Home / Transforming Travel & Expense Management with AI

Transforming Travel & Expense Management with AI

- Last updated:

- Blog

Sometimes Zoom meetings are not enough, and you have to go out there and professionally handle things. Afterwards, your finance team has a whole stack of receipts, invoices, and bills to track, categorise, and approve for reimbursement. This could be a time-consuming and draining process.

Leveraging modern technology like artificial intelligence (AI) can not only ease your travel and expense (T&E) workflows, but it can also help ensure compliance, flag fraud attempts, and boost your finance department’s performance. Let’s dive in and take a look and explore how AI can transform your company’s T&E management!

5 reasons for AI in travel and expense management

First, we want to highlight some key strategies and AI tools that will show you the need for companies to integrate AI into their processes:

Too many time-consuming, repetitive tasks:

Traditional T&E management often involves manual tasks like expense tracking, categorising expenses and processing reimbursement requests. These tasks are repetitive and require significant time and effort from Accounts Payable (AP) teams, diverting their focus from higher-value activities. By automating these processes, AI significantly reduces administrative burdens, streamlines operations, and frees up time for more strategic work.Lengthy reimbursements caused by complicated workflows:

In many organisations, T&E workflows are often complicated, involving multiple approval stages that can delay reimbursing employees. This can affect staff morale and satisfaction. Expense management solutions with AI tools can help to optimise these workflows by with approval processing, flagging anomalies for review and ensuring that expenses move swiftly through the system, reducing waiting times and improving overall efficiency.Too many different regulations in different countries worldwide:

Globalisation can be challenging when it comes to T&E due to varying regulations, tax laws, and compliance requirements. Manually ensuring adherence to these expense policies increases the risk of errors and missed deadlines. Modern solutions with AI algorithms can automatically apply the correct rules based on geographic location, ensuring compliance with international regulations and simplifying global expense management.Excessive susceptibility to errors due to manual input:

Human error is inevitable when relying on manual data entry. Misclassifications, duplicate entries or miscalculations can result in inaccurate reports, which again complicates financial decision-making. AI-driven T&E solutions can automatically categorise expenses, verify amounts and flag discrepancies, reducing the risk of costly errors and improving data accuracy for financial leaders.High risk of expense fraud:

Expense fraud is a common challenge in traditional T&E management, whether through inflated claims, duplicate expenses, or falsified receipts. Outdated processes often lack sophisticated tools to detect such activities early on. Modern AI tools can analyse patterns in real-time, identifying suspicious behaviours and flagging potential fraud cases immediately. This allows businesses to mitigate risks and protect their corporate finances more effectively.

How AI transforms travel and expense management

With AI-powered solutions, companies can automate routine tasks, improve compliance, and reduce errors. This empowers companies to streamline their travel and expense management while minimising risks. But let’s see how this works!

Saves time: Automating expense submission and approval processes

As mentioned above, AI technology easily automates repetitive tasks like expense submissions, expense tracking, and approval workflows. Instead of manually entering data into spreadsheets, employees can scan receipts—e.g., with mobile apps or web interfaces—and have expenses automatically categorised and submitted. This speeds up approval workflows by flagging only outliers or potential issues for review, ensuring faster processing and fewer delays in expense reimbursements. This automation saves time and allows CFOs to focus on more strategic activities rather than getting bogged down in paperwork.

Increases safety: Compliance and fraud detection

AI helps to ensure compliance with global regulations by automatically applying the associated rules for taxes, allowances and travel policies based on location. This reduces the risk of human error and compliance breaches, helping companies avoid fines and costly penalties. Additionally, AI enhances fraud detection by analysing patterns and flagging suspicious claims, such as inflated expenses or duplicate entries. By identifying potential fraud in real time, AI adds an extra layer of protection to the company’s finances, significantly reducing risk.

Improves decision-making: Real-time analytics and reporting

AI provides finance leaders with real-time data through advanced analytics and reporting tools. It can analyse expense trends, identify areas for cost savings and use predictive analytics. This gives finance teams the insights they need to make informed decisions, optimise budgets and better manage cash flow. With AI delivering actionable insights instantly and constantly, companies can improve cost control and make proactive financial decisions to support business growth.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Benefits of AI for AP managers and finance leaders

AI can empower AP managers and finance departments by improving efficiency, reducing costs, enhancing control and transparency, mitigating fraud and supporting scalable, adaptable processes that can grow with the business.

Improved efficiency and reduced manual workload: AI automates repetitive tasks such as receipt extraction, expense categorisation and approvals, reducing the need for manual intervention. This streamlines the entire T&E workflow, allowing AP managers to focus on more strategic priorities. By cutting down on administrative tasks, finance teams can operate more efficiently, completing processes faster and with fewer errors.

Cost savings: With AI, businesses can optimise expenses by identifying unnecessary costs and spotting inefficiencies. AI-driven insights help reduce overspending, prevent duplicate claims and streamline approval workflows, leading to faster reimbursements. By improving overall expense management, companies can achieve significant cost savings in the long term, improving profitability.

More control and transparency: AI gives AP managers and finance leaders full visibility into the expense process with real-time data tracking and reporting. Analytics provide detailed insights into spending patterns, making it easier to monitor expenses, control budgets and forecast future spending. This increased transparency allows for better financial planning and more informed decision-making.

Fraud detection and compliance: AI enhances the detection of fraudulent activities by analysing data in real time and flagging suspicious expense claims or irregular patterns. This reduces the risk of expense fraud, such as inflated or duplicate claims. Additionally, AI helps to ensure compliance with global and local regulations automatically. This allows businesses to avoid fines and penalties while maintaining audit readiness.

Scalability and adaptability: As businesses grow and their expense management needs evolve, AI systems can quickly scale to handle higher volumes of transactions without increasing manual effort. AI-powered solutions can adapt to different company sizes, international regulations and changing business needs, making them ideal for growing companies.

5 steps to adopt AI in travel and expense management

Now that we know the challenges of T&E and have looked into the importance of leveraging AI, here are five key steps for adopting AI solutions in your expense management:

Evaluate current processes:

Before implementing AI, your business should assess existing T&E processes. Identifying inefficiencies, such as bottlenecks in approvals, manual data entry errors, or compliance challenges, is crucial for advancements with new technology. This evaluation helps pinpoint areas where AI can have the most significant impact, ensuring that automation targets the right tasks and delivers measurable benefits.Find the right AI solution:

Once the needs are clear, you should research and select the best AI-driven travel and expense management solution that fits your company’s needs. Consider features like automated receipt tracking, real-time fraud detection, compliance monitoring and predictive analytics. Choosing a platform that integrates seamlessly with existing financial systems and can scale with your company’s growth is essential.Implementation:

As said, integrating AI solutions with existing software, such as enterprise resource planning (ERP) or expense management platforms, is a crucial part of a fluent switch. Ensure that your chosen AI solution is aligned with your company’s workflows and systems. This phase could mean setting up data feeds, configuring approval processes and testing the system to ensure everything functions smoothly before going live.Training and change management:

Modern AI solutions are not more than mere chatbots. Shifting to such complex solutions may involve also a shift in how teams operate. Providing comprehensive training to employees and finance teams to ensure they understand how to use the new Tools effectively is key to your success with AI. Think about fostering a change management strategy that communicates the benefits of AI, addresses concerns and encourages a smooth transition to the new system.Ongoing optimisation:

After implementation, continuous monitoring and evaluation of the performance of the new AI solutions are performed. Gather feedback from users to identify areas for improvement. As you may know, AI often includes machine learning to learn and adapt over time, so your businesses should regularly update and fine-tune the solution to ensure it stays aligned with evolving needs, regulations and company goals.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Automating time-consuming T&E tasks with AI-powered spend management solution Yokoy

All-in-one spend management solutions offer a comprehensive approach to automating time-consuming T&E tasks. With tools like Yokoy, you can enhance efficiency and reduce the manual workload for finance teams. Let’s see Yokoy’s key features that can improve your T&E processes.

End-to-End Travel Integration with TravelPerk

Unlike other solutions (e.g., SAP Concur), Yokoy integrated TravelPerk to streamline the entire travel booking and management process. Employees can book travel directly through the travel manager, and all relevant data — such as travel dates, destinations, and costs — sync seamlessly into Yokoy’s platform. This eliminates the need for manual entry of travel details, automates expense matching and ensures that travel policies are followed while maintaining full visibility over company-wide travel spending.

Yokoy’s Smart Lodge Cards

Yokoy’s Smart Lodge Cards further automate expense management by directly connecting corporate travel payments with the Yokoy platform. These virtual corporate cards can be used to pay for travel expenses like flights or accommodation, automatically linking the transaction to the correct travel expense report. This reduces manual reconciliation, ensures compliance with travel policies and simplifies tracking of high-volume business travel expenses.

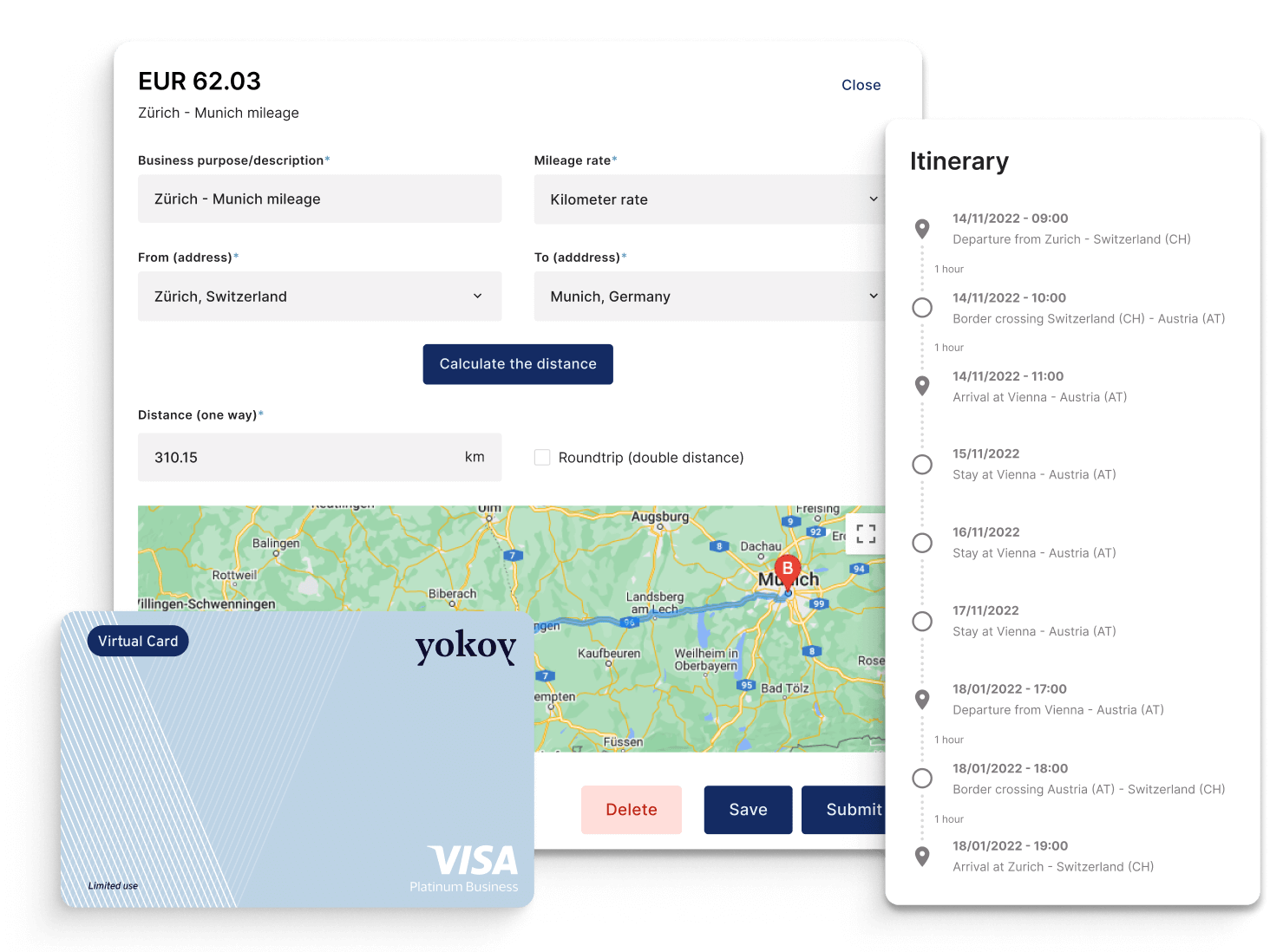

Automated Mileage Tracking

Mileage claims are often tedious and error-prone. Yokoy’s AI-driven mileage tracking automates this process by allowing your employees to enter travel distances or integrate GPS data for precise mileage calculations. The platform automatically applies the correct reimbursement rates based on company policies or country-specific regulations, reducing manual calculations and ensuring accuracy while also speeding up claim submissions and approvals.

Automated Per Diem Calculation

Per diem allowances can vary by country, employee role and duration of travel, making manual calculation complex. Yokoy automates per diem calculations based on local laws and internal company policies. Employees simply input their travel details and the system calculates the correct daily allowance automatically. This eliminates manual work for both employees and AP teams while helping to ensure compliance with different regulations.

Fully Automated Reimbursements

Yokoy’s platform automates the entire reimbursement process from submission to approval and payment. AI matches receipts with expenses, checks for policy compliance and flags any irregularities for review. Once approved, the system processes reimbursements automatically, ensuring employees are reimbursed quickly without the need for multiple approval stages. This end-to-end automation reduces processing times, enhances accuracy and improves the overall employee experience.

Next steps

The future of T&E management will focus on even greater automation with the help of AI: Handling more complex tasks like predictive budgeting, dynamic policy adjustments and advanced fraud detection can further improve your travel and expense management. Are you eager to try out one of the leading AI-powered solutions for expense management?

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.