Home / The ROI of Finance Transformation: How to Calculate, Communicate, and Maximize Your Returns

The ROI of Finance Transformation: How to Calculate, Communicate, and Maximize Your Returns

- Last updated:

- Blog

Managing Director Austria

In 2021, during the pandemic, McKinsey & Co. conducted a survey that revealed the CHRO and CFO roles as the least tech-savvy members of executive teams, with 28% of Chief Financial Officers labeled as obstructors of technology-related discussions, 40% as enablers, and only 25% of CFOs labeled as transformation-driving leaders.

Now, almost two years later, Microsoft’s 2023 Future of Finance Trends Report shows that 88% of financial leaders feel they are still primarily responsible for transactional, not strategic functions, and 81% think it’s a high priority for them to make change happen in the organization by investing in the right tools and prioritizing the right investments.

These numbers reflect a shift in attitude and confirm what we already knew: the role of the Chief Financial Officer is evolving rapidly, and the future of finance requires a different type of CFO; One that’s willing to step outside their traditional role and become champions of change for their companies, driving big-picture solutions for both revenue growth and cost savings.

Which brings us to the topic of this article: Finance transformation and its ROI.

In the end, any innovation project needs to demonstrate its financial benefits to justify the investment of time, effort, and resources. Finance transformation is no exception, and organizations need to be able to quantify the return on investment (ROI) of this initiative to justify the expenses and showcase its impact on the bottom line.

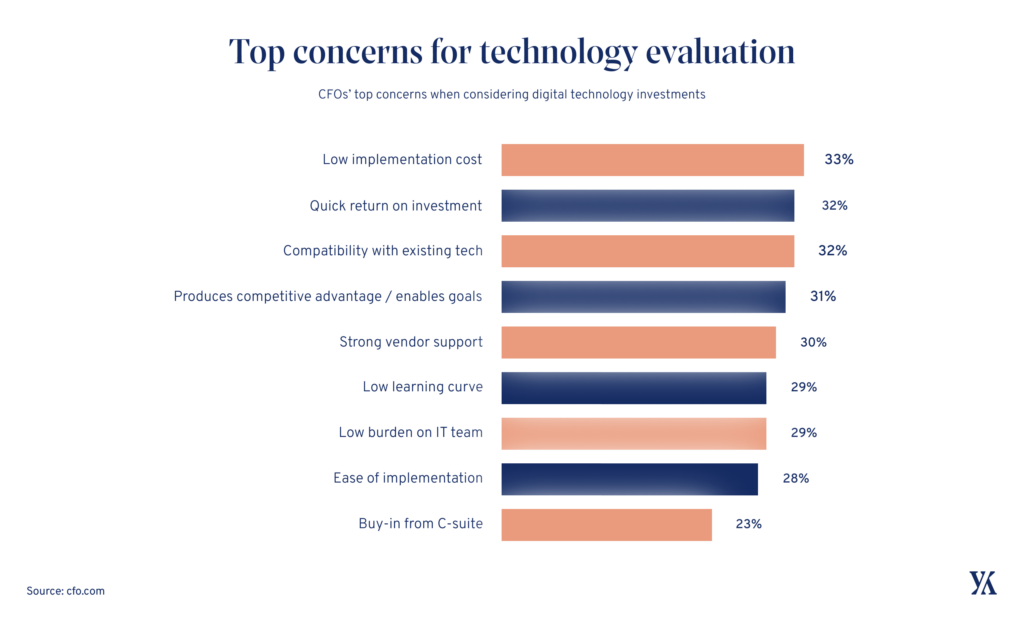

In fact, the return on investment is among the top concerns of CFOs when considering new digital technology investments.

So let’s take a look at how CFOs can build a solid ROI case for digital transformation in finance. This will help to gain support and encourage successful integration of new processes and technologies.

Quantifying the ROI of finance transformation

Without a clear understanding of the ROI, it’s difficult for executives to prioritize and allocate funds for finance transformation projects.

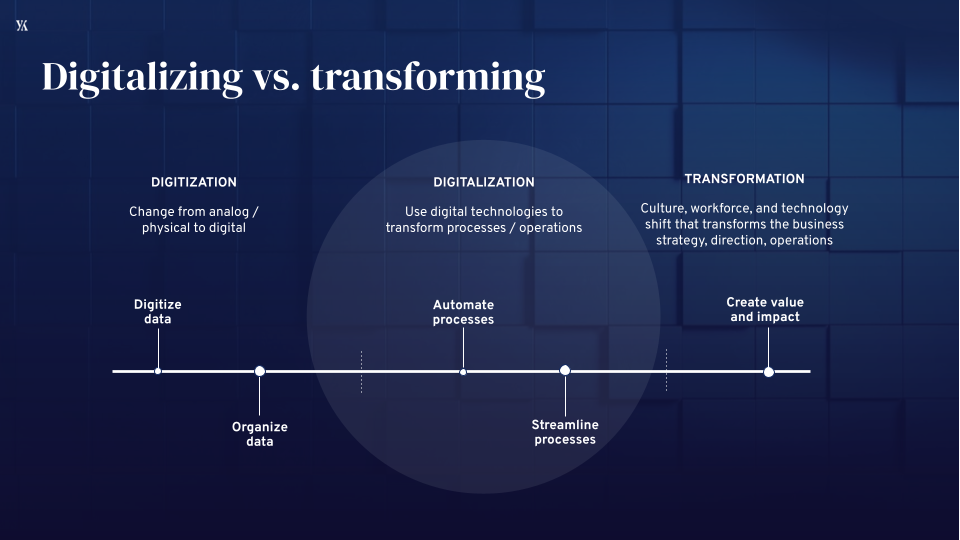

But the term “transformation”, in itself, doesn’t say much: It’s too vague to be useful, and comes with no universal prescription, meaning that there’s no standard approach to transforming the finance function. Moreover, “transformation” is often used interchangeably with “digitalization”, despite having a different meaning.

Digitalizing the finance department and implicitly finance operations means going from semi-manual processes to digital ones, automating tasks, and streamlining processes to achieve efficiency.

Transformation, on the other hand, means rethinking the way the finance team operates and leveraging technology such as AI and automation, as well as real-time data, to optimize operations, make insights-driven business decisions, and align the finance function to strategic business goals.

Thus, the digital transformation of finance processes involves more than adopting digital tools: It refers to a change in strategy and mindset as well.

The change management part is often the most challenging to handle for finance leaders, especially when not everyone in their teams sees the need to switch to a different solution. So it doesn’t just cost time – it can create a lot of emotional discomfort too, and without adoption, replacing an existing tool with new software is hard to justify.

On top of this, factors such as the ease of use or employee satisfaction are hard to quantify, so even in positive scenarios where change is welcome, such factors might be disregarded when building a case for a tech stack revamp.

At a closer look, though, proving the ROI of finance transformation projects is quite straightforward, as it comes down to two main aspects, both of them quantifiable: time and money.

Checklist

Finance Transformation Readiness Checklist

In this white paper, we delve into the essential steps for finance leaders to assess the readiness of their organization and construct a compelling case for digital transformation in finance.

The costs of not transforming your finance function

Every transformation project involves opportunity costs, which is why, when assisting clients in building an ROI case, I begin by assessing the costs of their existing processes in terms of both time and money.

Then, I compare these costs with the potential savings that a spend management solution like Yokoy can offer. That’s because quantifying the impact of a financial transformation requires looking at the finance transformation journey in perspective, and comparing the current state to the future one.

Here’s what I mean:

- An inefficient process costs companies both time and money. For example, in a scenario where reconciling invoices takes just five minutes per invoice, this can accumulate to 30 hours of manual reconciliation work each year, which amounts to a cost of $49,500 annually. And this is just one step in the invoice processing flow.

- Similarly, a combination of manual and automated steps in processing expenses can result in a cost of $58 per report processed, as finance teams must expend time and resources to chase, scan, process, and store physical receipts for later reference.

- Almost one fifth (19%) of expense reports contain errors. Fixing errors, as well as identifying duplicate and fraudulent transactions incurs additional time and financial costs, but it’s a must in order to decrease risks during auditing and avoid penalties.

- Additionally, companies can lose money due to unclaimed VAT, particularly on foreign goods and services, as well as the expense of petty cash and cash on hand. These costs can easily be minimized by using smart corporate cards.

And such inefficiencies are found in virtually all financial processes, from financial reporting to planning and forecasting. After tallying all the expenses, it becomes clear that failing to update your financial processes is resulting in more costs than just paying employee salaries.

Digitally transforming your finance organization, on the other hand, is an investment that pays off in the long run, ensuring competitiveness in the market.

But how much can you save?

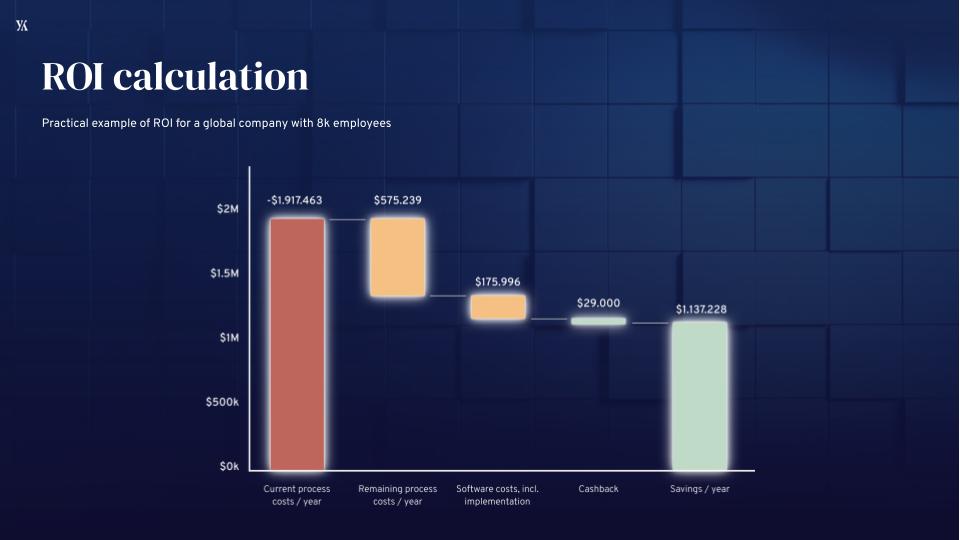

Practical example: Finance transformation ROI for a global enterprise with 8k employees

I’ll use the example of a global company with 8k employees, with entities in multiple countries.

For each company, the numbers below will depend, of course, on the people involved in each step of the process, their actual salaries, the volume of business travel happening in the company, the daily allowances, the amounts spent in foreign countries versus locally, and so on. But the approach will be the same.

In total, the employees of this particular company take around 15k business trips per year. Currently, this organization is incurring about $1.9M in process costs as a result of their inefficient working methods, undetected duplicate payments, cash payments, and unreclaimed VAT.

They have the potential to save $1.1M by automating their process logic and steps, eliminating manual labor, fraudulent or duplicate payments, as well as benefiting from VAT reclaims and cashback.

Here’s a quick breakdown:

- Through AI, machine learning, and process automation, the company can save around $1.1M by eliminating expenses such as processing costs for expenses or invoices, and VAT reclaims.

- At the same time, if the company replaces all cash transactions with corporate card transactions, they can receive $29k in cashback.

- This particular company would still have process costs of about $575k after digitalizing and automating most of their processes, due to the nature of their industry and local regulations.

The most significant cost savings are achieved by eliminating manual tasks and Excel spreadsheets, and implementing rules that eliminate manual errors and enforce compliance. Such changes help companies optimize and streamline their business processes, ensuring maximum efficiency, as they eliminate the need for human intervention and repeated revisions.

Next steps

In conclusion, calculating the ROI of finance transformation is crucial for any organization looking to justify the investment of time, effort, and resources into such initiatives.

While the process may seem daunting at first, the benefits of building a digital finance function are undeniable, from increased efficiency to better decision-making and cost control. By taking a structured approach, you can develop a solid business case and communicate the potential returns of successful financial transformation to stakeholders effectively.

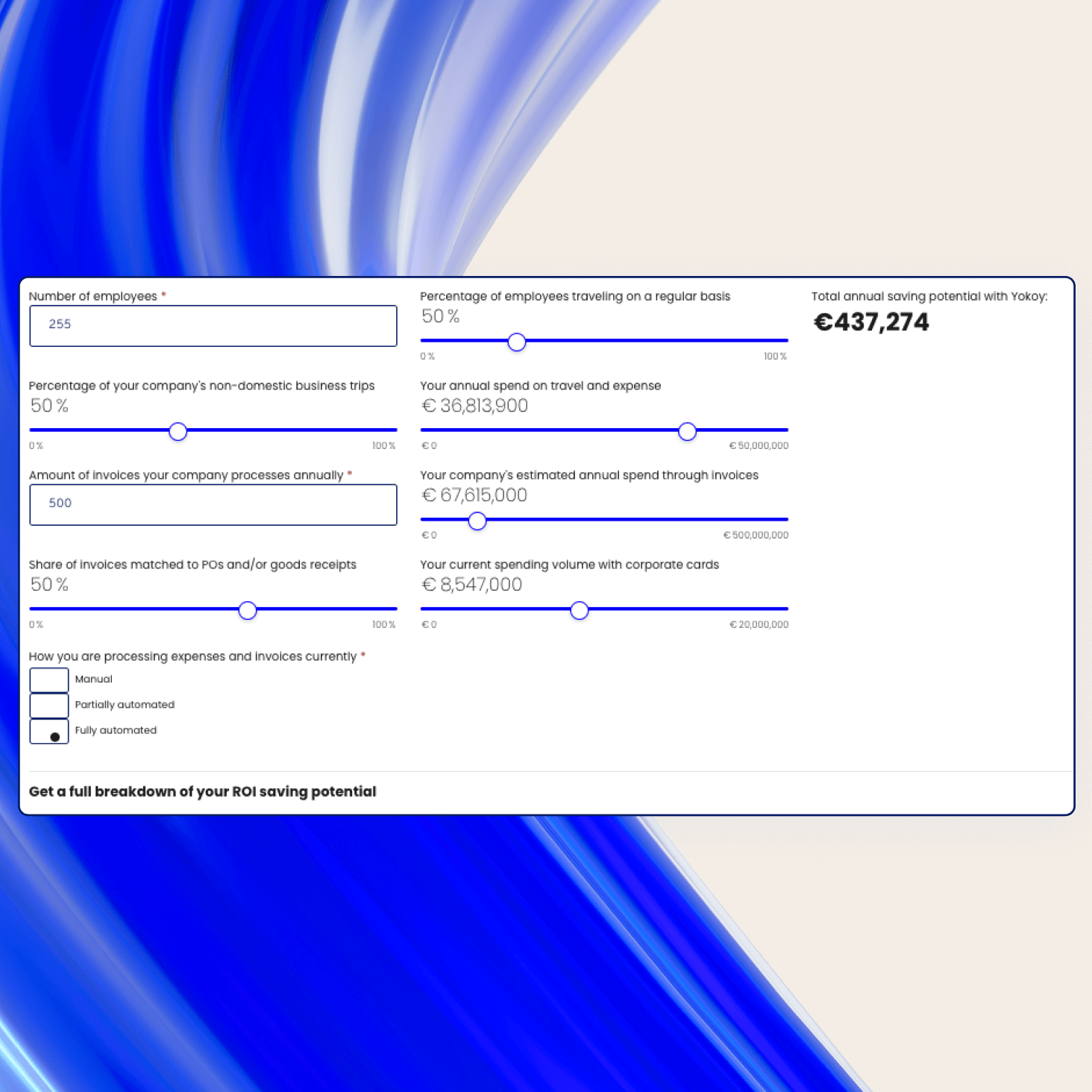

If you’d like to estimate your savings and build a case for digital transformation in finance, you can use our ROI calculator below.

ROI calculator

Calculate your savings

How much can you save annually if you choose Yokoy as your spend management suite? Our ROI calculator helps you quantify the return on investment, so you can build a solid case for finance transformation.

Related content

If you enjoyed this article, you might find the resources below useful.