Home / Navigating Global Business Travel and Multi-Currency Spend

Navigating Global Business Travel and Multi-Currency Spend

- Last updated:

- Blog

Managing global business travel and multi-currency expenses has become increasingly complex for finance teams. Challenges like fluctuating exchange rates, varying tax regulations, and compliance issues add layers of difficulty. However, with the help of automation and artificial intelligence (AI), this process is being revolutionised, making handling cross-border spending easier, reducing manual workloads and staying compliant. Let’s explore how your company can leverage these technologies to gain better control over its international expenses — from Europe to Singapore — making your travel experiences easier and smoother.

Increasing globalisation leads to more cross-border business travel

Globalisation has increased the frequency of cross-border business travel significantly. With companies expanding their operations across international markets, finance teams are now dealing with a surge in travel spending from various countries, each with its local currency, tax regulations, transaction fees and compliance requirements. This increasing complexity can make it challenging to accurately track, report and manage these expenses — especially when fluctuating exchange rates add another layer of difficulty.

Managing expenses across different currencies is a complex task for accounts payable (AP) teams. Frequent currency fluctuations can lead to discrepancies in reporting manually, converting expenses into a single currency, increasing the risk of errors. Additionally, ensuring compliance with local financial regulations across multiple jurisdictions can be time-consuming and prone to mistakes that can be easily overseen within all that hassle. This complexity underscores the need for automation and AI-driven solutions that can streamline multi-currency expense management and enable finance teams to maintain accuracy and control over their corporate travel spending while keeping an eye on profitability.

Impact of increasing global business travel on AP teams

Managing travel and expense (T&E) for international corporate travel is an intricate process due to the wide range of regulations and requirements that vary from one country to another. For AP teams, this means staying on top of constantly changing rules and standards to ensure compliance and avoid costly fines or even reputational damage.

Here’s a closer look at the specific regulations that AP teams need to consider:

Foreign exchange rates: Currency exchange rates are in constant flux, which can significantly impact the cost of business travel and expense reporting. AP teams must monitor these fluctuations in real-time to ensure accurate reporting and correct reimbursement amounts. If expenses are recorded at outdated exchange rates, this could lead to discrepancies in financial reports, affecting the company’s financial integrity.

Travel policies: Different countries have varying travel policies that govern allowable expenses for business trips, such as accommodation, meals, and transportation. For example, some countries may have strict limits on the types of expenses that can be reimbursed, while others might require detailed receipts for even minor expenses. AP teams need to stay updated on these policies to ensure all employee expenses align with both internal guidelines and local regulations.

Per diems: Daily allowances for meals, accommodation and incidental expenses — so-called per diems — vary widely between countries and even within regions of the same country. For example, per diem rates are lower in mainland China than in larger cities like Hong Kong. These rates can change frequently, so regular checks of government websites or local authorities are a must to ensure that your finance teams’ per diem calculations remain accurate. Incorrect application of per diem rates can lead to non-compliance issues and potential tax liabilities.

Tax regulations: Tax rules concerning travel and expenses differ significantly across borders. For instance, VAT (Value Added Tax) rates vary, and some countries allow VAT refunds on travel expenses while others do not. AP teams must know which expenses are taxable, how to handle VAT reclaims and the specific documentation required to support these claims. Keeping track of the latest tax legislation changes is essential to avoid costly non-compliance penalties.

Currency volatility: An additional challenge for AP teams is managing international expenses under currency volatility, as sudden shifts in currency values can alter the actual pricing of expenses and impact budgeting and reporting accuracy. AP teams need to work with solutions that provide real-time currency conversion rates to ensure they capture the most accurate financial data.

Compliance challenges: Ensuring compliance with local, regional, and international regulations is one of the most significant challenges faced by AP teams. This involves understanding anti-bribery laws, data privacy regulations, and travel-related compliance requirements, such as obtaining the right visas or adhering to immigration laws. Maintaining compliance is an ongoing effort that requires AP teams to regularly monitor regulatory changes, update internal policies, and train employees on best practices.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

What’s important when managing multi-currency spend

When managing multi-currency expenses, companies face a series of complexities that require careful planning and management to avoid costly mistakes and maintain financial accuracy. By focusing on these key areas—currency conversion, expense reconciliation, and FX hedging—companies can effectively manage the complexities of multi-currency spending, reduce financial risks, and gain greater control over their global expenses. Implementing automated and AI-driven solutions can further streamline these processes, allowing finance teams to operate more efficiently and accurately in an increasingly global business environment.

Currency conversion

A fundamental challenge in managing multi-currency expenses is currency conversion due to the constantly fluctuating nature of exchange rates. Ensuring that all expenses are correctly recorded, reported, and reimbursed in the company’s base currency is only possible while adhering to accurate currency conversion. Using outdated or inaccurate exchange rates for USD or EUR can lead to discrepancies in expense reports and financial statements. In the end, this can affect overall financial visibility and accuracy.

Expense reconciliation

Reconciling expenses in multiple currencies can be a time-consuming and error-prone process. When dealing with various currencies, AP teams need to ensure that expenses match the corresponding receipts and bank statements, all while factoring in the currency conversions and exchange rate fluctuations that may have occurred between the transaction date and the reconciliation date. In addition, transaction fees can be charged using the chosen payment methods.

FX Hedging for large transactions

Foreign exchange (FX) hedging is a strategy used by companies to protect themselves against the risk of currency fluctuations, especially when dealing with large international transactions. When a business expects to make a significant payment in a foreign currency, sudden changes in exchange rates can greatly impact the cost. FX hedging tools, such as forward contracts or options, allow companies to lock in exchange rates for future transactions, providing more predictability and control over costs. For AP teams, it’s crucial to identify which transactions warrant FX hedging and to implement strategies that minimise currency risk, ensuring that large expenses don’t unexpectedly impact the company’s bottom line.

Mitigating risks and maximising efficiency in multi-currency spend

Now let’s look at how your finance team can gear up for efficiently using multi-currency spending while mitigating risks:

Best practices for AP teams: Your AP teams should standardise their expense reporting and currency conversion processes to maintain clarity and minimise possible errors. Adopting spend management automation tools can streamline processes, ensuring accurate real-time currency conversions and reducing manual work. Staying updated on exchange rate fluctuations and centralising all multi-currency expense data in a single system enhances accuracy and simplifies reporting.

Partnering with FX providers: Engaging with a reliable foreign exchange provider can help manage currency volatility more effectively. These providers offer competitive exchange rates and hedging solutions, such as forward contracts, to lock in favourable rates for future transactions. By tapping into their market insights, your AP team and financial leaders can make more informed decisions about handling multi-currency transactions.

Using analytics for spend insights: Advanced analytics allow AP teams to identify spending trends, enabling better control over expenses and more accurate budgeting. By using data to monitor currency trends and spending patterns, teams can forecast future expenses and identify opportunities for cost savings, ensuring more efficient management of multi-currency spending.

Fraud prevention: Multi-currency transactions are particularly susceptible to fraud. Implementing spend controls, using AI-driven fraud detection tools to identify and flag unusual activities. Conducting regular audits can help reduce the risk of fraudulent transactions additionally. These measures enable your AP team to detect and respond to potential fraud quickly.

Regulatory compliance: Maintaining compliance with diverse and ever-changing international regulations is essential. Your finance and AP team must stay informed of regulatory changes. With the help of automated tools to monitor compliance requirements across different jurisdictions, you can keep accurate, detailed records of all transactions and ensure adherence to regulations during audits and checks.

White paper

The Future of Travel and Expense Management

After massive slumps caused by the pandemic, business travel is finally recovering. However, macroeconomic challenges are slowing the catch-up effect, forcing finance and travel leaders to cut costs by limiting business trips.

How can companies adapt?

Simplify multi-currency expense management with automation

As you might guess, leveraging modern technology can improve, simplify and transform your expense management for the better. By implementing strategies that include automation and intelligent technology, your finance team can effectively manage multi-currency spending while mitigating risks and maximising efficiency.

Here are some points where automation comes in very handy for your expense management:

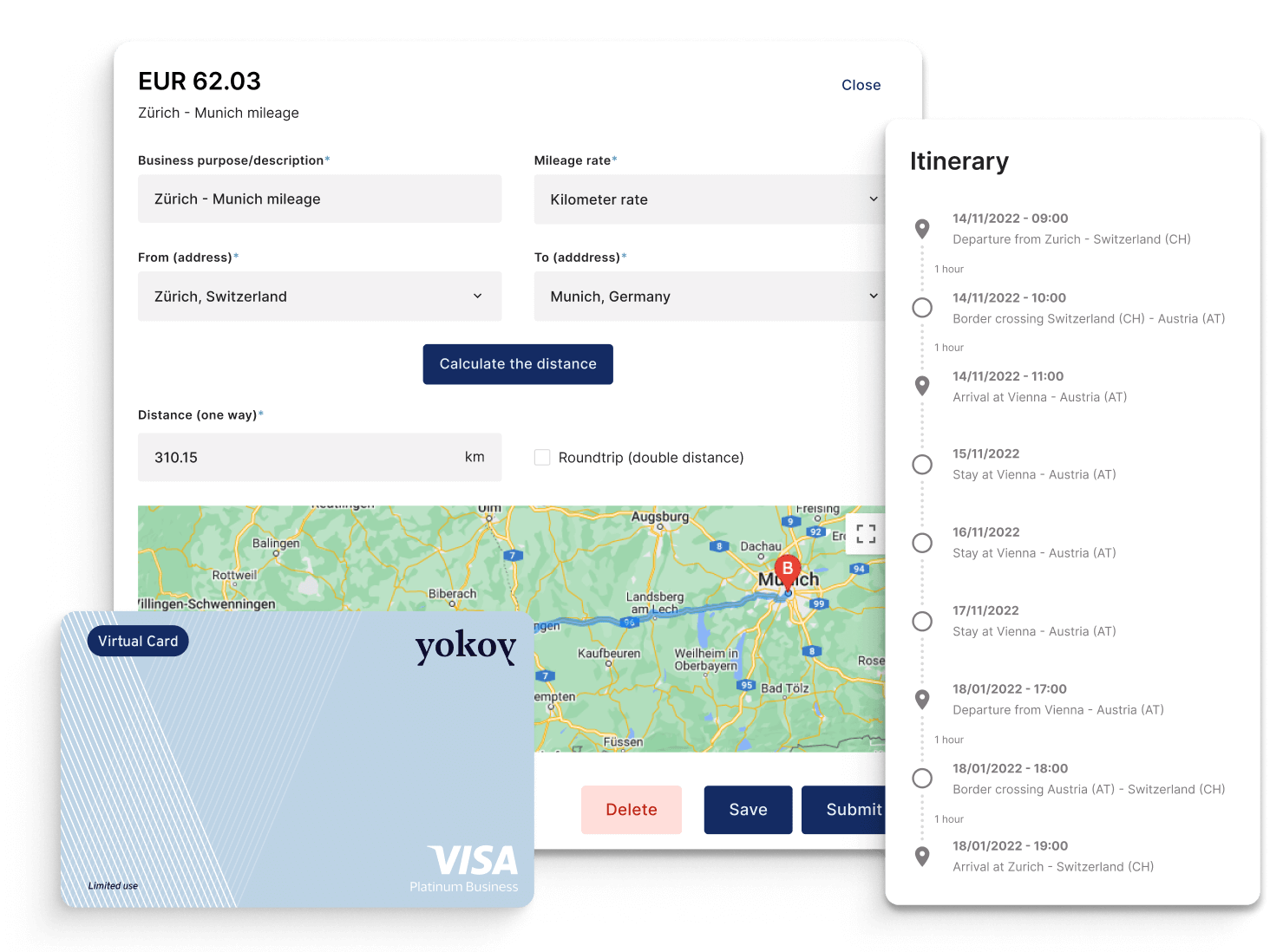

Automated expense reporting

With automation, multi-currency expense management can significantly streamline the entire reporting process: Employees can easily submit expenses using mobile apps, where receipts are scanned and converted into digital data instantly, using intelligent optical character recognition (OCR) technology. Real-time currency conversion ensures that expenses are accurately recorded in your company’s base currency, eliminating the need for manual data entry and thereby reducing errors. Automated expense reporting not only saves time but also ensures that your AP team has access to up-to-date, accurate financial data for better decision-making.

Integration with corporate cards

Corporate credit cards further simplify multi-currency expense management, as they can be integrated with expense management solutions. Transactions made with these virtual cards are automatically captured, categorised and matched with receipts, reducing the need for manual entry and reconciliation. This seamless integration of this modern payment solution ensures that all expenses are accurately tracked, regardless of the currency in which they were incurred, making it easier for your AP team to monitor spending patterns, control budgets, and streamline the reimbursement process. This can also be beneficial for your employees as they have less hassle with collecting bank statements or receipts.

Built-in expense policies

Automation solutions come with built-in expense policies that enforce compliance from the moment expenses are recorded. These policies can be customised to align with your company’s travel and expense guidelines, such as allowable spending limits, per diem rates, and eligible expense categories. By automatically flagging non-compliant expenses, your AP team can quickly identify potential issues, ensuring that all expenses adhere to internal policies and reducing the risk of fraudulent or unauthorised claims.

Custom workflows

Automated expense management systems offer the ability to create custom workflows that streamline the approval process. These workflows can be tailored to match your organisation’s structure, routing expenses through the appropriate channels based on factors such as the expense amount, department, or project. Such custom workflows ensure that multi-currency expenses are approved efficiently, reducing bottlenecks and speeding up the reimbursement process while maintaining full visibility and control.

AI for compliance and accuracy

AI-driven technology plays a crucial role in helping to ensure compliance and accuracy in multi-currency expense management. AI tools can detect anomalies, inconsistencies, or potential fraud by analysing spending patterns and comparing them to established policies or historical data. Additionally, AI-powered systems can handle complex tasks such as currency conversions, tax calculations, and regulatory compliance checks with a high degree of accuracy, reducing the risk of non-compliance and ensuring that expense reports are always accurate.

Next steps

As you see, there is a lot of good in modern expense management solutions that leverage automation and AI-driven tools. For example, MedSkin successfully unified and streamlined its travel and expense management by integrating Yokoy with TravelPerk. With sped-up and automated processes, the company was able to save up to 251 work hours per year. This partnership enabled MedSkin to speed up the processing time of financial reports by 12 times while reducing costs by 26%.

If you’re ready to simplify your company’s travel and expense management, explore how Yokoy can transform your processes.

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.