Home / Simplify Financial Audits with Automated Expense Tracking

Simplify Financial Audits with Automated Expense Tracking

- Last updated:

- Blog

Financial audits and expense tracking are not especially creative things and can sometimes become overwhelming for finance teams. Primarily, when relying on manual processes, there can be a lot of repetitive tasks, errors and inefficiencies. However, automated systems are transforming the way companies manage expenses and provide real-time insights. With advanced tools found in modern expense management software, finance leaders can improve efficiency throughout all departments, simplify audits, and make strategic decisions based on real-time financial reports.

Challenges of manual expense tracking

Manual expense tracking comes with many challenges that can slow down the operations of finance teams and create bottlenecks for accounts payable (AP) managers. Let’s take a closer look at some of the common pain points of manual expense tracking:

Time-consuming, repetitive manual tasks: When expenses are tracked manually, finance teams often spend hours entering data into spreadsheets, categorising receipts, and reconciling expenses. This can quickly become a tedious, repetitive process, taking valuable time away from more important tasks. As organisations grow and the volume of expenses increases, the manual workload can become overwhelming, leading to delays and burnout within finance departments.

High rate of human errors: Manual data entry is notoriously prone to errors. Even the most diligent employee can make mistakes when entering data in Excel or matching receipts to transactions. These errors can range from minor discrepancies to major inaccuracies that affect the organisation’s financial health. In the worst-case scenario, unnoticed mistakes can lead to audit issues, non-compliance and even financial penalties.

Inefficiency in approval workflows: In a manual system, approval workflows are sometimes very slow and disorganised. Employees may have to send paper forms or email receipts to managers for approval. This leads to delays as these physical documents move from one person to the next. Tracking missing approvals or documents can become a frustrating task, further slowing down the process and causing inefficiencies that affect overall productivity and profitability.

Insufficient and late overview of data: Gaining a real-time view of the organisation’s expenses is nearly impossible with manual expense tracking. Finance teams often have to wait until the end of the month or quarter to compile reports, meaning that any financial data would be already outdated. This lack of timely information makes tracking spending, spotting trends or making informed financial decisions nearly impossible.

Slow reimbursement processes: Once expenses are submitted, they may wait in a queue for approval and are processed manually by the finance team. This slow reimbursement process can frustrate employees who need to be reimbursed for business-related like travel expenses, potentially affecting their morale and productivity.

Benefits of automated expense tracking

In contrast to the challenges of manual expense tracking, adopting an automated expense tracking system can transform how financial leaders and AP managers handle expenses. Automated solutions offer powerful benefits that address the common pain points:

Time-savings through automation: One of the most immediate advantages of automated expense tracking is the amount of time saved by reducing manual tasks. Inputting data, chasing receipts, and reconciling expenses are replaced with automated receipt scanning and processing. Every employee can scan receipts or upload expense details directly into the expense management solution, and the software takes care of the rest: categorising expenses, matching them to the right transactions in the accounting system, and even flagging any issues or discrepancies. This automation eliminates repetitive tasks, giving finance teams more time to focus on higher-level, strategic work rather than drowning in paperwork.

Less human errors: With simplified and automated expense tracking, the risk of human error significantly decreases, as automated systems accurately capture and process employee expenses, reducing the chance of input mistakes or lost receipts. This means fewer discrepancies and far more accurate financial records, which in turn helps build a clearer and more reliable picture of your company’s financial health. By letting technology handle the tedious and error-prone aspects of expense tracking, financial leaders can have peace of mind knowing the numbers are accurate.

Improved compliance and audit trails: Automated expense tracking systems also come with built-in compliance features. They ensure that every expense is properly documented and aligned with company policies, providing a clear audit trail that can be easily accessed during an audit. Instead of spending time scrambling to gather paperwork or locate missing information, finance teams have everything neatly stored in one place. This simplifies audits and helps to ensure ongoing regulatory compliance, reducing the risk of penalties or fines.

Real-time data and reporting: Unlike manual systems, where financial data is often out-of-date by the time reports are generated, automated solutions give financial leaders access to real-time data. Instantly processed expenses allow finance teams to monitor spending as they happen. This up-to-the-minute insight into financial activity empowers leaders to make more informed decisions, adjust budgets quickly, and spot trends before they become problems. Automated expense management systems are game-changers for proactive financial management, giving organisations the agility to stay on top of their finances.

Faster reimbursements: Automation also speeds up the reimbursement process for employees. With automatically tracked and categorised expenses, approvals can be completed faster, and finance teams can process payments without delays. Employees no longer need to wait weeks to be reimbursed for business expenses, which boosts morale and ensures smooth day-to-day operations. Faster reimbursements create a better employee experience, encouraging prompt expense report submissions.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Impact of automated expense tracking on financial audits

Automated expense tracking can be the optimal solution not only for small businesses: Businesses of all sizes can save time and reduce the burden of manual tasks but also improve their data accuracy, enhance financial oversight, and make employees happier with faster reimbursements. All of these benefits contribute to smarter financial decisions, helping businesses operate more efficiently and focus on what truly matters.

Streamlined processes

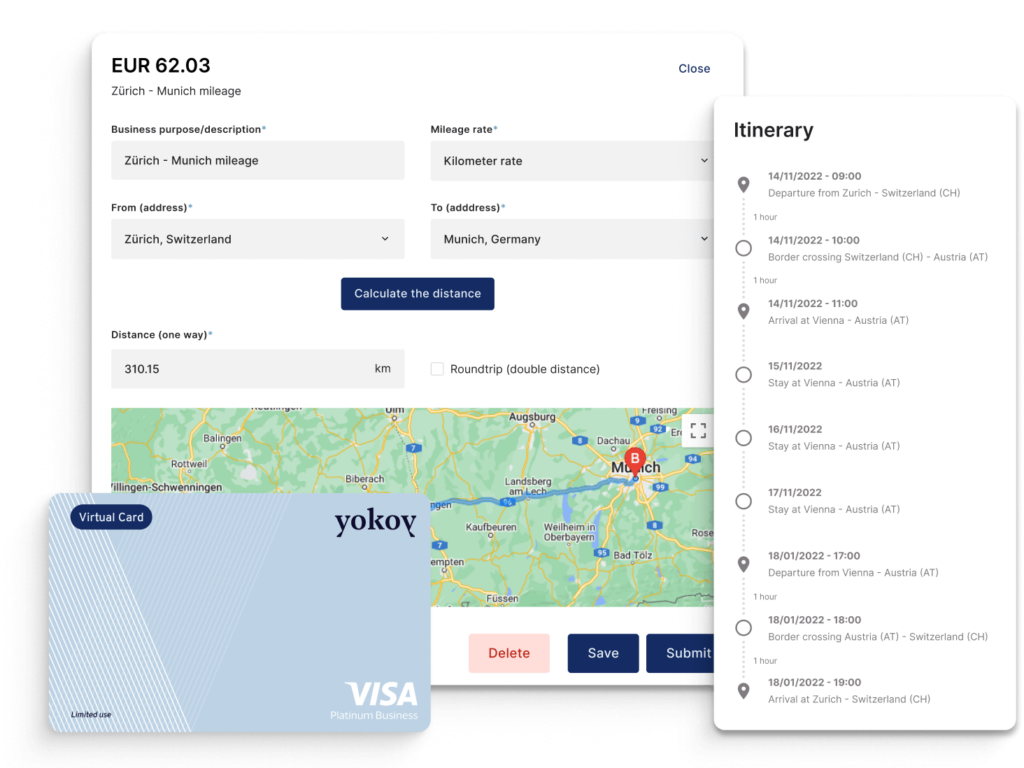

Automated expense tracking systems simplify and speed up the entire expense management process. Instead of employees manually entering every transaction and finance teams spending hours reconciling spreadsheets, automation handles these tasks instantly. Expenses are captured, categorised, and processed automatically—whether through receipt uploads in mobile apps or integrated company credit cards. The approval process will be streamlined, with expenses routed directly to the right managers for quick review. This saves valuable time for both employees and finance teams, allowing everyone to focus on more important work, affecting overall productivity and profitability.

Better data accuracy

Human error is inevitable when data entry is done manually. Automation greatly reduces the likelihood of mistakes. In addition, automated expense tracking systems ensure that transactions are recorded accurately and consistently, using machine learning to classify and match expenses with the right categories. This leads to more reliable financial records, as the system flags inconsistencies or duplicate entries for review. By improving data accuracy, businesses can avoid costly errors that might skew financial reports or cause issues during audits.

Enhanced visibility

One key advantage of automation is the real-time visibility it provides into company spending. With automated expense tracking, finance leaders have access to up-to-date expense data at any moment. With mobile apps, they can monitor trends, track budgets, and respond to potential issues as they arise. Instead of waiting for month-end reports, financial teams can generate on-demand reports that provide a detailed breakdown of expenses.

Higher employee satisfaction

For employees, manual expense reporting can be a frustrating and time-consuming task. Tracking down receipts, filling out forms, and waiting for approval and reimbursement can all contribute to leaving employees feeling demotivated. Automated expense tracking makes the process much simpler and faster. Employees can submit expenses with just a few clicks, and managers can approve them quickly, leading to faster reimbursements. This improves the overall employee experience and encourages timely and accurate submissions.

Better decision-making

Combining improved data accuracy, real-time visibility, and streamlined processes makes automated expense tracking a powerful tool for better decision-making. With reliable, up-to-date data at their fingertips, financial leaders can make informed, strategic decisions that align with business goals. They can analyse spending patterns, identify areas for cost savings, and adjust budgets as needed to ensure financial health. Leaders can stay informed and make decisions with confidence. This enhanced transparency ensures better financial oversight and the ability to act quickly when needed, supporting long-term business growth and enabling leaders to move from reactive to proactive financial management.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

How AI improves audit processes and predictive analytic

AI-powered expense tracking helps companies save time and make better decisions. By adding context to each expense, predictive AI reveals the reason behind transactions, supporting smarter budget planning. Real-time analytics offer instant insights, helping leaders quickly adapt to financial trends, while audit-proof data ensures full compliance, simplifying the audit process and reducing stress.

AI in Yokoy’s system is designed to streamline expense management and enhance financial oversight. AI in general is having a significant impact on improving audit processes and predictive analytics. With the power of AI, finance teams can simplify day-to-day tasks and gain deeper insights into their financial data.

Let us explore how Yokoy’s AI-powered features help companies make better financial decisions:

Predictive AI adds context to every expense

Yokoy’s predictive AI goes beyond merely tracking expenses: It adds valuable context to each transaction by analysing spending patterns, employee behaviour, and company policies. Yokoy’s AI power can predict the purpose and categorisation of future expenses.

For example, it might detect patterns in travel expenses or recurring vendor payments and automatically categorise them with accuracy. This predictive capability makes the entire process more intuitive, saving time for both employees and finance teams. Importantly, this added context helps finance leaders better understand their company’s spending habits, allowing them to make more informed decisions, such as adjusting budgets or negotiating with vendors.

Real-time analytics

With real-time analytics, Yokoy’s AI offers instant insights into your company’s financial data. Rather than waiting for monthly or quarterly reports, your finance team can access up-to-the-minute information in a user-friendly system to have real-time insights on expenses, spending trends, and potential cost-saving opportunities. This visibility is a game-changer for decision-makers, allowing them to react quickly to changes in financial performance or spending patterns. Your company’s financial leaders can drill down into specific expense categories, see who is spending what, and monitor policy compliance, all from one central dashboard. These actionable insights enable financial leaders to be proactive rather than reactive.

Audit-proof data

One of the biggest headaches in manual expense tracking is preparing for audits. Tracking down paper receipts, verifying data, and ensuring compliance can be a time-consuming process. However, with Yokoy’s AI, your company benefit from audit-proof data. Every expense is tracked, categorised, and stored digitally with full transparency, making it easy to retrieve and verify during an audit. Yokoy’s AI ensures that all transactions comply with your company’s policies and external regulations, minimising the risk of errors, fraud and non-compliance. This automated process not only simplifies your audits but also improves overall financial governance, giving your company confidence that your records are always accurate and audit-ready.

Next steps

In Yokoy’s case study with Stadler, you can see how our AI-powered spend management system boosted efficiency, reducing manual work and cutting expense report costs by 83 per cent. The intuitive platform integrated seamlessly into Stadler’s processes, enhancing collaboration and visibility across departments. Find out for yourself, how Yokoy’s compelling solution for finance teams can streamline workflows and improve decision-making.

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.