Home / How to Select the Best Small Business Corporate Card

How to Select the Best Small Business Corporate Card

- Last updated:

- Blog

Especially for small businesses, the need for smart spending practices is paramount. From the outset, establishing clear and efficient spending habits lays a solid groundwork for growth and financial resilience. However, studies have shown that about 53 per cent of small and medium-sized businesses (SMBs) face difficulties in securing sufficient financing. This challenge leaves them vulnerable to financial strain, hampering their ability to expand and thrive.

Despite being a popular financing option, only 28 per cent of smaller SMBs have access to corporate cards, revealing a significant gap in available financial resources for this sector. 25 per cent of SMBs express a keen interest in increasing their use of corporate cards in the near future. They recognise the potential advantages of managing expenses and enhancing financial flexibility.

Benefits of spend management and corporate cards for small businesses

Embracing spend management practices and working with corporate cards offer startups and small businesses a multitude of advantages. By making use of these tools effectively, you can optimise your financial operations, minimise risks, and position your company for sustainable growth in a competitive market. Here are the key benefits:

Increased efficiency

Spend management tools automate repetitive manual tasks, freeing up valuable time for employees to focus on strategic initiatives that drive much-needed business growth. By streamlining processes, businesses can operate more efficiently and effectively.

Empowered employees

Employee cards empower team members to make purchases quickly and independently within predefined spending limits. This autonomy expedites decision-making and fosters a culture of trust and responsibility within the organisation. On top, you avoid tedious reimbursement processes for business expenses that were paid for out of pocket. Instead of making sure repayments were made, small business owners can allow cardholders to purchase via corporate credit cards or debit cards.

Time savings

Customisable approval processes in spend management systems save time by streamlining the authorisation of expenses. This ensures that payments are approved promptly while maintaining control and oversight over spending activities.

Financial oversight

The use of corporate cards and spend management tools allows businesses to maintain a clear view of their finances in real time. By monitoring expenses and cash flow continuously, businesses can make informed decisions and adapt strategies as needed to achieve financial objectives.

Less errors

Unfortunately, manual handling of financial transactions increases the risk of costly errors. By automating processes and implementing controls through spend management systems, businesses can minimise the likelihood of mistakes, saving both time and money in rectifying inaccuracies.

Data-driven decision-making

Access to real-time data provided by spend management tools enables businesses to see the underlying potential and possibilities for development. By analysing spending patterns and trends, every company can identify areas for optimisation and allocate resources more effectively to drive profitability.

Enhanced compliance

Spend management systems simplify compliance efforts by providing tools to enforce card spending policies and regulatory requirements. By centralising expense data and implementing controls, businesses can ensure adherence to internal policies and external regulations, reducing the risk of non-compliance penalties.

Check out our newsletter

Don't miss out

Join 12’000+ finance professionals and get the latest insights on spend management and the transformation of finance directly in your inbox.

How to start with spend management

To define what is important for the company, you should always start by defining its unique requirements and objectives. What are your financial goals? What challenges do you currently face in managing expenses? Identifying these needs will help you tailor the selection process to find a solution that aligns with your company’s priorities and long-term strategies.

The next step is to check your current spending habits. Understanding how expenses have been incurred to date provides valuable insights. Ask yourself: How are expenses currently tracked and managed? What are the common categories of expenses, and how frequently are they incurred? Knowing your spending patterns helps identify areas for improvement and informs the selection of features and functionalities needed in a spend management solution, including necessary spending controls.

Efficiency is key for finance teams to handle tasks promptly and accurately. So think about how processes can be streamlined to save time and reduce manual efforts. Are there opportunities to automate repetitive tasks such as data entry or approval workflows? Implementing tools and solutions that enhance collaboration and communication within the finance team can also free up resources which are needed elsewhere.

Now, it is time to research your spend management solution, with features that you consider essential for your company. You may want to focus on automation capabilities for expense tracking and reporting, customisable approval workflows, real-time data analytics, integration with accounting systems, and robust security measures. Additionally, scalability, user-friendliness, and adaptability to future needs can be crucial factors to ensure the chosen solution can grow with your company and remain effective in the long run.

Our tip: Research available options and explore different providers and solutions in the market. Get to know the key players in the spend management software industry – and their outstanding features. Gathering information about each option and comparing their strengths and weaknesses will help you make smart decisions.

Comparing terms and conditions

When choosing a solution, do not just check the prices and annual fees. Comparison should involve evaluating the overall value proposition of each solution. What are the terms of service, including contract length and cancellation policies? Are there any hidden transaction fees or additional charges? Considering factors such as scalability, future-proofing, and the overall impact on spend management can help assess the true cost-effectiveness of each option.

While corporate cards are an integral part of spend management, you should view them as just one component of the broader picture. When selecting corporate cards, it is essential to consider how they fit into the overall spend management strategy. This means evaluating not only the cost but also the features, benefits, and potential savings (via cashback and high credit limit) they offer. The best business credit cards are always those which align with your company’s financial goals and enhance overall spend management efficiency and effectiveness.

Yokoy Smart Lodge Card

One card for all your travel bookings

Securely pay for flights, rail, hotel, and travel services with one central Smart Lodge Card. No transaction fees, no foreign exchange fees, no card fees.

What to consider when choosing corporate cards

When selecting corporate cards, we recommend considering several factors to ensure they meet your company’s needs:

Types of corporate cards: It is essential to understand the different types of corporate cards offered by card providers. Are there options for prepaid cards, charge cards, debit cards, or traditional credit cards? Which networks do their cards use: Visa, Mastercard or American Express? Are there gold card options for businesses?

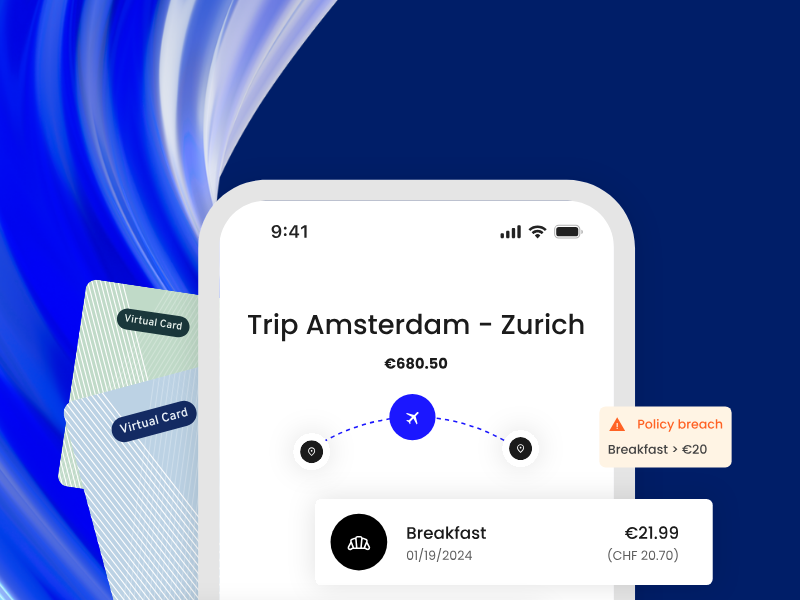

Additionally, inquire if virtual cards are available, as they offer added security and flexibility for online transactions, so that even freelancers can receive a charge card and employees enjoy the benefits of a personal credit card without having to share it with the whole team.

Terms and conditions: Carefully review the terms and conditions associated with each corporate card option. Does some offers have higher interest rates than others, ask for annual fees, and any other charges? Are there perks like rewards or cashback programmes? And how thorough is the provider’s eligibility check – does your credit history or personal credit score matter to your card issuer? Understanding these details helps assess the overall value and cost-effectiveness of each card.

Integration with spend management solutions: Ideally, corporate cards should be integrated into a holistic spend management solution. This integration ensures tracking and management of employee expenses, providing a comprehensive view of business spending. Also, confirm if the corporate cards can be linked to existing spend management systems for streamlined financial oversight of your card account.

Simplified and automated financial tasks: Consider how the chosen solution can simplify and automate financial tasks. Can tracking, reporting, and approval workflows be automated? Look for features that streamline processes, saving time and reducing manual errors.

Potential savings: Evaluate the potential savings achievable with the solution. Does it offer cost-saving opportunities through features like real-time expense tracking, policy enforcement, or discounts on business purchases or business travel? Understanding the potential return on investment helps justify the adoption of the solution.

Adaptability to company needs: Assess the extent to which the solution can be adapted to fit the company’s specific requirements. Can employee spending limits, approval workflows, and expense reporting structures be customised to align with corporate regulations? Flexibility is key for ensuring the solution meets evolving business needs.

Scalability: Consider the scalability of the solution, especially if the company anticipates growth or expansion in the future. Can the solution accommodate increased transaction volume, additional users, or new business units? This ensures that the solution remains effective and efficient as your company evolves.

How Yokoy can help: Holistic spend management and corporate cards

Simplifying spend management can be a game-changer for small businesses aiming to thrive and grow. Yokoy offers an intuitive spend management suite designed to modernise financial processes, boost productivity, and keep budgets on track. Here’s how Yokoy can help:

Yokoy’s flexible API integrations connect your financial tools, bringing together invoices, expenses, and corporate card payments into one central platform. This ensures a cohesive approach to spend management, eliminating data silos and enhancing efficiency.

With Yokoy’s easy-to-handle user interface and AI-driven automation, managing expenses becomes effortless. AI technology automates repetitive tasks, freeing up time for strategic initiatives and growth-focused activities. Plus, Yokoy’s platform is accessible across devices, allowing you to manage spend on the go with mobile apps. All this simplifies administration by eliminating manual work and preventing messy processes. Clearly defined user roles and custom workflows ensure governance and compliance, while AI-powered features detect outliers and prevent overspending.

Blog article

How Virtual Corporate Cards Boost Expense Control and Limit Discretionary Spending

What challenges virtual corporate cards solve, what are their benefits, and why are virtual cards the perfect solution for limiting discretionary spending?

Lars Mangelsdorf,

Co-founder and CCO

Compliance and security measures

Yokoy’s built-in controls and pre-approval flows enforce compliance with company policies, tax regulations, and international laws. Additionally, Yokoy adheres to the highest security standards, including ISO certifications and GDPR compliance, ensuring your data remains safe and protected.

How small businesses organise spend management

Don’t just take our word for it, also read what our customers have to say about their experience with Yokoy instead. From eliminating manual work to streamlining finance processes, Yokoy has helped organisations across industries achieve remarkable results.

Planted has earned international recognition and rapid growth as an innovative Foodtech startup. However, managing expenses and invoices across borders proved to be a challenge for the company’s expanding operations. Relying on manual processes and disjointed software solutions hindered scalability and threatened the company’s growth trajectory.

Scalable automation with Yokoy

To address these challenges, Planted turned to Yokoy’s modular spend management suite. Yokoy’s flexible API integration easily connected with Planted’s tech stack, providing the agility needed to adapt to evolving business needs. With Yokoy, Planted automated thousands of invoices, expenses, and card transactions, freeing up the finance team to focus on strategic initiatives. Yokoy’s AI-driven platform streamlined spend management processes, enabling Planted to seize new growth opportunities quickly and flexibly.

With Yokoy as a partner, Planted is cultivating success and nurturing its vision of disrupting the protein industry with sustainable innovation. Through scalable automation and integrated spend management, the Swiss business is now positioned for continued growth and global expansion.

Experience the power of Yokoy’s spend management suite firsthand. Book a demo today and discover how Yokoy can help you simplify spend management and working with corporate cards to improve productivity, and focus on growth.

Simplify your invoice management

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.