Home / How Virtual Corporate Cards Boost Expense Control and Limit Discretionary Spending

How Virtual Corporate Cards Boost Expense Control and Limit Discretionary Spending

- Last updated:

- Blog

Co-founder & CCO, Yokoy

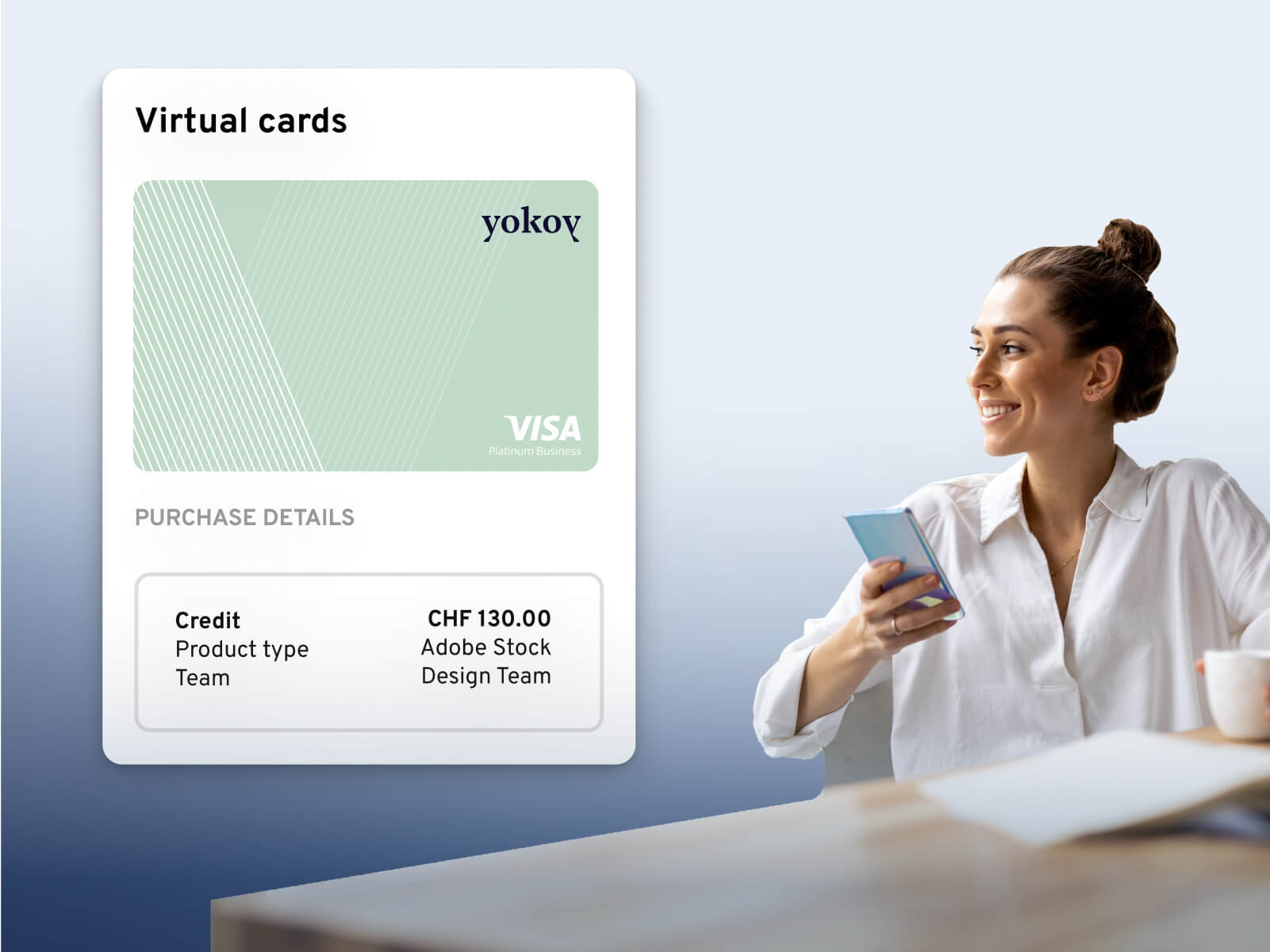

Corporate virtual cards solve a very specific problem for medium-sized and large organizations: They enable companies to tighten or loosen their spend control while keeping the real-time overview of business spending.

Unlike traditional cards, these intelligent payment cards can be fully integrated into spend management and expense reporting software, ensuring true end-to-end automation of the entire expense management process.

And if we look at the latest data from Visa, it’s safe to say that more and more businesses are starting to see the advantages of switching from physical to virtual cards.

Visa’s report on B2B payment methods shows that 1 in 3 businesses reduced their check usage in favor of electronic payment methods such as virtual cards, with use cases varying from supplier invoice payments to single use cards for employee expenses. Moreover, the virtual card market is expected to continue to grow, hitting $500B by 2025.

In this article, I’ll address the challenges these corporate cards solve, the benefits of virtual cards over traditional ones, and why virtual company cards are the perfect solution for limiting discretionary spending.

Let’s start with the basics.

What are virtual corporate cards and how are they different from physical cards?

At their core, both virtual and physical corporate cards do the same thing: They enable businesses to pay for their expenses. Just like physical cards, virtual ones have a cardholder, a card number, expiration date, and CVV.

Virtual cards can be issued on the go, can be used for a variety of payments – primarily online payments, and can be easily added to digital wallets for mobile payments. So for example, if you’re using Yokoy’s smart corporate cards and have an upcoming business trip, you can choose to pay for on-trip expenses with your virtual Yokoy card, through your mobile wallet.

Now let’s look at a few differences – I’ll refer to Yokoy’s virtual corporate cards, and compare them to traditional cards from other vendors.

Virtual cards:

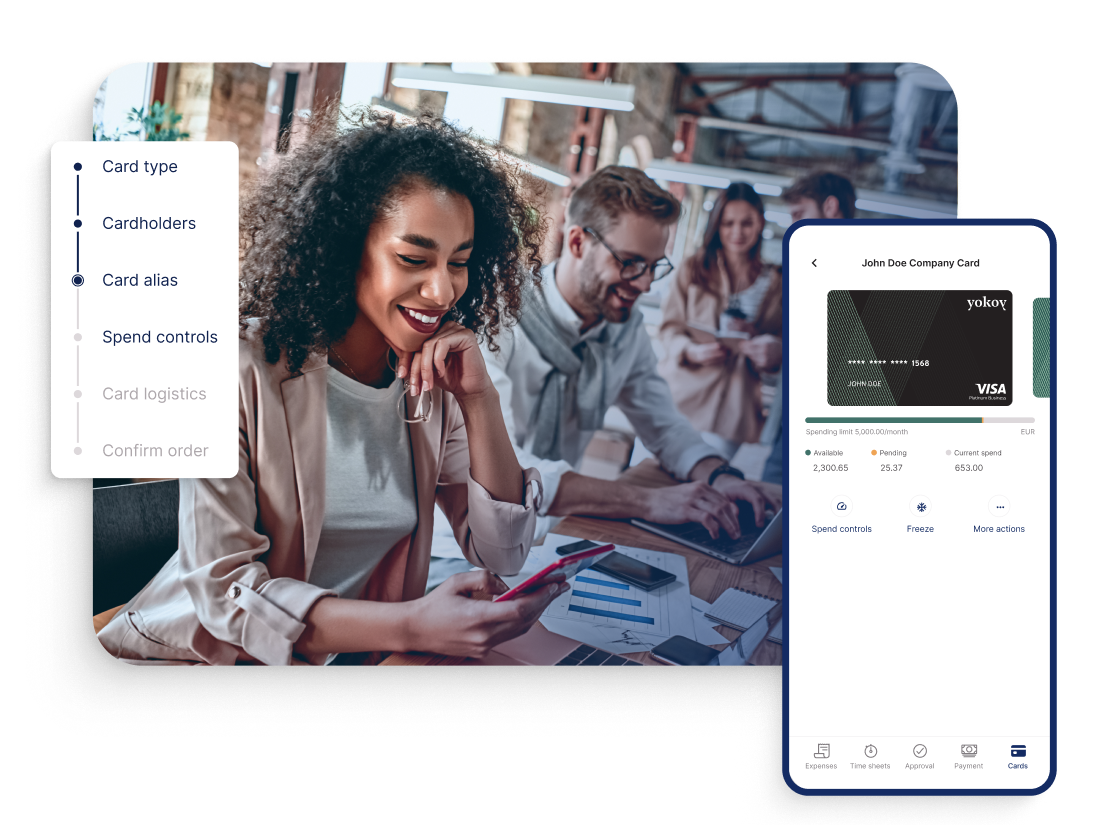

- Can be crated on-demand by any line manager or finance admin, directly from the Yokoy app.

- Can be frozen and terminated with one click, from our platform.

- Can be used for single transactions – in this case, they’re called single-use cards, or for multiple transactions such as recurring subscription payments for example.

- Can be customized with granular spend control, from spend limits to category or vendor restrictions.

- Can be used as virtual travel cards for travelers who need to make one-time purchases while on a business trip.

- And of course, being virtual, such cards can’t be lost, stollen, or shared between employees, which makes them excellent tools against expense fraud.

These are the high-level differences between corporate virtual cards and physical cards. Now let’s look at the main advantages and limitations of virtual company cards, before we dive into the discretionary spend topic.

Benefits and drawbacks of virtual company cards

Let’s start with the advantages – again, everything that I’m mentioning here refers to our smart corporate cards, not general company cards. If you’re curious to learn more about Yokoy’s cards, you can check our dedicated page: Smart corporate cards, or watch the webinar below.

Webinar on-demand

Why You Need Smart Company Cards

Smart company cards are increasingly surpassing the classic corporate credit card. But what advantages do smart company cards offer? And how can you benefit from them in practice?

Main advantages of virtual cards

Temporary validity

Probably one of the main benefits of virtual cards is their temporary nature. Such cards can be issued with a predetermined validity period, limiting their usability to a specific timeframe, transaction, vendor, category, team, and so on. This drastically reduces the risk of unauthorized use.

Granular spend controls

As mentioned earlier, virtual cards come with customizable spend limits, so you can set specific spending limits on each card, tailoring them to individual employees or departments.

Moreover, you can issue single-use virtual cards for one-time projects for example, or for team events, customer lunches, and so on. Single-use cards expire immediately after the first use, if the authorization was over 1 euro or GBP, so there is no risk that the cards would be reused.

Planted keeps spend under control with Yokoy

“A corporate card should be secure and uncomplicated – and this is exactly what the Yokoy Mastercard offers. In addition, the card is smart, saving us significant time.”

Christoph Jenny, Co-founder Planted

Full automation of expense reporting

Given that they’re fully integrated into the Yokoy spend management suite, our virtual cards – just like our physical smart cards, make it possible to automate your expense management from end to end. There is no need for additional spreadsheets and Excel tables with transaction details, so the burden of submitting expenses is removed for employees.

Automated reconciliation with expense receipts

Virtual cards make life easier not just for employees, but for admins too. Finance teams no longer have to waste time manually reconciling transactions with expense receipts, as all the data is available instantly in the Yokoy platform.

Enhanced security and fraud protection

Virtual cards add an extra layer of security to business transactions by minimizing the need to share sensitive card details. With limited validity and usage, the risk of card fraud or unauthorized transactions is significantly reduced.

Moreover, Yokoy’s smart virtual cards trigger real-time notifications in case of policy breaches or potentially fraudulent items, making it easy for managers and administrators to identify improper usage.

Limit private payments

Virtual cards are perfect for employees, as they can be immediately used to replace personal credit cards, saving them the inconvenience of using personal funds to cover business expenses. At the same time, this makes it easier for companies to track and keep expenses under control, so it’s a win-win situation.

Real-time spend data for end-to-end visibility

Both physical and virtual smart corporate cards provide admins and finance teams with real-time spend data, giving detailed insights into what gets spent, how, and by whom.

Through real-time tracking of transactions, finance teams can promptly identify potential discrepancies or irregularities, streamlining the reconciliation process.

Case study

How DO & CO Saved 750 Working Hours with Smart Corporate Cards

With 75% of all DO & CO’s expenses being paid with smart corporate cards, the expense management process is fully automated, saving 750 working hours in manual processes.

Flexibility for both users and admins

Virtual cards have the advantage that they can be immediately terminated, with no waste for the company. As there’s no plastic card issued, employees don’t need to return terminated cards. Moreover, they’re very flexible as you can set them as either single-use or multi-use cards, to limit risks and potential policy breaches.

Risks associated with company virtual cards

This one is really straightforward, as there’s just one disadvantage when it comes to virtual corporate cards: They can be used for mobile payments only through digital wallets, so unless you have that, you can’t use them on the go to pay for in-store purchases.

But other than this, you can use virtual cards for absolutely any transaction, and they’re ideal for online payments.

Before we move on to the topic of discretionary spend, one word on our Smart Lodge Card. This type of card is a virtual corporate travel card, meaning that its main use is paying for pre-trip purchases, such as hotel bookings or travel tickets. You can learn more about it below.

Yokoy Smart Lodge Card

One card for all your travel bookings

Securely pay for flights, rail, hotel, and travel services with one central Smart Lodge Card. No transaction fees, no foreign exchange fees, no card fees.

How virtual company cards limit discretionary spend

Limiting discretionary spending is not only sensible from a business perspective but also crucial for maintaining financial stability and long-term growth.

Without effective expense management, companies may unknowingly incur excessive costs, leading to reduced profitability and financial inefficiencies. Moreover, the absence of a clear spending policy can also contribute to a lack of transparency, making it challenging for finance teams to identify and address problem areas effectively.

Although we do love it when our customers trust their employees so much that they don’t have strict policies in place for discretionary expenses, we’ve seen multiple cases of companies losing millions every year to maverick or discretionary spend.

In fact, this is one of the main reasons why customers opt for Yokoy’s smart corporate cards. For instance, one of our customers struggled with uncontrolled discretionary spending for more than 10 years.

They always had to wait until the end of the month to get an idea of how much their employees were spending, and the conversations with employees who were overspending were never enjoyable.

Upon adopting virtual cards, they observed a remarkable 30% reduction in employee expenses, resulting in increased profitability and a stronger financial position. And this situation is quite common.

We talk to a lot of companies who would love to have more control over employee spending but are hesitant to put too many restrictions in place, to not hurt their company culture or introduce unnecessary bureaucracy.

Our advice is to equip their employees with smart corporate cards – physical or virtual, and use single-use cards when necessary to control discretionary spend.

DO & CO tracks expenses in real time with Yokoy

“Yokoy’s integrated corporate credit card solution played a pivotal role in our decision-making process. The seamless data transfer streamlines expense tracking, minimizing manual efforts and significantly enhancing efficiency.”

Johannes Echeverria, CFO at DO & CO

For example, company or team events with a fix budget can be paid with single-use cards. One-time online purchases for business purposes are a suitable candidate too – there’s no need to give an employee a permanent card if they need to pay for a one-time training session, for example.

Travel expenses for employees who don’t usually travel and don’t need a regular physical card can also be paid with virtual cards. This way, the company doesn’t waste resources on physical cards, and employees don’t have to pay with their personal cards.

Another recommended use of virtual cards is in industries where temporary workers are employed, for example in construction, retail, quick-service restaurants, and so on.

Companies can still give their employees corporate cards, but they can use virtual cards to limit spend and simplify the procedure of terminating the cards once workers’ contracts end.

Here are some more examples of expense categories where virtual cards can come to the rescue:

- Event participation – for example, your sales team is attending a trade show, and you want to make sure they stay within a budget.

- Work outsourced to freelance contributors and paying for collateral and other such marketing materials is a common use case with technology companies.

- Expenses made during field trips, customer visits, and so on. For example, our customers in the manufacturing industry often send their engineers to warehouses or production sites. Virtual cards are perfect for such visits.

Next steps

Corporate virtual cards present a transformative solution for medium-sized and large organizations, offering benefits such as granular spend controls, full automation of expense reporting, enhanced security, and real-time spend data for comprehensive visibility.

To truly experience the power of Yokoy’s corporate virtual cards and discover how they can transform your organization’s spend control, I invite you to book a demo below.

Yokoy Smart Corporate Cards

Pay the smart way

Simplify your card administration and gain real-time visibility and control over your global spend with Yokoy’s Smart Corporate Cards.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.