Home / 3 Steps to Implementing Real-Time Expense Tracking

3 Steps to Implementing Real-Time Expense Tracking

- Last updated:

- Blog

Businesses tend to get flooded with receipts and travel expenses. This can’t be helped, but what can be changed is the way they handle them. Finance managers who use outdated methods like spreadsheets and paper receipts usually process expenses that happened weeks ago rather than those occurring now. It’s like driving a car while only looking in the rearview mirror—you can’t see what’s coming, and you might miss potential issues until it’s too late.

Real-time expense tracking, on the other hand, offers a tech-driven solution that provides instant visibility into spending patterns and can streamline processes for your finance teams. Let’s explore the benefits of real-time expense tracking and outline a straightforward, 3 step-guide for implementation.

Why real-time expense tracking is crucial

Real-time expense tracking is a game-changer for finance teams and accounts payable managers. This approach offers immediate visibility into spending and allows for proactive cost control. It enables teams to spot and address overspending as it happens and adjust budgets in real time, which can prevent financial issues before they escalate. Additionally, it enhances fraud prevention, as real-time tracking helps identify suspicious spending patterns and tackle potential fraud swiftly to protect your organisation from unnecessary losses.

With live tracking, your organisation’s financial planning and forecasting can be significantly improved by providing accurate, up-to-date data. This helps finance teams make smarter, data-driven decisions for sustainable business growth. It also leads to faster reimbursements, resulting in much happier employees. Lastly, real-time tracking gives AP managers better visibility and financial control, allowing them to access up-to-date reports and make confident, strategic decisions based on accurate financial insights.

Challenges in traditional expense tracking

Many organisations still rely on traditional expense tracking methods in their accounting systems. But these older expense tracking processes come with certain challenges that can slow down your finance processes and cause headaches — not only for AP managers.

Here’s a closer look at three of the most common problems:

Inaccurate data due to manual entry: Manual data entry is not just a time-consuming task but also a vulnerable spot for your data accuracy. When employees have to input expenses by hand, there’s a high chance of mistakes slipping through. Whether it’s typos, incorrect numbers, incomplete information on receipts or duplicate entries: These small errors can add up, leading to inaccurate financial reports, mismatched budgets and even potential compliance issues. Incorrect data can make it difficult for finance teams to stay ahead of the company’s spending, ultimately hindering effective financial management.

Lack of visibility into current spending: Traditional expense tracking often means waiting for expense reports to be submitted, reviewed, and processed. As a result, finance teams and managers have to work with outdated information, making it hard to get an accurate picture of where money is currently being spent. However, you surely want to identify overspending or unusual patterns.

Delayed decision-making and cost control: When you’re waiting for expense reports to trickle in, it slows down your ability for informed decision-making. Finance teams may only receive expense data after the month-end close, which means opportunities to cut unnecessary expenditures might be missed. Additionally, fraudulent or unauthorised spending can go unnoticed for longer periods.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Core benefits of real-time expense tracking

Enhanced financial visibility: Real-time expense management systems offer up-to-date financial data, giving finance teams and AP managers a clear picture of the organisation’s spending as it happens. This real-time visibility makes it easier to manage budgets, spot spending trends, and make quick adjustments to financial decisions. This valuable insight allows finance teams to create sound financial strategies and identify cost-saving opportunities, overall improving your company’s financial health.

Reduced administrative burden: Traditional expense tracking often involves a lot of manual paperwork and data entry. Real-time tracking, on the other hand, automates much of this process, making it smooth and fast. Expenses are captured and logged instantly through digital receipts or mobile apps, which helps minimise errors and simplify reporting. This reduces the workload for finance teams. Additionally, faster processing means quicker reimbursements, which keeps employees satisfied and cuts down on the administrative burden.

Improved compliance and fraud prevention: Maintaining compliance and preventing fraud becomes much easier with real-time tracking. Since expenses are captured and reviewed immediately, finance teams can quickly identify and investigate any suspicious transactions or spending patterns. Accurate, up-to-date records help ensure adherence to company policies and external regulations. This proactive approach also makes it easier to prevent duplicate or unauthorised claims, safeguarding the organisation from potential fraud.

How to implement real-time expense tracking in 3 steps

Implementing real-time expense tracking software can be a game-changer but requires a structured approach to provide a smooth transition. With these following three steps, you can successfully implement such a system that streamlines your finance operations and provides enhanced visibility:

Step 1: Assess current expense management processes

The first step to implementing real-time expense tracking is analysing where your current expense management process falls short. Taking a deep dive into how expenses are currently managed can help identify inefficiencies.

Review how expenses are captured, approved and reported: Begin by examining your current expense management workflows from start to finish. Identify any delays, inconsistencies or frequent errors that occur throughout the process to understand where bottlenecks arise.

Identify inefficiencies, such as reliance on spreadsheets or paper-based systems: Manual methods like spreadsheets or paper-based systems are often slow and prone to errors, leading to inefficiencies. Determine how these outdated practices impact the process, causing delays or inaccuracies, and where automation could streamline operations.

Survey your finance team and other stakeholders to gather insights into pain points: Collect feedback from your finance team and employees who track business expenses regularly to understand their challenges with the current system and its functionality. Their insights will help you pinpoint specific pain points, such as slow reimbursements or confusing procedures, guiding you towards targeted improvements.

Step 2: Select and implement an expense-tracking solution

When choosing a real-time expense management software, focus on key factors that impact its effectiveness. Ensure seamless integration with your existing enterprise resource planning (ERP) system for centralised data management, reducing discrepancies and improving financial reporting. Look for AI and automation features like optical character recognition (OCR) to eliminate manual data entry and artificial intelligence (AI) capabilities for real-time categorisation and fraud detection. Finally, mobile access is crucial, allowing employees to submit expenses, receive notifications, and access insights on the go, boosting engagement and accountability.

Involve key stakeholders in software evaluation: Engage team members from finance, IT, and other relevant departments in the evaluation process to guarantee that the chosen solution meets everyone’s needs and expectations.

Set up an implementation timeline with specific milestones: Develop a clear timeline that outlines each phase of the implementation process, including key milestones to track progress and maintain accountability.

Test the integration in phases to ensure smooth data flow: Implement the solution in phases, starting with a pilot program that allows you to identify and address any issues before rolling it out organisation-wide. This approach helps ensure that the integration works correctly and that data flows seamlessly across systems.

Step 3: Drive user adoption and continuous optimisation

What would be any software solution without its users? That’s why adoption and continuous optimisation is worth every penny:

Setting up a training plan: Establish a comprehensive training plan to facilitate user adoption of the new system. Begin by assessing the varying levels of familiarity your employees have with technology and expense management processes. Incorporate a mix of instructional methods, such as in-person workshops, online tutorials, and easy-to-follow user manuals. Your employees need to understand the benefits of the new system, how to use it effectively, and how it simplifies their expense reporting tasks.

Monitoring via dashboards: Utilising dashboards to monitor system usage and performance is essential for understanding how well the expense-tracking solution is being adopted. Dashboards provide real-time insights into key metrics, like the number of expenses submitted, approval workflows and common issues faced by users.

Review expense policies and adjust based on real-time data insights: By analysing spending patterns and trends captured by the expense-tracking system, you can identify areas where policies may need to be revised to better align with organisational goals and employee behaviour.

Quarterly reviews to assess the system’s effectiveness: During reviews, gather feedback from users and stakeholders to understand their experiences of functionality and challenges with the system. This collected data helps to evaluate the system’s performance against set objectives, such as efficiency improvements, reduction in errors, and user satisfaction levels.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Start implementing AI-powered expense tracking solution Yokoy

Implementing an AI-powered expense tracking solution such as Yokoy can significantly enhance the efficiency and accuracy of your expense management processes. Here’s how it can transform your expense tracking:

Expense automation from end to end

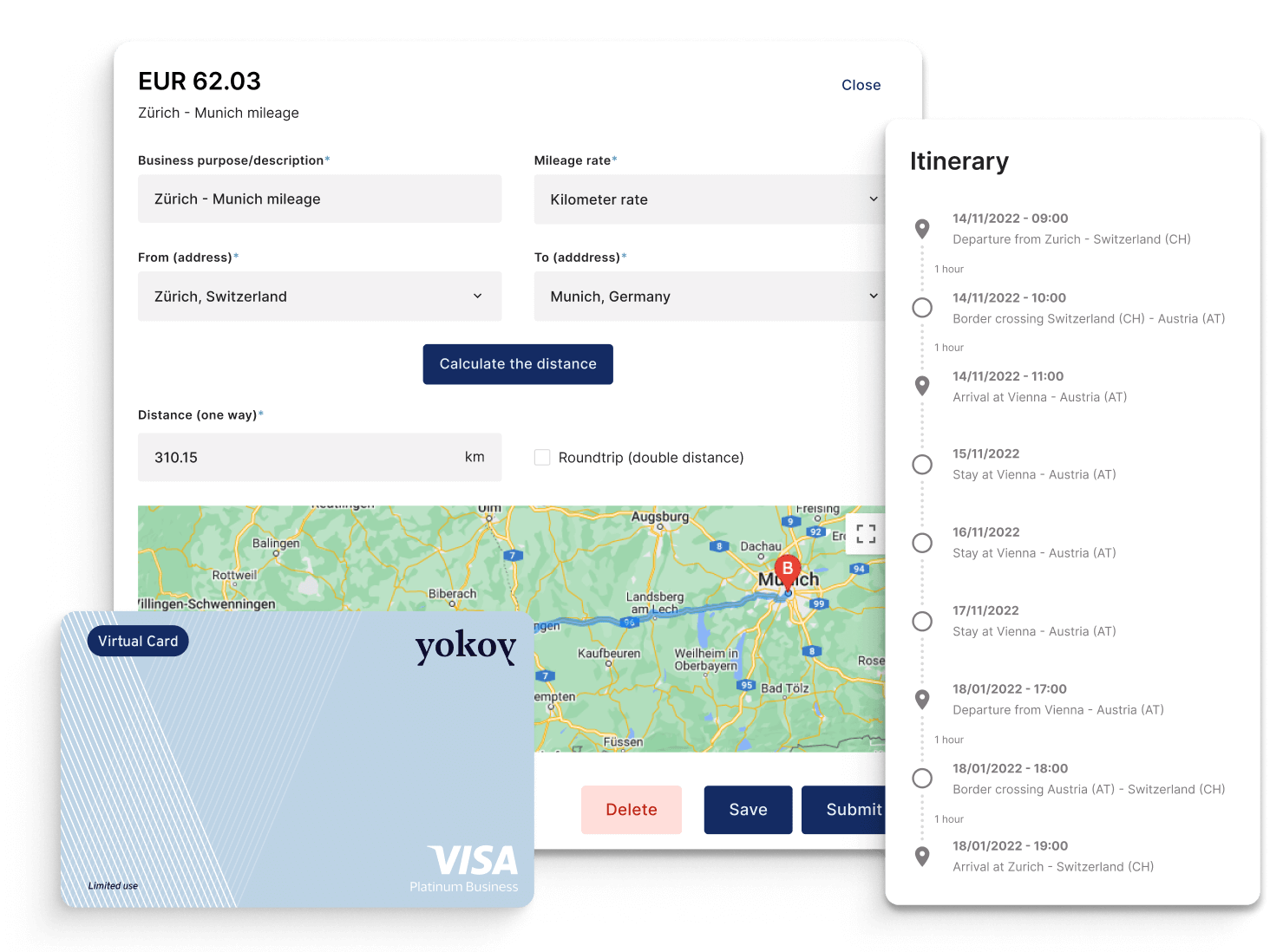

One of the standout features of AI-powered expense tracking with Yokoy is its ability to automate the entire expense management process, from receipt capture to reimbursement. This end-to-end automation streamlines workflows by eliminating the need for manual data entry and reducing the administrative burden on your finance team. Your employees can simply upload receipts through the app and Yokoy’s AI technology will automatically extract relevant data, choose expense categories and schedule for approval.

Real-time analytics

Yokoy provides real-time analytics that empowers finance teams with instant insights into spending patterns and trends. Up-to-date data can give organisations the possibility to monitor expenses as they occur, enabling proactive cost control and optimised profitability.

This level of visibility ensures that your company’s CFOs have the information they need at their fingertips to make informed choices and adjustments, rather than relying on outdated reports that may not accurately reflect current financial conditions.

Built-in expense policies

Yokoy comes equipped with built-in expense policies that ensure compliance and consistency in expense management. The solution can automatically enforce these policies at the point of data entry, preventing employees from submitting non-compliant expenses or exceeding set limits. Submissions are pre-validated against organisational guidelines. By embedding these policies directly into the expense management workflow, Yokoy assists in policy compliance and enhances accountability among employees.

Integration in travel booking systems

Yokoy also facilitates integration with travel booking systems, creating a pleasant experience for your employees who need to manage business travel and expenses. By linking travel bookings directly to the expense tracking system, organisations can automate the capture of travel-related costs to allow for accurately recorded and reported data. This integration streamlines the entire travel process, from booking to reimbursement and provides finance teams with comprehensive visibility.

Intuitive mobile app

With its intuitive mobile app, Yokoy empowers employees to manage their expenses on the go. The user-friendly app allows users to easily capture receipts, submit expenses and track the status of their reimbursements — all from their smartphones. This convenience enhances user engagement and encourages timely expense submissions. With this feature, you can reduce the likelihood of lost receipts or delayed claims.

Next steps

Rest assured: Yokoy offers even more features that can transform your expense management process. Book a demo today to see how our AI-powered solution can streamline your expense management, enhance visibility, and drive compliance. Don’t miss out on the opportunity to revolutionise your financial operations.

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.