Home / Navigating Regulatory Changes in Expense Management

Navigating Regulatory Changes in Expense Management

- Last updated:

- Blog

Industries like financial services, healthcare and manufacturing have faced significant regulatory changes recently, from stricter data privacy laws to evolving environmental standards. Technological advancements drive these changes, shifting market trends and new public policies to enhance transparency and accountability. On the other hand, leveraging advanced technologies, such as automation and predictive analytics, can help organisations navigate these changes more efficiently to stay ahead of the curve.

What drives regulatory change?

Businesses today face a mix of local, national and international regulations. Governments also frequently update policies in response to technological, economic and social changes, driving new compliance requirements. The rise of globalisation, the gig economy and sustainability trends add to this complexity of modern society.

Recent developments, such as the EU-US Data Privacy Framework, offer clearer guidelines for managing cross-border data transfers. It’s crucial for businesses to stay updated on such evolving regulatory changes to align expense policies with these shifts for risk management and maintaining ethical practices.

Most important regulatory bodies in Europe and their impact

When navigating the regulatory landscape across Europe, businesses face a range of country-specific rules concerning expense management, VAT reporting and digital receipt storage.

Here is an overview of the key regulatory distinctions in countries such as Austria, Germany and the UK, offering insights to help organisations stay compliant while managing international operations efficiently.

Austria: Businesses must maintain strict receipt documentation under Austrian tax law, with a mandatory seven-year retention period. The government sets per diem rates and strict guidelines apply for VAT and mileage allowances.

More on compliance in Austria.Germany: Businesses face detailed expense recording obligations, including digital storage under GoBD rules, and VAT must be properly managed. Travel allowances and per diem rates are carefully regulated, requiring precise reporting.

More on compliance in Germany.Spain: Spanish companies must adhere to strict documentation requirements, with digital storage of receipts permitted only if certified by the Spanish Tax Agency (AEAT). Per diems and mileage allowances are tightly regulated based on government-defined rates and VAT reporting must be done through the SII system.

More on compliance in Spain.Switzerland: Compliance is governed by Swiss tax law, allowing digital receipt storage if compliant. Swiss VAT rates, employee travel allowances and mileage reimbursements follow specific regulations, with varying rates for domestic and international business travel. Switzerland is also known for its strict labour laws, particularly concerning employee rights and workplace safety, alongside comprehensive environmental regulations.

More on compliance in Switzerland.Netherlands: Dutch law permits digital storage of receipts if integrity and completeness are ensured, with a 7-year retention period for most receipts. Companies generally reimburse actual expenses rather than per diems. For business travel, mileage is reimbursed at €0.23 per km tax-free, while VAT rates of 0%, 9% and 21% apply depending on the service or good. The country is also a leader in sustainability regulations, with ambitious carbon reduction targets and green initiatives.

More on compliance in the Netherlands.UK: Companies must retain clear records of expenses and benefits for at least three years post-tax year. Per diems, actuals and custom rates are used for subsistence, with HMRC benchmark rates guiding reimbursement. Mileage allowance payments are tax-free if within HMRC’s approved rates and companies can reclaim VAT on the fuel portion of business mileage. The UK also features P11D reporting requirements for expenses considered as benefits in kind.

More on compliance in the United Kingdom.France: Digital storage of receipts is permitted in France, but they must comply with strict archival rules, including e-invoicing for VAT compliance. The government mandates precise regulations for per diems and travel allowances. Mileage reimbursements follow a set scale based on engine power and distance. France also leads in corporate taxation transparency and sustainability reporting under laws like the PACTE Act.

More on compliance in France.Luxembourg: Luxembourg’s tax authorities allow digital archiving of receipts under stringent guidelines. The country uses actual expense reimbursements and custom per diems. Mileage allowance is capped at €0.30 per km and VAT reporting follows a tiered system with rates at 3%, 8% and 17%. Corporate governance is closely monitored and financial institutions must adhere to strict anti-money laundering (AML) regulations.

More on compliance in Luxembourg.Belgium: Belgium allows for digital receipt storage under certain conditions and VAT compliance is key. For business travel, companies can reimburse through per diems or actual expenses. Mileage reimbursement is set at €0.425 per km tax-free and VAT rates are 0%, 6%, 12%, or 21%, depending on the category of goods or services. Belgium is also proactive in environmental regulation, promoting sustainability and emission reductions across industries.

More on compliance in Belgium.

Blog article

How to Choose the Ideal Expense Management Software: Requirements and Features

How to choose the best expense management software for your company size. Improve efficiency and save costs with the right expense tracking solution.

Lars Mangelsdorf,

Co-founder and CCO

Challenges in navigating regulatory changes

Navigating regulatory changes can be tough, especially for businesses operating across different countries. Regulations vary widely, and frequent updates driven by technology, advanced privacy laws and market trends can strain resources. Managing compliance effectively requires an agile and proactive approach.

Let’s look into the most common challenges in navigating the regulatory landscape:

Evolving regulations: Regulations are changing rapidly, driven by advancements in technology, societal demands and evolving legal standards. Jurisdictions often implement new laws or update existing ones in areas such as data privacy (e.g., GDPR ), environmental sustainability (e.g., ESG) and security standards (e.g., ISO 27001). These shifts can differ significantly from one region or industry to another, making it hard for companies to stay informed. For example, healthcare industries frequently see updates to regulations that directly affect their operations, requiring businesses to monitor changes continuously to avoid discrepancies.

Complex regulatory language: The technical and legal jargon used in regulatory documents makes them difficult to interpret, particularly for non-experts. Misunderstanding this language can lead to unintentional non-compliance, as key requirements may be overlooked or misinterpreted. The complexity of this issue is further compounded when regulations are translated across different languages and legal systems, increasing the risk of gaps in compliance. In addition, regulations may conflict with one another, especially in cross-border contexts, further complicating the compliance process.

Ensuring cross-border compliance: Internationally active companies face the challenge of meeting varying regulatory requirements across multiple countries. Each jurisdiction may have its own set of rules related to taxes, data privacy, financial reporting and environmental standards. Staying compliant in one country does not guarantee compliance in another, making it difficult for businesses to standardise their internal processes. Cross-border compliance requires in-depth knowledge of local laws, frequent updates and the ability to adjust business practices quickly, which can stretch resources thin.

Potential disruptions: The need to adapt business operations to meet new regulatory requirements can cause significant disruptions. Changes to compliance frameworks may require reconfiguring workflows, training staff and updating software or documentation processes. For example, new data protection laws might force a company to overhaul its data handling practices, potentially causing delays and operational downtime. The constant need to pivot also affects long-term planning and can create instability in operations, as companies are forced to divert attention and resources from core business activities.

Costs of maintaining compliance: Ensuring compliance is not only operationally demanding but also financially burdensome. Businesses must invest in legal expertise, compliance software, staff training and regular audits to ensure they remain compliant. Failing to stay compliant can result in significant fines and reputational damage, increasing the financial pressure. Moreover, the costs of adapting to evolving regulations — whether by upgrading systems, hiring specialists, or redesigning processes — can be particularly high for smaller businesses. The cumulative financial burden of maintaining compliance can drain resources that might otherwise be invested in growth initiatives.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

A strategic approach to regulatory compliance

By taking the following steps, AP managers and financial leaders can develop a robust compliance strategy that not only addresses current regulatory requirements but also positions their organisations to effectively navigate future changes.

Risk assessment and opportunity identification

Start by reviewing all relevant local and international regulations affecting your organisation. Assess how well your current processes align with these requirements, identify any compliance gaps and evaluate the risks and impacts of non-compliance. Leverage regulatory changes to enhance business practices and explore advanced technology to streamline compliance, reduce manual effort and improve accuracy.

Building a cross-functional compliance team

Assemble a cross-functional team from finance, legal, operations and IT to ensure diverse expertise in compliance. Clearly define roles, including appointing a compliance officer to oversee initiatives and establish effective communication channels for sharing information and updates to keep the team aligned on compliance goals.

Continuous compliance with regular audits

Implement regular internal audits to ensure compliance processes with regulations and internal policies, update policies as needed based on audit findings, and communicate these changes across the organisation. Provide ongoing, role-specific staff training on regulatory updates and best practices, stay informed about emerging trends and invest in technology to enhance compliance management. Foster a culture of compliance with regular training, so that employees understand and are committed to adhering to regulatory requirements.

How technology helps navigate regulatory changes

Technology helps simplify regulatory compliance by automating time-consuming tasks, tracking updates and easing reporting. It helps businesses manage complex regulations, stay updated on changes and reduce manual work, making compliance more manageable amidst rapid legal shifts.

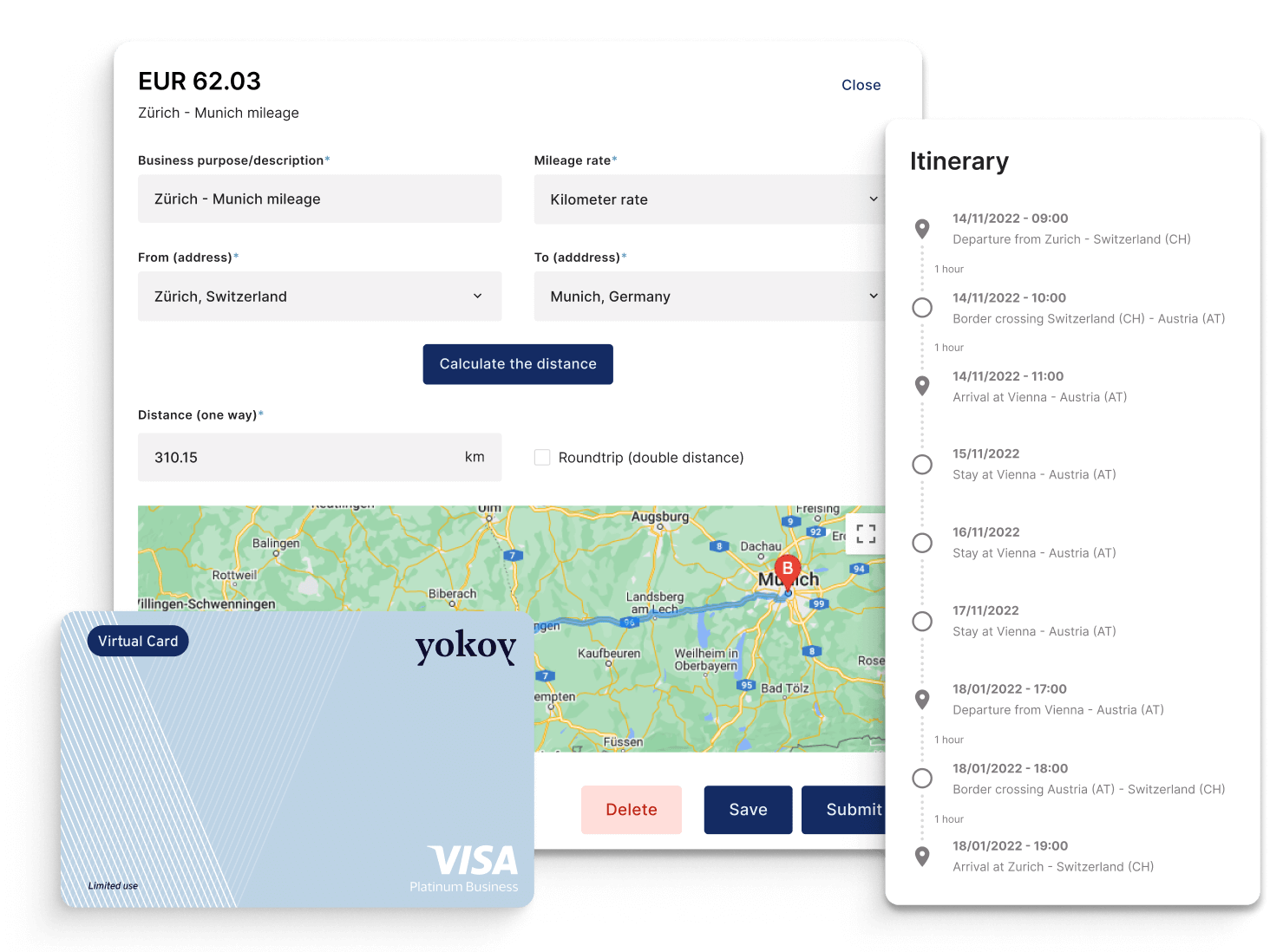

Software like Yokoy shows how tech can ease your compliance efforts: Its platform uses Artificial Intelligence (AI) to automate expense management, handle evolving rules like GDPR and VAT, simplify approval processes, and provide real-time insights for your financial leaders. This helps businesses ensure compliance without major disruptions or extra costs.

Holistic expense management software

Yokoy offers comprehensive expense management solutions that integrate all aspects of expense handling into one single platform. This centralised approach helps businesses manage diverse compliance requirements efficiently by consolidating expense data, streamlining approval workflows and ensuring consistency across various regulatory frameworks. This reduces the complexity of handling multiple systems and helps ensure compliance with both local and international regulations.

Automation for regulatory compliance across borders

Yokoy’s automation capabilities extend to managing regulatory compliance across different countries. By automating expense reporting and compliance checks, Yokoy ensures that companies adhere to varying tax rules, data privacy laws and financial reporting standards without needing manual oversight for each jurisdiction. This helps your business to ensure compliance in multiple regions while reducing the risk of errors and ensuring that updates are applied consistently across all operations.

Real-time data management and ongoing monitoring

With Yokoy’s real-time data management, companies can continuously track and monitor their compliance status. The platform provides up-to-date insights into expense data and regulatory changes, allowing businesses to adjust to new regulations swiftly. Ongoing monitoring helps identify potential compliance issues early so they can be addressed proactively before they lead to disruptions or costly penalties.

Built-in expense policies

Yokoy incorporates built-in expense policies that align with regulatory requirements. These policies are pre-configured to ensure that expense submissions and approvals comply with relevant regulations and company standards. This feature reduces the risk of non-compliance by automating adherence to policy rules and providing clear guidelines for employees, ensuring that all expenses are processed correctly and efficiently.

AI for automating manual tasks

Yokoy leverages AI to automate repetitive and time-consuming manual tasks involved in expense management. AI-powered features handle such things as data entry, expense categorisation and receipt matching, freeing up valuable time for financial teams. By reducing manual effort and human error, AI helps your company to stay atop of evolving regulations more efficiently, allowing staff to focus on strategic decision-making, rather than routine tasks.

Next steps

Discover how Yokoy can transform your regulatory compliance and expense management. With a holistic platform, automation across borders, real-time data insights, built-in policies, and AI-driven efficiency, Yokoy makes navigating complex regulations much easier and fun. Want to see how Yokoy can help ensure compliance and be efficient no matter where you operate?

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.