Home / How Mobile Solutions Boost Expense Management Efficiency

How Mobile Solutions Boost Expense Management Efficiency

- Last updated:

- Blog

Today’s business landscape differs immensely from some years ago: Automation has nearly eradicated the need for manual spreadsheet handling, and expense management software can boost efficiency like never before. In addition, mobile apps for intelligent spend management platforms like Yokoy can even further optimise cost control: Processing and accessing expense-related tasks on the go will make workflows more straightforward and allow for real-time insights.

Of course, mobile-friendly solutions have entered the business realm. They offer a powerful way to streamline expense processes, providing visibility from wherever you are, increased accuracy, and enhanced control over your business’s financial operations.

Mobile expense management and its importance for modern companies

Using mobile applications to track, manage and process business expenses in real time is a modern approach to expense management today. By leveraging mobile technology, companies can optimise expense-related tasks, such as capturing receipts, approving claims, and processing invoices—all from a smartphone or tablet. This enables employees and managers to handle expenses from anywhere in the world, providing flexibility and reducing reliance on traditional, paper-based or desktop-bound systems. By integrating AI and automation tools within mobile platforms, accuracy can be enhanced, and non-compliance will be reduced.

With mobile expense management, agility in financial decision-making can be improved, as a fast-paced digital economy sometimes needs businesses to decide quickly. With high visibility over their spending, CFOs and finance teams can react to changes immediately to control costs and stay competitive. This empowers companies to optimise their cash flow, minimise operational inefficiencies, and ensure that their expense management processes are aligned with strategic business goals. As the company grows, modern, mobile expense management systems can be scaled to the business needs for long-term financial health.

Benefits of mobile expense management

Efficient expense management simplifies workflows: Managers and your company’s employees can save time by enabling quick submission, approval, and reimbursement of expenses via mobile apps. All your company’s expenses are visible in real-time which allows you to monitor costs as they occur and enable you to make more informed decisions when needed.

This reduces the likelihood of overspending and helps in identifying cost-saving opportunities. Also, it increases accuracy by automating expense tracking, categorisation and approval processes, reducing human error and increasing compliance with policies and regulations.

Operational efficiency

Effective expense management enhances operational efficiency by streamlining the entire process of submitting, reviewing, and approving expenses. Mobile solutions even add the possibility of allowing employees to submit claims on the go, reducing delays and minimising exhausting paperwork. This automation not only frees up valuable time for your employees and finance teams but also enables them to focus on more strategic tasks and reduces the administrative burden.

Real-time data access

In a world where Nanoseconds count, having access to real-time data is essential for making quick and informed financial decisions. Mobile expense management provides up-to-the-minute visibility into your company’s spending, helping your business to stay on top of your expenses as they happen. This enables better cash flow management and allows you to react quickly to any budget overruns or inefficiencies.

Reduced human errors and fraud

With mobile expense management, tiring processes like receipt scanning, expense categorisation, and approval workflows can be easily automated, reducing the chances of manual errors. In addition, automated checks ensure that expense claims are accurately recorded, while AI-powered fraud detection can flag any suspicious or fraudulent activity.

Enhanced visibility and control

In general, expense management solutions give companies a more detailed and clear overview of their financial health. Managers can monitor employee expenses and spending across departments, identify trends, and ensure that budgets are adhered to. Knowing where and how much money your company spends is an important part of maintaining financial control and helps you make the best decisions under current market and business conditions.

Expense tracking

Accurate expense tracking and expense reporting are vital for maintaining financial health. User-friendly interfaces of mobile apps make it easy for employees to log travel expenses in real-time, ensuring that no costs are overlooked. By tracking every expense in one central system, businesses can analyse spending patterns, improve forecasting, and optimise resource appropriation.

Policy compliance

Increasing the chances of compliance with company policies and external regulations is crucial to avoiding costly penalties or audits. Mobile expense management platforms can automatically apply policy rules when processing claims, to ensure compliant expenses that go with your company guidelines. This automation helps to maintain consistency and reduces the risk of non-compliance.

Automation of manual processes

Manual processes like data entry from spreadsheets and receipt matching can be time-consuming and prone to mistakes. With mobile expense management, these tasks are automated and thereby significantly speed up the approval and reimbursement process. Smart automation processes reduce the need for manual intervention, increase accuracy, and ensure that expense reports are handled efficiently from submission to payment.

Yokoy Expense

Streamline your travel and expense management

Say goodbye to manual data entry, lost receipts, and complicated reimbursements. Yokoy handles everything from start to finish, for simple T&E management at any scale.

Why expense management should be mobile-friendly

By now, you should have an overview that mobile-friendly expense management is particularly useful because it offers flexibility, speed, and convenience for both employees and management. Mobile apps for expense management are time-saving solutions that help your employees capture receipts, submit expense reports, and track approvals from anywhere. This eliminates delays caused by waiting to access a desktop or physical paperwork. This real-time capability is essential if your business employs remote or travelling staff to ensure accurately and promptly logged expenses.

Additionally, mobile platforms enhance decision-making by providing managers instant access to up-to-date financial records that enable them to monitor budgets, approve expenses, and maintain control over spending no matter where they are. The ease of use with intelligent user experience design and automation also reduces the likelihood of errors, making the entire expense management process extremely efficient. But there is still more:

Scalable: Solutions with mobile access are designed to grow with your business. Whether you’re handling a few expenses or thousands, mobile solutions can manage increasing volumes of data effortlessly, making them a great fit for companies of all sizes.

Suitable for companies of any size: From small businesses to global enterprises, mobile expense management offers agile flexibility and adaptability. This means that no matter how your organisation evolves, the solution can be tailored to meet your specific needs.

Easy to use: With user-friendly interfaces, employees can quickly learn how to submit expenses, capture receipts, and track their reimbursements. This simplicity minimises the need for extensive training, allowing your team to get up and running in no time.

Flexibility: Mobile platforms enable employees to manage their expenses on the go. Whether in the office, on a business trip, or working remotely, they can handle expense-related tasks efficiently from any device.

Business travel: For employees who travel frequently, mobile apps for expense- and travel management eliminate the hassle of keeping physical receipts. They can log travel expenses in real-time and ensure that reports are submitted directly, streamlining the reimbursement process.

Remote work: Mobile solutions seamlessly integrate with remote work environments, allowing employees to manage and submit expenses from anywhere. This ensures that expense management remains smooth and efficient, regardless of where team members are located.

Higher employee satisfaction: By simplifying and accelerating the expense management process, mobile-friendly solutions reduce frustration and make the user experience more enjoyable for employees. This leads to higher satisfaction and a more positive overall process.

Integration of expenses in a holistic spend management solution like Yokoy

Combining the features and benefits of expense management into a holistic spend management solution like Yokoy offers businesses a comprehensive approach to financial control and efficiency. Yokoy’s expense management system provides seamless integration with your existing finance systems and includes several important features that make managing expenses easy and efficient, especially through its intuitive mobile app:

Country-specific controls

Yokoy’s app is built to navigate the complexities of international business by accommodating country-specific regulations. It handles unique tax rules and compliance standards in different regions, ensuring that every expense report is accurate and meets local requirements. This feature is especially valuable for businesses operating across borders, as it simplifies managing financial processes in multiple countries.

Automated tax readouts

With automated tax readouts, Yokoy takes the guesswork out of tax calculations. The system automatically applies the correct tax rates to expenses based on the location and your company’s specific rules. This not only speeds up the expense reporting process but also boosts efficiency by reducing the risk of errors, ensuring that your financial reports are precise and compliant.

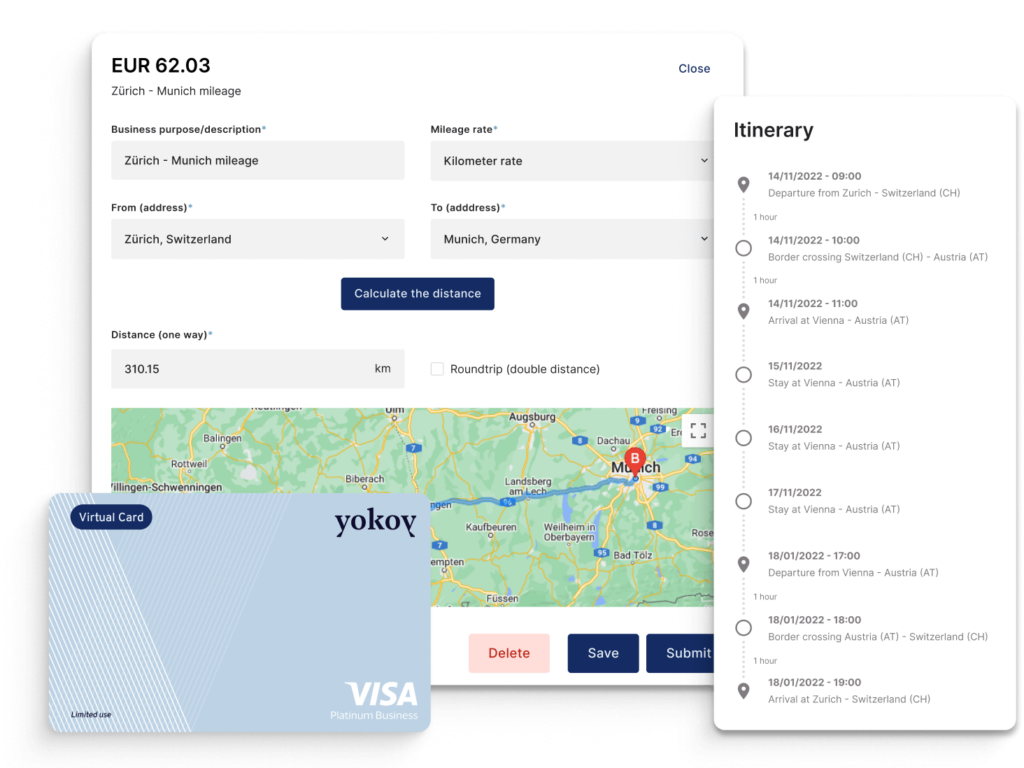

Automated mileage reimbursements

For employees who are often on the road, Yokoy’s app simplifies mileage reimbursements. It automatically calculates the repayment amount based on the distance travelled, eliminating the need for manual calculations and ensuring that employees are fairly compensated for their travel. This feature streamlines the reimbursement process and saves time for both employees and finance teams.

Custom workflows

Yokoy’s custom workflows offer flexibility, in how expense reports are reviewed and approved. Businesses can design approval processes that adhere to your unique policies, whether that involves different approval levels for various departments or specific spending thresholds. This adaptability ensures that expenses are handled efficiently and following company guidelines, making operations smoother and more organised.

Next steps

Yokoy’s spend management solution integrates country-specific controls, automated tax calculations, and custom workflows to create a seamless, holistic expense management experience. Our case studies show how automating global financial processes helps reduce manual tasks.

For example, Breitling used Yokoy to automate its global financial processes, reducing manual tasks and ensuring compliance. Similarly, the Canton Basel-Stadt benefited from automated mileage reimbursements and custom workflows, streamlining its financial operations and improving accuracy. And On, a global sporting goods manufacturer, achieved a 90 per cent expense management automation rate by using Yokoy, boosting efficiency by 472 per cent.

Want to find out how Yokoy could transform your business?

In this article

See intelligent spend management in action

Book a demoRelated content

If you enjoyed this article, you might find the resources below useful.