Worldwide, finance leaders have long embraced technology to enhance efficiency: From standardising data with ERP systems to automating tasks with Robotic Process Automation (RPA). Currently, 66 per cent of CFOs are investing in technology to drive growth – a figure that has nearly doubled over the past year. With the power of artificial intelligence (AI) driven systems like Yokoy’s Intelligent Spend Management Platform, finance teams can step up their workflow even more.

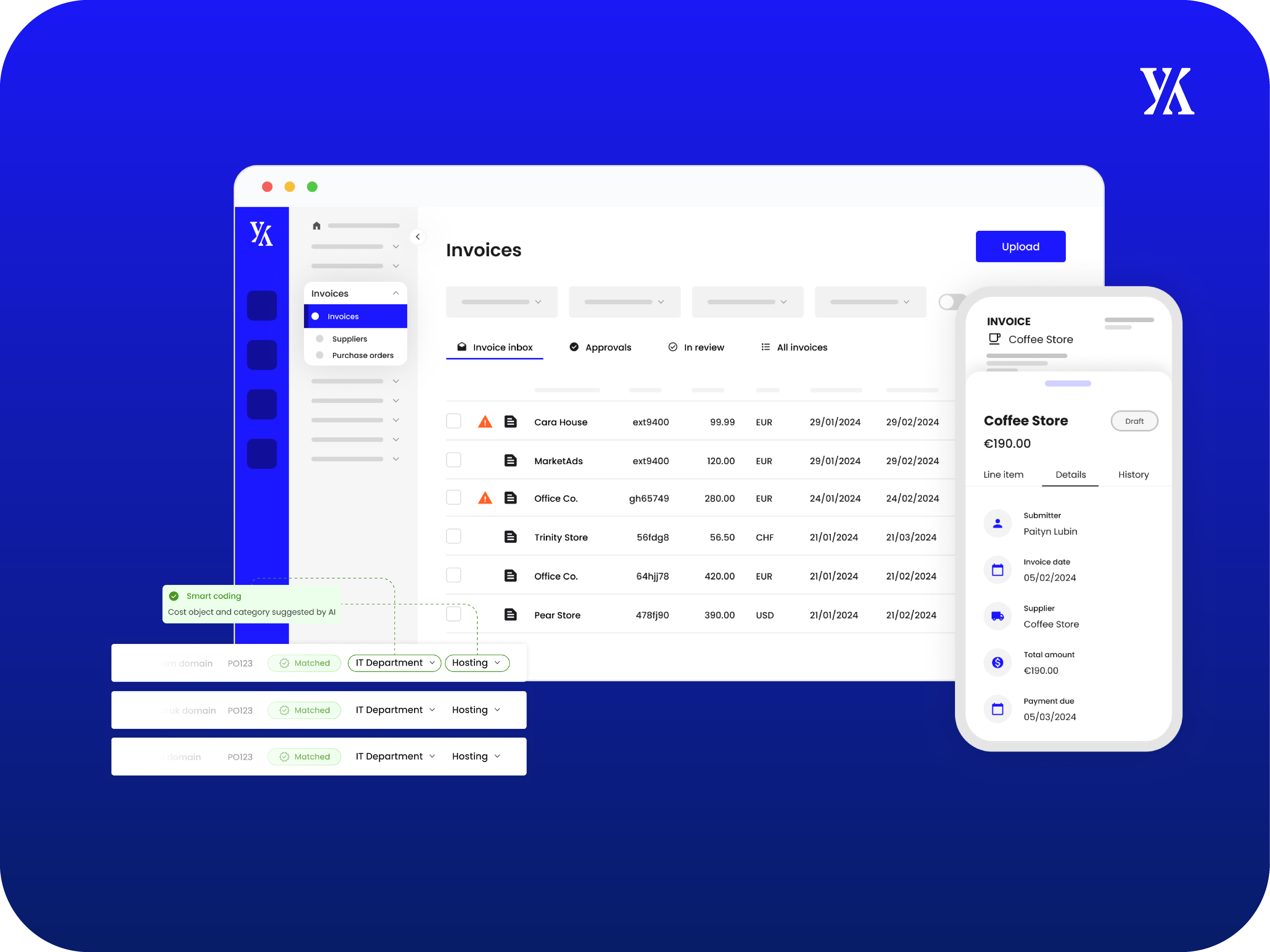

Yokoy’s AI has self-learning capabilities that help the platform understand and enrich data structuring. These capabilities combine with the ability to run multiple workflows simultaneously and dynamically adapt based on this learned behaviour. Seamlessly integrating with ERP systems, Yokoy streamlines financial processes, ensures compliance, and provides real-time insights with opportunities to optimise processes and recommend actions.

In this guide, you can learn what sets Yokoy’s approach apart from other competitors in the field and how you can easily spot tools that only pretend to work smart for you – you will be surprised!

Before we dive deeper into the topic, let us explain a few technical terms first that you may come across when reading about the possibilities of AI:

- Generative AI: an application of AI used to create new content

- Predictive AI: an application of AI that identifies patterns in past events to make predictions about future outcomes

- Prescriptive AI: an application of AI that uses the data available to it to recommend the right course of action to achieve a particular outcome

- Training data: a large data set used to train AI.

- RLHF: reinforcement learning from human feedback, a method used to train AI that prioritises learning from human input ahead of data. AI trained in this way will respond to human input by prioritising that learning over other, data-based learning.

Challenges in accounts payable that Yokoy’s AI can solve

These are common challenges in accounts payable that the traditional AP process can’t solve – but Yokoy’s AI can:

Manual cash management: Automates cash management, reducing manual oversight and improving accuracy.

Inaccurate invoice data: Ensures data accuracy by leveraging AI to validate and correct invoice information automatically.

Manual data entry and risk for human error: Eliminates manual entry, minimising errors through automated data capture.

Invoice fraud: Detects fraudulent activities by identifying anomalies and patterns that indicate potential fraud.

Duplicate invoices: Prevents duplicate payments by cross-referencing and flagging duplicate invoices.

Slow approval workflows: Speeds up approval processes with AI-driven automation and real-time tracking.

Time-consuming manual processes: Streamlines and automates lengthy manual tasks, increasing efficiency.

Repetitive tasks: Automates repetitive tasks, freeing up time for more strategic activities.

In contrast to other spend management vendors claiming to use generative AI, Yokoy’s AI engine is more than just a chatbot layered on top of other software without enhancing the product’s functionality.

Yokoy is built on a foundation of AI, which is being developed and constantly refined in-house, to ensure that the solution automates the entire accounts payable (AP) process, addressing the inefficiencies of manual systems. It eliminates labour-intensive tasks such as manual cash management, data entry, and invoice reconciliation by using advanced optical character recognition (OCR) and machine learning for accurate data extraction and validation. This reduces the time and effort required, minimises the risk of human errors, and ensures that data is processed consistently and accurately.

Let’s look at an example:

A legacy ERP system requires finance teams to manually input invoice data, leading to delays and potential inaccuracies. Even if information from financial documents is automatically extracted through OCR, additional context is missing and requires human intervention.

Yokoy’s predictive AI automates invoice processing by extracting invoice data, categorising expenses, and flagging anomalies. It predicts upcoming expenses or purchase orders based on historical data, and prescriptive AI proactively provides insights and recommendations for better financial planning and decision-making.

Enhancing accuracy and fraud detection

AP processes based on outdated systems or incompetent AI struggle with inaccurate invoice data and the risk of duplicate invoices or other types of fraud. With Yokoy, you can tackle these issues with intelligent algorithms that detect anomalies and patterns indicative of fraudulent behaviour. Its advanced duplicate detection capabilities avoid duplicate payments, while automated validation of invoice details against existing records enhances data accuracy and reliability, safeguarding your organisation from costly errors and fraud.

Optimising workflow and scalability

Slow approval workflows and repetitive tasks are significant bottlenecks in traditional AP departments. Yokoy’s powerful AI helps automate and optimise these workflows, dynamically routing invoices to the right approvers and adapting to approval hierarchies or urgent needs. This leads to faster approvals and timely payments. In addition, Yokoy’s scalable automation can handle growing transaction volumes efficiently, allowing businesses to expand their operations without increasing manual tasks. Thus, it minimises error-prone human interventions, ultimately improving operational efficiency and supporting strategic growth.

AP automation with Yokoy and artificial intelligence

Yokoy’s platform leverages both predictive and prescriptive AI to bring an intelligent AP automation solution into every stage of the spend management process, encompassing invoices, expenses, and payments. Predictive AI anticipates future trends by analysing historical data, aiding in expense forecasting, anomaly detection, and cash flow management. This proactive approach helps your business prepare for upcoming costs and identify potential issues before they escalate. Meanwhile, prescriptive AI provides actionable recommendations to optimise outcomes, such as ensuring compliance with expense policies, suggesting optimal supplier negotiation strategies, and streamlining workflow processes.

Our AI continuously evolves through adaptive learning, prioritising human input and interactions. By learning from thousands of invoices, expenses, and payment records, it gains a profound understanding of these documents’ specificities. This dynamic learning approach ensures that the AI aligns closely with your organisation’s workflows and preferences, becoming more effective and personalised over time. Whether you’re managing invoices, expenses, or payments, the AI’s ability to adapt and learn from your specific usage makes it an invaluable tool for every AP team.

Yokoy's AI-powered invoice management features include:

Automatic invoice processing: Yokoy’s AI captures invoices automatically, reducing the need for manual uploading, validating, and approving. This speeds up processing time and ensures data accuracy.

Real-time invoice overview: Gain immediate visibility into the status of your invoices, preventing payment delays and allowing for timely interventions if issues arise.

Error and fraud elimination: AI extracts invoice data automatically and sets custom approval flows to eliminate mistakes and errors. It flags outliers in real time, helping enforce compliance and preventing fraud.

Centralised invoice management: Yokoy reduces the number of tools needed to manage accounts payable by centralising all invoice-related activities in one platform. This includes support for multi-legal entity setups.

Multi-format invoice handling: Whether it is paper invoices, PDFs, or e-invoices, Yokoy can process them all automatically.

Invoice matching with purchase orders: Yokoy increases efficiency through smart line-item coding and automated 2- and 3-way matching. It accurately matches invoices to purchase orders and goods receipts, ensuring compliance and preventing fraud.

Smart coding for accuracy: Yokoy’s AI codes invoices based on up-to-date master data from your ERP. It becomes more accurate with each invoice processed, handling new supplier invoices efficiently after the first coding. At the same time, you and your team have full control over how and what Yokoy’s AI is learning about your business.

Unauthorised payment prevention: Increase organisational transparency regarding invoice approvals to ensure only approved supplier invoices are paid, avoiding duplicate or erroneous payments.

Reduced approval steps with pre-approval flows: The system automatically identifies necessary approvals and routes them for faster supplier payments. Through dynamic approval flows, invoices are submitted to the appropriate cost object, line manager, or supplier.

Custom workflows for governance: Set up tailored workflows and pre-approval flows to automatically redirect invoices to the correct approvers or PA teams, enforcing governance across global entities.

Payment delay prevention: Custom workflows can automatically approve recurring invoices, avoiding late payment fees and keeping suppliers satisfied. Bill payments are synced into your accounting system or ERP for accurate bookkeeping.

Timely book closing: Automate invoice processing and validation to streamline the monthly closing process. Ensure compliance through built-in rules and sync spend data in real time via API integrations.

Audit-proof and simplified reporting: Yokoy simplifies invoice tracking and ensures an audit-proof management process with automated audit trails. All invoices, approvals, and bill payments are visible in one central place, facilitating easy financial reporting.

Yokoy Implementation Process

Implementing Yokoy and our powerful AI features is always smooth and goal-oriented. In the first phase, we gather your requirements, understand your current setup and desired end state, and agree on a project timeline. Your team will become familiar with our product as we officially kick off the transformation project.

In the second phase, we start with the technical setup, including configuring a Yokoy sandbox account with the required integrations. The phase concludes with acceptance testing to ensure everything meets your teams’ needs.

In the third and last phase, your team uses the system and receives in-depth live training from Yokoy’s Academy, along with training guides and videos for self-study. Meanwhile, our implementation team is preparing the production environment to go live.

How Yokoy’s AI transformed AP teams from small to big companies

Let’s see some use cases where Yokoy’s process automation solutions helped companies transform their accounts payable: In all cases, AI reduced processing time and costs, improved data accuracy, and allowed for faster payment approvals – to help them work more efficiently and maintain robust financial control.

Planted Foods

Challenges and transformation: Planted Foods, a fast-growing food tech company, faced inefficiencies with manual accounts payable processes. Implementing accounts payable automation solution transformed their operations by automating invoice processing, improving approval routes, and providing real-time financial insights. This shift significantly reduced processing time and errors, enabling the company to handle more invoices efficiently and maintain up-to-date cash flow records.

Impact:

60 per cent reduction in invoice processing time

90 per cent improvement in data accuracy

30 per cent boost in operational efficiency

Crisp

Challenges and transformation: Crisp faced bottlenecks and errors with its manual financial processes. Adopting Yokoy’s AI-driven solution upgraded their invoice management and approval processes, and provided enhanced visibility into their financial data. This transformation allowed Crisp to scale efficiently and manage cash flow more effectively.

Impact:

70 per cent reduction in processing costs

80 per cent faster turnaround time for payments

Enhanced scalability and real-time financial insights

With Yokoy’s Intelligent Spend Management Platform, you can automate invoices, payments, and expense processes. Yokoy’s AI provides intelligence throughout spend management and helps your finance team make better decisions.

Next steps

Discover how Yokoy’s cutting-edge AI can support your finance team and drive your company’s financial transformation. Our advanced technology scales with your business, adapting to your needs and handling growing transaction volumes effortlessly. By booking a demo, you’ll see firsthand how Yokoy helps save time, reduce costs, and improve your company’s financial operations. Let us show you how our solutions can empower your team to concentrate on what matters most.

Simplify your invoice management

Related content

If you enjoyed this article, you might find the resources below useful.