Home / Invoice Capture Solutions: From Manual Processing to OCR and AI Technology

Invoice Capture Solutions: From Manual Processing to OCR and AI Technology

- Last updated:

- Blog

Growth Marketing Manager

For years, manual invoice processing has been the norm, but it comes with its own set of challenges. From data entry errors to time-consuming workflows, finance professionals have long sought ways to streamline this critical aspect of their operations.

Enter OCR (Optical Character Recognition) and AI (Artificial Intelligence) technology – two game-changers in the realm of invoice capture. These cutting-edge solutions have ushered in a new era of efficiency, accuracy, and productivity, revolutionizing how finance departments manage their invoices.

In this article, we will embark on a journey through the landscape of invoice capture methods, starting from the traditional manual processes and venturing into the exciting realms of OCR and AI technology.

We’ll explore how these innovations are reshaping the way finance professionals work, enabling them to navigate the complex world of invoices with precision and ease.

What does it mean to capture an invoice?

Capturing an invoice refers to the process of gathering and recording essential information from an invoice, typically received from a vendor or supplier. This information includes critical details such as invoice number, date, vendor details, line items, quantities, prices, and any applicable taxes.

The objective is to transform the invoice, often in paper or digital format, into a structured and digital data format that can be efficiently processed, validated, and recorded within an organization’s financial systems.

Key steps in the invoice capture process

- Receipt: The initial step involves receiving the invoice, whether it’s in a physical or electronic form.

- Data extraction: The relevant data is extracted from the invoice. In manual processes, this is done by manually entering the information into accounting systems. With OCR and AI technologies, this step is automated, greatly reducing the need for manual data entry.

- Validation: The captured data is verified for accuracy and completeness. Any discrepancies or errors are flagged for resolution.

- Approval workflow: In many organizations, invoices must go through an approval workflow where various stakeholders review and authorize the payment.

- Recording: Finally, the invoice data is recorded in the organization’s accounting software, updating financial records and reflecting the obligation to pay the vendor.

Efficient invoice capture is fundamental for accurate financial management, timely payments, and compliance.

Manual invoice capture: The traditional approach

Manual invoice processing has been a longstanding practice in finance departments across industries. This traditional approach involves physical invoices, often received in paper format, that need to be manually sorted, entered into accounting systems, and approved for payment.

It’s a labor-intensive process that has its fair share of challenges.

To name just a few:

-

- Data entry errors: Manual data entry is susceptible to errors, including typos, misinterpretations, and misplaced decimal points. These errors can lead to discrepancies and payment delays.

-

- Time-consuming workflows: The manual handling of invoices involves multiple steps, from sorting and data entry to approval routing. This can result in slow processing times and bottlenecks.

-

- Limited visibility: Tracking the status of invoices and gaining real-time insights into financial obligations can be challenging with manual systems.

-

- Costs and compliance risks: The cost of manual processing, including labor and physical storage, can be substantial. Additionally, compliance issues may arise due to missed deadlines or lost invoices.

According to research by the Institute of Finance & Management (IOFM), manual invoice processing can cost an organization up to $25 per invoice in processing costs. Moreover, manual data entry has an error rate of 1-5% per character, contributing to inaccuracies in financial records.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Invoice OCR - Going from paper to digital invoices

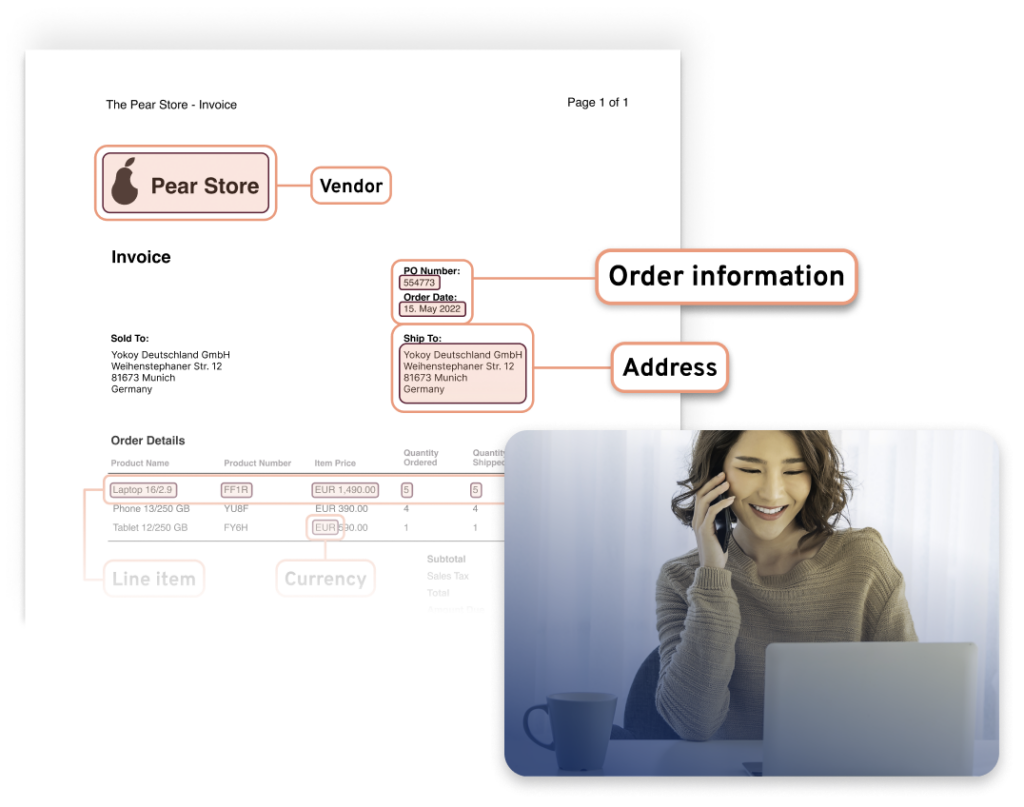

Optical Character Recognition (OCR) technology plays a pivotal role in modernizing invoice capture. It’s a sophisticated system that scans and interprets printed or handwritten text, turning it into machine-readable data.

In the context of invoice capture, OCR extracts vital information from invoices, such as invoice numbers, dates, amounts, and vendor details, with remarkable precision.

How OCR transforms invoice processing

When it comes to invoice capture, OCR (Optical Character Recognition) technology brings a multitude of advantages that can transform how finance professionals handle invoices:

- Enhanced data extraction: OCR goes beyond basic data entry by intelligently extracting key information from invoices, such as invoice numbers, dates, amounts, and vendor details. This structured data is invaluable for automation and reporting.

- Error reduction: The automation provided by OCR minimizes the chances of data entry errors, ensuring that your financial data is error-free and compliance-ready.

- Improved accuracy: OCR software excels at reading and interpreting text, significantly reducing the risk of human errors associated with manual data entry. This translates to more accurate financial records and reduced discrepancies.

- Speed and efficiency: OCR processes invoices at remarkable speeds, swiftly converting paper or digital documents into machine-readable data. This acceleration of the capture process results in faster approvals and payments.

- Cost savings: Reduced manual data entry requirements and increased efficiency lead to substantial cost savings in terms of labor and operational expenses.

However, invoice OCR technology has its limitations.

Limitations of invoice OCR technology

While Optical Character Recognition (OCR) technology has significantly improved the efficiency of invoice capture, it does have limitations when compared to the capabilities of Artificial Intelligence (AI). So let’s explore the constraints of OCR and how AI can overcome them.

1. Handling unstructured data: OCR excels at extracting structured data, such as numbers and text, from invoices. However, it struggles when faced with unstructured data or irregular layouts. For example, handwritten notes or invoices with non-standard formatting can pose challenges for OCR systems.

2. Limited contextual understanding: OCR focuses on text recognition but lacks contextual understanding. It may not interpret the meaning behind the text it captures, which can be crucial for tasks like invoice categorization or identifying discrepancies.

3. Inability to learn and improve: OCR is primarily rule-based and doesn’t have the capability to learn or adapt over time. It relies on fixed rules for data extraction, which can be limiting as invoice formats evolve.

4. Limited data validation: OCR is efficient at extracting data, but validating it for accuracy often requires manual intervention. For instance, verifying that an invoice’s total matches the sum of its line items can be challenging for OCR alone.

5. Scalability: As OCR is rule-based, scaling its capabilities to handle a wide range of invoice types and languages can be cumbersome and time-consuming.

In summary, while OCR has been a valuable tool in invoice capture, artificial intelligence surpasses its limitations.

Invoice AI technology

AI’s ability to handle unstructured data, understand context, continuously learn, automate data validation, and scale effortlessly makes it a more comprehensive solution for modern finance teams looking to optimize their invoice processing workflows.

Structuring and validating complex data

AI, with its machine learning capabilities, can adapt to unstructured data.

Artificial intelligence software employs techniques like OCR and deep learning to “read” the textual and numeric information on invoices. It recognizes patterns in the data, such as the consistent format of invoice numbers, dates, and line items.

Additionally, AI can detect handwriting and non-standard fonts, converting them into machine-readable text.

At the same time, artificial intelligence can automate data validation processes. It cross-references invoice data against predefined rules and historical patterns, flagging discrepancies for review. This reduces the need for manual validation, improving accuracy and efficiency.

In the article below, we’ve detailed how Yokoy’s invoice processing module uses AI to fully automate the handling of invoices, from capture to validation, matching, and approval.

Blog article

Automated Invoice Processing: Process Steps and How to Get Started

What is invoice processing automation all about? Learn how AI-powered invoice automation works and how it can help you save time, reduce risks, and improve your view of cash flow.

Mauro Spadaro,

Product Manager

Contextual understanding

AI goes beyond text recognition; it can understand the context and semantics of the data it processes. For instance, AI can classify invoices based on content, recognize line items, and flag anomalies by analyzing patterns and historical data.

Because artificial intelligence technology doesn’t just analyze isolated data points, but considers the context in which data appears, it “understands” the relationships between various elements within an invoice.

AI’s ability to understand invoice content leads to precise categorization, reducing the likelihood of misclassification. By dynamically adapting to changing terminology and evolving categories, invoice artificial intelligence enable faster invoice approvals, preventing payment delays.

Automated invoice classification and coding

Automated Invoice Processing: How to Get Started and Process StepsAI algorithms can intelligently categorize invoices based on content, ensuring that each invoice is routed to the appropriate department or approver. This reduces the risk of misclassification and delays during invoice processing.

Artificial intelligence employs Natural Language Processing (NLP) and machine learning algorithms to analyze the textual content of invoices. It recognizes keywords and patterns that indicate the nature of the expenses or services.

For instance, AI might identify terms like “office supplies,” “consulting fees,” or “software licenses.” It then maps these keywords to predefined categories, ensuring that each invoice is routed to the appropriate department or approver based on the identified content.

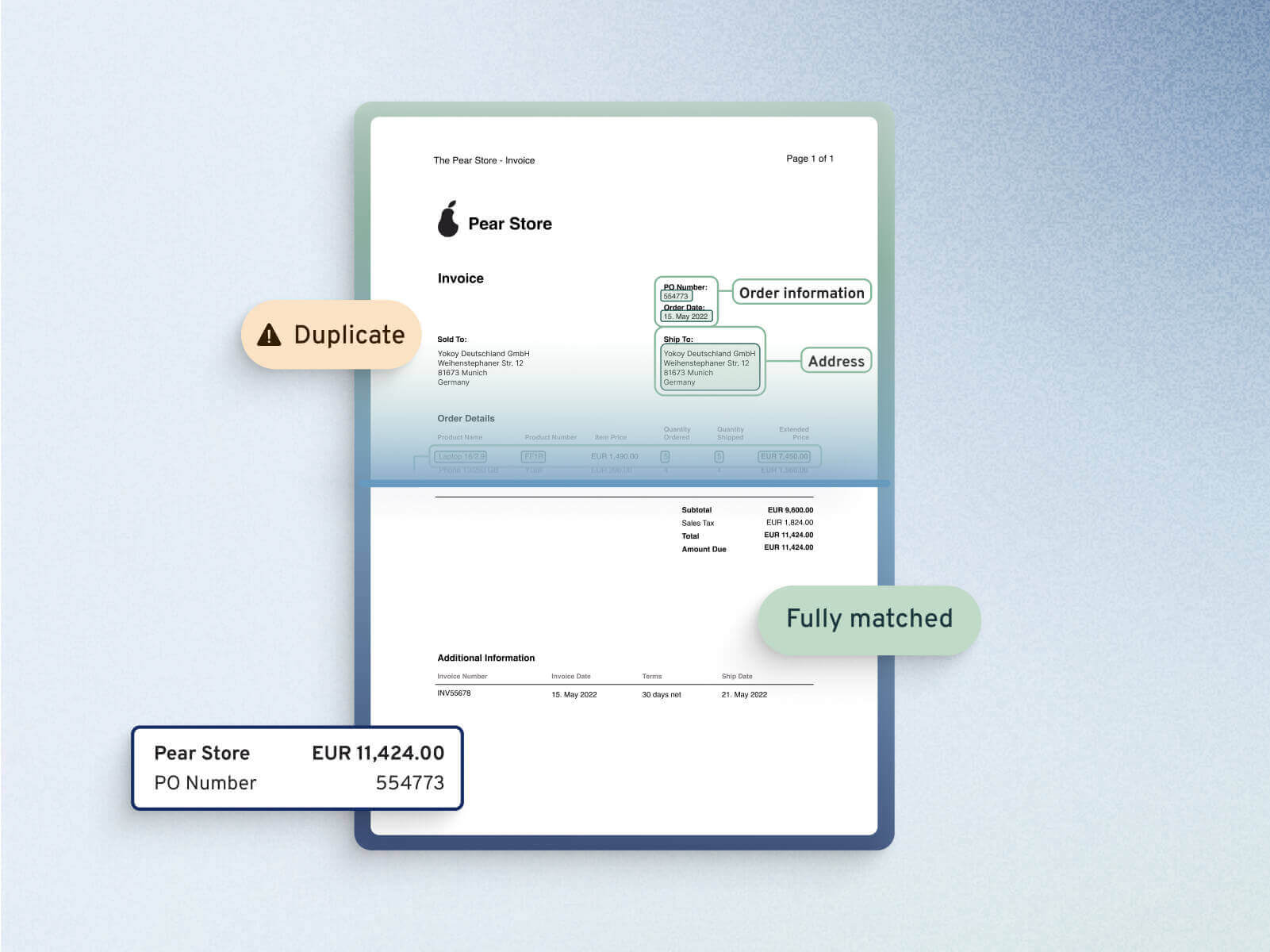

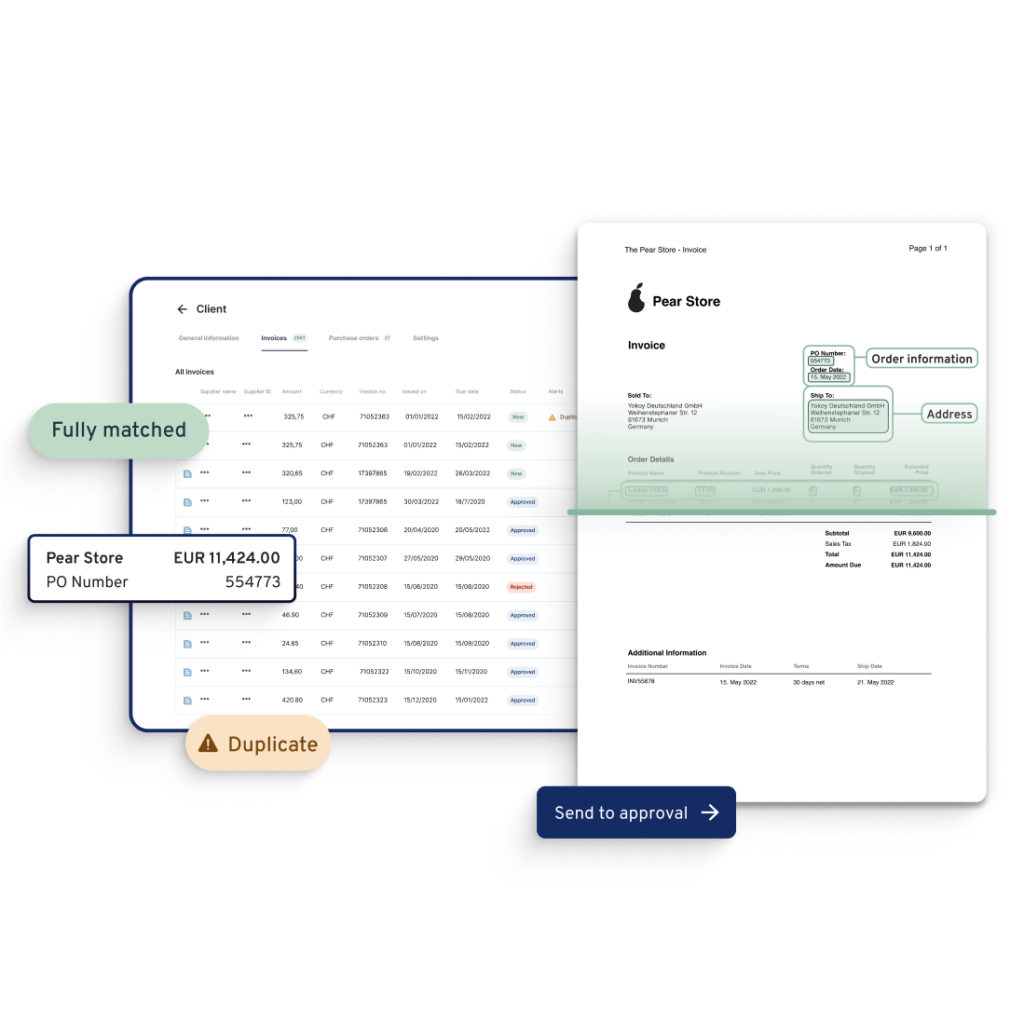

Automated invoice and PO matching

Next to invoice capture and validation, artificial intelligence enables finance teams to automatically match invoices with purchase orders and goods receipts.

AI algorithms scan these documents and cross-reference them to ensure that they align perfectly. This alignment verifies that the goods or services have been received as specified in the PO, and the corresponding invoice accurately reflects these details.

Blog article

How to Use Invoice Matching Technology to Improve Your Process Efficiency

See how invoice matching technology automates the 2- and 3-way matching of supplier invoices with POs and goods receipts, for an efficient AP process.

Mauro Spadaro,

Product Manager

Predictive analytics and autonomous reporting

Invoice AI not only processes individual invoices but also has the capacity to consolidate data across multiple invoices. AI can analyze historical invoice data to predict future spending patterns, helping organizations make informed financial decisions.

This capability streamlines the generation of reports, enabling finance professionals to gain insights into spending patterns, monitor cash flow, and make informed financial decisions with ease.

Finance teams can empower AI-driven systems to create customized reports effortlessly. For instance, an FP&A manager can instruct a chatbot to generate a report that includes all open invoices from a specific region, exceeding a particular amount, and originating from new suppliers, all in a preferred format like Excel.

This process, which used to take hours, can now be accomplished in a matter of milliseconds, thanks to the efficiency of AI-driven reporting tools.

Fraud detection for enhanced compliance

Invoice AI technology enhances the security and integrity of financial operations by detecting anomalies and potential fraud. It can flag unusual patterns or suspicious invoices for immediate attention, reducing the risk of financial misconduct.

Moreover, artificial intelligence ensures that financial operations comply with industry regulations and internal policies – automatically and at scale. It reduces the risk of errors that might lead to compliance issues and simplifies audit preparation by providing accurate and organized financial records.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

AI learns with every processed invoice

For example, AI recognizes that a specific line item belongs to a particular category based on the context provided by other elements in the invoice.

AI is dynamic and can continuously learn and improve. Through training on large datasets, AI algorithms adapt to changing invoice layouts and become more accurate over time. They can even adapt to regional or industry-specific variations.

Unlimited scalability

AI scales easily. Once trained, AI models can handle diverse invoices without significant adjustments, making it more adaptable to the growing needs of finance departments.

Artificial intelligence software thrives on complexity. It thrives when presented with diverse and intricate invoice layouts, handwriting styles, or even unstructured data. Unlike rigid rule-based systems, AI adapts effortlessly to the ever-evolving landscape of invoice diversity.

Once AI models are trained and integrated into the invoice processing workflow, they require minimal ongoing adjustments. This ease of implementation means that as your finance department grows, AI seamlessly scales to meet increasing invoice volumes without the need for extensive modifications.

Next steps

While OCR and AI offer substantial benefits independently, their true potential shines when combined. The synergy between these technologies takes invoice capture to a whole new level.

Organizations leveraging both OCR and AI in their invoice capture processes report up to an 80% reduction in manual data entry. Error rates in invoice capture drop to less than 1% when OCR and AI work in tandem, significantly improving data accuracy.

If you’d like to experience such improvements in your invoice processing workflows, book a demo below to see Yokoy’s AI-driven invoice engine in action.

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.