Home / What is ViDA (VAT in the Digital Age)?

What is ViDA (VAT in the Digital Age)?

- Last updated:

- Blog

As businesses continue to transform digitally, the tax system is also evolving. One significant initiative making waves is ViDA (VAT in the Digital Age). In this article, we’ll delve into the intricacies of ViDA and how it impacts businesses. Whether you’re a finance professional, CFO, or accountant, understanding ViDA is paramount for staying ahead in the ever-changing tax landscape.

What is ViDA?

ViDA stands for VAT in the digital age. The initiative by the EU Commission represents a regulatory framework that aims to modernise the existing VAT system. The primary objective is to create a fair and efficient mechanism for the collection of VAT from businesses engaged in online transactions with customers within the European Union. This way, the EU can ensure that VAT is applied equitably to businesses, regardless of their location within or outside the EU.

Why was ViDA launched initially?

The existing VAT system was originally tailored for conventional businesses. This outdated structure struggles to effectively manage the complexities of the modern digital economy, especially when it comes to regulating and collecting value added tax from businesses involved in online transactions.

On top, the current system’s susceptibility to VAT fraud, particularly in intra-EU trade transactions but also with reverse charge, has become a significant threat. According to the European Commission’s 2023 VAT Gap Report, EU member states lost €99 billion in VAT revenues in 2020 and still €61 billion in 2021. The conventional practice of scrutinising transaction data months after their occurrence creates a significant window of opportunity for criminal activities, making it challenging for member states to promptly identify and combat tax evasion.

So simply put, ViDA is a proposal that will enable EU countries to:

increase efficiency for businesses with VAT obligations

reduce losses due to VAT fraud by implementing improved VAT reporting

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

Who does the ViDA initiative apply to?

It is safe to say that ViDA will affect all businesses that have customers in the EU. This also includes platforms, online marketplaces, and intermediaries working between sellers and buyers – whether they operate within or outside the EU.

The recommended course of action for all those businesses is to prepare accordingly. Companies that cannot currently send and receive e-invoices will need to adapt their systems quickly in order to comply with upcoming rules and regulations.

Business VAT: Practical implications

With regard to the transformative objectives of ViDA, experts often point out the “three pillars of ViDA”: e-invoicing and digital reporting, the single VAT return for trading across the EU, and platform economy. However, a more pragmatic approach to understanding the changes focuses on key processes such as invoicing, reporting, auditing, and VAT registration.

Invoicing

ViDA seeks to expedite the adoption of e-invoicing across EU member states, envisioning widespread usage by 2028. This acceleration will be facilitated by the introduction of e-invoicing mandates by the respective governments involved.

Reporting

Beyond promoting the use of e-invoicing, the ViDA proposal outlines a strategy to implement Digital Reporting Requirements (DRRs) across all member states starting from January 1, 2028. These DRRs aim to eliminate the necessity for recapitulative statements, compelling businesses to report pertinent transactions directly to a central VAT Information Exchange System (VIES) database.

Blog article

How to Ensure Regulatory Compliance With Automated Audit Trails

Learn how to get started with automated audit trails for monitoring financial transactions, detecting anomalies and ensuring compliance to internal controls and external regulations.

Lars Mangelsdorf,

Co-founder and CCO

VAT Registration

As far as ViDA proposals go, there is a vision for introducing a unified VAT registration system. It would empower businesses engaged in cross-border transactions within the EU to fulfil all VAT requirements through a singular portal and in a unified language. Referred to as the import one-stop-shop (IOSS) scheme, this single VAT registration system aims to streamline and simplify the VAT compliance process for businesses operating across borders.

Auditing

If ViDA proceeds as planned, the initiative paves the way for more efficient and accurate audits. Tax authorities will have enhanced access to real-time transaction data.

Important timelines for the implementation of ViDA

ViDA’s implementation is set to unfold step by step. Some regions and countries will probably introduce the regulations quicker than others. The anticipated process across all countries involves an initial pilot program, followed by a rollout phase and compliance deadlines depending on company size or transaction amount.

Regarding the specific dates outlined in the proposal, the envisioned timeline originally looked as follows:

1 January 2025:

From January 2025 onwards, the EU’s VAT import one-stop-shop (IOSS) scheme will undergo expansion to take various B2C supplies of goods into account. The revised scheme will also encompass the cross-border movement of goods, making the use of the IOSS scheme mandatory for specific transactions.

1 January 2028:

From 1 January 2028 onwards, companies will have to report all B2B transactions within the European Union within a tight window of two business days from the invoice date, marking a considerable reduction from the existing 45-day period.

By this date, compliance with EN 16931-compliant e-invoicing will become obligatory for intra-community supplies of goods. Additionally, certain pre-clearance data validations are expected to be introduced.

The full report by the European Commission, including proposed deadlines for ViDA can be found here.

Expected delays

However, sign-off for pillar 1, including DRR and e-invoicing, is still pending as the European Parliament’s Committee on Economic and Monetary Affairs voted for a one-year delay to all three ViDA pillars. Efforts to finalise the terms are now expected in early 2024. Consequently, the originally scheduled implementation date will probably shift to 2030.

As of now, the progress of the other two pillars – single VAT registration and platform economy – remains on track for a potential political agreement later this year, maintaining their existing implementation dates. However, certainty in this regard is not assured, and there could be further revelations of delays to Pillars 2 and 3 in the near future.

Good to know: For platforms facilitating the sale of low-value goods in the EU, there already exists a “deemed supplier” regulation.

The AI-powered spend management suite

Bring your expenses, supplier invoices, and corporate card payments into one fully integrated platform, powered by AI technology.

How to prepare

Even though delays are likely, every business should be prepared for the change that is about to come. The sooner the better!

Catch up on new developments

A proactive approach allows you to plan your strategy effectively, steering clear of the risky situation of updating your systems in a hurry to meet new deadlines.

Check your systems

Conduct a comprehensive evaluation of your current processes and systems. This involves identifying what is necessary to support ViDA’s digital requirements and pinpointing potential weak points.

Rethink invoicing

Past practices don’t necessarily dictate future strategies. Even if you’ve managed all B2B messaging internally before, exploring external solutions is a viable option. For many businesses, achieving compliance with ViDA requirements is simplified and cost-effective by updating your electronic invoicing.

Key benefits of ViDA

In light of existing and upcoming digital challenges, ViDA is introduced to overhaul the VAT system, adapting it to the requirements of the digital age. With the proposed changes, the aim is not only to enhance the system’s responsiveness to the intricacies of online commerce but also to establish simplification and a more robust mechanism for the fair and efficient collection of VAT within the European Union. The objective is to address the shortcomings of the existing system and fortify it against the threats of VAT fraud in a rapidly evolving economic landscape.

Although the initial implementation might incur costs, it serves as a strategic opportunity to reassess B2B strategies and construct a more robust e-invoicing solution.

Benefits for businesses

Streamlined processes and less manual work will lead to optimised operational efficiency. The digitisation of VAT processes is expected to enhance accuracy by minimising discrepancies. Over time, the change is expected to translate into substantial cost savings for businesses.

Benefits for authorities

Similarly, authorities stand to gain from ViDA through real-time access to transaction data, fostering more efficient and transparent systems. The potential reduction in VAT fraud is significant, presenting an opportunity for tax authorities to operate more effectively.

Benefits for the public

The increase in VAT revenue, a direct outcome of ViDA implementation, offers governments additional funds for public projects such as road construction or health initiatives. This way, all taxpayers will profit from the initiative.

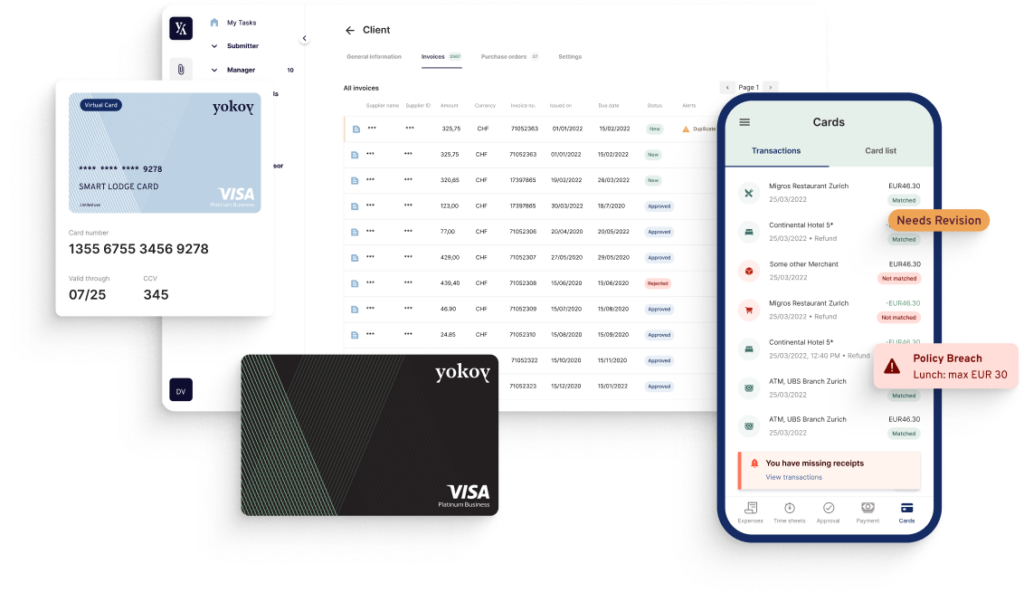

Yokoy Invoice

Process invoices automatically

Streamline your accounts payable process to manage invoices at scale and pay suppliers on time with Yokoy’s AI-powered invoice management solution.

Next steps

ViDA promises to streamline processes, reduce errors and enhance transparency. To navigate this transition effectively, it is crucial to partner with a service provider that not only comprehends ViDA but also seamlessly incorporates its principles into its solutions and offers ongoing support. Additionally, it is prudent to consider providers with a proven track record in facilitating e-invoicing, digital reporting, and VAT registration processes. Their expertise becomes invaluable as you adjust your systems and processes to meet ViDA requirements.

Streamline your AP process with Yokoy

Automating invoice management with Yokoy aligns with ViDA’s principles of real-time compliance, accuracy, efficiency, digitalisation, transparency, and adaptability to changing regulations. By leveraging Yokoy’s capabilities, businesses can stay ahead in invoice management and seamlessly integrate with the evolving VAT system in the digital age.

Considering the expected demands regarding electronic invoicing, integrating Yokoy’s solution can provide several advantages for EU and non-EU businesses:

ViDA compliance

Yokoy’s automated invoice processing aligns with ViDA’s aim to streamline digital transactions and reduce manual tasks, ensuring VAT-registered businesses can meet evolving compliance requirements.

Real-time visibility and reporting

Integration with Yokoy enables real-time visibility into invoice statuses, bringing your business up to par with the upcoming requirements and reporting system. The centralised dashboard facilitates easy reporting for ViDA-related financial requirements.

Fraud prevention and governance

Yokoy’s features, such as custom approval flows and automated fraud detection, contribute to ViDA’s goal of eliminating errors and ensuring governance. This is particularly crucial in the context of VAT compliance within the digital landscape.

Efficient supplier payments

ViDA emphasises timely payments and efficient supplier management. Yokoy’s capabilities in automating approval flows and preventing payment delays align with ViDA’s objectives, contributing to a seamless accounts payable process.

Automation for accuracy

ViDA’s objective of increasing accuracy in VAT-related processes is complemented by Yokoy’s AI-powered smart coding. The system learns from each invoice processed, enhancing accuracy over time.

By incorporating Yokoy’s AI-supported solution within the ViDA framework, businesses can not only achieve ViDA compliance but also gain additional benefits. Increase your efficiency, reduce costly errors, and improve transparency in your digital VAT processes. The automation provided by Yokoy can be a valuable asset in navigating the complexities introduced by ViDA in the digital age.

You can already now check your finance transformation readiness

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.