Home / Expense Management Challenges in Construction Companies and How Automation Can Help

Expense Management Challenges in Construction Companies and How Automation Can Help

- Last updated:

- Blog

Co-founder & CCO, Yokoy

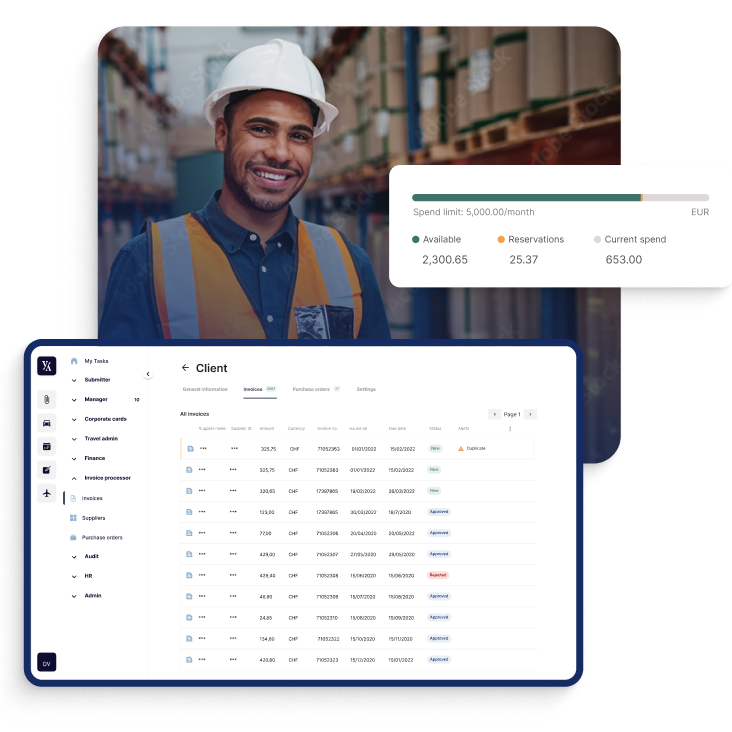

In construction companies, traditional expense management methods often result in limited visibility into field expenses, disjointed tech landscapes, time-consuming data entry tasks, and the persistent challenge of missing receipts. However, the adoption of automation is transforming expense reporting in this industry.

Automation allows for the effortless capture of receipts, enhancing process efficiency, minimssing errors and fraud, and providing greater control over spend. Moreover, it ensures rigorous compliance enforcement and offers end-to-end visibility into expenses.

As construction businesses embrace modern expense management solutions powered by automation and artificial intelligence, they pave the way for more streamlined, efficient, and accountable expense management practices that contribute to their financial success and competitiveness in the industry.

Traditional construction expense management and its challenges

Traditional construction expense management is fraught with challenges that can hinder efficiency and transparency within the industry.

Expense management challenges

Out-of-pocket expenses

In construction, it’s common for employees to incur out-of-pocket expenses while on the job, such as purchasing small tools or materials needed for a project.

Managing these out-of-pocket expenses can be challenging, as employees often use personal funds and may not always remember to report them promptly.

Without a streamlined process for tracking and reimbursing these expenses, there is a risk of these costs going unaccounted for, which can impact both the financial accuracy and employee satisfaction.

Maverick spending

Maverick spend refers to unauthorized or non-compliant spending within an organization. In construction, where projects are fast-paced and dynamic, maverick spend can be a significant challenge.

Construction projects often involve various teams, subcontractors, and suppliers who may make purchases without adhering to the established procurement processes or approved business expenses.

This can result in inflated project costs, discrepancies in reporting, and difficulties in maintaining budget control. Identifying and curbing maverick spend is crucial to maintaining financial discipline and limiting unapproved construction costs.

Receipt tracking

Receipts are crucial for verifying expenses and ensuring compliance. However, in the challenging environments of construction sites, receipts are frequently lost, damaged, or otherwise rendered unusable.

This poses a significant challenge for construction firms, as reconciling expenses without proper documentation becomes a daunting task. Missing receipts can lead to disputes, delays in reimbursement, and financial discrepancies that are challenging to resolve.

Inefficient approval workflows

Traditional approval workflows in construction expense management often involve a paper-based or email-driven process. These workflows can be inefficient and prone to bottlenecks.

Delays in approvals can disrupt cash flow and create frustration among employees awaiting reimbursement.

Limited visibility into field expenses

Construction projects are inherently decentralized, with expenses incurred across various job sites and locations. This geographical dispersion makes it challenging to gain real-time visibility into field expenses for effective cost management.

Construction companies often struggle to track and manage these project expenses effectively, leading to potential overspending and operational inefficiencies. Without a clear view of where funds are going, financial control becomes elusive.

Compliance and auditing complexity

The construction industry is subject to numerous regulations and compliance requirements, both internally and externally. Ensuring that all expenses align with company policies and industry standards can be a complex and time-consuming endeavor.

Traditional expense management methods may lack the automated checks and balances needed to enforce compliance effectively and keep operations audit-proof. As a result, construction companies are at risk of non-compliance issues and potential financial penalties.

On top of this, construction companies deal with general spend management challenges.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Spend management challenges in construction companies

Budget overruns

Construction projects often encounter unexpected costs, such as unforeseen site conditions or changes in project specifications. These surprises can strain the initially planned budget, making it challenging to stay within financial constraints. Additionally, evolving project requirements may necessitate adjustments, further complicating budget control.

Procurement complexity

In the construction industry, the variety of materials and equipment required for projects can be vast. Managing the procurement of these diverse items can be a complex and time-consuming task. This complexity includes sourcing suppliers, negotiating contracts, and ensuring timely deliveries, all of which demand meticulous attention.

Supplier relationship management

Construction companies rely on a network of suppliers and subcontractors. Maintaining relationships with these parties to ensure reliability and cost-effectiveness can be challenging. Dependence on external entities means that any issues on their end can impact the construction project, highlighting the importance of strong supplier relationships.

Time-consuming processes

Traditional expense management in construction often involves manual data entry processes. Employees are required to input expense details, such as receipts, amounts, and categories, into spreadsheets or accounting software.

This manual approach is not only time-consuming but also error-prone. It diverts valuable human resources away from more strategic tasks and introduces the risk of inaccuracies that can have financial repercussions.

Disjointed tech landscapes

Many construction companies rely on a patchwork of software solutions for various aspects of their operations. These solutions may not seamlessly integrate with one another, creating a fragmented and disjointed tech landscape.

This complicates expense tracking and reporting. The inability to synchronize data across different systems can result in data silos, making it difficult to compile comprehensive expense reports and gain holistic insights into spending patterns.

Addressing these challenges often requires the adoption of modern technology, streamlined processes, and robust training and communication within construction companies.

How automation streamlines expense management in construction companies

In the construction industry, where precision, accountability, and efficiency are paramount, embracing automation can revolutionize the entire expense reporting process.

Here’s an in-depth overview of how automation can bring about this transformation.

Easily capture receipts

One of the most significant advantages of automation is the seamless capture of receipts. Mobile apps equipped with OCR technology allow field workers to snap pictures of receipts on the go.

This feature significantly reduces the risk of losing critical documentation amidst the hustle and bustle of construction sites. Every receipt is digitally preserved, ensuring that no expense goes unaccounted for.

Yokoy Expense

Manage expenses effortlessly

Streamline your expense management, simplify expense reporting, and prevent fraud with Yokoy’s AI-driven expense management solution.

Real-time expense tracking

Automation provides real-time visibility into expenses as they occur. Project managers and finance teams can monitor expenditures as they are reported, rather than waiting for manual updates. This immediate access to expense data empowers timely decision-making, helping construction firms stay on budget and prevent overspending.

Streamline expense reporting

Traditional expense reporting often involves manual paperwork, email submissions, or spreadsheets. Automation replaces these cumbersome methods with user-friendly, digital interfaces and mobile apps, simplifying expense reporting.

As a result, field workers can effortlessly submit expenses on the go, ensuring that no expense goes unreported. This streamlined process saves valuable time for both employees and administrators.

Enforce compliance

The construction industry is rife with regulations and company policies. Automation serves as a diligent guardian, ensuring strict adherence to these guidelines.

Spend management tools enforce compliance with company policies and industry regulations, reducing the risk of costly non-compliance issues. This level of adherence safeguards the financial health and reputation of construction companies.

Opinion

Maximizing Compliance through Automated Expense Reporting

Automated expense reporting has been gaining traction as a solution to help finance teams streamline their workflows and gain real-time insights into company expenses. But there’s one more area where automation can help tremendously: Staying compliant.

Lars Mangelsdorf,

Co-founder and CCO, Yokoy

Control spend in real time

Automation equips construction companies with real-time visibility into spending. Finance professionals can monitor expenses as they occur, rather than relying on retrospective analysis.

This level of control empowers organizations to proactively manage costs, prevent overspending, and make informed financial decisions on the fly. With automation, no expenditure goes unnoticed.

Remove errors and fraud

The construction industry leaves no room for error. Automation excels in reducing human error by automating calculations and validations.

Furthermore, it offers built-in fraud detection mechanisms, ensuring that expense data maintains its accuracy and integrity. With automation, construction companies can rest assured that their financial records are error-free and fraud-resistant.

Automate workflows

Automated expense management tools act as the backbone of streamlined expense workflows. They simplify and expedite the entire process, from expense submission to approval and reimbursement.

With automation, construction professionals can bid farewell to the tedious, time-consuming data entry and approval processes that often plague traditional expense reporting.

Blog article

How to Prevent Expense Fraud with AI-Driven Compliance and Custom Workflows

Expense fraud is a pervasive problem that continues to plague companies of all sizes and industries. In fact, a recent survey by the Association of Certified Fraud Examiners found that organizations lose an estimated 5% of their revenue to fraud each year, with expense reimbursement fraud being one of the most common types of fraud.

Lars Mangelsdorf,

Co-founder and CCO

End-to-end visibility

Expense management software doesn’t just provide a snapshot of the expense reporting process; it offers a panoramic view from start to finish.

From the moment an expense is submitted to the point of reimbursement, automated systems provide end-to-end visibility. This transparency is invaluable, allowing construction companies to track expenses, monitor approval progress, and ensure timely reimbursements.

Next steps

In conclusion, automation isn’t merely a convenience for construction companies; it’s a catalyst for efficiency, accuracy, and fiscal responsibility.

As construction companies continue to embrace automation, they embark on a journey towards more efficient operations, reduced costs, and enhanced compliance in an industry where every detail matters.

Yokoy’s AI-powered spend management suite helps global organisations streamline their expense management process, automating the entire expense processing flow through functionalities like AI data capture and validation, automated transaction matching and reconciliation, and automated booking.

If you’d like to see what Yokoy can do for your AP process, you can book a demo below.

See Yokoy in action

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.