: Things to Know

- Last updated:

- Blog

The concept of a traditional office is evolving rapidly, with more employees embracing remote work and flexible work arrangements instead of ordinary commuting to work regularly and using a permanent workplace. Deloitte highlights that among the professionals whose companies offer flexible work options, 82 per cent say they have used them. This shift has led to a significant rise in business travel that is not tied to a specific place of work but instead focuses on enabling employees to work from anywhere. As a result of this convenient trend, travel expenses and incidental expenses are becoming more diverse: It is no longer just about flights and hotels but also other remote work-related expenses such as rent for temporary workplaces like co-working spaces or personal office setups.

Moreover, many enterprises nowadays acknowledge their corporate responsibility and sustainability when it comes to business travel as they are increasingly mindful of their environmental impact. That is why they are adopting eco-friendly travel practices, such as opting for public transportation, choosing hotels with green certifications, and offsetting carbon emissions from flights. Google trends show that searches for “sustainable travel” have increased by 191 per cent from 2020 to 2023. Especially remarkable: From 2023 to 2027, the sustainable travel market in the business tourism sector is expected to grow by £271 billion. This trend towards sustainable travel is reshaping the way companies think about business travel expenses.

However, economic efficiency remains a priority for companies. With the rising cost of travel and accommodation, companies are looking for ways to optimise their travel expenses without compromising on the quality of their business trips. This includes negotiating corporate discounts with travel providers, leveraging technology for efficient booking, and implementing cost-saving measures such as virtual meetings and remote collaborations.

Fortunately, digital transformation simplifies the way companies manage their business travel expenses. From online booking platforms to automated expense tracking systems, technology is making it easier than ever to manage travel arrangements and expenses. Automation improves efficiency, reduces errors, ensures compliance, and provides valuable data insights that enable better financial decision-making.

Automating travel expenses – how to prepare for a change

From our perspective, it is crucial to find a software solution with robust features that offer you ways to deal with expense tracking, automated approvals, real-time reporting, and compliance management.

Before selecting a product, we recommend defining the exact needs of your company. Consider factors such as the volume of travel, the number of employees, and the complexity of expense policies. This helps you identify the specific features that are essential for your business, such as integration capabilities, customisation options, and security features.

When evaluating software solutions, we suggest looking for the following special features to ensure they meet the regulations and requirements of your company:

Compliance management: The software should be capable of enforcing company rules and HMRC compliance automatically, reducing the risk of tax issues and overspending.

Integration capabilities: Ensure the software can integrate seamlessly with your existing travel booking platforms, virtual card providers, and accounting systems.

Real-time reporting: Opt for a solution with real-time reporting features to gain insights into spending patterns, pending transactions, and budget allocations.

Mobile accessibility: Choose a solution that allows for convenient expense submission and approval on the go.

Why you need to automate your travel expense management

As a matter of fact, keeping track of business expenses helps companies make better financial decisions with real-time data as it:

saves time

reduces errors

increases employee satisfaction

From a CFO’s standpoint, automating your travel expense management is a strategic move to enhance operational efficiency. Manual expense tracking consumes significant resources in terms of time and manpower. By automating this process, you can redirect these resources to more value-added activities that contribute directly to the company’s bottom line. Automated expense management accelerates the entire expense reporting and reimbursement cycle, allowing finance teams to process reports more efficiently and improve cash flow management.

Manual expense tracking is highly susceptible to human errors, which can lead to inaccuracies in financial reporting and potential audit issues. Automated systems enforce policy compliance, validate expense data in real time, and provide a clear audit trail, thereby reducing financial risks and enhancing the integrity of our financial data. Additionally, a data-driven approach enables you to identify cost-saving opportunities, negotiate better terms with travel providers, and optimise budget allocations.

Moreover, employees no longer have to spend time on tedious administrative tasks, allowing them to focus on their core responsibilities. This improved user experience has proven to boost morale and job satisfaction, leading to higher productivity and employee retention rates.

How modern businesses approach business travel expenses

By consolidating all expenses in one digital hub, your company gains a clearer picture and better control over its spending. This unified system simplifies how you manage expenses, offering a cohesive overview for easier tracking, reporting, and analysis.

Streamlining finance operations through automation minimises the need for manual labour. Today’s expense management tools handle everything from tracking to validation and reimbursements, saving time for both employees and financial teams.

Automation in expense management does not just make things faster; it also strengthens compliance. These tools ensure adherence to company policies and regulations by verifying expense data in real time and automating approval processes, thereby enhancing efficiency and reducing mistakes.

Speedier reimbursement is another advantage of automated systems. They expedite the approval and reimbursement phases, ensuring employees get their money back promptly. This can be a great relief for many team members as they might be working with a tight budget or use their own vehicle instead of a company car.

Going digital with expense management means ditching paper-based systems from start to finish. With digital receipts, e-approvals, and online reimbursements, you save trees and enhance efficiency, making processes smoother and more sustainable.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Virtual cards are a game changer

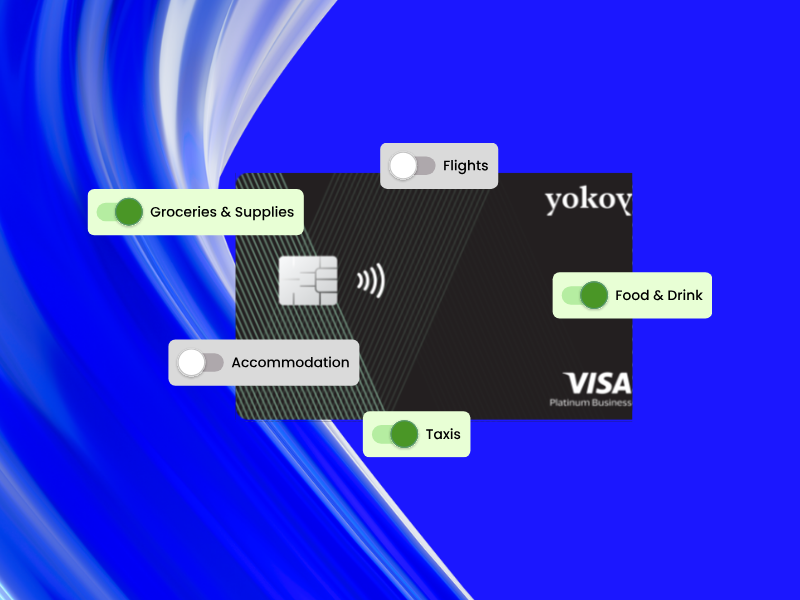

Virtual cards are emerging as a popular alternative to traditional corporate credit cards for managing business travel expenses. They offer a range of benefits that make them an attractive option for modern businesses.

Virtual cards can be issued immediately, eliminating the wait for a physical card to be delivered.

Cards can be limited by spend value, merchant type, or event, offering more control and support for travellers.

Improve or optimise efficiency

Ensure alignment with company policies

Mitigate risk

Support employees while travelling away from the office

Enhance the employee experience

The main benefit: Virtual cards can boost security and convenience by cutting down on the chances of loss or theft. They give immediate insight into spending, let you set spending limits, and ensure compliance with company rules. Plus, they simplify reconciliation by going digital, cutting out the need for manual input, which helps finance teams manage expenses more smoothly.

Losing a wallet or a physical card during a trip can turn into a major hassle for employees. Waiting for a replacement often means being stuck in a new place without access to funds for days. Virtual cards step in to solve this issue as they blend effortlessly with digital tools today. They fit right into a user’s digital wallet, letting employees pay easily through Apple Pay or Google Pay. This setup boosts user convenience and provides payment flexibility, especially when paying for travel costs such as airfare, congestion charge,tolls, parking fees, overnight stays or other transport costs online.

If an employee misplaces their virtual card or thinks it might be at risk, it can be instantly locked or replaced. Plus, spending limits can be changed right away to keep things secure, giving employees confidence and added safety while travelling.

Tip: The Yokoy Smart Lodge Card goes beyond being a virtual card by offering a clear overview of all spending. You don’t have to wait for end-of-month statements to get a handle on expenses. Both finance teams and employees can check a central dashboard to see all ongoing and completed transactions in real time. This not only simplifies keeping track of expenses but also aids in more effective budgeting and financial management. By adding the Yokoy Smart Lodge Card to your expense tracking system, you enhance control, clarity, and efficiency in handling travel expenses – all without transaction fees, foreign exchange fees, or card fees.

Blog article

How Virtual Corporate Cards Boost Expense Control and Limit Discretionary Spending

What challenges virtual corporate cards solve, what are their benefits, and why are virtual cards the perfect solution for limiting discretionary spending?

Lars Mangelsdorf,

Co-founder and CCO

How we help with travel expense automation at Yokoy

At Yokoy, we recognise the value of smooth travel planning for business trips. Our Yokoy Smart Lodge Card links up your travel management provider, making it a breeze to book flights, hotels, and transport all in one spot. This setup makes booking simpler, keeps travel spending in line with company rules, and offers a clear snapshot of all travel costs. With the Yokoy Smart Lodge Card, employees can handle all their travel bookings using just one card, cutting down on payment hassles and making expense tracking straightforward for everyone involved.

You know: handling corporate travel by hand can eat up a lot of resources. That is why Yokoy provides automated travel allowances that suit your company. Our system figures out allowances automatically, taking into account factors like where the trip is, how long it lasts, and why it is happening. Tailored approval processes make sure allowances get the green light from the right people, slashing the chance of mistakes and evading your enterprise’s travel policy.

Repaying for actual costs during business journeys is key to keeping employees happy. Yokoy’s expense system comes with tailored expense forms that fit your needs, making it a cinch for employees to file accurate expense claims. Our automated reimbursement setup speeds up the process, making sure employees get their money back fast. Regular updates keep everyone in the loop on the status of their claims, boosting transparency and keeping the lines of communication open between staff and the finance team.

Keeping tabs on employee travel expenses is vital for good financial health and compliance. Yokoy’s expense system gives you a real-time look at all company travel costs, complete with customisable spending limits, restrictions on where the card can be used, and instant alerts. Plus, the Yokoy Smart Lodge Card adds extra layers of security like instant card replacement, locking, and spending limit changes, upping the ante against fraud and unwanted charges. Even self-employed team members can receive and use a lodge card.

Yokoy’s expense system is loaded with compliance tools to help you stick to the script, pay tax and claim tax relief thanks to tax-deductible or tax-free expenses. Automated checks, rule enforcement, and live expense checks make following the rules easier than ever.

Next steps

Yokoy’s platform gives you a one-stop solution for managing all your expenses, from sourcing to billing. This holistic approach consolidates all spending, including travel expenses, for clearer oversight and better financial planning. Designed to work seamlessly with your current ERP, accounting, and HR tools, Yokoy brings consistency to your data and cuts down on manual errors. Its flexibility means it is adaptable, whether you are a startup or a big enterprise.

With Yokoy’s reporting and analytics features, you get deep insights into how money is being spent, helping with budgeting and tracking overall financial health. Its tools cover everything from easy travel bookings with the Yokoy Smart Lodge Card to automated travel allowances and quick reimbursements. You also get real-time spending updates, added security, and compliance features to make sure you are following all the rules.

Get in touch to see how Yokoy can streamline your travel expenses and support your business growth.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.