Home / Overcoming Common Pain Points in Expense Management

Overcoming Common Pain Points in Expense Management

- Last updated:

- Blog

As a matter of fact, expense management is essential for maintaining financial control. However, many organisations struggle with severe inefficiencies that inflate costs and reduce productivity. As companies grow and operations expand, the complexities of managing expenses can overwhelm even well-structured finance teams. Luckily, with the advent of automation and AI-driven solutions as game-changers, businesses can address these pain points. This article will highlight the common challenges in expense management for you. Let’s dive in!

Common pain points summarised

Many businesses still depend on manual processes for managing expenses and adhering to expense policies, such as entering data into spreadsheets or physically handling receipts. What some people haven’t realised yet: This approach is slow and prone to human error, which adds to the administrative burden on employees and finance teams. Such inefficiencies consume time that could be spent on more valuable tasks.

Moreover, expense approval can often be delayed by bureaucratic bottlenecks. Lengthy approval chains and unclear delegation of responsibilities can cause delayed reimbursements and slow down expense reporting—the absence of a transparent, streamlined process results in unnecessary frustration for employees and management alike.

Maintaining inefficient, manual expense systems also incurs both direct and indirect costs. The manual entry of expenses requires considerable staff time, driving up labour costs. Additionally, errors made during the submission or approval process can lead to duplicated efforts or missed deadlines, further inflating costs.

Outdated expense data affects the accuracy of financial forecasts. Manual data entry makes it difficult to track expenses in real time. This lack of visibility results in poor financial decision-making, hindering strategic planning and risk management.

Many organisations also continue to use outdated software that is not equipped to handle modern expense management demands. These systems tend to be inflexible, preventing companies from adapting to new regulations or scaling as their businesses grow. Moreover, integrating such systems with newer technologies is often challenging.

Risk of fraud and non-compliance

Without the proper controls in place, companies are vulnerable to expense fraud. Common forms of fraud include inflated claims, false receipts, and duplicate submissions. Traditional expense management systems often lack the sophisticated monitoring needed to detect fraudulent activities early.

Expense management also involves navigating complex compliance requirements. Ensuring that all claims meet local tax laws and company policies can be difficult without automated checks. Compliance errors can lead to penalties or increased scrutiny from tax authorities, which may damage a company’s reputation.

How to overcome common pain points in expense management

To mitigate these pain points, companies need to embrace digital transformation. Technologies powered with automation and AI offer numerous advantages, from reducing costs to improving compliance. Below, we have summarised the fundamental approaches that can transform your expense management.

Automation for more cost efficiency

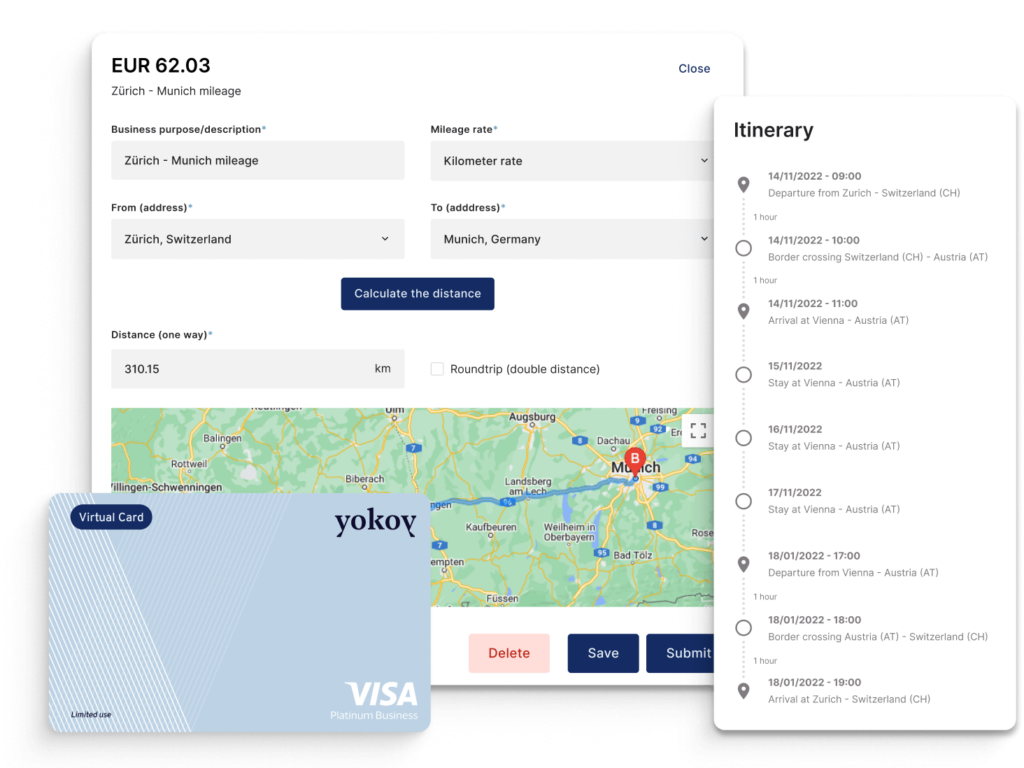

Automating the expense management process has proven to reduce costs significantly by eliminating manual tasks like data entry and receipt tracking. Platforms like Yokoy can automatically capture receipts via OCR (Optical Character Recognition) technology, streamlining the submission process for employees and minimising errors. Automating approval workflows reduces delays, making financial reporting more accurate and timely.

Moreover, freeing employees from repetitive tasks helps businesses reduce labour costs while improving efficiency. Automation also ensures more consistent adherence to policies, further reducing the risk of non-compliance or expense-related errors.

AI for fraud detection and compliance

AI is also transforming how businesses handle fraud detection and compliance monitoring. Yokoy, for instance, uses AI algorithms to detect unusual patterns in expense claims, such as duplicate submissions or inflated amounts, which can signal fraud. The system learns over time to become better at spotting anomalies, providing an additional layer of security.

In terms of compliance, AI can automatically check that all submitted expenses comply with local tax regulations and internal company policies. This ensures that businesses remain compliant without needing to manually review every single claim, saving time and reducing the risk of fines or audits.

Real-time data for better decision-making

If you are a finance professional, CFO or AP manager, you will agree with us: Access to real-time data dashboards is essential for making informed financial decisions. Delayed or inaccurate expense data, on the other hand, can lead to misguided budgeting or resource allocation. By adopting real-time expense tracking platforms, businesses can gain visibility into their spending at any moment, enabling more agile decision-making.

Yokoy integrates access to real-time data into the expense management process, allowing for up-to-date reporting that enhances forecasting and financial planning. With full transparency into where the company’s money is going, managers can more easily identify cost-saving opportunities and respond to potential budget overruns.

Integration in holistic platform solutions

Fragmented systems that don’t communicate with each other create inefficiencies and are error-prone. An integrated platform solution like Yokoy connects expense management with existing business tools, such as payroll, software for accounting teams, and ERP systems. This integration allows for

valuable insights

seamless data sharing

reduced duplication of effort

centralised financial data that is easily accessible.

By consolidating different processes within a single platform, businesses benefit from more streamlined workflows and a unified view of their financial operations. This makes it much easier to track performance and reduces the risk of non-compliance.

Scalable software solutions

As companies grow, so do their expense management needs. A system that works for a small business may not be adequate for a larger one. This is why scalability is critical. Yokoy’s platform is built to accommodate businesses as they grow, providing the flexibility needed to handle increasing transaction volumes and complex reporting requirements.

Scalable solutions ensure that businesses don’t outgrow their expense management software, and that the software remains adaptable to changing needs, such as regulatory updates or geographic expansion.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Barriers to implementing solutions

While the benefits of automation and AI in expense management are clear, some businesses are still quite hesitant to adopt these technologies due to perceived barriers. However, many of these concerns are based on misconceptions. Let’s clarify some common business myths:

Concerns about the costs

Many organisations believe that adopting a holistic expense management system will be too costly, particularly for smaller companies. In reality, the cost savings from reduced errors, faster processing times, and fraud prevention often outweigh the initial investment. Moreover, platforms like Yokoy are designed to be cost-effective, especially considering the long-term reduction in labour costs and administrative overhead.

An additional benefit: Automating expense management can also increase productivity and lead to fewer operational interruptions, further enhancing a company’s profitability and return on investment (ROI).

Supposed long implementation time

Another misconception is that implementing a new system will be time-consuming and disruptive to daily operations. However, modern platforms like Yokoy are designed for fast and efficient implementation. With pre-built integrations and a user-friendly interface, businesses can be up and running in weeks, not months. The ease of onboarding ensures minimal disruption to workflows, and the benefits are quickly realised in terms of improved efficiency and reduced errors.

Effort required to set up new workflows

Some businesses worry about the effort required to set up new workflows when implementing an expense management system. Yokoy addresses this concern by offering flexible, customisable workflows that adapt to each organisation’s individual needs and preferences. Instead of overhauling existing processes, companies can configure the platform to match their current approval structures and reporting requirements.

By offering ongoing support and tailored onboarding, Yokoy ensures that the transition to a new system is smooth and that employees can quickly adapt to the new tools provided.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Learn from companies overcoming these common pain points

Several organisations have successfully tackled these common pain points by adopting Yokoy’s expense management platform. Let’s take a look at how they benefited from automation, AI, and integrated solutions.

Sporting goods manufacturer On was facing high costs due to inefficiencies in manual expense processing. By implementing Yokoy, the company automated much of its expense management process, reducing administrative overhead and processing times. These improvements resulted in 79 per cent cost savings in processing expenses and more accurate financial reporting.

Luxury watchmaker Breitling experienced delays in its transactional processes due to inefficient manual systems. After integrating Yokoy’s platform, Breitling was able to fully automate its expense management processes, improving speed and reducing possible compliance issues by avoiding discrepancies, while also freeing up resources for other strategic priorities.

Canton Basel-Stadt needed to reduce manual efforts in its expense management. The implementation of Yokoy has significantly relieved the Finance and Human Resources department of the JSD. Our user-friendly solution now simplifies the expense process for both submitters and approvers alike, while reducing processing times by 90 per cent through automated compliance checks.

Next steps

You see: Overcoming common pain points in expense management doesn’t have to be a daunting task. By embracing automation, AI, and working with real-time data, businesses like yours can improve efficiency, reduce costs, and ensure compliance. Modern platforms like Yokoy offer scalable, integrated solutions that allow companies to streamline their processes and stay ahead of potential challenges.

Are you ready to take the next step toward optimising your expense management?

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.