Home / From $456K Lost/Year, to Full Spend Control: Three Process Changes You Can Implement Today

From $456K Lost/Year, to Full Spend Control: Three Process Changes You Can Implement Today

- Last updated:

- Blog

Co-founder & CFO, Yokoy

In the current economic context, with inflation peaking and recession looming, companies – mainly their finance departments – are under pressure to control costs and cut unnecessary spending. The fastest way to do this is to identify hidden costs – nothing new here, but oftentimes, this task proves to be more challenging than it should.

Given the advancements in spend management technology, you’d expect companies to be on top of their spending. But the truth is that even organizations who’ve entirely digitalized their finance departments years ago are still lacking full visibility into their expenses. And this makes it virtually impossible to accurately and timely calculate how much money they’re losing, where, and why.

As real-time data is key for any company in a fast paced environment, decision makers should not have to wait until the end of the month or quarter to discover unplanned money drains. So here are three levers you can pull today to stop the leakage and gain back control over your spend.

The black box of corporate spend

Having worked with hundreds of mid-sized and enterprise companies from all over the world over the past few years, we know that the most common causes of complaints over cost control topics are:

- Missing control over corporate card spendings and handling of active cards,

- No insights into spend patterns such as supplier spend overviews or costs for business trips,

- Unclaimed tax returns, often resulting from a lack of knowledge when it comes to international rules and regulations,

- Duplicate invoices or expense claims caused by human error and/or fraud,

- Inefficient ways of working which waste personnel’s time, therefore costing the company money.

In a small organization, such spendings and inefficiencies might go unnoticed, and the potential tax returns might be too insignificant to be worth the effort.

But at scale, in companies with hundreds or thousands of employees and millions in spending, these costs quickly add up, and what looks isolated like a low cost issue expense today can easily – and quietly – turn into a $456k/loss per year.

So how do you prevent this from happening? The short answer is end-to-end visibility.

Three process changes for total visibility and spend control

"Even organizations who’ve entirely digitalized their finance departments years ago are still lacking full visibility into their spending."

Thomas Inhelder, CFO at Yokoy

When customers approach us saying that they lack visibility into their corporate spend, they don’t necessarily mean data.

In the same way, a lack of control rarely means a lack of policies. In fact, most of our customers are using some data collection and reporting mechanism and have a set of policies in place when they turn to us.

What they usually lack is real-time overview of their expenses and processes, as well as real-time checks and automated enforcements to prevent policy breaches.

Without these in place, the process is rather reactive, and there’s no real way to know if budget leaks occur or receipts and invoices get stuck in approval flows.

If this sounds familiar, here’s what you can do to gain full visibility into your company’s spending and prevent hidden costs from draining your budget.

1. Centralize operations and data streams

Bring your expenses, invoices, card payments and tax reclaims under one roof, by centralizing both your processes and your data streams into one end-to-end spend management platform. This will act as your single source of truth for all your corporate spend.

From a process point of view, this eliminates bottlenecks by providing your team with a central cockpit for all operations, and ensures better governance, as all workflows, rules, and restrictions are built into one platform.

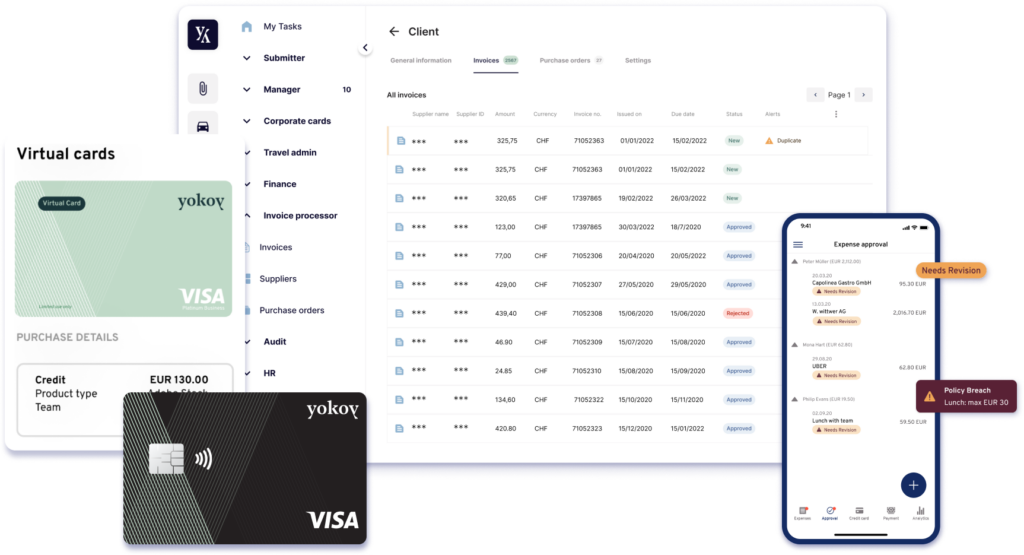

With Yokoy, for example, you can monitor spendings – including card payments – very closely, in one central place and in real time, so you can react fast through options such as instant freezing or limit changes for particular cards deposited with suppliers.

Furthermore, using one system instead of multiple point solutions reduces the number of integrations required for end-to-end automation, and saves your team time by eliminating the need of switching between systems for data checks and expense approvals.

Finally, one central platform for all your data ensures not only better visibility but also cleaner data and easier exports and financial audits, especially when using open APIs for integrations.

Fenaco standardized their expense management with Yokoy

“With Yokoy, we have opted for a uniform and group-wide expense management solution that unifies our different expense processes on one platform and automates them across organizations, for increased efficiency.”

Marianne Schluep, Head of Finance and Accounting

2. Eliminate errors and hidden costs with AI

Once all your payments are centralized in one single platform, employ AI to automate the logic of your process, from end to end.

At Yokoy, for example, we use AI to automate the logic of most steps, from receipt checking and reconciliation with card transactions to invoice processing and VAT reclaims.

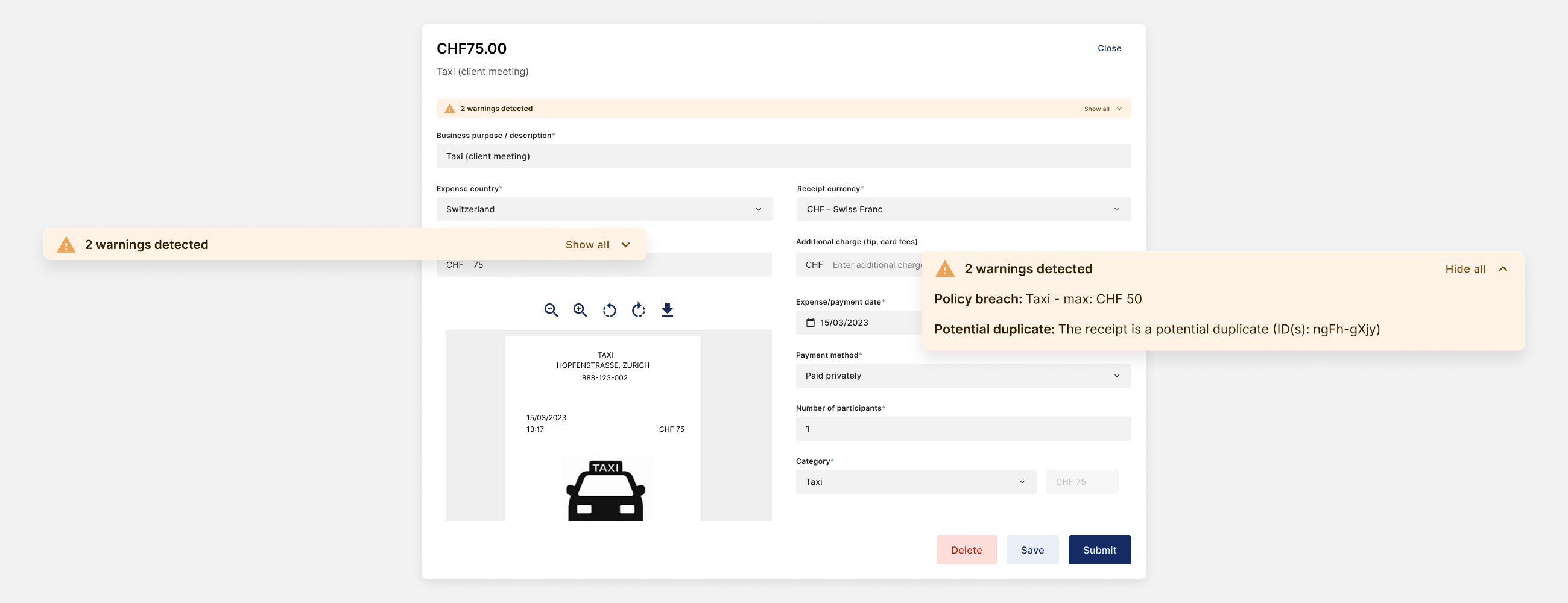

AI takes over the compliance checks for internal and external policies too, by identifying duplicates and outliers, and signaling questionable invoices or expenses in real time. This way, we achieve efficiency without compromising on security.

It’s this combination of data centralization and AI-powered governance and automation that is helping customers to identify non-compliant items and saving potential, while serving as a basis for procurement to potentially negotiate better rates with suppliers.

By using Yokoy’s analytics capabilities customers are able to detect unusual patterns in their spendings – for example, hidden increases in material costs for a supplier. Once rules are implemented and custom approval flows set up, the risk of budget leaks can be significantly reduced.

3. Increase efficiency through automation

While AI helps you save money by unveiling hidden costs and ensuring governance over tax risks and process flows, the automation of process steps through workflows saves your team time by helping them work more efficiently.

In the end, this translates into savings too, as a single receipt can cost you around $60 to process.

"Through automation, our customers eliminate 80% of their invoice processing tasks, saving 300 days / year in manual work."

Thomas Inhelder, CFO at Yokoy

Looking for example at the expense process, with most tools, employees have to take a picture of a receipt, upload it into the expense management system, and manually add the data into the dedicated fields.

From there, the finance team goes into checking and approval mode: if the expense is in line with company policy and is approved, your finance team then needs to figure out the account to book it, the VAT to reclaim, and where to archive it.

All of this costs a lot of time: GBTA data shows that companies spend 20 minutes on every expense report that needs to be processed. Moreover, almost one fifth (19%) of expense reports contain errors, and this adds an additional 18 minutes – and $52 – which goes into correcting the expense report.

Automating this process can save you 3,000 hours of manual work and almost $500k/year, for an average volume of 50k reports processed. And this applies to invoice processing as well.

With Yokoy, for example, AI takes over the matching of invoice line items to PO line items and checking against good receipts forms. Through automation, our customers eliminate 80% of their invoice processing tasks, saving 300 days / year in manual work for an average volume of 60k invoices processed.

We’ve covered these process changes, as well as the benefits of transforming your spend management, in the webinar below.

Webinar

The CFO's Blueprint for Spend Management Transformation

Learn how to get a holistic view of your spend management process to easily identify inefficiencies, streamline operations to remove system and data silos, and use real-time analytics to eliminate risks, control costs, and plan ahead.

Conclusion

At Yokoy, we transform the way corporate spend is managed. We’re building a future where companies manage their money safely, efficiently and compliantly, with as little human intervention as possible, by relying on AI and automation.

We’d like to have you on board!

So if you’d like to see how much money you’re losing yearly, try out our ROI calculator here, or jump on a call with our team – we’ll gladly look at your specific situation and walk you through your potential savings!

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.