Home / Expense Cards for Contract Employees: Recommendations and Features

Expense Cards for Contract Employees: Recommendations and Features

- Last updated:

- Blog

Co-founder & CCO, Yokoy

Expense cards have revolutionized the way companies manage their finances, providing a streamlined and efficient solution for employee spending.

In this article, we’ll delve into how expense cards work, explore the types available in the market, and highlight their key features, catering to finance professionals seeking clarity and efficiency in expense management.

What is an employee expense card?

Let’s start with the basics.

An employee expense card, also known as a corporate expense card, business expense card, or employee spend card, is a payment solution designed for employees to cover business expenses conveniently.

It operates much like a debit card, allowing employees to make purchases and pay for expenses directly from a company-funded account.

Here’s what sets it apart.

How does an expense card work?

Expense cards are designed to simplify the process of managing company expenses. Here’s how they work:

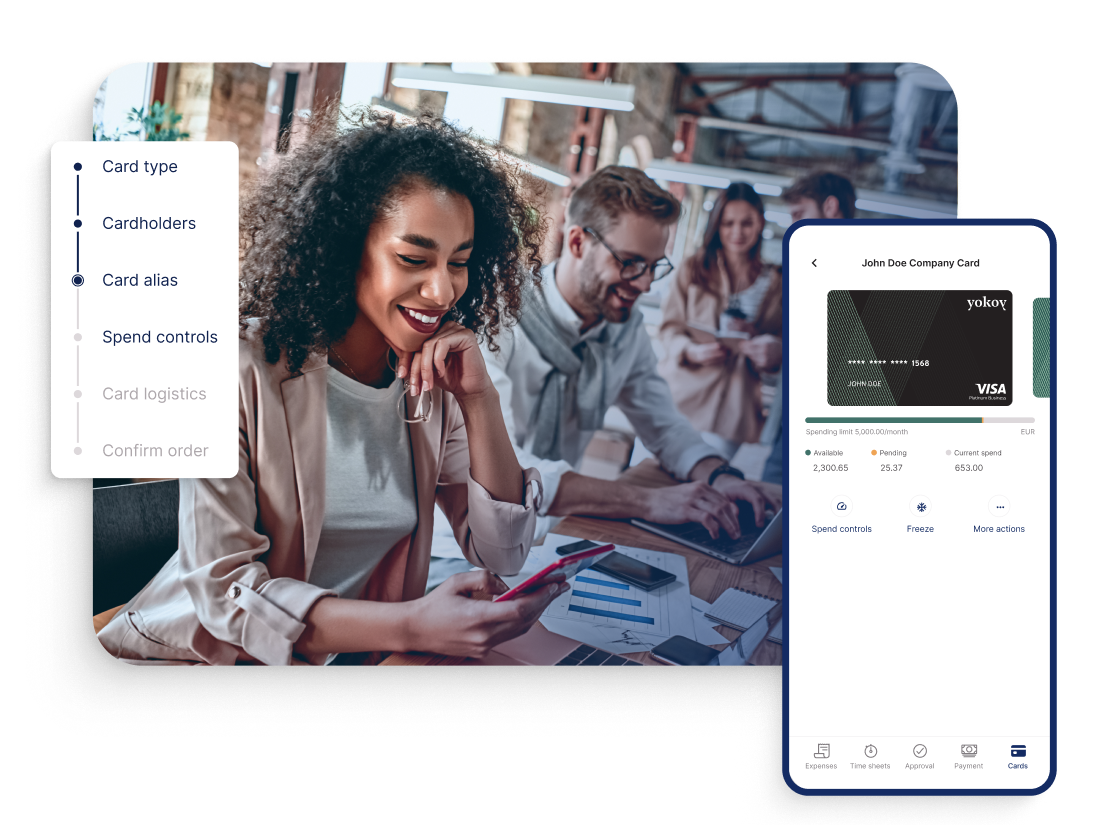

Card issuance: The company issues expense cards to employees who need to make business-related purchases or incur expenses. These cards can be physical or virtual, with each having its advantages.

Funding: The company allocates funds to each card, typically based on the employee’s spending needs and responsibilities. These funds are often pre-loaded onto the card, ensuring that employees can only spend what has been budgeted.

Usage: Employees use their expense cards to make purchases, pay for travel expenses, or cover any other business-related costs. These cards work similarly to debit cards, allowing for seamless transactions.

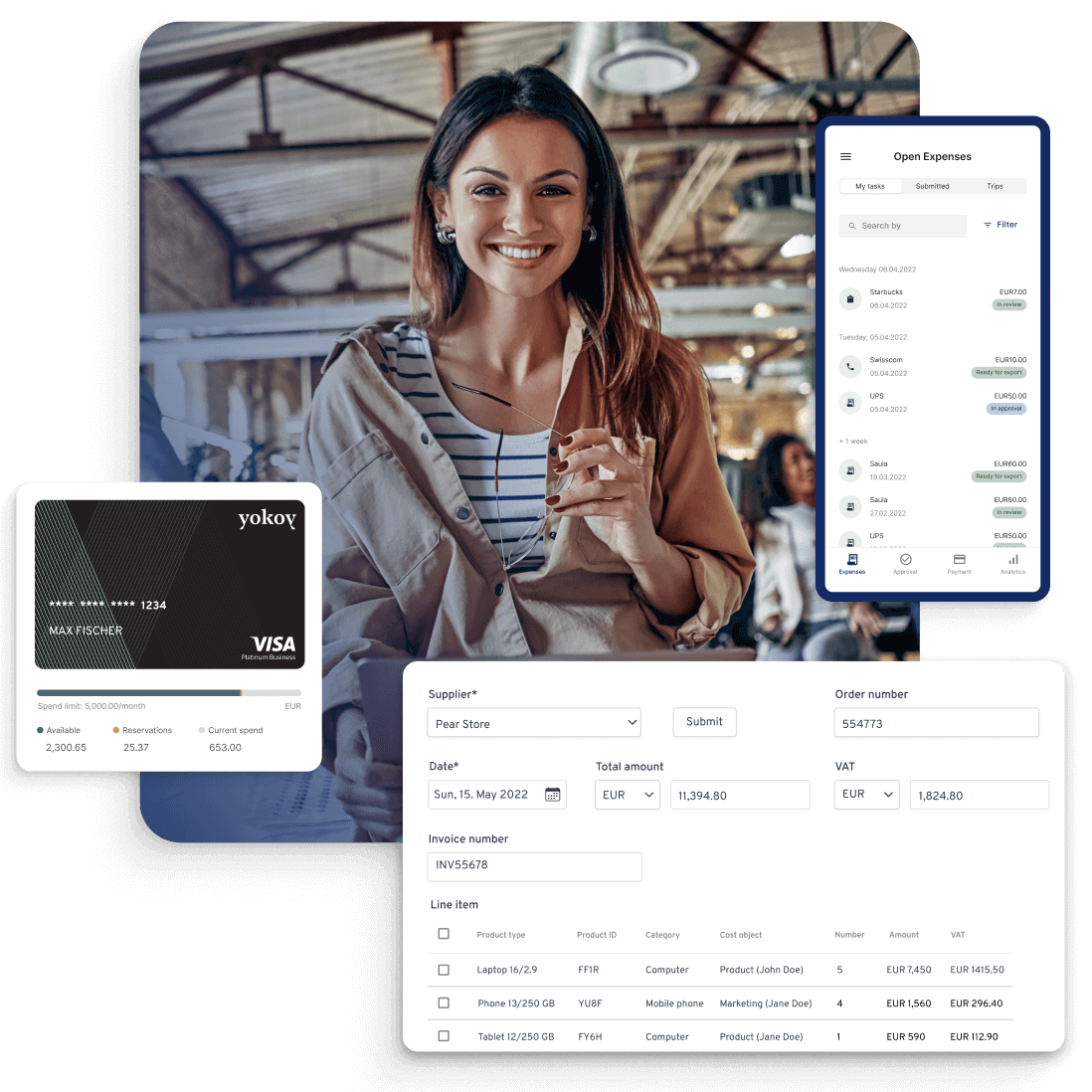

Expense categories: Many expense cards allow users to categorize transactions in real-time. This categorization simplifies expense tracking and reporting, ensuring that expenses are properly accounted for.

Receipt capture: Some expense cards come with mobile apps that enable employees to capture and attach receipts to transactions. This feature simplifies the reimbursement process and ensures compliance with record-keeping requirements.

Real-time monitoring: Finance professionals can monitor card transactions in real-time through a dashboard or software. This visibility enables them to identify any irregularities, unauthorized spending, or policy violations promptly.

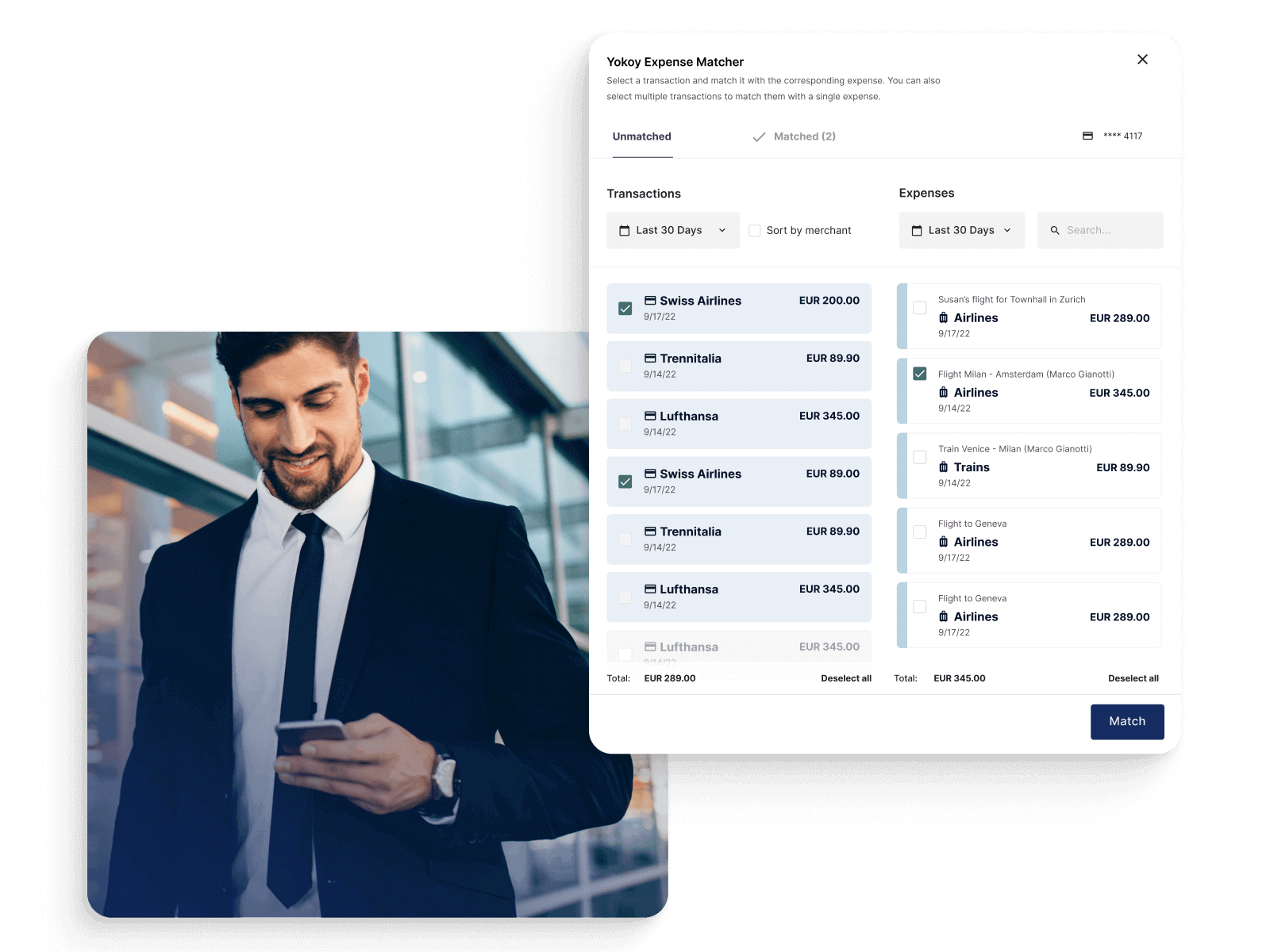

Expense reporting: Expense cards often integrate with expense management software, making it easier for employees to submit expense reports. These reports can be generated automatically, reducing manual work for both employees and finance teams.

Reconciliation: At the end of the billing cycle, finance teams can reconcile card transactions with the company’s financial records. This process ensures accuracy and transparency in expense management.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Key features of employee spend cards

Now, let’s explore the key features that make employee spend cards a valuable asset for finance professionals:

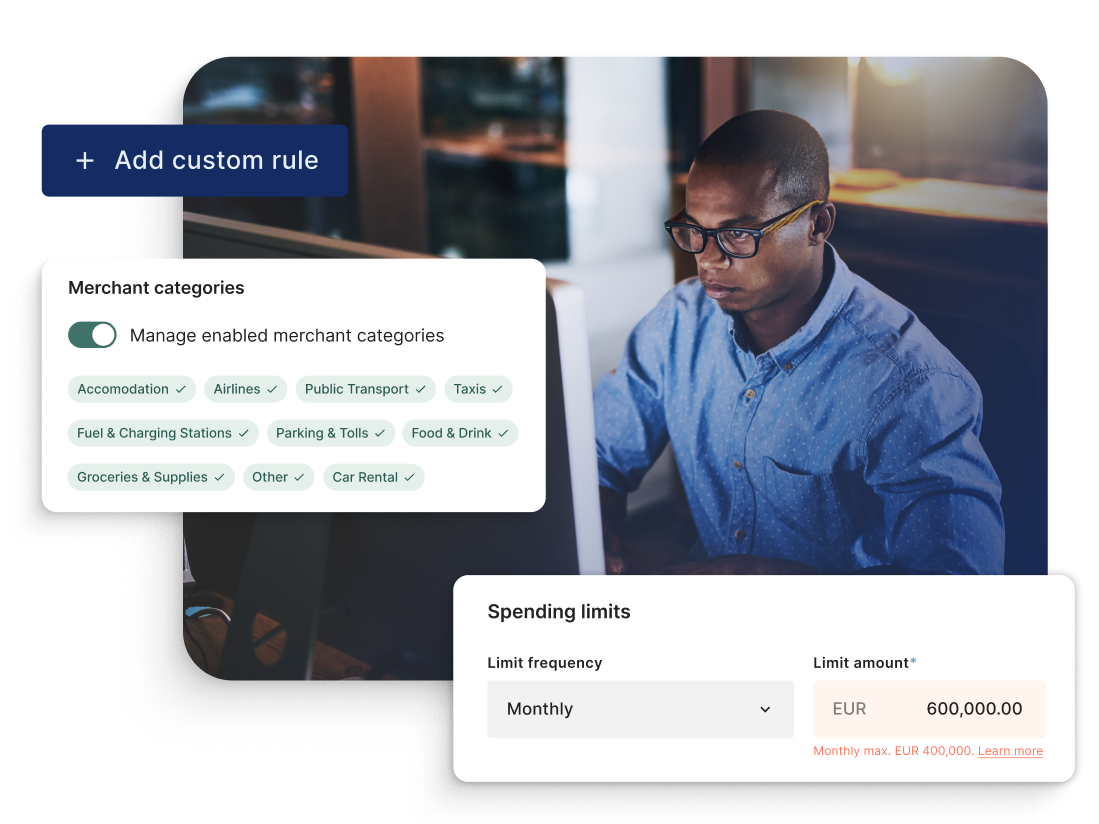

- Customizable spending limits: Finance teams can set spending limits for each card, ensuring compliance with budgets.

- Real-time transaction monitoring: Access to real-time transaction data empowers finance professionals to track expenses efficiently.

Expense categorization: Users can categorize expenses on the go, simplifying expense management and reporting.

- Receipt capture: Mobile apps allow employees to attach receipts to transactions, promoting accurate record-keeping.

Integration with expense software: Many expense cards seamlessly integrate with expense management software, automating the expense reporting process.

Enhanced control: Finance teams can instantly deactivate cards in case of loss or unauthorized use, enhancing security.

Compliance and audit trails: Expense cards create digital audit trails, aiding compliance with financial regulations and internal policies.

In conclusion, expense cards are a powerful tool for finance professionals, offering control, visibility, and efficiency in managing company expenses.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

How does an employee expense card differ from a corporate credit card?

Now, let’s explore the distinctions between employee expense cards and corporate credit cards:

Funding mechanism

- Employee expense cards are linked to pre-funded accounts, ensuring that employees spend only what’s allocated by the company. This feature minimizes the risk of overspending.

- Corporate credit card function as a revolving line of credit, with expenses paid by the company at the end of the billing cycle.

Expense categories

- Employee spend cards often come with the ability to assign specific expense categories to transactions. This categorization simplifies tracking and reporting, making it easier for finance professionals to manage expenses effectively.

- Regular corporate cards lack this built-in categorization feature, which can lead to more complex expense tracking and reporting processes.

Expense control

- With expense cards, employers can set custom spending limits for each card, ensuring that employees adhere to budgetary constraints.

- Corporate credit cards offer limited control over individual spending, often relying on employees’ discretion.

Risk and liability

- Employee expense cards: Unlike personal credit cards, contract employees aren’t personally liable for charges made on employee expense cards. This reduces the financial risk for employees.

- Corporate credit card: Employees may have personal liability for unpaid balances, potentially affecting their personal credit if the company does not reimburse charges promptly.

Real-time visibility

- With employee expense cards, finance teams can monitor transactions in real-time. This visibility helps identify discrepancies or potential issues promptly.

- Corporate credit cards may lack real-time transaction monitoring features, making it harder to detect issues as they arise.

Billing and reconciliation

- Employee expense card: Transactions are typically reconciled automatically, reducing manual work.

- Corporate credit card: Requires manual expense reporting and reimbursement, which can be time-consuming and prone to errors.

Credit checks

- Employee expense card: Usually doesn’t require a credit check for employees.

- Corporate credit card: Often involves a credit check and may impact employees’ credit scores, potentially creating hurdles for some individuals to obtain a card.

In summary, employee expense cards offer a more controlled and streamlined approach to managing contract employees’ expenses.

They are ideal for organisations looking to enhance efficiency, reduce errors, and maintain financial compliance, all of which align with the principles of spend management and automation.

Types of employee expense cards available in the market

Expense cards come in various forms to cater to the specific needs of businesses and employees. Here are some common types.

Corporate expense cards

Physical corporate expense cards are versatile and suitable for general business expenses. These cards may offer features like customizable spending limits and real-time expense tracking, and may come with perks such as cashback on each transaction.

Benefits of corporate expense cards

Customizable spending limits.

Real-time expense tracking.

Simplified expense reporting for employees and finance teams.

Versatile usage.

Limitations of business expense cards

- Physical cards can easily get lost or stollen, and can be shared between employees, even when having a designated cardholder.

Traditional company credit cards offer limited travel benefits.

Traditional payment cards may not be optimized for specific procurement needs like procurement cards.

Suitable for

- Companies with diverse expense needs across different departments.

- Organizations seeking customizable spending controls and real-time expense tracking.

Travel expense cards

Designed for employees who frequently travel for work, these cards come with travel-related perks such as travel insurance and rewards programs.

Travel expense cards are ideal for companies with employees on the go, offering travel perks and focused expense tracking for travel-related costs.

Benefits of business travel cards

Travel-related benefits such as travel insurance, rewards programs, and discounts.

Streamlined travel expenses.

Real-time expense tracking ensures compliance with travel policies.

Limitations of travel expense cards

Not optimized for general business expenses outside of travel.

Employees may need additional cards for non-travel expenses.

Suitable for

- Companies with employees who frequently travel for work.

Organizations prioritizing travel-related perks and streamlined travel expense management.

Yokoy Smart Lodge Card

One card for all your travel bookings

Securely pay for flights, rail, hotel, and travel services with one central Smart Lodge Card. No transaction fees, no foreign exchange fees, no card fees.

Fuel cards

Ideal for companies with a fleet of vehicles, fuel cards allow employees to purchase fuel and other vehicle-related expenses.

Fuel cards are a specialized choice for companies with substantial fuel-related expenses, offering control and efficiency for this specific category.

Benefits of fuel cards

Ideal for companies with a fleet of vehicles, simplifying fuel purchases and tracking.

Customizable spending limits ensure budget adherence.

Provide insights into fuel-related expenses for cost optimization.

Limitations of business fuel cards

Limited for non-fuel expenses.

Typically lack travel perks.

Suitable for

- Companies with a fleet of vehicles or significant fuel-related expenses.

Organizations seeking to streamline fuel purchasing and control costs in this area.

Virtual and temporary employee cards

These are digital cards that aren’t available in physical form. They are often used for online purchases and can be easily generated and managed through software.

Virtual cards offer enhanced security and automation, making them well-suited for contract employees and finance professionals seeking efficiency and security in expense management.

Benefits of virtual expense cards

Virtual cards reduce the risk of physical loss or theft.

Easily integrated with expense management software for streamlined tracking and reporting.

Suited for online transactions and digital expense management.

Limitations of virtual cards

May not be accepted by all vendors, particularly for in-person transactions.

Requires a reliable internet connection for use.

Suitable for

Companies prioritizing security and automation in expense management.

Organizations with employees who primarily make online purchases.

Blog article

How Virtual Corporate Cards Boost Expense Control and Limit Discretionary Spending

What challenges virtual corporate cards solve, what are their benefits, and why are virtual cards the perfect solution for limiting discretionary spending?

Lars Mangelsdorf,

Co-founder and CCO

Selecting the right expense card for contract employees

When choosing a card for contract employees, several specific factors matter the most, as they directly impact expense management efficiency and control.

Expense type and category

Consider the primary types of expenses your contract employees incur. Are they general business expenses, travel-related, or fuel-related?

Choose a card type that aligns with these specific expense categories, to enforce adherence to your expense policy.

For example, for contract employees frequently on the move, Yokoy’s Virtual Smart Corporate Cards offer the convenience of being accessible online. This means that employees can access their virtual cards and manage business-related expenses, even while travelling, ensuring they have the necessary financial tools at their fingertips.

Mobility and usage patterns

Analyze how mobile and remote your contract employees are. If they frequently travel or work remotely, cards that offer online accessibility and travel-related perks may be more suitable.

For example, Yokoy’s virtual spend cards are particularly suitable for contract employees who are mobile or work remotely.

These virtual cards can be easily generated and managed through software, providing accessibility from anywhere with an internet connection. This makes them ideal for employees who need to make online purchases and submit expenses while on the go through Yokoy’s expense management tool.

Expense control and customization

Evaluate the level of control required over contract employees’ spending. Look for cards that allow for customizable individual spending limits and real-time expense tracking to align with your budgetary constraints.

For example, Yokoy’s virtual Smart Corporate Cards provide robust expense control features, allowing finance teams to set custom spending limits for each card. This level of customization ensures that contract employees adhere to budgetary constraints, reducing the risk of overspending.

Planted keeps spend under control with Yokoy

“A corporate card should be secure and uncomplicated – and this is exactly what the Yokoy Mastercard offers. In addition, the card is smart, saving us significant time.”

Christoph Jenny, Co-founder Planted

Integration capabilities

Assess whether the expense card can seamlessly integrate with your existing expense management software, accounting software, or ERP system. Integration streamlines expense reporting, reconciliation, and data analysis.

For example, Yokoy’s virtual cards are fully integrated into the expense management platform, ensuring real-time expense tracking. This means that finance professionals can monitor transactions as they occur, providing immediate visibility into spending patterns.

Any deviations from budgetary constraints can be identified promptly, allowing for corrective actions to be taken in real time.

Security features

Prioritize security features, especially if contract employees handle sensitive financial information. Cards with enhanced security measures and customizable permission levels can reduce the risk of fraud and unauthorized use, making it easy for the finance team to control spending.

Vendor acceptance

Consider the vendor acceptance of the chosen card type, particularly if contract employees frequently make in-person purchases. Ensure that the card is widely accepted by the vendors they engage with.

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Costs and fees

Evaluate the cost associated with each card type, including issuance fees, maintenance fees, and any other applicable charges. Ensure that the chosen card aligns with your budget while providing necessary features.

User-friendliness

Choose cards that are user-friendly and easy for contract employees to use. Intuitive interfaces and clear expense reporting procedures can enhance adoption and compliance.

Gather input from contract employees regarding their preferences and needs. Their insights can provide valuable guidance in selecting a card that aligns with their workflow and expectations.

Bitpanda relies on Yokoy's smart corporate cards

“We chose the Yokoy card as our corporate card because thanks to the zero-fee model, we not only enjoy the ideal solution on the cost side, but at the same time it allows us to avoid a lot of manual administrative work as well as making our spend management much clearer and more efficient.”

Peter Grausgruber, former CFO Bitpanda

Best expense cards for employees

Now that you know what features to look for, let’s see some card options.

Yokoy virtual corporate cards

The Yokoy virtual cards for employees are ideal for industries like hospitality, quick service restaurants, retail, agriculture, transportation, and so on.

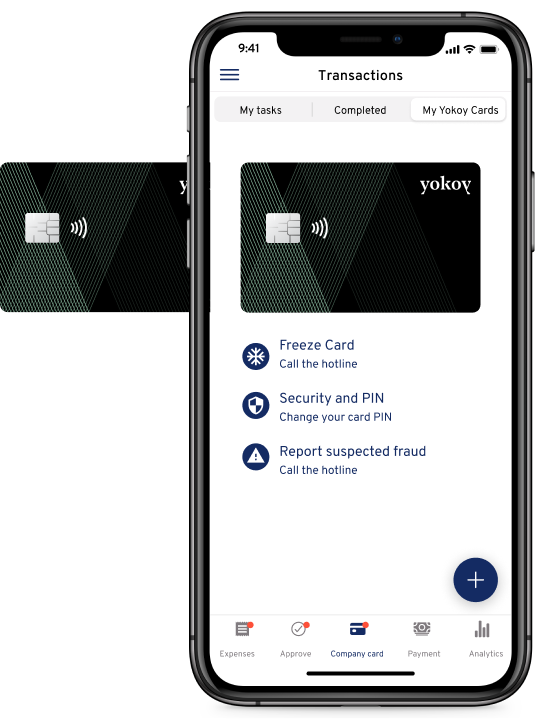

These virtual cards can be issued in seconds, directly from the web or mobile app, and can be set up to work only with specific expense categories or vendors. This makes the Yokoy cards very flexible while ensuring compliance with company spend policies and preventing overspend.

The virtual cards are natively integrated into the Yokoy suite, and can be frozen or terminated with one click, so the administration and management are significantly simplified.

You can learn more about the Yokoy virtual cards below.

Physical and virtual cards

Yokoy Platinum Visa Cards

Spend safely and limit out-of-pocket expenses while enjoying maximum flexibility and control with the Yokoy Platinum Visa Card. No FX fees.

Circula employee cards

Circula cards are available in both physical and virtual form, although for contract employees you might prefer the virtual ones. The cards can be issued and managed easily in the web app, and can be set up for individual spend limits.

Pleo credit cards

Pleo’s credit cards are also a good option, as they come in both physical and virtual form. The cards enable finance teams to see transactions in real time and can be customized with individual spend limits. Pleo cards can be used for business travel, regular office expenses, as well as online purchases and software subscriptions. For contract employees, the virtual cards are a better option.

Ramp employee cards

Just like the Pleo and Circula cards, the Ramp employee cards are available in both virtual and physical form. The cards are integrated into the Ramp platform, for easy management, and provide cutomization options such as individual spend limits, approval flows, and vendor restrictions.

Next steps

In summary, when selecting a card for contract employees, it’s essential to focus on their specific expense types, mobility, control needs, security, integration capabilities, and user-friendliness.

Yokoy’s Virtual Smart Corporate Cards can be a strong choice as they address many of these key considerations, offering enhanced security and integration while catering to various expense categories.

Moreover, thanks to its API-first approach, the Yokoy spend management platform can easily integrate into any tech landscape, streamlining expense management processes from end to end.

If you’d like to see Yokoy’s cards in action, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.