Home / Compliance Center / Compliance in Belgium

Compliance in Belgium

- Last updated:

Product Marketing Manager, Yokoy

The information provided on this website (https://yokoy.io/) is for information purposes only. All information on the website is provided in good faith, however we make no warranties of any kind regarding the accuracy, adequacy, validity or completeness of any information provided on the website or suitability for your specific business case. In order to discuss your specific business case please book a demo and we will arrange a call.

In Belgium, compliance emerges as a pivotal foundation within the intricate framework of regulatory adherence.

Complying with these standards is not merely a legal mandate but a reflection of Belgium’s dedication to fostering transparent and principled financial practices.

As we delve into the nuances of Belgium’s compliance landscape, this blog aims to shed light on the challenges and opportunities that businesses encounter in their pursuit of aligning with regulatory requirements.

Download for later

No time to read right now? Get the .pdf version of the guide below.

Proof of Receipt

Regulations in place

According to Belgium government, companies can process and store digital receipts using an expense management tool. To comply with the regulatory requirements, the expense management tool must have obtained permission and certification from the Belgium government.

If the tool does not have the certification, companies must store original receipts for audit purposes.

Yokoy's solution

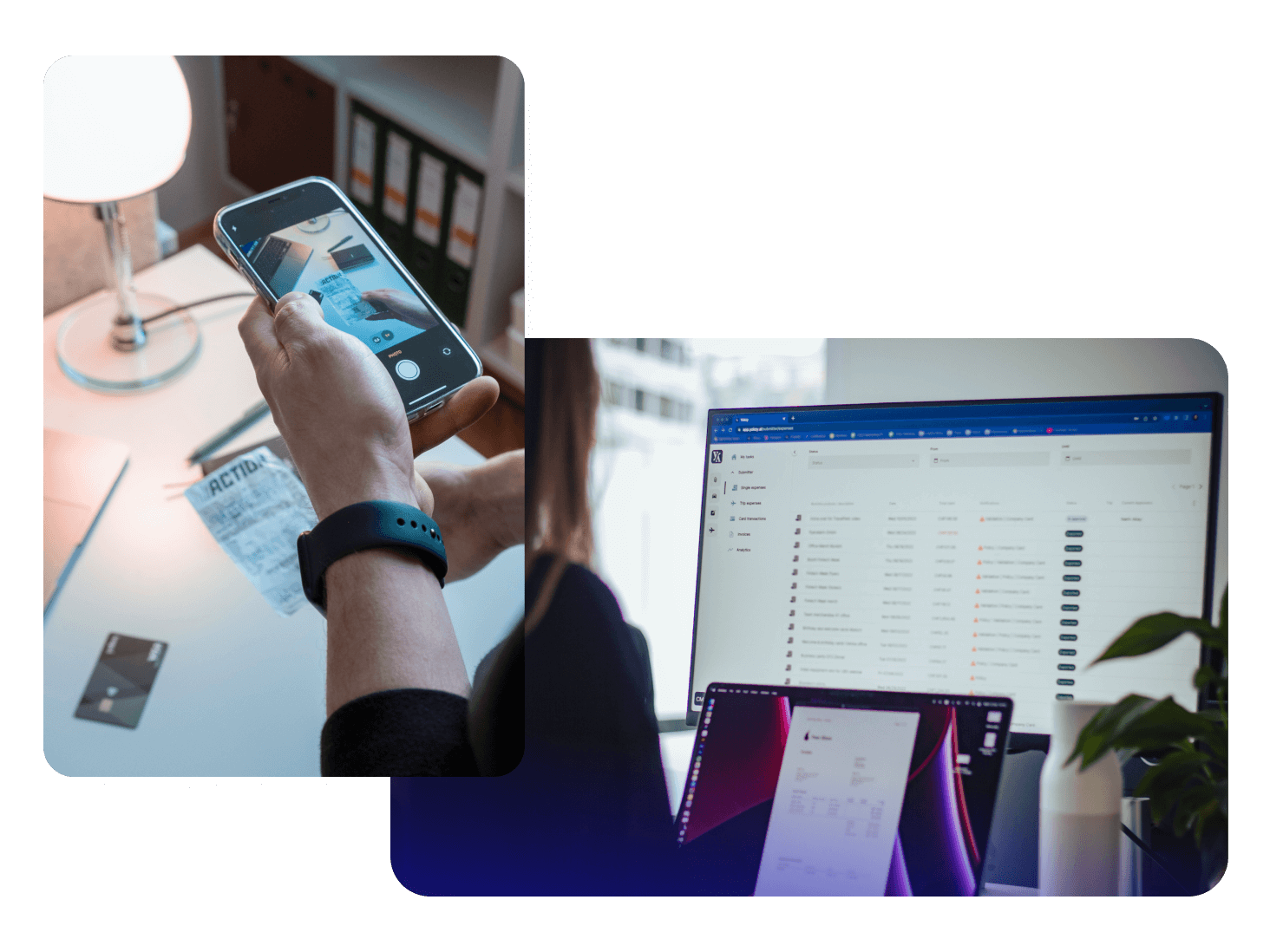

Yokoy enables employees to take a picture of the receipt or upload digital expense receipt and submit them via Yokoy mobile or web application. Once uploaded, Yokoy processes and extracts all receipt and automatically prepares the expense report in seconds. With any potential frauds or policy breaches, Yokoy immediately triggers a warning to highlight specific event.

Depending on the specific workflow and company policy, expense report can be checked by multiple parties before being approved and booked into the ERP or Finance tool, ensuring correctness and completeness of the receipt.

Yokoy adheres to GDPR regulations and stores receipts securely for the statutory retention period on it’s servers hosted in EU. However, to comply with Belgium regulations Yokoy recommends companies to store physical receipts.

Per Diem

Regulations in place

Per Diems are fixed amount paid to employees for expenses incurred during a business trip such as meal, lodging and incidental expenses without needing to have an expense receipt as a proof of expense.

Employees in Belgium are entitled to receive Per Diem for their business trip. Per Diem rates are defined by the Belgian government which outlines the permissible limit for meal and lodging reimbursement that has no tax implications. However, any amounts surpassing these limits are regarded as taxable income for the employee.

Domestic Per Diem

As per Belgian government, the base amount for domestic Per Diem is €10,00/day and the maximum amount is €19,99/day from 1st Jan 2023. To receive Per Diem, the business trip should meet certain requirement,

- Duration of the business trip should be at least six hours

- The distance of the trip should be more than 25 kilometer outside of the home address or company’s office address

For accommodation, employees are entitled to receive €149.99/night

Reductions

- Any accommodation or meals provided by the employer should be reduced and accounted for the employee.

- If the employee receives a meal voucher for the day, the daily allowance should be reduced with the amount the employer paid for the meal voucher (max. €6,91 per meal voucher).

Foreign Business trip

Every year, the Belgian government announces Per Diem allowances for foreign countries. The daily allowances covers the cost of the meal and other small expenses such as local transport cost, drinks, snacks and telecommunication during the business trip.

Only employees who works inside a company (non-field employees) and who do not travel on a daily basis are entitled to receive Per Diem.

The government divides Per Diem into two categories,

- Category 1: Short business trips – Business trips lasting <30 consecutive calendar days.

- Category 2: Long business trips – Business trips lasting >30 consecutive calendar days up to 24 months

Depending on the location, the maximum Per Diem rates for both these categories can be found in the document attached below. Furthermore, employees are entitled to only receive Per Diem up to 24 months. Beyond 24 months, Per Diem are considered as taxable income for the employee.

If the employee travels to multiple countries Per Diem will be issued based on the location of the overnight stay.

One day business trip

Applies to business trips that lasts a one single day which means, the departure and arrival of the business trip are on the same day. In such cases, if the business trip lasts,

- more than 10 hours, a full day allowance can be claimed

- less than 10 hours, Domestic Per Diem will be applied

Reductions

Reductions/deductions must be applied when the employer had already paid any of the allowances for the business trip. If the accommodation had already been provided or paid by the employer, accommodation allowance will not be applicable. In case employer provides any of the meals during the business trip, reductions should be applied as follows,

- Breakfast: 15% of the daily allowance

- Lunch: 35% of the daily allowance

- Dinner: 45% of the daily allowance

For a business trip, the employee is allowed only to receive either the actual expense amount or the daily allowance outlined by the Belgian government.

Check the list of Per Diem rates for each country defined by the Belgian government here, applicable as of 15th February 2023.

Yokoy's solution

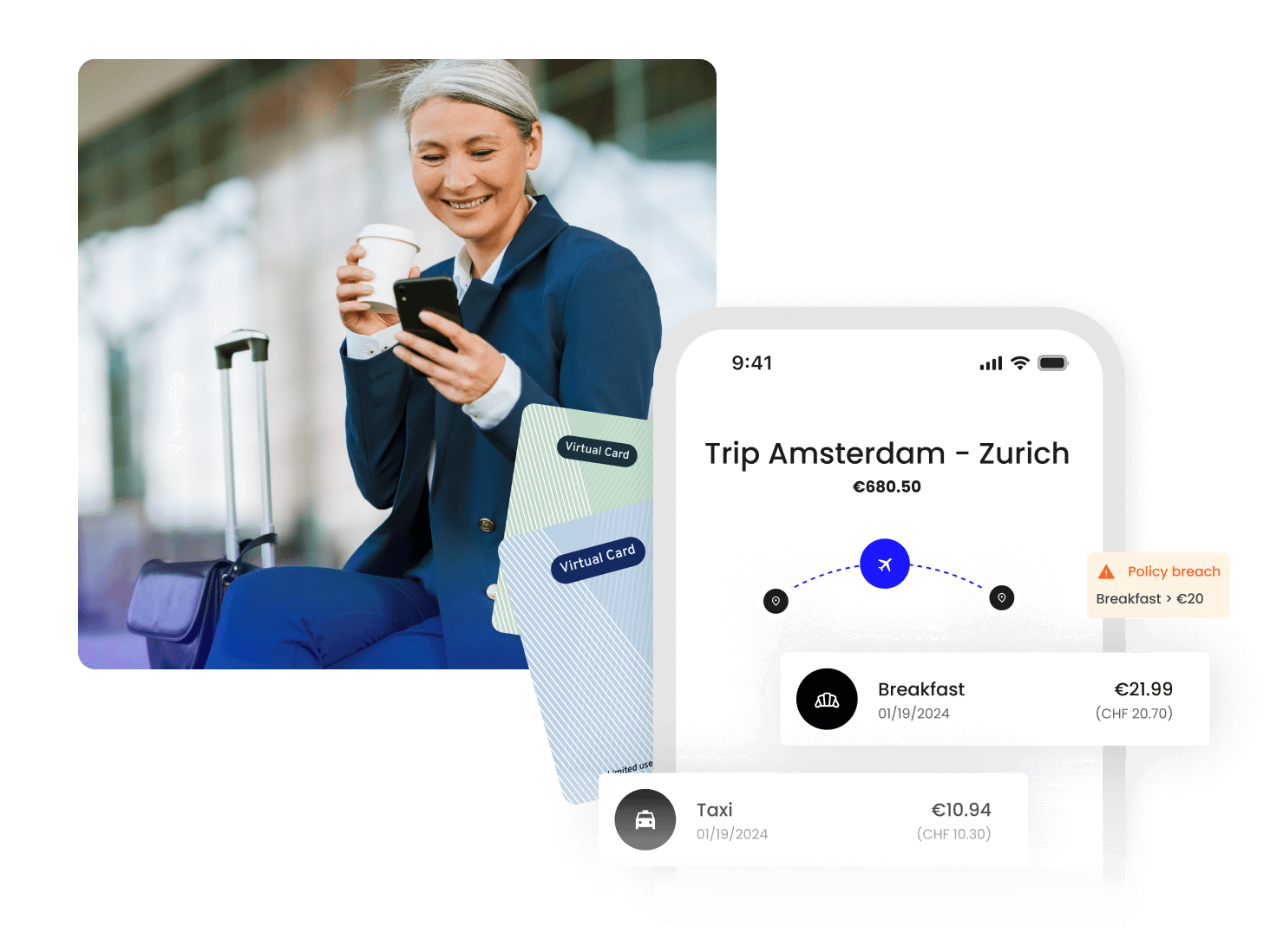

As you can imagine, these rules could be quite complex, and you must always verify the user’s travel history to calculate Per Diem and check the amount that falls under income tax.

Yokoy can automatically calculate Per Diem rates based on the business trip and calculation rules without requiring any manual work from the employees.

If the user receives allowance higher than the governmental rate, the difference can be booked and exported differently in the Finance tool.

Mileage Allowance

Regulations in place

Mileage allowances are intended to cover the employee’s travel cost for business trips when using a private vehicle. Mileage allowances are independent of daily allowances paid by the employer. The Belgium government recognises the below mentioned mileage allowances for specific periods as a flat rate for all costs incurred for the use of private vehicles for a business trip.

As per Belgium government, an employee is entitled to receive,

- €0.4259 per kilometer from 1st October 2023 to 31st December 2023

- €0.4237 per kilometer from 1st July 2023 to 30th September 2023

- €0.4246 per kilometer from 1st April 2023 to 30th June 2023

- €0.4259 per kilometer from 1st January 2023 to 31st March 2023

- €0.4201 per kilometer from 1st October 2022 to 31st December 2022

Yokoy's solution

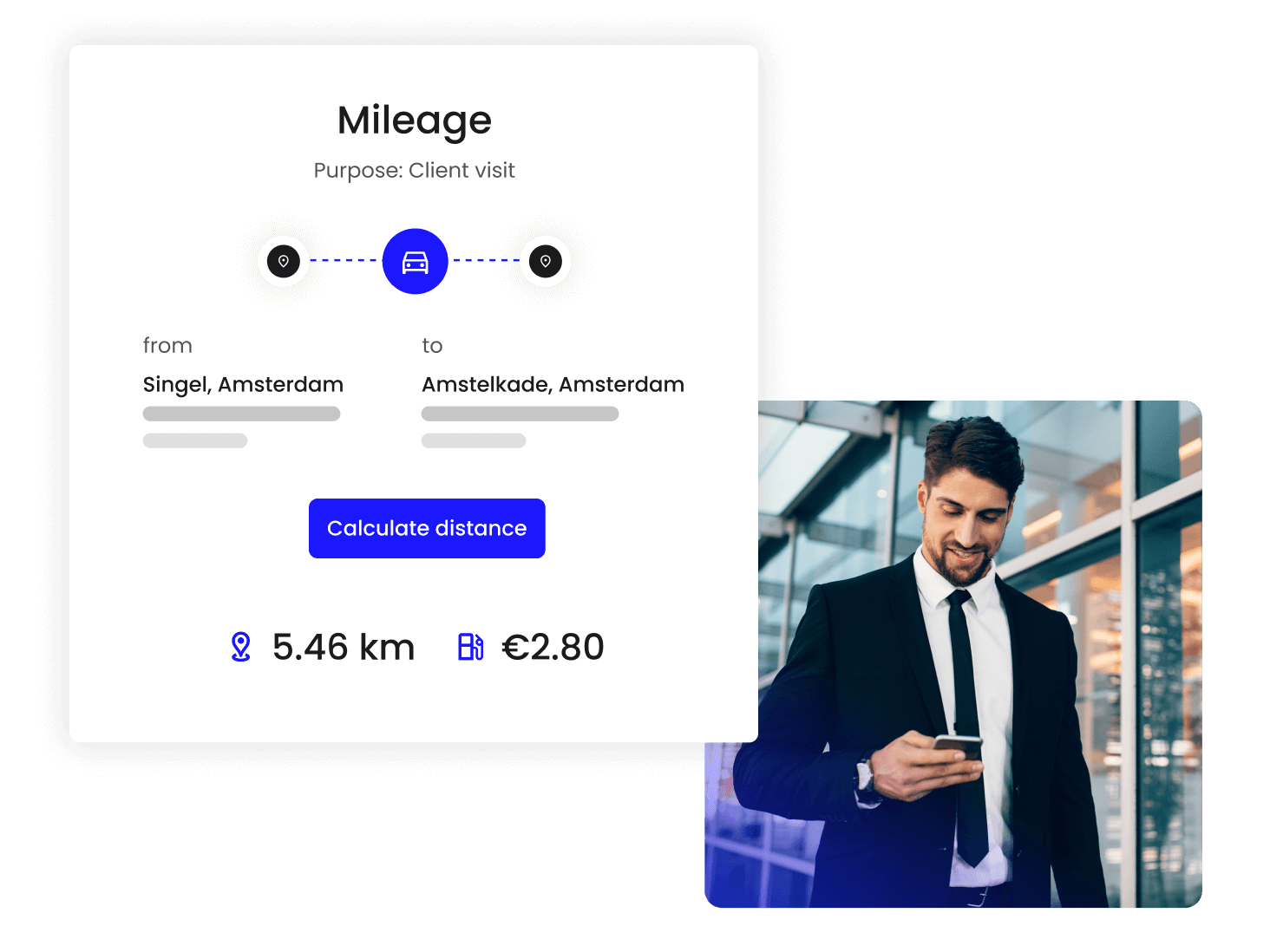

Yokoy recognises all the official rates defined by the government and therefore can automatically calculate mileage expenses based on the distance travelled.

In addition, companies can pre-configure mileage rate in advance with an expiration date; therefore, Yokoy automatically recognises the mileage rates for specific period, according to the Belgian regulation.

If a company decides to pay more than the rates defined by the government, Yokoy can export/book the excess amount separately in the Finance tool.

VAT Rate

Regulations in place

Belgium government levies VAT rates for exchange of goods and services. There are four different VAT rates relevant for expense management:

- Standard VAT – 21% is applicable for majority of goods and services

- Reduced VAT rate – 6% and 12% is applicable for basic goods and food served in restaurants respectively.

- Zero VAT rate – 0% is applicable for postal services

Yokoy's solution

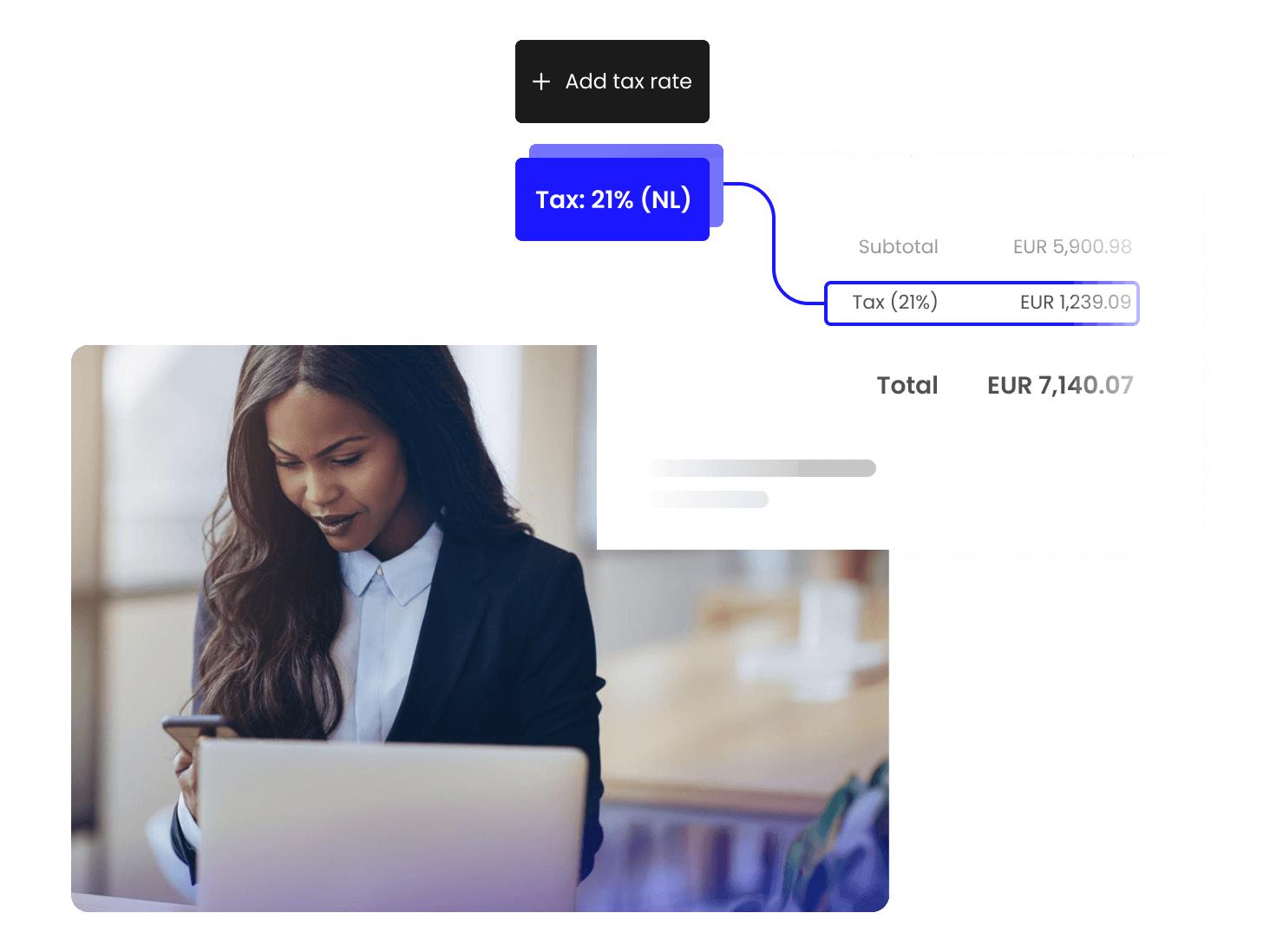

Yokoy automatically extracts all VAT rates; companies can also add additional VAT rates for extraction. Yokoy extracts all relevant VAT rates for expense receipts and books them to the ERP system.

Additionally, Yokoy supports customers in reclaiming VAT, through an integration with VAT reclaim providers. This integration allows Yokoy to automatically export extracted VAT rates for specific countries together with image of the submitted expense receipt to the VAT reclaim tool.

Simplify your invoice management

Book a demoRelated content

See spend management in action

Gain full visibility and control over your business spend with AI-powered automation.

Book a demo