Home / Streamlining Expense Approvals with Automation

Streamlining Expense Approvals with Automation

- Last updated:

- Blog

You may have experienced this yourself: Traditional expense approval methods often slow down operations and can cause costly errors for the company. Further on, those issues can lead to severe inefficiencies and plenty of wasted resources. Enter automation—a true game-changer for expense management. By streamlining and digitising approval processes, automation helps you accelerate workflows, boost accuracy and reduce the risk of non-compliance. In this article, we explore how adopting automated expense approvals can revolutionise financial management, offering both immediate improvements and long-lasting advantages for your organisation.

Definition and importance of expense approval automation

With expense approvals being a fundamental component of financial management, you should make it a priority that expenditures are authorised and aligned with organisational policies. Broadly speaking, expense approvals can be classified into two categories:

Pre-approved expenses are expenses that receive approval before they are incurred, often as part of a budget or project plan.

Post-expense approvals occur after the expense has been made and require a review and approval process to validate the expenditure.

Traditionally, managing these approvals needs significant manual effort for data entry and validation—a real burden for your team that is time-consuming and error-prone. Automated expense approval systems, however, use advanced technology to handle these tasks efficiently.

Expense approval automation refers to the use of digital tools and workflows to streamline the approval process, reducing the need for manual intervention. The importance of this automation cannot be overstated. It helps in expediting approval cycles, helps you adhere to your company’s policies, and significantly cuts down on administrative loads. But let’s clarify all the benefits in the following chapters!

Benefits of automating expense approvals

The shift to automated expense approvals offers plenty of advantages. Here are five main benefits that could convince you to automate the entire process.

Cost savings: Automation reduces the need for manual processing and the associated administrative costs. By minimising the amount of time spent on managing expenses, organisations can achieve significant cost efficiencies.

Increased productivity: With routine tasks handled automatically, employees and your finance department can focus on more strategic activities. This shift leads to enhanced productivity across the board as less time is spent on administrative work.

Reduced manual errors: Human error is an inevitable part of manual processes. Automated systems reduce these errors by handling data entry and approval workflows with precision, leading to more accurate records and fewer discrepancies.

Increased compliance: Automated systems can help enforce compliance with company policies and regulatory requirements consistently. By automating policy checks and approval workflows, organisations ensure that all business expenses are in line with set guidelines, reducing the risk of non-compliance.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

How expense automation tools make work easier

Expense automation tools come equipped with a range of features designed to simplify and enhance the expense approval process.

Receipt scanning and OCR

One of the most time-consuming aspects of expense management is manual data entry. Employees must submit physical or digital receipts, which then need to be processed by the finance team—a process that often leads to delays, errors, and frustration. This is where receipt scanning and OCR (Optical Character Recognition) technology comes into play.

OCR technology allows users to simply take a photo or upload an image of their receipt, which the system then reads and converts into structured data. The key details—such as date, vendor, amount, and category—are automatically extracted and entered into the expense report. The benefits of this technology are immense:

Employees no longer need to enter receipt details.

By eliminating manual data entry, the system reduces the risk of human error.

Employees can submit expenses on the go, directly from their smartphones, with no need to hold on to paper receipts.

OCR helps ensure that all receipts are processed similarly to standardise data across the organisation.

Automated workflows

At the heart of expense approval automation are automated workflows, which replace traditional, manual expense approval processes. In many businesses, expense approvals can involve multiple layers of review, with requests being passed back and forth between managers and finance teams. This manual approach is slow and prone to bottlenecks, especially during busy periods or when employees are spread across multiple locations. Automated workflows streamline this entire process by routing expense reports through a pre-configured approval path. Some of the advantages include:

Automated expense approval workflows can be tailored to fit your organisation’s specific approval rules, ensuring that business expenses are routed to the correct approvers based on factors such as department, amount, or project code.

Approval requests move through the system much faster, with notifications and reminders automatically sent to approvers.

Automated systems track and record every step of the approval process, providing a transparent audit trail. Approvers can see who has already reviewed the request, while finance teams can quickly identify where delays are happening.

Rules can be set up to handle varying approval thresholds automatically. For instance, lower-value expenses might be approved with fewer reviews, while higher-value expenses are escalated to senior management.

Automated workflows can help enforce compliance by automatically flagging any expenses that fall outside company policy or budget.

Integration with accounting systems

Expense automation doesn’t end with approvals. The real power of automated systems lies in their ability to integrate directly with the company’s accounting software, closing the loop between expense submission and financial reporting.

When integrated, expense data flows seamlessly from the approval system into the accounting platform, eliminating the need for manual data transfer. This integration provides several key benefits:

With expenses being automatically fed into the accounting system, finance teams can access up-to-date expense data.

Manual data transfers are prone to errors, such as mistyped numbers or incorrect categories.

The integration allows for smooth reconciling expenses with company credit cards or other payment methods.

Integrated systems make complying with tax and audit requirements easier, as expenses are recorded accurately.

When expenses are integrated with the accounting system, custom reports that provide detailed insights into spending patterns, budget tracking, and departmental expenditures are easier to generate.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Rethink your expenses – with Yokoy's holistic spend management solution

Yokoy offers an innovative and comprehensive platform designed to streamline your company’s entire expense management process. With cutting-edge technology, Yokoy simplifies expense approvals and gives you full control over how expenses are managed, tracked, and reported. Let’s dive into the critical features of Yokoy’s holistic spend management solution!

Receipt scanning and data capture

Yokoy’s advanced receipt scanning technology significantly reduces the manual workload involved in submitting and processing expenses. Your employees no longer need to input details from paper receipts tediously. Instead, Yokoy’s system allows users to snap a photo of their receipt or upload a digital file, and the platform immediately begins processing.

The scanning feature uses OCR (Optical Character Recognition) to extract data from receipts instantly. As soon as the receipt is scanned, the data is captured and made available in real time, speeding up the entire expense reporting process and allowing your team members to submit their claims on the go.

Automated data extraction

Beyond receipt scanning, Yokoy employs powerful AI-driven algorithms to extract and interpret key information from receipts and invoices automatically. Without human intervention, the system identifies essential details like VAT amounts, payment methods, and expense categories. By using AI to pull out relevant information from receipts, invoices, and other documents, Yokoy considerably minimises the risk of errors that could otherwise occur from manual input or oversight.

Customisable workflows

Expense approval processes are never one-size-fits-all, and Yokoy understands the importance of tailoring workflows to meet the specific needs of each organisation. Our platform offers fully customisable workflows, allowing managers and CFOs to design approval processes to fit their internal structure and policies. Approvals can be routed based on factors such as expense type, department, employee level, or spending limits. For example, minor expenses might follow a more straightforward approval path, while higher-value claims are escalated for senior management review.

Another benefit: Yokoy’s workflows can be adjusted and scaled as your business grows or evolves. Whether your organisation operates across multiple teams or regions, the platform adapts to provide flexibility while controlling expenses. If an expense report is delayed in the approval process, Yokoy can automatically escalate the request, sending reminders or routing it to another manager to avoid bottlenecks.

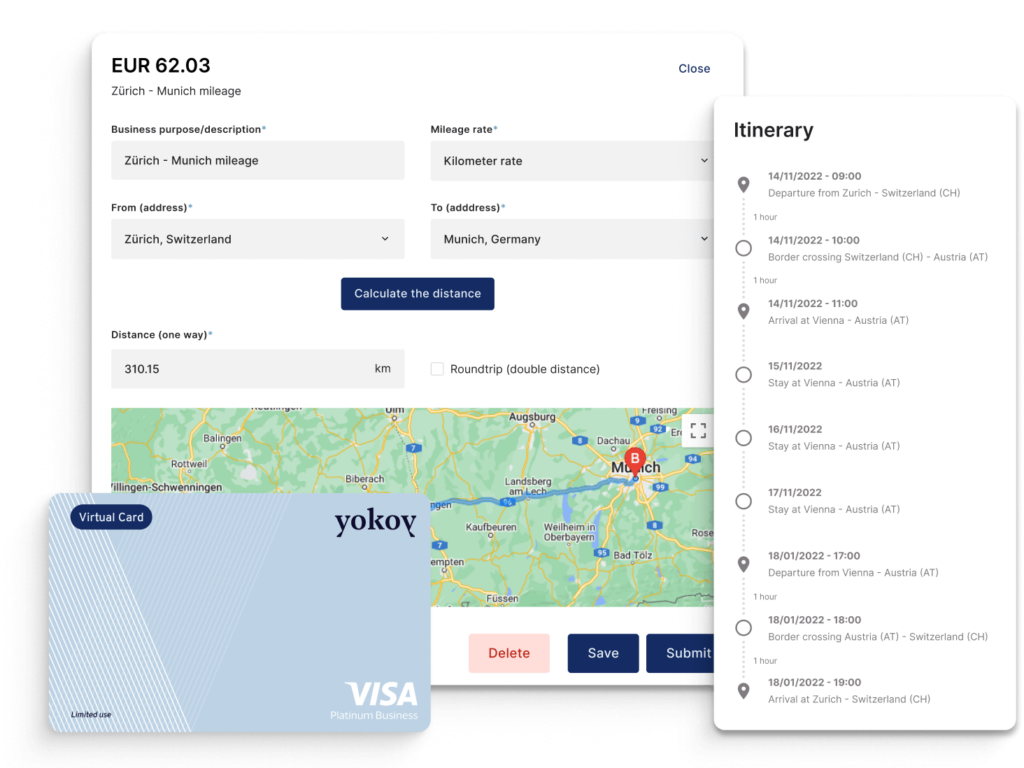

Integration with your travel expense management solution

Yokoy is not an isolated platform; it seamlessly integrates with existing travel expense management solutions, so travel-related expenses are captured, processed, and approved within the same system. By integrating with travel booking and management platforms, Yokoy provides a single entry point for all types of expenses—whether related to travel, accommodation, or general business spending.

Travel expenses often involve quite complex interactions between multiple providers—from hotels and airlines to car rentals. Yokoy’s integration with travel systems ensures that these expenses are automatically matched with receipts and invoices, simplifying the expense reimbursement process for finance teams.

Country-specific controls

Global businesses must navigate various regulatory environments, and ensuring compliance across different jurisdictions can be challenging. Yokoy’s platform is equipped with country-specific controls to manage the complexities of local laws and tax regulations, helping ensure that expenses meet tax requirements, such as VAT reclaim eligibility or local per diem limits. This capability is particularly beneficial for multinational companies operating in different regulatory areas.

Built-in expense policies

One of the key challenges of managing expenses is ensuring adherence to company policies. Yokoy’s system comes with built-in expense policy enforcement, which means that company rules are automatically applied during the expense submission and approval process.

As employees submit expenses, the platform instantly checks for policy violations—such as exceeding daily limits, using unauthorised vendors, or submitting duplicate claims. This real-time check prevents non-compliant expenses from reaching the approval stage. But that is not all: Yokoy allows businesses to define and enforce their own set of rules, including spending limits, travel restrictions, or mandatory receipt submission for certain expense types.

End-to-end expense automation

Yokoy also delivers true end-to-end expense automation, meaning every step of the expense management journey is streamlined—from initial receipt capture to final approval. Once a receipt is scanned, the system captures the data, processes the approval, checks compliance, and integrates the information into the accounting system—all with minimal human involvement.

On top of this, detailed reports and dashboards provide insights into spending trends, policy adherence, and potential areas for cost savings. Yokoy’s platform integrates with existing accounting, ERP, and HR systems, ensuring that expense data flows seamlessly into your financial reporting and payroll processes.

Best practices for implementing expense automation

We hope that we could showcase sufficiently how beneficial automating expense approvals within your expense management system can be—from cost savings and increased productivity to improved accuracy and compliance. We at Yokoy are convinced that by adopting an automated approach, your organisation can transform its expense management processes and enhance overall financial performance. Consider booking a demo today to explore how Yokoy’s solutions can streamline your expense approvals and provide a comprehensive view of your spending.

Next steps

Discover how Yokoy can revolutionise your expense management with AI-powered automation, seamless e-receipt handling and easy integration into your existing systems. See how it can enhance your company’s efficiency, improve accuracy and streamline your financial processes. Book your demo today!

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.