Home / Compliance Center / Compliance in Germany

Compliance in Germany

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

Proof of Receipt

Regulations in place

According to German regulation, companies can store expense receipts digitally.

The original physical receipts are no longer required if the picture of the receipts are stored and server hosted in Germany/EU and adhere to principles of GoBD (Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff).

The GoBD principles requires companies to have a proper management and storage of books, records and documents in forms. The authenticity of the origin, the integrity of the content and their legibility must be ensured throughout the retention period in the digital storage. The principle also states that the companies should ensure the following:

- Traceability & verifiability: The processing of individual business transactions and the accounting and recording procedures used must be traceable. It must be possible to trace the origin and processing of business transactions without any gaps (progressive and retrograde auditability).

- Obligation to keep individual records: The law stipulates that cash register records for income and expenditure must be kept individually.

- Completeness: The business transactions must be recorded in full and without gaps.

- Correctness: Business transactions shall be accurately reflected in documents in accordance with the actual circumstances and in compliance with the legal provisions.

- Readability: The reproduction must correspond to the original both visually and in terms of content if it is made legible (visual verifiability).

- Mechanical Evaluability: Enabling a mathematical-technical evaluation, a full text search or an examination in the broadest sense.

- Timely Document backup: Receipts must be backed up promptly and secured against loss.

- Order: Business transactions shall be recorded in a systematic, clear, unambiguous and identifiable manner.

- Immutability: Once information has been introduced into the processing procedure, it may no longer be suppressed or overwritten, deleted, altered or falsified without being identified, so that its original content can no longer be determined.

- Availability: The data subject to retention must be available (for the duration of the statutory retention period) and must be able to be made readable without delay.

- Integrity: Integrity of the contents.

- Authenticity: Authenticity of origin. A business transaction can be clearly assigned to an originator.

Yokoy's solution

Depending on the workflow of the company, the data and pictures can be checked by multiple parties (including the Finance team) before the expense is approved, booked in the Finance tool and reimbursed to the employee. Such checks can include the correctness of the data or quality and completeness of the picture.

Per Diem

Regulations in place

Per Diems are fix amount allowances paid to employees for expenses incurred when travelling (for lodging, meals, and incidental expenses) without the need to have a receipt.

There are Per Diem rates defined by the German government, which outline permissible limits for meal and lodging reimbursements that come with no tax implications. However, any amounts surpassing these limits are regarded as taxable income for the employee.

Note: The rates are published by the German Government on a yearly basis. Refer this link for Foreign Per Diem rates.

Per Diem Deductions

If the employee receives meal from the company/employer or already paid together with the accommodation, the meal should be deducted from the daily allowance.

The deductions for each meal may vary:

- Breakfast – 20% deductible

- Lunch – 40% deductible

- Dinner – 40% deductible

One day Domestic trip

Employees are allowed to receive Per Diem for single day trip. According to German regulation, the employee must travel more than 8 hours to receive Per Diem for the one-day business trip.

If the employee travels:

- More than or equal to 8 hours, then the employee is entitled to receive reduced Per Diem rate of 14€

- Less than or equal to 8 hours, the employee is not entitled to receive any Per Diem

Multi-day Business trip

If the employee travels for multiple days and has overnight stays during the business trip, the employee is entitled to receive:

- Reduced Per Diem allowance of 14€ for the day of departure and arrival

- Full Per Diem allowance for the rest of the day(s) during the business trip

Per Diem Rule

Per Diem rates are highly influenced by the location, duration of the business trip. German government has a set of rules and may vary based on each business trip.

Midnight Rule

Unlike the name says, the business trip does not necessarily have to be in the midnight, the employee can travel in anytime of the day to receive Per Diem. If the business trip meets the below requirement, then the employee receives Per Diem based on this rule:

- Midnight rule applies only if the business trip falls within two calendar days

- Travel time:

- Day 1 = < 8 hours

- Day 2 = < 8 hours

- Total travel time = > 8 hours

- If both the requirements are met, the employee is entitled to receive Per Diem of 14€ for both these days.

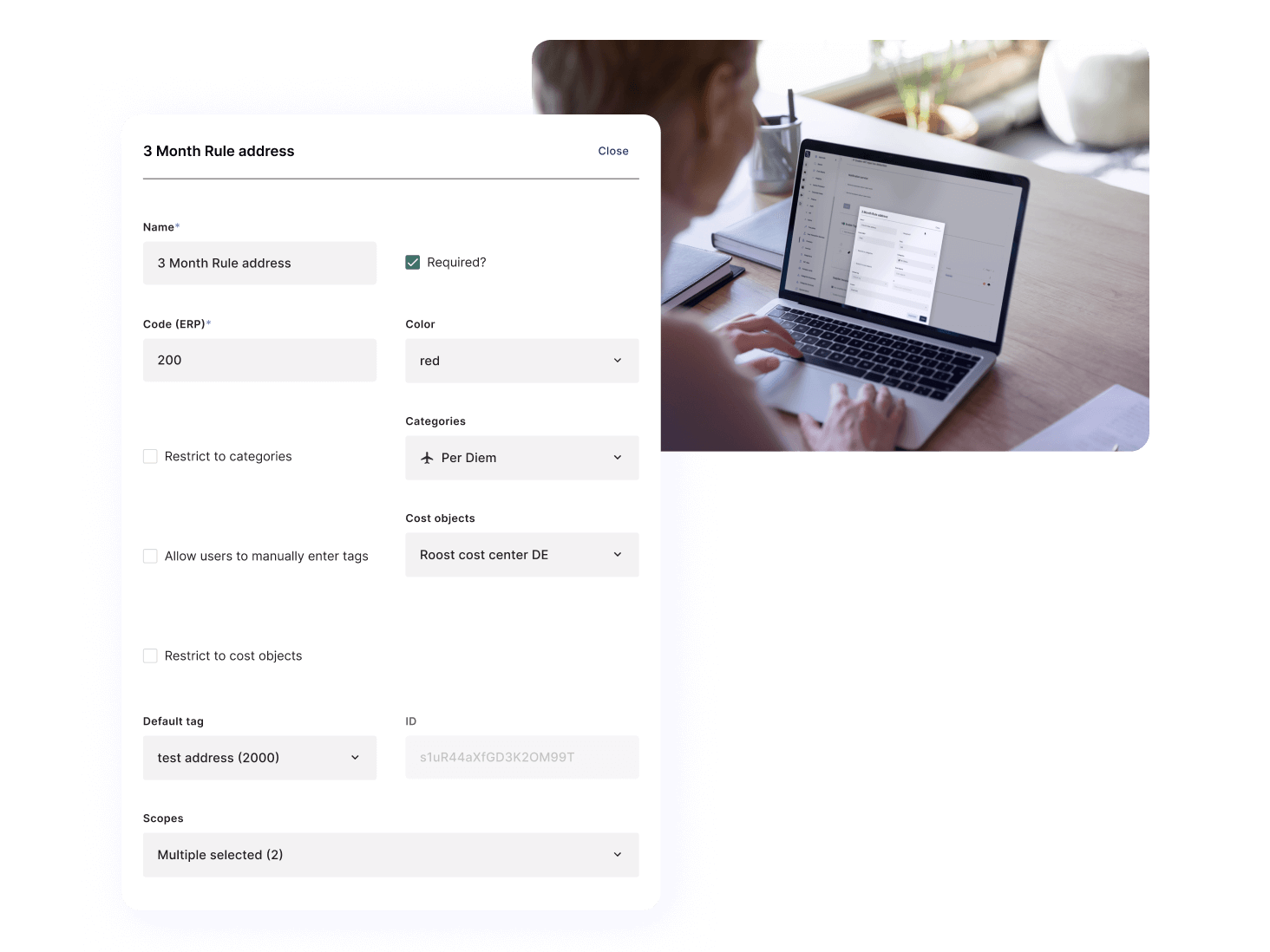

3 Month Rule

According to German regulation, Per Diem is taxable after 3 months of consecutive travel to the same location.

3 Month rule commences if the employee travels to the same location or works in a temporary work location for at least three days in a week. If the employee travels to the same location less than 3 days in a week, the three-month rule does not apply.

If the employee receives Per Diem for 3 months according to the above-mentioned criteria, then the Per Diem is subjected to income tax after 3 months.

Additionally, if the employee does not travel to the same location at least 4 weeks, then the calculation will reset, resulting to an initiation of a new calculation.

M Report

Employees should be able to have a clear reporting on their reimbursement including Per Diem and Mileage allowances every month; this supports employees and companies submit a report to tax authorities in Germany.

Benefits-in-kind

In some cases, employees receive meal from the company this commences Benefits-in-kind rule. For such instances German government states, if the meal provided by the company is more than what’s recommended by the government, then the value of the meal is considered taxable.

Yokoy's solution

These rules are complex and as an employer you must always accurately verify the user’s travel history to calculate the appropriate Per Diem and check if any amounts fall under income tax.

A company can enter different Per Diem rates and the respective calculation rules into their Yokoy system. Per Diems are thereby automatically calculated based on the relevant rates and the calculation rules without manual work or calculations.

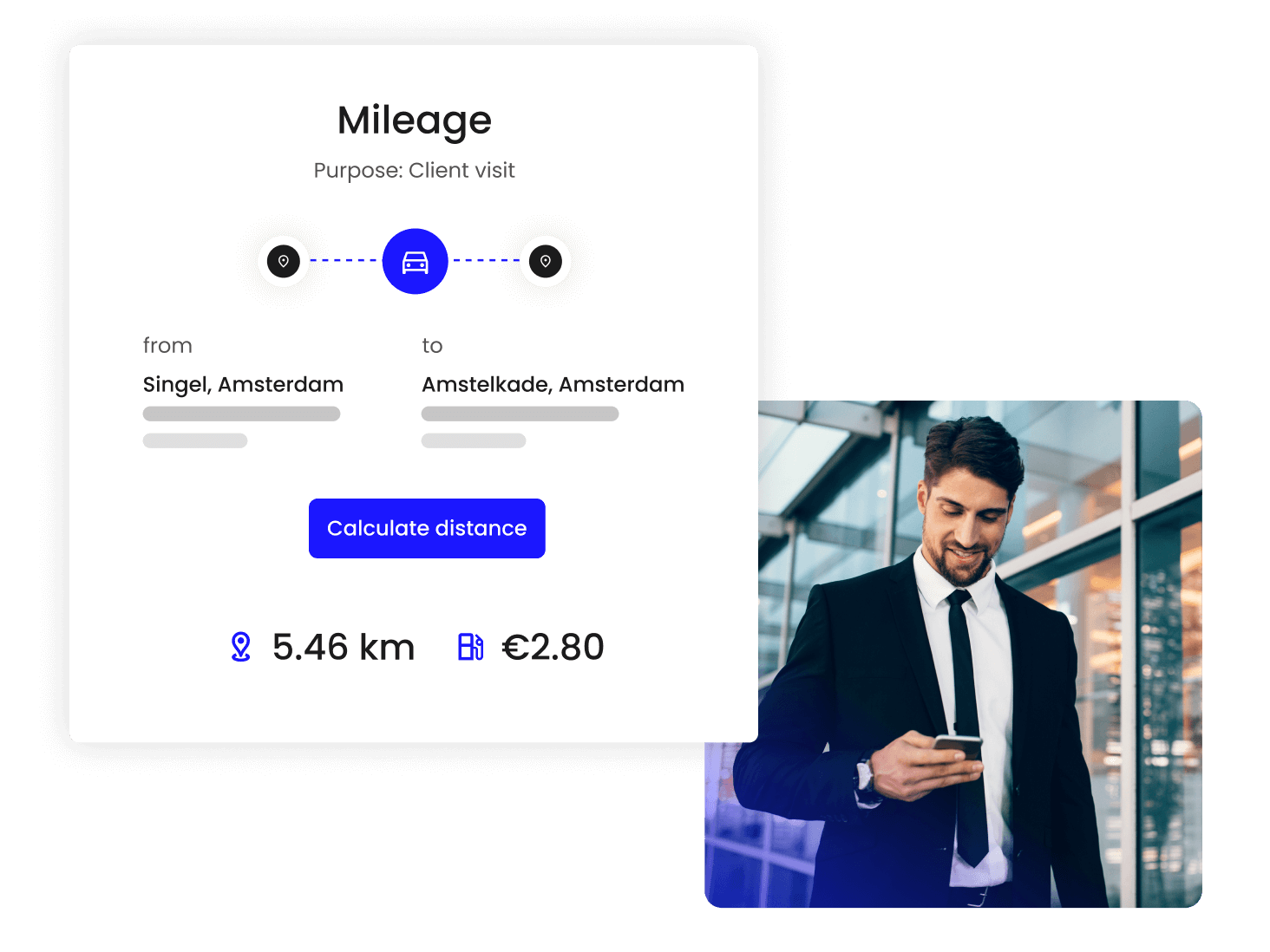

Mileage Allowance

Regulations in place

Mileage expenses are intended to cover the employee’s commute cost for business trips when using a private vehicle apart from the daily allowance/Per Diem. The German government recognises mileage allowances as a flat rate for all costs incurred for the usage of private vehicles for eligible business trips.

Current mileage rates in Germany can be found here

If the employee receives the amount more than what’s recommended by the government, the additional amount falls under income tax.

For example: The government recommends 0.30€ Per kilometer; however,if the employee receives 0.50€ per kilomoter, the difference of 0.20€ per kilometer would be subjected to income tax and needs to be accounted differently.

Yokoy's solution

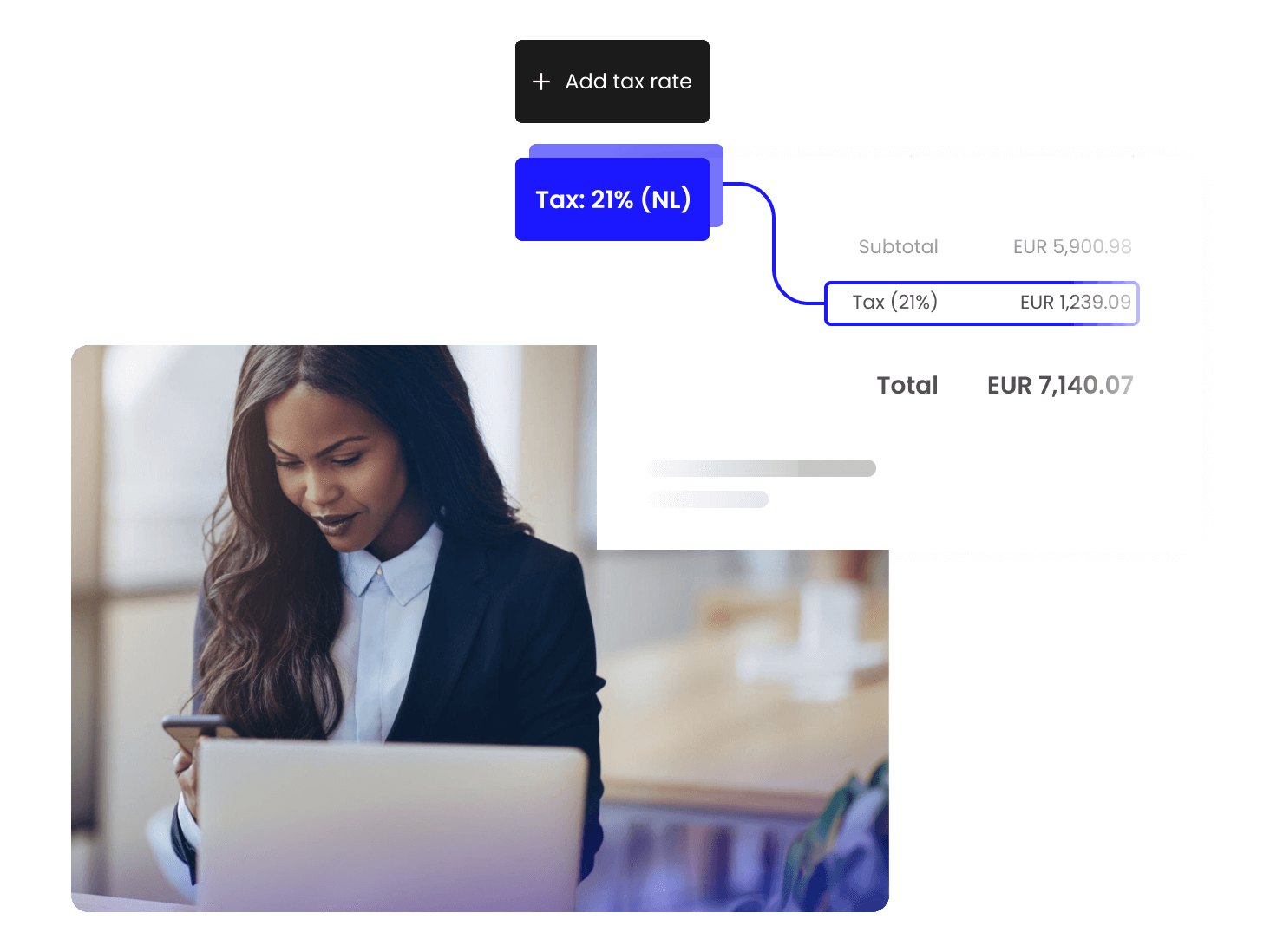

VAT Rate

Regulations in place

German government levies VAT rates for exchange of goods and service. There are three different VAT rates relevant for expense management:

- Standard VAT – 19% for most of the goods and services

- Reduced VAT – 7% for Health care, books, water supplies, Food items and a lot more

- No/Zero VAT – 0% for VAT exempted goods and services

Yokoy's solution

Yokoy automatically extracts all VAT rates relevant for expense management (see table above) on the receipt pictures. Companies can also add additional VAT rates for extraction, if relevant.

Yokoy can also extract VAT rates from other countries (e.g. Germany) and book/export them separately in the Finance tool.

Additionally, Yokoy offers standard integrations with external VAT reclaim providers, whereby the receipt pictures and the extracted VAT rates are for specific countries are automatically sent from Yokoy to the third party.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo